Whole Life Insurance Dividends: Options, Rates, History, Taxation, Etc.

Bottom Line Up Front on Whole Life Dividends:

Most people think Whole Life dividends work like stock dividends. They don’t. They’re not necessarily tied to company profits, they’re not guaranteed, and the dividend interest rate you see online does not equal the actual return of your cash value.

Here’s the real story:

- Dividend rate ≠ policy performance.

Two companies’ base Whole Life policy with the same “dividend interest rate” can produce drastically different cash value results because each carrier uses its own internal crediting formula and timing metrics. - Dividends enhance performance, but are NOT the engine.

Your base Whole Life policy’s guaranteed growth curve drives performance. Dividends simply enhance it like a fuel additive. A weak base policy with a high dividend rate can still underperform a stronger base policy with a lower rate. - Policy design matters more than the dividend rate.

An optimally engineered blend of base Whole Life, term rider, plus PUA rider will lay the rails to maximize future dividend payments.

- Dividend rate ≠ policy performance.

Nelson Nash, author of Becoming Your Own Banker: Unlock the Infinite Banking Concept, saw this firsthand in his own policy:**

“By the way, these dividends can get pretty significant over a long period of time. I bought a policy from a major insurance company in 1959, and the annual dividend is over ten times the annual premium now.” – Nelson Nash

Keep reading for a deep dive on Whole Life insurance dividends, or click one of the quick navigation links below to answer your specific question.

Quick Navigation – Find Your Answer:

- What dividends are and what they are not (3 min read)

- The 3 factors determining mutual company dividends (3 min)

- Dividend Rate vs. Total Return: what really matters (4 min)

- Which of the 6 dividend options should I choose and why? (5 min)

- Which Whole Life companies have the best dividend history? (4 min)

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What Life Insurance Dividends Are & Are Not

Here’s what most agents won’t explain clearly: dividends paid from a life insurance policy are essentially just a return of premium from the insurance company.

Think about it like this. When you pay your Whole Life premium, the insurance company collects more than they mathematically should need to guarantee your death benefit. This “overpayment” has created a cushion for these rock-solid mutual insurance companies for nearly two centuries now, keeping them safe against:

- Unexpected investment losses during recessions, depressions, and world wars.

- Higher-than-expected death claims during different outbreaks

- Or increased operational costs during times of high inflation

Dividends aren’t “profit sharing” in the traditional sense. They’re literally giving you back money they collected from you but didn’t need after insuring their multi-generational solvency.

Are Whole Life Dividends Taxable?

It depends on whether you withdraw more in dividends than you paid into the policy.

Since the IRS classifies them as a return of excess premium. Therefore, dividends received on participating life insurance policies are tax-free up to however much you paid into the policy, as you can see here:

“Any amount received which is in the nature of a dividend or similar distribution shall…not be included in gross income to the extent allocatable to the investment in the contract.” ~ IRC §72(e):

That said, you can always take a tax-exempt policy loan for policy distributions over how much you paid into the policy.

In fact, with life insurance cash value, you are allowed to take a tax-free return of principal first (FIFO) without affecting the earnings or growth. With the exception of a Roth IRA, you cannot withdraw all of your basis first without incurring some taxable implications.

In fact, most Whole Life illustration calculators have a built-in solve function for “withdraw to basis then borrow” when agents optimize life insurance for retirement. More on that later on in this article where we simplify how to choose between the 6 different dividend options during different life stages.

Although Whole Life dividends aren’t directly tied to profit sharing, there are correlations to the issuing mutual company’s profitability metrics. Let’s take a look.

The 3 Factors Insurance Companies Use To Calculate Dividends

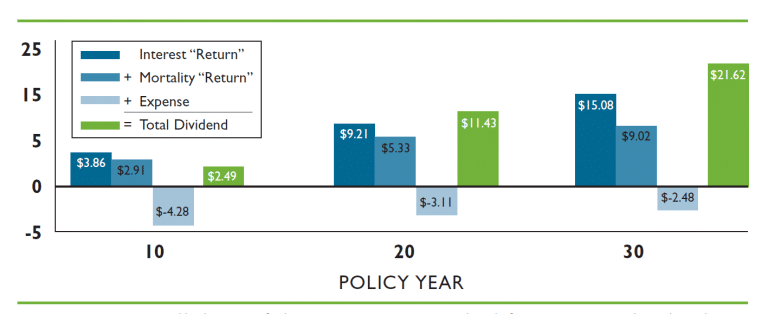

Life insurance dividends are made up of these three components:

- Interest returns (the yield on the company’s general portfolio)

- Mortality credits (the actual claims experience vs. the underwriters’ projections)

- Expense debits (the overall efficiency of company operations)

Seems pretty straightforward, right?

