Becoming Your Own Banker Explained

Can I become my own bank?

Yes, you can “become your own bank” by borrowing against the cash value of a properly-structured whole life insurance policy. Like an actual bank you must seed first this policy with ample reserves, then borrow as needed against its continuously-compounding cash value rather than depleting it via withdrawals.

Why you should become your own bank?

Using Whole Life insurance to become your own banker rather than utilizing traditional banks can often result in better growth rates, tax advantages, multiple protection benefits, but most importantly – the continuous compounding of your cash value balance even while borrowing against it for other expenditures, emergencies, or strategic investment opportunities.

How Does Being Your Own Bank Work?

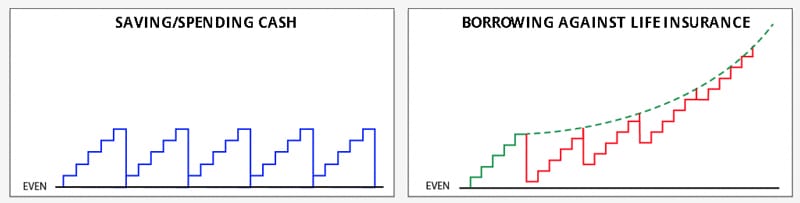

Being your own bank entails structuring a whole life policy in a way that prioritizes cash value growth by funding the policy to maximum allowable limits (per the IRS). When you’re ready to deploy these reserves, you would elect to borrow against the cash value rather than withdraw it to keep your full cash value balance compounding inside the policy. By borrowing and repaying over time rather than withdrawing and replenishing, you always keep your full balance working for you creating a larger compound interest curve over time.

Another positive aspect of Whole Life insurance cash value is the fact that it’s tax-exempt as long as you keep your policy in-force until the death claim is paid. Don’t worry, you can still utilize your Whole Life cash value throughout your entire life. You can even actually withdraw all the premiums you paid in without taxation, but if you want to access your growth tax-free, you must borrow.

Let’s delve into Whole Life’s borrowing option.

Even though “borrow” and “loan” are often thought of as dirty words, remember that compounding is the most important feature of being your own bank with insurance. Borrowing against your Whole Life insurance policy is precisely how to maintain the continuous compounding of your cash value while still using it for major purchases, emergency funds, as well as strategic investment opportunities that arise.

When you withdraw rather than borrow from a Whole Life policy you remove assets that could’ve kept compounding on your behalf. The longer you allow compounding to work the better it gets over time. Withdrawing cash value out of a Whole Life policy would result in resetting your compound curve to a lower position. Plus you would hinder your policy’s future growth by receiving a smaller cut of future dividend pools from the mutual insurance company.

On the other hand, if you borrow your cash value, you never miss a beat on that continuously compounding curve while maintaining your right to those bigger future dividends.

We have an entire section of our website discussing the intricacies of how Whole Life works when properly structured to be your own bank.

Who Started "Being Your Own Bank"?

The concept of being your own bank using Whole Life insurance was originally laid out by Nelson Nash in his now-famous book The Infinite Banking Concept – Becoming Your Own Banker. Nelson shared how the inspiration behind using Whole Life insurance to be your own bank occurred to him while healing in a hospital bed with heart trouble. Nelson would go on to popularize IBC by publishing different editions of the original Infinite Banking book while gaining a massive following among infinite life insurance agents and consumers looking to become their own bank.

That said, there are documented examples long before Nelson Nash’s books that famous entrepreneurs like Walt Disney, J.C. Penney, and Ray Kroc of McDonalds all borrowed against Whole Life insurance to be their own bank in the process of starting, growing, or saving their business. Although the specifics of the insurance products and dividend rates have changed over time, the underlying mechanics of using Whole Life insurance to be your own bank is the same as when these well-known titans of industry utilized the same concept.

Even still, Nelson Nash should be honored for articulating this complex strategy in a way that was digestible and actionable for the public (both clients and agents). Although I do not personally use Nelson’s early text as an owner’s manual of sorts for modern-day IBC optimization strategies, I do respect and revere his early work in helping people take greater control of their finances by becoming their own bank.

Is Becoming Your Own Bank with Whole Life a Scam?

Using Whole Life insurance to be your own bank is NOT a scam. That said, some unfortunate people do get scammed from buying a poorly-designed Whole Life insurance policy from either ignorant or unscrupulous agents marketing the concept with lackluster products and designs.

