2025’s Top 5 Whole Life Companies for Infinite Banking

I’ve designed thousands of Infinite Banking Whole Life policies for clients over the last 18 years, and I also proudly own 14 policies for 6 family members with more than 7 figures of cash value inside. I have seen clearly what works, what doesn’t, and how to properly optimize an ordinary Whole Life policy so it excels for Infinite Banking. – John “Hutch” Hutchinson, 12/6/2025.

Bottom Line Up Front:

For the vast majority of client situations, the best Infinite Banking policy will come from one of the top 3 performing Whole Life companies: Penn Mutual, Mass Mutual, or Guardian, since all key features can be found within these three without sacrificing performance or True Mutuality.

Key Takeaways on the Best Infinite Banking Companies:

- Simply choosing the right company is not enough. The policy must be optimally designed and custom-fitted with the proper combination of riders and funding ratios.

- Typically, clients overweight Infinite Banking companies with the highest early cash value or those that allow the smallest Base policy. Ironically, both can lead to substantial mid-to-long-term underperformance.

- Several prevalent myths must be dispelled to ensure proper policy selection, such as dividend rate myths, the distinction between Direct and Non-Direct recognition, and understanding the difference between a True Mutual Company and a Mutual Holding Company.

- Unique ancillary riders offered by certain carriers shouldn’t be the main reason to choose a Whole Life Company, but they may provide a tipping point in a tie-breaker situation.

Here is our most recent video update, going over the illustrated performance of the best Whole Life insurance companies of 2025.

Thankfully, Infinite Banking research is so much more transparent than when I first discovered the concept. Eighteen years ago, there were only cryptic mentions on the web, forcing me to learn by trial and error, which thankfully led to my innovation in this space.

That said, even today, there’s still a lot of conflicting information and posturing by gatekeeping agents trying to corral you towards Whole Life companies they have incentivized selling contracts with.

Below you can find the companies with the top Whole Life policies, as well as the specific criteria to determine the best fit for individual clients

Table of Contents

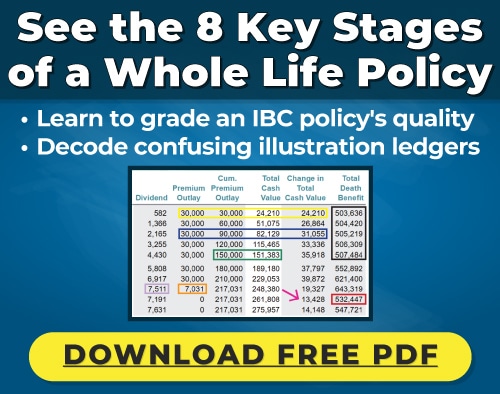

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

The Best Companies For Infinite Banking

Below is the shortlist of Whole Life companies you would even want to consider for Infinite Banking. Keep scrolling to learn more about the specific criteria.

In our professional opinion, either Penn Mutual, Mass Mutual and/or Guardian will be the best Whole Life company for the vast majority of people pursuing an Infinite Banking policy. Their top-tier performance, their True Mutuality, and their access to some of Whole Life’s desirable ancillary features put them in the top tier. That said, sometimes the impeccable credit rating and immense size of New York Life is appealing and worth sacrificing a bit of illustrated performance.

We have yet to find a compelling reason to direct our clients towards any of the Mutual Holding Companies, such as Ameritas, Mutual Trust Life, National Life Group, or One America, since we find their performance continually lags that of their True Mutual peers.

If you have illustrations and would like an apples-to-apples comparison with the top True Mutual insurance companies, you can book a custom competitive analysis at BankingTruths.com/Schedule.

Lafayette Life did, however, earn its way onto our shortlist, despite being a Mutual Holding Company, because they do have the highest cash value in the very early years. Although this can often be initially appealing to fledgling Infinite Banker researchers, we would encourage you to quantify the tradeoff in mid-to-long-term performance before commiting lifelong dollars to any insurance company.

We believe that understanding our criteria and methodology behind our ratings will help you make a more informed decision when choosing the Best Infinite Banking Company for your family.

Our Criteria For Choosing The Best Whole Life Companies

You can click any of the criterion below to learn more about each one:

- True Mutual Company Structure

- Quality & Performance (short, mid, and long term)

- Company Dividend History Relative to Itself & Peers

- Paid-Up Addition Stacking and Flexibility

- Whole Life Base Policy Efficiency

- Loan Considerations (Direct vs. Non-Direct Recognition)

- Ancillary Riders (Overloan Protection & Chronic Illness)

A True Mutual Company vs. A Mutual Holding Company

Choosing companies that have been and will likely remain 100% committed to their mutuality should be your very first filter when considering the best Infinite Banking companies. Remember that you’re setting up a relationship with an insurance company that should ideally last your “Whole Life,” the same as they call their product. The continuance of robust dividends and the ongoing performance from your Infinite Banking policy will depend heavily on whether they maintain their mutuality for multiple generations.

We would consider selling a Mutual Holding Company (MHC) if one of them were outperforming its True Mutual peers. But they’re not, and it’s not even close. In fact, over my 18 years in the business, I have NEVER seen any of the Mutual Holding Companies outperform one of the top 3 True Mutuals when appropriately designed. I did, however, see firsthand what happens to policyholders after the biggest and most popular MHC demutualized.

In 2022, when Ohio National demutualized into a stock company, it left its former policyholder-owners in the lurch with:

- no further ownership

- a paltry cash buyout

- and watered-down policies paying no further dividends.

