Why IUL is Considered a Bad "Investment"

The main reason why IUL is considered a bad investment is that the S&P 500’s total returns have undeniably outperformed Indexed Universal Life over any multi-decade timeframe.

To make IUL vs. the S&P 500 look superior, life insurance agents have to isolate and cherry-pick the worst decades in stock market history. However, critics of IUL also hype-up hate against it.

I can promise there’s more to both sides of the story…

Ironically, what makes Indexed Universal Life a “bad investment” is also simultaneously its biggest value proposition – IUL’s protective 0% floor.

Here’s what I mean:

The tradeoff for insulating IUL from losses in bear markets simultaneously limits its upside in bull markets.

However, this may not be such a bad thing for a portion of your assets.

Here’s why:

If you’re striving for the highest return possible, why even invest in the S&P 500?

Why not just invest in the “magnificent 7”, or better yet, just pick who you think the best performer will be (like Apple or Amazon) and just go all-in?

You’re probably going to tell me something about “diversification,” right?

A max-funded IUL can help you diversify far better than the S&P 493 (The S&P 500 minus the “magnificent 7”). Due to its contractual 0% floor, a max-funded IUL provides safety when every other investment you own correlates to the downside.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

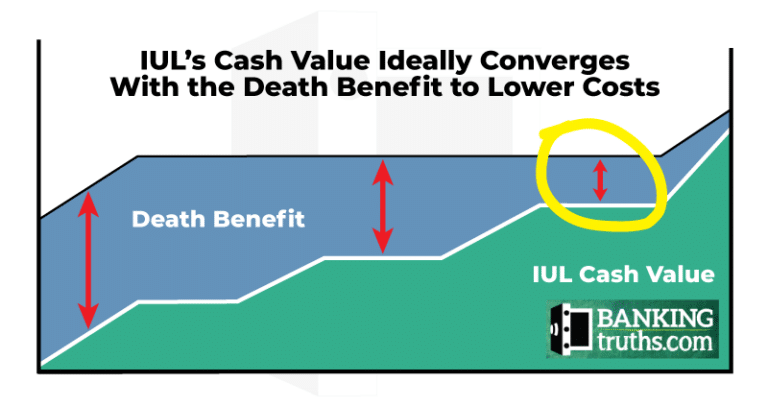

IUL Cash Value is a Super-Charged Savings Account

One reason critics say that IUL is a bad investment is because they’re comparing it to investments with a much more volatile risk/reward profile.

Ironically, these same haters of Indexed Universal Life insurance will tell you that the cash value is just a juiced-up savings account with an insurance wrapper.

Guess what… We agree!

So shouldn’t we be comparing IUL to something with a similar risk profile, like a savings account?

Maybe we should do what big banks themselves do and shrink-wrap insurance around our cash reserves to earn better growth rates that are immune to taxes?

Here’s how IUL cash value improves upon traditional savings accounts:

- Historically better growth rates

- Tax-advantaged growth for the life of the policy

- Tax-exempt access at any time (not after age 59.5)

- Built-in protection hedges for death (possibly disability & lawsuits)

Best of all, you can borrow against your IUL policy when emergencies or outside investment opportunities arise, while still keeping your full balance compounding on your behalf inside the policy.