Except when you learn that no standard formula exists between mutual insurers.

Why Comparing Dividend Rates Between Companies Is Useless

That’s right… No two mutual companies calculate their dividends in the exact same way.

They each weigh these 3 factors differently. Not to mention, different companies vary in how much of the dividend pool each policyholder is entitled to based on their age, rating class, tenure in the policy, amount of cash value, and permanent death benefit in their policy.

Here’s a weird dividend example from real client work:

In fact, in 2022 Mass Mutual, one of the top-performing Whole Life companies, kept its published dividend interest rate the same as the year before. However, they lowered their mortality credit adjustment to the policy due to COVID-19’s higher death toll.

“The large print giveth, and the small print taketh away.” ~ Tom Waits

One of our clients asked us to rerun his projected income and was quite surprised to find lower future dividends despite the fact that their declared dividend rate remained the same at 6%.

Dividend Rate vs. Total Return: What Really Matters

These are NOT the same thing.

Remember, dividend rate declarations are just factors in an actuarial structure. The number that actually matters is your total return on premiums paid: how much you paid in, over what time frame, and the resulting cash value.

A company can declare a 6.5% dividend interest rate, while its actual long-term cash value IRR may be closer to 4.5% percent (before tax advantages).

Conversely, a company with a 6% dividend interest rate may produce a higher long-term cash value IRR.

Why, you ask?

Again, it’s because each mutual company constructs its Whole Life policies differently in terms of:

- Base policy guaranteed cash value growth

- Paid-Up Addition performance

- Cost of one-time PUA Loads

- Term insurance rider costs

- Timing of dividends

Life Insurance Dividend Rates Are All Lower Than They Appear

Here’s another layer of complexity most agents won’t tell you: the declared dividend rate is actually made up of the policy’s guaranteed growth rate plus an additional dividend rate.

If you see, for example, that a Whole Life company has a 6.25% dividend rate. It’s actually comprised of something like:

- Their contractually guaranteed 3.5% growth rate

- Plus a 2.75% additionally declared dividend this year

6 Whole Life Dividend Options Distilled Down to 2

Once a dividend is declared, you have six different options on how to use it, and you can elect different dividend options every year if you want.

But let me make this really easy for you before explaining your options. In most years, one of these two will be your ideal dividend option:

- If you’re not taking retirement income, have your dividends buy Paid-Up Additions

- If you are taking retirement income, consider taking your dividends in cash (depending on your other assets, tax status, longevity, etc.)

Are there other dividend options? Yes, but most of the time they’ll lead to suboptimal performance.

Here are all six Whole Life insurance dividend options:

- Buy One-Year Term Insurance

- Buy Paid-Up Additions

- Accumulate at Interest (with the insurance company)

- Cash Payment

- Reduce Premiums Due

- Reduce Outstanding Loans

We’ll discuss each one below, or if you get the point, we can jump straight down to dividend history by company.

Dividend Option 1 - One-Year Term: Your Access to More PUAs

What this does for you: OYT can maximize the amount of Paid-Up Additions you can buy in your policy by expanding the total death benefit of your Whole Life policy. The most cost-effective way to do this is to allocate a portion of your dividend payment to purchase one-year term.

How it works: Similar to how Indexed Universal Life charges for insurance, OYT is cheap while you’re younger, with the cost per unit of insurance increasing incrementally in your working years, and then exponentially increasing from retirement to life expectancy.

The idea is that you’ll either drop the term rider before it becomes cost-prohibitive, or it gets steadily replaced by overfunding with Paid-Up Additions or choosing PUAs as your dividend option.

Why it’s powerful: To be clear, one-year term may be an attractive dividend option to maximize your policy’s overfunding potential, but its cost will often be nominal and much less than your total dividend, allowing the remaining dividend to go towards PUAs. Also, certain companies have other term riders that are more conducive to overfunding (such as LISR with Mass Mutual or APPUA for Penn Mutual).

Dividend Option 2 - Paid-Up Additions: The Compounding Cheat Code

How PUAs work: When electing this option, only 5-10% of your dividend goes toward buying additional paid-up insurance. The lion’s share (90-95%) rolls directly into your policy cash value.

Four things Paid-Up Additions do for you:

- Immediately adds to your guaranteed cash value, locking in that steady guaranteed growth rate going forward

- Instantly adds paid-up death benefit (1.5x to 4.5x the dividend amount, depending on your age and rating class)

- Raises the bar of your guaranteed growth curve, since Whole Life’s cash value must equal your death benefit by age 121.

