Whole Life Insurance For Retirement

“But I won’t need life insurance in retirement.”

No, won’t need Whole Life in Retirement, but there are 3 reasons you’ll wish you had it.

“But I will have built up my assets by then and can self-insure.”

Maybe so, but that would be an incredibly inefficient use of assets.

“What do you mean?”

To self-insure entails that like an insurance company, you must maintain a large portion of assets purely as reserves and therefore out of your reach for retirement.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

Getting away from the burdensome shackles of self-insurance is the most overlooked reason to own Whole Life.

When you let insurance companies reserve against the simultaneous risks of both your death and longevity, you free up assets on your balance sheet by opting into the economies of scale of risk-pooling and actuarial science.

“That sounds too good to be true.”

It’s not too good to be true. In fact, our parents and grandparents’ retirement plans depended on it. The lost art of “actuarial science” found in pensions was once used by almost every major corporation before switching to the 401(k).

People don’t realize they can opt back into the efficiency of risk-pooling by buying select insurance products from some of the most well-capitalized companies. You insure your house, your car, your health. Why wouldn’t you insure your retirement against these risks:

- Systematic Spend-Down of Assets

- Wealth Replacement Upon Death

- Buffer Against Market Downturns

- Wipe out Tax from High Brackets

- Chronic Illness/Injury Protection

This extremely powerful combination of benefits can be installed into any strategy using Whole Life insurance for retirement. You can literally make fewer assets spend like more by opting back into “retirement risk-pooling”.

Conversely, when self-insuring you NEED significantly more investments to create the same level of income and enjoyment since you are an “average of one” and must reserve against all these risks simultaneously.

Let’s explore how having some Whole Life insurance can make retirement income more abundant, less stressful, and more enjoyable

Table of Contents

Become the Primary Beneficiary of Your Whole Life Death Benefit

Before we get into how Whole Life can protect your portfolio from market losses and future higher taxes, let’s address this death benefit elephant in the room.

I’ll bet you’re saying things like:

- “I don’t really care about the death benefit.”

- “My primary goal is cash value growth & income.”

If so, you may be overlooking one of the most powerful strategies in retirement planning.

What if I showed you how to unlock some “selfish value” within your own death benefit?

What if you could monetize this future phantom value in your policy while still being able to use your cash value?

Let me share a simple story that best explains this special death benefit strategy:

Imagine you had an uncle who really loved your family, and he was extremely rich. In fact, imagine he loved them so much he said to you:

“I’ve funded a special trust with $1,000,000 for your family. Your spouse can start drawing from the trust right after you pass away and whatever’s left will go to your kids.”

Aside from this sounding a little creepy, and the fact your rich uncle didn’t include you personally in the trust, he actually did you a HUGE favor.

Here’s why:

Since your heirs have this $1,000,000 waiting for them at the time of your death, can’t you now aggressively spend down at least $1 million of your own portfolio rather than “self-insure” and keep the principal intact?

On the other hand, without your rich uncle, you will have painted yourself into a corner of scarcity, not knowing exactly how long these assets even need to last! You’ll probably be relegated to taking income only so the $1M can endure for your spouse and whatever’s leftover gets passed down to children.

However, thanks to your rich uncle’s trust fund you can now more freely enjoy your wealth in abundance since his $1,000,000 is filling up your bucket right after you kick it!

Okay, that might have sounded a little harsh, but I think you get the point.

Guess what…You can use guarantees from an insurance company as your rich uncle with Whole Life insurance to replace assets you consumed in retirement.

Whole Life’s guaranteed death benefit could be retirement withdrawal insurance.

Its existence in your retirement toolbox allows you to either increase your retirement income by aggressively spending down your nest egg manually, or you can buy certain annuity products that guarantee income for life, even if the principal goes to zero.

But wait…Ken Fisher hates annuities!

Of course, he does. His company can no longer manage any assets you put into a guaranteed income annuity.

Think about it…Isn’t it infinitely better for asset managers if you “self-insure” with your investment portfolio? You only get to take a 4% withdrawal rate from your nest egg and they get to charge management fees for life.

Let me ask you this…Will Ken Fisher or any wealth manager be so confident in their portfolios that they’ll sign a contract saying your portfolio will last longer than you will?

Nope! They sure won’t. They can’t!

Only insurance companies can contractually promise “you can’t outlive your retirement income” with centuries’ worth of actuarial data and the tool of risk-pooling amongst millions of clients.

What if instead of the infamous 4% Safe Withdrawal Rate, you could take 6.7% – 7.7% from the same size portfolio and have that mailbox money keep coming as long as you live…guaranteed? These happen to be the guaranteed withdrawal rates for 2 different types of annuity products for a male age 65.

- The 6.7% withdrawal rate annuity allows your unused principal to keep growing.

- The 7.7% withdrawal rate annuity offers more income, but no access to principal.

Instead of using an entire $1,000,000 portfolio to produce $40,000 income using the 4% rule, you could carve off as little as $520,000 or $598,000 into certain annuity products for the same $40k income and have it be guaranteed for life.

This still leaves either $480,000 or $402,000 in the market for discretionary expenses or additional income using the 4% rule.

In either case, Whole Life is the tool that essentially unlocks the greater guaranteed withdrawal rates, since any assets depleted in the annuity get refilled for heirs with the death benefit.

Also, since Whole Life’s death benefit is guaranteed, you could take any excess dividends in cash as a tax-exempt supplemental income stream or replace the income from the other portfolio assets when markets are down.

