What is a Mutual Insurance Company vs. a Stock Insurance Company?

Understanding the difference between a Mutual vs. Stock insurance company as well as the lesser-known “Mutual Holding Company” can help you choose the right type of insurance company to help with your family protection plan as well as your long term investment strategies.

What’s the Difference Between Mutual Insurance Companies vs. Stock Companies?

Mutual vs. stock insurance companies differ by their ownership structures, as well as how each distributes profits. Mutual companies are owned entirely by Whole Life policyholders, who share profits in the form of a dividend. Stock insurers are owned by investors who hold shares of stock. Stock insurance company profits (earned from policyholders) increase the value in their shares of stock or may be distributed via stock dividends.

Dividends from Mutual Insurance Companies vs. Stock Companies

Mutual company dividends are paid to owners of the company, their Whole Life policyholders. Since dividends are technically a return of premium to the policyholder, these dividends receive special tax treatment per the IRS. Learn more about how Whole Life policy dividends work from mutual insurance companies.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

With one less hand in the cookie jar than stock insurers, it is easier for mutual companies to deliver consistent policyholder value. These annual dividends are not guaranteed to be paid. That said, all the oldest and the largest mutual companies in the US have consistently paid a dividend every single year for well over the last hundred and sixty years, in spite of:

- Recessions

- Depressions

- World Wars

- Deflation

- Inflation

- Etc.

Some of these mutual insurance companies even paid a dividend throughout the Civil War!

Table of Contents

Why choose a mutual company over a stock company?

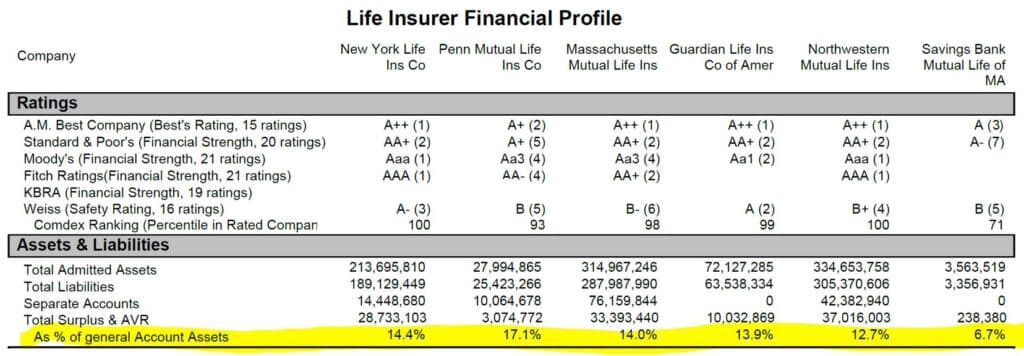

Mutual life insurance companies are the most solvent financial enterprises in existence. A mutual company’s primary purpose is the long-term financial commitment to policyholders. This often promotes more conservative investment strategies, expense management, and larger surpluses on a mutual company’s balance sheet than seen in their stock company peers.

You see, stock insurance companies are scrutinized every quarter on the stock exchange. Thus, stock insurers focus more on shorter-term shareholder profits, especially since executive teams are often compensated with dated stock options.

Which true mutual companies still offer dividend-paying whole life insurance to new policyholders?

- New York Life (since 1845)

- Penn Mutual (since 1847)

- Mass Mutual (since 1851)

- Northwestern Mutual (since 1857)

- Guardian Life (since 1860)

- Savings Bank Life Insurance (since 2017)*

* recently converted from a stock insurance company to a mutual company

What is the advantage of a stock insurance company over a mutual company?

The only advantage stock insurers have over mutual companies is in their ability to raise capital. Either company type can take on debt, but stock insurance companies have the unique advantage of issuing stock to raise money. Whether it be for financial stability, recruiting talented executives, or acquiring other insurance companies, a stock insurer can simply issue shares of stock to finance these initiatives.

