How to Start The 4-D Banking System

With rampant inflation and taxation eroding our ongoing wealth-building efforts, it’s critical to be:

- Continuously stacking assets

- Creating multiple layers of compounding

- Keep these assets compounding when possible

- Borrow against assets when you can defend the leverage

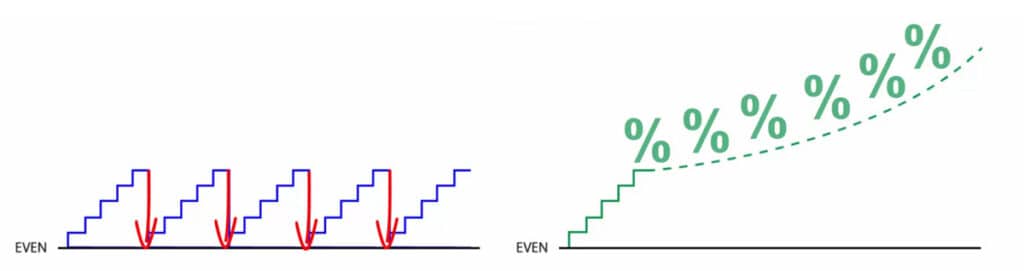

By doing so, you keep your place in line on your compound curve, rather than killing it every time you need liquidity. Instead of replenishing your savings, you pay down your liens against your asset base and hopefully end up at a higher place in line as a result.

This can also create tax advantages in a couple different ways:

-

-

- Investment interest is deductible (and often the cheapest cost of money)

- You don’t pay capital gains tax when selling assets for liquidity.

-

I realize that borrowing causes some knee-jerk resistance, but remember:

“You finance everything that you buy – you either pay interest to someone else or you give up interest you could’ve earned otherwise.” – Nelson Nash

At Banking Truths, we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Learn in the context of your model

- Never any pressure or hard pitches

Hear Hutch take a deep-dive into the psychology of debt and leverage in the context of 4-D Banking. I also realize that irresponsible leverage can also get you wrecked if left unchecked, so it’s important that you position yourself in a way you can always defend it.

“Don’t Do What Banks Say…Do What They Do” has been our company tagline since the beginning. At first, it just referred to the fact that major banks park Billions of their safe & liquid reserves into life insurance cash value on their key executives, a great endorsement of Infinite Banking with life insurance.

Having that stable liquidity allows them to engage in “money creation,” lending those same dollars out multiple times over through fractional reserve banking and creating multiple yield streams for themselves as a result.

Obviously, you can’t engage in fractional reserve lending without exposing yourself to financial ruin, and you don’t have the unlimited backstop of the Federal Reserve or the US government. However, you can take a page out of their books when practicing responsible and strategic borrowing. Here’s how:

- Life insurance as a liquid stable reserve asset also protecting their key people

- Gold as the ultimate hard reserves, just like the major central banks keep on hand

- 401(k) loan access is the closest thing to a governmental bailout fund waiting on tap

- All of the above safeguards allow you to access your cheapest cost of money (stocks)

Like banks themselves, these different dimensions of reserve assets can give you the mental confidence and liquid dollars to practice some responsible and defendable leverage when prime investment opportunities present themselves.

Reverse Financial Moves That Strangle Your Liquidity

It’s typical for financial gurus to prioritize and celebrate long-term growth for retirement as the end-all-be-all when it comes to financial planning, hence the max-funded 401(k), Roth IRAs, 529 Plans, and even over-paying your mortgage.

But what about all your goals before retiring at age 59.5?

Aren’t these tactics counterproductive to building liquidity you can use along the way?

What 2 things do all of these government-approved plans have in common?

- You pay a 10% penalty and any taxes due for liquidity before their intended use.

- You must consume to use these accounts. You can’t keep them compounding while borrowing against them.

All of these heavily-celebrated accounts can only ever be single-use assets!

Not so, when prioritizing assets in the 4-D Banking system!

Here’s the 4-D Banking mindset for “old money” in your existing accounts while setting up new accounts that prioritize liquid access for 4-D Banking:

- Old Money in Existing Accounts: See how much penalty-free liquidity can possibly be accessed from your 401(k), Roth Accounts, 529 Plans, and even Home Equity in your primary residence and investment property. The following sections will show you how.

