Infinite Banking Concept Explained: How to Become Your Own Banker

Updated 11/26/2024

What is Infinite Banking?

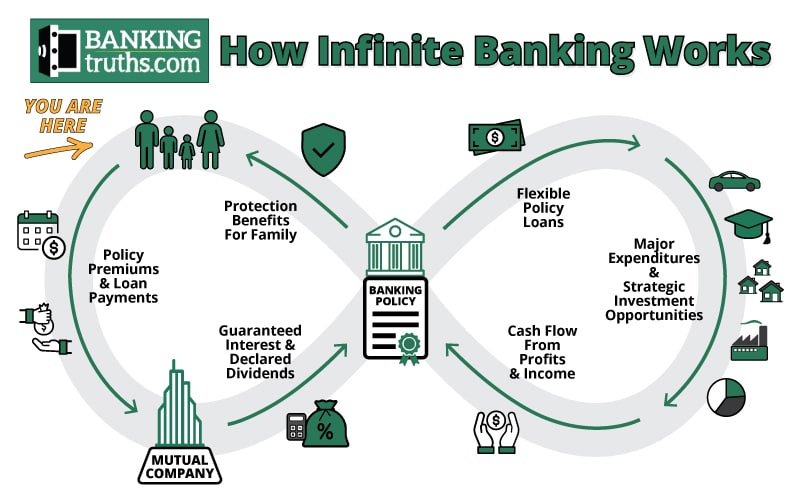

Infinite Banking is a cash flow management system using the cash value in a life insurance policy rather than traditional bank accounts.

Instead of saving, spending, and replenishing cash in banks, IBC (the infinite banking concept) involves overfunding a Whole Life policy designed with custom riders and then borrowing against its continuously compounding cash value.

Leveraging cash-value in a life insurance policy to essentially create your own personal bank can provide these 4 lifelong benefits:

- Guaranteed growth every single day

- Lifelong tax-sheltering & tax-free access

- A hedge against death, disability, and lawsuits

- Continual cash value compounding even when borrowing (this is BIG!)

Albert Einstein was enchanted with compound interest, referring to it as:

- The 8th wonder of the world

- The most powerful force created by man

See our 6-minute video explanation about the simple science of how behind infinite banking harnesses the power of compounding on dollars that would normally slip through your hands, or keep scrolling through the extensive write-up below it:

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

(Clickable) Table of Contents

How Does the Infinite Banking Concept Work?

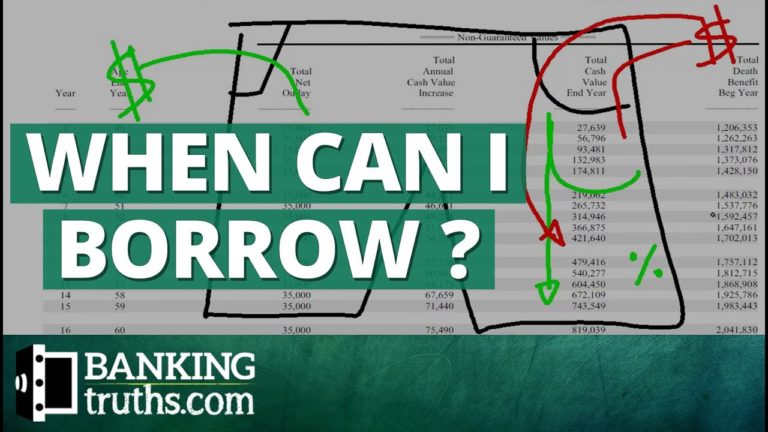

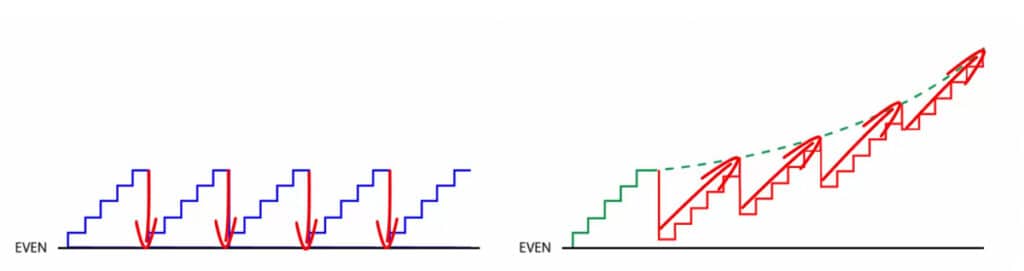

Here is the Infinite Banking visualized:

Step 1 – Create Your Infinite Banking Structure

No, you won’t be opening your own local bank branch in town, but you will be mimicking what major banks do with their own safe & liquid reserves.

“Don’t Do What Banks Say…Do What They Do!”

Did you know that the 2 biggest banks in America park billions of dollars of their tier 1 capital into high-cash-value life insurance policies on their key executives?

Most infinite banking newbies don’t realize that when you set up one of these types of infinite banking life insurance policies, you actually become part owner in the underlying mutual insurance company, which are the highest-rated and financially stable companies in the world.

In fact, during the Great Depression it’s documented that these mutual insurance companies bailed out failing banks long before the FDIC even existed.