If you like hearing the word “guaranteed”, remember these terms can only be offered by the insurance companies who deal in actuarial science and the risk pooling of insurance.

Conversely, the only assurance Ken Fisher and wealth managers can offer you with a portfolio-only approach is Monte Carlo projections. It’s not coincidental that this calculator is named after a casino because you are essentially gambling without guarantees of actuarial science.

Let’s see how much sure of a thing you can get by “self-insuring” with a portfolio-only approach, whether by yourself or with a wealth manager.

How Whole Life as a Volatilty Buffer Helps You Increase the 4% Rule

Have you ever heard of the 4% Rule?

Financial planner William Bengen conducted a now-famous study to find a safe withdrawal rate for his clients. Using market data up to 1994, he concluded that retirees couldn’t pull more than 4% (adjusted for inflation) from their nest eggs without risking running out of money.

Bengen suggested the 4% rule must be followed even if the portfolio seems to be earning more since retirees cannot predict if the future sequence of returns will meet their income needs.

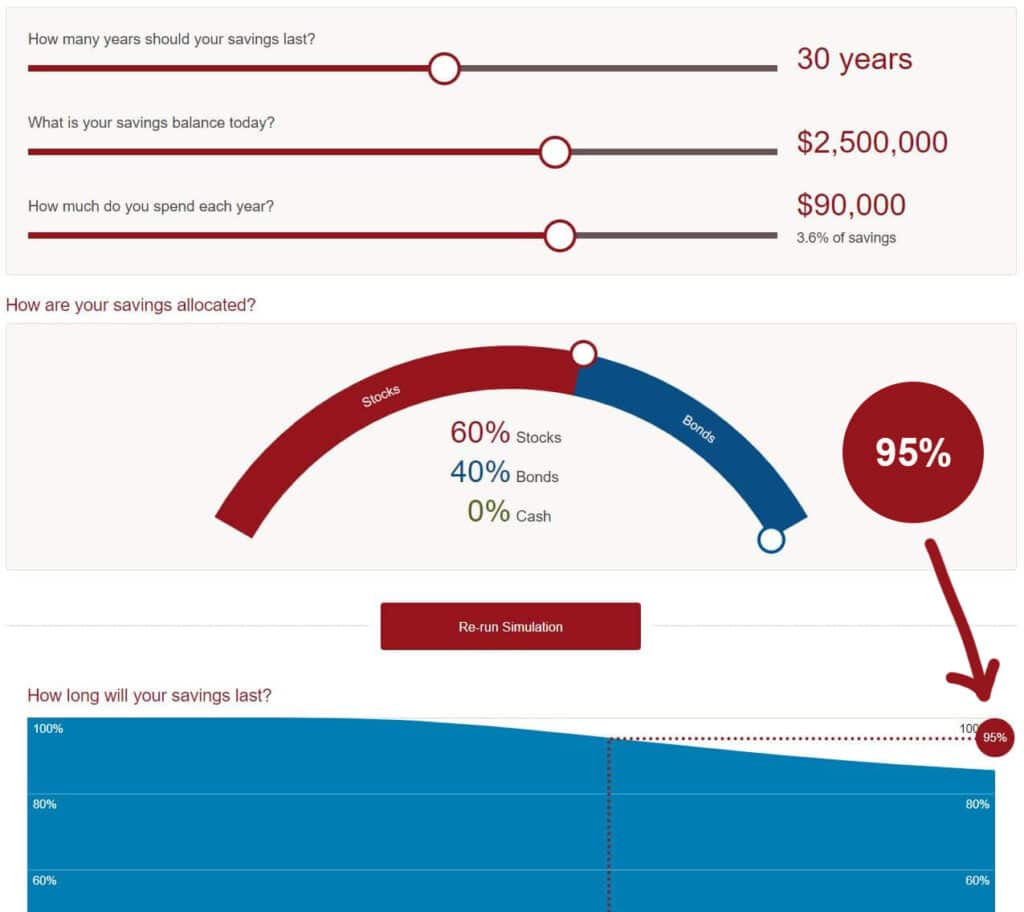

The 1994 assumptions that derived the original 4% rule are somewhat outdated, but we can see the safe withdrawal rate concept still applies using Vanguard’s online Monte Carlo calculator.

A Monte Carlo calculator simultaneously runs over 100,000 different 30-year historical scenarios to stress-test a desired retirement withdrawal strategy.

A Monte Carlo’s output shows your overall probability of success/failure dependent on your proposed allocation and withdrawal rate.

When taking the portfolio-only approach without any contractual guarantees, then choosing a safe withdrawal rate based on probabilities spit out by a Monte Carlo calculator is as close as you can get to “a sure thing.”