(Note: The inability to raise capital through a stock exchange may be a disadvantage for mutual company startups. However, this has not slowed the growth of true mutual companies as consumers continue flocking to dividend-paying whole life, a product no longer offered by stock insurance companies.)

Is a “Mutual Holding Company” a stock or a mutual insurance company?

A mutual holding company is technically a stock company formed by consolidating the ownership rights of mutual policyholders into a separate parent company from their operating subsidiaries.

What’s the advantage of a Mutual Holding Company over a true Mutual Company?

The only reason to reorganize a true mutual company into a mutual holding company is the same as with any stock insurance company: the ability to raise capital by issuing shares of stock.

As long as the mutual holding company issues no further shares of stock in the parent or subsidiary companies, then their whole life policyholder-owners will not be diluted. In this case, a mutual holding company would feel the same as a true mutual company.

However, conversion to a mutual holding company may eventually lead to dilution or demutualization as reported by S&P Global in 2020 after a wave of COVID-related insurance company mergers:

Benefits to mutual insurance company conversions beyond M&A, according to Sentry and SECURA, include broader access to capital and the ability to grow ancillary and non-insurance subsidiaries while preserving the benefits of mutuality for current members. But those conversions could, over time, lead to the dilution of the ultimate voting control currently held by the companies’ members.

Which mutual holding companies (or subsidiaries) are still selling dividend-paying whole life:

- Mutual Trust Life (2015) was absorbed by Pan-American Life Insurance Group

- Lafayette Life (2005) merged into Western & Southern Financial Group

- One America (2000) became the stock subsidiary of American United Mutual Insurance Holding Company

- Ameritas (2000) merged with Acacia Mutual Holding Company

- National Life Group (1999) merged into National Life Holding Company

Make no mistake about it, converting from a true mutual insurance company into a mutual holding company is taking one step closer to demutualization or perhaps the softer, better-sounding dilution route.

What is demutualization of an insurance company?

Demutualization is the process where a mutual insurance company, owned by its policyholders reorganizes its ownership structure into either a stock insurance company where shares of stock either trade on an exchange or are sold outright to private companies (including private equity groups).

How does demutualization affect whole life policyholders?

Participating whole life policies of a demutualized insurance company may or may not receive dividends going forward as a return of premium. The policies themselves are stripped of any company ownership rights. But the newly demutualized company will buy the ownership interests from policyholders in exchange for cash or stock in the new parent company.

What are some examples of demutualized stock insurance companies?

- Ohio National (2022) in exchange for cash payments

- Prudential (2001) in exchange for PRU stock

- Met Life (2000) in exchange for MET stock

- John Hancock (1999) in eventual exchange for MFC stock

- Equitable (1992) in eventual exchange for AXA stock

What Happens When a Mutual Insurance Company Changes into a Stock Insurance Company

Regardless of their ownership structure, both stock and mutual insurance companies tend to be stable, predictable, and profitable businesses for the most part. To illustrate this, we are going to look at two stock company charts that were once mutual insurers. Both of these charts are set on the “Max” timeframe, meaning the chart goes back to their initial public offering on the New York Stock Exchange, not to the beginning of their existence as mutual a company.

Since both of these insurers have been around for over 100 years, you would expect these charts to go back much further than the early 2000s. That is because only the history after demutualizing will show up on a historical stock chart. (Demutualization is the process of transforming a private mutual company into a public stock company.)

Notice how at first the dividends were paid annually just like the policy dividends when it was a true mutual company. Eventually the stock company began paying stock dividends quarterly to appease Wall Street and investors holding shares of stock.

As you can see from the steep rise in value after the IPO, acquiring an early piece of ownership in a solid mutual company can be a profitable venture.

Let’s just say that prior to the demutualization process, the only way to “get a piece of this rock” was to buy one of the company’s whole life policies. However, once this company demutualized, anyone off the street could immediately become part owner of this company by buying shares of stock on an exchange regardless of whether they owned a whole life policy or not.