- New Money into New Accounts: Position all future incoming cash flows for maximum liquidity into 4-D Banking accounts. Instructions below on how to start them.

The actual priority of new money flows and your exact order of operations will vary by individual situation. You can request a complimentary consultation at any time, but these are the approximate order of operations when adopting the 4-D Banking mindset:

Contrarian Cash Flows Prioritizing 4-D Banking:

- Stop extra mortgage payments & contributions to 529 Plans, IRA, Roth, or 401k (beyond match).

- The above accounts are now your buy-and-hold accounts, so you can focus on more tactical liquid access & cash flow going forward.

- Find out your job’s 401(k) loan parameters, or set up a self-directed 401(k) with a loan provision for each spouse if possible

- Think of your 401(k) loan as your new “emergency fund” since it’s otherwise trapped anyway until 59.5 with an invertible tax hit at floating rates.

- Reallocate high-yield savings accounts into max-funded life insurance & brokerage accounts with margin.

- Transfer existing taxable brokerage accounts to reputable brokers with the lowest margin rates.

- Apply for a HELOC on your primary residence for cushion, as well as HELOCs on investment property if possible.

- Consider buying gold & silver bullion on dips to act as your ultimate “physical emergency fund.”

Read below for more details on each.

Again, the goal is to prioritize wealth building that remains liquid, so you can take advantage of strategic buying opportunities that present themselves while still handling emergencies as they occur.

Let's Start With the Foundation - Life Insurance

“Cash is King” or “Cash is Trash” – which is it?

Yes, cash is definitely the most fungible medium of exchange, but use it as that and nothing more. Cash collecting taxable dust in bank accounts that don’t keep up with inflation is not a store of value. It’s a slow decay of value.

Your 4-D Banking system should be keeping cash constantly in motion between your assets and liabilities. Convert any excess incoming cash flow into safe & assets that will support your system.

The 4 reasons that major banks and famous icons of business have used life insurance for their safe and liquid reserves over the years are as follows:

- Immunity to taxation forever

- Better long-term growth rates

- Ability to keep compounding while borrowing

- Protection against death, disability, and possibly lawsuits

Remember, this is like a turbocharged emergency/opportunity fund supporting your 4-D Banking system, and the fact that you can keep your liquidity compounding even while using it is in line with the 4-D philosophy.

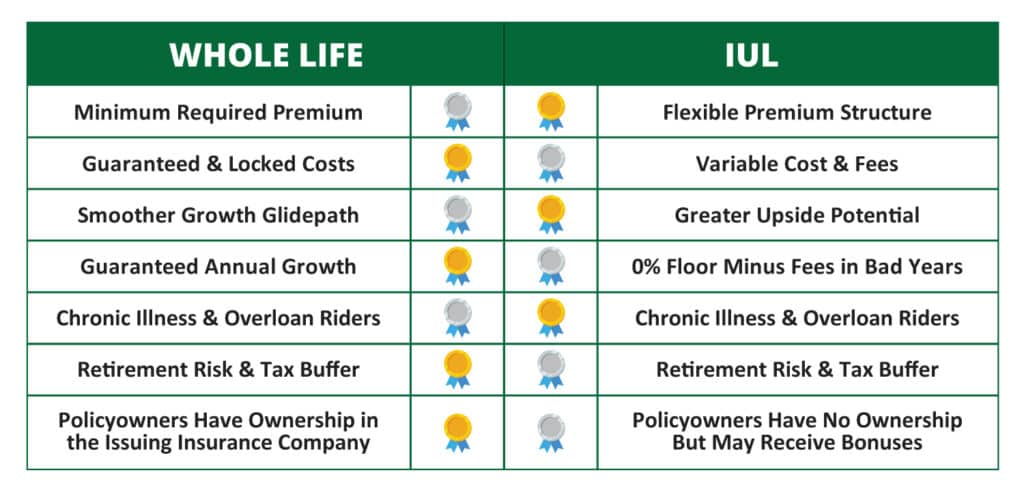

I realize this may ignite several questions in your head, such as how much to start with, how it works, which type of insurance will work best for you, etc. Below is a grid from our article discussing the differences between Whole Life & Indexed Universal Life.

