Whole Life Dividends Explained + Dividend History By Company

Certain kinds of life insurance policies pay dividends to their policyholders. Generally, these dividend-paying Whole Life insurance policies are “participating” policies issued by mutual companies. Since a mutual insurance company is owned by its Whole Life insurance policyholders, it is customary for these mutual insurers to pay dividends annually back to its Whole Life policyowners.

Are Whole Life Insurance Dividends guaranteed?

Whole Life dividends are not guaranteed to be paid, but every mutual company still in existence has a massive surplus and has found a way to pay a dividend every year for the last 150+ years. Also, your dividends once paid can be added to your cash value, raising up your Whole Life policy’s guaranteed growth.

However, the internet is full of dividend myths, misunderstandings, and misinformation in terms of a mutual company’s:

- Annual dividend interest rate

- Annual dividend amount paid

- Dividend history

- Dividend options

Here’s everything covered in this article:

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

A Mutual Company’s Dividend Interest Rate

Is a Whole Life policy’s dividend rate, the same as the internal growth rate?

No, the dividend interest rate is NOT the internal growth rate of the underlying Whole Life insurance policy. Just because a mutual insurance company declares a policy dividend rate of 6%, it does not mean your policy cash value will grow by 6% that year. That said, it may feel similar if you factor in the tax-advantaged nature of Whole Life cash value.

The other misconception about Whole Life dividends is that the dividend interest rate is the only component that makes up a dividend. In fact, there are three different components, which we will discuss below.

What factors determine a mutual company’s dividend payout?

As the word dividend suggests, you are actually part-owner of the company that issued your policy. Therefore, you participate in all 3 of these distinct aspects of the company’s performance described below:

- Dividend Interest Rate Credit – Whole Life policyholders share in the yield from the insurance company’s entire investment portfolio. However, the declared dividend rate is simply one factor in determining your policy’s specific dividend payout.

- Mortality Credits – The mortality component of the dividend is expressed as a credit for having fewer insurance claims than originally anticipated when they underwrote all outstanding policies. This includes profits from the mutual company’s other lines of business (term insurance, disability insurance, annuities, etc.).

- Company Expense Debit – As part owner of a mutual company by the nature of being a Whole Life policyholder, you share in the company’s operational expenses. How efficiently the company is managed each year determines how much or little they deduct from your dividend.

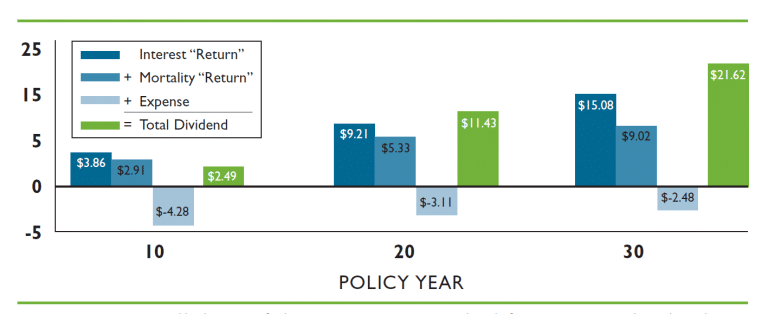

To see how all three of these components work in conjunction together, take a look at this schematic below that was put out by a very solid Mutual company. It’s an older piece, but still the best I’ve seen in explaining how Whole Life dividends work.

It shows in different policy years how the actual dividend amount paid to Whole Life policyholders is calculated by tallying up the debits and credits from the 3 different components discussed above.

What you can clearly see is that the “Interest Return” component of the dividend definitely will help to juice up the dividend, but it is not the only factor to be considered.

You can also see that your “tenure” in the policy matters. The longer you pay into a Whole Life policy, the more you build cash value and permanent death benefit. Both of these are the primary drivers in determining what kind of ownership interest you have in the company, and therefore what cut of future dividend payouts you deserve.

Inconsistent Dividend Calculations by Each Mutual Company

Hopefully what you’re realizing through the schematic above is that there are more pieces to the dividend puzzle than the dividend interest rate.

As much as we would like to quantify things simply in our minds, Whole Life insurance dividends are a lot more complex than the declared rate.

In fact, from 2021-2022 one major mutual company recently kept their declared dividend interest rate exactly the same, but they negatively adjusted their mortality component for an increase in COVID-related deaths.

One of our retired clients asked us to run an updated annual dividend projection for his retirement income. We couldn’t figure out why the actual dividend payout was projected to be less since the dividend interest rate stayed the same. We had to call the mutual company and do some digging to discover the reduced mortality credit does NOT need to be disclosed when declaring a dividend rate.

Remember that there is no consistent formula between companies when it comes to what part of the year they credit their dividends with interest. Not to mention, different mutual insurance companies vary with how much of the dividend pool each policyholder is entitled to based on current their cash value, death benefit amounts, rating class, and tenure in the policy.