Ohio National had previously transitioned from a True Mutual Company into a Mutual Holding Company structure, which made its demutualization easier to do. Mutual Holding Companies immediately spin off the operating insurance business into a stock company, even though it’s still initially 100% owned by policyholders in the newly formed holding company. That way, if a Mutual Holding Company needs to raise capital by issuing stock, selling stock, or creating new stock subsidiaries, they won’t be restricted in doing so because of its prior True Mutual Structure.

I honestly don’t understand the rationale of how any well-researched consumer can justify adding this additional risk to their multi-generational plan, especially when they can already get a much better-performing policy from one of the True Mutual companies.

Which Infinite Banking Companies are Mutual Holding Companies?

Here are all the Mutual Holding Companies that sell Whole Life for Infinite Banking in 2025:

- Lafayette Life

- One America

- Ameritas

- National Life Group

- Mutual Trust Life

Which Infinite Banking Companies are True Mutual Companies?

Below are the remaining True Mutual Companies whose Whole Life policies ranked in order of overall performance for Infinite Banking:

- Penn Mutual

- Mass Mutual

- Guardian Life

- New York Life

There hasn’t been a major mutual company demutualization since the late 1990s and early 2000s, when a trend of mutual insurance companies going public was underway. At least, the Whole Life policyholders for Prudential, Met, and John Hancock retained their company equity stake after demutualization by being issued shares of the IPO stock as the newly formed stock company was listed on the NYSE.

There is also the unique “Mutual-to-Mutual Merger” option open to True Mutual Companies looking to consolidate, as in 1996, with Mass Mutual and Connecticut Mutual. Connecticut Mutual’s issued Whole Life policies remained completely intact, with Mass Mutual honoring all the original guaranteed schedules for every owner’s policy. In fact, each new policyholder even got a new pro rata share of ownership in the newer, bigger/stronger Mass Mutual. Their policies were the same as before, only they were now printed on Mass paper and received their dividends going forward.

This Mutual-to-Mutual Merger option would not be impossible for companies that adopted the Mutual Holding Company since they already spun off the operating insurer into a stock company, which legally can’t be merged with a True Mutual.

Dividend Performance

This is important, but not as important as some people think. As you can read in my comprehensive Whole Life Dividends Explained blog article, dividends are just one component of the best Whole Life companies’ overall performance.

One of the biggest dividend myths is that “you CAN compare one company’s dividend rate to another,” when in fact, you CAN’T!

As a part owner in your underlying policy’s insurance company, there are 3 components to every Whole Life company’s annual dividend distribution.

- Interest (credit)

- Mortality (credit)

- And Expense (debit)

You see, each company’s dividend rate is just an internal factor. How and when each Whole Life company applies it towards policyholders’ cash value accounts will vary by company. You usually only hear about the dividend interest rate, which is a top-line figure. However, some companies are now raising their dividend interest rate while internally lowering the amount of dividend credits received from the mortality component.

So when you look across this dividend history from company to company, you can’t make valid comparisons horizontally since each dividend rate means something different to each company. But when looking down vertically, you can see how aggressively certain companies raise and lower their dividends relative to their peers.

That said, you want to see that these companies, for the most part, have been trending in the same direction as their peers and not lagging in the dividend department.

Dividend Rate History Chart For Whole Life Insurance Companies

The table above shows GREEN years (rate increases), GRAY years (maintained), and RED years (decreased) for major mutual companies over the past 15-20 years.

Since dividends only tell part of the story, we have to look at total return when comparing the best Whole Life companies apples-to-apples with each other.

Cash Value Performance - Not Just Early, But Overall.

Many fledgling Infinite Bankers come seeking the Whole Life company with the highest early cash value performance. Remember though, the product is called “Whole Life” for a reason. It would be one thing if long-term performance meant waiting until your deathbed, but we find that Whole Life policies with the highest early cash value will lose their lead before even reaching the 10th policy year.

Not only that, but their early cash value lead may only be just a few thousand dollars ahead to begin with, which later results in being hundreds of thousands of dollars behind. Be sure your agent is helping you measure that tradeoff before you commit to underperformance for your “Whole Life.”

The fascination with High Early Cash Value often stems from deceptive sales practices. Oftentimes, Infinite Banking agents will misrepresent Nelson Nash’s original teachings by creating manufactured urgency to “get their money working for them inside a policy.”

It’s true that funneling your cash flows through an Infinite Banking policy can create excess compounding over time. However, with any Whole Life policy, there’s always going to be some hit to early liquidity, even the ones with the absolute highest early cash value.

In fact, you know what financial product has the highest early cash value?

CASH always has more early cash value than any Infinite Banking policy!

If you really need that extra few thousand dollars in year one, shouldn’t you just start with a smaller, but better-performing policy in the first place?

Since the only reason to sacrifice any early liquidity is to get better performance over time, shouldn’t you look closer at that performance across all timeframes (near, mid, and long term)?