- Increases your cut of all future dividend pools. Your ownership stake in the mutual company is actually calculated by your Whole Life policy’s cash value & death benefit, both of which are increased by PUAs.

Why it’s powerful: PUAs create a compounding effect. Each year’s dividend buys more PUAs, which earn their own dividends next year, which buy more PUAs, and so on. This is why we call Paid-Up Additions “Whole Life’s turbocharger.”

As Nelson Nash wrote in Becoming Your Own Banker: Unlock the Infinite Banking Concept:

“If the owner uses the dividend to purchase Additional Paid-Up Insurance, the result is an ever-increasing tax-deferred accumulation of cash values that support an ever-increasing death benefit.” – Nelson Nash

The IRS confirms Nelson’s claim about the tax sanctuary of PUAs:

“Any amount described in paragraph (1)(B) shall not be included in gross income under paragraph (2)(B)(i) to the extent such amount is retained by the insurer as a premium or other consideration paid for the contract.” – IRS Section 72(e)(4)(B), titled “Treatment of policyholder dividends”

Dividend Option 3 - Accumulate at Interest: The Dilutive Tax Trap

How “Accumes” works: The insurance company distributes your dividend from your policy, holds it in a side account.

Tax Treatment: However, unlike PUAs, accumes are not tax sheltered per the IRS in Publication 550, “interest on insurance dividends left on deposit with an insurance company that can be withdrawn annually is taxable to you in the year it is credited to your account.”

Why they dilute growth: So unlike Paid-Up Additions, there’s no immediate 5-10% one-time premium load. However, since the dividend was expelled from the policy:

- The interest from the insurance company’s side account is taxable (unlike PUAs)

- “Accumulating at interest” doesn’t boost your cut of future dividend pools

- This option doesn’t simultaneously buy additional paid-up death benefit

A real life accumulate at interest anecdote:

When I started my career at Prudential in 2007, I was allowed to call upon existing “orphan” clients whose agents had left the company. I found one of Pru’s Whole Life policyholders who had a substantial amount of their past dividends accumulating at interest.

He probably thought, like I did at the time, “I don’t need more Paid-Up Additional insurance, I just want to earn interest on my dividends.”

In doing so, he received a fluctuating interest rate that trended towards 0% over the next 15 years, along with an annual tax bill. Instead, he could have paid a nominal one-time PUA load for extra guaranteed death benefit, where the cash value contractually climbs toward it at a better growth rate with no tax bill, since the dividend stayed within the tax sanctuary of the policy.

Dividend Option 4 - Paid in Cash: Income for Retirees

How it works: The mutual company you’re a part-owner of will automatically send you a check for the dividend amount.

Tax Treatment: As stated earlier, dividends received in cash are tax-free up to your taxbasis. Only after you’ve withdrawn your full premium investment would any additional dividends become taxable.

Key advantage over PUA surrenders: Taking dividends in cash does NOT decrease your death benefit. Your cash value still climbs towards that higher death benefit every year on a guaranteed basis.

However, if you want to maximize retirement income, you can also surrender PUAs purchased from prior dividends. Although this will reduce your death benefit, the insurance company will automatically surrender the least-efficient Paid-Up Additions, the ones propping up the least amount of paid-up death benefit.

When to Choose Policy Loans Over Dividends in Cash:

After you’ve recovered your entire premium investment through dividends paid in cash, you can switch your dividends back to Paid-Up Additions and then take policy loans to avoid taxation.

You may want to choose PUAs as your default dividend option in retirement over dividends in cash, if you’re not in the best health and want to preserve as much death benefit as possible. Since your paid-up additional death benefit will always be some multiple of the cash value, you may end up with more death benefit by increasing your PUAs and then borrowing against them (depending on policy performance vs. the loan rate and length of the loan).

Dividend Option 5: Reduce Premiums: Imperfect Temporary Fix

How it works: You apply your dividend payout dollar-for-dollar to reduce your required base premium payment.

When it makes sense: I suppose if you’re experiencing a cash flow crunch and can’t pay your base premium on time, but there’s a permanent opportunity cost to this temporary fix.

The opportunity cost: You lose all the future compounding those dividends could have generated as Paid-Up Additions.

Better temporary alternative: Use the policy’s Automatic Premium Loan (APL) provision. Your policy borrows against its cash value to pay the base premium, allowing your dividends to continue maximizing compounding through PUA purchases. You repay the loan as soon as cash flow improves.

Dividend Option 6: Reduce Loans: Suboptimal Fix

How it works: Your dividend applies dollar-for-dollar to pay down any policy loan balance.

Why it’s tempting: It feels good to reduce debt.

Why it might not be optimal: If you apply dividends to loan paydown, you miss out on the future compounding potential of those dividends as PUAs. Remember, your full cash value continues earning interest and dividends even on the amount you borrowed.

