Best IUL Company Reviews for Cash Accumulation

There is so much hype and hate around Indexed Universal Life on social media, you must be diligent about choosing an IUL company before entering into a lifelong contract.

If done right, IUL can be an invaluable tool to buffer against market losses and taxes in retirement while acting as your own private banking mechanism all along the way.

If done wrong, Indexed Universal Life can be expensive death benefit protection cannibalizing your cash value account.

Getting favorable performance from an Indexed Universal Life insurance policy will be dependent on these four factors:

- Choosing a top IUL companies

- Designing the policy properly

- Funding the product optimally

- Monitoring your IUL annually

Table of Contents

Dos & Don'ts When Evaluating The Best IUL Policy

Having taken countless clients through the IUL education and eventual buying process, our team of independent Indexed Universal Life agents compiled these helpful hints so you don’t get bamboozled with lackluster products or design techniques that leave you with an underwhelming IUL policy. In the wise words of singer Tom Waits:

“The large print giveth, and the small print taketh away.” – Tom Waits

Here’s how you can become a better-educated shopper when vetting the best Indexed Universal Life companies:

The "Dos" of Evaluating the Best IUL for You:

- Do plan to max-fund your IUL for at least 4 out of the first 7-years

- Do run an illustration with lighter premiums in case you can’t overfund

- Do run illustrations showing both 1% and 2% below the default growth rate

- Do ask to have a detailed fee report run for each scenario to see the impact

- Do make sure the issuing insurance company is a mutual insurance company

- Do find out how much of the cash value growth comes from non-guaranteed bonuses

- Do demand a locked/capped policy loan that still participates in the indexed accounts

- Do demand solid S&P 500 indexed crediting accounts, preferably with an uncapped option

The "Don'ts" When Selecting the Best IUL for You:

- Don’t be enchanted by algorithmic volatility-controlled indexes you can’t track or understand

- Don’t rely on non-guaranteed bonuses to be there for you over the next several decades

- Don’t just choose the illustration that appears to have the most cash value in retirement

- Don’t select your IUL company simply by who has the highest IUL cap rate (today)

- Don’t just compare IUL companies based solely on their default illustrated rates

- Don’t assume you will always be able to max-fund your IUL according to plan

- Don’t limp in and light-fund an IUL unless you can max-fund it very soon

- Don’t choose a stock insurance company over a mutual company

Believe us now, and thank us later.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What to Look For in the Best IUL Policies for Cash Accumulation

It’s common to want to latch onto some simple metric like an IUL’s cap rate or compare cash values from an IUL calculator to pick a winner from the illustration beauty content, but neither of these things will stay static in the future…guaranteed.

Here are the four main factors we focus on when evaluating the best IUL policies for cash accumulation:

1. Company Financials, Ratings & History

Seeing the ratings and balance sheets of the top IUL companies in a side-by-side comparison is the first step in walking our clients through the IUL education process. This is a product you’re ideally buying into for your entire life, so the financial solvency and credit ratings relative to other Indexed Universal Life insurance companies will be very important.

The other aspect you MUST learn about these companies is how they treat their in-force policyholders:

- Do they unfairly squash the caps on older product versions to subsidize new offerings?

- Do they then create the brightest, shiniest, new IUL product that’s NOT sustainable?

- Do they raise cap & participation rates on their older product versions too?

Similar to how banks offer bonuses or teaser rates to new savings account openers, several Indexed Universal Life companies have a regular habit of cannibalizing their existing policyholders by squashing caps to subsidize new product offerings.

If you don’t see the name of what appears to be the best-performing IUL company on our list below, this is most likely the reason why.

2. Solid IUL Crediting Strategies

The best max-funded IUL policies have not just one, but multiple diverse indexed accounts to grow your cash value account in different market environments. Ideally, you have not only a high cap, but an uncapped strategy as well. That way, you can better capture the upside in trending bull markets, or reallocate more aggressively after a dip but still retain IUL’s protective floor in case it’s not the bottom.

