Max-Funded IUL: Safely Grow Tax-Free Cash Value

What is a Max Funded IUL?

Max-funded Indexed Universal Life (IUL) is simply a strategy using an IUL insurance policy optimized for cash value growth by stuffing a smaller amount of life insurance protection with the maximum allowable premium payments. This reduces IUL’s overall cost structure and stays within IRS guidelines to preserve its income tax-free treatment.

It’s completely counterintuitive:

Since we’re dealing with insurance, you’re probably thinking, “What’s the least amount of money I can pay for the most amount of coverage?”

With a max-funded IUL, it’s exactly the opposite. “What’s the most amount of money I can legally pay into the least amount of life insurance coverage?”

Think of it like shrink-wrapping a prime piece of meat.

By shrink-wrapping the least amount of death benefit possible around your premiums, you’re creating an airtight environment, preserving the quality of your IUL’s cash value.

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

How Max Funded IUL Works

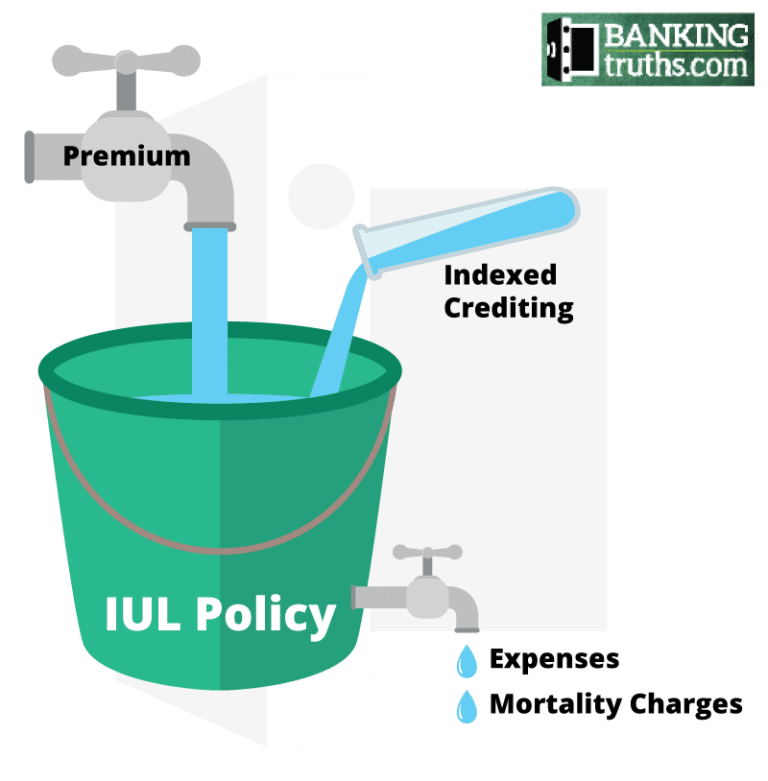

When starting any Indexed Universal Life policy, a portion of your premium payment goes toward:

- Paying for the permanent death benefit (which preserves your tax benefits)

- Growing inside the cash value (via the various indexed crediting strategies)

Let’s unpack how the credits and debits work within a max-funded IUL.

How Max-Funded IUL Reduces Fee Drag

By max-funding an Indexed Universal Life policy early and often, you are disproportionately shifting the allocation of premiums towards the cash value, thereby reducing the initial and ongoing costs associated with the death benefit.

Contrary to popular belief, IUL’s ongoing fees are not based on how much premium you pay. They’re based on how much death benefit you’re buying. The massive amount of surplus premiums beyond IUL’s cost structure goes towards growth within the indexed crediting strategies.

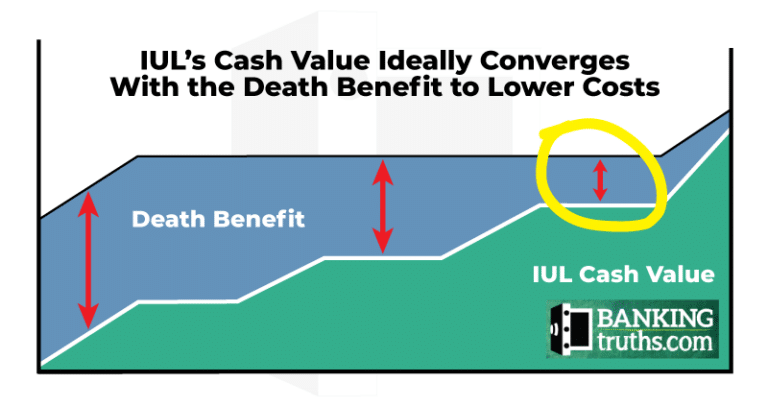

As the cash value converges upon a max-funded IUL’s death benefit, this further reduces the amount of “pure death benefit” you’re buying, which enhances cash value accumulation further, which reduces future death benefit costs, and so on.

