The Best Whole Life Insurance For Infinite Banking

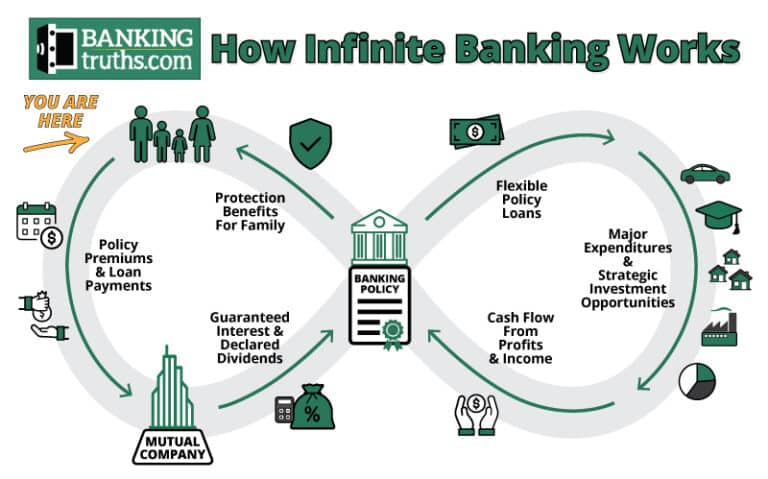

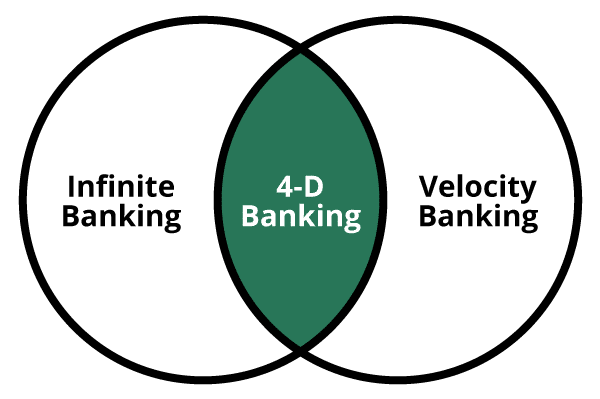

This article takes a deep dive into understanding the key drivers behind what qualifies the best dividend-paying Whole Life companies to be an ideal fit for the Infinite Banking Concept. The amount of features and riders available on Whole Life can be overwhelming when it comes to specifically designing it for Infinite Banking and cash value performance.