5 Steps to Be Your Own Bank with Whole Life Insurance

Becoming your own banker may seem like smoke & mirrors, but when this private family banking concept is implemented correctly, you actually can recoup your cash flow that would normally be lost forever while safely channel a massive amount of compounding in your favor.

The most popular private banking bestsellers (in bullets below) echo this bold claim, but they don’t really elaborate in detail on the necessary steps to become your own banker:

- Becoming Your Own Banker – The Infinite Banking Concept * by Nelson Nash

- Bank on Yourself ** by Pamela Yellen (see footnotes for trademark details)

Upon first hearing that you can “be your own bank” you may have thought that you’d be starting a local bank branch in your neighborhood.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

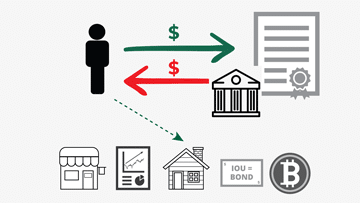

By now though you probably realize these books discuss borrowing against some sort of magical life insurance policy to double dip on growth when becoming your own banker.

Now you’re probably left wondering if this whole “be your own bank” concept is a scam or legit, right?

I can personally attest to the fact that when executed correctly, borrowing against a properly-structured life insurance policy as your own bank can produce vastly more liquid wealth than if you saved and paid cash for everything in your life simply because of a very powerful mathematical force called compounding.

Wait… What?

Here are the most common ways people access whole life loans to become your own banker:

- Cars & Trucks

- College Tuition

- Real Estate (personal or investment)

- Business Inventory

- Business Equipment

- Major household expenses

Yes, there is actually merit to the underlying mechanics of this so-called “private family banking strategy” at the heart of these wordy books promoting “The Infinite Banking Concept®” * and “Bank on Yourself®.” **

However, I will boil down this private family banking concept much more succinctly in 5 simple steps below.

If you’d rather watch a 6-minute video depicting the simple science behind this banking concept, we put together a video specifically for that purpose. Otherwise, keep reading to learn the 5 steps to becoming your own banker…

The 5 Steps to Becoming Your Own Banker with Whole Life Insurance

Step 1 - Start a Whole Life Policy to Be Your Own Private Family Bank

Quite simply, the strategy requires that you take out a whole life insurance policy on yourself if you can qualify medically for it. If not, you can purchase a policy on someone close to you to be your own bank.

Warning: Insurance companies hate STOLI (stranger-owned-life-insurance) and so does the IRS.

However, here are the types of relationships insurance companies will sometimes issue a whole life policy on for you to own and control as your own bank:

- Spouse

- Child

- Business Partner

- Key employee

- People you have loaned significant amounts of money to

Note: With proper documentation, other scenarios may be possible to become your own banker using other people as the insured for your infinite banking life insurance.

Once you have identified who to buy insurance on, what’s the next step?

Step 2 - Whole Life Insurance Policy Design Necessities and Add-ons to Become Your Own Banker

Now, you shouldn’t get any type of life insurance policy as your private family bank.

Nelson Nash’s book “The Infinite Banking Concept – Becoming Your Own Banker” and Pamela Yellen’s “Bank on Yourself” books insist that it must be a Participating Whole Life Insurance Policy from a mutual insurance company.

Although we are big fans of using certain Whole Life insurance policies for the infinite banking strategy, we also recognize that certain Indexed Universal Life insurance (IUL policies) may also work if structured properly. However, since there is additional risk associated with these types of policies, we recommend that you fully understand all the pros and cons of Indexed Universal Life before using IUL to be your own bank.