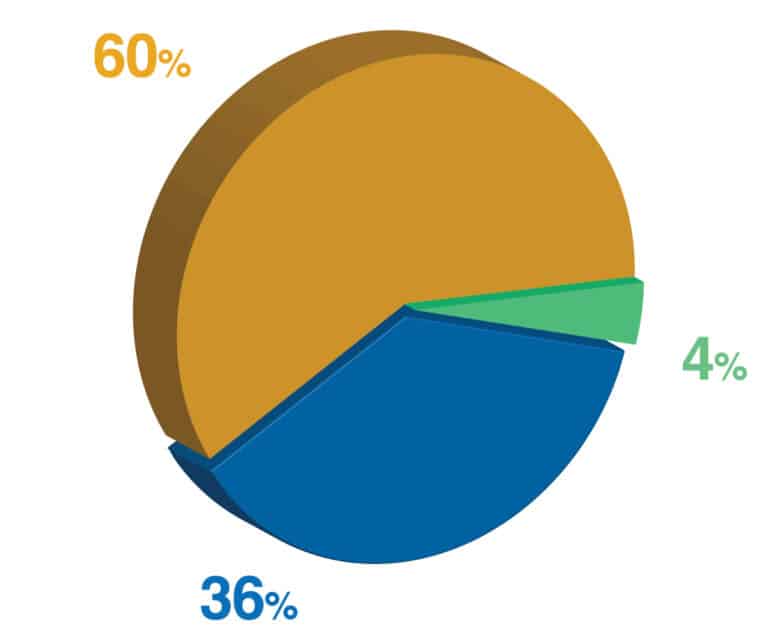

This Monte Carlo analysis below shows with a 3.6% withdrawal rate you have a 95% chance of success when pulling $90,000 of inflation-adjusted income for 30 years from a $2,500,000 portfolio invested 60% stocks and 40% bonds.

Recent academic studies have proven that the 4% safe withdrawal rule actually runs closer to 3.5% using market data that William Bengen didn’t have from 1995-present.

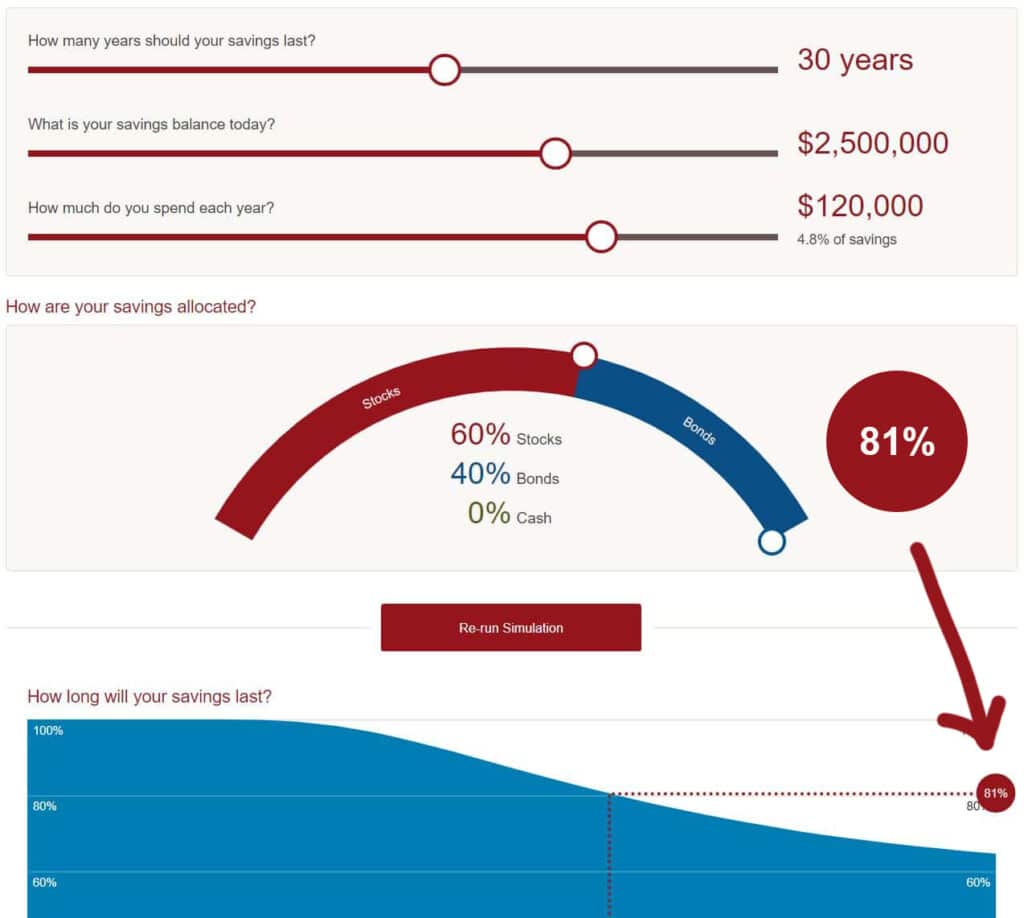

Some of you must be thinking that $90,000 of inflation-adjusted retirement income may not be sufficient. Even though bumping your income from $90k to $120k may not seem like much from a $2,500,000 portfolio, but take a look at the success rate when increasing your withdrawal rate from 3.6% to 4.8%.

The chance that your portfolio will endure 30 years suddenly drops from 95% to 81%! Your systematic withdrawal strategy went from having a 1/20 chance of failure to almost a 1/5 chance of failure.

This may be a favorable risk/reward proposition if you’re betting a black chip in Vegas, but are you willing to gamble for the highest stakes of your life when you can’t return to work on Monday?