When we look across different time spans, here is the consistent pattern we have found across our age-based case study for ages 37, 47, 57:

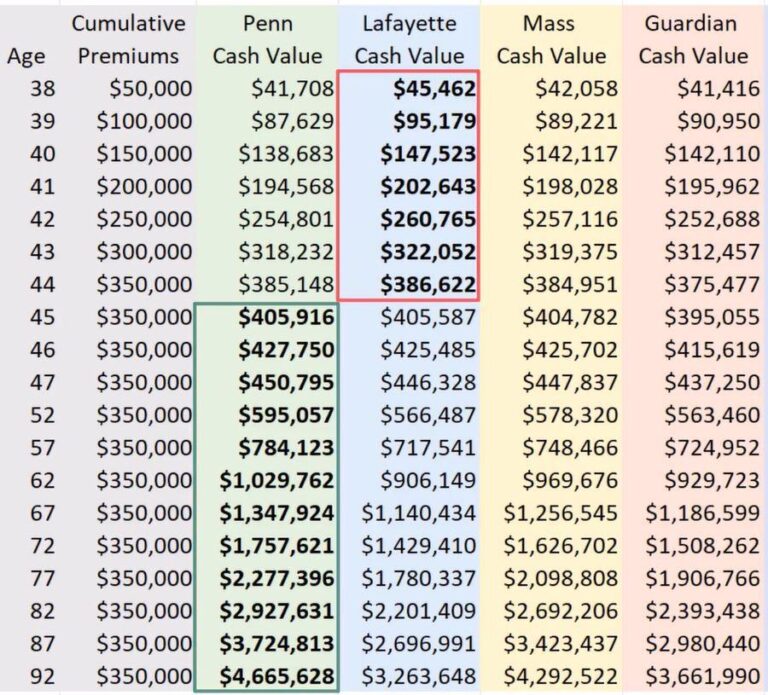

- Lafayette Life has the highest early cash value in years 1-5, and Mass Mutual is 2nd.

- By year 10, Penn Mutual has pulled ahead of both, with Mass Mutual not far behind.

- From years 20-40, Lafayette Life lags both Penn and Mass Mutual substantially.

Once clients see the tradeoff laid out for them, they often realize that having access to a few extra thousand dollars of cash value early isn’t worth forgoing True Mutuality, not to mention hundreds of thousands of dollars of long-term cash value permanence that could result in more cash value for banking or retirement income.

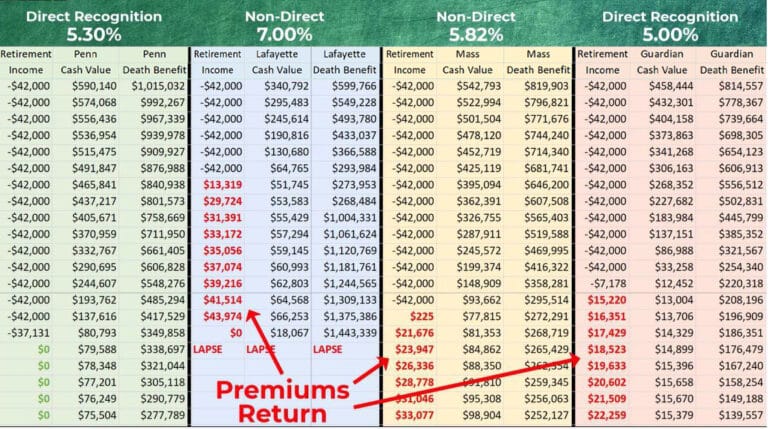

Below is the middle-of-the-road 47-year-old example showing every carrier’s optimized 7-pay policy, designed with each Whole Life company’s least amount of Base Policy and maximum allowable amount of Paid-Up Additions:

The patterns in this 47-year-old example are very similar to the results seen in both the 37-year-old and the 57- year-old. You can see all age-based case studies in our annual Whole Life update video at the top of the page.

With the top 2 True Mutuals, Penn and Mass, running fairly close across all timeframes in this case study and the other True Mutuals not far behind, you then have to consider some of the qualitative or soft benefits that the best Whole Life companies offer.

Paid-Up Addition Flexibility & Stacking Capability

Even though it’s ideal to pay the maximum amount of Paid-Up Additions every single year into your Infinite Banking policy, life sometimes gets in the way. This is where a flexible PUA rider comes into play.

Some years, you may have to underfund your policy, even if it means not getting as much money “working for you” early on. We’ve tested and measured this exhaustively and found that, despite the urgency so many Infinite Banking agents manufacture to make a sale, as long as you can maximize premiums in 4 out of the first 7 years, then you don’t lose much in the way of financial efficiency at all.

You’ll obviously have less cash value compounding on your behalf, but the performance of the premiums you did pay will be nearly identical to if you had max-funded the entire period. We find that clients like to know they have the flexibility to skip years and later catch-up if they need to, which is important to knowing you can keep your policy efficiently funded even through life’s hiccups.

However, keep in mind that taking advantage of excessive flexibility can lead to an underperforming policy. For example, if you can’t even do maximum overfunding once every 3-5 years, then either you bought too big a policy, or something really bad is happening with your cash flow. If that’s the case, and you can’t overfund, then your Base policy’s core performance will be even more important than if you were adding PUAs regularly.

Regardless, your Base Policy’s underlying performance should be important anyway because any PUA payments you do make or dividends you roll back into your policy will ride on your Base Whole Life policy’s hard-coded guaranteed cash value curve that grows daily closer to its guaranteed death benefit.

Whole Life Base Policy Efficiency

This is probably one of the most overlooked aspects that makes or breaks the best Whole Life policies for Infinite Banking. Many agents discuss the Base policy like it’s some kind of necessary evil, when in reality it’s the main growth engine, the workhorse if you will, that all future PUAs will ride upon.