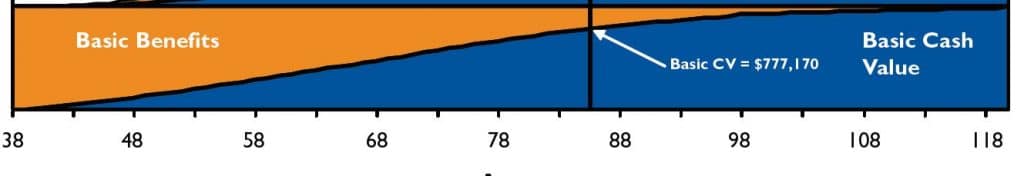

Getting back to using the time-tested & true Whole Life insurance to become your own banker, we fully agree that it’s of utmost importance to get your policy from a Mutual Life Insurance Company (as opposed to a stock insurance company). This is critical since mutual companies are owned by policyholders and share their profits with Whole Life policyholders in the form of dividends. It’s what makes Whole Life insurance cash value a true non-correlated asset with solid steady growth rates, unlike “high-yield” savings accounts or CDs.

In order to maximize cash value growth and early access to the equity inside your own bank, you also will need to make sure your Whole Life policy includes these 2 key riders:

- Paid-Up Additions (PUA) Rider: this is how to turbo-charge your “banking engine.” (more on this below)

- Term Insurance Rider: this would be like the titanium frame that holds the turbo-charged engine in place.

FAQ: “But wait, a term insurance rider? I thought you needed Whole Life for IBC banking?”

Answer: When being your own bank, you do need Whole Life. However, blending it with this additional term rider can substantially bring down the overall cost of the total death benefit needed to support overfunding. It also increases the amount of Paid-Up Additions you can buy in the early years, which is like the turbocharger that will greatly accelerate ongoing growth inside the whole life policy as your own bank.

Watch our “Whole Life’s Growth Components & Riders” video to fully understand the proper construction of an infinite banking life insurance policy.

Now that you know who to buy insurance on, where to buy it from, and which features you want to add, what’s the next step to be your own bank?

Step 3 - Properly Funding Your Life Insurance Policy So You Can Become Your Own Banker

Now, I realize that it seems completely counterintuitive to pay any more than you absolutely need to pay when it comes to insurance. So, prepare to have your paradigm shifted and your mind blown!

The way to outrun the internal costs of a Whole Life insurance policy is to pay additional premium over and above the amount required for the basic coverage. In fact, you will want to pay substantially more when becoming your own banker… as much life insurance premium as the IRS will let you.

[Hint: When the IRS regulates anything, doesn’t that usually mean that they’re trying to limit something good going on there?]

Here are the 4 reasons you want to pay the maximum amount of Whole Life insurance premium to be your own bank:

- The commission paid to the agent for the additional overfunding payments is peanuts

- 90-95% of this additional premium goes straight to your cash surrender value (in other words, these overfunding payments become immediately accessible inside your private family bank)

- The other 5%-10% of this extra payment which doesn’t go toward building immediate equity goes to buying a little slice of extra permanent death benefit (called a Paid-Up Addition or PUA). What’s nice is that no further premiums will be due on PUAs since it is contractually paid-up with this one-time payment, hence the term Paid-Up Addition. PUAs immediately increase your Whole Life policy’s guaranteed cash value, as well as entitle you to a bigger cut of future dividend pools from your mutual insurance company.

- These Paid-Up Additions get stacked onto your cash value, which contractually starts growing at a favorable guaranteed rate of return (even if no dividends were ever paid again).

Now that you’ve got your banking engine in place, you’ve filled it with fuel, and the engine is humming, now what…?

Step 4 - Use Cash Value to Be Your Own Bank and Fund Expenditures and Fuel Outside Investments

Using our car analogy, it’s time to take your infinite banking life insurance policy for a ride. Most people don’t want to accumulate wealth simply just to have an impressive set of ink dots on an annual statement. You want to become your own banker to buy things, build wealth, and invest for your retirement and legacy.

Now you can utilize the equity inside your own bank to do these things at any time for any reason using one of these 4 methods:

- Withdraw your cash surrender value or…

- Borrow against your cash surrender value using the guaranteed policy loan feature for maximum flexibility

- Increase your total borrowing capacity by using outside financing without even having to pledge your policy (i.e.: 1.9% Auto Loan)

- Pledge the policy as collateral to a Cash Value Line of Credit (CVLOC) program when you can often get a better rate than a policy loan (or for convenience when you own multiple policies).

