Pros and Cons of IUL Insurance: Who Should Buy IUL Insurance

The pros and cons of IUL are often sensationalized and exaggerated by both promoters and haters. We take a deep educational dive into its good and bad qualities as well as who should buy Indexed Universal Life insurance.

Key Article Takeaways:

- Contrary to noisy promotors, IUL isn’t meant to replace or beat traditional investing, but it can help provide a better vehicle for safe & liquid assets.

- Indexed Universal Life can be designed and funded in such a way that it provides unique growth options and tax features with limited risk that must be managed in retirement.

- Although IUL has the potential for greater cash value accumulation than Whole Life, this comes with the tradeoffs of additional complexity and a lack of guarantees.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

(Clickable) Table of Contents

What is Indexed Universal Life Insurance?

The words “Indexed” in front of Universal Life means the insurance company offers crediting strategies tied to market indexes for the potential to earn higher annual interest than what a UL’s traditional fixed account yields (around what prevailing long-term bond yields have been paying).

Just like IUL’s non-indexed predecessor Universal Life, the insurance company deducts the fees and cost of insurance from the premium contribution, while the remaining premium stays in the policy cash value to grow. Some of the growth goes to pay for future policy costs, and any surplus cash value can be used for tax-exempt distributions.

Hutch’s Take on IUL’s makeup:

On paper IUL is functionally sound so long as it is chosen, designed, funded, and managed properly.

Consumers often prefer a set-it-and-forget-it approach. They must realize that adjustments must be made if their policy doesn’t perform as originally illustrated.

How IUL Works with Index Crediting

Wouldn’t it be great if after a bad year in your investment portfolio, you could replace the loss with a zero, hit the reset button, and start over from the next year’s new lower market position?

You can do exactly that with Indexed Universal Life Insurance! This is the large print.

- The small print says it will be hard to capture large chunks of the upswings as the market rebounds due to IUL’s limiting caps and participation rates.

- The small print says the ongoing fees & costs of insurance will average between 0.50%-1.5% when the policy is designed optimally

Here’s how IUL’s cap & floor growth strategy works with S&P 500 Options:

Let’s start with the fact that all types of Universal Life have an interest rate that’s declared annually. Let’s call it 4% for comparison’s sake.

With IUL you can choose that same 4% stated crediting option, or you can instead elect an S&P Index crediting strategy with say a 0% floor and a 10% cap. There may be other index crediting strategies as well, but let’s focus on this core cap & floor strategy every IUL policy has.

The insurance company is able to offer you this 0% floor with no stock market losses because it’s tied to how S&P 500 call options work.

Your max loss with when buying options is simply the cost of those options. In this case, your max loss is the 4% fixed account growth rate you could’ve had.

Even though you technically have no market risk per se, you are essentially risking the 4% you had in your hand for the potential of 10% in the bush if the S&P grew by at least that much.

IUL’s floor is guaranteed, but the cap can and will be adjusted annually by insurance companies depending on movements in interest rates and market volatility, because both of these things affect option pricing (how much S&P 500 exposure Universal Life’s fixed yield can buy).

Note: Contrary to what the haters would have you believe, the insurance company is NOT keeping any profits above 10%. Actually, the various indexed crediting strategies are usually profit-neutral to them. IUL companies simply managing these options-hedging strategies for you in a tax-exempt wrapper as a value-added feature to lure clients into their life insurance offering that ideally last a lifetime.

IUL Growth Mechanism Trends of 2024

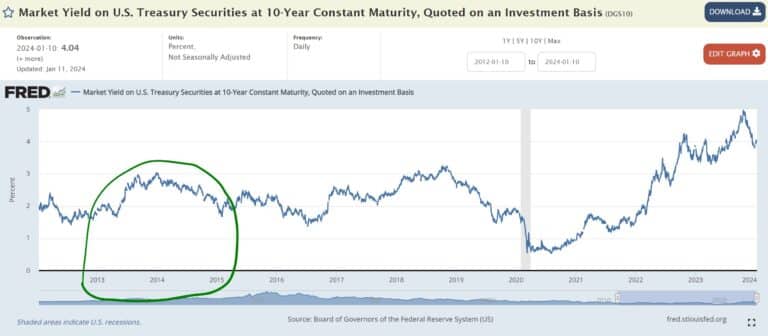

The heyday of Indexed Universal Life was between 2013-2015 when interest rates were relatively high and S&P 500 volatility was low. This meant:

- Stock options were cheap due to low volatility

- Insurance companies had more money to buy them from higher yields

However, COVID created an environment for historically low yields and abnormally high market volatility. This multi-year environment created challenges for insurance companies offering IUL. To compensate for these tough times, many companies turned to very exotic “volatility control indexes,” which have not panned out for clients.