Clients get enchanted by agents offering 10/90 policies where only 10% of their premiums will go to Base premiums, and the other 90% goes towards PUAs. But you must remember that Paid-Up Additions are simply just mini scale models of the Base policy itself. So, minimizing an underperforming Base Policy so you can buy more underperforming PUAs won’t beat the best-performing Base policies as long as you maximize PUAs, even at a lower allowable ratio.

You know that Quality > Quantity with most things in life. That same principle also applies to the best Whole Life policies for Infinite Banking.

Many clients say that they don’t care about the death benefit, but even if you don’t, you must remember that with any Whole Life insurance policy, your cash value has to grow towards the death benefit daily, no matter what, like reverse gravity. That’s why Penn Mutual, the best long-term performing policy for Infinite Banking, has not only the most cash value, but also the highest death benefit.

Loan Considerations (including Direct vs. Non-Direct Recognition)

All too often, you hear die-hard Infinite Banking agents say that you MUST use companies with Non-Direct Recognition loans, which is odd because Nelson Nash only showed Direct Recognition policies throughout Becoming Your Own Banker: Unlock The Infinite Banking Concept.

I can personally attest that all 14 of my family’s Whole Life policies are Direct Recognition from 3 separate True Mutual Companies. That’s right, I’m in the business and can get whatever I want, and I chose Direct Recognition even with my 3 Mass Mutual policies, where Mass will let you irrevocably choose either Direct or Non-Direct recognition at the onset of the policy.

Perhaps there’s more to this dynamic than so many Infinite Banking agents would have you believe. Here’s the surface-level thinking:

- Non-Direct Recognition sounds better because there’s “no effect” to dividends paid on the portion of your cash value with an outstanding loan against it.

- Direct Recognition sounds worse because there’s always a “direct effect” on the dividends you receive from borrowed cash value.

I’ll admit that on the surface, Non-Direct Recognition indeed sounds better. Therefore, most agents just begin and end the discussion right there, since the Mutual Holding Companies they’re married to are Non-Direct recognition companies. However, even if Non-Direct Recognition was categorically better, then the biggest True Mutual Companies, Mass & NYL, both offer Non-Direct Recognition loans.

But the Direct vs. Non-Direct Recognition argument is NOT that simple. You also have to consider these 3 arguments against Non-Direct Recognition:

- In a rising interest rate environment, when loan rates are above dividend rates, Non-Direct Recognition companies must raise their loan rates. As stated before, there is “no effect” on your dividend payments, meaning you’ll often find yourself in a negative arbitrage situation on loaned money, like with Lafayette Life’s current 7% loan rate.

- However, in that same environment where the loan rate is above the dividend rate, Direct Recognition does have a “direct effect” by raising your dividend rate on the borrowed money, to compensate you for paying any above-market loan rate.

- Conversely, in the low-interest-rate environment that we had in the prior 15 years, the Non-Direct Recognition companies never lowered their loan rates down even close to what you could get by using Cash Value Line of Credit products or Insurance Backed Lines of Credit. This completely nullified the alleged benefit of Non-Direct Recognition.

In the last decade, policy loan rates hovered around 5% across the board, while you could have easily borrowed at 3%-3.5% using turnkey line of credit products, assuming your insurance company was considered acceptable collateral by the lender. The problem is that most of the Mutual Holding Companies were not eligible, whereas these lenders readily accepted their True Mutual peers.

So, to me, the ideal Whole Life policy for Infinite Banking is one where I have:

- Maximum optionality in favorable borrowing environments as a True Mutual.

- Maximum protection in unfavorable borrowing environments with Direct Recognition.

For that reason, I see Direct Recognition from a True Mutual Company as the ideal best of both worlds. That’s why my 14 family policies are with Penn Mutual, Guardian, and Mass Mutual (where I could’ve chosen Non-Direct Recognition at the onset, but I didn’t).

There are other qualitative soft-benefits such as unique riders that must be considered when making a final determination on your Best Whole Life Company for Infinite Banking.

Let’s discuss:

Ancillary Riders From Whole Life Companies (chronic illness & overloan protection riders)

We’ve found that when the decision between the best companies for Infinite Banking is really close, having access to certain unique riders may be the tipping point.

Although most of our clients are concerned mainly with Whole Life’s cash value growth, many of them overlook or underestimate the value of:

- An Overloan Protection rider

- A Chronic Illness rider.

Overloan Protection Riders and How They Work

This rider should be mandatory for all the Infinite Banking companies to offer, but unfortunately, only 2 Whole Life companies offer an Overloan Protection Rider:

- Penn Mutual (True Mutual Company)

- One America (Mutual Holding Company)

An Overloan Protection Rider keeps your policy from blowing up and lapsing near life expectancy after taking excessive retirement loans you have no intention of repaying.

For example, Penn Mutual’s Overloan Protection Rider kicks in automatically when all 3 of these factors exist:

- You are at least 75 years old when the policy is about to lapse due to excessive loans

- Your Penn Mutual Whole Life policy has been in force for at least 15 years

- Your total policy loan is eclipsing your total whole life cash value by 99%

When all 3 of these things happen, Penn Mutual will automatically freeze that remaining 1% of non-loaned cash value to preserve a minimal amount of whole life death benefit for your heirs, almost like a burial policy. Doing so preserves just enough death benefit to uphold the tax-exempt status of all prior lifetime distributions (policy loans or withdrawals).

Let’s say that during retirement, you take recurring policy loans as a tax-exempt income stream that you have no intention of repaying. Without an Overloan Protection Rider, you’ll have to constantly manage your loan-to-cash-value situation and possibly even make premium or loan payments deep into old age to keep your policy from lapsing.

Otherwise, if your policy lapses and you took out more money than you put in, you may get stuck with a huge tax bill when you can afford it the least!

An Overloan Protection Rider solves this impending problem when using Whole Life for retirement income.

Chronic Illness Riders on Whole Life Insurance

A Chronic Illness rider allows the policyowner to have tax-free access to the death benefit (over and above the cash value), even though the insured isn’t dead yet. There’s a catch, though. The insured has to be deemed by a doctor to be too sick or hurt to ever work again or fully care for themselves on their own.

Although you may not ever need this rider, it’s better to have it and not need it than to need it and not have it. If you do need it, having this kind of financial injection when you can no longer work or not having to worry about money during your final days may be precisely what the doctor ordered.

Some of the best whole life insurance companies for Infinite Banking offer these types of riders for an additional charge, while others offer them as a free rider at the onset of the policy.

(Note: The ability, limits, and conditions to the receipt of a tax-free portion of the death benefit are described in more detail in Internal Revenue Section 101(g). Qualifying distributions are not deemed to be taxable since they are an acceleration of a tax-free death benefit. The current year IRS per diem amount for long-term care is $420/day or $153,300/year as of 2025.)

The Best Dividend-Paying Whole Life Companies for Infinite Banking

#1 Penn Mutual

Penn Mutual also happens to be the 2nd oldest life insurance company in America. Along with New York Life, they are the only mutual insurance companies that can boast that they’ve paid their Whole Life policyholders a dividend every single year since 1847 (during the Civil War, even).

In addition to its solid history, Penn Mutual has recently revamped its product to have all the necessary attributes of the best Whole Life policy for Infinite Banking, such as:

- Increased Term Rider for greater PUA’s and early cash value

- A flexible PUA Rider requiring overfunding only once every 5 years

- A built-in Chronic Illness Rider that can be added for no additional cost

- Highest death-benefit-to-cash-value ratio with both their Base Policy & PUAs

- Built-in Overloan Protection Rider allowing 99% access to cash value for retirement loans (only true mutual company to offer this).

Any Whole Life policy for Infinite Banking for will always have certain tradeoffs, and it’s up to you to decide what those tradeoffs are most important to you.

But here are the most commonly discussed downsides of Penn Mutual:

- At $34 Billion in assets, Penn Mutual isn’t as big as other big mutual companies. To put it in perspective, that’s comparable to Hershey or eBay and twice the size of Southwest Airlines.

- Penn is a Direct Recognition company, meaning loaned money will receive a different dividend payout than non-loaned money. This however, can benefit borrowers during periods of rising rates.

- Penn Mutual’s Whole Life policy focuses more on having the best long-term cash value & death benefit performance than the highest early cash value. Their recently enhanced term rider does create more early cash value, but not as much as some of the other Whole Life companies.

#2 Mass Mutual

Mass Mutual’s sheer size, solvency rating, steady performance, and the fact that you can choose between direct or non-direct recognition at the onset of the policy makes it one of the top Whole Life companies across the board.

However, certain qualitative factors make them less than ideal as the best Whole Life policy for Infinite Banking:

- Their flagship performance product, 10-Pay Whole Life, has a 2% guaranteed growth, making performance more dependent on dividends.

- The 10-pay policy requires higher structured payments for the first 10 years, making it less flexible than other banking policies.

- Their LISR term rider and ALIR paid-up additions rider are much less flexible than other Whole Life companies. It is possible to restructure your originally scheduled payments, but it entails officially adjusting your policy’s payment schedules with the insurance company.

- Whatever you pay in the very first year will be the cap for all future overfunding payments. So, you cannot “limp-in” the first year and increase your max funding later on like with other companies. Also, you must max-fund at least once every 3 years, or you lose the ability to do so in future years.

- The lack of an Overloan Protection Rider can cause premiums or loan payments to become due near life expectancy to keep the policy from lapsing when heavily borrowing without paybacks has taken place.

- There is no free chronic illness rider, only a true long-term-care rider that comes at a cost that drags on cash value growth.

Don’t get me wrong, Mass Mutual is a great Whole Life company if you have steady cash flow, and flexibility won’t be needed. Also, when getting policies on multiple family members, adding a Mass Mutual 10-pay into your family portfolio can be a great diversifier, especially when not as much death benefit is needed on that family member.

#3 Guardian Life

Guardian offers a free chronic illness rider, but also has a very inexpensive true “Long-Term Care” rider, which can be used for temporary conditions, unlike the chronic illness rider where the debilitating condition needs to be diagnosed as permanent.

Guardian allows for a large term rider and PUA payments that can be as high as 9x the base premium. Their policy started the 10/90 buzz, where you can pay 10% base premium and the other 90% in PUA premiums. However, a 10/90 policy limits how many future premiums you can pay and often doesn’t outperform Penn or Mass Mutual with higher base and lower PUA premiums.

That said, one of Guardian’s key strong suits is their flexible PUA rider where as long as you pay at least $250 per year into the PUA rider, you maintain your right to max-fund in any given year.

However, if you skipped the prior year’s overfunding (beyond the $250 minimum mentioned above), you can’t make up for the prior year, unlike with Penn Mutual where you can make a full catchup payment, You can only add catchup PUA payments for the prior year equal to 1x the base premium over what you’re allowed to overfund in the current year.

Historically, Guardian was always a Direct Recognition company, but implemented a feature where the policyholder can irrevocably flip to an adjustable non-direct recognition loan rate in the 11th policy year. Again, we believe you’re better off always controlling your cost to borrow by maintaining the native Direct Recognition status after the 11th year.

What’s concerning about Guardian Whole Life policies:

There’s not much, really.

- Guardian’s one-time PUA load is definitely on the high side at 10% charged in any year a PUA is paid, which definitely hinders their long-term performance.

Guardian was once more competitive with their dividend, continuously going neck and neck with Mass Mutual, but they seem content to stay tied for third place, and instead rely on their large career sales force incentivized to recommend Guardian over the other top dividend-paying Whole Life companies.

#4 New York Life

Unfortunately, the performance of their standard Whole Life overfunded with a PUA + term rider pales in comparison to the other true mutuals on this list. However, their “Custom Whole Life” product is a solid performing Whole Life policy as long as you can do without premium flexibility

You see, the Custom Whole Life product is like a 10-pay Whole Life policy, except you get to pick the number of years whether it’s a 5-pay or a 19-pay. Then your base premium will be higher than a standard Whole Life policy, since you’re essentially scheduling your overfunding into the base premium.

New York Life is a massive company with an impeccable credit rating for those that demand absolute perfection when it comes to creditworthiness. When dealing with massive premiums, New York Life can be a good diversifier, and they will also underwrite very large policies.

When families are doing large dump-ins (such as reallocating large savings account balances into a family portfolio of Infinite Banking policies), New York Life offers competitive premium deposit accounts, where you can make big deposits without turning your policy into a MEC.

Even with the rigid premium structure of their Custom Whole Life policy, New York Life will allow for some amount of an additional term rider with PUA payments.

What’s concerning about New York Life:

Unfortunately, no matter how much term we blend and PUAs we add onto their policies, it simply seems to lag Penn Mutual and Mass Mutual with the same inputs. Obviously, actual performance will differ from a static illustration run in any given year, but it is what it is.

Similar to the Mass Mutual 10-pay, the New York Life Custom Whole Life product has a rigid base premium that’s higher than normal because you’re basically baking in overfunding into a limited pay policy.

Also, their PUA rider is of the “use-it-or-lose-it” variety and therefore much less flexible than the other true mutual companies on this list. If you want to skip paying PUAs one year, you won’t be able to pay them again in the future. That’s a dealbreaker for most infinite bankers.

#5 Lafayette Life Insurance Company

Lafayette Life comes in 5th on our list, mainly because they have the highest early cash value in the first 5 years of our studies. Because of this feature, Lafayette is still one of the most popular Whole Life companies for Infinite Banking, despite it being a Mutual Holding Company vs. what we consider a “True Mutual Company.”

We’re proud to report that we never sold not one Ohio National Whole Life policy before they transitioned from a Mutual Holding Company to a fully demutualized stock company. Even though Ohio was one of the most popular Infinite Banking companies, their performance lagged that of their True Mutual peers. For that reason, it didn’t justify having our clients take on the added risk of the Mutual Holding Company structure, where the operating insurance company had already been transitioned to a stock company, albeit still 100% owned by policyholders in the Mutual Holding Company before it demutualized.

Although Lafayette Life is not showing any signs of financial distress or intention to demutualize, its overall policy performance lags the other True Mutual companies on this list. We, therefore, don’t see a reason to stray from the tried, tested, and True Mutuals.

That said, Lafayette Life policies can be designed to have the highest early cash value from years 1-5. This is because, similar to Guardian Life, Lafayette Life lets you add more of a term rider and, therefore, more PUAs, which accelerates those early cash values. They also have a Single Premium PUA rider, where new clients add an extra large term rider and basically front load their policies with money sitting in a savings account. However, we find that on any mid-to-long-term timeframe (basically anything over a decade), Lafayette Life’s early cash value lead starts to lag substantially with or without this rider.

We understand that new clients often get enchanted by high early cash value, and often begin and end their analysis with this data point.

However, we often have to remind them that pure CASH will always beat any Whole Life policy designed for Infinite Banking out of the gate.

So, since Infinite Banking will always entail sacrificing some early access for better long-term performance, we encourage them to do a more in-depth analysis of this tradeoff. They should look at not only early cash values, but mid-long term performance of all top Infinite Banking companies.

We’ve found that if the maximum amount of early cash value is needed for other investment opportunities, then perhaps starting with a smaller policy allows them to take on these outside investments, while having the best-performing policy working in the background for even greater cash value for their next wave of endeavors.

What’s concerning about Lafayette:

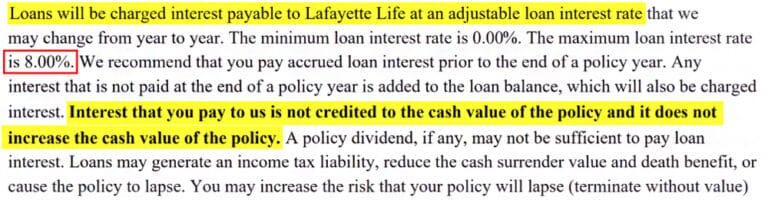

Despite offering popular Non-Direct Recognition loans, Lafayette Life raised their loan rate to 7% in 2024 and kept there through most of 2025. This was concerning as it was notably higher than their True Mutual peers. They appear to have lowered it back to at least 6.75%

Keep in mind, that even though Lafayette Life offer some of the highest early cash values and the ability to front-load a policy more so than the others, policyholders may have to pay an above-market loan rate to access their liquidity. Also, the fact that their loans are Non-Direct Recognition, means that there will be no dividend subsidy on borrowed money despite the fact that their loan rate is higher than all other carriers on this list.

