Does Velocity Banking Work? Payoff Debt & Build Wealth Faster

What is Velocity Banking?

Velocity Banking is a cash flow management strategy that exploits the timing and interest accrual of various loan products so borrowers can eliminate debt and build wealth at an accelerated rate.

How Velocity Banking Works

Velocity Banking operates mainly by borrowing against a line of credit, which charges simple interest, to pay down higher-interest credit cards or even lower-interest amortized loans like mortgages, which will front-load the majority of interest onto the early payments.

Often, Velocity Bankers will also use a strategy called “paycheck parking,” where they funnel their incoming paychecks directly through this primary line of credit to minimize the ongoing simple interest charges and free up their capacity to use the line.

Velocity Banking enthusiasts may also run several of their monthly bills directly through certain credit cards. Doing so can not only accrue reward points but also exploit gaps in timing between when that card actually starts charging interest and when the next payment is due. The float plus any rewards can further reduce the total volume of interest paid while paying off higher-priority debts elsewhere.

By combining meticulous budgeting with systematic discipline, borrowers practicing Velocity Banking can optimize every penny of their household cash flow while accelerating their path toward financial freedom.

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Never any pressure or hard pitches

- Learn Velocity Banking to build wealth

Velocity Banking Strategy to Pay Off a Mortgage Faster

The entire Velocity Banking strategy started strictly as a way to pay off home mortgage debt quicker by borrowing from a home equity line of credit (HELOC) to make additional principal payments. Doing so reduces the mortgage balance faster, which lowers the amount of interest being charged and tilts future monthly payments towards paying down more mortgage principal.

Ideally, the borrower’s paycheck is auto-deposited directly into the HELOC, lowering both the simple interest charged on the HELOC balance. Velocity Bankers focused on mortgage payoff will often take out more simple interest HELOC debt as soon as possible to pay down their mortgage principal faster. That way, they permanently reduce the amount of front-loaded interest that occurs early on every mortgage amortization schedule.

Note: One major issue with paying down a mortgage faster is the lack of liquidity if you ever needed these extra principal payments for emergencies or timely investment opportunities.

Instead of paying down mortgage debt, learn how to utilize a HELOC to build wealth using the same principles of Velocity Banking.

Velocity Banking with Credit Card Debt

An offshoot of the original Velocity Banking concept has been focused on eliminating credit card debt using a similar process

People who can’t get a HELOC can still reduce high-interest credit card debt using 0% balance transfer promotions, personal lines of credit products, or simply by timing how interest gets charged between their various credit cards and their statement cycles.

Practicing the same Velocity Banking principles used with mortgage debt, borrowers can still systematically eliminate cancerous debts by exploiting interest payment timing opportunities, interest rate differences, and potential rewards offered by different credit cards and personal lines of credit products.

"Paycheck Parking" Enhances the Velocity Banking Strategy

“Paycheck parking” is when borrowers direct deposit their paychecks into a line of credit or credit card instead of a traditional checking account. By doing so, Velocity Bankers can immediately reduce their outstanding loan balance, which brings down their average daily balance for the month, thereby resulting in less interest charged over that period.

Using The Velocity Banking Strategy to Build Wealth

Even after you’re completely debt-free (or at least have eliminated all bad debt), the same HELOC strategy and monthly payment efficiencies can be applied in a positive cash flow situation to acquire assets and/or increase passive cash flow by:

- Investing in low-cost index funds

- Building up a rental real estate portfolio

- Maxing out tax-efficient retirement plans

- Creating their own infinite banking system

- Or turning their side hustle into a scalable business.

Why should a successful Velocity Banking strategy cease with paying off bad debt?

Debt can only be paid to zero, but then what’s next?

Using Velocity Banking to eliminate cancerous consumer debt is just the training grounds on your journey to financial freedom.

Being debt-free may feel nice, but on its own does not equate to financial freedom.

Creating cash-flowing assets to replace trading your labor for money is the way!

To fully monetize this dramatic shift in financial discipline inspired by Velocity Banking, one must apply the same principles to stacking assets and free cash flow!