When this company demutualized however, every single whole life policyholder was issued shares of stock proportionate to their policy values in addition to being able to keep their whole life policies intact. This practice is commonplace when mutual companies demutualize into stock companies.

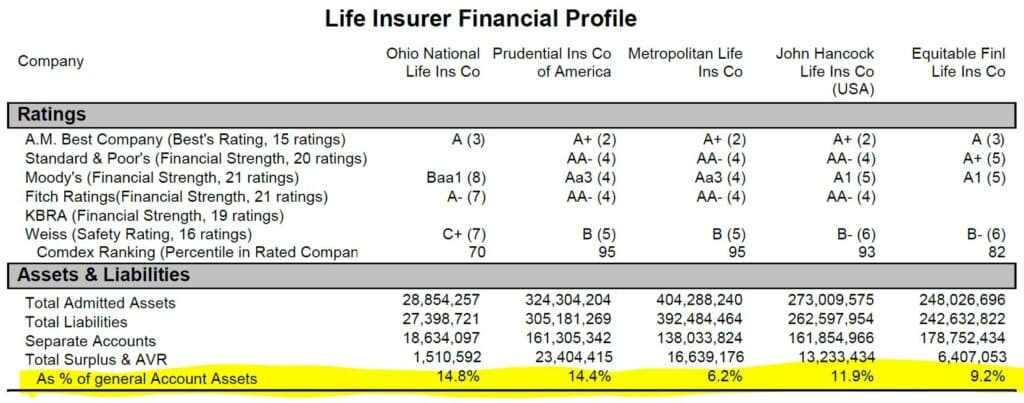

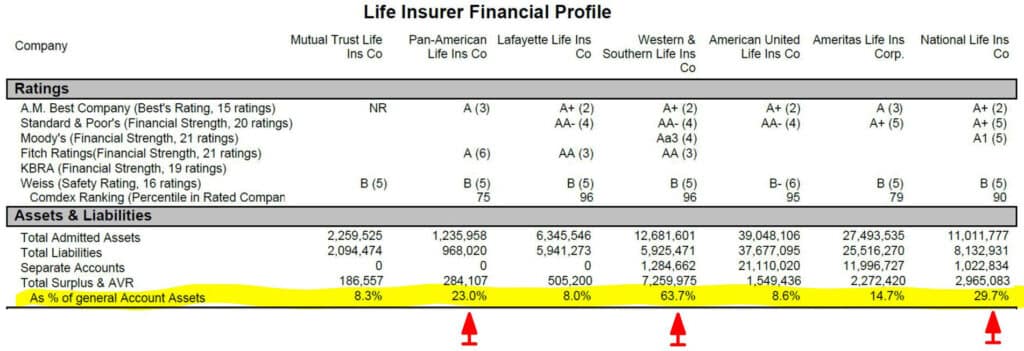

Company Surplus with Mutual Companies vs. Stock Insurers

On average, mutual insurance companies tend to maintain much larger surpluses as a percentage of total assets than their stock insurer peers. This is in line with a mutual company’s long-term commitment to multiple generations of policyholders.

Most of the old and solid mutual companies in the U.S. have already built a very robust surplus over their liabilities since their main focus is on delivering continued long-term policyholder value.

Conversely, stock insurance companies often retain smaller surpluses because of the quarterly scrutiny from Wall Street with how they are delivering value to stockholders regardless of what happens to policyholders.

You can see how holding smaller surpluses on their balance sheet does result in how whimsically these demutualized stock companies have been valued by Wall Street over time.

When looking at some of the parent companies in these Mutual Holding Company structures, you can see the surpluses of the parent can be quite large. This means they have aggresively been siphoned off profits from the operating insurance company that is now a stock company subsidiary.