Below are the full pros & cons of using Lafayette Life’s Whole Life policies for Infinite Banking.

Spoiler alert: the cons far outweigh the pros, especially when compounded over multiple decades.

The Pros of Lafayette Life:

- Highest early cash value of the list

- Single-Premium dump-in rider

- Non-Direct Recognition loans

The Cons of Lafayette Life:

- The Worst long-term performance (by far)

- Not even a “true mutual” insurance company

- Highest loan rate at 7% (with no dividend subsidy)

Lafayette's Has The Best Early Cash Value (But By How Much)

- Lafayette’s early cash value is highest!

- But how much higher are they?

- And how long do they hold the top spot?

You can see below that around the 7th year the other True Mutuals are not only keeping pace, but about to lap LL.

When you look even closer, none of them were never really that far behind in the first 7 years!

What I can tell you is that over my last 17 years as an insurance agent, Lafayette Life has NEVER been in the top 3 finalists with any mid to long term scenario!

You’ve probably heard me say so many times in my videos, “There are no deals in insurance!”

I guess the “high early cash value” blinders fit so nicely with most clients think they want with Infinite Banking, that it’s just such an easy sale for the agent. Meanwhile the client never realizes that by sacrificing a nominal amount of early access could’ve meant a mountain of extra cash value in the future.

Lafayette's Single Premium PUA Rider for Lump Sum Dump-Ins

Another early-cash-value boosting feature Lafayette Life offers is their Lump-Sum-Dump rider which allows for big 1st year lump sum premiums without turning your policy into a MEC.

However, a massive term rider (that erodes cash value) is required in order to fit that much year 1 premium into the policy.

It sounded almost too good to be true, so we fully analyzed the math against staggering the dump-in over 2-4 years into a more streamline and better performing policy at BankingTruths.com/Dump.

This GIF below compares one scenario where all premiums are equalized by year 9. LL is already losing on the left once premiums are equalized, and never even holds a candle after that.

Anyone who got one of these policies with a dump-in rider over the last 2 years now has TRAPPED liquidity.

In order to access their cash value, they must either:

- Surrender PUAs killing their lifelong compounding

- Borrow @ 7% without a boost to LL’s current 5.3% dividend rate

It’s a damned if you do/damned if you don’t situation. Delaying the inevitable just makes the problem get worse, the longer you let it compound against you.

We recently reviewed a new client’s 11-year-old policies with very heavy loans. He thought his money was “working for him.”

His cash value wasn’t working nearly hard enough, and even the older policy with the lower loan rate was on a crash course to IMPLODE on him even if he took out no more loans for retirement or anything.

All that Infinite Banking effort & energy goes POOF!

Are Non-Direct Recognition Loans a Pro or a Con For LL?

This is a tricky one because most Infinite Banking agent tout Non-Direct Recognition Loans as a must-have.

Non-Direct recognition loans can be a good thing when the loan rate stays well below the dividend rate.

But what about when a Non-Direct Recognition company raises their loan from 5% to 7% like Lafayette did in 2024?

Did they give away too many below-market loans to policyholders for too long, and now have to balance their books?

Could this be a sign of a deeper issue at the company like we saw cracks in the foundation at Ohio National 9 years ago?

Regardless, with Non-Direct Recognition Loans, the insurance company doesn’t boost your dividend with any kind of subsidy (unlike how Direct Recognition companies true up your dividend when higher than the loan rate). Most unsuspecting Infinite Banking clients don’t understand the effect of Direct vs. Non-Direct Recognition in a rising interest rate environment.

You can see it in black in white right off LL’s illustration report:

Another thing that sounds much better than it is the loan cap of 8%.

It’s actually really scary. Here’s why:

Lafayette’s current loan rate is 7%, just 1% away from their 8% cap in this middle-of-the-road interest rate environment.

What happens if the FED someday goes ballistic raising rates to combat hyperinflation like in the 1980’s?

If prevailing interest jump from 5% to 8% or worse yet 11% or 13%, then Lafayette Life MUST squash everyone’s dividend (whether they’re borrowing or not) to compensate for all the money leaving their balance sheet at 8%.

If you think cash value trapped at Lafayette earning a 5.3% dividend rate while borrowing at 7% is bad, what happens during those cycles.

Not very promising for those who plan to keep your whole life through different cycles!

Lafayette Life vs. Other Non-Direct Recognition Companies

If you’re dead set on Non-Direct recognition, consider the much bigger and older TRUE MUTUAL companies like Mass Mutual or New York Life on the list above.

Mass Mutual or New York Life early cash value may lag Lafayette’s by a few thousand in the first handful of years, but they exceed by tens or hundreds of thousands of dollars later on when it really counts.

Penn Mutual is a Direct Recognition company, which can actually boost your dividends in a rising rate environment. Regardless, with vastly better long-term cash value performance to Lafayette Life, they have a lot of room to be wrong and still win.

Regardless, with Mass and NYL both with Non-Direct Recognition loans in the 5% range rather than LL’s 7%, it’s hard for me to understand why a prospective Infinite Banking client would ever choose them… unless that’s all they’ve been offered or shown!

Is Lafayette Life a “True Mutual Company”?

Lafayette Life reorganized its entity structure from being a true mutual insurance company to a “mutual holding company.”

Is a mutual holding company a mutual or stock company?