If you are trying to figure out who the most competitive company is, we recommend running the exact same premiums through several different mutual companies’ illustration software to see who is currently the most generous with their dividends. Equally important is a company’s guaranteed growth structure since this is the rails that compounding dividends will ride on.

A savvy agent knows how to unbundle these factors in a comparative way for you to consider. We designed a special free report so you know exactly what to ask for.

Whole Life Dividend History Mutual & Stock Companies

As demonstrated above, there is no standardized formula that all mutual companies agree to follow when declaring their annual Whole Life insurance dividend rates. Different companies have entirely different methodologies of calculating exactly how and when the dividend interest rate is applied.

Each company differs as to how the actual dollar amount paid to their Whole Life policies is calculated.

Since there is no absolute value that translates apples to apples between different companies, this annual dividend interest rate is only valuable when comparing the same company in the past and in the present.

Below you can easily see if one particular company is trending with its peers or doing its own thing in a good way or a bad way. If you look down the columns vertically, it shows GREEN years where each company has raised its dividend interest rate (DIR), GRAY years where they have maintained their dividend interest rate, and RED years where they have lowered their dividend interest rate.

We added each mutual company’s historical dividend interest rate for reference, but again the dividend rate is nothing but an internal factor mutual companies use in determining the actual dividend payouts. So, it is only meaningful to see how much each individual company raised or lowered its own arbitrary dividend rate against itself over time.

Dividend Rate History Chart For True Mutual Companies

Dividend Rate History Chart For Stock Companies

(Including Mutual Holding Companies)

* One America (AUL) does not publish its dividend rates, only if they raised or lowered annually.

Unfortunately, we can only illustrate today’s already low dividend rates or lower, but history has shown how fluctuating dividends can greatly enhance the dividend payout of all future dividend payouts, even if rates spike only temporarily (like they may in the near future).

To see an example of a whole life policy over time, check out a video we put together titled “Fluctuating Dividends on a Historic Whole Life Policy from 1980.” This short video course goes back in time, revealing the dividend history of an actual policy started in 1980 compared to the lower cash value and death benefit projections that were originally illustrated.

Tax Treatment of Whole Life Dividends

Are Whole Life Dividends Taxable?

Whole Life dividends are generally not taxable since they are considered a return of premium. However, dividends can be taxable when the amount returned to the policyholder in cash exceeds the total amount they paid in premiums. Also, if the policyholder chooses to have their dividends accumulate at interest with the insurance company, the interest will be taxable.

These rare cases where dividends get exposed to tax can be easily avoided.

Let me explain:

Only take dividends in cash up to your basis (amount of premiums paid), and then borrow against your policy after that since loans are tax-exempt. Plus, your entire cash value balance (including the dividends you didn’t take out) keeps earning guaranteed interest as well as more non-guaranteed dividends.

Also, why would you ever have your dividends “accumulate at interest” with the insurance company causing taxable interest, when you could instead use your dividends to buy “paid-up additions” earning tax-sheltered growth and dividends within the tax sanctuary of your Whole Life policy.

Since both paid-up additions and accumulate-at-interest are potential life insurance dividend options, let’s explore all your dividend options below.

What can life insurance dividends be used for?

Whole Life dividends can be used with any of these 5 dividend options:

- Buy paid-up additional insurance (PUA)

- Earn interest from the insurance company

- Pay some or all of your premium due

- Pay down an outstanding policy loan

- Paid out to you in cash

Once your annual Whole Life dividend is declared, you have any of these options, and you can also change how your dividends are allocated in any given year.

Let’s drill a little deeper into each Whole Life:

- Dividends to Purchase Paid-Up Additional Insurance (PUA) – When using dividends to purchase PUAs, only a very small portion (5%-10%) goes to buying the paid-up insurance, while the lion’s share of the dividend payout will roll back into your policy cash value. It will be added to your guaranteed cash value, getting that steady growth rate every year going forward, as well as helping you to claim a bigger cut of future dividend payouts. Plus (unlike the accumulate at interest option) the growth you get from PUAs remains sheltered from taxation inside your Whole Life insurance policies.

- Dividends to Accumulate at Interest – With “accumes” you have the insurance company pay you an annual taxable interest rate on your dividends. So, although your dividends technically do accumulate-at-interest, this interest rate is often paltry, not to mention it would be taxable since you left the tax sanctuary of the policy.

- Dividends to Reduce Premium – That’s right. Whole Life insurance dividends can pay your premiums. You can always apply your dividend payout dollar for dollar to reduce how much premium you’re required to pay on your base Whole Life insurance policy.

- Dividends to Reduce Loans – You can apply your dividend payout dollar for dollar to reduce any outstanding policy loan balance you have.