Warning: many IUL agents have their clients focus solely on a their preferred IUL policy’s top-line growth without unpacking what the fees will be in the later years. Work with an IUL expert who will show you the top IUL companies as well as their full fee schedule.

With a properly-designed max-funded IUL policy, we’ve found the all-in average annual costs over the life of a max-funded IUL to be around 0.8%-1.5% as a percentage of your cash value. By choosing a front-loaded design (where you max-fund your entire policy in as little as 4-7 years), you can substantially reduce IUL’s ongoing fees.

Ironically, a max-funded IUL works out to be far cheaper than professionally managed money, yet when you look at who is hollering the loudest about Indexed Universal Life being expensive, it’s professional money managers.

How Max-Funded IUL's Safely Build Cash Value Growth

Your total cash value (made up of surplus premium payments + prior indexed crediting) can earn compounded growth linked to the performance of a particular stock market index like the S&P 500 within certain parameters.

What does that mean?

Typically, Indexed Universal Life tracks the annual growth of the S&P 500 dollar for dollar up to a certain “cap” (these days in the 9%-11% range). In return for limiting your upside, most max-funded IULs have a 0% floor, protecting against losses.

Some of the best IUL companies have uncapped indexed crediting strategies where you still keep your 0% protective floor. However, there is no cap when tracking an index, but you often will have a participation rate of less than 100%. This means instead of dollar-for-dollar growth up to a cap, you may only get 0.55 cents or 0.75 cents of growth on the dollar with no cap (with a 55% or 75% participation rate, respectively).

Keep in mind, that this has nothing to do with the IUL insurance company keeping a share of the growth for themselves. It simply has to do with the fact that hedging costs for an uncapped strategy are obviously more expensive than with a capped strategy, hence the tradeoff.

Max-Funded IUL Growth Example

Using round number examples, let’s look at examples showcasing the two main IUL growth strategies described above:

- A capped IUL strategy with a 10% cap & a 100% participation rate

- An uncapped IUL strategy with a 70% participation rate

Note: All examples will assume you still have the 0% guaranteed floor is obviously still in place protecting you from market losses unlike when investing in an S&P 500 mutual fund.

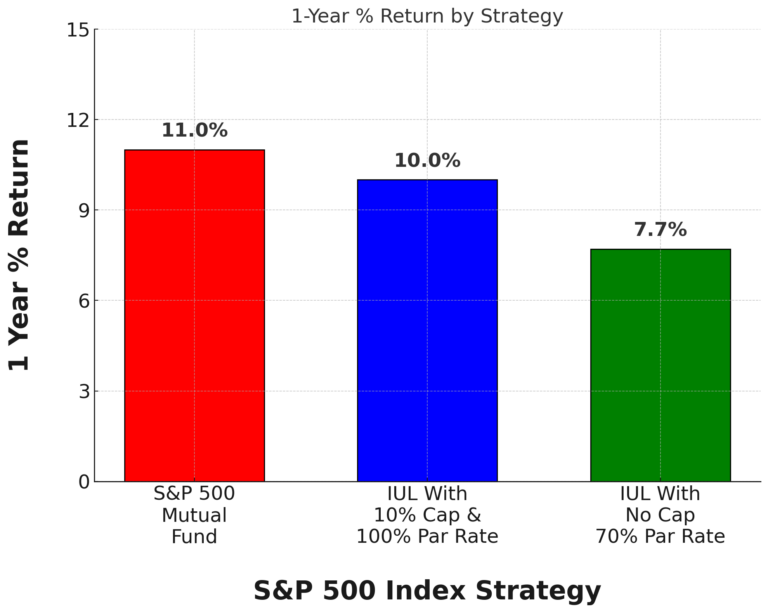

First, let’s assume the S&P 500 returned 11% in one year:

- The capped IUL strategy would credit you 10% since it participates in 100% of the S&P’s 11% gain, but only up to a cap of 10%

- The uncapped strategy, on the other hand, would credit you 7.7% since it only participates in 70% of the S&P’s 11% gain.

So the annual crediting in an 11% year would look like this:

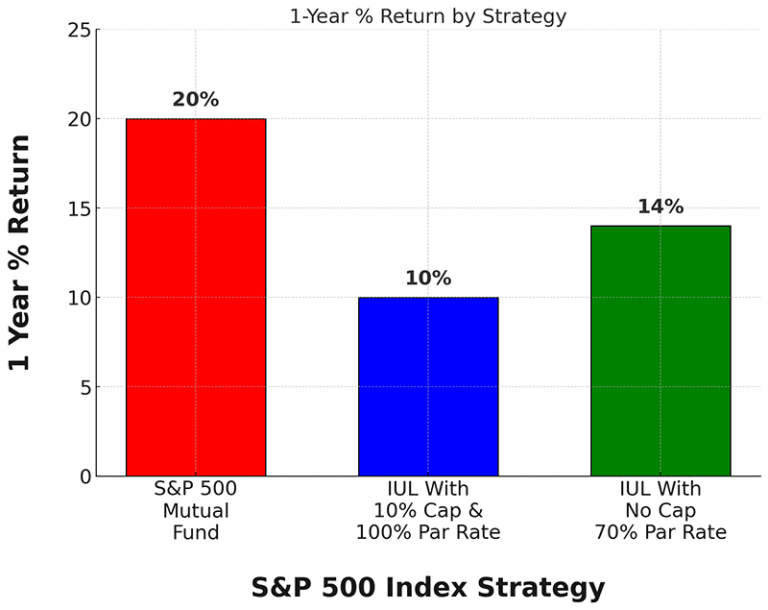

Next, let’s assume the S&P 500 had an annual return of 20% in another year:

- The capped IUL strategy would again only credit you 10% since it participates in 100% of the S&P’s 20% gain, but only up to a cap of 10%.

- The uncapped strategy, on the other hand, would credit you 14% since it only participates in 70% of the S&P’s 20% gain.

In a vacuum, it still seems like it’s better to put all everything in an S&P 500 mutual fund, but we didn’t look at what happens in down years.

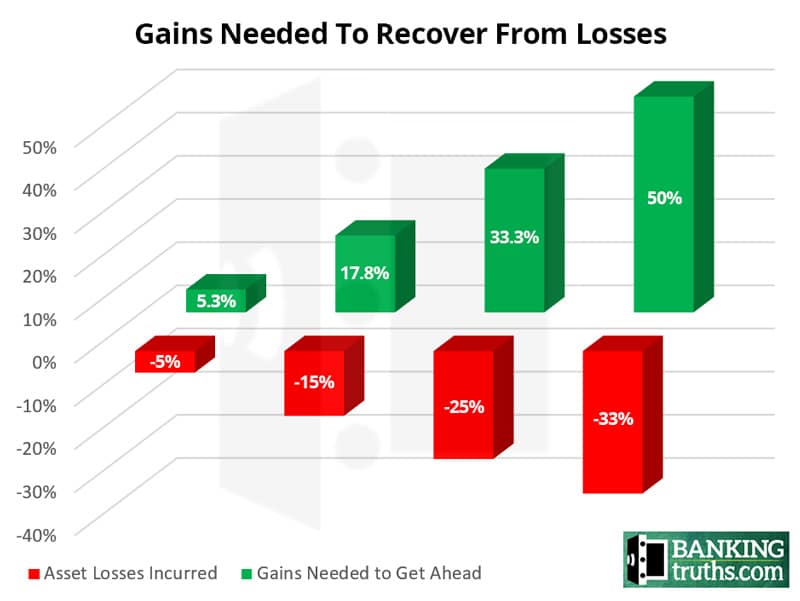

The ability for max-funded IUL to earn double-digit crediting in bull market years while limiting losses to the cost of your insurance policy in bear market years seems like a worthy proposition. This is because so much of an S&P 500 mutual fund’s ensuing gains after a loss would be needed to just to break even.

Even though IUL may not earn as much is bullish years, it does not have to play catchup after bearish years. This can be especially useful when markets tank, and you are looking to scoop up generational buying opportunities and/or when preserving your other market based assets by not having to liquidate them in retirement when they’re down.

Also, even though your max-funded IUL incurred no market losses, your future indexed crediting will start tracking that new lower value of the S&P 500, making it easier to earn future gains.

Here’s why

The "Annual Reset" Feature Within all IUL Policies

The 0% floor protects against losses in down market years, but IUL’s “annual reset” feature makes it easier to get gains the following year.

After a losing year in the market (where your IUL earned 0% rather than incurring market losses), the annual reset feature allows you to track the following year’s growth from the new lower starting point of the S&P 500.

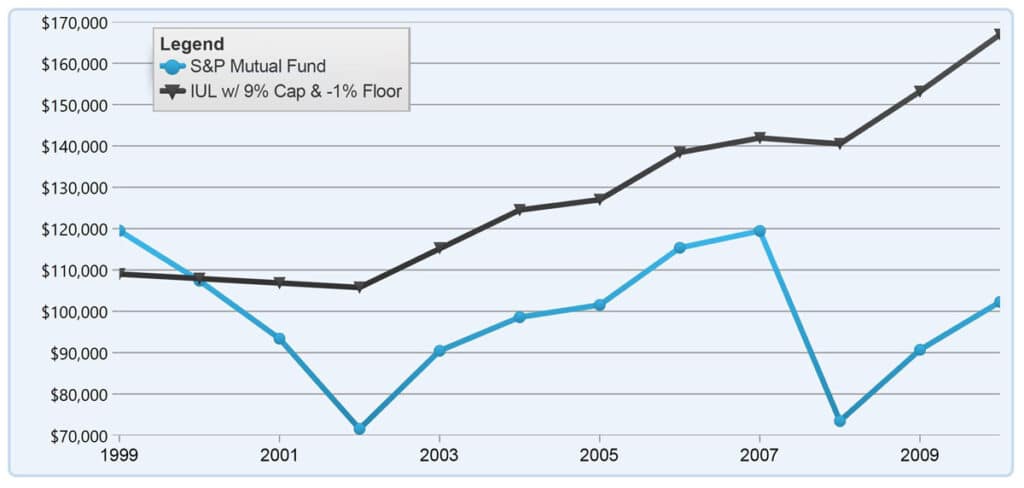

See the effect of IUL’s annual reset feature during “the lost decade.” We added 1999 so the S&P 500 mutual fund (in blue) starts out well ahead of a max-funded IUL (in black), but never regains the ground from having to recover those losses for over a decade. To be fair we also imputed a 1% fee drag lowering the effective IUL cap to 9% and the 0% to -1% in the example below.

Certain IUL policies even have strategies that allow for uncapped strategies with higher participation rates, so you can maximize your upside exposure while minimizing downside risk.

Book a call with an IUL expert to understand your options and avoid common pitfalls by insurance companies and agents with a tendency to overpromise and underdeliver.

Will a Max-Funded IUL beat the S&P 500?

Over time, the S&P 500 will likely outperform Indexed Universal Life, only with more volatility and exposure to taxation, which can erode much of that outperformance on paper when funds are actually needed.

Let me ask you something…

If you’re striving for the highest return possible, why even invest in 500 stocks? Why not just invest in the magnificent 7? Heck, why not just pick your best performer (like Apple or Amazon) and just go all-in?

The correct answer is “diversification”, correct?

Remember the old saying,

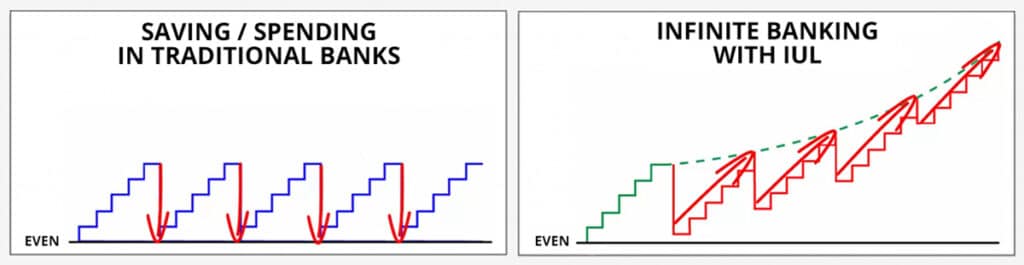

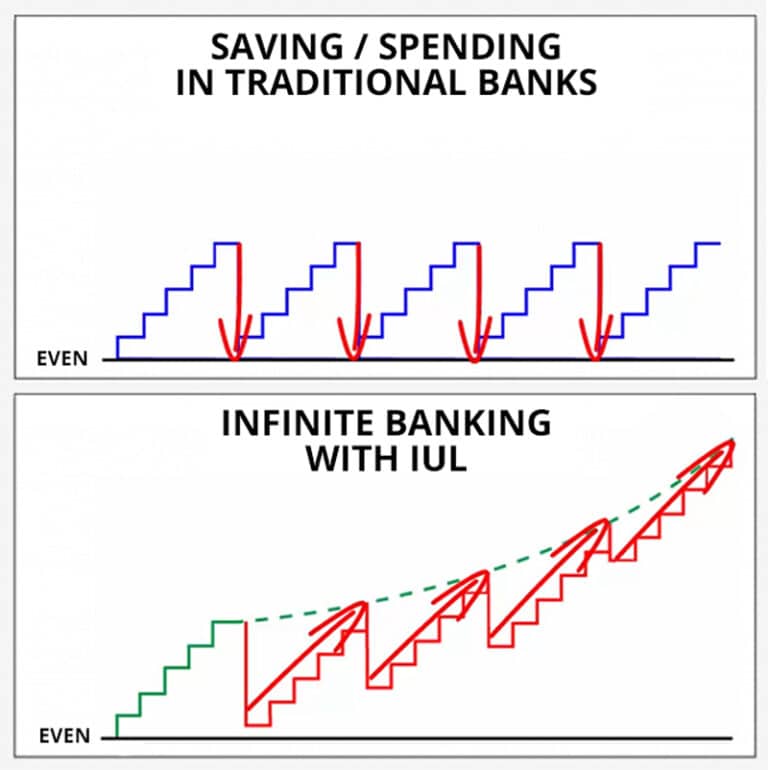

“Stocks tend to take the stairs on the way up, but they use a window on their way down.”

Indexed Universal Life undoubtedly helps you diversify better than the S&P 493 (stocks other than the “magnificent 7”, which make up the bulk of S&P 500 returns). Due to its contractual 0% floor, a max-funded IUL provides safety when every other investment you have correlates to the downside.

Is Max-Funded IUL a Good Idea?

A max-funded Indexed Universal Life policy is ideal for safely growing liquid capital in a way that’s immune from stock market losses, future higher taxes, or lawsuits.

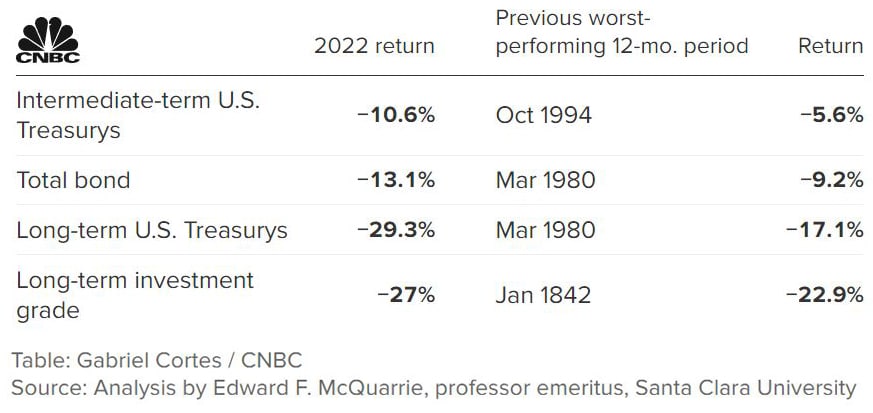

Critics are quick to say IUL is a bad investment, either without full understanding of the product or because the pure stock market will have greater long term returns over multiple decades. But this can lead to concentration and correlation risk since bonds have become almost just as volatile as stocks as seen in 2022:

In the past people chose the 60/40 portfolio with 40% bonds to dampen volatility, but using IUL can actually be less volatile than bonds, without sacrificing 40% of your portfolio’s valuable exposure to equity markets.

Due to its unique tax treatment and growth methodology, IUL works well as an invaluable “buffer asset” in retirement and your own private bank along the way.

You can read all about the detailed pros & cons of Indexed Universal Life here, but below are two ideal use cases for a max-funded IUL.