Infinite Banking Life Insurance Design Techniques

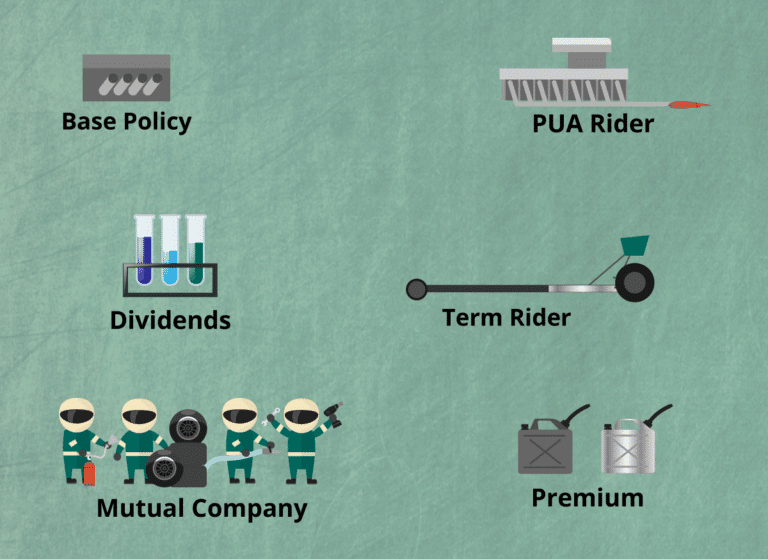

We get that learning about the different riders needed to optimize infinite banking life insurance can be confusing.

So we created this simple “Whole Life Race Car” analogy video below to help you better understand the interplay between Whole Life dividends, the guaranteed growth of the base Whole Life policy, the paid-up additions rider (PUA), and a term insurance rider.

To learn more about how to design an Infinite Banking life insurance policy for optimal performance and maximum flexibility (as well as policy design traps touted by other agents), download our “Starter Guide to Infinite Banking” below.

You can also book a call with one of our Infinite Banking policy design specialists here to educate you about your options and shop the top Infinite Banking Life insurance companies for your specific situation.

Step 2 – Seed Your Infinite Banking Life Insurance with Reserves

Just like a bank must seed its balance sheet with reserves to lend against, you must fund your customized Whole Life policy with premium payments.

Normally, people think of any kind of insurance payment as being just another bill where money will be leaving their pocket, never to return again unless something bad happens. This is NOT the case with infinite banking life insurance, where you can borrow against your cash value anytime after the first 30 days for emergencies or opportunities.

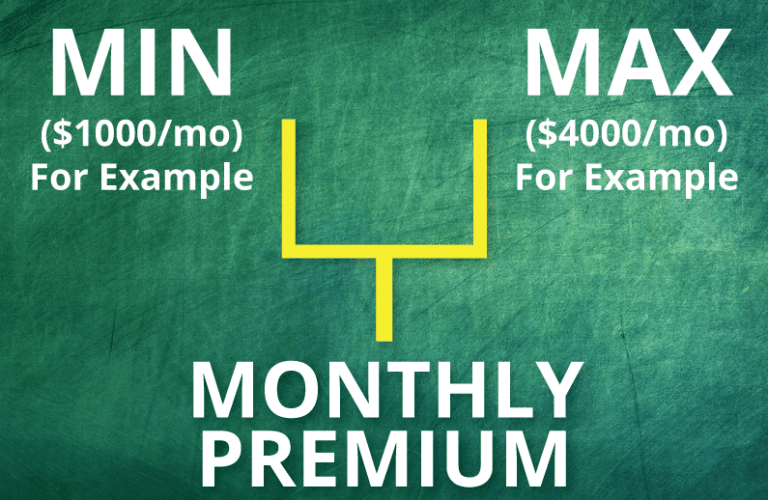

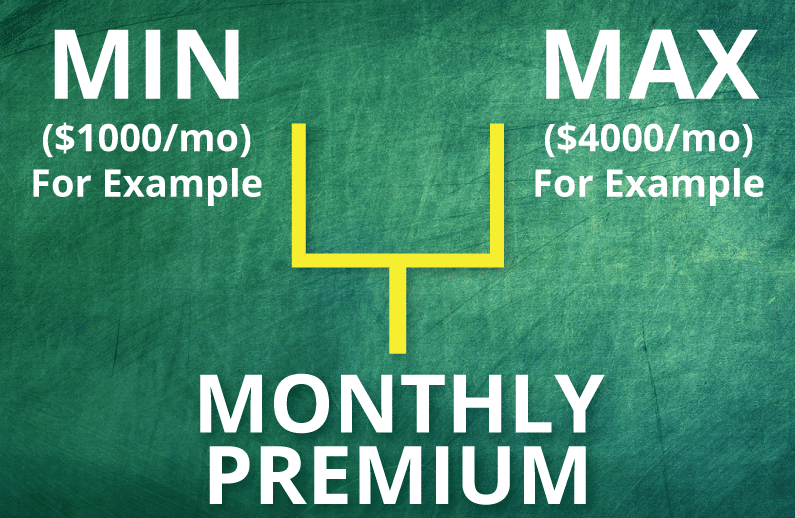

Also, a Whole Life policy that has both a PUA rider and a term rider allows for a lot of premium flexibility. In any given year, you can pay anywhere between the minimum premium and maximum allowable premium to keep your own private bank solvent and thriving.