Amortized Loans vs. Simple Interest Loans

People fixate only on their loan rate. However, knowing not only how much, but when and how interest will be charged is often far more important.

Understanding the distinction between amortized loans and simple interest loans is key to developing a successful Velocity Banking strategy:

- Amortized Loans like mortgages or auto loans both have a set schedule for interest charges and repayments. However, early mortgage payments are heavily tilted towards paying interest with very little paying down the mortgage balance.

- Simple Interest Loans like credit cards and certain lines of credit products calculate interest based on your average daily balance. Variable payments are allowed, but Velocity Bankers can reduce the total interest paid by extra principal payments as soon as possible.

Simple Interest Loan Options for the Velocity Banking Strategy

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a revolving credit line collateralized by equity in their primary residence. HELOC interest accrues at simple interest according to their average daily balance, allowing borrowers to withdraw funds as needed, up to a predetermined limit.

This flexibility enables you to borrow money from your HELOC balance to pay off high-interest credit debt or pay off your mortgage principal faster.

First Lien HELOC vs. Second Lien HELOC

Most HELOCs are second-lien HELOCs, meaning the borrower keeps their primary home mortgage and adds a HELOC on top to access their equity over and above their mortgage balance.

A first-lien HELOC is like a primary mortgage and home equity line of credit rolled into one loan. Essentially, 90% of your home equity is available to borrow against using a first-lien HELOC, and your average daily mortgage balance accrues at simple interest rather than the front-loaded amortized interest structure of a traditional mortgage. Velocity Bankers will often practice “paycheck parking” to lower their total volume of interest paid.

Calculate the difference between a traditional 30-year Mortgage and a First Lien HELOC here.

For borrowers that don’t own a home, or can’t qualify for a HELOC, there are other simple interest credit lines beyond just a HELOC.

Personal Lines of Credit (PLOC) for a Velocity Banking Strategy

A personal line of credit (or PLOC) may take on the role of a HELOC when the borrower:

- Can’t qualify for a quality HELOC product

- Doesn’t have enough equity in their home

- Doesn’t own any real estate

Utilizing personal lines of credit, velocity bankers can better manage high-interest debts as well as avoid front-loaded amortization schedules, all while capitalizing on the benefits of simple interest.

Using Credit Cards as Part of a Velocity Banking Strategy

Velocity Bankers who integrate credit cards into their overall strategy can accrue incremental benefits that, compounded over time, can prove quite significant. Even once the borrower is out of debt, this practice also can help enhance their ongoing wealth-building efforts.

Borrowers who use credit cards for monthly bills and daily expenses not only accumulate rewards but also pause interest accrual on these purchases if their balance is paid in full before the due date. This strategic timing of these purchases and payments creates a temporary 0% float in addition to the accrual of reward points which can equal an additional 1%-5%.

Taking advantage of 0% balance transfer promotions allows borrowers to move high-interest debt to a card that doesn’t accrue interest for months or even years. Incorporating this tactic effectively pauses the negative compounding long enough for the borrower to knock out their highest-interest debts and/or bring down their HELOC balance to eventually absorb whatever balance transfer amount remains by the end of the promotional period.

Asset-Backed Lines of Credit

Similar to how a HELOC allows homeowners to access the equity in their real estate assets, asset-backed lines of credit allow borrowers to extract liquid cash from their assets without selling them.

Examples of asset-backed lines of credit include:

- Life insurance policy loans

- Margin loans on stock portfolios

- HELOCs on Investment Properties

- Precious Metals Loans

- 401(k) Loans

The main benefit of asset-backed loans for Velocity Bankers is that there are often no qualification hurdles to accessing these loans beyond simply owning the asset. Also, all of these asset-backed loans (except for a 401k loan) have fairly flexible payment terms and accrue at simple interest according to your average daily balance. Some of these asset-backed loans also qualify as “investment interest”, which may the borrower some deductions.

Velocity Banking Pros & Cons

The Velocity Banking strategy offers a repeatable framework that can enhance your overall financial efficiency. However, this method is not without its complexities and risks, which require meticulous planning and precise execution to navigate effectively.