- Dividend in Cash Option – By electing the cash dividend option, you can have your Whole life insurance dividends paid from a life insurance policy are paid to you outright in cash. Whole Life dividends are considered by the IRS to be a refund for an overpayment of prior premiums. Therefore, the cash dividend option is not taxable to you so long as they do not exceed how much you’ve paid into the policy in terms of total premium. As previously discussed, you can always take a loan against your policy if you need tax-exempt cash.

What should I do with my whole life dividends?

Paid-up Additions (PUAs) are the best dividend payment option if your goal is to maximize the performance of both your Whole Life’s cash value and death benefit. Choosing the paid-up additions dividend options creates the most long-term compounding of your cash value, death benefit, and therefore future dividend payouts.

We wrote an entire article about paid-up additions as Whole Life’s turbo-charger since they immediately:

- Increase your cash value by 90%-95%

- Buy 1.5x – 4.5x of paid-up death benefit depending on age/rating

- Increase your Whole Life’s policy’s cut of future dividend pools

- Lift your policy’s guaranteed growth curve, since your cash value must equal your death benefit by age 121.

There may be times when it seems like other dividend options may seem more appropriate, but not if these are only temporary needs, and your primary goal is to maximize your Whole Life policy’s compounding.

For instance, if you are experiencing a temporary cash flow crunch where you can’t pay your Whole Life base premium on time, then you could elect to have your dividends to reduce premium.

However, you would then lose all the future growth those dividends could’ve compounded into as Paid-Up Additions. Another solution would be to have your Whole Life policy borrow against its own equity to pay the base premium via an Automatic Premium Loan (APL). That way your dividends could continue maximizing compounding through purchase paid-up additions.

Another temporary issue would be if you already had a loan outstanding. It may be tempting to switch your dividend option to reduce the loan. Again, doing so would cause you to miss out on all the future compounding potential of those dividends if they had purchased paid-up additions. A temporary solution would be to have your dividends buy more PUAs and keep floating the policy loan, since your full cash value continues earning interest and dividends (even the amount you borrowed).

If either temporary situation becomes a permanent problem where you can no longer pay either premiums or a policy loan, you can always do an RPU, Whole Life’s ultimate bailout provision. RPU stands for the Reduced Paid-Up non-forfeiture option available by law with any Whole Life policy from any mutual company. It was created to offer consumers a smaller but fully paid-up Whole Life policy if they can’t afford to keep paying for whatever reason.

Since you are prepared for the worst with this ultimate legal bailout provision, we believe it’s often better to hope for the best. Having your policy dividends buy paid-up additions as early and often as possible will build up substantial guaranteed cash value as well as contractually paid-up death benefit, both of which increase your share of future dividend payouts from your mutual insurance company.

Life Insurance Policy Dividends During Your Distribution Years a.k.a. “Retirement”

Once you are ready to retire, you may be ready to stop funding your policy, and no longer want to pay back loans. For this stage, we recommend switching future dividends to be paid in cash for a steadily increasing income stream.

Taking dividends in cash does not decrease your death benefit, yet your cash value still climbs each and every year on a guaranteed basis. If you want a more aggressive income stream, you can also surrender PUAs purchased from prior dividends. This will obviously reduce your death benefit but may provide a much higher ongoing retirement income stream.

Once you have taken out more cash than you have put into your policy, you can always take a policy loan against what cash value is left in your policy to avoid taxation. So long as some minuscule amount of death benefit is in-force at the time of your passing, there is legally no tax imposed on any prior lifetime withdrawals, loans, or the death benefit itself.

One Mutual insurance company offering Whole Life has even created a special rider called an “Overloan Protection Rider” to guarantee that your policy does not lapse from unpaid loans, regardless of how long you live without paying back loans.

Whole Life Dividends If You Get Sick in Retirement

Keep in mind, that the general advice given above in sections assumes that preserving death benefit is not your priority. However, if you find yourself in bad health, you can change your dividend option back to purchasing PUAs to maximize the amount of tax-free death benefit left behind for heirs.

Although Whole Life dividends can be a great source of tax-free income during your lifetime, a Whole Life policy’s death benefit will always be greater than the amount of cash value you can spend while you’re alive.

Final Word on Whole Life Dividends

There are certainly an awful lot of myths, misunderstandings, and misinformation when it comes to dividend paying Whole Life insurance. Don’t get me wrong, dividends will matter when it comes to the overall performance of your Whole Life policy.

But arguably more important are Paid-Up Additions, an option once dividends are declared. You can learn more about how Whole Life’s growth components and riders interact with each other here.

Also, clients will often judge a mutual insurance company’s dividend rate even though each company’s dividend formula and crediting methodology differs from each other.

The best thing you can do is work with a financial professional who is willing to educate you on the top mutual companies and compare their leanest possible designs for you. That way, you can see not only how robust the dividends are, but also the efficiency of the guaranteed growth and PUA ratios to provide the best overall performance.

Book a call with our team below if you are ready for that kind of analysis.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com