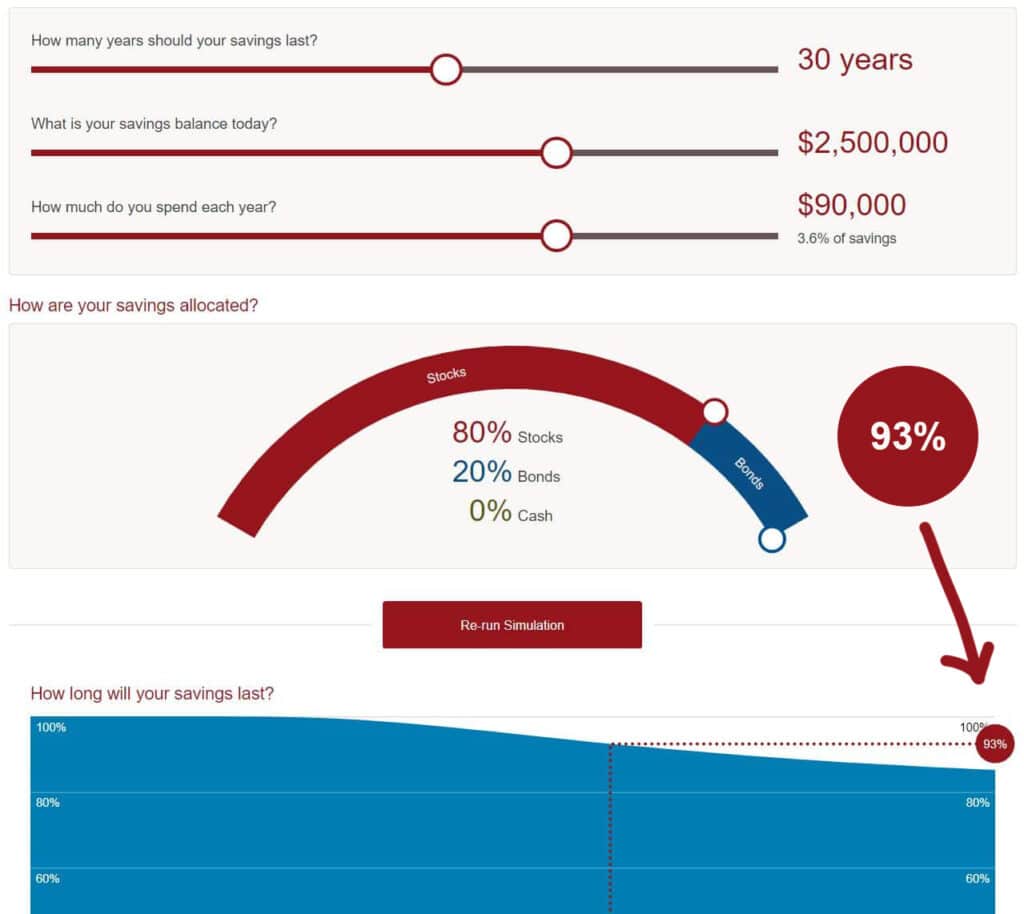

Some of you probably think you can fix the problem by simply allocating more to stocks and less to lower-yielding bonds, right?

However, you’ll notice that that your portfolio’s chances of lasting 30 years actually go down from 95% (60/40 portfolio) to a 93% chance with an 80/20 portfolio even if we dial back the income to the safer 3.6% withdrawal rate.

Don’t get me wrong, an 80/20 portfolio may get lucky catching a good bull run and end with even more money than a 60/40 portfolio, but both the Vanguard calculator and William Bengen say you lower your portfolio’s overall chances of lasting 30 years by upping your risk.

That’s why Bengen’s original 4%-Rule study actually used an even more conservative allocation of 50/50 stock and bonds.

What if instead of allocating your entire 40% or 50% bond component to traditional bonds, you used a portion of your bond component to instead acquire a combination of “actuarial bonds” like Whole Life insurance and Fixed Annuity Products that acted like a pension?

As we discussed in the last section, if more income is produced from this bond/annuity portion of your portfolio, then less income will be needed from the stock portion. That way your stocks have the chance to be volatile and actually earn the long-term inflation-adjusted returns they’re known for.

Whole Life’s death benefit may replenish assets consumed through guaranteed annuity income, but a portion of Whole Life’s cash value and dividends can then be used to support your portfolio while it’s wounded.