Thankfully are interest rates leveling off at this new higher level and market volatility is subsiding to a manageable level. So we are seeing IUL’s core value proposition of tracking the S&P 500 index with reasonable caps and participation rates coming back now.

Many of the best IUL companies offer solid S&P 500 growth options. Some even offer competitive uncapped options.

Hutch's Take on Index Crediting:

You should fully understand the growth mechanism before entering into a lifelong contract. If your agent can’t explain it to you in a way that’s understandable, then maybe you both need to learn more about it.

Also, be sure to learn more about the insurance company offering the policy and their history of treating inforce policyholders. Ultimately they control the levers which can change the assumptions you’re looking at.

Definitely work with an agent who’s not afraid to model what happens if things don’t end up how they look with good illustration assumptions, and understand what options you have to manicure the policy if that happens.

Pros of Indexed Universal Life

There are a number of unique aspects with IUL that make it an ideal component to using as your own private bank and retirement vehicle. Anyone considering one of these policies should make sure these features are part of your policy:

- Locked loan rates

- Controlled growth strategies

- Continuous compounding on cash value (even while borrowing)

- Additional protection benefits (chronic illness, lawsuits)

- Tax-sheltering on growth & distributions

Pro: IUL’s Market Exposure with Limited Risk

Since most clients are already over-exposed to the threat of a stock market crash, having some of your downside hedged by Index Universal Life will be a net positive for most.

Participation in stock market gains without stock market risk isn’t too good to be true, it’s just too good to be free, and therefore not as good as it sounds.

Let me explain…

Insurance companies employ complex options-hedging strategies to produce growth inside Indexed Universal Life. In a nutshell, S&P 500 options that last an entire year can be extremely expensive. In order to keep the cost of these options affordable, IUL carriers must cap the amount of growth that can be earned within a year.

By limiting the amount of growth potential in the options strategy, the IUL carriers bring down the net cost of the options backing this growth strategy to the point where it is economically viable for them to offer it. By limiting your upside with caps and participation rates less than 100%, they can offer you the attractive 0% floor in down years. Also, with most of the new “volatility control” indexes offering participation rates greater than 100%, you’ll discover that much of your year’s exposure will be to bond indexes, which obviously have much less growth potential.

Keep in mind too, that Indexed Universal Life will often miss big chunks of the stock market’s best moves due to these caps, participation rates, and volatility control crediting strategies.

Hutch’s Take on IUL’s hedged growth mechanisms:

For clients that are underexposed to the stock market due to fear of volatility, IUL can be a great option to get them at least some limited market exposure they can stick with since they know their downside is hedged.

For clients that have sufficient exposure to the pure stock market through brokerage and retirement accounts, the true non-correlated growth of Whole Life may be more advantageous for a balanced retirement withdrawal strategy. Plus, using Whole Life insurance as a complement to market-based assets may open up additional retirement income strategies due to its unique combination of guarantees. Read more about Whole Life vs. Indexed Universal Life here.

Pro: Flexible Premiums of IUL

IUL is a very flexible policy without any rigid premium structure.

Everyone sighs with relief when they hear about Indexed Universal Life’s complete and total flexibility for premium payments, since they often stress about adding another bill to be paid.

But ultimately, it is the policyholder’s responsibility to make sure their Indexed Universal Life insurance policy is funded with enough premium and earning enough crediting to sustain the ongoing IUL fees.

Remember, any Indexed Universal Life product is still officially called “Flexible Premium Adjustable Life”, which is the same as its traditional Universal Life predecessor only without the fancy IUL crediting strategies. What this contractual language means is the policyowner has the flexibility to fund the policy as flexibly as he/she wishes, but in return the insurance company can and will adjust the cost of insurance annually to account for the risk that the insured is more likely to pass away during the later ages.

Hutch’s Take on the Flexibility of Indexed Universal Life:

You should pay as close to the maximum allowable premium as early and often as you can to maximize the compounding in the policy and outrun IUL’s ongoing fees.

IUL’s flexibility should be thought of as more of a contingency plan than an ideal funding strategy if cash value accumulation is your goal. Light-funding IUL will result in less than optimal performance, although late-funding IUL isn’t as bad.

Pro: High Contribution Limits of Index Universal Life

Clients are often familiar with the maximum contribution limits of a 401(k) vs. IUL, or the income limits of a Roth vs. IUL with high-earners.

One of the major benefits of Indexed Universal Life (or Whole Life) is they are both tax-advantaged accounts only without the various restrictive shackles associated with a 401(k), IRA, or Roth. Since life insurance provides a social good in the eyes of federal and state governments, you get special tax treatment inside your Indexed Universal Life insurance policy.

Now to be clear, there is a cap to the amount of premium someone can pay into their IUL insurance policy, but that is only limited by the amount of death benefit their cash value supports. Theoretically, someone could simply increase the amount of insurance they have to increase their IUL contributions to whatever level they want. Obviously, this entails they’re either still healthy enough to qualify or they’ve acquired some cheap term insurance that’s guaranteed convertible to IUL at whatever rating the term policy was issued at.

Hutch’s Take on IUL’s more flexible contribution limits, withdrawal age, income limitations:

For higher-income earners already maxing out their retirement accounts, life insurance is one of the few remaining tax-advantaged account option with the ultimate flexibility to both fund and use that money before any specific retirement age.

Most clients are already allocated to bond funds or target date funds inside their 401(k). But having an “actuarial bond” in the form of life insurance outside the plan may allow them to consider a more aggressive allocation inside their 401(k) as well as optimized retirement withdrawal strategies using IUL.

Pro of IUL: Locked Loan Rates for

Unlike other tax-advantaged accounts like a 401(k) or IRA there is no age 59.5 withdrawal penalty with Indexed Universal Life. You can always take out up to what you put into an IUL policy via a tax-free withdrawal. Similar to a Roth, the IRS will actually let you take your principal out on a FIFO basis (first-in-first-out), while leaving all your earnings in the policy to keep compounding.

You can also always take a tax-exempt loan against the earnings or your principal for that matter if you want to keep the maximum amount of cash value compounding for you inside the policy.

When it comes to infinite banking (using life insurance as your own private bank), people typically associate Whole Life insurance as the ideal product type.

However, Indexed Universal Life can also work for infinite banking for the most sophisticated clients ready to manage multiple variables with IUL’s lack of guarantees.

Hutch’s Take on the access and liquidity of IUL’s cash value:

Liquidity is being able to handle an emergency or pounce on a timely investment opportunity without taking on cancerous consumer debt and ideally without sacrificing compounding on your assets.

Normally clients sacrifice a reasonable return for keeping large sums of liquidity safely on hand in oversized emergency funds, but it doesn’t have to be that way.

Pro: Tax Deferred Growth & Tax-Exempt Income

The higher your marginal tax bracket will determine how valuable this major benefit of Indexed Universal Life is. Thinking critically, one should also consider the potential impact of future higher tax rates with over $36 Trillion in National Debt and no end in sight to spending.

The reason why the federal government sets income limitations and contribution limits to a tax-free vehicle like a Roth IRA is they understand how powerful it is to shelter growth from future higher taxes. Since life insurance provides a social good in the eyes of federal and state governments, you get special tax treatment on your cash value growth without such stringent limitations.

Note: the tax classification of Indexed Universal Life is slightly different than a Roth in that the cash value growth and any income distributions are technically considered tax-deferred until the insured passes away.

Once a death benefit is paid then IUL’s tax status is officially consummated as tax-free even if both of these things happen:

- Even if the policyowner drew much more lifetime income than they paid in premiums.

- Even if the actual death benefit paid turns out to be much smaller than the original face amount.

Summing up the legal technicalities, as long as you plan on keeping some amount of the death benefit in force until you die, any taxes that would normally be due on your growth will be erased.

Hutch’s Take on IUL’s Tax Benefits:

Income tax rate volatility since 1913 has been arguably more volatile than the most violent stock market downturns even though it is caused with a simple stroke of a pen. Prepare now or pay later!

Not setting up a significant pool of tax-exempt assets now could be disastrous to anyone’s nest egg in retirement since you may be forced to sell more of your investments just to pay a higher tax rate.

Cons of Indexed Universal Life

Outside IUL’s hype or large print, one must consider its drawbacks before committing to a product that only functions properly if kept your entire life (at some level). Oftentimes, agents selling Indexed Universal Life insurance aren’t properly preparing clients with proper expectations or the potential consequences if things don’t go as planned.

Con: Index Growth Options Are Capped or Diluted

Everyone likes Indexed Universal Life’s 0% floor, but how do these indexed crediting strategies handle upswings in the stock market? Generally, an IUL product will capture only a portion of the stock market’s annual gains, since the market usually moves up violently in spurts.

Oftentimes, your IUL’s annual growth will get cutoff wherever your IUL’s cap happens to be (around a 9-10% cap in 2023).

Even though bond yields are rising which theoretically should increase the insurance company’s overall options hedging budget, it has been negated by a rise in volatility which inflates the cost of the options.

Some Indexed Universal Life companies have an uncapped S&P crediting strategy with something called a “spread”, which is like an initial hurdle rate before your crediting kicks in. (Uncapped spreads start at around 8-10% in 2023).

There are also uncapped IUL crediting strategies with a “participation rate” on the S&P 500, meaning you only get a percentage of the index gains only from the first dollar without any hurdle rate. (Uncapped S&P 500 participation rates are between 35-55% in 2023).

A new trend with Indexed Universal Life is a shift towards algorithmic “volatility control” indexes. These Indexed Universal Life Insurance crediting strategies are often uncapped and with participation rates between 100-200% meaning you get credited more than 1x that annual movement in that particular index.

I realize this may sound way “too good to be true”, but it’s more of a case of “it sounds better than it actually is.” Allow me to explain…

The reason the volatility control indexes are able to offer participation rates greater than 100% is because the algorithmic index will move to cash or bonds when options get expensive. These times when options become too expensive due to volatility spikes are like those “missing the best days in the market” brochures you see. To clarify, how the insurance company is able to offer you a higher participation rate is because they only buy stock market options when they are cheap since they’re less likely to move.

Hutch’s take on IUL’s growth options being capped or diluted:

No matter how sexy IUL’s large print is, the small print makes it very unlikely that Indexed Universal Life will outperform the stock market over time.

If IUL should not be used as a substitute for the market, but rather a complement to it, then perhaps look at other insurance alternatives like Whole Life with less correlation and more guarantees to facilitate advanced retirement withdrawal strategies. Read how Whole Life uniquely helps retirement in a way that IUL cannot.

Con: IUL Complexity Requires Ongoing Understanding

Within the entire universe of life insurance products, Indexed Universal Life gets the gold medal for complexity, without a doubt. This is true whether it comes to:

- Indexed Growth Options

- IUL Fees, Costs, & Charges

- Ongoing Regulation to Curb Abuses

IUL takes the top prize for the most complicated life insurance product ever made. In fact, insurance commissioners have enacted 3 major regulatory changes since 2014 to curb abusive IUL sales practices and increase transparency. Yet the Indexed Universal Life products offered today are some of the most shrouded and complex as ever.

None of this necessarily means that Indexed Universal Life is bad or that you shouldn’t own it. But you should at least gain a solid understanding of how IUL works, what to monitor, and how to make adjustments if need be in the future.

The last thing you want to do deep into retirement is take on a new learning curve just so your IUL policy doesn’t cannibalize itself from lackluster performance and rising fees.

Hutch’s take on Indexed Universal Life’s complexity:

Investments are complex, too. In general, I believe clients should take a more proactive approach to understand how all their financial assets could be working in concert together, both now and in retirement. You may not want to learn to build a clock, but you should at least know how to tell time.

Although regulators have actually made it more difficult to properly illustrate IUL, make sure you work with an agent who is comfortable stress-testing vastly different growth rates and what-if scenarios.

Con: No Guarantees Inside IUL’s Rising Cost Structure

Indexed Universal Life’s rising cost of insurance is one of the biggest risks considerations that must be managed by every IUL policyholder, especially during retirement. This risk will be substantially mitigated if your IUL policy was funded with the maximum allowable premiums, and it achieved the IRR originally illustrated.

However, if either of the above variables missed their mark, you run the risk of imploding your IUL insurance policy in retirement. Unlike Whole Life’s guaranteed level premium supporting a guaranteed death benefit that actually increases over time, you are actually trying to make IUL’s net death benefit shrink over time to reduce the ongoing fees.

