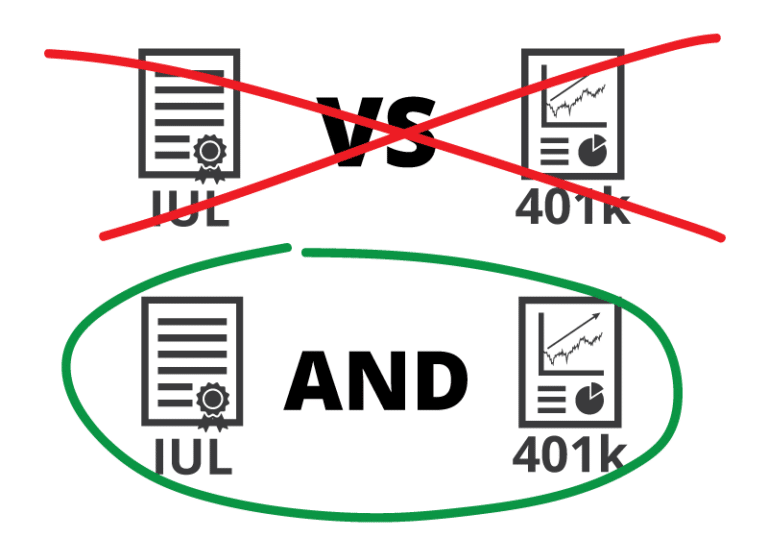

IUL vs 401k or Both?

It’s normal for people to get caught up in these types of EITHER/OR comparisons.

But the truth is that having BOTH a 401(k) and an Indexed Universal Life policy is actually better than having only a 401k (even if you don’t care about IUL’s death benefit).

Here are 4 reasons why both an IUL & 401k are better together:

- IUL complements a 401k’s shortcomings and vice versa

- IUL can help you reduce future taxation on your 401(k)

- IUL can still capture market gains even while using cash

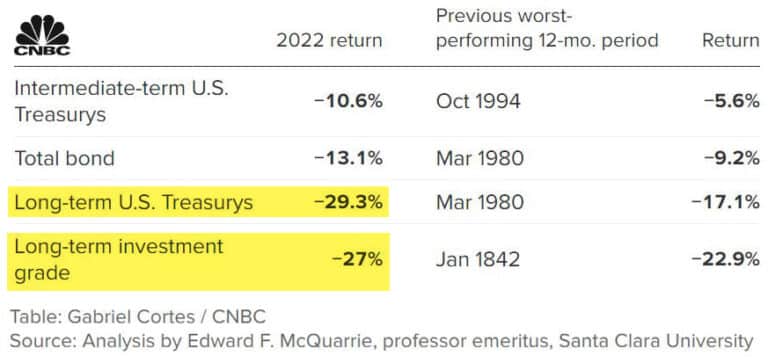

- Bonds no longer provide safe diversification, but IUL can

This article will dig into the advantages and drawbacks of both IUL and a 401(k), why it may be optimal to have some of both, as well as the optimal order to start an IUL vs. 401(k).

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

Table of Contents

What’s Indexed Universal Life Insurance, How It Grows, and How It’s Taxed?

Indexed Universal Life is a type of insurance policy where the insurance company grows your cash value using S&P 500 options strategies to track the market’s upside up to a certain cap, but also with a protective 0% floor to insulate against market losses.

IUL also has a death benefit component that can pay out not only at death, but possibly even beforehand if the insured becomes too sick or hurt to keep working (with a free chronic illness rider added onto the policy).

There is, of course, an ongoing cost of insurance, but these fees can be greatly reduced with an optimally designed and max-funded IUL. IUL’s cost of insurance provides both a death benefit, but also a discounted cost for the ongoing tax immunity for your cash value while living.

What’s a 401(k), How It Grows, and How It’s Taxed?

A 401(k) is an employer-sponsored retirement plan, allowing employees to temporarily defer taxes on however much they personally contribute to the plan as well as any employer matching contributions. Most plans offer an array of mutual fund choices within a 401(k) plan that will directly track the stock market both to the upside and downside.

Although plan participants avoid taxes on their pre-tax dollars going into the plan, they will pay full taxes on not only what they put in, but all the growth it earned along the way at whatever tax bracket they’re in when they take retirement income.

Why a 401k Is Better With an IUL

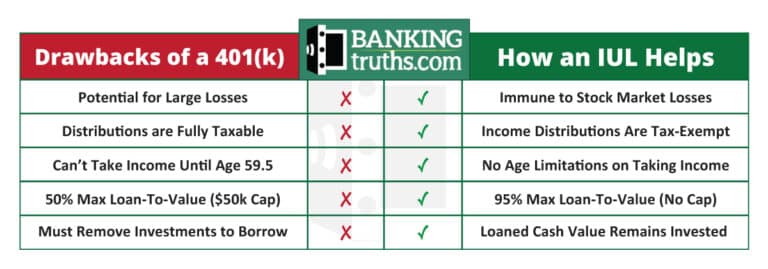

When you overlap the benefits of an IUL next to the drawbacks of a 401k, you can easily see why they complement one another.