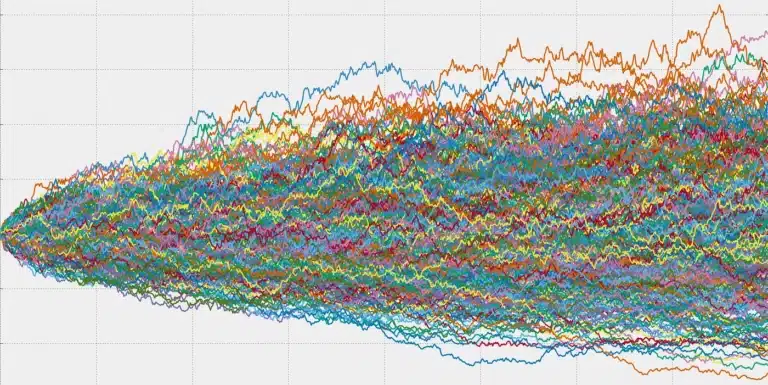

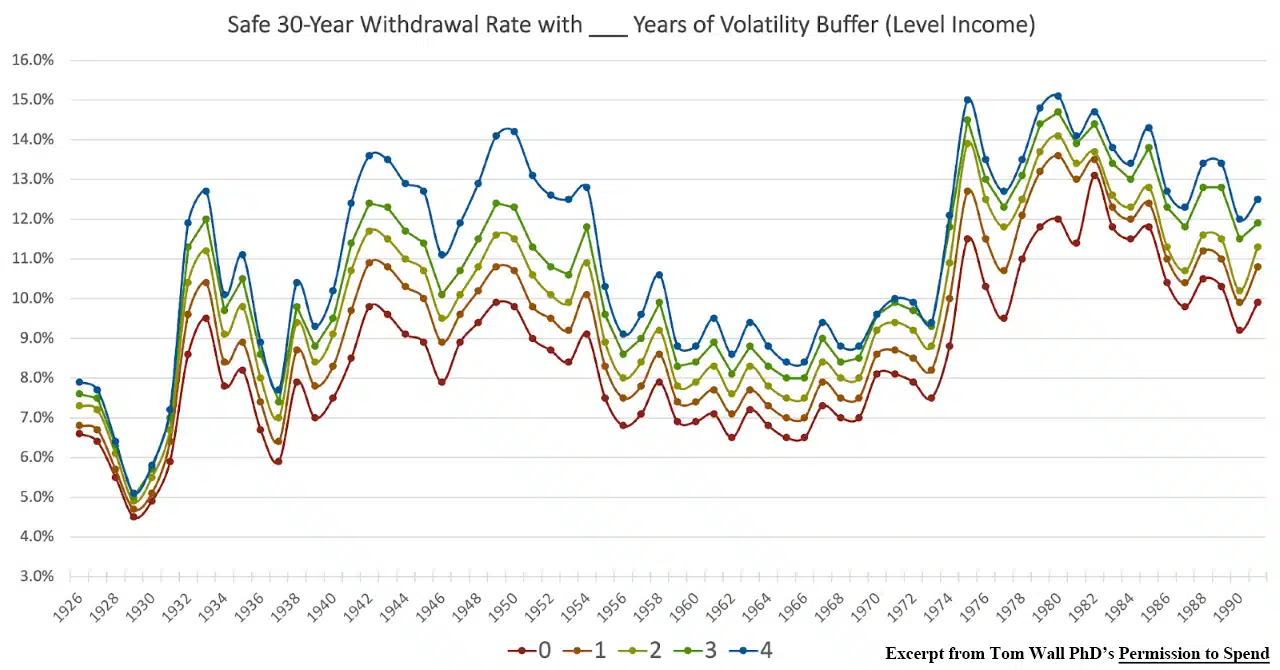

Author Tom Wall PhD did a study of the maximum allowable withdrawal rate depending on when exactly withdrawals were started and how many years of income you could pull from other non-market sources.

However, his study historically validates the utility of a volatility sponge in retirement and its ability to either preserve a portfolio for longer or improve the allowable withdrawal rate…sometimes quite dramatically.

Notice the height difference between the 5 lines over the different years where retirement would’ve started. The different color lines represent the withdrawal rate you could’ve sustained from the same portfolio, depending on how many years’ worth of replacement income you held elsewhere (i.e.: Whole Life cash value).

Of course, this study could only be conducted in hindsight, since retirees won’t have the clairvoyance to know the exact sequence of returns coming in the future to determine their maximum possible withdrawal rate.

However, it’s obvious your allowable withdrawal rate increased (sometimes substantially) due to the existence of a volatility sponge-like Whole Life insurance for retirement. The more years of non-market retirement you have stored to delay drawing from your portfolio in down years, the greater the withdrawal rate you could take from those assets.