Traditional Infinite Banking begins and ends with Whole Life, and this should likely be the rock of your foundation. However, there are clearly some advantages to both IUL’s greater upside potential as well as the ability to acquire locked loan rates for LIFE.

Remember, this life insurance decision doesn’t need to be an either/or conversation!

Most families will get different policies on different family members, since 4-D Banking will hopefully be the beginning of a multi-generational family banking system.

We can answer these questions for you in real-time in a live complimentary consultation and deepen your learning to help you better understand your options.

An Optimized Brokerage Account is Key

If you have existing brokerage accounts, you should consider doing a tax-free ACAT transfer of your existing positions into a broker with both:

- Low ongoing simple interest margin loan rates with no qualifying criteria

- They automatically tally & report margin loan interest deduction amount on their 1099-B report.

- Free 24-hour ACH cash transfers to & from your checking account or free wire transfers for larger amounts

That way, you can take a margin loan and transfer it overnight to make strategic investments or nimbly juggle cash flow. Or, if you have taken a margin loan, and then the market starts to falter even a little, you can borrow against other 4-D Banking assets to quickly deposit them back into your brokerage account to pay down the margin loan.

What’s nice, is the broker doesn’t care if you cushion your balance with cash or more positions, so 4-D Banking may turn into a “disciplined DCA” strategy if you transfer funds back into your brokerage account and force yourself to buy a bit of every dip to some degree.

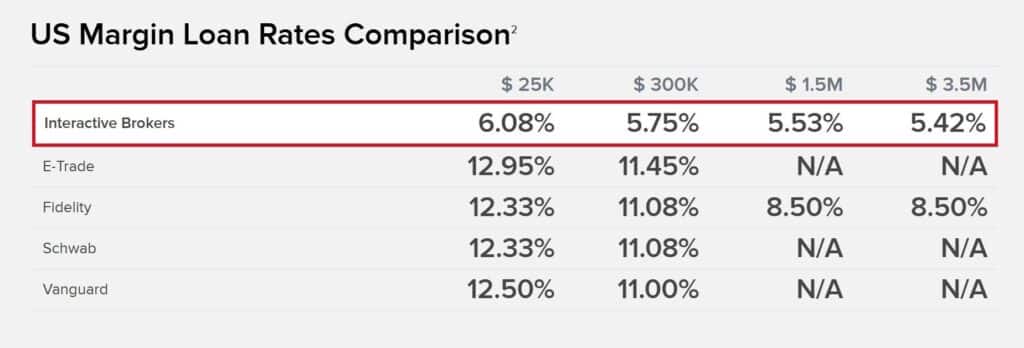

Here’s a comparison of the major online brokerages and their margin rates. Essentially, Interactive Brokers Pro is half the cost to borrow, and their software is secure, requiring fingerprint verification on your phone to make these 24-hour transfers.

Margin Loans Can Be Deducted Against Investment Gains

Using the margin account as your first stop for liquidity can also be very tax-efficient.

The margin rates above can be deducted against your net investment proceeds such as rental income, short & long-term capital gains, dividends, and even ordinary interest from CDs, savings accounts, bonds, etc. (as long as you itemize deductions on your tax return).

So depending on your tax bracket, a 6.08% margin loan from Interactive Brokers may feel like:

- 5.17% when deducting against a 15% federal & state tax bracket

- 4.62% when deducting against a combined 24% federal & state tax bracket

- 4.07% when deducting against a combined 33% federal & state tax bracket

- 3.65% when deducting against a combined 40% federal & state tax bracket

[Note: If changing brokers makes you feel uncomfortable to move everything away from Fidelity or Charles Schwab, maybe just move some of your most stable positions to Interactive Brokers and leave the rest where you’re comfortable.]

Get up to $1,000 of free stock when you open an Interactive Brokers account here.

Isn't Borrowing on Margin Risky?

The simple, truthful answer is YES.

Margin can be risky without a comprehensive system designed to protect and defend the leverage.

First of all, let’s discuss the worst-case scenario when a typical margin account gets a “margin call” when your loan equals more than 50% of your total account. So under these parameters:

- If you borrow cash up to 25% of your holdings, your account could lose 50% before a margin call

- If you borrow cash up to 20% of your holdings, your account could lose 60% before a margin call

- If you borrow cash up to 15% of your holdings, your account could lose 70% before a margin call

Anyway, 4-D Banking is not advocating raw borrowing with hope as your exit strategy, but the above figures should give you an idea of where the thresholds of danger lie for unmanaged loans.

