Whole Life’s Guaranteed Growth and 4 Ways to Accelerate it for Banking

A Whole Life insurance policy’s cash value is contractually guaranteed to equal the death benefit as soon as the insured dies or at age 120, whichever comes first.

That may sound laughable now, but with the advances in modern medicine, that may occur with some of the juvenile policies I’m placing today.

Even though you may not intend to reach age 120, what’s nice is that your Whole Life policy’s cash value climbs on that track each and every year on a guaranteed basis toward your total death benefit amount. That’s mainly what we’ll be discussing below, as well as how you can accelerate that phenomenon.

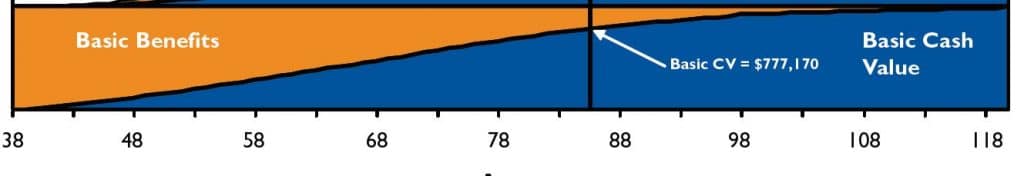

Your guaranteed cash value growth is unfettered by prevailing interest rates, economic downturns, the amount of company death claims, and so on. Once you initiate premium payments into a Whole Life insurance policy, you are guaranteed your own version of the growth schedule depicted below.

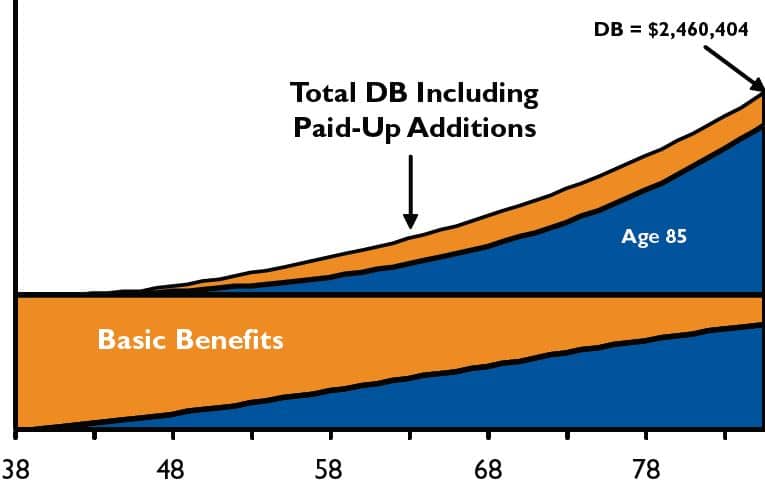

The graphic below shows a $1M policy written on a 38-year-old with a guaranteed level $13,840 annual premium to be paid for 28 years so the policy is contractually paid up by age 65. (Zoom in or tilt your phone to landscape to see more clearly.)

In this example, the guaranteed cash value steadily converges on the $1M death benefit even after the contractual premium payment period ends. In all Whole Life policies, the cash value must equal the death benefit at age 120 (or sooner if the insured dies) even if no dividends whatsoever are ever paid to policyholders.

In a totally different article I discuss how Whole Life dividends work, but be very clear that the guaranteed growth is the core engine of a Whole Life policy. In fact, as soon as you roll dividends back into your policy, they too become part of the guaranteed cash value.

“So what are the 4 possible ways to accelerate the guaranteed growth curve of a Whole Life policy?”

I’m so glad you asked.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

1 – Start with a “Limited Pay” Whole Life Policy

Just like in the graphic above where the 38-year-old male had Whole Life Paid-Up at Age 65, many carriers have policy types that allow you to pay larger premiums for a shortened number of years, rather than pay smaller premiums for your “whole life.” The actuaries dial in the amount of extra premiums that need to be paid in that shortened time-frame so that the guaranteed cash value eventually reaches the death benefit at the end age 120 in spite of premiums not being paid in the later years of the policy.