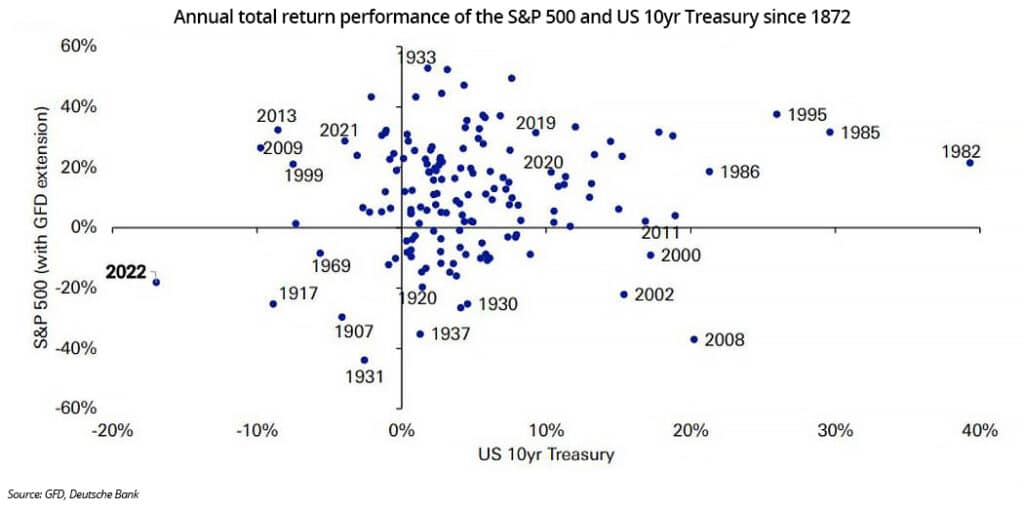

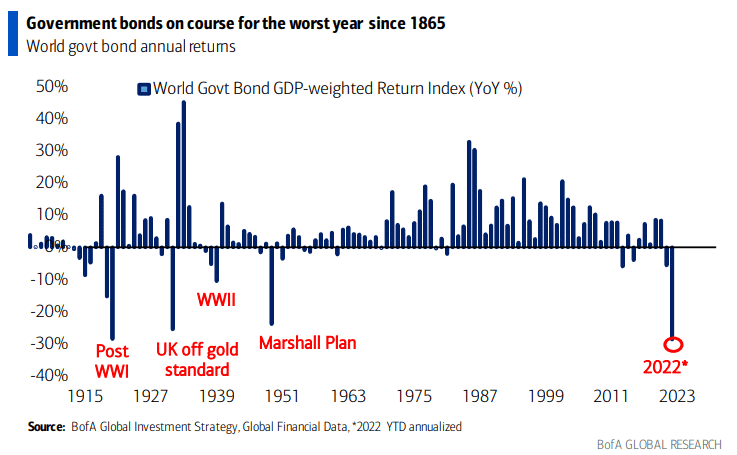

It used to be that bonds acted as a balanced portfolio’s volatility sponge, but as you can see here in Deutsche Bank’s 2022 scatter plot, both stocks and bonds correlated together to the downside in nearly identical portions.

Mutual fund company Alliance Bernstein found that replacing even just half of a 60/40 bond component with fixed-indexed annuities “beat the traditional 60/40 over 98% of the time, with an average outperformance of 9.9% in winning periods.”

Using Whole Life insurance as yet another type of “actuarial bond” can provide true immunity from market losses, backed by the most solvent financial companies in America.

Not one of the true mutual insurance companies took a penny of bailout money in 2008, and mutual insurance companies were actually the ones that bailed out failing banks after 1929, long before FDIC was in existence. This is because life insurance companies are held to much higher regular standards than fractional reserve banks in terms of financial solvency and liquidity.

We talked a lot about how to use Whole Life’s death benefit as a wealth replenisher for guaranteed income annuities and its cash value as a volatility sponge for your portfolio assets. In addition, Whole Life can also be used as a tax-eraser which can enhance a retirement withdrawal strategy even further.

Whole Life as a Tax-Eraser in Retirement

We saw with a Monte Carlo calculator that a higher withdrawal rate definitely increases the sustainability of a portfolio.

But the impact of taxes actually makes things much worse. Think about it…

Pulling any additional income from your 401(k) does 2 things actually:

- We saw how increasing your desired income from $90k to $120k with a $2.5M portfolio increased its failure rate from 1/20 to 1/5.

- Plus, you’re likely leaving a tip for Uncle Sam since that extra $30k withdrawal will always leave your 401(k) at your highest marginal tax bracket.

Let’s just say that extra $30,000 withdrawal from your 401(k) was taxed at 28% federal + 5% state tax. You would only need $20,100 from your Whole Life policy to end up with the same net spendable amount.

It’s all about efficiency. Using Whole Life this way over a 25-year period helps you erase $247,500 from your tax returns ($9,900 x 25 years).

Who cares who wins the performance battle between 401(k) and Whole Life before retirement?

In fact, you absolutely need your 401k to crush it since you’ll have to withdraw an extra $750,000 from your 401k at a modest tax bracket just to equal the same $502,500 of cumulative tax-exempt income from Whole Life ($20,100 x 25 years).

Imagine withdrawing amounts from your taxable sources right up until you reach any really ugly tax brackets and then supplementing the rest of your desired lifestyle using Whole Life’s tax-exempt distributions. The higher the tax rate, the more efficient Whole Life becomes.

As different regimes occupying Congress during your retirement change tax rates for better and for worse, what if you could “time your tax” by toggling the amount of taxable retirement distributions you want each and every year? The more egregious tax policy becomes, the more valuable your Whole Life cash value will be to you.

Most people are highly concentrated to investments where their retirement income will be taxable in some way, shape, or form. None of the following are immune from Uncle Sam:

- Rental Real Estate

- Brokerage Accounts

- Social Security Payments

- CDs, Checking, and Savings

- Deferred Compensation Plans

- IRAs, 401(k)s, Profit Sharing Plans, Pensions, etc.

Can you think of a reason why Congress may need to raise taxes in the future…on everybody?

Off the top of my head, I can think of over 36,000,000,000 reasons, and growing! What’s pitiful is that when I originally posted the first iteration of this “Whole Life for Retirement” piece, the national debt was just over $20 Trillion. Seven years later, it increased by over 60% to over $36 Trillion.

What will the lowest and highest tax bracket look like when you finally retire?

Whole Life is no longer just an estate planning tax tool for the rich.

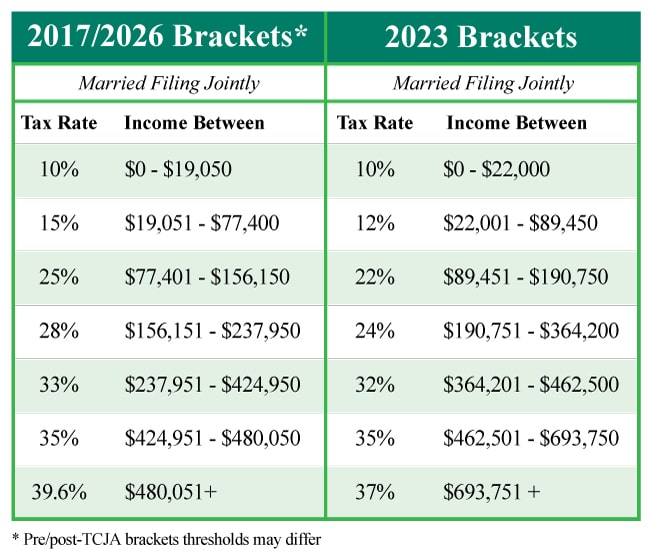

Did you realize that tax rates are already set to rise for everybody in 2026?