Understanding both sides of the equation is essential for anyone considering Velocity Banking to ensure that its touted benefits will outweigh the challenges involved.

Benefits of the Velocity Banking Strategy:

- Faster Debt Elimination: Enables borrowers to pay off their mortgage faster or eliminate multiple debts at an accelerated pace by strategically funneling monthly expenses and income through a combination of optimally orchestrated loan products.

- Significant Interest Reduction: Decreases the overall volume of loan interest paid by making massive lump sum payments early in the repayment process of amortized loans or high-interest debt. These balances get shifted to more manageable simple interest lines of credit products or promotional 0% balance transfer opportunities.

- Enhanced Cash Flow Management: Takes advantage of temporary 0% interest floats by exploiting payment cycles and orchestrating one’s expenses and paycheck against the due dates of different loan products.

- Increased Financial Literacy: Deepens the borrowers’ understanding of personal finance and ongoing money management skills, fostering measurably better ongoing decision-making.

- Eventual Wealth-Building Potential: Facilitates an orderly transition from debt repayment to wealth accumulation by utilizing the same ongoing payment efficiencies to accelerate investing into a combination of income-generating assets.

- True Financial Independence: Increases financial control and optionality by reducing dependence on traditional banks through increased creditworthiness and therefore access to alternative credit products, allowing borrowers to eventually become their own banker.

Drawbacks of Velocity Banking

- Up-Front Costs: The long-term benefits often come with initial costs in the form of account setup fees, balance transfer fees, or financial education costs. Even the slightest increase of initial debt amounts can deter some borrowers from pursuing this method.

- Necessary Discipline for the Added Complexity: Transforming impulsive financial behavior to meticulous budgeting and monitoring will be essential to success. Even though much of the ongoing methods can eventually be automated, te initial learning and legwork may prove to be too overwhelming for many.

- Risk of Overextension: Leveraging additional loan products to pay down existing debt increases the likelihood the borrower may accumulate even more debt if they fail to maintain discipline. The added credit capacity could backfire if they lose their job or regress back into the pattern of frivolous spending.

- Market Sensitivity & Variable Interest Rates: A period of rapidly-rising interest rates may force the borrower to readapt their plan multiple times to keep up with the changing conditions. Also, a major economic downturn often reduces many lenders’ appetite to extend credit. Even the most successful velocity bankers may find their various lines of credit capped, reduced, or even revoked during housing market drops.

- Emotional Stress: Managing multiple debt payments and the constant need for monitoring may cause immediate anxiety, potentially overshadowing the future benefits. This emotional strain may lead to compromised future financial decision-making, ultimately jeopardizing the benefits that Velocity Banking.

Step-by-Step Guide to the Velocity Banking Strategy

Step 1 - Assessing Your Financial Situation

Before starting Velocity Banking, it’s imperative to meticulously review your income, expenses, assets, and liabilities. Quantifying these variables will help you set realistic financial goals, and discover what new accounts are needed.

Additionally, this foundational step often exposes any bad financial behavior that will need to be transformed to successfully implement this strategy.

Step 2 - Organize and Refine Your Monthly Expenses

Next, you must itemize and organize your monthly expenses keeping these factors in mind:

- categorizing them into essential and non-essential expenditures

- documenting their various due dates to optimize payment timing efficiencies

- discovering which expenses can be automatically paid by credit cards (taking advantage of reward points and/or 0% promotional purchase periods)

By inventorying your monthly expenses, you establish a clearer financial picture and may also discover additional resources to help with debt repayment and future investments.

Step 3 - Setting Up the Optimal Accounts

Establishing these 4 types of financial accounts is critical in successfully optimizing the Velocity Banking strategy to its fullest potential:

- Line of Credit: Start by opening a dedicated line of credit, ideally one with a low interest rate and favorable repayment terms. When possible a home equity line of credit (HELOC) will serve as the cornerstone for your monthly cash flow management. Otherwise, you can consider a personal line of credit (PLOC) or asset-backed lines (see #4 below).

- Credit Cards with Rewards: When opening a line of credit is not possible, consider using promotional credit card offers, such as 0% interest on purchases and balance transfers. Credit cards offering favorable rewards based on your spending patterns can also help.

- Checking & Savings Accounts: Having a free online bank account that can process the timely transfers between your different accounts is essential. If you are actively paying down bad debt, then a high-yield savings account isn’t really needed yet because any free cash flow should be devoted to lowering balances.

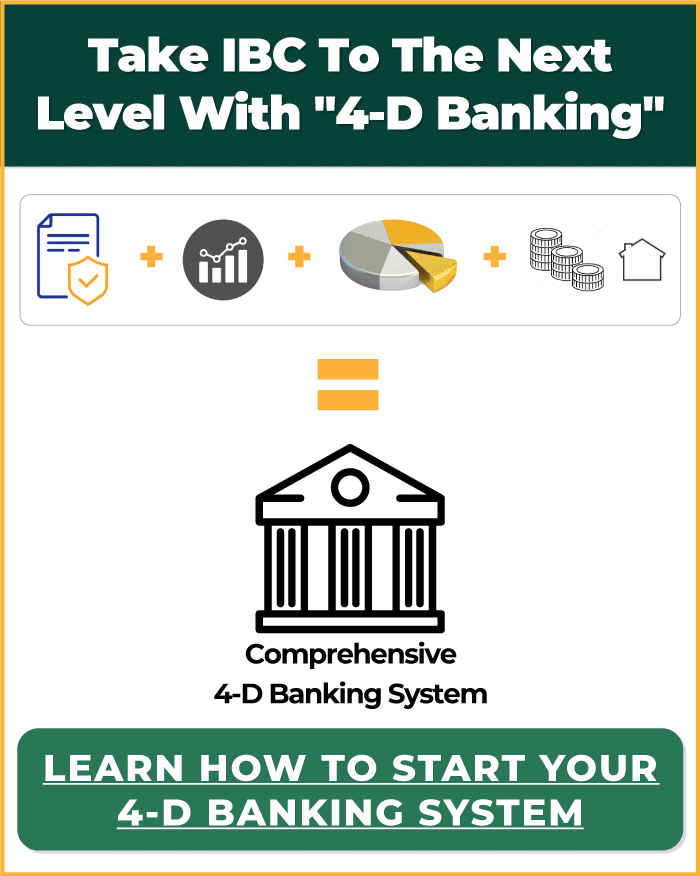

- Asset Building Accounts: Once you pay down all bad debt, you can more carefully consider where to park free cash flow as it comes in. Velocity Bankers should consider layering in the following accounts over a high-yield savings account due to their ability to continue compounding even while borrowing:

Step 4 - Structuring Your Payments Effectively

Begin by prioritizing your debt payments based either on:

- which debts have the highest interest rates

- or which debts have the highest minimum payments

Although it may seem counterintuitive, aggressively knocking out a lower-interest debt first may make sense when it has a higher payment. Freeing up that higher minimum payment amount can help pay down other higher-interest debts going forward.

Also, adjusting your various bill due dates to align closer to your paycheck deposits can lower the overall interest you pay throughout the month. Another strategy when running certain bills through your credit cards is to push those bill due dates towards the beginning of that credit card’s statement cycle to take advantage of a temporary 0% interest float before your due date.

Adjusting the timing on these payment cycles can significantly reduce the overall interest paid and shorten your repayment timeline.

Step 5 - Continually Monitor These Key Metrics

It is essential to monitor the following 4 key metrics both when you begin Velocity Banking to establish a baseline, but also to measure the effectiveness of your execution:

- Monthly Cash Flow: It’s crucial to monitor the timing of your monthly inflows and outflows so you can realign your Velocity Banking strategy when necessary. Things change: paycheck amounts may differ, payment timings may change, and certain accounts may get paid off, all of which may cause you to restructure your plan.

Learn how to put your own custom Velocity Banking system on autopilot.

- Volume of Interest: All too often, borrowers will focus solely on the interest rate being charged, not taking into account the actual volume of interest being accrued. You may discover you’re paying much less than the stated interest rate by using strategic loan products in sequence with the optimal timing of payments.

- Debt to Income Ratio: The debt-to-income (DTI) ratio is a critical financial metric that measures an individual’s monthly debt payments against their gross monthly income. A high DTI signals to potential lenders that you are over-leveraged, which will often block your eligibility for new, more efficient credit products. Systematically lowering your DTI through the Velocity Banking process will often result in better offers on credit cards and lines of credit products. Expect this to happen slowly, then suddenly if you stick to the plan.

- Credit Score: Similar to the debt-to-income ratio, your credit score can unlock your access to more borrowing capacity as well as more efficient loan products and/or promotional offers. All of these may greatly reduce the total volume of interest paid over the year and will increase your options when investment opportunities come knocking.

Step 6 - Building a Long-Term Financial Plan Using the Velocity Banking Method

Establishing a long-term cash flow management structure through the Velocity Banking method paves the way for future financial stability and growth. This begins with setting clear, achievable financial goals that span various timelines—short-term, medium-term, and long-term.

- Short-term goals could include building an emergency fund or paying off specific high-interest debts.

- Medium-term objectives might involve saving for a down payment on a home, funding a child’s education, starting a business, or stacking streams of passive income.

- Long-term goals should include retirement planning as well as estate planning.

Upon defining these goals, it’s crucial to integrate them into a comprehensive financial strategy that leverages the Velocity Banking principles to expedite them. This entails regularly reassessing and adjusting your cash flow management tactics to align with your evolving financial position and goals.

Learn how to put your own custom Velocity Banking system on autopilot.

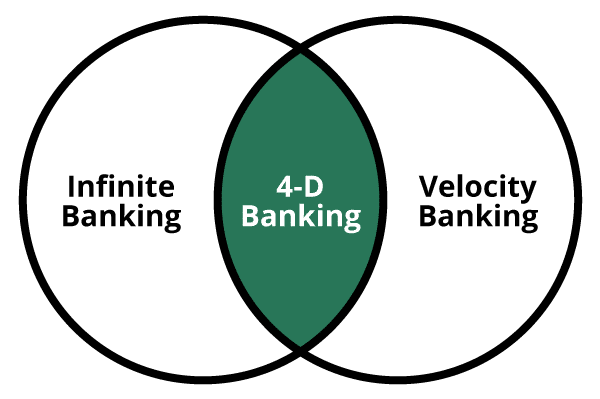

What's the Difference Between Velocity Banking and Infinite Banking?

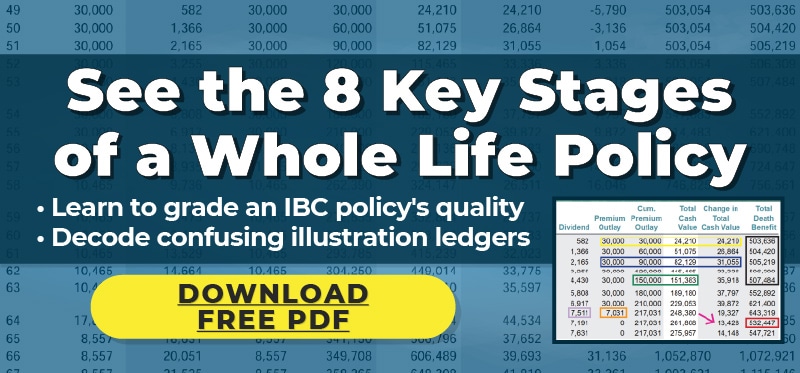

Although these two alternative “banking” strategies share some commonalities, Velocity Banking uses lines of credit loan products to accelerate paying down mortgages or credit card debt. Infinite Banking, on the other hand, uses life insurance cash value as an alternative to traditional bank accounts and policy loans for major expenditures, emergencies, and investment opportunities.

Both Velocity Banking and Infinite Banking focus on alternative methods of cash flow management and repurposing traditional financial products to accelerate one’s path to financial freedom.

Warning: Although our experts specialize in helping people become their own bank using Infinite Banking life insurance, I would caution those still laden in “bad debt” to NOT prematurely start a policy. Doing so would mean you are essentially financing your Whole Life policy using high-interest debt, and the cash value growth certainly cannot inately overcome that hurdle.

Instead, I recommend getting a cheap term life insurance policy while still in “bad debt.” Make sure it is a “convertible term policy” that you can upgrade to a dividend-paying Whole Life policy without further testing, even if your health gets worse. That way, if you pass away prematurely, your family will have money left over after using the tax-free death benefit to pay off your debts.

Misconceptions & Fears with Velocity Banking

4 Common Fears and Misconceptions with the Velocity Banking Strategy

Many borrowers face intense psychological barriers (some imagined and some real) when it comes to considering Velocity Banking for their situation.

- One common fear is the misconception that using credit, even strategically, is inherently bad and always leads to more debt.

The cultural narrative which praises a “debt free” approach and shames any use of credit will often deter the most intelligent and disciplined individuals from a mathematically superior strategy.

- Another misconception is the belief that debt management plans are too complex or time-consuming to understand.

Unfortunately, this internal barrier often keeps borrowers trapped in a debt pattern that may be simple to understand but impossible to overcome. Like anything else that’s new in life, over time what once seemed dauntingly complicated gradually becomes second nature.

- Another prevalent fear involves the concern that velocity bankers can no longer spend to enjoy their lives with such an aggressive repayment regimen.

When shifting from impulsive financial behavior to becoming fiscally responsible, Velocity Bankers often find a comfortable balance between saving for their “financial future” and spending for their “financial now.”

- Some view the act of borrowing against their house as a risky gamble rather than a calculated strategy for reducing the true cost of maintaining their household.

Velocity Banking is often the precursor to becoming your own banker, where you stop viewing fragmented financial strategies in a vacuum and instead take a holistic approach with the sum of the parts to benefit the whole.

A Mental Recipe For Overcoming Mental Blocks to Velocity Banking

It’s crucial to replace fictional fears with functional facts about both your current situation and proven abilities.

Here are a few questions to ask yourself that can immediately shift your mindset to make the velocity banking strategy work:

- Where have I been organized before? Or what facet of my life is well-organized TODAY? Perhaps it’s a trading card collection, or your desk at work, or maybe even a certain set of folders on your computer.

- When have I successfully navigated complexity in the past? What do I do on autopilot now that used to overwhelm me? Whether it’s preparing your favorite dinner or learning to drive a stick shift, we’ve all had these sorts of transformations.

- What systems in my life now did I once resist because they seemed so complicated? How many people used to pay bills by check until they finally gave in and used online bill pay? There’s probably some system in your life you resisted initially, but now couldn’t live without.

In addition to these mental shifts, perhaps modeling out a velocity banking example in the context of your precise situation can give you the confidence you need to execute on a more-informed decision-making process.

Learn how to put your own custom Velocity Banking system on autopilot.

Final Thoughts on the Velocity Banking Strategy

Summary of the Velocity Banking Strategy

The Velocity Banking strategy is a way to systematically orchestrate your monthly income and expenses through an array of loan products re-engineered to accelerate your path to debt elimination.

However, the discipline, skills, and tactics used to get out of debt with Velocity Banking could and should be applied towards building wealth with income-producing assets to achieve true financial freedom.

Is Velocity Banking Right for You?

Individual financial discipline is a crucial factor. Those who are committed to adhering to a structured repayment plan and are willing to actively engage in monitoring their financial progress are typically better suited to implement Velocity Banking effectively.

You must be prepared to educate yourself on the principles of cash flow management and loan mechanics, which will enable you to navigate the common risks of Velocity Banking.

Finally, assess your long-term financial aspirations. If your goals include not only debt elimination but also wealth building through income-generating assets, the skills cultivated through Velocity Banking can be invaluable.

In conclusion, if you are disciplined, informed, and motivated to take control of your financial future, Velocity Banking may very well be the right strategy to propel you toward achieving your broader financial objectives.

Read more about how to apply the principles of using a HELOC for Velocity Banking towards Building Wealth and furthering your financial freedom.

Still Just Researching Velocity Banking?

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Never any pressure or hard pitches

- Learn Velocity Banking to build wealth