However, beware if an IUL’s best indexed accounts are volatility control indexes (VCIs). These VCIs are offered by well known investment banks with complicated algorithms to move you in and out of the market. The problem is, you often lose your exposure to stocks when you want it the most. Now that interest rates have risen, it turns out there’s quite a costly hurdle rate to overcome inside these index accounts before you can earn interest.

VCIs sound great on paper, but we’ve found them to greatly underperform pure S&P strategies, whether capped or uncapped. Plus, the S&P strategies are transparent and trackable, so you know where your cash value will stand at any moment, whereas the VCIs are a black box.

3. Low IUL Fees & Cost Structure

It’s important that you understand how the best IULs will behave under the following stress-tested conditions:

- When cash value performance runs much lower than the default illustration rate

- If you can’t fund the policy as heavily as you were hoping to

- While taking extensive retirement distributions

What you’ll find is many IUL policies illustrate favorably when fully funded and the performance is good. This is because the cash value converges upon the death benefit, which lowers the amount of effective death benefit you’re paying for within the policy.

However, these same Indexed Universal Life products will substantially underperform if they’re light funded and/or their performance lacks. That means that the internal fee load baked into the product is higher than it should be, and heavily dependent on performance to outrun the costs. These poorly designed products that get sold to the unsuspecting masses are the reason you often hear why IUL is a bad investment.

IUL is an ongoing combo of debits and credits, so it’s wise to know what both sides of the ledger look like. In fact, our independent agents create additional reports unpacking the fees and doing apples-to-apples comparisons so you can better compare the top IUL companies.

4. Locked or Capped Participating Policy Loans

It’s pretty standard these days for most IUL policies to have some sort of participating loan option, where your cash value still has market exposure even while borrowing against it for emergencies or opportunities.

However, it’s important to ensure that the loan rate is locked for the life of the loan or at least has a reasonable cap on the cost to borrow.

Also, it’s wise to consider the spread between whatever the loan rate is and the cap so you know what kind of positive arbitrage you can expect in bullish years. Similarly, how much loan interest will accrue against you during the down years?

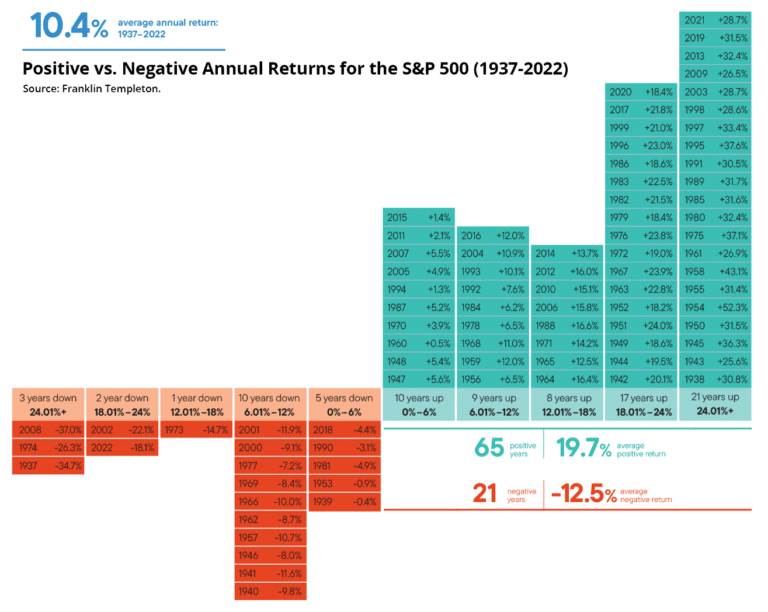

Remember, over the last 80+ years the S&P has gone up over 3/4 of the time and down only 1/4 of the time. So, having a built-in mechanism to capture this potential arbitrage will be critical in choosing the best-performing IUL policy.

There are IUL calculators to help you determine if you can expect long-term positive arbitrage on your cash value over different timeframes during bull and bear markets.