The favorable tax cuts from the 2017 Tax Cuts & Jobs Act were written in temporarily and already scheduled to sunset at the end of 2025. Even if Congress doesn’t meet to stroke the pen again and raise taxes even further, their pen has already been stroked to raise all but the lowest brackets.

This will obviously eat into the income of all retirees.

You can either proactively prepare or react and adjust your standard of living downward.

It is true that you can also take tax-exempt income from a Roth. But remember that a Roth IRA is also volatile and won’t help you protect your portfolio in down markets like Whole Life can. You wouldn’t want to redeem shares within your Roth IRA while it’s down even if it gave you some tax arbitrage.

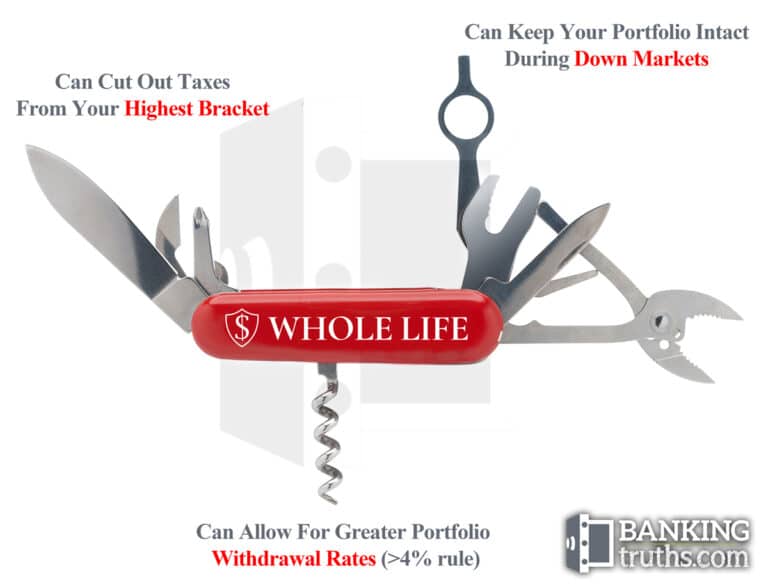

What makes Whole Life insurance so valuable is that its cash value has the ability to be simultaneously a “tax eraser” and a “volatility sponge” in retirement while the promise of its death benefit replenishes increased annuity steams you can’t possibly exhaust.

Tying Together Whole Life’s Primary Trifecta of Benefits in Retirement

It used to be that bonds fulfilled the role of volatility sponge in the balanced portfolios William Bengen studied to come up with his famous 4% rule.

However, due to increasing correlation and volatility, bonds failed retirees miserably in 2022 in helping protect retirees against sequence-of-withdrawals risk as seen in this chart from Bank of America Global Research:

Whole Life insurance offers cash value returns on par with higher-paying bonds, only with true principal protection backed contractually by the most financially stable companies in America.

Not only that, but Whole Life insurance offers a trifecta of unique utility in retirement due to risk-pooling and actuarial science.

- Whole Life’s net death benefit (over & above the cash value) allows you to aggressively annuitize a chunk of retirement assets you can’t outlive since they will be replenished upon your passing.

- You can use Whole Life’s cash value to temporarily pause income from market-based assets that are down. This allows them to fully recover without having to withdraw disproportionately more shares during down years.

- Utilizing Whole Life dividends can help preserve your portfolio during eras of bad tax policy or whenever discretionary spending in retirement pushes your income into unfavorable tax brackets.

Why is Whole Life an indispensable tool along the retirement journey?

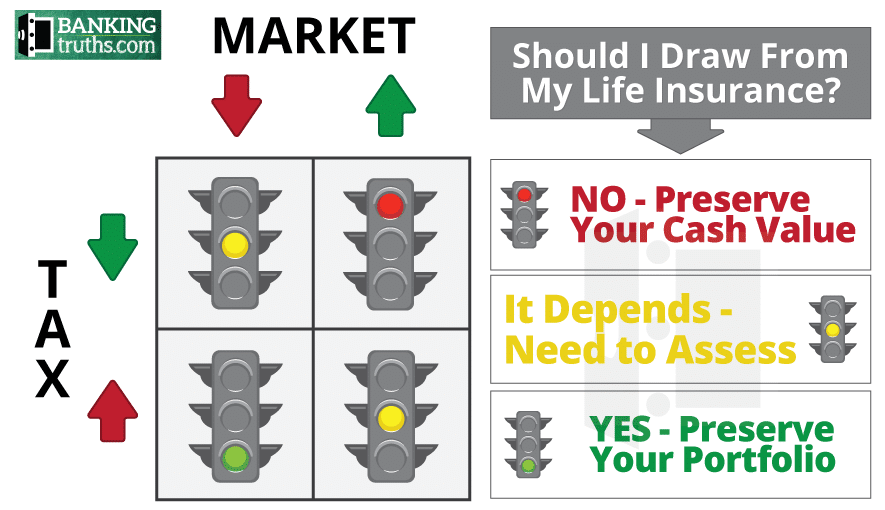

Because only Whole Life insurance gives you the full optionality of pausing retirement withdrawals from your portfolio assets and other taxable sources without sacrificing your lifestyle. Below is a simple matrix I show clients that help them make year-by-year “where do I pull my money from” in retirement.