Now, I know that most of you just cringe and see RED when you hear the words BORROW and LOAN.

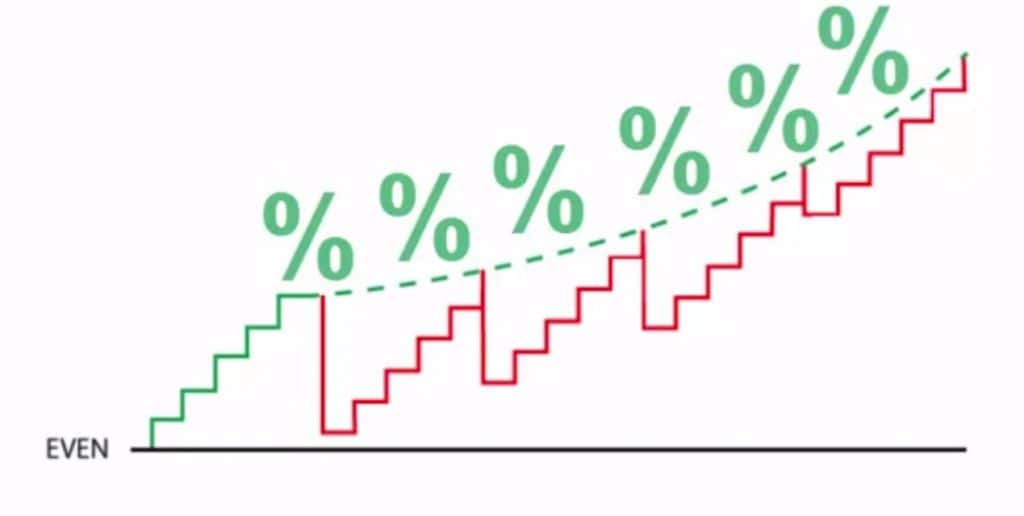

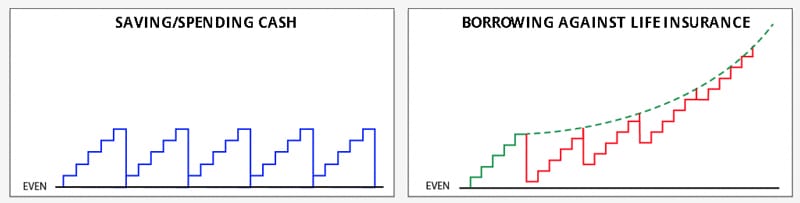

That said, even though you are technically borrowing funds when becoming your own banker, your entire cash value balance continues growing within your Whole Life insurance policy, including the amount you borrowed.

Hmmmm…

You see, some people mistakenly think they are “borrowing out” the cash value from the policy and “paying themselves back with interest.” That’s not true at all, and is often used as a deceptive sales pitch.

Your cash value never actually leaves your Whole Life policy, even when you take a loan and “borrow against” it. You see, the mutual insurance company is happy to give you a loan out of their general account because they’re always holding your cash value as collateral, and it’s guaranteed to grow every year no matter what!

That’s why it seems like you pay yourself back the interest.

Again, this is important:

None of your cash value ever leaves your Whole Life policy when you borrow! Your entire cash value balance continues to grow inside your banking life insurance policy, INCLUDING the amount you borrowed.

Question: “What if I don’t ever want to pay back the darn loan?”

Answer: “You don’t have to, but you may want to. And you have the ultimate flexibility in how you do that.”

Step 5 - Pay Down the Loan ON YOUR TERMS with your Own Private Family Bank

Thankfully, a Whole Life insurance policy loan is a private loan between you and the insurance company, so it doesn’t show up on any credit report. Also, since the mutual company is holding your growing cash value as collateral, there’s no stringent payment structure in place with your own bank. Here are your options for repayment:

- Pay principal and interest on whatever schedule you want

- Make interest-only payments

- Pay nothing until you can make a balloon payment for the entire balance

- Pay nothing (hoping the cash value growth keeps pace with the loan interest that’s rolling up into the loan balance) then eventually have the Whole Life death benefit pay off the loan when the insured passes.

Needless to say, there’s no other institution (or even a mafia loan shark) that offers this kind of flexibility to be your own bank with. Obviously, you should schedule some sort of regular loan maintenance, but it’s certainly not required by the insurance company.

In fact, I have contractor clients who bid on jobs and have to come out of pocket for materials and labor costs. They float a Whole Life policy loan for close to a year and then pay it off in one fell swoop when they get paid for the entire job. We encourage them to pay whatever minimum interest maintenance is needed to maintain simple interest on a flat loan balance while earning compound interest on an increasing cash value balance. However, when a banking life insurance policy is performing well as your own bank, the minimum required loan payment may be nothing at all.

A lot of people hear how about paying interest on the loan and think, “Ah see, I knew there was a catch! I knew it was too good to be true.”

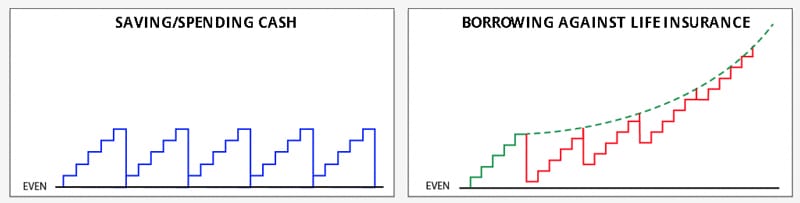

But think about it – even if you just kept your cash in a bank account and made a withdrawal for every single purchase, don’t you start making deposits shortly thereafter to true up the account for the next purchase?

So if you apply the exact same “save-spend-replenish” routine but instead funnel the exact same cash flows through a properly designed Whole Life insurance policy as your own private family bank, you will often see that the difference in net wealth is staggering when practicing what they call the infinite banking concept.

Here are the 3 reasons why Being Your Own Bank using life insurance works:

- Your cash value usually earns a much better growth rate than any bank account, CD, or even safe bonds (with minimal fluctuating values)

- The growth, as well as any lifetime distributions, are immune from income tax as long as some small amount of whole life insurance policy’s death benefit stays in place until the insured passes away.

- When you borrow rather than make a withdrawal, your full cash value continues growing inside the policy despite any loans you have against the policy with the insurance company.

That’s it! And that third factor is huge. Believe it or not, the combination of these 3 factors can contribute to vastly more wealth for the policyholder if this banking strategy is employed properly.

What I mean by that is that you should pay your loans back as soon as you can so you can continue to practice the banking concept throughout your Whole Life.

Question: If you have a goose laying golden eggs, when would you want to kill the goose?

Answer: Never!!! In fact, feed that goose as early and as often as you can so it keeps laying more and more golden eggs.

Let’s wrap up this whole “Be Your Own Bank” thing:

Between all the books, videos, radio ads, and insurance agents out there discussing “The Infinite Banking Concept®”, “Bank on Yourself®” and Velocity Banking, the information surrounding becoming your own bank can be overwhelming. Hopefully, our 5 Steps to becoming your own banker described in this article has simplified the mechanics of this banking strategy for you.

If you have specific questions about the general strategy described above, or you want to see how it can look with your own personal finance goals, we invite you to schedule a call to discuss your unique situation with one of our team members so you can have all your questions answered and start the architecture of your own private family bank.

If you’d like to keep reading, click to learn more about the absolute best dividend-paying whole life insurance policy to become your own banker.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

The Top 4 Myths Behind Becoming Your Own Banker (Article)

Learn How This Banking Concept Really Works (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life Insurance (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

John “Hutch” Hutchinson has no affiliation or association with any of the following and does not feel compelled to do so since he is a published life insurance authority, policy design geek, and a multi-faceted accredited financial strategist:

- The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

- Bank on Yourself, Pamela Yellen, nor her book The Bank on Yourself Revolution

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.

** “Bank On Yourself®” is a registered trademark of Hayward-Yellen 100 Limited Partnership.