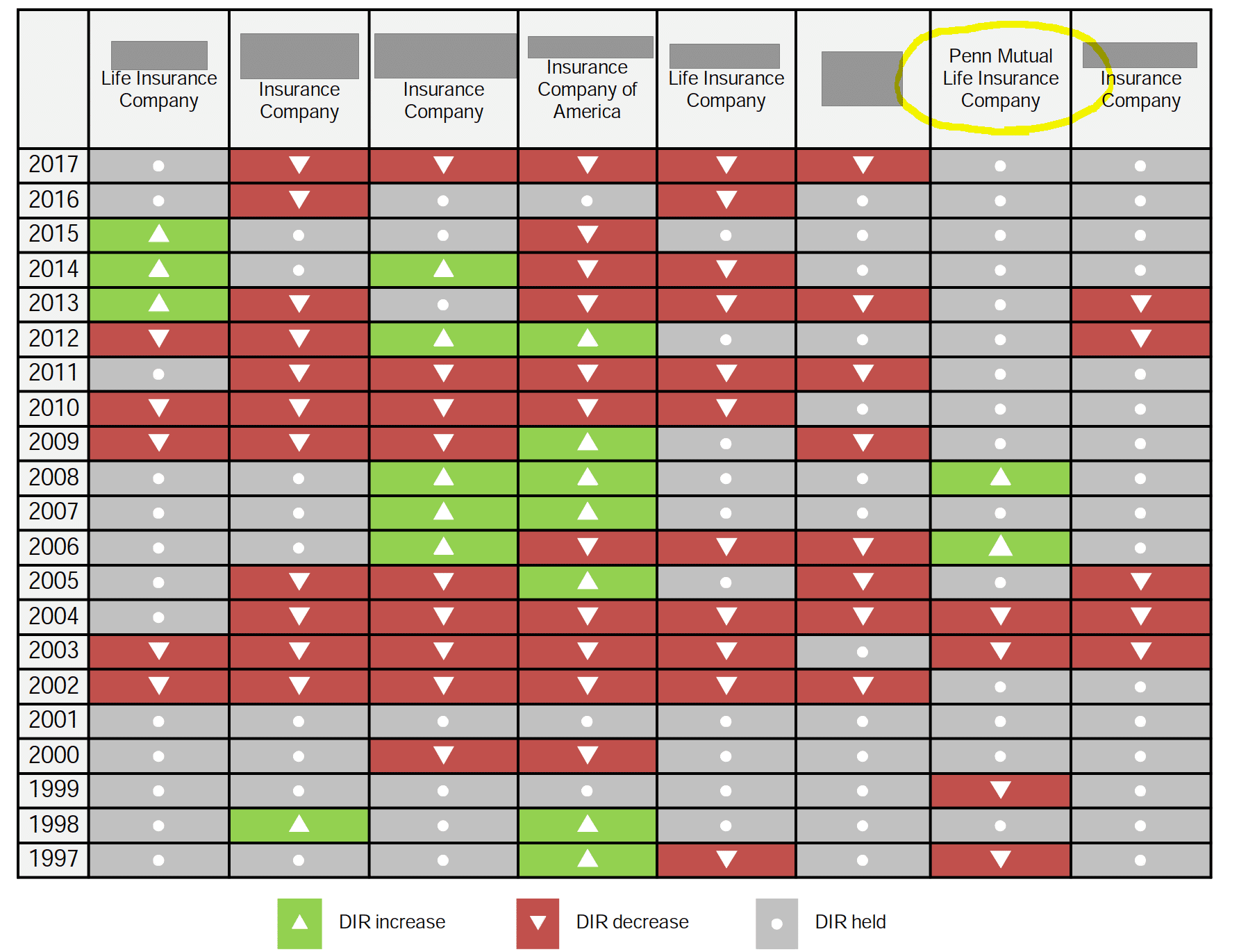

Whole Life Dividends Explained + Dividend History By Company

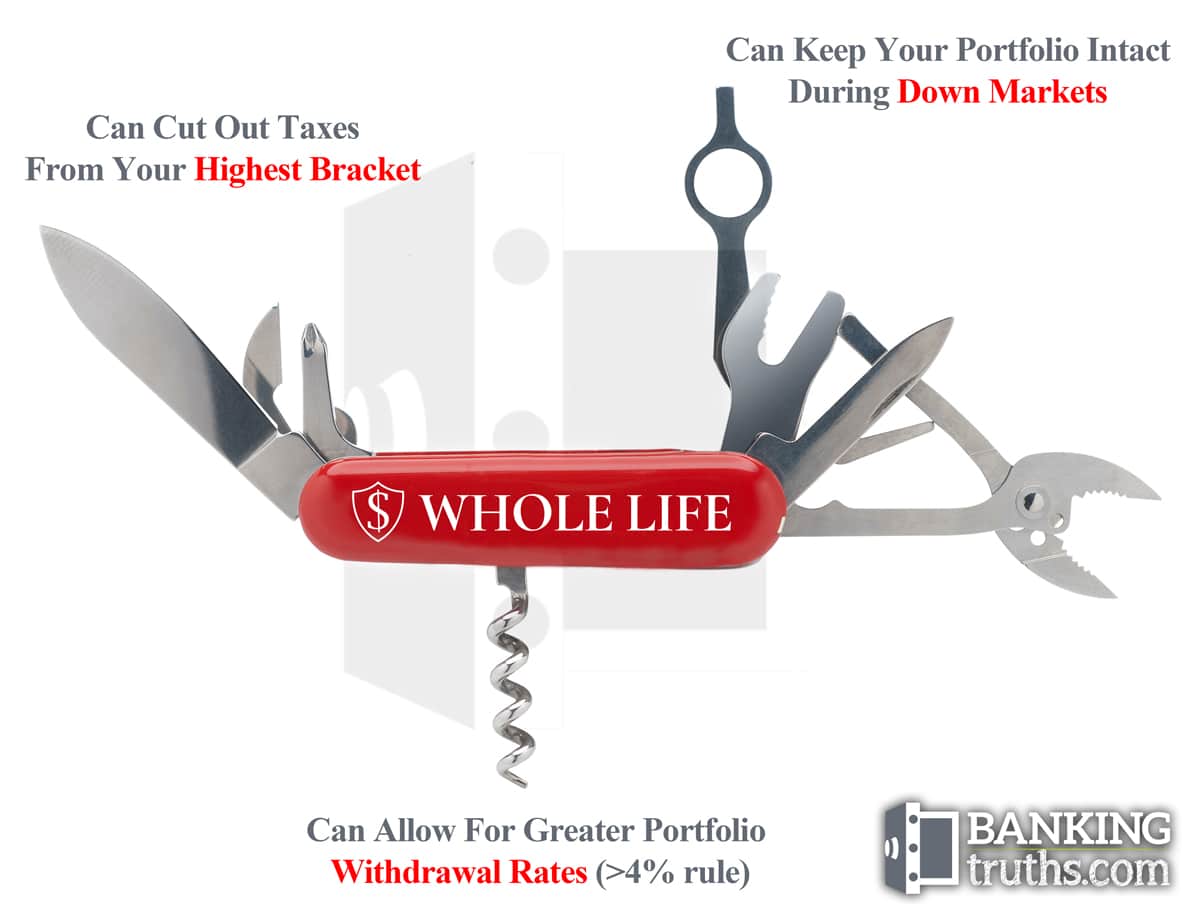

