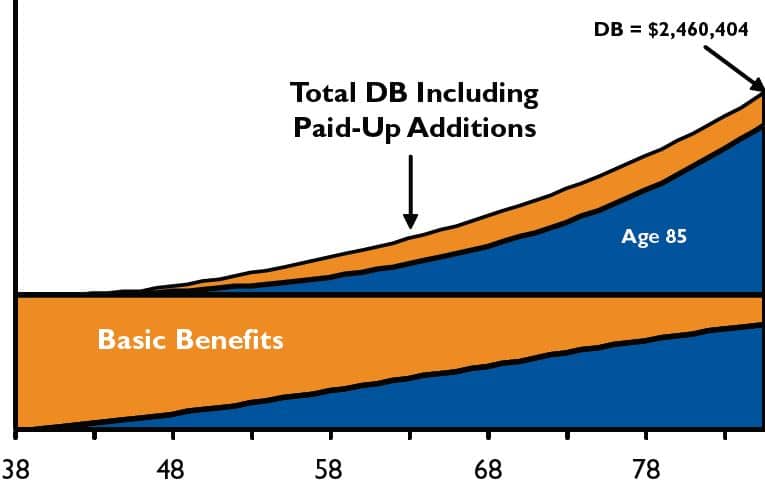

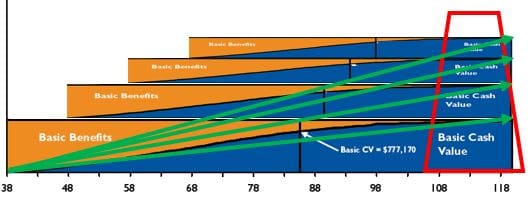

Paid Up Additions: Whole Life’s Turbocharger

Paid-up Additions are mini single-premium Whole Life policies that can only be purchased as an add-on to a larger ordinary policy. They are purchased either by dividends or a PUA rider and then stacked onto the base Whole Life insurance policy, accelerating its overall performance for Infinite Banking and retirement planning.