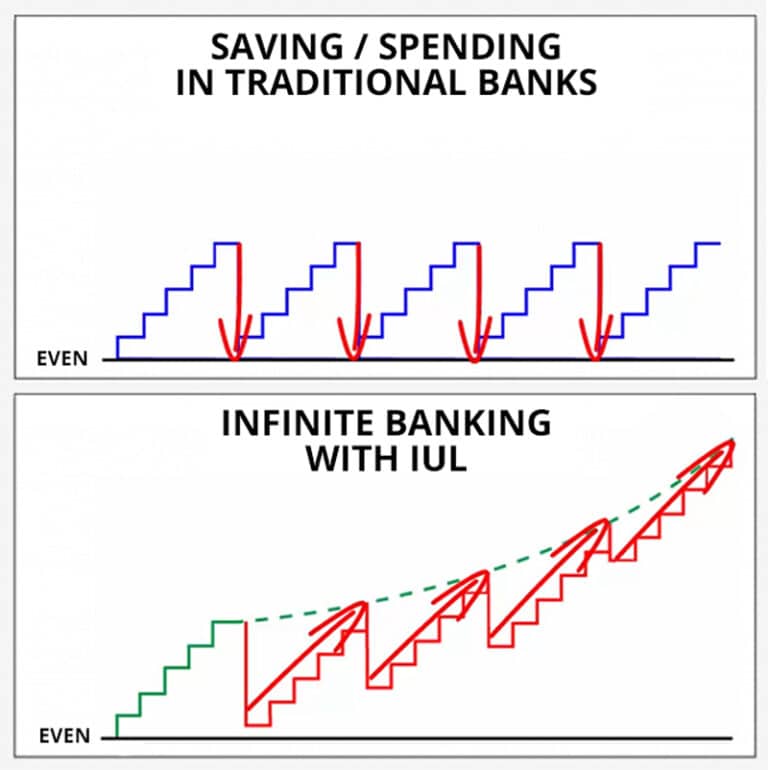

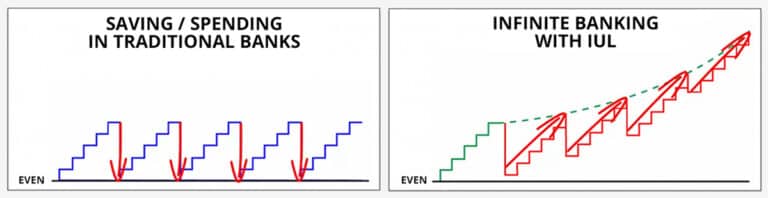

Can IUL work for Infinite Banking?

This ability to keep your safe & liquid assets compounding for you even while using them stems from something called Infinite Banking.

Typically, Whole Life insurance vs. IUL is the most common type of insurance used since Whole Life has steady growth every year.

However, since the S&P 500 index has gone up over 3/4 of the time during the last 85 years, then using a max-funded IUL for Infinite Banking can be a smart long-term strategy, especially when you’re protected against market losses.

Think about it! The best investment buys you’ll ever make will almost always be during a deep recession.

Having money safely growing while staying immune from losses and taxes will help you make the most of well-timed investments whether you’re:

- Investing in Real Estate

- Funding Property Renovations

- Buying Business Inventory or Equipment

- Acquiring Other Businesses (including stocks)

When these deals become available, your existing investments will likely also experience a downturn. You won’t want to cash out stocks while they’re down to buy stocks or vice versa.

Learn how to structure IUL to act as your own private bank now and retirement vehicle later.

It doesn’t matter which aspect you like best about Indexed Universal Life Insurance, since you get them both!

Is IUL a Good or Bad Investment for Retirement?

Have you heard that old saying:

“Stocks tend to take the stairs on the way up, but they use window on their way down.”

IUL as a Retirement Risk Buffer

Having a portion of your assets protected by IUL’s 0% floor during a major market downswing can help your 401(k) or stock portfolio to recover from those losses.

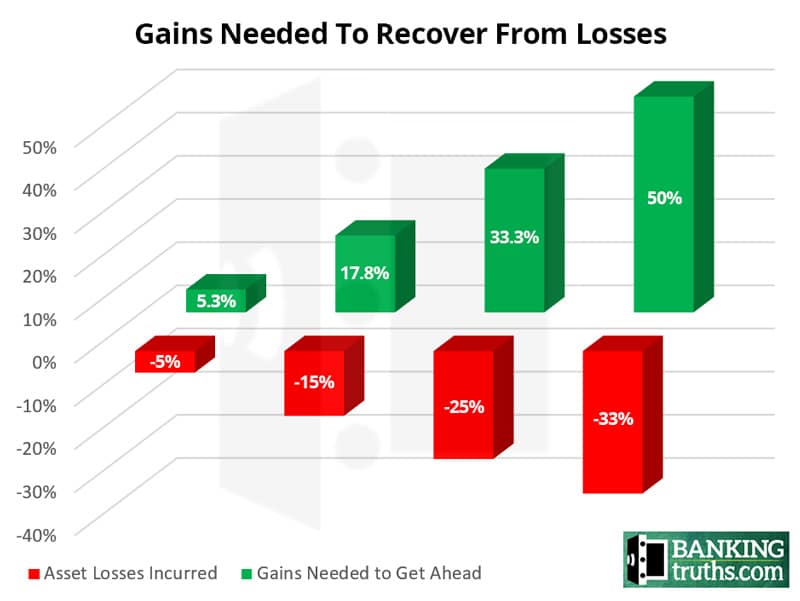

Did you know that the bigger the drop in the market, the more gains you need to recover? Take a look:

Sure, you could ride out these types of downswings while you’re working.

However, pulling out retirement income from investment accounts that are bleeding is like kicking them when they’re down.

You’ll need to cash out significantly more shares when stocks are down, simply to provide the same income you’ve grown accustomed to. Those shares obviously won’t be invested anymore to recover, leading to the portfolio death spiral.

In spite of IUL not returning as much as stocks, its 0% floor could provide that cushion while your other investments heal.

IUL as a Better Proxy for Bonds

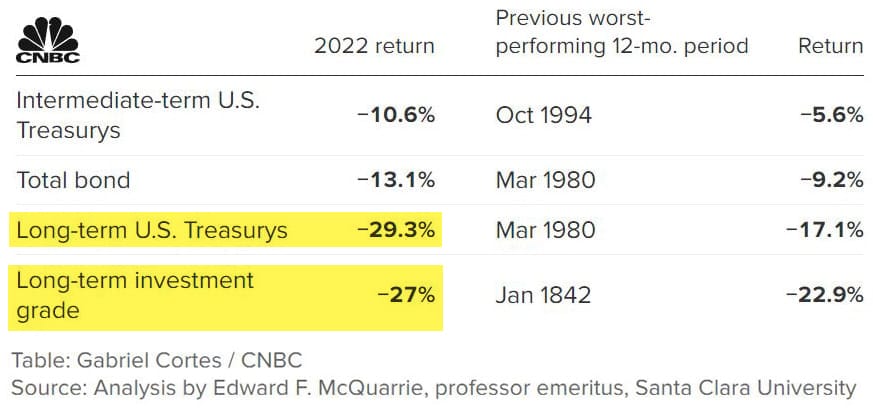

In the past, investors cushioned their stock portfolio with bonds to dampen volatility. When stocks were down, their bonds held strong. But nowadays, bonds are almost just as volatile.

Look at how much bonds lost during the 2022 bear market:

Bonds don’t have a guaranteed 0% floor, but IUL does.

Can you imagine relying on your investment grade bond funds as your “safe” retirement asset only to have it be down over 25% when you need it the most?

Indexed Universal Life clearly has a safer risk profile than bonds, while still being able to participate in a chunk of the upside that stocks have to offer.

Not only that, but the bonds that lost 25% are subject to ongoing tax, but not an Indexed Universal Life insurance policy.

IUL as a Tax Shelter

When it comes to taxation, IUL is quite a good investment because of its tax-sheltered growth and tax-exempt distributions at any age.

Don’t think in terms of “should I put money in an IUL vs. a 401(k)?”.

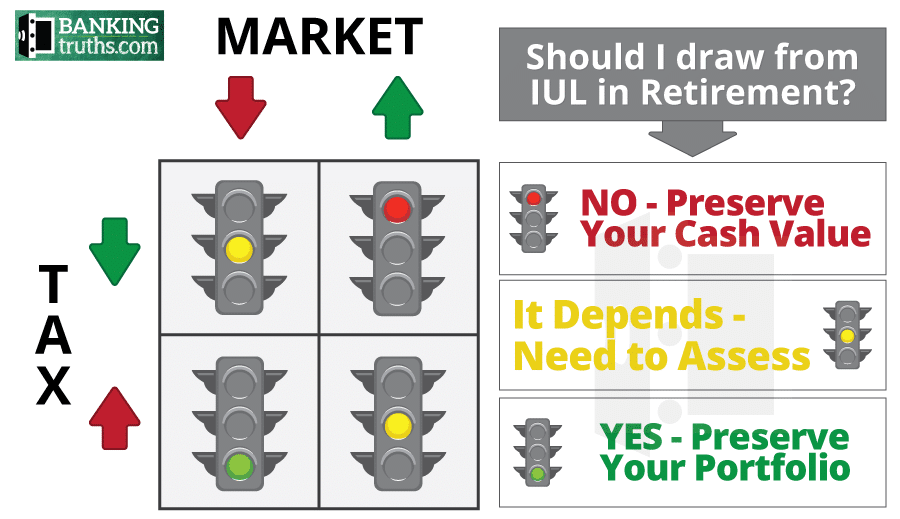

Do think of IUL being a complement to your 401(k), which most people are overallocated to anyway. Temporarily diverting some unmatched 401(k) contributions into a max-funded IUL policy may actually help preserve your 401(k) throughout retirement.