Most mutual insurance companies at least offer a contractual 10-pay Whole Life policy and a Whole Life Paid-Up at Age 65 policy in addition to the standard Life Paid-Up at Age 100 policy. Keep in mind, the shorter the premium payment period, the larger the premiums must be, and therefore the quicker your guaranteed cash value grows and approaches the death benefit. More-in-sooner is better when it comes to growth.

The downside to getting a Whole Life insurance policy that is paid-up in a contractual number of years is the lack of flexibility. In order to get the life insurance company to guarantee this early paid-up policy status, you have to commit to the rigid premium structure.

Note: Certain insurance companies allow you to customize the shortened payment period exactly the way you want it. If you want a contractual 14-pay, you can dial it in that way. If you want a 22-pay or you want a 7-pay, so be it. This can be especially appealing to clients who have very steady cash flow, or a dedicated block of assets that they want to systematically deploy into Whole Life insurance.

Since more-in-sooner is better, there are carriers that even offer policies that can be contractually paid up in as little as 5-years. No further premiums are due, and that cash value starts chugging towards the death benefit on a guaranteed basis.

2 – Add a Paid-Up Additions (PUA) Rider

If you are not ready to commit to the structured accelerated premium structure of a Limited Pay Whole Life policy, most Mutual Insurance Companies offer some version of a flexible PUA rider. PUA stands for “Paid-Up Addition,” which actually allows for additional paid-up life insurance that you can add to your existing Whole Life insurance policy. Click here to read all about PUA’s.

With PUAs no underwriting is necessary and no ongoing premiums are due. They are like little mini Whole Life policies that are paid-up in one shot and stacked upon your existing policy.

Now many of you are thinking, “That’s great, but I don’t want additional insurance. I just want to accelerate the growth of my Whole Life policy.”

Well, if you want to pay additional payments into a Whole Life insurance policy to accelerate its growth, those are technically premium payments. And what do premiums have to buy? Yep, more life insurance.

But guess what? This is the most efficient type of Whole Life insurance you can buy from a cost standpoint. Usually 90%-95% of that PUA payment goes straight to your guaranteed cash value and only 5%-10% pays for the additional death benefit. On that new little block of insurance, no additional premiums are due, hence its name “Paid-Up Addition.”

Remember how your guaranteed cash value must climb toward your death benefit each and every year? What do you think happens when you raise the bar…the death benefit bar that is? Your cash value must now climb even higher to hit that new higher death benefit target.

Remember how “more-in-sooner is better?” You just identified a strategy for jamming additional premiums into your Whole Life policy where 90-95 cents on the dollar goes straight to your cash value. And that cash value must converge upon your death benefit on a guaranteed basis. And you also just increased the total death benefit figure that your guaranteed cash value is climbing towards.

How do you like Paid-Up Additional insurance now?

When our same 38-year-old male makes additional premium payments to buy PUAs (Paid-Up-Additions), these little paid-up policies stack upon the initial death benefit to accelerate both the Cash Value and Death Benefit.

Still unclear about Paid-Up Additions (PUA)? Click here to read an entire article about using Paid-Up Additions (PUA) to stack your growth inside a Whole Life policy.

However, it is worth noting that you are limited to how much in PUAs you can buy in any given year both by the insurance company and by the Internal Revenue Service (IRS).

Let me explain:

All insurance companies have certain limits or ratios they allow for when it comes to how much in PUAs you can stack on top of your underlying base Whole Life policy. Think about it, it’s the least profitable part of their business. They are only collecting 5-10 cents on every dollar for mortality charges and then agreeing to grow your other 90-95 cents every single year on a guaranteed basis. Not only that, but they are giving you even more death benefit that’s fully paid up, so unless you cancel it, they have to pay.

As far as the IRS goes, remember that they are agreeing not to tax your cash value growth since you are alleviating some of the Federal Government’s burden of caring for widows and orphans. But once you cross their line in the sand (when your policy becomes too lopsided with cash value and not enough death benefit) the IRS will revoke many of the key tax benefits normally associated with Whole Life insurance.