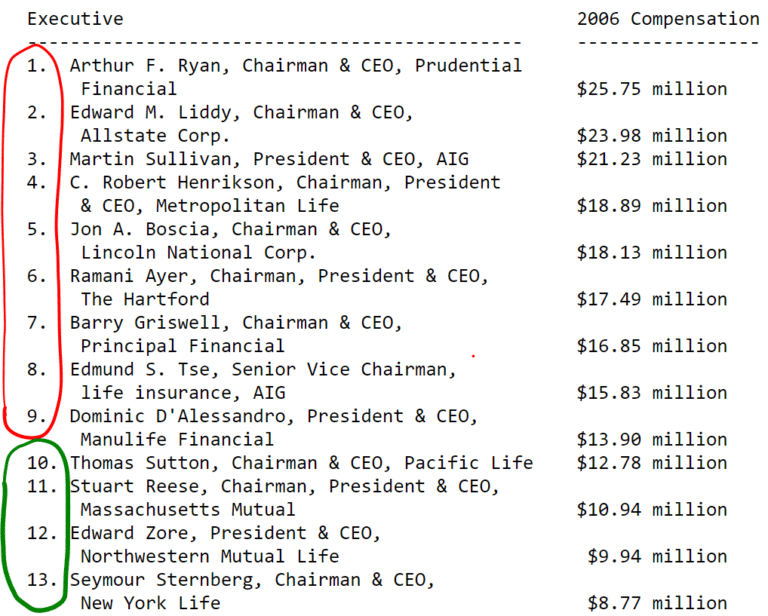

Mutual Insurance Companies vs. Stock Insurance Companies with Management Structures

Surveys have shown that mutual insurers are much tighter on the purse-strings when it comes to executive compensation than their stock insurer counterparts. This is due to a more fiscally conservative stance that pervades the culture of mutual insurance companies when it comes to

- Investment strategies

- Product parameters

- Management styles

- Compensation packages

Take a look at the infographic below from National Underwriter magazine, a life insurance industry news source. The annotated red circles indicate the Chairmen and CEOs of stock insurance companies vs. mutual insurance companies indicated by the green circles.

You can click here to access the entire article on life insurance executive compensation by National Underwriter.

Click here to read “How Safe Are Life Insurance Companies” so you can better understand the safety measures for these insurance companies backing your promises for a lifetime.

Voting Rights with Stock Insurance Companies vs. Mutual Companies

Let’s discuss how these highly compensated executives are chosen. Since mutual insurers are owned by their policyholders, every qualifying policyholder gets to vote for the board of directors. The mutual insurance company’s elected board will ultimately appoint executives that they believe will benefit the long-term interests of the mutual insurance company’s policyholders. With this primary purpose in mind, it’s no wonder that a mutual company executive compensation is often less than half that of a peer stock insurance company.

Conversely, stock insurance companies are not owned by policyholders unless the policyholders also happen to own shares of stock in the same insurance company. The investors that collectively own the company have either bought stock outright, or they are employees who have earned stock via bonus or stock options. The primary purpose of a stock company’s executive team is NOT to prioritize policyholder value, but rather to increase profits and shockholders’ equity.

Don’t get me wrong, life insurance products sold by stock companies can also provide consumers with safety and predictable growth. However, all things being equal, I think you can clearly see the advantage of buying into a mutual company by owning one of their participating Whole Life policies.

Mutually Beneficial Exploration

The long-standing symbiotic relationship of mutual insurance companies to their policyholders has gone on for well over 1.5 centuries now. Delivering long-term value for policyholders is the primary purpose of these steadfast financial giants owned by no one besides the clients they serve.

Although stock companies also have a duty to eventually deliver on their promises to policyholders, it becomes evident every single quarter that stockholders come first in that ownership structure

It’s also important to understand the distinction between a true mutual company and a mutual holding company since we have seen many of these mutual holding companies either demutualize or dilute policyholders’ over time.

When developing a financial relationship with an insurance company that likely will last your “whole life”, I think it’s pretty obvious that choosing a true mutual company is the way to go.

Click here to schedule a no-obligation meeting where we educate you about the subtle nuances between the top mutual companies you should be considering and why. We will help you understand the qualitative differences as well as create apples-to-apples cash value comparisons using premium numbers that fit your budget, so you can customize your perfect program.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com