See how the benefits of IUL line up perfectly with the drawbacks of a 401(k)?

Don’t get me wrong. I’m not saying you should be choosing one over the other. Keep in mind though, that simultaneously having an IUL can help you maximize the long-term benefits of a 401(k), while minimizing its drawbacks.

Not to mention that IUL can be used as your own private bank on the way to retirement.

Why People Say a 401(k) is Better Than an IUL and Why It's Not

Many people will make a blanket statement that a 401(k) is better than an IUL for the following reasons listed below.

It’s true that certain advantages of a 401(k) are definitely worth having, but if your retirement savings plan is concentrated mostly within a 401(k), there are certain dangers that can be balanced using Indexed Universal Life.

Being able to supplement that final month or two of income each year from an IUL can keep you from bumping into whatever your next higher tax bracket is. Otherwise, you’ll have to cash out proportionally more shares from your 401(k) to satisfy the same amount of income in those final months which caused you to hit those higher tax brackets.

Employer Matching Contributions on a 401(k)

Getting a match from your employer is probably the single biggest reason to do a 401(k). After all, what other investment gives you free money to add that’s yours to keep?

We agree that a free match is too good to pass up despite a 401k’s downsides.

However, contributing beyond what will get you employer matching contributions is rarely worth sending to federal prison until the approved retirement age of 59.5.

Let’s explore the other benefits of a 401(k) to see why.

Pre-Tax Income Goes into a 401(k)

The fact that you get to defer taxes on your contributions and essentially use some of the government’s money on your behalf to invest in the stock market seems like a great thing, right?

It is, except for the fact that you now have a silent partner in that investment venture.

Look at it this way, contributing to a 401(k) above the match is like an investment partnership between you and the federal government:

You contribute pre-tax income to this partnership.

They contribute the tax dollars you’d otherwise owe if you didn’t pay into the 401(k).

You decide on the investment vehicles.

They decide on the earliest you can remove money and the latest you MUST remove money.

You dictate exactly when you’ll take out profits and exactly how much.

They dictate what their share of those proceeds will be only at the time you take them.

If anyone else invited you into this kind of partnership, would you accept?

Why send your pre-tax dollars to federal prison with so many rules and restrictions, especially when the warden can change the terms of your sentence with a stroke of a pen?

Think of how many times both tax rates and distribution rules have changed over the years!

You’ll almost certainly put your money in a 401(k) with one set of assumptions, and take it out later with a completely different set of variables you have absolutely no control over.

Ongoing Tax Deferral Inside a 401(k)

This alleged benefit of a 401(k) is actually kind of a nothingburger. Here’s why:

First of all, with both a 401(k) and IUL you get tax-deferred growth on your money. The key difference between Indexed Universal Life insurance and a 401(k) is what happens on the back-end:

- With a 401(k), you pay ordinary income tax on all distributions

- With an IUL policy, you can get tax-free retirement income

The tax deferral of a 401(k) actually comes with a tradeoff.

You see, even if you wanted to invest in actual index funds (mutual funds) outside a 401(k), you still can actually defer taxes on growth simply by just holding and not selling. Only with mutual funds outside the 401(k), you can actually get more back-end tax benefits with favorable long-term capital gains rates.

However, you forgo these long-term capital gains rates by accepting the “tax-deferral” within a 401(k), not to mention your money will now be illiquid until age 59.5.

So for unmatched money inside a 401(k) the tax-deferral is actually kind of a trap.

The only way the tax-deferred growth of a qualified retirement plan is beneficial is if you’re heavily invested in bond funds, or doing tactical trading and reallocating every month or so.

401(k) Plans Are Protected from Lawsuit

Since a 401(k) is a qualified plan under ERISA, it is protected from lawsuits and judgements, which is a huge benefit.

OJ Simpson proved that by living off of his NFL pension even after losing his civil suit to the tune of millions of dollars.

However, depending on the state, IUL can also be creditor protected.

This is especially important for business owners and real estate investors who are often an easy target of frivolous lawsuits, and also need to keep their capital safe and liquid rather than sloshing around in volatile markets.

401(k) Plans Are Protected from Lawsuit

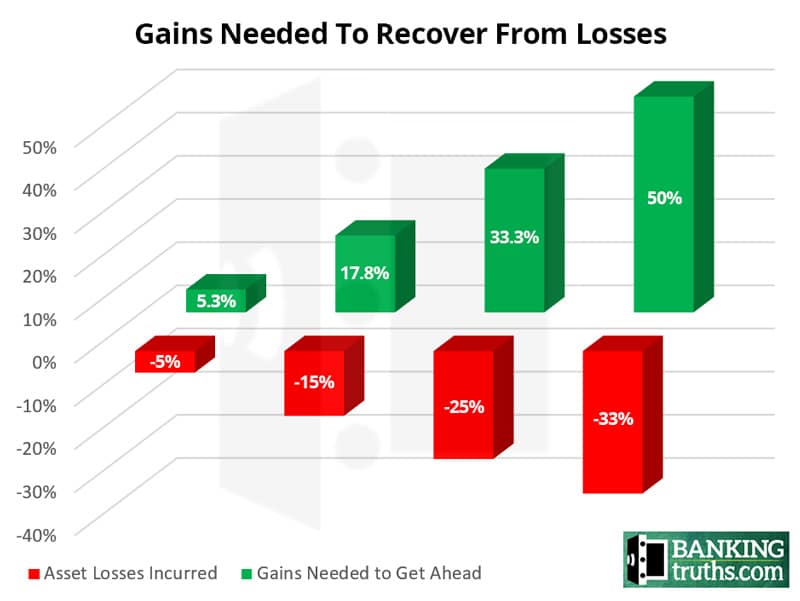

The fact that a 401(k) has unlimited upside potential with full stock market participation sounds great until you fully participate in a multi-year bear market like 2000-2002 or even a single-year plunge like 2008. Both of these downturns resulted in peak-to-trough portfolio drawdowns over 50%.

Being fully invested in mutual funds without any buffer assets can put a lot of pressure on a portfolio since the bigger the loss, the more gains you need to recover.

Although you may have time to reinvest and recover while still working, any income taken during the down years compounds the losses since it requires cashing out more shares that have no chance of recovering.

Imagine if you had a few years’ worth of retirement income inside an IUL to draw from!

If so, you could let your 401(k) fully heal during the negative years rather than cash out more shares of mutual funds while they’re down to create the same amount of retirement income you took the year before.

IUL also can protect against 4 to 8 years of bad tax policy that would require you to pull out more shares just to pay future higher taxes.

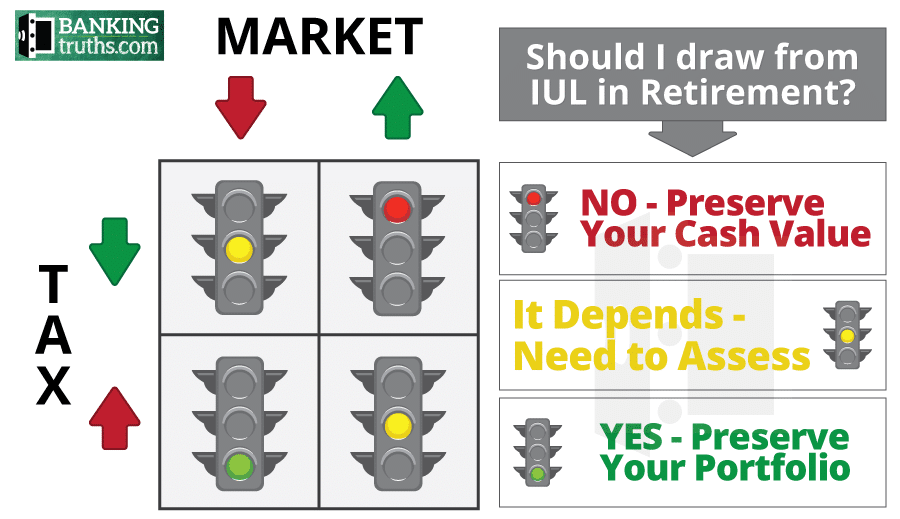

This handy flow chart from our IUL for retirement article shows you which years you should pull retirement income from your IUL vs 401k.

By the way, certain IUL policies have uncapped S&P 500 index crediting strategies that still have a protective floor to guard your cash value against market losses.

Book a discovery call with one of our independent agents to learn about uncapped options here.

Is IUL Really a Bad Investment?

It’s common to hear from critics that IUL is a bad investment.

But when you probe deeper into why, you’ll find they are often misinformed or discussing situations where the IUL was not designed properly or not even one of the best IUL companies.

To have Indexed Universal Life excel for cash value growth and income, your policy must be:

- Chosen Wisely

- Designed Optimally

- Funded Thoroughly

- Monitored Annually

Even though you only have to max-fund an IUL for 4-7 years, Indexed Universal Life insurance should be considered a lifelong commitment so you can get the most of what it offers.