Click to download The Ultimate Guide to Whole Life for IBC on PDF so you can be knowledgeable about how best to design Whole Life as your own private bank regardless of who you work with.

However, even if you did for some reason purchase a lackluster Whole Life policy, it could still be your own bank. You simply wouldn’t have as much access to capital early on nor as strong of a cash value growth curve compounding into the future.

Since you always control how the cash value in your Whole Life policy is used, the only way to really get “scammed” per se, would be if you borrowed against your cash value to make a bad investment. Needless to say, that would not be a problem with the banking concept itself, but rather how you chose to utilize it.

Benefits of Being Your Own Bank with Whole Life Insurance

It helps to see your actual numbers modeled out to fully grasp the gravity of the benefits available when using Whole Life insurance as your own bank.

Here are summarized benefits of becoming your own bank with Whole Life insurance:

- Better growth than banks provide

- Tax-Sheltered growth & distributions

- Multiple protection benefits available

- Continuous compounding even while borrowing

Again, the sum of the benefits to being your own bank is nice, but by far the biggest and best one is the fact that your cash value continues compounding on your behalf even if you access it for other purposes via loan.

We each have limited time and limited funds to compound for our futures, and most of us must spend more than we can save.

Running our cash flow through a Whole Life policy optimally-designed to be our own bank is a way to get extra money compounding on our behalf that would normally be lost to us forever once spent. Conversely, we lose the financial momentum of single-use investment accounts like 401k plans or 529 plans once we withdraw for their single purpose.

Drawbacks of Whole Life Becoming Your Own Bank

Much of the negative hit pieces you’ll read about Whole Life insurance come from heavy bias and/or uninformed opinions parroting other hit pieces. In actuality, the biggest criticisms against Whole life (slow growth & high commissions) can be easily alleviated with a heavy blend of term insurance riders and PUA riders installed by the savviest life insurance agents.

However, even if you have a Whole Life policy designed optimally, there still are these 4 drawbacks you must be sure you’re ok with before becoming your own banker:

- Mandatory premium payments are due while funding your policy

- Early liquidity will be somewhat limited during the first few years

- You must qualify for a policy both medically & financially

- Discipline is needed to stay the course to be your own bank

It’s worth noting, that this banking strategy works best for strong savers already demonstrating good financial discipline. It helps too if you already have a lump sum sitting dead in the bank collecting dust. If so, most of these 4 drawbacks will be irrelevant. If not and you’re starting from scratch, then you need to double down on discipline and start with a policy that’s sustainable under any circumstances.

Whole Life Insurance to Be Your Own Bank With

Our entire site is devoted to why Whole Life insurance is the best way to become your own bank and how best to design a policy. In fact, you can visit this section on our Articles & Videos page to hone in on Whole Life insurance specifically.

To simplify things, these 8 features are why Whole Life is the ideal vehicle to become your own bank with:

- Safety of principal – Guaranteed

- Annual growth – Guaranteed (plus fluctuating dividends)

- Locked cost structure – Guaranteed never to increase

- Flexible Loan Available Always – Guaranteed

- Maximum access with the best loan-to-value ratio (95% LTV)

- Tax-sheltering of growth & loans (throughout the life of the policy)

- Solid backing by the oldest & most financially stable insurance companies

- Issuing company owned by Whole Life policyholders

No other financial product or company in existence can cobble together this powerful set of benefits, not to mention, you see the word “Guaranteed” over and over. This is one of the biggest advantages of using Whole Life insurance to be your own bank.

Whole Life insurance is often touted as an expensive rip-off. It’s because the bulk of the internal costs and agent commissions of Whole Life is based not so much on the size of the premiums, but rather on how much death benefit those premiums buy. The most exorbitant costs can often be mitigated by the designing life insurance agent shrink-wrapping the least amount of death benefit (allowed by the IRS) around however much in premiums you were planning on playing.

There are other design tricks such as blending term riders and other riders such as a Paid-Up Additions rider into the Whole life policy that will become your own bank.

We boiled down 15 years of industry knowledge into our 10-page Ultimate Guide to Understanding Whole life for Infinite Banking. It’s everything you don’t even realize you need to know about choosing the right agent, company, product, and combination of riders to make sure you’re getting the best insurance to be your own bank.