Remember, none of your 401(k) account has been taxed…yet. So you’ll still owe the tax on what you originally owed, plus all the growth in your 401(k).

The so-called “tax savings” in your 401(k) isn’t savings at all. It’s almost like:

- You have a mortgage on your 401(k) from what you owe the government

- You will pay the tax you originally owed plus interest (from all the growth)

- You can’t even control what rate you’ll pay the deferred taxes at

You’re not saving taxes at all, you’re just deferring or postponing the eventual pain until later when you have less control.

Since IUL enjoys the tax-advantaged wrapper of permanent life insurance, income can be taken tax-free (so long as you leave at least a minimal death benefit to be paid out). This means that you could pull income from a max-funded IUL right before you bump into that next higher tax bracket.

Sure, you could also draw income from a Roth to keep from bumping into the next tax bracket, but do you really want to cash out shares of your Roth when taxes are up, but markets are down?

As the ultimate diversifier, IUL is a good investment because of its ability to relieve pressure from 401(k) accounts when they are subject to high tax brackets or they down in value from market volatility.

Check out our flow chart on when to pull retirement income from a 401(k) vs IUL in our in-depth article on using IUL for retirement.

While some financial advisors tout IULs as the ultimate “tax-free retirement” solution, it’s important to recognize that they are primarily insurance contracts, not pure investments. The marketing often glosses over the high costs and limitations inherent in these products. Before committing to an IUL, make sure you’ve fully funded your 401(k), IRA, or other low-cost investment vehicles. If, after that, you still have excess income and need a specific estate or legacy strategy, an IUL might have a role in your broader 4-D Banking strategy, but it’s not the magic bullet it’s sometimes made out to be.

Frequently Asked Questions About IULs

An IUL can be useful in very specific circumstances, but for most people, it is not a good primary investment vehicle. The fees, caps on growth, and complexity make it less attractive than simpler options like IRAs, 401(k)s, or brokerage accounts.

Yes — especially in the early years. High upfront costs and fees can eat into your premiums, and if you stop funding the policy properly or take too much out, it can lapse and even trigger taxes.

IULs are best suited for high-income earners who have already maxed out other tax-advantaged accounts and are looking for a way to supplement estate planning or legacy goals. For most middle-income families, it’s overkill.

For nearly everyone, a 401(k) or IRA is a better first choice. These accounts generally offer lower fees, higher growth potential, and more transparency.

If you stop funding your IUL and there isn’t enough cash value to cover the internal costs, the policy can lapse, and you could lose both your coverage and any tax benefits.

Summing Up If IUL is a Bad Investment

If you’re asking if “IUL is a good investment? Is IUL a bad investment? Is it worth it?”, you may be trying to answer the wrong question correctly.

IUL is not an investment at all.

It’s a safe savings vehicle with the potential for market-linked returns (assuming it’s designed and funded properly).

In addition to a robust savings plan, Indexed Universal Life is an insurance policy.

However, IUL not only insures you against a premature death, it also helps hedge against:

-

-

- Market Losses

- Future Higher Taxes

- Judgements from Lawsuits

- Debilitating Chronic Illness or Critical Injury

-

People think they’re diversified by having a bunch of different stocks or mutual funds, but they’re all correlated to the same tax system and movements from global markets.

There are just too many unique benefits to simply dismiss IUL as being “a bad investment.” Rather than just accept this sort of blanket statement from the mass media or critics with competing agendas, why not book a free call to get your questions answered and see the top IUL policies modeled out for you.

Click here to learn more about the detailed pros and cons of Indexed Universal Life.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson is the founder of BankingTruths.com, an educational site discussing how to maximize the lifetime benefits of both Whole Life Insurance and Indexed Universal Life Insurance by creating your own private family banking mechanism.

Information presented in this article by John “Hutch” Hutchinson is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities product, insurance products, financial services, or investment strategies. Be sure to first consult with a knowledgeable, ethical, and licensed insurance professional before implementing any strategy or product discussed herein.