IUL vs Whole Life Insurance: Key Differences Explained

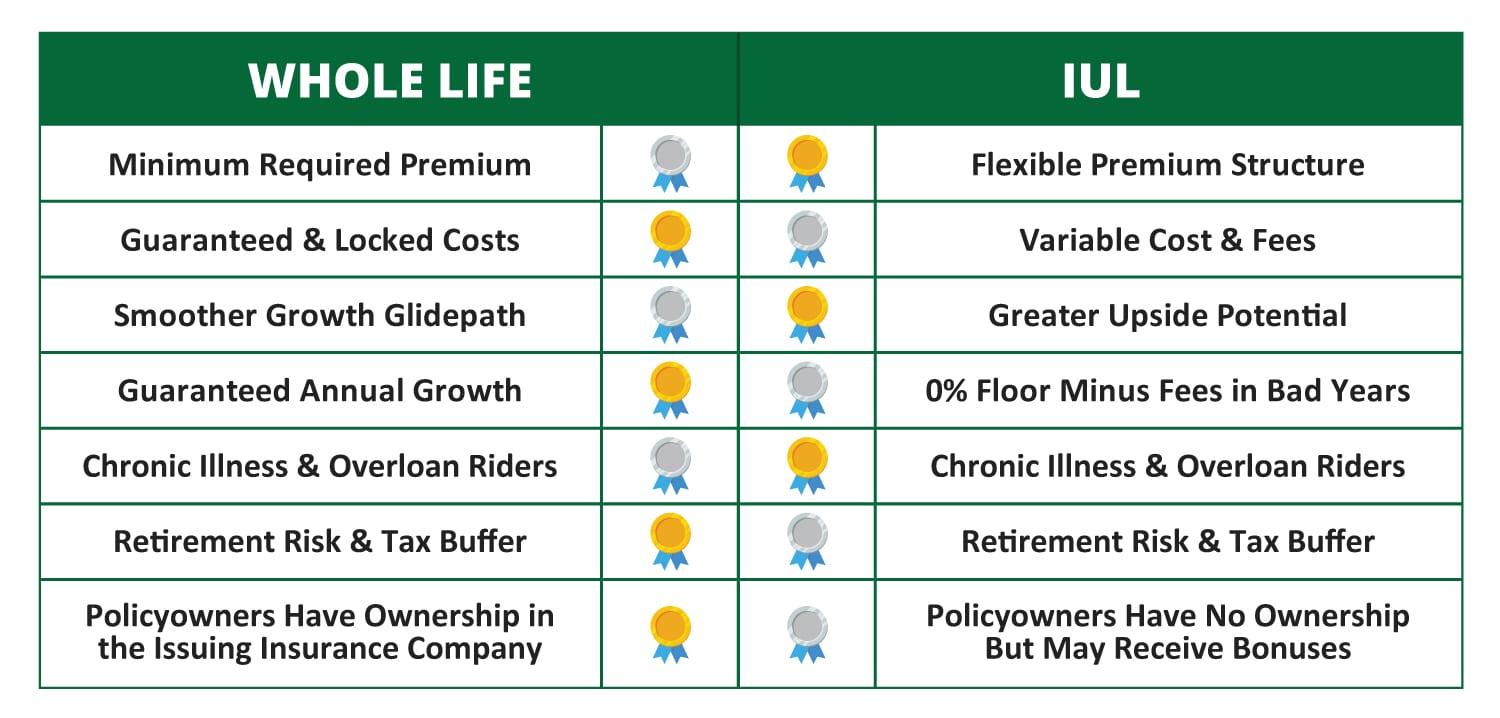

Comparing IUL vs Whole Life seems like it would be a simple task, but oftentimes you’re comparing apples to oranges. Below we categorize the various benefits of both insurance products so you can see which product has an advantage vs where they are essentially equal.

This article looks through the lens these various categories to see where Whole Life is better than IUL (and vice-versa).

I am uniquely qualified to weigh-in on the differences between Indexed Universal Life vs Whole Life because I’ve both sold & owned each product for well over a decade now.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

Since either insurance policy should ideally last a lifetime, you’ll want to get balanced context so you can make an informed decision.

Do NOT just simply run an “illustration horse race” and pick the highest number. The only certainty about policy illustrations is that they will all be WRONG!

Assuming your policy is chosen, design, funded, and monitored well, here’s how either can help:

- Better holding tank for safe & liquid reserves (infinite banking)

- Retirement tax eraser & volatility sponge

- Protection hedges for death & chronic illness/injury

- Wealth-replacement fund upon passing of the insured

One of my early mentors once told me, “It doesn’t matter which benefits you like best, because you get them all!” However, depending on which benefits you do like best is often a good indicator of whether IUL or Whole Life insurance will be better suited for you.

Structurally we’re dealing with two totally different insurance animals when it comes to Whole Life insurance vs. Indexed Universal Life in terms of the following categories:

You can click into any of these categories above or the table of contents below. Before we dig into the details, let’s discuss the basics of what exactly are Indexed Universal Life and Whole Life insurance as well as how they work.