The 4-D Banking system is all about creating these “backstop” lines of credit in place, so if the economy seems rocky, you can quickly make your brokerage account whole again, to not only reduce the loan risk but possibly even buy desirable assets at a deep discount.

Watch Hutch’s deep dive about both the advantages and risks of borrowing against a margin account as well as how to cushion it using life insurance and other 4-D Banking reserve assets.

If you’re not ready to manage this kind of complexity on a DIY basis, we can connect you with a licensed financial planner fluent with this strategy.

Rethinking 401(k) Plans & Roth IRAs

Let everyone else celebrate the limited utility of these single-use assets, and shift your focus to enjoying the multiplicity of money in motion using the 4-D Banking system.

Unfortunately, what’s done is done with your prior contributions to retirement plans, since they’ll be trapped by the 10% early withdrawal penalty plus taxes at your highest bracket if you now try and liberate that money from Federal prison.

That’s ok, simply think of these accounts as your long-term buy & hold strategy now, since you’ll likely be employing a more tactical strategy focused on cash flow with your new brokerage account.

However, to give you that extra reassurance when embarking on this new endeavor, each spouse can take advantage of their $50,000 loan option in their respective 401(k) plan. It may not be your first stop in borrowing, but this is a quick and easy way to exponentially increase the amount of available liquidity you have, so you don’t feel constrained.

Since some of that money technically belongs to the federal government (you still owe them a lot of tax on it), it’s almost like they’re subsidizing your new 4-D Banking venture to a degree by providing you this liquidity at par without tax. Just like major banks look to the Feds for a bailouts during recessionary events, now you can too.

You may be familiar with “asset allocation”, but what about “ASSET LOCATION?”

Think about it – if you’re going to invest in generational buying opportunities, would you rather do so in a 401(k) you can’t touch until you’re 59.5 and they can change the amount of tax you owe at any time? Or would you rather do it in a margin account you borrow against whenever you want without ever paying tax?

Do you keep your tech stocks and growth stocks in IRAs, when that’s an ideal asset for a taxable brokerage account because they don’t kick off any taxable dividends? Plus growth stocks can often grow faster to increase the size of the bank you can borrow against. On the other hand, slow growing dividend funds may be better in retirement accounts because they tend to grow slower (not creating future tax when they come out), and the ongoing dividend payouts stay in a tax-sheltered environment.

Create a $50k-$100k Line of Credit That Can't Be Taken Away

The best way to ensure this $50,000 line of credit per spouse cannot ever be taken away from you is to start what’s called a “Self-Directed Solo 401(k)”. Hopefully, you have some sort of self-employment income to justify starting this. If not, it’s time to start thinking about what kind of side hustle you and your spouse can start (without other full-time employees; otherwise, you have to include them).

All you need to technically start this type of account is a “reasonable expectation of profit” from your new self-employment activity. Anyway, here’s a detailed article about starting a separate solo 401(k) plan, even if you already have one at your job.

Yes, you can potentially have both, a 401(k) at your job as well as a self-directed 401(k) as long as it’s for a metrially different activity.

Funding this type of account is easy if you roll any old IRA or 401(k) accounts where your old job into your own Self-Directed Solo 401(k).

You can borrow 50% of your account value with a loan cap of $50k. So, you need a $100,000 account value in your 401(k) to be able to take a $50,000 loan.

So if you have $100,000 in IRA money, you’re golden. If not, you simply have a smaller 401(k) loan that’s possible to start.

I personally chose to open a Self-Directed 401(k) plan using the help using Broad Financial, and they have been wonderful to work with from onboarding to ongoing service and answers within 24 hours to my complex questions on investing in crypto, precious metals, real estate, and private money lending. Often, if you mention my name, you will get a coupon for $200 off to start a plan.

Hard Assets (Real Estate & Precious Metals)

Extracting Liquidity On-Demand from Brick & Mortar (Real Estate)

Rental Real Estate is often touted as the holy grail of investing, and the home equity of your primary residence is probably the most off-limits-sacred-cow in personal finance.