Imagine being able to stop the bleeding in your portfolio or cut out the taxman from the worst tax brackets you’ll face in retirement. Whole Life provides the full optionality whether you have a red light, yellow light, or green light situation:

Whole Life helps uncork and consume more assets than you otherwise could. Whole Life helps to repair broken portfolios from volatility damage. Whole Life helps to cut out the most egregious tax brackets from your income each year throughout retirement.

Whole Life offers triple-threat protection to the most common eroding factors in retirement:

- Longevity Risk

- Market Downturns

- Future Higher Taxes

In addition, certain Whole Life policies can offer protection against one more common retirement threat: chronic Illness or critical Injuries needing long-term care.

Bonus #1: Whole Life for Chronic Illness or Critical Injury

What if you become chronically ill or critically injured?

Statistics show that nearly half of all retirees will need some sort of “Long-Term Care” whether inside a professional facility or within the comfort of their own home.

Nobody cares to imagine themselves too sick or hurt to function in society at any age. Everybody believes it can’t happen to them; however, bad things can happen to good people, especially as they get older.

Traditional Long-Term-Care policies can be extremely expensive. Furthermore, LTC premiums are essentially a pure cost since they don’t build any cash value equity you can use along the way.

However, certain Whole Life insurance policies have riders allowing the policyholder to hedge against this serious risk while simultaneously building up a guaranteed death benefit to replace any consumed retirement assets.

I’ve heard several tear-jerking stories over my career about clients who had policies like these only to end up contracting some kind of horrible debilitating illness. Having this chronic illness rider in place allowed them to:

- Alleviate financial stress, which could’ve accelerated their illness

- Get quality care they couldn’t otherwise afford to pay out of pocket

- Pay the travel & lodging expenses for extended family to be with them

Who wouldn’t want this kind of hedge in their back pocket?

Bonus #2: Whole Life for Pre-Retirement Liquidity

Everyone needs to keep a certain amount of safe and liquid cash reserves, especially on the way to retirement.

If you’re a real estate investor or business owner, you probably have considerably more money in cash than you do invested in the stock market. Even W-2 employees are advised to keep somewhere between 6-12 months of expenses safely in cash.

Not only do you want to handle most emergencies, but you want to be prepared to take advantage of timely investment opportunities.

When the sky is falling everywhere else, cash is truly king and the best opportunities present themselves. Keeping 5 to 6 figures parked in savings accounts can create a lost opportunity cost with little to no growth, or a lot of unnecessary tax since bank interest is fully taxable.

What If you could use Whole Life insurance as your own bank in between major expenditures?

What if you kept just enough in your checking account to manage your month-to-month expenses, while your longer-term reserves were compounding safely inside Whole Life?

Did you know that the two biggest banks in America each have over $20 Billion Dollars of their customers’ deposits invested in Life Insurance policies taken out on their key executives?

That’s why our site is called Banking Truths and our motto is “Don’t do what banks say…Do what they do!”

The major banks know that properly structured life insurance is the only way to simultaneously keep money liquid while safely growing it, without either market risk or taxes.

Click here or on the image below to watch our 4-minute video examining the balance sheets of the two biggest banks in America with data from straight from https://www.fdic.gov/.

Although Whole Life insurance is not guaranteed by FDIC, it can have your liquid assets working harder and wearing multiple hats for you before retirement.

Having substantial liquidity before retirement may substantially increase the size of your eventual nest egg. Think about all the opportunities you could have capitalized on if you were highly liquid following the crash of 2008. What’s not actionable is to cash out stocks that lost 50% to buy depressed real estate or vice-versa.

With Whole Life you earn a steady tax-exempt return while simply waiting for the pandemonium to set in, so you scoop up assets on sale.

Imagine the positive impact on your retirement if you had all your assets working for you all the time, even your safe and liquid cash…or cash value rather. You would be well-positioned to capitalize on timely opportunities whenever the sky does start falling again, without the lost opportunity cost while you wait.

Conclusion...

The commonly touted ideal of “self-insuring” in retirement is at best misaligned and at worst malpractice by financial media moguls promoting their preferred wares:

- Managed money

- Mutual Funds

- Term Insurance

For eons, the investment and insurance industries have been bashing each other competing for the same client dollars. Unfortunately, clients are better off with a blend of both like in the days of old when risk-pooling and actuarial science produced a sense of certainty that is lacking today with most peoples’ retirement strategies.

Clients can opt back to the certainty of actuarial science by simply reallocating what should be the more conservatively allocated portion of their portfolio to the undeniably useful combination of Whole Life with Guaranteed Income Annuities to some degree. Their unique utility will help combat these very real risks in retirement:

- Systematic Spend-Down of Assets

- Wealth Replacement Upon Death

- Buffer Against Market Downturns

- Wipe out Tax from High Brackets

- Chronic Illness/Injury Protection

In addition to hedging against these risks, the powerful combination of Whole Life coupled with the greater withdrawal rates offered by Guaranteed Income Annuities can literally make less assets spend like more and provide higher guaranteed income in the worst of scenarios.

Ironically, having this combo in place also allows you to let investment assets do what they do best likely providing more discretionary liquidity and income, since you can pause distribution during down years knowing Whole Life will pick up the slack with tax-exempt non-correlated income.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com