Table of Contents

Whole Life vs Indexed Universal Life for Infinite Banking

We realize there’s a lot of hype and misinformation on the internet around the infinite banking concept (IBC). We named our site Banking Truths because our mission is to provide thorough, factual, and educational info about how and why infinite banking works.

This is because IBC is one of the most powerful strategies to deploy your safe & liquid reserves in between life’s various opportunities & emergencies. But you may be wondering, is Whole Life or Indexed Universal Life insurance better when practicing the infinite banking concept?

Many die-hard infinite banking practitioners swear that only Whole Life can work, which just isn’t true!

Even though we agree that Whole Life will provide more stability for a private banking strategy, IUL has the potential for better long-term returns as well as the prospect of immediate positive arbitrage!

Regardless, despite what any banking agent says, IUL empirically has what it takes to function for infinite banking as long as it is designed, funded, and managed well throughout the life of the policy.

Whole Life's Advantages for Infinite Banking?

-

Whole Life’s cash value is guaranteed to grow each & every year no matter what.

This is especially important because most people will likely want to take advantage of outside investment opportunities when “the sky is falling” with stocks and housing markets. Whole Life cash value contractually keeps growing regardless of external economic conditions. This awesome phenomenon not only gives you more borrowing power during these periods, but also less maintenance over the following years since your collateral keeps growing to offset unpaid loan interest.

-

Ability to get outside line of credit programs for up to 95% Loan to Value on a turnkey basis with Whole Life whereas IUL you cannot.

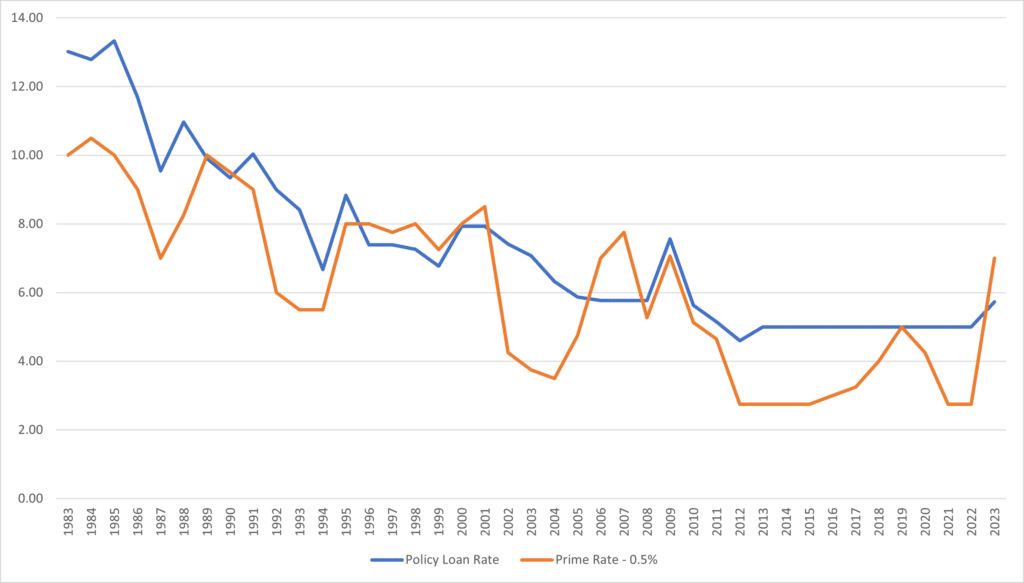

Although both policy types have embedded loan options, Whole Life historically has been able get more attractive rates from outside lenders. Its worth nothing that right now you cannot because of the inverted yield curve. Short-term rates are normally what determines these outside loan rates.

When rates fall someday, there may be massive arbitrage opportunities for long periods as you can see with the orange line below.

Indexed Universal Life's Advantages for Infinite Banking?

IUL has the “potential” to earn higher growth rates through indexing.

Over time, Indexed Universal Life illustrations project to beat Whole Life since its growth is tied to an external market index. But remember, this gets balanced out by 0% years when the index is flat, which translates to slight negatives from fees plus any accruing loan interest. Generally, IUL illustrations don’t show any 0% years.

You want to be sure to choose a company with multiple growth strategies, ideally some uncapped or high-cap S&P index crediting strategies.

That way you win whether a bull run’s growth is more evenly spread out amongst several different years or if it is concentrated amongst a few spikey years.

IUL’s have multiple embedded loan options.

Although IUL doesn’t qualify for the turnkey line of credit programs, some policies have very competitive locked loan rates in the 5%-6% range. These participating loans where your cash value stays invested in certain index crediting strategies. This gives policyholders the “potential” for positive arbitrage in years when the cash value grows more than the loan rate

Indexed Universal Life policies have multiple loan options embedded into the policy itself. There’s always a fixed loan option as a failsafe for policyholders since it has no positive arbitrage opportunities. A fixed loan often credits you exactly what the loan interest is from the 11th policy year onward, and usually a -1% arbitrage situation for the first 10 years.

Hutch’s Take on IUL vs Whole Life for Infinite Banking:

So which product has the advantage when it comes to Whole Life vs Indexed Universal Life for infinite banking and parking your safe and liquid reserves?

We give the advantage here to the IBC original Whole Life, but Indexed Universal Life may suit some nicely when using the infinite banking concept.

- We find that most real estate investors and business owners using life insurance as their own private bank prefer the stability of Whole Life even if they don’t have quite as much upside potential. Think about it, doesn’t the bulk of your alpha come from your strategic and timely investment opportunities rather than the growth rate of your liquidity?

- However, many people want the immediate possibility of double-digit growth and ongoing positive arbitrage. They’re willing go slightly backwards for a couple/few years if the market catches a bad run. If so, then IUL can certainly work for IBC if your policy is chosen, design, funded, and monitored properly.

IUL vs Whole Life: How Each Work

Indexed Universal Life Insurance Explained Simply

IUL is simply a traditional Universal Life policy only with some added growth options tied to stock market indexes rather than simply just a traditional fixed crediting option that behaves like an adjustable-rate bond.

Just like with the old school Universal Life, the insurance company deducts a dynamic cost of insurance from any premium contributions, and the remainder stays in the policy cash value to grow. Some of the growth goes to pay for future policy costs, while any surplus cash value can be used for tax-exempt distributions throughout the life of the policy.

Universal Life is known for maximum flexibility and IUL is no different. In addition to fully flexible premiums (as long as the internal costs are satisfied), most policies offer additional flexibility with your cash value growth options. There are often multiple indexed crediting strategies to choose from that will ideally give you better long-term performance than the fixed account. However, you can re-allocate your selections every year as the insurance company adjusts their parameters.

The tradeoff for this flexibility is a lifelong responsibility to make sure you have paid enough premium and/or gotten enough indexed crediting to pay the costs all the way through life expectancy. On paper, with today’s assumptions, Indexed Universal Life should be a favorable lifetime proposition, but remember that IUL’s parameters are flexible for both you and the insurance company.

To dig even deeper into IUL’s pros & cons you can check out our in-depth article.

Whole Life Insurance Explained Simply

On the surface, Whole Life Insurance sounds a lot like an old-school (non-indexed) Universal Life Policy, since most Whole Life companies pay an adjustable bond-like crediting rate declared annually called the dividend interest rate.

(Note: There are certain insurance companies that do offer “Indexed Whole Life insurance.” This gives you the ability to earn indexed crediting on your dividend payout, but it’s just an ancillary crediting option for these select companies).

Only part of the Whole Life dividend is tied to prevailing interest rates, and the rest comes from the overall profitability of the issuing insurance company. That’s because whenever you buy a Whole Life insurance policy from a mutual insurance company vs. a stock company, you actually become a small part-owner of that company, hence the term mutual.

Whole Life’s growth is unique in that in addition to its dividend component, there is an underlying guaranteed growth assumption of 2%-3.75% whether the company pays a dividend or not in any given year. In addition to its guaranteed growth, Whole Life also has a guaranteed level premium, a guaranteed death benefit, and a guaranteed cost structure.

Because of these contractual guarantees are locked in at the onset of the policy, the only lever that can be changed in Whole Life by the insurance company is the dividend interest rate we first spoke of.

Without further ado, let’s discuss how these 2 distinct variations of life insurance products work, where they shine, and where they fall short.

Whole Life vs IUL in terms of Transparency & Guarantees

When it comes to guarantees this is where Whole Life dominates since it has a:

- Guaranteed Cost Structure

- Guaranteed Death Benefit

- Guaranteed Level Premium

- Guaranteed Cash Value Growth

The flipside of Whole Life’s guarantees is that it is a “bundled product” or a “black box”. This means Whole Life’s specific annual costs and growth rates are neither transparent nor easily discernable for clients or agents alike.

Conversely, Indexed Universal Life lacks these key guarantees and instead has maximum transparency. Each month’s costs and growth are unpacked down to the penny on the annual statement. The main reason for this transparency is that it is ultimately the client’s responsibility to manage the balance of growth and costs to keep their policy in force.

Indexed Universal Life does NOT have guaranteed growth, but it does have a guaranteed 0% floor protecting against any market losses. However, that does not mean IUL is principal-protected since its 0% floor doesn’t account for the ongoing fees or cost of insurance. That said, if your policy is properly designed and managed then the average annual cost over the life of the policy should be on par with professional money management.

Lastly, although this is not touted as one of IUL’s express guarantees since it doesn’t sound great, Indexed Universal Life’s cost per unit of death benefit is set to increase every year as the insured ages. Not only that, but insurance companies are allowed to adapt this cost structure further if they feel they originally mispriced the product. So, IUL’s cost structure is guaranteed to change, and the cost per unit of insurance is guaranteed to be higher.

With Indexed Universal Life it’s up to you to cover the fees by achieving sufficient growth and/or trimming the death benefit as needed. All of this can be reasonable done as long as your policy is designed, funded, and monitored properly.

Hutch’s Take on Transparency & Guarantees:

Although the true transparency of IUL is nice to see, the Whole Life’s guaranteed level premium, guaranteed fee structure, and guaranteed death benefit are very valuable.

When people are younger these guarantees may not seem as important. Remember though that both Whole Life insurance and Indexed Universal Life are meant to last for your whole life.

However some people do prefer the better upside potential available in IUL, and are willing to forgo guarantees for the opportunity.

IUL vs Whole Life with Flexible Premiums & Overfunding

Believe it or not, the lack of guarantees in IUL actually becomes an advantage over Whole Life in terms of flexibility.

Why?

With IUL there is technically never any premium due. There may be a suggested premium, or you may get a notice in the mail for whatever scheduled premium you originally committed to. However, this is essentially just a guideline. As long as there’s enough cash value to support the ongoing charges, your policy won’t lapse.

That’s why on every single Universal Life policy contract they specifically call it “Flexible Premium Adjustable Life”.

IUL premiums are indeed truly flexible, but the tradeoff for that flexibility is the fact that the insurance company adjusts the cost of insurance as you get older. To be fair though, the rising fees can be lowered by the strong performance reducing the amount of death benefit over and above the cash value, or you can manually reduce your death benefit if you

For Whole Life, in order to maintain all its guarantees there is ZERO flexibility in paying this guaranteed minimum premium each year (unless you would borrow against existing cash value to do so). That said, the minimum premium due is usually just a small fraction of the maximum possible premium you can pay, and most people do overfund above the maximum to get maximum cash value growth from paid-up additions.

With IUL you can skip multiple years of paying the maximum premium and catch-up your policy years later with one lump sum. Whole Life on the other hand offers you the ability to catch up a certain amount in future years, but many Whole Life companies have a use it or lose it provision when it comes to overfunding.

We have clients that have paid the absolute maximum into their Indexed Universal Life policy in year 1 and then skipped multiple years thereafter. Their cash value likely will be simply treading water in these cases, but their policies aren’t even close to lapsing by this point either.

Hutch's Take on premium flexibility & overfunding:

It’s undeniable that IUL is the clear winner when it comes to flexibility. However, if maximum cash value growth is your goal though, then flexibility probably should NOT be your main criteria for deciding between IUL vs Whole Life.

Pro Tip: If cash value growth is your goal, then you need to pay premiums far greater than the minimum premium for robust cash value growth in either IUL or Whole Life. That way the vast majority of your premium payments goes toward uninterrupted cash value compounding, while only a small fraction goes towards fees and insurance costs.

If premium flexibility is your main concern, then perhaps you should be considering a smaller size policy regardless of whether it’s Indexed Universal Life or Whole Life insurance.

IUL vs Whole Life with Growth Options & Market Participation

Again, Indexed Universal Life easily takes the prize here over Whole Life when it comes to growth choices and some kind of market participation.

Practically any Indexed Universal Life will have an array of indexed crediting strategies, whereas Whole Life Insurance often has no choices, just its guaranteed growth plus whatever dividends get credited to the policy each year. However, certain Whole Life companies do offer the option of simplified indexed crediting on your dividend payout.

Book your own custom call to fully understand your best policy options.

Although Whole Life’s growth mechanism is relatively simple, it is completely unique in that it is totally non-correlated to the stock market, and only the non-guaranteed portion of its growth is correlated to interest rates. That said, the major difference between Whole Life and bonds is that bonds will go down when interest rates go up, whereas Whole Life cash value has to go up every year.

Another alleged advantage of Indexed Universal Life is its ability to participate in market gains in up years while maintaining a 0% floor in down years.

On paper, this sounds amazing! It’s good, but you’ll hear some agents boasting about how it’s better than the long-term stock market average (which is NOT true).

However, even though I’m hedged during the down years, I end up leaving A LOT of upside on the table when the market is roaring higher due to index caps (except for certain IUL products I have with uncapped crediting options).

Even though Indexed Universal Life allows me to lock in most of my previous gains with the 0% floor, don’t forget that fees and any loan interest will erode some of these gains in down years. This makes IUL’s 0% floor a slight negative number actually, so long the policy is designed and funded properly and has a low locked loan rate.

Since Whole Life is guaranteed to grow every year, and the loan rate often corresponds to the dividend rate, it’s much harder to lose ground when borrowing as your own bank or retirement vehicle.

Hutch’s Take on Growth Options:

When it comes to IUL vs Whole Life for growth choices and market participation, Indexed Universal Life does indeed win. However, you have to ask yourself, “Are you perhaps striving to answer the wrong question correctly?”

Indexed Universal Life is not supposed to be a proxy for investing in the stock market, but at best to complement it. The only place where IUL should be a pure substitute for investing in the stock market, is when someone has zero exposure to equities due to their extreme fear of any volatility whatsoever. In this case, we feel some exposure is better than nothing for these most conservative clients.

If you already have sufficient exposure to the stock market through your 401(k) or ETFs, then IUL’s additional watered-down market exposure may not be as valuable as the true non-correlation of Whole Life insurance. This is especially true in how each can help in retirement like we discuss below.

Both Whole Life & Indexed Universal Life Help Retirement

Remember at the beginning of this article we mentioned how Whole Life and IUL can add unique value in retirement? It doesn’t matter which of the benefits you like the best because you get them all!

Whether you’re a serial entrepreneur who’ll never fully retire, or just someone playing catchup, isn’t it safe to say at some point you’ll want to lessen your efforts and have your assets at work replace your efforts to some degree?

Even though at Banking Truths we’re primarily known for how to use Whole Life for infinite banking, the Indexed Universal Life vs Whole Life argument has some very subtle but crucial distinctions when it comes to retirement planning.

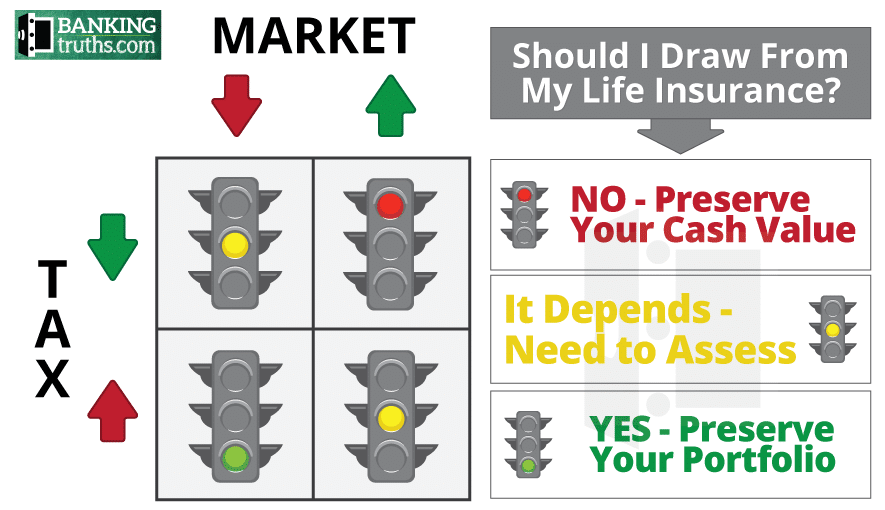

Two unique ways that both can help you when it comes to retirement planning are managing taxes and market volatility, both of which can inefficiently erode your other retirement savings.

Think about these 2 realities we will all have to grapple with in retirement:

- If tax rates go up with a stroke of a pen in Congress, you’ll have to liquidate more of your investments to support the same amount of lifestyle spending in retirement.

- If your investments go down in value due to market volatility, you’ll have to sell more shares to support the same lifestyle you’re used to.

Either way, those extra shares you had to sell won’t be able to rebound to help you in later years.

They’re gone!

And they really provided no additional value for you or your family. If all your eggs are in the same basket, exposed to market volatility and bad tax policy, then you will have painted yourself into a corner in retirement.

What’s the alternative?

Using Whole Life or IUL as a volatility sponge & tax eraser. Take a look at this simple matrix I made for when to more heavily rely upon your life insurance in retirement.

So, let’s discuss which is superior when it comes to IUL vs Whole Life insurance in retirement for both market volatility and taxes, two of retirement’s main eroding factors.

Learn the differences between IUL vs 401k in retirement and on the way there.

IUL and Whole Tied as a Tax Eraser in Retirement

Both Indexed Universal Life and Whole Life are equally immune to taxation as long as you keep even just a small amount of death benefit in force until the insured passes away.

Here’s why protection against taxes is so important…

Unlike market losses which typically last 1-3 years, couldn’t extremely unfriendly tax policies last for 8, 12, or even 16 years if certain political regimes dominate in Washington D.C.?

Aren’t there over 32,000,000,000,000 reasons (and growing) why taxes will likely have to rise throughout your retirement at some point?

If so, what if you could steadily and aggressively pull streams of cash flow from your IUL or Whole Life policy when your other taxable or tax-deferred retirement accounts could push you into the more penal tax brackets?

That way you have the capacity to ward off a decade or more worth of the highest tax brackets through a decade or more of bad tax policy, thereby conserving your taxable and tax-deferred retirement assets.

Hutch’s Take on the tax buffer:

Since both product types offer you the same tax immunity, we’ll call it a draw when it comes to Indexed Universal Life vs Whole Life for tax-exempt retirement income.

Although a Roth IRA or Roth 401k may do the trick as a tax eraser, it likely won’t hold up as a volatility sponge since it’s also correlated to stock market fluctuations. Also, you cannot tap into your Roth IRA beyond your basis before age 59.5 without incurring penalties, whereas you can utilize up to 95% of your cash value at any time for any reason.

Whole Life vs IUL as a “Volatility Sponge or “Actuarial Bond” in Retirement

Historically people would invest in balanced portfolios such as a 70/30 or 60/40 blend of stocks/bonds. The bond component was meant to lessen volatility in a portfolio. As you get older you ideally would ratchet down your potential volatility by exchanging stocks for bonds as you rebalance to ensure a smoother ride on the retirement roller coaster, so to speak.

The 2 major challenges facing bonds as a volatility sponge going forward are:

- Whenever interest rates rise, the principal value of existing bonds goes down! (Which way are interest rates likely trending long term?)

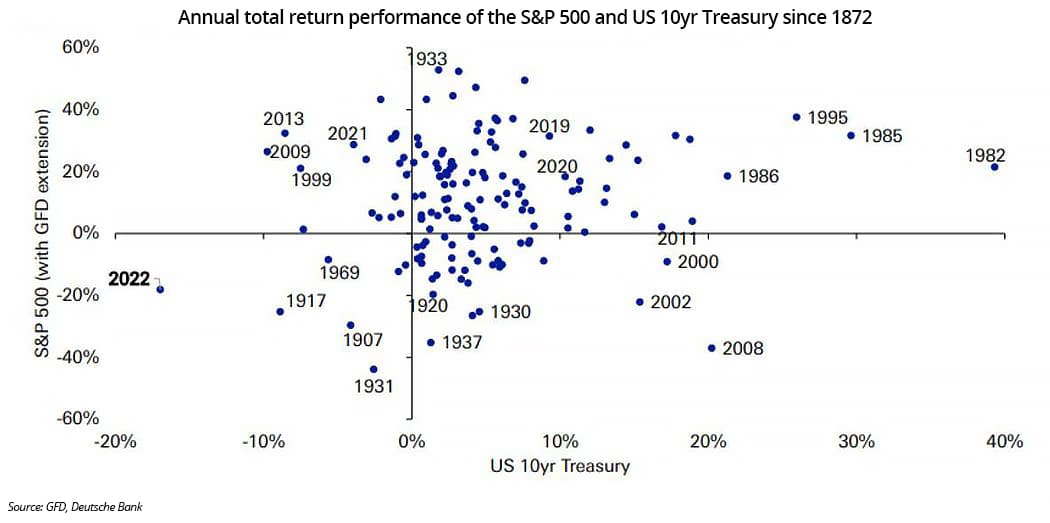

- Bonds aren’t as safe as they used to be, as evidenced by their precipitous drop in value in 2022 shown in this scatterplot by Deutsche Bank:

For these reasons and the fact that most folks approaching retirement feel they are playing catchup, we often find them overexposed to massive swings of volatility by being allocated to 90-100% stocks with little to no exposure to bonds. Retirees may acquire a mathematical advantage by allocating some of their retirement assets to actuarial bonds from insurance companies.

By having a true non-correlated source of retirement income from an “actuarial bond” like Whole Life, retirees would be able to temporarily pause income from their 401(k) or brokerage accounts while they healed, thereby preserving more shares for future market rebounds.

Keep in mind that Indexed Universal Life is still somewhat correlated to market movements with a 0% floor less any fees. However, temporarily taking income from IUL while pausing your portfolio would be better than having no volatility sponge at all.

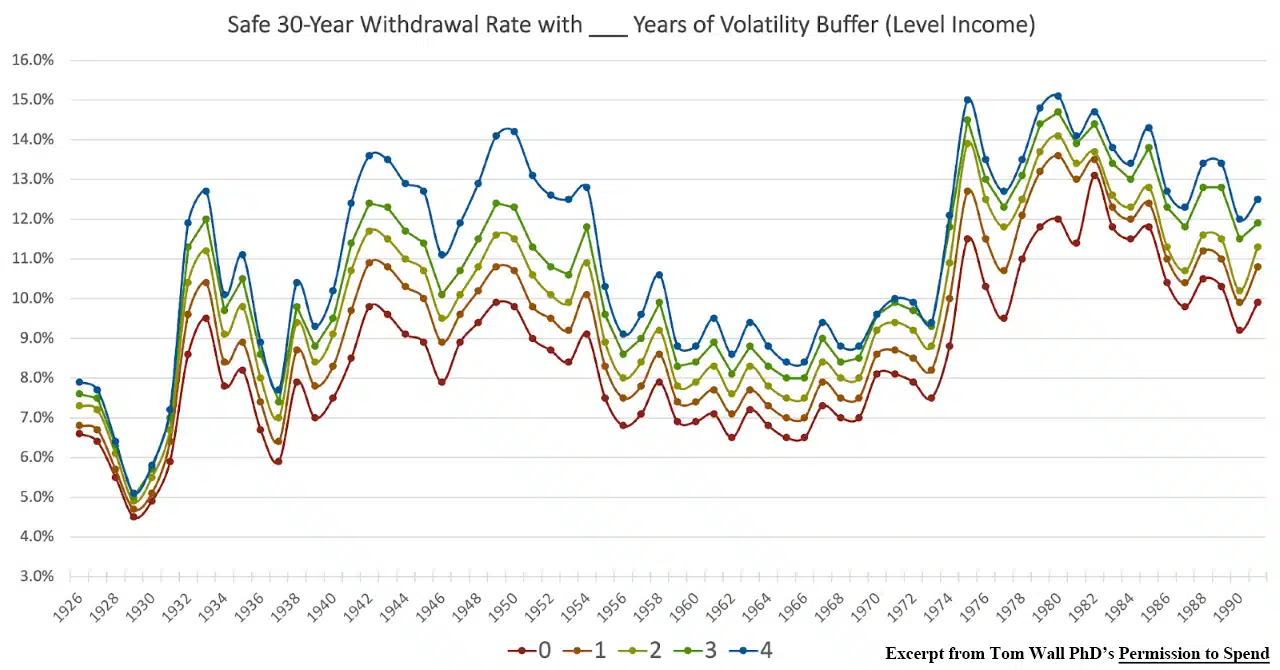

See Tom Wall Ph.D.’s study from his book Permission To Spend on the range of viable withdrawal rates on the same portfolio depending on what year you started and how many years of a “volatility sponge” (he calls it a “buffer asset”).

Although the study above has the benefit of hindsight, clearly retirees would’ve been able to enjoy higher withdrawal rates from their 401(k) and brokerage accounts with the existence of any amount of volatility sponge in place before retirement.

With Whole Life insurance, you can withdraw up to your basis (how much premium you paid) without incurring one penny of fees or loan interest in retirement. And you can do so without compromising the integrity of Whole Life’s guaranteed growth or death benefit giving you the confidence that the product will indeed be there for your Whole Life.

Multiple years’ worth of aggressive income distributions from an IUL product (whether withdrawal or loan) will cause more fees to add up plus any accruing loan interest from prior distributions. This may reduce the ultimate capacity of Indexed Universal Life to act as your volatility sponge when you arguably need it the most even if IUL outperformed Whole Life during pre-retirement years.

Hutch’s Take on the "Volatility Sponge" in Retirement:

The edge here definitely goes to Whole Life insurance over Indexed Universal Life in terms of a volatility sponge in retirement due to its true lack of correlation and overall guaranteed integrity every single year regardless of external market forces.

Since people often keep cash before and during retirement, consider redeploying some of these funds to one of these “actuarial bonds” offered by insurance companies. Cash value life insurance when properly designed historically provides superior tax-adjusted returns long-term for its similar risk profile to cash while also providing additional benefits.

Whole Life vs IUL for Wealth-Refiller Upon Death

Once people see the value of Whole Life or IUL in retirement they often plan on using only the cash value as this strategic income replacement when markets are down or taxes are up. The death benefit in their mind is seen as purely an ancillary benefit.

I’ll bet you still catch yourself saying things like:

- “I don’t really care about the death benefit.”

- Or, “The death benefit is secondary to me.”

- Or, “My primary goal is cash value growth & income.”

If you’re saying any of these things, then you may be overlooking one of the best strategies in retirement planning.

What you’re missing is the fact that the guaranteed death benefit of specifically Whole Life is one of the most powerful and forgotten tools for retirement distributions. Unfortunately, Indexed Universal Life won’t cut it because there’s no way to guarantee the death benefit without losing your access to the cash value.

You can read why else some people think IUL is a bad investment here.

What if I told you that there was some “selfish value” within your own death benefit you could monetize while still keeping full control of your policy?

What if you effectively become the primary beneficiary of your own death benefit while you’re still alive?

If you want to take your retirement withdrawal strategy to the next level, you must consider how the death benefit can act as a unique wealth-replacement strategy.

Let me explain the concept with a simple analogy:

Imagine you had a very rich uncle, and he really loved your spouse and children. In fact, imagine he loved them so much he said to you, “Hey, I’ve put aside $1,000,000 in trust just for them, and they can start drawing from it right after you pass away.”

At first, you may be miffed that your rich uncle didn’t include you personally in this family trust fund. However, he actually did you a major favor. Let me explain…

Since you know your family has a guaranteed accounts-receivable of $1,000,000 that comes in at the time of your death, can’t you more aggressively spend at least $ 1 million of your own retirement assets rather than keep that money intact for heirs?

Said another way, without this trust from your uncle, you would have to be extremely conservative about how you manage and spend your own $1m nest egg. You’ll have to sparingly tap into these funds to make sure your assets endure for both you and your spouse in addition to whatever you want to pass down to children.

Guess what… even if you don’t have a rich uncle, couldn’t you manufacture one using Whole Life insurance to replace the consumed assets?

By having the guaranteed replacement of that $1m, you could violate the infamous 4% rule and instead withdrawal 7%-8% per year from the same $1m million dollars and guarantee you’ll never outlive the income. (This math is as of 1/13/2024 and assumes a male starts retirement at age 65 using a Fixed Indexed Annuity or Single Premium Immediate Annuity.)

What’s even better is that since Whole Life’s death benefit is guaranteed, you could take any excess dividends in cash as that tax-exempt supplement or roll them back into the policy to buy even more paid-up additional death benefit depending on which is more important to you each year.

Without a guaranteed death benefit to replenish these consumed retirement assets, you’ll almost certainly have to do one of two things instead:

- Scrimp and save taking meager income streams throughout retirement

- Or consume your assets anyway, putting undue pressure on your surviving spouse when they’re least equipped to handle it

It doesn’t have to be that way!

Hutch’s Take on the wealth replacement bucket at death:

This one is not even close! Whole Life’s guaranteed death benefit is simply the only one that works here.

Lock in some amount of guaranteed death benefit now using whatever portion of your savings you want to keep safe & liquid anyway. Remember, it doesn’t matter which parts of Whole Life you like best – you get them all!

Since we’re on the topic of guaranteed death benefit, let’s get into another unique dimension of utility it has providing selfish benefits for the insured policyholder

IUL vs Whole Life for Protection Against Death and Chronic Illness/Injury

Nobody likes to imagine themselves too sick or hurt to function on their own in society. Everyone thinks it can’t happen to them, however, bad things do happen to good people. A traditional Long-Term-Care policy can be extremely expensive, and those premiums would be a pure cost since they never build any cash value equity you can use along the way.

However, a hybrid life insurance policy with chronic/critical illness/injury provisions allows the user to hedge against this serious risk while simultaneously building up cash value and death benefit they can use for retirement.

I’ve heard countless tear-jerking stories over the years about clients who bought these types of hybrid life policies only to end up coming down with some kind of horrible illness. Having this benefit allowed them to:

- Alleviate financial stress that could’ve accelerated their condition

- Afford quality care they couldn’t have otherwise paid out of pocket for

- Paid for travel & lodging expenses for extended family to be with them

Who wouldn’t want this kind of hedge in their back pocket?

So, when it comes to Indexed Universal Life vs Whole Life for these types of chronic illness riders, which is better?

That’s a trick question because some of these riders are free and the more robust ones are paid riders that incur additional charges which erode cash value significantly.

That said, I’ll give the edge here to Indexed Universal Life over Whole Life for the chronic illness category because there seems to be a greater selection of benefits in Indexed Universal Life policies vs Whole Life insurance on this front.

Learn about the best IUL policies of 2024 here.

Also, when it comes to a free version of these chronic illness/injury riders, it seems like almost every Indexed Universal Life company has them, whereas only certain Whole Life companies offer a free chronic illness rider.

Keep in mind though that, similar to the “wealth-refiller” topic above, the chronic illness riders are attached to the death benefit. So, unless the IUL has some sort of guaranteed death benefit rider, it is not guaranteed to be there when you may need it the most, unlike with a Whole Life policy.

Hutch’s Take on Chronic Illness Riders:

This one is tricky!

Even though a slight edge goes to Indexed Universal Life for the fact that nearly every IUL policy has some sort of free chronic illness provision, you can’t really count on it being there once you start using the cash value for other retirement needs.

Only certain Whole Life policies have the free provision, but if you do get this free provision on a Whole Life policy at least it is tied to a guaranteed death benefit. At least then you know it will be there no matter what.

Comparison of Whole Life and Indexed Universal Life

Feature | Whole Life | Indexed Universal Life (IUL) |

|---|---|---|

| Premiums | Fixed & level | Flexible |

| Cash Value Growth | Guaranteed & steady | Linked to market index (with caps/floors) |

| Risk | Very low, predictable | More variable, upside potential but no guarantees |

| Loan Options | Available, predictable | Available, but cash value may fluctuate |

| Best For | Conservative savers, estate planning | Growth-oriented, flexible savers |

Frequently Asked Questions

That depends entirely on what you’re trying to accomplish. If you want certainty, predictable growth, and a simple set-it-and-forget-it plan, Whole Life is hard to beat. If you’re okay with some unpredictability in exchange for potential upside and more flexibility, an IUL could make sense — assuming it’s structured correctly.

Not really — and definitely not in the long run if you don’t fund it properly. An IUL can look cheaper upfront because of its flexibility, but that flexibility can also hurt you if you don’t keep up. Whole Life premiums are higher and fixed, but at least you know what you’re getting.

Sometimes. You could surrender a Whole Life policy or do a 1035 exchange into an IUL, but there are tax implications and potential surrender charges. Make sure you actually understand what you’re giving up before making a move like that.

Whole Life builds cash value slowly and steadily — no surprises. IUL has more potential upside thanks to its index-linked returns, but no guarantees beyond its floor (usually 0%). Over time, it depends on how the markets perform and how well the policy is funded and managed.

If you value stability and don’t want to think about it too much, Whole Life is a solid choice. It works especially well for conservative savers, estate planning, or anyone who just wants predictable, guaranteed growth.

If you’re okay with complexity and can commit to properly funding it, an IUL could work for you — particularly if you want the chance for higher returns and need more flexibility in premiums or death benefit.

Yes — if you stay within IRS guidelines. Both grow tax-deferred, and if structured properly, you can access the cash value without triggering taxes. But if you overfund and turn your policy into a MEC, you lose those benefits.

Final Thoughts on IUL vs Whole Life:

There really is no one-size-fits-all right or wrong answer. It all comes down to your particular preferences, risk tolerance, how you plan to use the policy, and when you’ll likely use it the most. Both Indexed Universal Life and Whole Life can help immensely during retirement and before, as well as your own bank.

If long-term retirement applications are your main goal, we strongly suggest you read our write-up on how each Indexed Universal Life and Whole Life help retirement. There is definitely some overlap as well as some clear differences.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson is the founder of BankingTruths.com, an educational site discussing how to maximize the lifetime benefits of both Whole Life Insurance and Indexed Universal Life Insurance by creating your own private family banking mechanism.

Information presented in this article by John “Hutch” Hutchinson is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities product, insurance products, financial services, or investment strategies. Be sure to first consult with a knowledgeable, ethical, and licensed insurance professional before implementing any strategy or product discussed herein.