To be clear, I’m not saying Real Estate is bad, it’s just innately illiquid, that’s all. So when the goal is to stack assets, each with its own liquid escape hatch, you have to at least explore your HELOC options, even if it’s not your first stop for liquidity.

I recently applied for a HELOC with our credit union. There were no origination fees, no minimum initial draw, no ongoing cost other than simple interest for usage, a promo rate for the first 6 months, and a 10-year draw period at prime – 0.5%. So, my rate automatically went down the last two times the Fed cut rates.

For real estate investors, it’s often even possible to apply for a HELOC with your investment properties as well. They will have higher rates and lower LTVs (loan-to-value ratios), but why wouldn’t you at least open up that option in case generational buying opportunities come along?

Again, having this option is simply that, an OPTION!

Why not build in this optionality into a comprehensive 4-D Banking system?

You would never pull that trigger to heavily encumber your home equity and add to your mortgage carrying costs unless you had all the of the following:

- ultra-high conviction

- deep discount on the asset you bought

- steady cash flow generated from the investment itself

- a backup plan to pay down principal & interest from other sources of income

If so, simply having this potential in your back pocket to borrow against your HELOC to build wealth will often create the confidence to make shrewd investment moves with your other 4-D Banking assets & loan options.

Precious Metals Liquidity Options

First of all, I realize that investing in precious metals gets a bad rap in the investment community. It’s usually people parroting the opinions of famous investors who talk trash about gold with the same “either/or” mentality on asset building that permeates herd thinking.

John Bogle on Gold:

“Your money is more productively employed in investments that earn returns, like stocks and bonds.” – John Bogle

Or Bill Gates on Gold:

“Investing in companies that innovate and create value makes sense; gold is not productive, and it doesn’t create anything.” – Bill Gates

Or Mark Cuban on Gold:

“Gold is a religion. I don’t believe in gold. Gold is a store of value, and that’s it.” – Mark Cuban

Now truth be told, I’m not a fan of either Gates or Cuban, but ironically they’re actually bolstering my thesis on Gold when it comes to a 4-D Banking system:

Get rid of your either/or mindset. Get rid of the “rate-of-return-horse-race” when comparing gold to stocks. Remember you’re building your own private banking system. There’s a reason why the central banks of almost every country use gold as a reserve asset is to backstop the solvency of their profitable lending operations. -Hutch

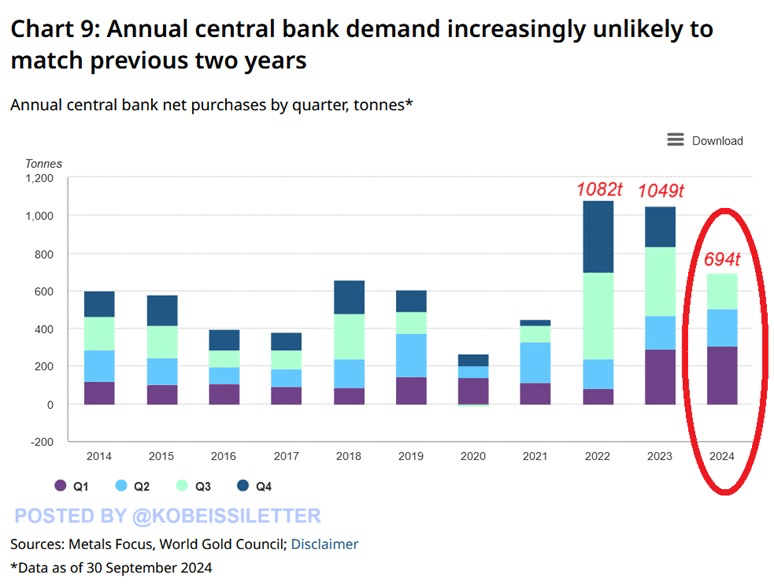

Take a look at the recent gold-buying spree of central banks as global leverage has increased to record levels:

Even though the voracious gold-buying by Central Banks subsided a little bit in 2024 after gold surged past record highs, it still is above the levels seen prior to the COVID pandemic, when money printing went parabolic.

So is this whole gold/silver thing actionable for 4-D Banking?

First of all, you could start with the paper ETF derivatives readily available in any brokerage account. This may act as a nice volatility hedge of sorts when borrowing against stocks.