A “mutual holding company,” is technically a stock company that’s has an element of mutuality only because the stock is owned 100% by its policyholders (for the moment).

Mutual Insurance companies reorganize themselves as a Mutual Holding Company, often claiming that it’s easier to raise capital, even though the True Mutuals have no problem raising capital when they need it through surplus notes.

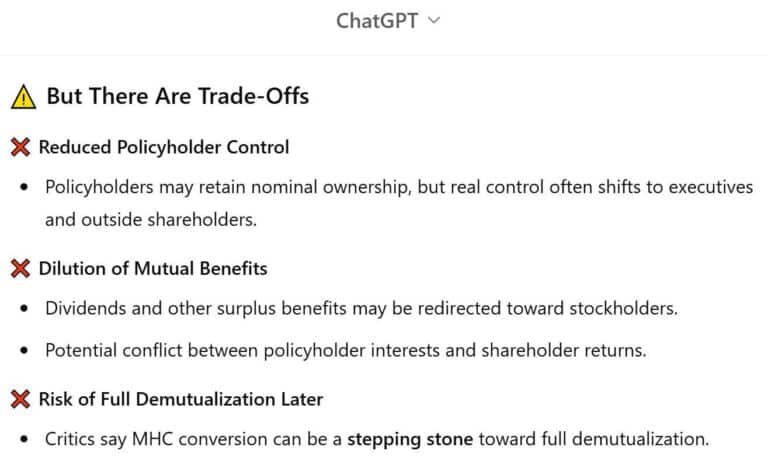

Most people don’t realize that restructuring as a Mutual Holding Company is the first organizational step towards demutualization. Even if these Whole Life companies delay demutualizing for decades, it’s common for policyholders of a Mutual Holding Company to experience dilution per Chat-GPT:

We can already see a dilution effect happening on LL’s projected cash value & death benefit performance compared to the True Mutuals when taking income, where it’s not even close!

We sounded the alarm early on with Ohio National and actually helped a lot of people rescue their policies. A Canadian Pension Fund bought out Ohio National at fire sale prices, and policyholders got thrown a small bone for the buyout and were left holding crap watered down Whole Life policies.

It’s no surprise that so many of the Infinite Banking agents who used to sell Ohio National policies exclusively, now are allegiant to Lafayette Life. They both have the same business model with progressive commission rates for concentrating business there.

We’re proud to say we sold ZERO Ohio National Whole Life policies and ZERO Lafayette Life policies.

This screenshot below shows why comparing all the companies and their steady income (or not so steady income) from age 67-89.

The red numbers are when retirees instead have to pay premiums back just to save the policy (instead of getting the income they counted on).

We were open to trying to fit LL into our practice since they do have some snazzy features some clients like. But these LARGE PRINT features do have very scary SMALL PRINT implications, that we just couldn’t get comfortable with.

How could we, when we know most Lafayette policies won’t last through retirement? Your focus may be Infinite Banking today, but Whole Life for retirement can be one of the most powerful cornerstone assets to hold, assuming your policy stays solvent.

Lafayette's Top Feature Helps the Exit Strategy

There’s no long-term solution to solving these problems except to take advantage of LL’s main redeeming feature; the high early cash value. By year 11, Lafayette’s cash value performance hasn’t YET taken a leap off the cliff.

That means you can jump off the pain train before it derails.

The high early cash value gives you the ability to 1035 into a better- performing policy while you can still qualify for one.

Here are the 3 things we’ve been modeling for other dissatisfied Lafayette policyholders, so they can fully understand the dilemma they’re in, and how best to solve it.

Scenario 1) Keep doing everything with Lafayette

Scenario 2) Do a full 1035 exchange (rollover) over to a True Mutual company of your choosing

Scenario 3) Or pay the absolute minimum toward Lafayette while sending your overfunding premiums into a new optimized policy after seeing the True Mutuals modeled out for you (with and without a rollover).

Seeing your numbers play out long-term and getting fully educated on your options can really helps you make the best lifelong choice.

At the very least, I hope this makes you a more informed consumer before being railroaded into a lackluster policy that’s supposed to last your Whole Life, but engineered to fall miserably short if you use it as intended (with banking and retirement loans).

Picking the Best Whole Life Policy for Your Personal Infinite Banking Strategy

This should be pretty clear cut decision dealing mostly with the math. Sure sometimes non-mathematical features like a Whole Life company’s flexibility may override making a decision based on pure performance.

But all too often, Infinite Banking agents are shaming their clients into thinking that the company selection and policy design isn’t as important as “the philosophy”, which is nonsense!

Don’t fall for this ploy to sell you a lackluster Whole Life policy so they can simplify their business model and enjoy higher commissions.

Work with a team of independent brokers shop and model your intended premiums and loans into policies by all the top Whole Life companies so you can learn through the numbers and decide which will work best for you.

Better yet, learn to combine other assets and loan options into a comprehensive 4-D Banking strategy so you can maximize compounding, minimize loan drag, minimize taxes, and maximize optionality with Infinite Banking.

Final Thoughts on the Best Infinite Banking Companies

Obviously, the best Whole Life company and policy for your situation will depend on your unique fact pattern. As much as consumers would like a quick and easy answer or some simple metric to latch onto like a congruent dividend rate between companies, the decision will always be much more complex.

We hope you found the detailed information on how we rate the top policies after 18 years of experience designing thousands of policies helps you narrow things down. When you’re ready to have an expert help you model your own custom numbers, you can book yourself a free consult on our team’s calendar here.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com