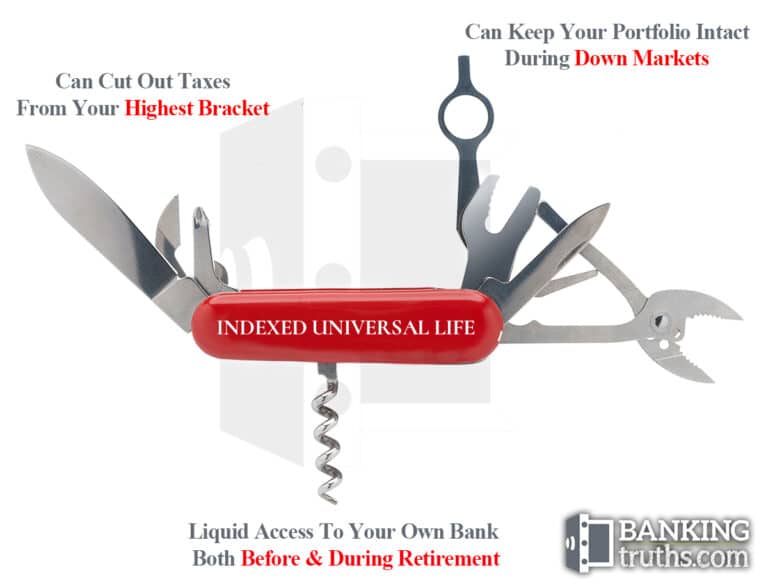

When properly structured, a max-funded IUL pairs perfectly with a 401(k) for these 4 reasons:

- IUL lets your 401(k) investments heal when markets are down

- IUL’s Tax-free income keeps 401k withdrawals from pushing you into higher brackets

- IUL’s participating loan lets your cash value keep compounding even while using it elsewhere

- IUL’s chronic illness rider provides tax-free withdrawals of the death benefit even if you’re not dead, but too sick or hurt to keep working

I highly recommend that any potential buyer of IUL should thoroughly educate themselves about IUL’s pros and cons so they can be more informed when speaking to an agent.

Which Should I Start First - IUL vs 401k?

What if you can only currently afford to fund either your 401(k) or IUL?

If so, you may want to ask yourself questions like these to decide which to contribute to first:

- Will I likely need some or all of this liquidity before age 59.5?

- How much of my short-term goals be affected by short-term market losses?

- Will my taxable income be higher in the future, causing more taxes with 401(k) withdrawals?

If you answered yes to any of the above questions, then perhaps you may consider delaying contributions to your employer sponsored 401k until you develop enough accessible powder in the short term.

Remember too, that Indexed Universal Life is permanent life insurance coverage that’s both age and health-sensitive. If you see the value of incorporating life insurance as both a risk and tax mitigation tool, then you may consider locking in the insurance sooner rather than later since there is no age or health cap on your 401(k) plan

That said, if your 401(k) offers employer matching contributions, you probably want to contribute the minimum necessary to qualify for the maximum match (often only around 3%-5% of your salary). Any leftover money can go towards starting the age/health-sensitive IUL.

Either way, using IUL as your own bank can definitely help you achieve whatever financial goals you have before retirement, while still helping you during your golden years

Final Word on IUL vs. a 401(k)

Unfortunately, most financial reps and influencers are attached to either pure investments or pure life insurance, and their clients suffer as a result. Ironically, these same financial pundits may also be telling you out of the other side of their mouth to diversify according to your risk tolerance.

IUL is the ultimate diversifier for a 401(k) from both a market risk & adverse tax implications (even if you don’t care about IUL’s death benefit).

Having IUL can allow you to accept the amount of market risk needed for your portfolio to help you go the distance in retirement.

Complementing a 401(k) plan with Indexed Universal Life may help you be more nimble in managing both asset volatility and adverse tax regimes in retirement. The existence of a non-correlated and tax-exempt asset class like a permanent life insurance policy can keep you from redeeming more shares in your 401(k) when markets are down and/or taxes are high.

Perhaps more importantly, having a cache of liquidity using fixed life insurance as your own private bank before retirement can create timely investment opportunities or keep you from cashing out a 401(k) for emergencies.

None of this means you shouldn’t do your 401(k), but the question becomes more of when and how much, given its unfavorable rules that can be changed without your control.

Regardless, you should do thorough research and stress-testing of any type of insurance policy before entering into what should be a life-long financial commitment.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson is the founder of BankingTruths.com, an educational site discussing how to maximize the lifetime benefits of both Whole Life Insurance and Indexed Universal Life Insurance by creating your own private family banking mechanism.

Information presented in this article by John “Hutch” Hutchinson is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities product, insurance products, financial services, or investment strategies. Be sure to first consult with a knowledgeable, ethical, and licensed insurance professional before implementing any strategy or product discussed herein.