The Best IUL Companies of 2024 & Why

- IUL with the Best S&P Strategies + Guarantees: Penn Mutual

- IUL with the Best Company Strength: Nationwide

- IUL with the Widest Selection of Strategies: Allianz Life

- IUL with the Best Response to Rising Rates: Columbus Life

- IUL with the Best Chronic Illness Rider: National Life Group

We go into detail on each of these best IUL company categories below, but the best IUL caps and participation rates can change frequently.

For these reasons, we strongly recommend a complimentary consultation with one of our independent brokers, who is staying abreast of this rapidly changing market and can alert you to the latest news and opportunities.

Penn Mutual – Best IUL Company for Guarantees + S&P Strategies

It’s not surprising that Penn Mutual ranks the highest of the best IUL companies in terms of guarantees since they also offer the best-performing Whole Life policy, a product known for its guarantees.

Click here to read more about the difference between Whole Life & IUL.

Being the 2nd oldest mutual life insurance company in America, they have a track record of treating their policyholders fairly dating all the way back to the Civil War.

Several of Penn Mutual’s indexed accounts come with a guaranteed 1% floor, which means that even in down market years, you earn interest to offset the ongoing cost of the death benefit. Despite this 1% floor, Penn Mutual still offers competitive caps on its S&P 500 strategies.

Unlike the other best IUL companies on this list, Penn Mutual does NOT offer Volatility Control Index strategies. Given that most of these VCIs have returned 0% to policyholders in the last few years, it turned out to be a great pivot. (In case you missed it above, VCIs are algorithmic market timing strategies managed by well-known investment banks with high internal costs and a lack of transparency).

What Penn lacks in complex black-box strategies, they make up for with a plethora of transparent S&P 500 strategies, such as:

- Competitive Caps on the S&P 500 (sometimes with a 1% floor instead of 0%)

- The ability to raise your S&P 500 cap (for an extra fee or spread of around 3%)

- Uncapped S&P 500 crediting strategies for maximum growth

With Penn Mutual’s contractually locked 6% policy loan rate for the life of its IUL policy, you can keep your cash value working in the S&P 500 Index even while borrowing against it for emergencies or outside investment opportunities.

What We Like About Penn Mutual:

- Multiple pure S&P Index strategies

- The ability to have a 0% or 1% floor

- Locked 6% lifelong policy loan rate

- Different uncapped options, including a multi-year

- 2nd Oldest life insurance company in the US

What Concerns Us About Penn Mutual:

- Mid-sized but the fastest-growing life insurance company

Allianz – Best Stock Company with Diverse Indexed Accounts

Allianz has been competitive in the IUL space since they entered the scene over a decade ago. Allianz happens to be the only stock insurance company on the list and a foreign stock company at that.

It’s valid to worry that a German parent company may not have allegiance to American policyholders if economic times get tough, but others like the fact a foreign stock company has varied sources of earnings in diverse insurance markets.

Allianz does all its own option hedging in-house to back its various indexed crediting strategies. This allows them to offer their “rate lock feature,” where IUL policy owners can freeze whatever gains they have at any point throughout the year.