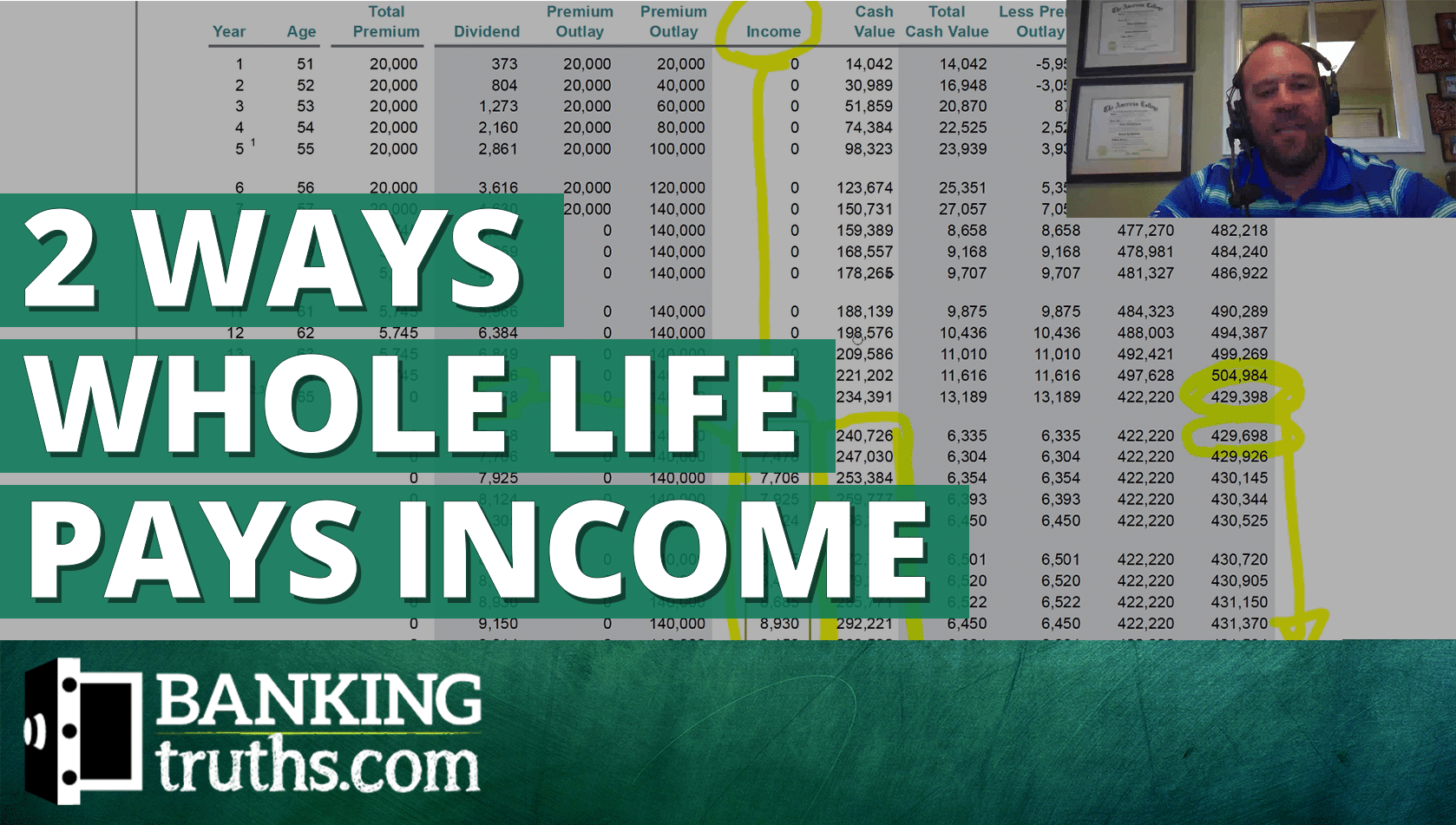

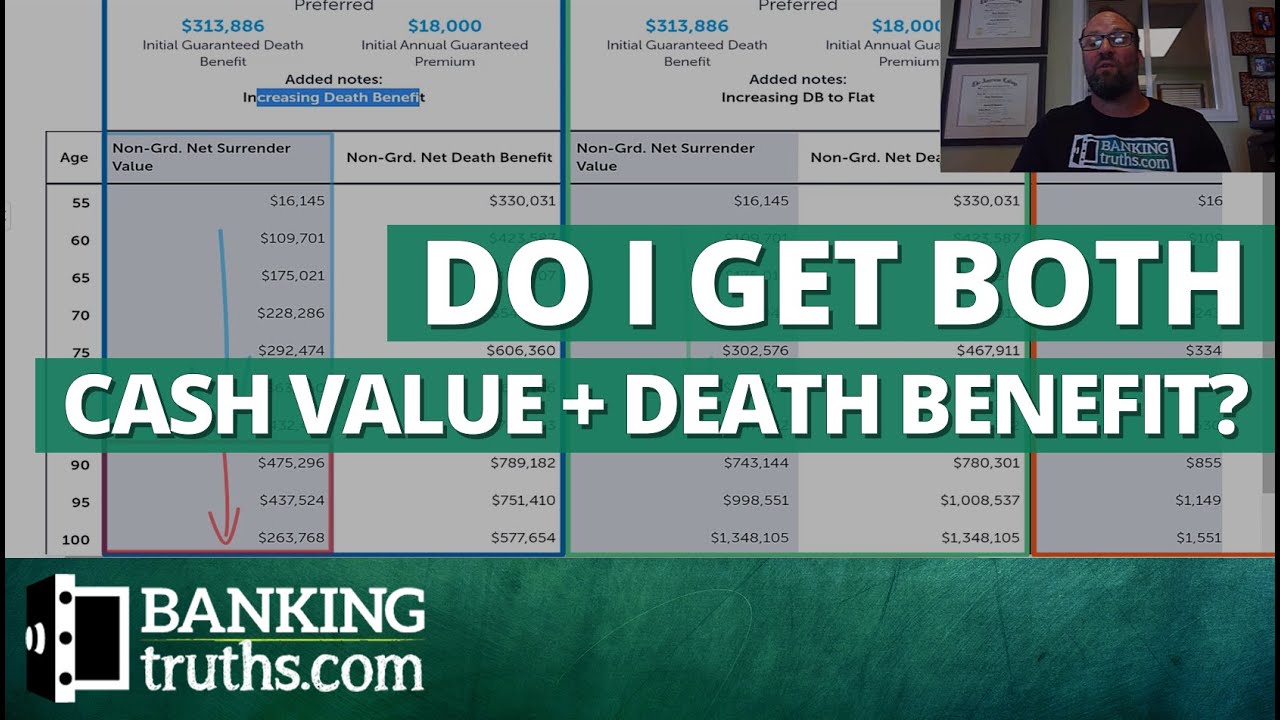

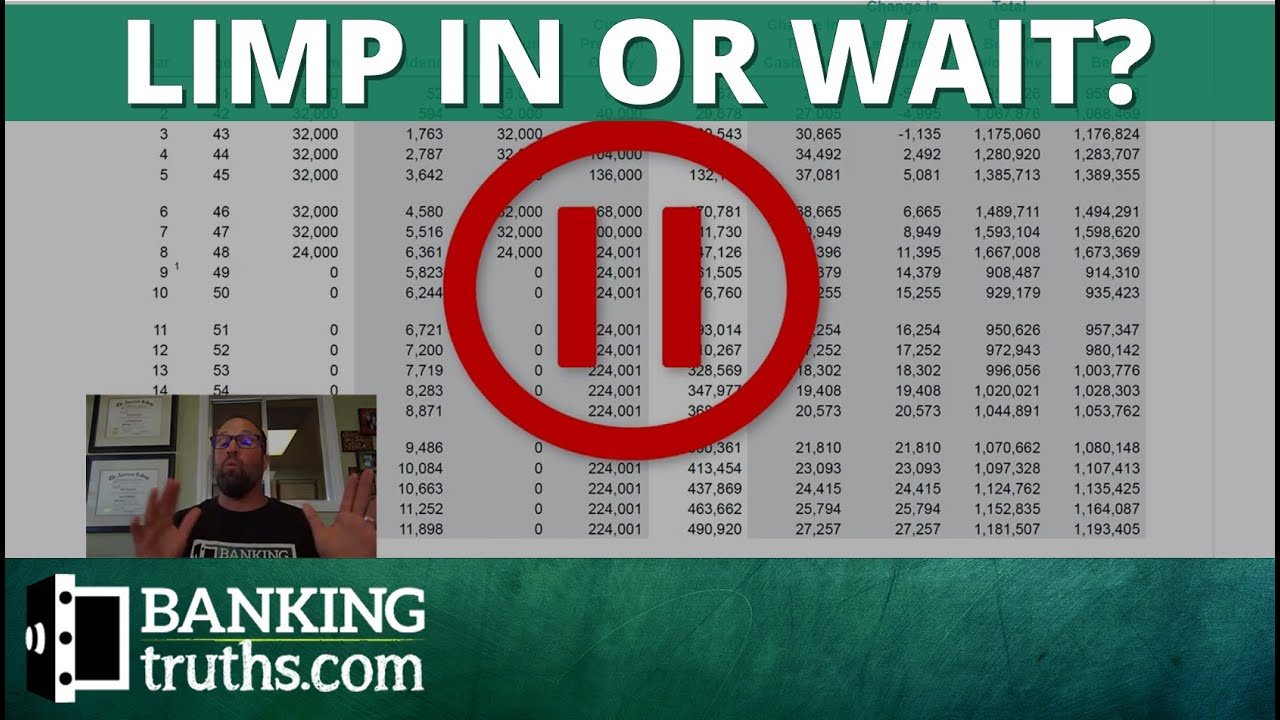

Whole Life dividends are one of the most attractive features of using a policy building your own private family bank. This article explores common dividend myths, how to maximize dividends while accumulating wealth, and how to best distribute them when using Whole Life for retirement.