The only guarantee with IUL’s fees is that the cost per $1,000 of death benefit will rise each year. So, you are incentivized to either lower IUL’s death benefit manually or hope your cash value will converge towards your death benefit before those internal charges become unsustainable.

Hutch’s take on IUL’s rising cost structure and the lack of guarantees:

Your Indexed Universal Life will likely go the distance if you are diligent about max-funding for at least the first 5 years and reduce your IUL death benefit to compensate for any shortfalls in growth.

If monitoring and managing this risk seems daunting in retirement, consider a product where you can pull income yet still maintain a guaranteed death benefit, so you don’t inadvertently implode the policy.

Con: Gains Are Taxed Instantly If Your IUL Policy Lapses

There’s no getting around this with any permanent life insurance policy, since all growth or income over what you’ve paid is technically tax-deferred until a death benefit is paid. Only then is IUL’s growth and income deemed to be tax-free. If your Indexed Universal Life policy lapses before you do, then the tax-deferred wrapper is removed, and the IRS has a very simple 3-step tax calculation:

- You paid X in total premiums

- You took Y in total policy distributions over the years

- Subtract Y – X then multiply by Z being your marginal tax rate

This could be especially devastating in retirement, where you likely don’t have 6-figures of extra cash lying around. Plus, you may push your marginal tax bracket up to abnormally high levels due to all the phantom income from policy distributions in the past.

Believe it or not, this happened to a swath of the original Universal Life policyholders that were wooed by the high fixed crediting rates that resulted in rampant inflation during the 1980s. Thankfully, insurance companies did something positive after all the public backlash after learning that great-grandmothers were getting saddled with enormous tax bills.

Most Indexed Universal Life companies and even a couple of Whole Life companies have implemented something called an Overloan Protection Rider onto their policies to avoid this pitfall. Each product’s rider language differs, but essentially if certain reasonable parameters are met while taking substantial policy loans during retirement, then the insurance company will freeze a nominal death benefit amount rather than lapse your policy. These riders were designed specifically to help consumers avoid this tax catastrophe.

Hutch’s take on the potential for taxes if your policy lapses:

Be sure to understand how this risk of lapse can come to fruition, and know all your levers to avoid it ahead of time (such as funding contingencies, death benefit reductions, and/or any rider provisions)

Since IUL has no guaranteed death benefit, consider not bleeding down all your cash surrender value as income throughout retirement and possibly by repaying loans with retirement funds during market upswings (consult with licensed professionals beforehand).

Closing Thoughts

Most of the online slams you find against Indexed Universal Life (IUL) come from sources with a clear agenda to stir up hype and/or push their wares instead. The biased slander between the investment and insurance industries has gone on for years. True advisors should spend more time educating and discovering their clients’ true preferences to make the most appropriate product recommendation, rather than bashing products they are not familiar with.

Like most other financial products, there have been negative occurrences in the past as well as professionals who taint the overall reputation of the product by misrepresenting it. However, most of these sad stories could have been averted with semiregular reviews by the client, either with an ethical agent or directly with the carrier. The fact of the matter is, IUL as a financial product functions quite well if funded properly, reviewed regularly, and adjusted to meet the ever-evolving financial goals of the client.

All of this misinformation and negative propaganda causes confusion for consumers, many of whom may otherwise benefit from blending Indexed Universal Life or Whole Life into their overall mix of retirement assets. Life insurance products in retirement have unique risk-management, investment, tax, asset protection, estate planning, and lifetime liquidity characteristics that can’t be found in any other financial vehicle. The more affluent you are or intend to become, the more powerful these benefits can be for you.

Hopefully, this article will continue to be an ongoing beacon of factual clarity in the dense fog of biased opinions that appear for the public as they search for the pros and cons of Indexed Universal Life Insurance (IUL).

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson is the founder of BankingTruths.com, an educational site discussing how to maximize the lifetime benefits of both Whole Life Insurance and Indexed Universal Life Insurance by creating your own private family banking mechanism.

Information presented in this article by John “Hutch” Hutchinson is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities product, insurance products, financial services, or investment strategies. Be sure to first consult with a knowledgeable, ethical, and licensed insurance professional before implementing any strategy or product discussed herein.