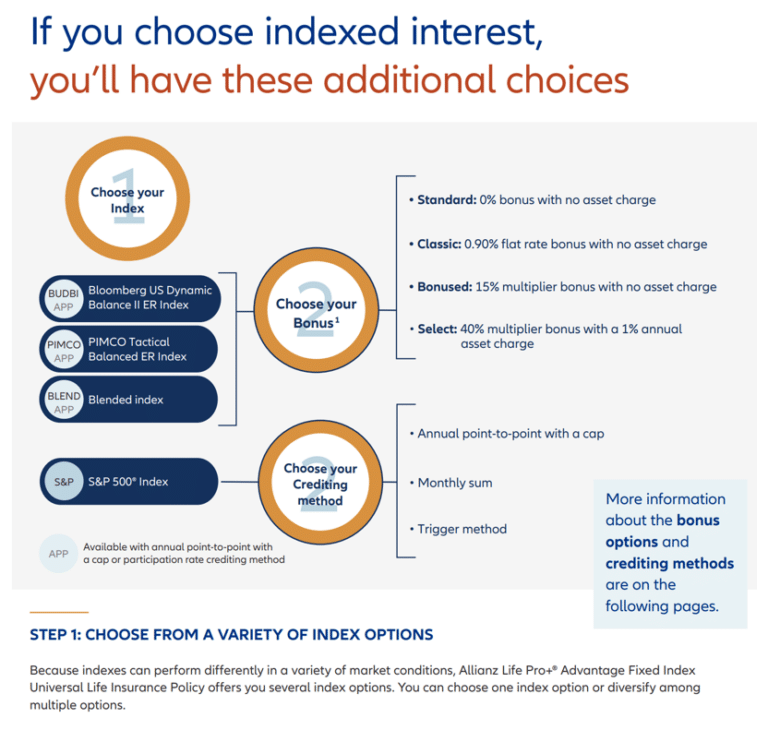

However, it’s worth noting that you can only do this with their various volatility control indexes (VCIs) and not the pure S&P strategies. In fact, Allianz also has different fee options that allow you to increase your exposure to their indexed options.

Quite frankly, we’ve found so many IUL investment choices can be confusing to clients, but in terms of the widest and most diverse selection of indexed accounts, Allianz definitely deserves a spot on the best IUL companies list.

It’s worth noting that I’ve been an Allianz policyholder since 2014, and I can attest to the fact that my IUL caps and participation rates aren’t as competitive as what they’ve consistently offered on whatever their latest product is. They claim it is because my fee structure is allegedly lower than the new policies.

Therefore, it’s critical to stress-test how Allianz’s IUL policy holds up at lower crediting rates compared to the other top Indexed Universal Life companies. Book your free consult to have the best IUL companies stress-tested using your exact numbers.

What We Like About Allianz:

- A wide assortment of exotic indexes to choose from

- Rate-lock feature when using the volatility control indexes

- Ability to be more aggressive with a 40% multiplier (for a 1% fee)

- Locked 5% loan rate to borrow against any of the indexed accounts

What Concerns Us About Allianz:

- Their “Index Lock” only works with Volatility Control Indexes, not the pure S&P strategies.

- Past policyholders have lower caps/pars than new offerings (but not egregiously lower like the worst IUL companies).

- Will a foreign stock company ever use the block of American insurance business to reward stockholders at the expense of their IUL policy owners?

Nationwide – Best IUL Company For Financial Size & Strength

“

But that actually is why Nationwide is one of the top IUL companies. Their size, rating, and overall financial strength are unmatched. Not only that, but they are a true mutual company, meaning they have no outside stockholders nor a holding company to siphon profits to. Their only obligation is to the long-term obligation they have to policyholders.

Nationwide entered the Indexed Universal Life arms race around the middle of the last decade, but came in hot, since they were already a major player in the fixed-indexed annuity space. Nationwide is largely responsible for ushering in the Volatility Control Index movement into the IUL space. Although we personally are not huge fans of the VCIs, many clients like having the ability to diversify growth options.

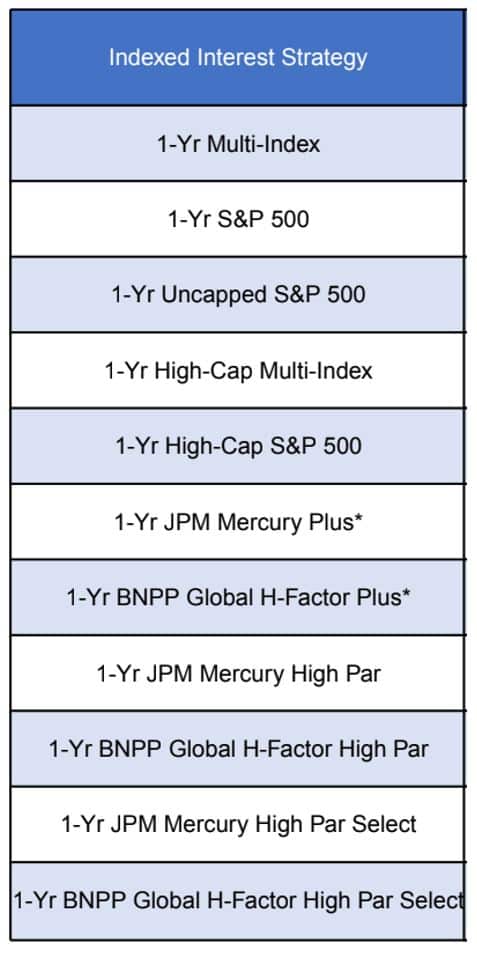

Similar to Allianz, Nationwide has a collection of diverse indexed accounts, both traditional S&P 500 IUL crediting and different Volatility Control Indexes.