Better strategy in many cases: Keep floating the policy loan, use dividends to buy more PUAs, and the increased cash value growth increases your loan collateral, which may outpace the loan interest cost in the long run (depending on policy performance vs. the loan rate and length of the loan).

When reduce loan makes sense: If your insurance company/policy is suboptimal, you can no longer afford to pay premiums, AND you can’t service the policy loan, then redirecting dividends to loan reduction may be necessary to prevent lapse.

Whole Life’s Ultimate Bailout: Reduced Paid-Up (RPU) Non-Forfeiture Option

If you’re considering the Reduce Premium or Reduce Loan as your long-term dividend options, thankfully, the Department of Insurance and consumer advocates installed what is called the Reduced Paid-Up non-forfeiture option into every single Whole Life policy.

RPU is not a dividend option, it’s a bailout option. Even though there are some similarities to Paid-Up Additions and both terms contain the words “Paid-Up” and “option,” an RPU is materially different from a PUA.

The Paid-Up Additions dividend option can be elected every year, unlike the Reduced Paid-Up non-forfeiture option, which will irrevocably:

- Extinguish any loan balance using the policy cash value

- Make it so that no further premiums will ever be due

- Reduce the death benefit accordingly

However, an RPU is similar to a PUA in that by electing Reduced Paid-Up status, you essentially turn your policy into one big PUA going forward. No further payments are due, and the remaining cash value is guaranteed to climb towards the newly reduced death benefit, hopefully earning dividends along the way.

Let’s now look at the historical dividend fluctuations for each major mutual insurance company.

Whole Life Dividend History By Insurance Company

Remember, there’s no standardized dividend formula among Whole Life companies. The annual dividend rate is only valuable when comparing the same company’s historical performance to itself, not when comparing different companies to each other.

Dividend Rate History Chart For Infinite Banking Companies

The table above shows GREEN years (rate increases), GRAY years (maintained), and RED years (decreased) for major mutual companies over the past 15-20 years.

Dividend Rate History Chart For Infinite Banking Companies

The table above shows GREEN years (rate increases), GRAY years (maintained), and RED years (decreased) for major mutual companies over the past 15-20 years.

Looking up those columns vertically for each company, you can spot patterns in how they raise, lower, or hold their dividend. You can visually scan across to see if they are trending positively or negatively in relation to their peers.

When I left Prudential and moved to Guardian Life in 2008, I was baptized by fire on Whole Life education during the Great Recession. It was then that I saw the true value of Whole Life as a non-correlated asset, when the sky was falling with every other asset class.

You’ll notice that around that same time period, there was a bit of an arms race for supremacy between Mass Mutual and Guardian. Then Penn Mutual, a smaller but more nimble mutual company, made some shrewd investments, which boosted its dividends. They became the fastest-growing mutual company for the next 1.5 decades. Since 2010 Penn and Mass have been locked into that arms race as the #1 & #2 best-performing Whole Life companies.

Guardian and New York Life are not far behind, but the lesser-known mutual holding companies continue to substantially lag the True Mutual Companies in terms of long-term performance.

Dividends in Theory vs. Application and Reality

Remember that both current and historical dividend rates are just theory until you input these following factors through the different Whole Life companies’ illustration software:

- Your age & health rating

- Your premiums: how much & how long

- Your policy design (base to term to PUA ratios)

- Intended dividend & loan distributions in the future

We’ll model your specific premium, age, and health rating across Penn Mutual, Mass Mutual, and Guardian so you can see the actual differences.

In your custom company comparison, you’ll see:

✓ Side-by-side illustrations showing dividend projections over 10, 20, and 30 years

✓ Guaranteed vs. projected performance under different dividend scenarios

✓ How each company’s PUA structure impacts long-term compounding

✓ Loan strategy comparison (Direct vs. Non-Direct Recognition)

✓ Total return on premium analysis—the number that actually matters

You can also learn how to repurpose a properly-designed Whole Life policy to act as your own private bank and retirement vehicle using our comprehensive and proprietary 4-D Banking system.

About the Author:

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

• 18-year practitioner professionally & personally

• 14 family banking policies across 3 different companies

• Independent broker (can model all top mutual companies)

** Disclosure: John “Hutch” Hutchinson has no affiliation or association with The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book “Becoming Your Own Banker: Unlock The Infinite Banking Concept.”

This analysis represents the author’s professional opinion based on 18 years of experience and should not be considered tailored financial advice for your personal situation. Individual policy performance will vary based on personal circumstances, company dividend performance, policy design, and loan usage. Consult with a qualified financial professional before making insurance decisions.