Although past performance is no indicator of future returns, see how gold (in yellow) has behaved during the last few major corrections of the S&P in green/red candles

Here are a list of some popular ETFs for you to do your own research on, since this is not investment advice:

- Gold: PHYS & GLD

- Silver: PSLV & SLV

A Physical Emergency Fund = The Ultimate Backstop

As soon as you have built up multiple liquidity options within your 4-D Banking system, you may want to consider setting up a “physical emergency fund”:

Remember, the stereotypical 3-12 months of expenses in a high-yield-savings account? Well, you should have plenty of access to paper liquidity on demand if you’ve set up the other dimensions of your 4-D Banking system.

Think about it: if we have a major currency repricing, your 6-month emergency fund in paper cash may quickly become a 1-month emergency fund or a no-month emergency fund if we went full Armageddon.

Conversely, a 6-month emergency fund in gold/silver should always be a 6-month emergency fund, but during times of extreme panic, the scarcity and premium of actual physical bullion may quickly become a 60-month reserve fund for you

So the trash-talking icons of investing were right. Your “physical reserve fund” is just that, a “store of value” that can’t be debased out from under you. It can also help you buy “productive assets” at the deepest discounts ever when the sky is falling for stocks, but not for gold.

And just like a bank, you need to backstop your lending practices with hard reserves!

Hear Hutch discuss how he uses precious metals and “paper gold” as part of his 4-D Banking system.

I realize that physical gold & silver may seem contradictory to the philosophy of maximizing your liquid optionality with 4-D Banking, but you can actually get liquid capital with these 3 options:

- I’m actually a customer of https://cfcgoldloans.com/, where you can set up a physical metals line of credit. They also have a competitor at https://www.moneymetals.com/gold-loan. These are the top 2 juggernauts in the national online physical precious metals retail business and offer insured shipping for their gold/silver loan programs.

- Local Coin Shops, or LCSs, as they’re known with gold bugs, make the regular practice of buying, selling, and lending off of precious metals. Sure, the rates won’t be as attractive as the online retailers above, but if short-term liquidity is needed quickly to backstop a problem, then the rate doesn’t matter.

- In the worst-case scenario, you can always just sell your bullion to an LCS or one of the aforementioned online retailers if liquidity is desperately needed at par, and this is the last house on the block.

After trying out many online brokerages, I found that Bullion Exchanges and Monument Metals had the cheapest prices consistently for buying physical gold and silver. They offer free insured shipping for orders over $2,000.

What to do with Single-Use Assets (Crypto, Private Loans)

It’s true that unless you premeditate borrowing against your gold/silver and set up the borrowing infrastructure ahead of time, it’s really more of a single-use asset.

I agree.

The same can be said for crypto assets. Coinbase used to have a line of credit available built into their platform, where you could borrow against your Bitcoin for 8%, but all the draconian crypto regulations made them take that feature down.

Who knows, maybe it will come back someday with a crypto-friendly regime entering Washington now.

Until then, retirement plans like 401(k)s, IRAs, or Roth IRAs can be a great place to invest in these long-term single-use assets since it’s hard to borrow against them anyway.

Needless to say, you’ll probably want to put things that have the biggest chance of appreciation in a Roth, even if they’re volatile.

Retirement plans like 401(k) are Roth Accounts are ideal locations for single-use assets, and I-Trust-Capital has the leading platform to do both of these things with ease.

Putting All The Pieces Together

I realize your head may be spinning with all this new information, leaving you unsure what to do next. The idea behind this piece was designed to get you to think differently about your existing assets and future incoming cash flows.

If there was a way to create more liquidity, more access, more control, more options, more compounding, less taxes, and less risk (if orchestrated properly), when would you want to know about it?

My suggestion is to take up this free offer for a complimentary consultation to:

- Answer any questions you have about the different pieces

- Help you understand 4-D Banking in the context of your situation

- Discuss specific implementation options that will best suit your model

It’s literally just a no-pressure conversation with a licensed financial professional who fully understands the dynamics of this strategy, so you can see if it’s worth exploring further.

Brick by brick. Start with one chunk at a time.

You don’t have to do it alone.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson has no affiliation or association with any of the following and does not feel compelled to do so since he is a published life insurance authority, policy design geek, and a multi-faceted accredited financial strategist:

The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.

More on 4-D Banking 401(k) Plans