Nationwide also gives you the ability to essentially buy additional upside potential with their “High-Cap” or “High-Par” Indexed Universal Life insurance investment strategies, which come with an additional 1%-2% fee. Although this lowers an IUL’s floor below 0%, there may be years when you want the additional upside potential.

What We Like About Nationwide:

- Diverse Set of IUL Crediting Strategies

- Unique Multi-Index Strategy

- History of Treating Inforce Policyholders Fairly

- Large Size, Mutuality, and Solid Financial Strength

What Concerns Us About Nationwide:

- Strong focus on Volatility Control Indexes

- Good long-term growth, but lackluster early cash values

- Participating policy loan rate is capped to be no higher than 8%

Columbus Life – IUL Company with Fairest Treatment for Inforce Policyholders

Columbus Life Insurance is the IUL arm of the well-rated insurance conglomerate of Western Southern Group, which entered the IUL arms race in the middle of the last decade. As a mutual holding company, neither Columbus Life nor Western Southern answer to the fickle becks and calls of Wall Street stockholders.

Since their only obligation as a company is to the long-term obligation of policyholders, they are more likely to do right by their inforce block of business.

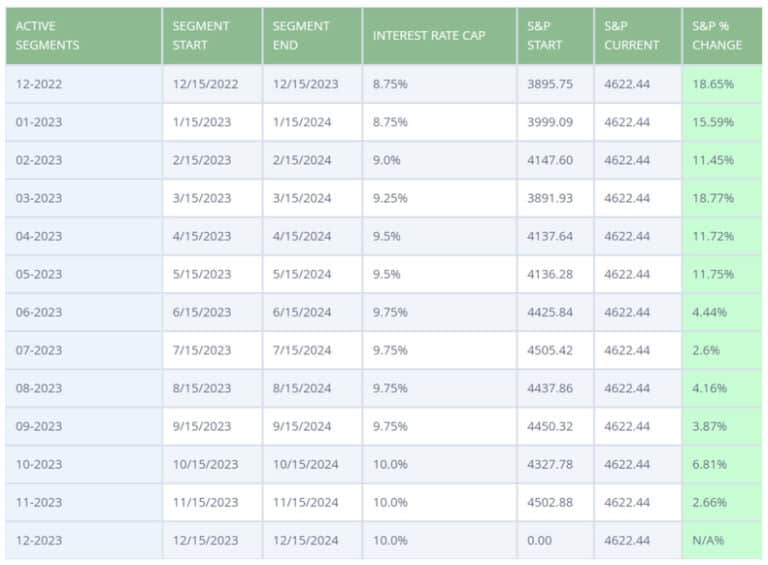

This can be clearly seen in this screenshot we recently sent to one of our clients showing how Columbus Life’s IUL cap rates have steadily increased from 8.75% in December 2022 to 10% exactly one year later as rates ticked up.

What puts Columbus Life on the best Indexed Universal Life insurance companies list is their willingness to nimbly raise caps for not only their latest product offering but also their existing policyholders.

The worst IUL companies continuously claim to have the best Indexed Universal Life insurance policy with the highest cap. However, they’ll start with a very high cap to capture market share, then quickly pull the rug out from under their customers once they shelve that product and start a new one.

It’s worth noting too, that when Columbus Life had to aggressively lower their IUL cap rates during COVID like every IUL company, they simultaneously lowered their participating indexed loan rate. That way, policyholders borrowing for outside investment opportunities still had the potential to earn at least some positive arbitrage.

What We Like About Columbus Life:

- Solid S&P 500 cap rate

- Participating loan rate is capped at 6% (but has been lower for a while)

- Their documented history of treating in-force policyholders fairly

- Mutual Holding Company with no outside stockholders

What Concerns Us About Columbus Life:

- Their uncapped indexed account is currently unattractive and inactionable.

- The smallest IUL company on the list, but still highly rated with solid financials.

National Life Group – Best IUL for Chronic Illness Rider

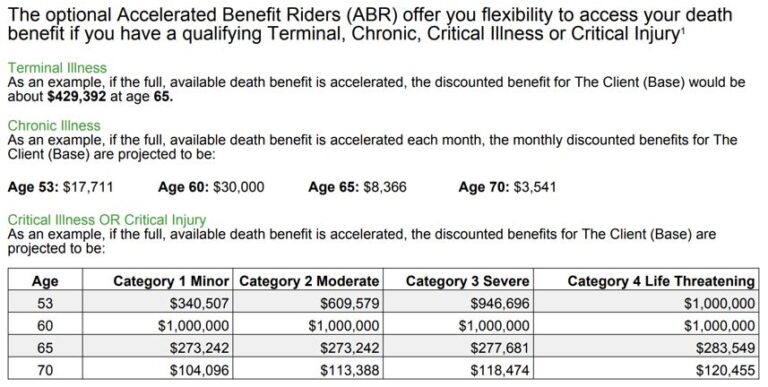

To clarify, all the best IUL companies in this article offer some sort of free chronic illness rider, but National Life Group’s is arguably the most robust. I also want to point out that I am specifically discussing their “Peak Life” product, which is their “larger case” product offering a more streamlined fee structure.

National Life Group and their subsidiary Life of the Southwest were really the pioneers of a competitive IUL with free chronic illness riders. Technically the rider is “free”, but we’ve found when stress-testing fees that the mortality expenses are a bit higher than other of the best IUL companies. This is to be expected, and you may have heard me say, “There’s rarely any deals in insurance. Everything gets priced perfectly rather quickly.”

That said, National Life Group is in the running for the best Indexed Universal Life insurance company for clients looking for a balance of performance, income, and comprehensive protection.

Whereas many companies have ambiguous definitions about what can trigger their chronic illness riders, National Life Group clearly delineates it as you can see below. Don’t spend too much time on these details as your numbers will certainly vary, but this shows the type of chronic illness rider payments they offer.

Book a custom call with one of our independent brokers to find out which are currently the best IUL policies with robust Chronic Illness Riders and solid IUL crediting strategies for tax-free income if you don’t become too sick or hurt to function independently.

What We Like About National Life Group:

- Diverse S&P 500 crediting strategies (including uncapped)

- International Exposure with an Emerging Markets index strategy

- Locked 5% Participating Loan (against a simple S&P 500 index)

- Most comprehensive & delineated chronic/critical illness rider

What Concerns Us About National Life Group:

- Mutual holding company, but one of the lower-rated ones in our best IUL company list

- Slightly higher mortality structure needed to offset the additional “free” chronic illness benefits

Next Steps in Researching the Best IUL Companies

Remember, all IUL companies can make their illustrations look amazing with favorable conditions, so it’s imperative to stress-test and compare to see how their best IUL policy performs at far less than projected performance.

Indexed Universal Life Insurance has so many moving parts at its core, not to mention all the potential bells and whistles different companies add to their policies.

Don’t just fall for a good story and slick sales pitch. Make sure your agent will stress-test the best IUL policies at less than favorable inputs and answer all the hard questions for you now that you know what to ask.