Max-Funded IUL for Infinite Banking

Using life insurance to become your own banker is traditionally done with Whole Life insurance. Many Infinite Banking practitioners prefer Whole Life vs. IUL for this purpose. However, a max-funded IUL can absolutely work with Infinite Banking when the following 3 features exist:

- A guaranteed 0% floor, protecting your cash value growth against market losses

- A low and locked indexed loan rate, enabling borrowed cash value to earn indexed crediting

- High IUL caps and participation rates, allowing you to earn well above the indexed loan rate

Rather than saving, spending, and replenishing your savings in traditional bank accounts, Infinite Banking seeks to keep your liquid capital compounding, even while borrowing against it for emergencies, opportunities, and major expenses.

By funneling your household or business cash flows through a max-funded IUL policy as your own private bank, you are simultaneously building up an invaluable retirement “buffer asset.”

Max-Funded IUL for Retirement

A properly structured and max-funded IUL policy is supposed to complement your retirement income plans, not replace them.

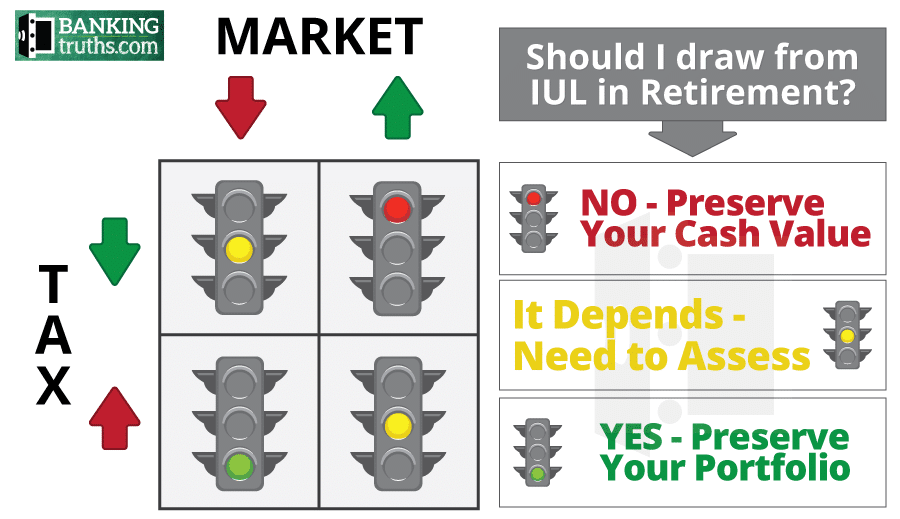

By having Indexed Universal Life in retirement, you won’t have to cash out more shares of your stock portfolio, 401(k), or Roth just to supplement retirement income when markets are down. If you own IUL you can pause your mutual fund redemptions and borrow against your max-funded IUL policy instead.

Also, if an unfriendly Congress enacts bad tax policy for 4-8-12 years during retirement, you can take a tax-exempt supplement from your max-funded IUL rather than bump into the next highest tax bracket causing you to cash out more shares of your 401(k).

Take a look at this handy grid taken from our in-depth article about how and when to use IUL for retirement, depending on if the stock market and tax rates are up or down:

Is an IUL Better Than a 401(k)?

Indexed Universal Life is better than a 401k because any 401(k) withdrawals are taxed at your highest bracket, whereas IUL distributions are tax-exempt.

Also, you can borrow against 95% of your cash value long before age 59.5 while simultaneously still growing it inside the indexed crediting strategies. IUL loans are also totally flexible, allowing you to choose your own repayment schedule.

Conversely, you must remove your money from the 401(k) investments to provide loan proceeds vs. keeping your intact cash value compounding inside IUL while borrowing. Also, you can only borrow 50% of your 401(k) balance up to a maximum of a $50,000 loan vs. 95% loan-to-value in IUL with no cap. 401(k) loans have structured principal and interest payments, fully paying off the loan within 5 years vs. loans from a max-funded IUL are totally flexible and not due until death.

IUL has no such limitations when emergencies arise or generational buying opportunities present themselves (usually when everything else is down).

We believe it’s not a question of “should you do a max-funded IUL or 401(k),” but rather when to do each:

- If you get a 401(k) match, take it, but why defer more?

- If no match, don’t bother unless you’re in the highest tax bracket

- If you don’t have an emergency fund, you may want to wait on the 401(k) anyway

Since many people are often over-allocated to the 401(k) tax trap, it may be wise to divert some 401k contributions beyond the match towards a maximum funded Indexed Universal Life insurance policy that can act as your own private bank now and a retirement buffer to better preserve your 401k in retirement.

Chronic Illness Riders within a Max-Funded IUL

Most Indexed Universal Life policies come equipped with some sort of Chronic Illness Rider for no additional cost. Chronic illness riders allow policyholders to access a portion of their death benefit income tax-free even while still alive, assuming they are diagnosed with a qualifying chronic illness or critical injury.

The ability to tap into the death benefit, even though you aren’t dead yet, can offer peace of mind, knowing that there is a safety net available in case of unexpected health issues or debilitating injuries. This feature can provide crucial financial relief, helping to cover medical expenses or everyday living costs during difficult periods without requiring the depletion of other savings or assets.

Benefits & Drawbacks of Max Funded IUL Policies

| Benefits of Max Funding an IUL | Potential Drawbacks |

|---|---|

| Faster cash value accumulation | Higher premiums required |

| Lower cost per dollar of cash value | Risk of becoming a MEC if overfunded |

| Lower insurance costs due to minimal death benefit | Complexity in setup and ongoing monitoring |

| Tax-advantaged withdrawals & growth | Not suitable for everyone — needs careful planning |

Frequently Asked Questions About Max Funded IULs

Max funding an IUL means paying the highest allowable premium into your Indexed Universal Life insurance policy without triggering a MEC (Modified Endowment Contract). This strategy is designed to minimize the death benefit relative to the contribution, so more of your money goes toward cash value accumulation — not insurance costs.

Max funding can supercharge the tax-advantaged growth of the policy’s cash value. People who use this strategy typically want a place to store capital with downside protection, tax-free growth, and access to the money through policy loans — especially once they’ve already maxed out 401(k)s or IRAs.

Your maximum allowable premium depends on factors like your age, the death benefit, and the structure of the policy. The IRS has rules that determine how much you can contribute based on the policy’s size and design. A properly structured IUL for max funding will use the lowest legally allowable death benefit to let you contribute the most without becoming a MEC.

Overfunding your policy causes it to become a Modified Endowment Contract (MEC). That means policy loans and withdrawals could become taxable and subject to a 10% penalty before age 59½. The tax treatment essentially becomes more like a non-qualified annuity, removing one of the biggest benefits of IULs.

Yes, most IULs allow some flexibility with premium payments. However, to keep the policy efficient and avoid MEC status, changes must stay within IRS guidelines. It’s critical to work with someone who understands these funding corridors to avoid unintended tax consequences.

While the policy can remain in force indefinitely, many people aggressively fund it for 5–10 years to build up cash value quickly. After that, you may reduce or stop contributions depending on your goals, provided the policy is designed to remain compliant and in-force.

Is Max-Funded IUL Right for You? (Final Thoughts)

Max-funded IUL may be ideal for those who are risk-averse, susceptible to future higher tax increases, and/or keep excess liquidity for their own business or outside investment deals.

Most people are overexposed to raw market risk in their 401k and brokerage accounts, not to mention their own job security in a turbulent economy. Having a pool of cash value that grows immune to market losses can help you stay afloat in rough times and possibly even help you take advantage of generational buying opportunities during major market dips.

Also, with the $36 Trillion of National Debt intensifying the threat of future higher taxes, the tax-exempt nature of Indexed Universal Life can keep you from having to cash out more shares of your taxable investment or retirement accounts when liquidity is needed.

Yes, you could also draw income from a Roth to keep from bumping into the next tax bracket, but do you really want to cash shares of your Roth when taxes are up but markets are down?

Contrary to popular belief, it doesn’t need to be an either/or conversation. Adding a max-funded IUL to your mix of wealth-building tools creates an unparalleled opportunity to diversify and protect against:

- Market Downturns

- Future Higher Taxes

- Lawsuits (state dependent)

- Chronic Illness or Critical Injury

- Liquid Assets When They’re Crucially Needed

However, it’s crucial to get full transparency so you can thoroughly understand the policy’s intricacies and its impact on your financial goals before proceeding.

Be sure to consult with a licensed insurance broker who can shop the best policy offerings and provide personalized insights, so you can determine whether a max-funded IUL is the right fit for your financial future.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches