How Life Insurance Policy Loans Differ From Traditional Debt

Many people hear the word “loan” or “borrow” and immediately see red!

A policy loan is substantially different than traditional loans in many ways. Believe it or not, utilizing the policy loan feature can actually put you in a better financial position than someone who pays cash for the same transaction. This article will explain this concept through the course of answering the most frequently asked questions about policy loans.

Here we go…

Am I Borrowing My Own Money?

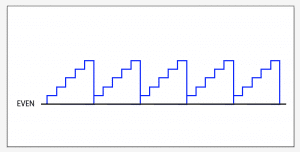

Contrary to popular belief, you don’t borrow your own money or borrow “from your policy.” In fact, when you take a policy loan, your cash value never actually leaves your policy. It continues earning the guaranteed growth plus any dividends declared during the time of the loan.

Whatever interest rate the insurance company charges you to borrow from their general account can be offset by the credits that your policy continues to receive (even while your equity is out on loan doing double-duty for you).

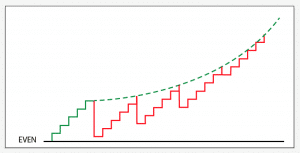

So each time you pay down a lien against your cash value, you end up at a higher spot on your compound curve because it was never thwarted by withdrawing funds.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

How Easily Can I Get Money?

It’s simpler than you think. The reason why we are outlining the behind-the-scenes mechanics of a policy loan below is so you can fully understand what’s going on. Here it is in 7 simple steps.

- You call your agent or the insurance company directly and request a loan. Certain companies allow you to use an online portal, or you can sometimes even use a special checkbook.

- The insurance company determines whether or not you actually have enough equity (cash surrender value) to support the loan.

- If so, the insurance company immediately sends you a check from their general account with no questions asked.

- The insurance company puts a lien against a portion of your cash value for the amount you borrowed plus interest as it accrues.

- You deposit the funds into your checking account and use it for your desired purchase or investment.

- Your entire cash accumulation balance continues to earn interest and possibly annual dividends inside the policy (including the amount you borrowed because it never actually left the policy).

- Whenever you choose to pay back principal and/or interest (neither is on a rigid or mandatory schedule), the lien against your cash value will then be reduced accordingly.

Are Policy Loans Better Than Bank Loans?

A policy loan may not be the cheapest loan you can find, but barring a loan from your loving family, it will definitely be the most private and flexible loan you can get.

Even though a policy loan is a private transaction not showing up on any credit reports, the insurance company has obligated itself to make these loans available to you on a guaranteed basis. In fact, they are happy to provide it to you privately on a no-questions-asked basis because they are holding your cash value as collateral.

What are the Loan Terms?

Technically a policy loan is held against the death benefit, so it doesn’t “come due” until the insured dies. When that happens, the beneficiary gets the death benefit minus whatever loan balance as well as any accrued interest due at that time.

For these reasons, the insurance company won’t even set any rigid terms for the loan. You set your own flexible loan terms, and you can change them as often as you’d like. As long as you have more cash value than loan outstanding, the insurance company won’t bug you for a payment at all. Remember that your entire cash value balance continues to earn interest and annually-declared dividends.

Unlike traditional loans where some regular loan maintenance is mandatory, you have all 6 of these repayment options with a policy loan:

- Set up automatic principal and interest payments from your checking account

- Set up automatic interest-only payments from your checking account

- Manually send in interest and/or principal payments sporadically whenever you are able

- Let interest roll up into your total loan balance until you can make a balloon payment (Note: Great for real estate investors and contractors)

- Pay nothing if your cash value growth offsets the accruing interest due

- Have the death benefit proceeds pay off the loan at the time of the insured’s passing.

Obviously, you don’t want to kill the goose that can continue laying golden eggs for you. However, circumstances sometimes warrant that you must exercise your right to some of the more flexible options listed above. For example:

- Maybe there’s a family emergency, and you need cash quick.

- Maybe you’re a business owner, and your accounts receivable are slowly funneling in, but you need cash for your next project.

- Maybe you’re a real estate investor that found a choice fixer-upper needing some serious TLC, and you know you’ll profit much more than your original investment back on the deal.

All these are perfectly fine. Once whatever temporary cash-flow-crunch subsides, you would be wise to diligently build up your equity again by paying down the lien against your growing cash value. That way you have full access and flexibility should you ever need it again.

What If I Can’t Ever Service the Loan and I Default?

Well, let’s think about this. Even though you are borrowing from the insurance company’s general account, you could simply choose to wipe out that loan any time on a moment’s notice. Remember, they are holding a liquid asset of yours that’s safely compounding and large enough to extinguish the loan whenever you want. So are you technically in debt?

If you did surrender your policy to wipe out the loan, wouldn’t you basically be in the same position as if you had just paid cash in the first place (no loan due but no cash either)?

Let’s be clear that the insurance company won’t ever let you get upside down. If it ever got close to that point, they would give you some notice to pay the minimal maintenance payment, or you could always just surrender your policy’s cash value to extinguish the loan.

Why Should I Bother with Borrowing?

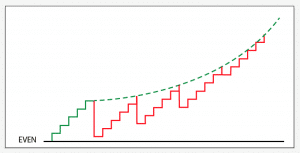

Let’s assume for a moment that the policy loan rate and the crediting rate you earn from your collateralized cash value is exactly the same. “What’s the point,” you ask?

“Why not just withdraw the money and pay cash?” First of all, you actually can withdraw your cash value if you really want to.

However, there are 5 specific reasons why you may not want to. In fact, I wrote a very detailed blog post on this debate complete with graphics and some simple examples.

The long and short of it is that you maintain compounding on your entire cash value balance, including the portion collateralizing the loan. People underestimate the long-term power of compounding, and you actually kill it every time you withdraw cash from your balance sheet and put it on someone else’s.

By borrowing against your equity, you keep your place in line on that almighty compound interest curve that gets steeper and steeper the longer you keep your money on it working for you.

You also maintain the additional benefits that life insurance can provide like the death benefit of course, and potentially some other benefits like:

- Disability benefits

- Critical injury benefits

- Critical/Chronic illness benefits

- Terminal illness benefits

- Creditor protection of your cash value against lawsuits (Note: especially important for real estate investors and business owners in high-risk industries).

How many of these benefits you get depends on how your policy is structured, but these can often be free riders attached to your policy.

Hopefully, you won’t ever need this kind of protection, but if you did, the benefit to you and your family could be game-changing.

Conversely, what would it look like for your family if you did NOT have this kind of protection in place?

Let’s be clear that none of these benefits occur with paying cash or opening a money market account.

You can learn more about life insurance loans by reading “5 Reasons Borrowing May Be Better Than Paying Cash” to really understand the potential power of a policy loan.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com