Generally, the maximum amount you can pay will be about 3x-5x whatever the minimum required premium for your customized Infinite Banking Whole Life insurance policy.

Even though the minimum required base premium will accrue cash value over time, you will still want to accelerate early and long-term cash value performance by paying the maximum allowable premium as early and as often as possible.

Here are 2 banking truths when it comes to funding Infinite Banking life insurance policies, or any steadily compounding asset class for that matter:

- More in sooner will be better

- Put in more, get more. Put in less, get less.

Keep in mind that certain Infinite Banking life insurance companies offer more flexible parameters than others.

For instance, some companies make you start with your maximum allowable premium year 1, whereas others will let you build up to it in the future. Also, some companies have a “use-it-or-lose-it” rule if you can’t pay your maximum allowable premium every other year or third year, and so on.

Again, max-funding every year is ideal for maximum compounding, but if flexibility is needed, then choosing the right company that allows you to skip overfunding payments without sacrificing your right to do so in the future will be critical.

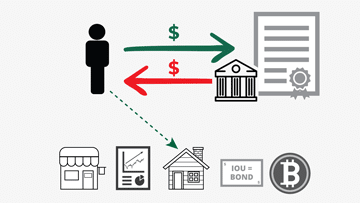

Step 3 – How Money Flows Through Your Infinite Banking System

Without a doubt, the most misrepresented aspect of the Infinite Banking Concept is that “you borrow FROM your policy, and you pay it back the interest.”

I get that it sounds really good from a sales and marketing standpoint.

In fact, it may even feel this way within your Infinite Banking insurance policy.

But it simply just is NOT true.

What actually happening is that “you are borrowing AGAINST the collateral of your continuously compounding cash value.”

Your Whole Life insurance company will lend you money from their general account up to around 95% of your cash value. Even though the net available cash value goes down by the amount of the loan, your entire cash value balance from before the loan keeps accruing policy dividends and guaranteed interest as if it never left the policy.

You know why?

Because the cash value never left the policy!

Think about it, your Infinite Banking life insurance company is essentially already holding your cash value as collateral. That’s why they’re happy to provide a policy loan at any time for any reason with no questions asked.

Here are the ongoing cash flows to & from your infinite banking policy:

- You contribute premiums as reserves for at least 7 years

- The insurance company credits at least 2%-4% annually of guaranteed interest

- Mutual companies also pay non-guaranteed dividends (160+ year dividend-paying history)

- You take loans against your policy when cash is needed for strategic investments or major expenditures

- No loan payments are technically due until death, and interest accrues annually at simple interest (if paid annually)

- Your entire cash value balance continues collecting interest and dividends (even on the borrowed money)

- You pay down loans from your maturing investments or from paychecks to reduce loan interest and increase future borrowing capacity

The net effect of diligently repeating this Infinite Banking process is:

You earn tax-sheltered compound interest on an increasing cash value balance while paying simple interest on a flat or decreasing loan balance.

Unfortunately, many infinite banking promoters make IBC sound like some kind of quick sugar high, whereas it should be thought of as more of a long-term superfood that endures and thrives over time.

It’s all about continuously compounding your base of liquid capital, even while using it elsewhere.

About Infinite Banking Loan Options

Let’s address the elephant in the room, that dirty little 4-letter word… LOAN.

People naturally have a knee-jerk reaction whenever hearing the words loan, borrow, or especially debt. However, to be considered “in debt” means you have more loans you owe than assets you own.

When using infinite banking loans to buy more assets, you still maintain a positive solvency, and are in an especially good financial position if the assets you borrow for are appreciating and/or cash flowing nicely.

When borrowing against your Infinite Banking life insurance, you’re not technically “in debt” because you can technically surrender your policy to extinguish the loan.

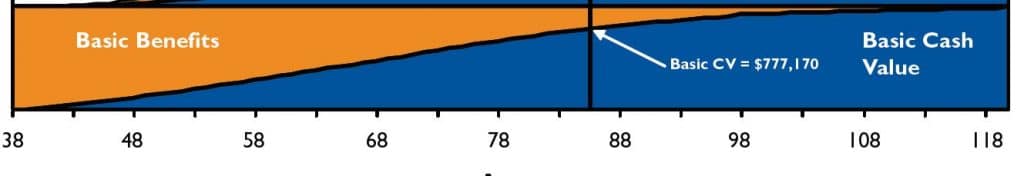

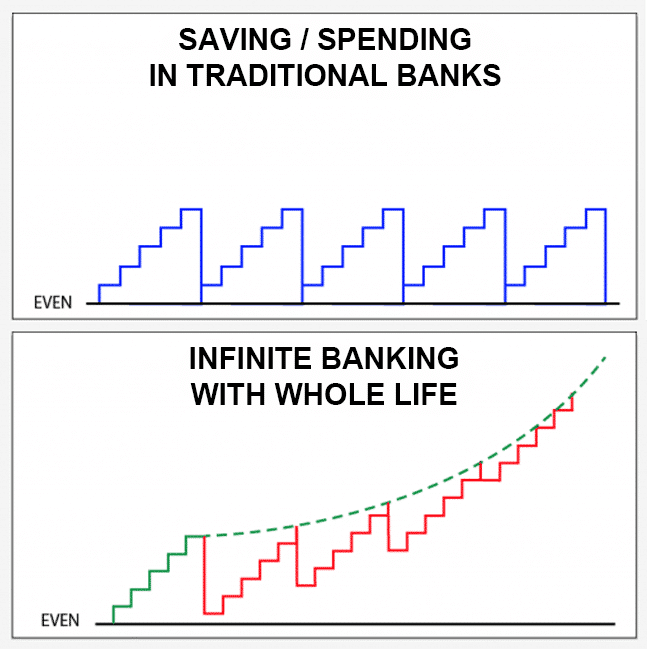

The problem is, if you withdraw rather than borrow from your infinite banking Whole Life insurance policy, you would be removing assets that could’ve kept compounding on your behalf. The longer you let compounding work for you the better it gets, especially at the upper-right-hand side of the graph.

By withdrawing cash value from your infinite banking policy, you rewind your compound curve to a lower position, not to mention you stunt future growth by receiving a smaller cut of any future dividend pools.

Conversely, if you borrow against your Whole Life’s continuously compounding cash value, you never miss a beat on that steepening compound curve while maintaining your place in line for those bigger future dividends.

Regardless of all the gimmicky rhetoric you’ll read/hear about “paying yourself back the interest,” this is the true scientific explanation of how infinite banking works. It may feel like you’re paying yourself back interest, but that’s because you’re earning compounding interest on an increasing balance while paying simple interest on a flat or decreasing balance (assuming you’re minimally servicing the loan).

Learn more about Infinite Banking loans in our curated content collection on borrowing.

Infinite Banking Pros and Cons

You’ll usually hear the pros and cons of infinite banking from either one of two biased sources. It seems like all you hear is HYPE or HATE from either:

- Whole Life insurance agents trying to sell a policy

- Other “financial gurus” touting their product/strategy of choice

You obviously have to consider the source and their agenda when evaluating whether their opinion of infinite banking life insurance is overstated or even accurate for that matter.

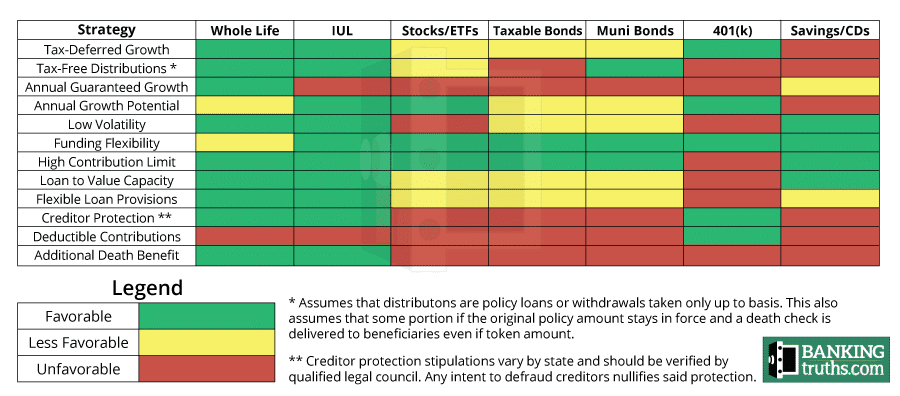

Below is a simple table that hits on the most common infinite banking pros and cons:

In the sections below, we plan to provide a deep dive with some balanced context when unpacking the various infinite banking pros and cons found on the internet.

Benefits & Pros of Infinite Banking

Compounding of Borrowed Funds in an IBC Whole Life Policy

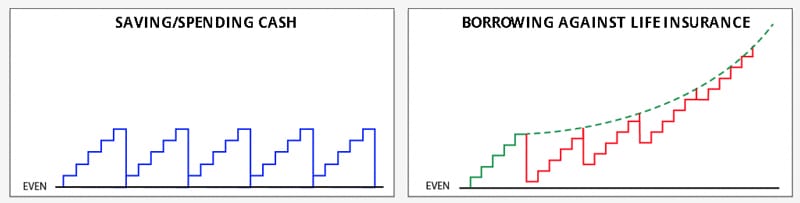

One of the biggest benefits of infinite banking is the ability to earn continuous compounding on borrowed funds.

Having one dollar continuously compounded safely within your infinite banking Whole Life policy while out on loan for your other wealth-building efforts is by far the most potent component of IBC.

Being able to have $1 doing triple-duty, wearing many hats, playing offense and defense, while helping you get multiple bites of the apple, is by and large what most clients find appealing about Infinite Banking.

By keeping their liquidity compounding (even while using it elsewhere), a properly-designed infinite banking life insurance policy helps people build up a bigger liquidity fund than saving, spending, and replenishing a high-yield savings account.

That way they end up with way more after-tax liquid capital than they would otherwise have for future expenditures and investment opportunities.

Guaranteed Loan Provision (while still growing inside an IBC policy)

Bob Hope famously said, “A bank is a place that will loan you money if you can prove you don’t need it.”

Another massive benefit of infinite banking is the ability to extract liquidity on demand without killing the compounding curve of your savings.

It is possible to also borrow against your brokerage account, real estate, or 401k. However, none of these assets are guaranteed to keep growing while you’re borrowing, unlike with Whole Life insurance. This is exactly why the amount you can borrow from these other sources is far less than the 95% loan-to-value ratio allowed only with an infinite banking life insurance policy.

Also, none of these are guaranteed to be available to you when you may need them the most. If the sky is falling with generational buying opportunities galore, stocks will often lose value, eroding your margin borrowing power, home equity lenders will commonly freeze your line of credit, and you may get laid off, which would trigger a 401k loan repayment request due in 90 days rather than 5-years.

Guaranteed Growth + Dividends of an Infinite Banking Whole Life Policy

Non-correlated growth is another unique benefit of the infinite banking concept.

What else in your world does not correlate to the stock market, the real estate market, or the overall economy in some way?

The 2 ways a Whole Life insurance policy grows is one of the most popular aspects of Infinite Banking:

- Whole Life has a contractually guaranteed growth rate between 2%-4%.

- Mutual Companies also pay a non-guaranteed dividend that fluctuates annually.

Whole Life dividends aren’t guaranteed, however, the oldest and most solvent true mutual companies can boast they have paid a dividend for the last 160+ years through depressions, recessions, inflation, deflation, and world wars. A couple of the oldest mutual companies were even around to pay Whole Life dividends during the Civil War!

Definitely check out minute marker 11:00 – 12:30, and you will see the unique wat dividends stack upon each other even if there is just a temporary spike in rates.

Tax-Exempt Status of IBC Insurance

As seen in the video directly above, whatever the actual growth rates are in your Infinite Banking Whole Life policy, the net effect is actually higher due to it’s tax-exempt nature.

If you’re in a combined 33% federal + state tax bracket, you would need to earn 7.5% in a taxable high-yield savings account to equal 5% in an infinite banking life insurance policy.

I know there’s talk about lowering taxes or even abolishing the income tax altogether. Well, I can think of 36 Trillion why that won’t happen anytime soon.

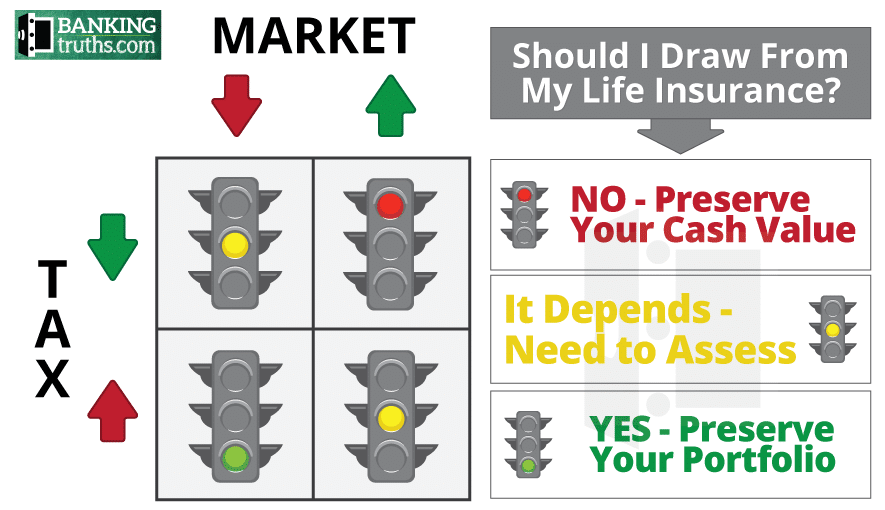

Furthermore, as tax rates continue to rise with our swelling national debt, an IBC insurance policy can help you optimize your other assets in retirement by better managing a dynamic distribution strategy.

What if during your retirement we get 4-8 years of an especially unfriendly Congress imposing painful tax policies?

What if you had this pool of tax-exempt funds built up from practicing Infinite Banking during your working years?

What if every time your taxable Social Security, 401(k) withdrawals, and rental income was about to push you into some penal tax brackets you could instead pull tax-free income from your policy?

The above infographic comes from our detailed article on how to use whole life for a dynamic retirement income strategy.

The same article discusses how to monetize the death benefit in retirement, which brings us to our next benefit of infinite banking.

Death Benefit Utility of Infinite Banking Life Insurance

A Whole Life’s death benefit is probably one of the most overlooked pros of the infinite banking concept. A lot of clients will say something like:

“I don’t really care about the death benefit, I just want the cash value” – Many IBC Clients

If you think about it though, the death benefit will always be higher than the cash value by the very nature of it being life insurance.

What if you could even tap into your tax-free death benefit even while you were living?

There are 2 ways you actually can.

1) Your Whole Life death benefit is your permission slip to aggressively spend down other retirement assets rather than just live off the interest or stick to the 4% rule. It’s like the

2) Certain infinite banking insurance companies have a provision allowing tax-free access to your death benefit if you are deemed too sick or hurt to function in the world by yourself. This is known as a chronic illness/injury rider (often free to add on) that has the same triggers as a true Long Term Care insurance policy, which can be quite expensive.

The death benefit may not be the primary reason you’re getting Infinite Banking life insurance, but as one of my mentors once told me:

“It doesn’t matter which benefits of Whole Life you like the best…You get them all”

Creditor Protection With Infinite Banking Life Insurance?

If you were to get sued, your high-yield savings account or stock brokerage account would be on the table for your creditors to pillage.

However, your Whole Life policy for Infinite Banking will be OFF-LIMITS to your creditors.

It’s worth noting that this is not determined by the life insurance company or any special IBC company you choose, but rather by state law. Certain states provide full immunity from lawsuits for life insurance cash value, while some offer partial protection or none at all.

We compiled a state-by-state guide for the creditor protection of life insurance. We do not guarantee its accuracy since legislative changes happen, but major movements in this area don’t happen very often.

Regardless, we listed the state-specific codes and statutes clearly, so perhaps they can act as a starting place for you to do your own legal research if you are in the DIY camp.

Ultimate Privacy using IBC

One of the biggest pros of infinite banking is hidden in plain sight…literally.

Some folks very much enjoy the privacy aspect of using Whole Life insurance for infinite banking. Unlike banks, brokerage accounts, and even LLC interests that show up on an asset search, Whole Life insurance does not since it’s considered a protection product primarily with the cash value being a secondary feature.

Also, any policy loans the policy owner takes won’t show up on your credit report. Even certain outside lenders who offer turnkey line of credit programs tied to Whole Life policies for IBC consider it a cash-secured loan and therefore don’t report your balances to the credit bureaus.

Ok, enough about all the pros of infinite banking.

What about the cons of infinite banking, its downsides, and the fine print other agents won’t tell you about?

Cons & Problems with Infinite Banking

Limited Early Liquidity with Infinite Banking Life Insurance (from Costs)

For most people, the biggest problem with the infinite banking concept is that initial hit to early liquidity caused by the costs.

Although this con of infinite banking can be minimized substantially with proper policy design, the first years will always be the worst years with any Whole Life policy.

With a max-funded specially-designed Whole Life insurance policy for Infinite Banking, you will normally only have access to 70%-80% of your first premium payment after 30-days.

That said, there are certain infinite banking life insurance policies designed primarily for high early cash value (HECV) of over 90% in the first year. However, the long-term performance will often substantially lag the best-performing Infinite Banking life insurance policies. Having access to that extra four figures in the first few years may come at the cost of 6-figures down the road.

For some reason, people are ok with delayed gratification when acquiring investment real estate or starting their own business.

Contrary to popular opinion, the money missing from Whole Life’s first couple/few years doesn’t go down a black hole never to return. You actually get some substantial long-term benefits that help you recoup these early costs and then some.

We find that this hindered early liquidity problem with infinite banking is more mental than anything else once thoroughly explored. In fact, most clients have other sources of liquidity they may not be aware of if they absolutely needed every penny of the money missing from their infinite banking life insurance policy in the first few years.

Mandatory Annual Payments Due With Whole Life Insurance

Fear of commitment often causes another mental block for people with infinite banking.

Although a Whole Life policy for infinite banking can be designed to be somewhat flexible, there will still be some level of minimum annual or monthly premium payment due for at least the first 7 years.

Since most clients overfund their policies when they start them, theoretically, they could skip or delay future premiums by borrowing against their cash value equity.

Also, don’t forget that whatever your maximum premium is NOT what’s due. The minimum mandatory premium payment due is only about 1/4 to 1/3 of the maximum allowable premium.

Even this minimum required premium builds equity and is actually an Infinite Banking benefit because it guarantees these 3 things:

- A guaranteed death benefit where the cost structure can’t be adjusted

- A guarantee that your cash value must equal this death benefit by age 121

- A guaranteed cash value glide path that grows every single year, which almost equals the death benefit by normal life expectancy (age 85-90)

All of your future dividends and paid-up additions from overfunding will also ride along this curve on a guaranteed basis.

Qualification Hurdles of an Infinite Banking Whole Life Policy

Unlike most financial products, where you can simply make a call or point and click to buy them, acquiring Infinite Banking life insurance can be more complicated.

Favorably qualifying for an IBC policy will depend on:

- Your age

- Your health

- Your hobbies

- Your driving history

- Your financial situation

- Your family health history

Thankfully, some of these stodgy old mutual insurance companies have adopted advanced technology, making the entire underwriting process quicker, simpler, and less intrusive.

Some companies even use AI-underwriting, where securely enter your basic data into DocuSign while their artificial intelligence network scours multiple online databases.

They still reserve the right to do full manual underwriting if something spooks them, but it’s now possible to get 7-figures of insurance at the highest rating after a 15-minute online app, as opposed to a:

- Lengthy paper application

- 20+ question call-center phone interview

- Poking and prodding of a paramedical exam.

Many of our clients with clean health histories often pass A.I. underwriting with flying colors after just a few clicks. We’ve even had their ideal Whole Life policy optimized for Infinite Banking fully issued with the highest rating in as little as 48-hours.

Learning and Maintaining the Discipline Needed for IBC

This alleged problem with the infinite banking concept will ironically be how to maximize all the benefits.

It’s human nature to get attached to old patterns of behavior and the status quo. So it can be difficult for some people to adopt the process of overfunding an insurance policy only to subsequently borrow against it whenever funds are needed.

Also, it can be downright counterintuitive to think of your annual insurance premium as anything other than a pesky bill for a necessary evil cost rather than a limited privilege allowed by the IRS to shelter your savings from taxation while it’s safely growing to increase your future purchasing power capacity.

Change is never easy when it’s new. However, we find like with many other valuable processes in your life, once you get into the swing of things it becomes second nature, especially as you start to reap the benefits and see the power of infinite banking along the way.

Remember, it’s all about maximizing compounding interest on an increasing equity balance, while minimizing simple interest on a decreasing or flat loan balance. Taking a page out of the book of Velocity Banking may help you optimize IBC even further.

Who is IBC Ideally Suited For?

Risk-averse investors who prioritize control, self-direction, and take a non-traditional approach to wealth-building tend to be most attracted to infinite banking as part of their financial strategy.

Having helped and educated thousands of clients to become their own bankers with IBC for the last 17 years, we’ve found that it especially resonates with:

- Entrepreneurs

- Real Estate Investors

- Fiscally-Responsible Savers

- Risk-Averse Retirees (and Pre-Retirees)

Once these types of investors understand how a properly-designed Whole Life policy can produce guaranteed growth, tax efficiency, and the ability to continuously compound liquid capital (even while borrowing), they often use infinite banking as the main hub for their incoming and outgoing dollars. That they can build 2 assets at once through the velocity of their cash flow.

Is the Infinite Banking Concept Legit or a Scam?

The infinite banking concept is indeed legit. IBC is not a scam. However, many people do get scammed after buying a poorly-designed Whole Life insurance policy to act as the primary engine for their own private family bank.

To be clear, infinite banking is simply a system for continuously compounding your liquid capital by borrowing against it, rather than depleting it when making strategic investments or major expenditures. In fact, this same methodology can be used with assets other than insurance products, but Whole Life is often the ideal foundation due to its:

- Safe & Steady Growth

- Embedded Tax Immunity

- Guaranteed Flexible Loans

Where people feel like they’ve been scammed is after buying a Whole Life policy with lackluster performance. These questionable policies are often from second rate companies and usually without the optimal combination of riders, which substantially enhances performance by lowering the cost of the death benefit.

How their infinite banking policy is designed often determines whether people feel they got scammed or not. Click to download The Starter Guide to Whole Life for IBC on PDF so you can be knowledgeable about how best to design infinite banking Whole Life as your own private bank regardless of who you work with.

Who Started the Infinite Banking Concept?

“The Infinite Banking Concept©” was originally coined in the 1980s by the late Nelson Nash. Nelson would later popularize IBC with his book The Infinite Banking Concept – Becoming Your Own Banker.

However, long before Nelson Nash’s work was published, it is documented that famous entrepreneurs like Walt Disney, Ray Kroc, and J.C. Penney used Whole Life insurance as their own private bank to either start, grow, or save their respective businesses.

I had the pleasure of speaking to Nelson Nash early in my career. He revealed how the Become Your Own Banker concept came to him as an epiphany while lying in a hospital bed with heart trouble.

As you would expect, so much has changed in terms of insurance product innovation, overall interest rates, and infinite banking optimization strategies combining different asset classes and loan options.

Even though Nelson’s early cannot be used a strict owner’s manual for modern-day IBC tactics, I do honor his discovery and am inspired by how he has helped myriads of people for over 40-years now.

IBC Alternatives Other Than Life Insurance Products

Can other assets work for infinite banking besides life insurance products?

Yes, but no.

Yes, you can borrow against other assets, sometimes at lower rates.

No, in that borrowing against these Infinite Banking alternatives in a vacuum without life insurance as the steady foundation can be risky and far less tax efficient.

Learn how to combine accounts you may already have into a comprehensive 4-D Banking strategy.

However, here is a grid showing the good, bad, and the ugly of all infinite banking alternatives along with detailed descriptions below:

Can Stocks Work With Infinite Banking?

Borrowing against Stocks/ETF on margin can be a very management-intensive way to do Infinite Banking, not to mention risky and with less available liquidity. Normally, you can only borrow against 50% of your stock’s value using margin vs. 95% of your cash value. Also, since your best investment opportunities will often come when markets are down, you ideally want your private banking assets to be non-correlated to equity or real estate markets if possible.

Can Muni Bonds work for IBC?

With municipal bonds, you can often borrow up to between 50%-75% of their value. However, bonds, in general, are facing headwinds since they lose market value and available equity as interest rates rise. Did you know that even some of the safest of bonds (which don’t yield much) have lost value when the stock market tanks, since people fear repayment risk by the issuer? Even though this drastic loss of value may only be temporary as fear pervades, these periods will often be your best opportunities to use your own private family bank for other investment opportunities.

Can I Use a HELOC for Infinite Banking?

A home equity line of credit (HELOC) is one tool to build wealth, it is NOT guaranteed to be available like a life insurance policy loan. In fact, I personally had a home equity line of credit revoked from under me in 2009 when global credit markets tightened. Counting on a HELOC as an emergency fund or hoping to leverage it into other real estate when prices are falling can be downright unreliable.

Can I Use a 401(k) Loan for Infinite Banking?

A 401k loan is not even in the same ballpark as infinite banking because you are no longer borrowing against steadily compounding assets. You actually must sell your mutual funds and remove them from the market to borrow those funds from your retirement plan. So again, when markets are down, you must liquidate assets at a low point to buy discounted stocks or real estate using a 401k loan.

Also, there is no payment flexibility because you technically must pay yourself back monthly with interest over 5 years. To make matters worse, if you lose your job during the normal 5-year loan period then the entire loan would come due within 90-days, or else you’ll be taxed along with a 10% tax penalty for an early distribution.

To be clear, a 401k loan can be useful as the ultimate backstop emergency account when borrowing against other account types first.

Can Indexed Universal Life (IUL) work with IBC?

The raging debate of Whole Life vs. Indexed Universal Life is often a point of contention amongst infinite banking agents. Most will adamantly insist that Whole Life is the only possible product that can work for IBC.

I used to blindly subscribe to this popular opinion out of fear of being shamed by my peers. However, after genuine curiosity and thorough analysis a decade ago, I determined that Indexed Universal Life (IUL) can work for infinite banking simply because:

- IUL is still considered a fixed insurance product, not a security

- Indexed crediting is paid from the insurance company’s general account

- There is a floor of 0% during bad market years (minus the cost of insurance)

- You can often borrow somewhere between 90-95% of your IUL cash value

However, you would be sacrificing the certainty of Whole Life’s guaranteed growth and locked cost structure for the POTENTIAL of higher long-term returns with IUL.

The last couple of years of higher interest rates has increased the budget IUL companies to buy S&P 500 options supporting higher caps. The best IUL companies have caps in the low double-digits, and some even have uncapped S&P 500 options still with a protective floor that limits losses to under 3% under the worst case scenarios.

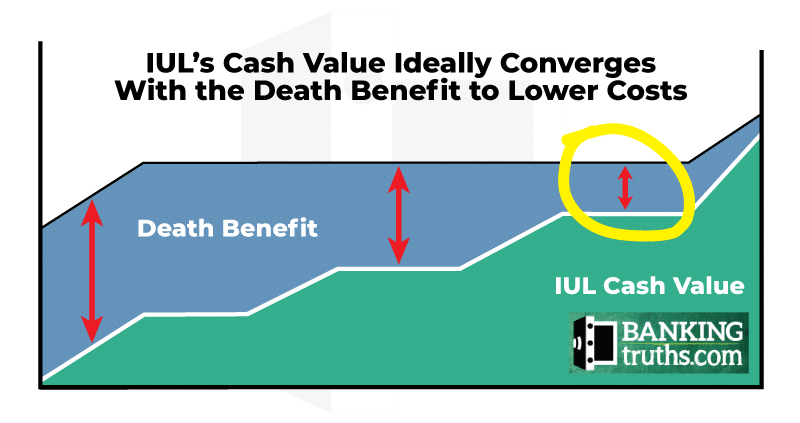

The idea is that the long-term outperformance will outrun the fluctuating fees that are possible within an IUL policy. This sounds scarier than it is because when designing an Indexed Universal Life policy for Infinite Banking, the pure death benefit reduces over time as your cash value growth converges with it, thereby reducing the ongoing fees.

Infinite Banking Concept Example

The back half of this new Infinite Banking example video shows the best insurance companies for Infinite Banking after explaining the different riders and growth components that enhance performance.

Obviously, the most relevant example would be to book your own banking custom consult so you can see one using your own true-to-life policy design and premium numbers. However, this infinite banking concept example will give you some idea of how the numbers of IBC can look for a 47-Year-Old Male at the 2nd Best Rating.

How to Choose an IBC Agent to Work With

Choosing your infinite banking agent can be one of the most important decisions you make in this process. You should be able to count on your agent to do the following 5 things:

- Give you factual information about IBC & Whole Life

- Help you choose the best mutual company or companies

- Design your infinite banking Whole Life insurance optimally

- Help you reroute inefficiently allocated assets cash flows to maximize IBC

- Be there in the future to service your policy and answer your ongoing questions

After all, this is why we as life insurance agents get paid. Most lone wolf agents aren’t incentivized enough by Whole Life renewals to properly service their clients. This is why we believe it’s important to deal with a team, so you have multiple points of contact if necessary.

As you probably realized if you have been on our mailing list, we leverage the same technology we use for marketing to also help service our clients and continue bringing them valuable information. However, we are also always make ourselves available for a live check-in call with a click of a button to update your infinite banking strategy and help with your insurance portfolio.

Your Next Steps to Research Infinite Banking

Final Thoughts on IBC

The Infinite Banking Concept is one of the most heavily-promoted and also misunderstood strategies using Whole Life insurance. Yes, it can be complicated, but so are most financial strategies. It’s just that some you are now more familiar with, and this is new.

Hopefully this deep dive has helped to clarify things, so you can now take your learning to the next level.

In terms of financial strategies to simultaneously keep your liquid assets safe, but also growing while staying immune from both taxes and market losses, nothing else compares to an Infinite Banking life insurance policy. However, the fact that you can keep your liquidity continuously compounding while simultaneously utilizing it for expenses, emergencies, and promising investment opportunities is what really sets the infinite banking concept apart.

I encourage you to use the rest of our site as a free learning resource while you research at your own pace, and you can always apply to book a meeting with our team to see if it would make sense for us to work together in bringing this strategy to life for you and your family.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson has no affiliation or association with any of the following and does not feel compelled to do so since he is a published life insurance authority, policy design geek, and a multi-faceted accredited financial strategist:

- The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

- Bank on Yourself, Pamela Yellen, nor her book The Bank on Yourself Revolution

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.

** “Bank On Yourself®” is a registered trademark of Hayward-Yellen 100 Limited Partnership.