Starting Your Own Bank with Life Insurance

You can buy almost any other financial product with a point-and-click transaction, but buying a properly structured Whole Life policy to be your own bank is a much more involved process.

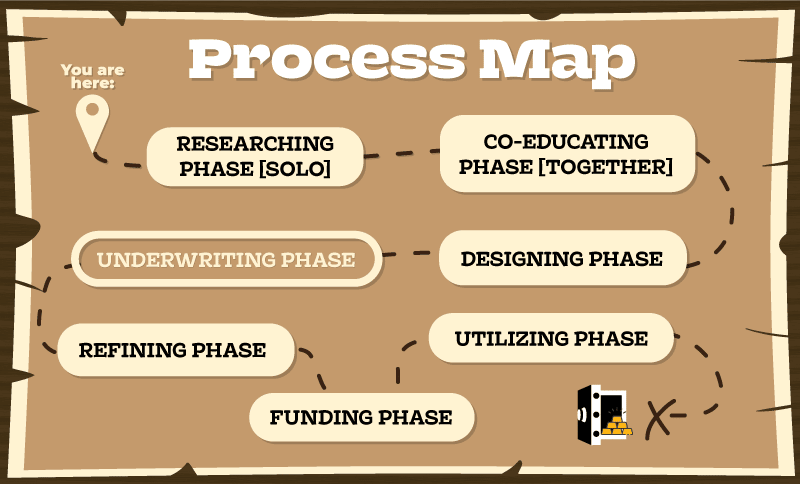

Below we’ve summarized the various onboarding stages so you know what you’re getting into.

Anytime you’re ready, you can book your own custom consult to have your questions answered or to design an optimal Whole Life policy to be your own bank.

[This summary is taken from our PDF “Ultimate Guide to Whole Life for IBC”. Downloading it here can certainly help you understand what you need to know regardless of who work with on a policy.]

Researching Stage [Solo]

Are you sifting through random opinions on the internet to see if becoming their own bank is really worth your time and energy. People often feel scattered, confused, & overwhelmed during this initial research stage.

Co-Educating Stage [Together]

We help you with your learning journey by answering questions and filling in the blanks about how being your bank with Whole Life really works. You then educate us about your situation so we can model your own true-to-life numbers to help you cement the concepts.

Clients feel excitement and relief as AHA’s happen and light bulbs go on.

Designing Stage

Our team designs multiple custom proposals from the best insurance companies that reflect your details shared with us in the prior meeting.

Distinct differences in features and performance of the different Whole Life insurance products now become clearer for clients.

Underwriting Stage

After we assist with education, the first decision point you have is simply determining which insurance company(ies) you feel can provide the best product(s) to become your own bank.

Underwriting sounds scary, like it’s a commitment. But actually, underwriting is not a contract nor a binding obligation. It’s simply an official petition to the insurance company for a health rating. That way we can model accurate proposals for you.

Some companies are even using AI-underwriting these days which may alleviate the need for a physical examination. However, the insurance company always reserves the right to revert to traditional underwriting depending on what their algorithm finds.

Refining Stage

Since insurance carriers will take time to decide on an accurate health rating, we have time to educate you about your range of options by modeling different policy sizes and what-if scenarios for you.

Thankfully your comprehension of the concept has progressed tremendously, so you feel more confident deciding what cash flow sources you have to funnel through your own bank.

Funding Stage

When the insurance company finally decides on a health rating for you, we do the final custom fitting for the policy you actually want to have issued. 24-72 hours afterward, they will issue your policy electronically where you can consummate the contract with online signatures and an ACH payments using the insurance company’s secure online portal.

Once the contract is in force, you will feel a rush of excitement to embark on this new course of financial control with a hint of nervousness since it’s all somewhat new to you.

Utilization Stage

Our team is here to help with service (even after “the sale”)

Whether you need to update payment schedules, request a loan, update your beneficiary, or even transfer ownership of the policy, we are simply an email or a phone call away from a Zoom meeting together. Plus we provide ongoing premium reminders as well as other strategic content via email to help you expand your policy strategy beyond being your own bank.

You feel confident knowing you have a way to safely grow your wealth in a tax-sheltered manner while staying liquid and building a buffer asset for retirement. Plus you have a team you can reach out to.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com