Ugh, you don’t want that. The next section discusses a handy workaround that allows for maximum overfunding while staying compliant with insurance companies and the IRS.

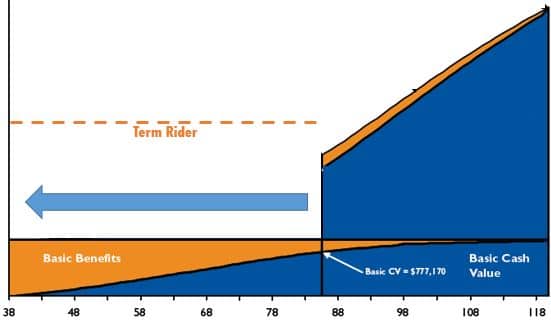

3 – Blend your Whole Life Policy with a Term Insurance Rider

Just to be clear, this term rider on its own does nothing to enhance wealth building inside a Whole Life policy. In fact, it will even add additional mortality charges, but usually, a very nominal amount considering the amount of temporary death benefit it props up.

Here you go again, “But wait! I don’t want more life insurance. I just want to maximize my cash value growth.”

Remember how all insurance companies and the IRS mandate that you have a certain amount of death benefit per additional premium dollars that you want to stuff your policy with?

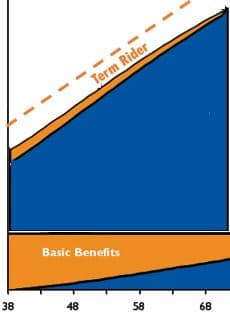

More-in-sooner is better, right? Blending in a Term Insurance Rider is a way to maintain all the proper death benefit ratios while still allowing you to stuff your policy with an abundance of PUA premiums.

By stacking a disproportionate amount of PUAs upon our Base Whole Life policy early on, you accelerate the amount of guaranteed cash value you have growing for you, and you also raise the bar of what that cash value must grow to because of all the paid-up additional insurance those premiums bought. Growth that wouldn’t normally occur until late into the life cycle of the policy, can now happen much earlier thanks to adding the term rider.

The effect illustrated above can be even better if you have an existing Whole life insurance policy that wasn’t constructed with this kind of efficiency. You can actually roll your existing cash value into a new more efficient design. See below

4 – Do a 1035-Exchange (Rollover) of an Under-Performing Policy into a Legal PUA

If you have a policy that is already in force, you have the ability to do what is called a 1035 exchange, which is a part of the tax code that allows for a tax-neutral swap of an existing life insurance policy into a new one. It is very similar to an IRA rollover. However, in the eyes of the IRS, you actually get credit for all the death benefit that you already paid for in your old policy.

Remember all the necessary death benefit ratios you need? If you have already paid quite a bit of freight in your old policy, the new one can often be streamlined and turbo-charged to be a lean mean growth machine since you satisfied the necessary requirements in your old policy.

We can actually design these 1035-exchange policies to be more efficient than we could a brand-new policy for someone who is starting from scratch. Because you have already paid for so much death benefit in the old policy, we can essentially make your new policy almost like a PUA, requiring no further payments. If you want to the ability to keep paying, then we combine enough of the appropriate riders, so that the lion’s share of your ongoing premiums purchase PUAs: the turbocharger of Whole Life’s growth.

Time for a Policy Check-Up?

Whether you’re an existing policyholder or just exploring all your options before you get started with a new policy, you should definitely take a look at what we can design for you:

We know exactly what most banking clients are looking for – maximum cash value growth and the earlier the better. Am I right?

- How would you like it if your banking agent nailed it on the very first go-around?

- How would you like it if you were shown comparable illustrations from the top 3 companies using the leanest policy design specs possible from the jump?

Click here to save time, energy, and money now.

Just like a PUA inside a term rider, we’re here to streamline and accelerate this whole process for you.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

The Top 4 Myths Behind Becoming Your Own Banker (Article)

The Simple Science Behind The Banking Concept (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

The Top 4 Myths Behind Becoming Your Own Banker (Article)

The Simple Science Behind The Banking Concept (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)