The Evolution of Indexed Universal Life Insurance (A Brief History)

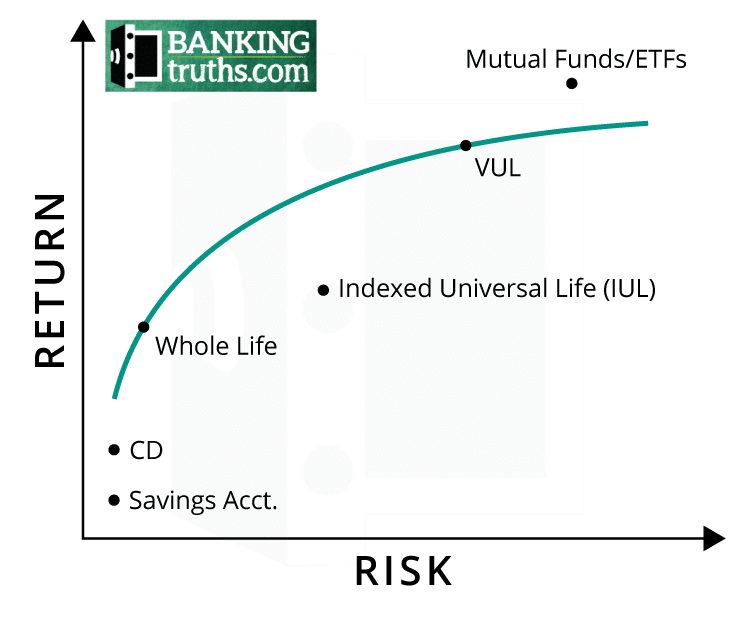

If you’re intrigued with the best IUL for cash accumulation, then you may want to understand how Indexed Universal Life came to be, since it essentially was spawned from its two predecessors Whole Life and Variable Universal Life.

Throughout most of the 1900s the only life insurance products were Whole Life and Term. Term insurance provided lower costs for temporary life insurance coverage. Whole Life provided a guaranteed death benefit for a guaranteed level premium, but also had an attached savings component with a guaranteed permanent growth rate as well as non-guaranteed dividends.

In 1979, the investment brokerage E.F. Hutton invented a revolutionary new product called Universal Life, which combined a dynamic savings component with the lower mortality costs of term life insurance.

The cost per unit of death benefit started lower since Universal Life’s cost structure is based on “annual renewable term.” However, the cost per unit of UL’s insurance becomes more expensive every year since clients will inevitably get older. The idea with Universal Life is that the growth of the savings account will reduce the amount of pure insurance in the policy, which would bring down the rising cost per unit of death benefit.

In 1986, shortly after the meteoric rise of Universal Life, life insurance companies had the idea of adding an investment component. Since interest rates were starting to come down, insurance companies replaced the savings accounts with mutual funds, and Variable Universal Life (VUL) was born!

Investment companies heavily advertised variable life as “the last great tax shelter.” Sadly, the IRS and regulators took notice of these ads. This led to the IRS limiting how much premium anyone could pump into any amount of permanent death benefit for future tax-free retirement income.

Regardless, as the stock market raged on throughout the 1990s, VUL became the insurance product of choice for cash accumulation.

In 1997, the first Indexed Universal Life product was invented by TransAmerica (not on the list of 2024 Best IUL companies).

At first, Indexed Universal Life insurance didn’t make a big splash at all. Who would want to limit the stock market, since everyone wins investing in Dot.coms?

However, consumers would start to take notice of IUL as the S&P 500 lost over 50% of its value between 2000-2002 and again in 2008-2009.

I briefly recount the history for you to see that Indexed Universal Life is essentially a mashup product of sorts, combining elements of Whole Life and VUL.

Having this naturally hedged asset of Indexed Universal Life for retirement can help you better manage volatility and taxation to protect and preserve your other investments.

Final Thoughts About the Best IUL Companies

There is so much hype around IUL right now on social media that you must be careful before entering into what should be a lifelong financial contract. Be sure your IUL agent is willing to stress-test their best proposed IUL for you so you make sure it isn’t the best Indexed Universal Life company for them.

Just remember, that the most important vetting factors for any of these best IUL policies will be:

-

-

- Available Growth Options

- Underlying Fee Structure

- Participating Loan Rates

- Company Reputation (since much of the above won’t be guaranteed)

-

Since IUL cap rates, participation rates, and loan rates have been a moving target fluctuating wildly, we did not want to post actual numbers only to have them become obsolete a month or two later.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches