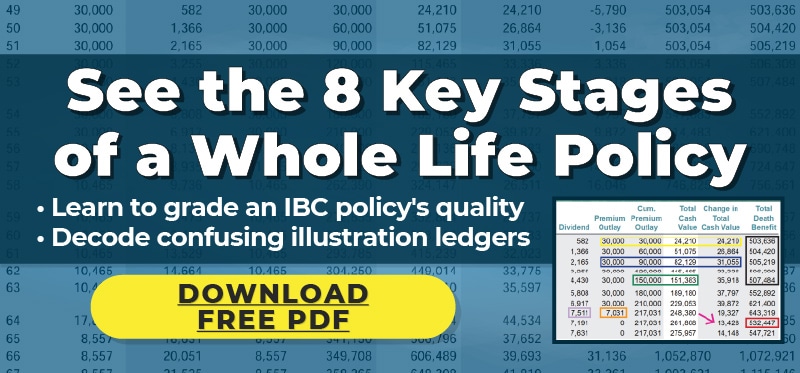

Researching Banking with Life Insurance?

Not sure where to start?

Peruse our articles & videos to make more informed insurance decisions.

Make Less Spend Like More in Retirement with Actuarial Science

Join our FREE webinar on Feb 14 at 12PM (Noon) PST as Hutch discusses how you can make less savings spend like more (and for longer) by creating your own private pension plan.

About Infinite Banking Loan Options

Let’s address the elephant in the room, that dirty little 4-letter word… LOAN.

People naturally have a knee-jerk reaction whenever hearing the words loan, borrow, or especially debt. However, to be considered “in debt” means you have more loans you owe than assets you own. If you are truly “in debt”, you’re borrowing against your future earnings and hopefully servicing the debt with your ongoing income.

When using infinite banking loans to buy more assets, you still maintain a positive solvency, and are in an especially good financial position if the assets you borrow for are appreciating and/or cash flowing nicely.

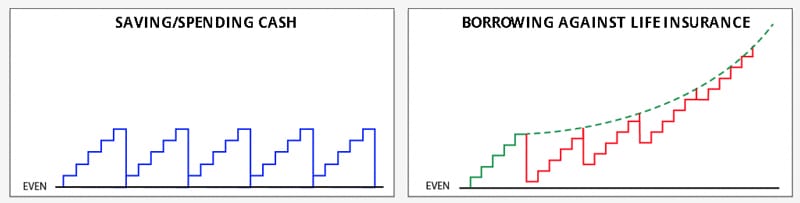

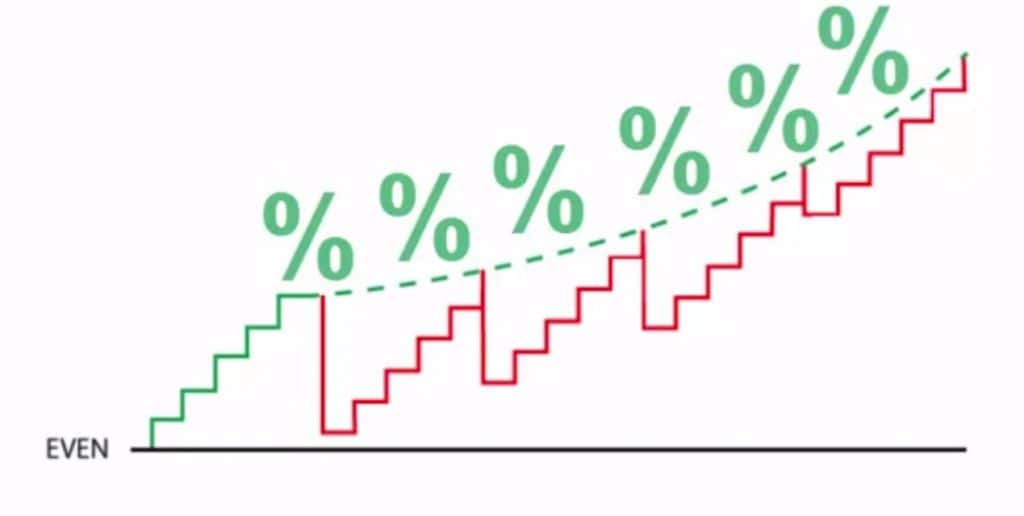

Remember how I said that continuous compounding is the most important ingredient of the infinite banking concept? Borrowing against your infinite banking life insurance policy is exactly how you maintain the compounding of your cash flow and liquidity while still funding major expenditures, emergencies, and other investment opportunities.

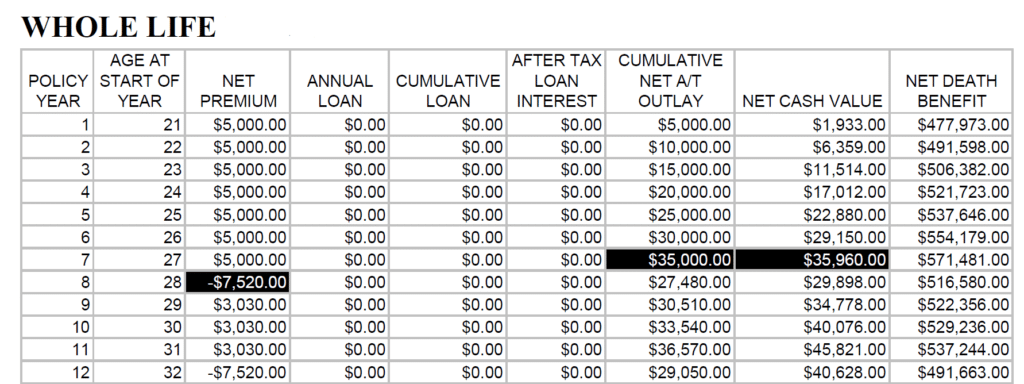

You see, if you withdraw rather than borrow from your infinite banking Whole Life insurance policy, you would be removing assets that could’ve kept compounding on your behalf. The longer you let compounding work for you the better it gets, especially at the upper-right-hand side of the graph. By pulling cash value from your infinite banking policy, you rewind your compound curve to a lower position, not to mention you stunt future growth by receiving a smaller cut of any future dividend pools.

Conversely, if you borrow against your Whole Life’s continuously compounding cash value, you never miss a beat on that steepening compound curve while maintaining your place in line for those bigger future dividends.

Regardless of all the gimmicky rhetoric you’ll read/hear about “paying yourself back the interest,” this is the true scientific explanation of how infinite banking works. It may feel like you’re paying yourself back interest, but that’s because you’re earning compounding interest on an increasing balance while paying simple interest on a flat or decreasing balance (assuming you’re minimally servicing the loan).

When borrowing using an infinite banking systems, you have multiple loan options in addition to using Whole Life’s built-in policy loans. One of the most often overlooked advantages of setting up an infinite banking policy is the optionality to shop for the most efficient loan option.

Using Whole Life's Built-In Policy Loan for Infinite Banking

The built-in loan provision contractually embedded into every infinite banking Whole Life insurance policy is the most common type of IBC loan, popularized by the late Nelson Nash’s book. He correctly pointed out that you had more privacy with a policy loan than you would using any sort of outside financing from traditional loans. Plus, Whole Life policy loans are guaranteed to be extended without any sort of credit check.

Also, Whole Life policy loans are also the most flexible since they are technically held against death benefit. Therefore, there is no set loan term where a policy loan can be called by the insurance company, since it will be paid off at death.

As long as you have enough cash value collateral to support the loan, no payments are technically due ever. That being said, it is wise to service your infinite banking policy loan with at least interest-only, to essentially pay simple interest on a flat balance while earning compound interest on your increasing cash value balance. Paying down the policy loan principal reduces future loan interest as well as increases your capacity more for future opportunities and expenditures.

So if you prioritize either loan flexibility or privacy, then a policy loan will be the way to go.

One of the downsides of using built-in whole life loans is that the borrowing process can sometimes be a bit cumbersome to initiate. Some carriers require manually requesting it through your insurance agent or the insurance company’s direct phone line. However, more carriers are creating automated systems to request securely loans online. Even this can still be somewhat inefficient when taking multiple loans from insurance policies written on different family members.

Regardless, once policy loans are initiated, you can set up scheduled auto-draft payments for however much you want, whether the payment handles interest-only or any level of loan principal you want to pay down. As stated earlier, you can also totally float the loan without any payments for as long as you want, as long as your loan doesn’t exceed a 95% loan to value ratio with your cash value.

At this particular moment in time, policy loans do offer cheaper money than most outside loan options, but as you can clearly see there have been large swaths of arbitrage opportunities using other types of loans (discussed below).

The nice thing about using Whole Life insurance as your banking hub is you always have the built-in policy loan option available to you, while still being able to shop more efficient borrowing options to achieve positive arbitrage.

Let’s discuss these other infinite banking loan options…

Combining Outside Loans with Infinite Banking

One of the greatest misconceptions about infinite banking is that you must funnel all loans through your policy to make it stronger. That’s because Nelson Nash’s book showed examples with a direct recognition policy, which will pay higher dividends on loaned money when borrowing.

The truth of the matter is, you should almost always opt to borrow cheaper money if you can get it, while keeping the cash value component in your infinite banking life insurance as backup equity. Consider the advantages attained by using outside loans:

- Less Ongoing Loan Drag

- More Capacity if Further Loans Are Needed

- The Untapped Cash Value Policy Can Service The Outside Loan if Needed

Keeping your maximum loan capacity is huge since you must continuously qualify for outside loans, but you are always entitled to an infinite banking life insurance loan.

Think about it…

During 2008-2009, HELOCs were often frozen and banks weren’t lending to practically anybody. If you had already tapped the equity in your Whole Life you couldn’t take advantage of the biggest fire sale in either the real estate market or stock market. Worse yet, if you needed cash flow for your own business, you would’ve been screwed.

Not so if you would’ve taken advantage of the outside loan opportunities first, even if they were at slightly higher rates. Get it?

So, where can you sometimes get these outside loans?

- Car dealerships

- 0% interest promotions

- Student Loan Programs

- Home Equity Line of Credit (HELOC)

- Retirement Plan Loans (401k/403b/457)

- Margin Loan Rates at Certain Online Brokerage

Turnkey Cash Value Line of Credit (CVLOC) Programs for IBC

There are a number of traditional banks offering a turnkey line of credit programs specifically for Whole Life policies keeps growing every year.

Why?

Because these Cash Value Line of Credit programs collateralized by infinite banking life insurance are some of the safest loans that traditional banks ever make. These loans actually help banks more safely diversify their loan portfolio, since they are allowed to practice fractional reserve lending (loaning out multiple dollars for every dollar they have in deposits).

That’s why most CVLOC programs only accept Whole Life policies from the biggest, oldest, and strongest mutual companies around. So certain infinite banking life insurance from mutual holding companies won’t even have the option to use an outside line of credit. Using the policy loan will be the option available.

“But wait! Isn’t the infinite banking concept about getting away from banks?”

It never was, actually. Did you really think the insurance company would issue you a policy loan with bitcoin or a suitcase of small-unmarked bills?

Any infinite banking insurance company is going to send loan proceeds via ACH deposit to a connected bank account or at the very least a check you must bring to an actual bank.

Since banks will still be involved in your infinite banking strategy at some level, why not use traditional banks for what they are best at…a convenient conduit for money transfers.

Infinite banking is definitely about REDUCING your dependence on banks, since their savings rates are taxable and always below the rate of inflation. Plus, as the late Bob Hope said, “A bank is a place that will loan you money…if you can prove you don’t need it.”

So think about it… if you can prove you don’t need their loans by showing them you have Whole Life cash value from the top mutual companies, certain lenders will offer very favorable cash value line of credit programs since they are all competing against each other for your business.

This is where you can continually shop for arbitrage opportunities. One of my business owner clients put it perfectly, “You mean when those business bankers try and get me to take their loans, I can say ‘Well you better sharpen your pencil, buddy’!”

Again, arbitrage opportunities have been available for most of the last 40 years by using these turnkey line of credit programs vs. any insurance company’s policy loan. In fact, many programs offer CVLOC’s at Prime minus 1% vs. the Prime minus 0.5% as shown in the graphic below.

It just so happens in this “inverted-yield-curve” environment that policy loan rates are lower than most CVLOC programs, but different banks keep offering specials. Also, notice the whenever the orange line has spiked above the blue line, it doesn’t tend to last very long. Position yourself accordingly.

Remember the 3 advantages of the built-in Whole Life policy loan?

- Privacy

- No credit checks

- Ultimate payment flexibility

What other advantages do these turnkey CVLOC’s offer for infinite banking policy loans:

- You can combine multiple family policies into a single line of credit for ease of use.

- You can borrow up to 95% of your aggregate family cash value within 24 hours after a few clicks

- Most CVLOC lenders offer free wires, free ACH to your checking account, as well as a convenience checkbook

- CVLOC programs have offered rates substantially lower than Whole Life policy loans for most of the last 4 decades

However, if at any time the bank rates are not better than your built-in infinite banking policy loan rate, you can always roll the bank loan back into your policy loan.

Direct vs. Non-Direct Recognition Loans and “Synthetic Non-Direct” with a CVLOC

On another note, using a CVLOC is a way to create your own “synthetic non-direct recognition loan” even if you have a direct recognition policy.

Many infinite banking agents swear that only a non-direct recognition Whole Life policy should be used, but nothing could be further from the truth. In fact, throughout the book Becoming Your Own Banker: The Infinite Banking Concept, all the examples Nelson featured were using a direct recognition company.

So what gives?

The truth is that direct recognition policies often pay higher dividends than non-direct recognition policies, since they can be fair to all policyholders. Also, direct recognition gives you backstop protection in a rapidly rising loan environment. In fact, that’s why Nelson was able to show that an infinite banking Whole Life policy that borrowed paid higher dividends than the same policy with no loans.

The difference between direct and non-direct recognition loans is quite a complex subject beyond the scope of this article, but you can learn more about it in our extensive article on the matter at BankingTruths.com/Direct.

I am of the personal belief that it’s optimal to opt for the best performing infinite banking life whole life insurance you can get (often direct recognition both now and 30+ years ago when Nelson wrote his book). Direct recognition gives you a backstop subsidy of sorts in case Whole Life loan rates spike against you, like the last time inflation reared its ugly head in the 1980s.

Then you can always shop for the most optimal loan arbitrage opportunity, not just from CVLOC lenders, but from other loan outlets you likely already have access to.

Debt Consolidation Using Infinite Banking Life Insurance

Oftentimes the infinite banking concept is pitched as a panacea for helping people get out of debt.

Although this may work in certain situations, for the most part, we found that starting an infinite banking insurance policy may delay the client’s primary goal which is to knock out the most cancerous of their consumer debt ASAP.

There’s no getting around the fact that the first years are the worst years when it comes to starting infinite banking whole life insurance. If someone initiates an IBC policy instead of knocking out high-interest consumer debt, they are essentially financing their new policy at those high interest rates.

This may be good for the agent, but rarely will it be beneficial to those in debt.

On the other hand, if someone can see the light near the end of their debt tunnel, and they could fully “refinance” any egregious debt through the first year’s cash value, then this may be a case for starting an infinite banking Whole Life insurance now. Otherwise, they should really just throw all their financial resources towards knocking out cancerous consumer debt.

The only insurance recommendation we can make in good conscience would be to start a convertible term life insurance policy, which can be easily converted into infinite banking whole life insurance after the worst debt is taken care of. Most people aren’t aware that a convertible term product is an option where someone can lock in their health today for a future banking policy while providing death benefit protection for loved ones ASAP.

On the other side of the debt spectrum, if you only have low-interest auto loans, deductible mortgages, HELOCs, and business debts that are deductible, then it can absolutely make mathematical sense to strategically start an infinite banking (or Velocity Banking) insurance portfolio custom-fitted for your situation.

Grab a slot on our calendar for a free custom consultation where we can help you engineer these types of advanced cash flow strategies through an optimal policy.

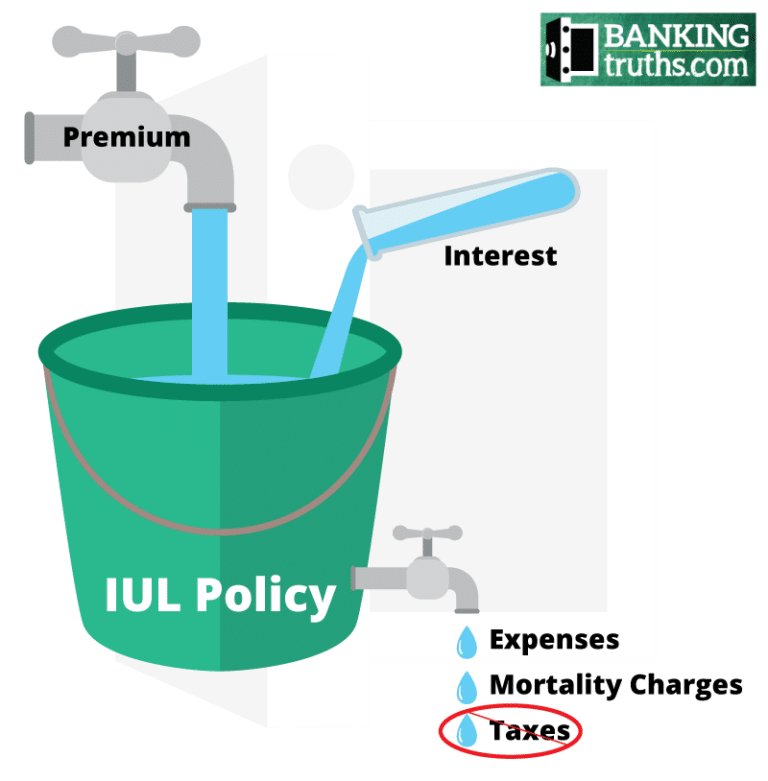

Problems with Max-Funded IUL

While Indexed Universal Life policies offer numerous benefits, they are not without certain drawbacks. Remember that many of IUL’s risks described below can be mitigated by committing to a max-funded structure. This is because excessive premium payments naturally enhance performance, decrease fees, and increase early surrender value so you can exit the product if absolutely necessary.

Inherent Complexity

One common concern is the complexity behind these products, which can be difficult to understand and manage. Indexed Universal Life has multiple moving parts, but thankfully, its statements exhibit full transparency, showing you to the penny what is being charged and what is being earned each month within max-funded IUL.

Again, serious scrutiny will only be needed to keep an IUL in force when it is not max-funded or substantially underperforming market averages. If dealing with complexity is of great concern or there’s a strong possibility you won’t be able to fully fund it within the first 10 years, then perhaps Whole Life insurance vs. IUL may be a better choice.

Indexed Crediting Won't Capture Full Market Upside

It’s true that the various indexed crediting strategies will not outperform or even match the performance of the S&P 500 in raging bull markets. Obviously, IUL caps will stunt cash value growth, and participation rates will water down the performance of any external index strategy. Even IUL’s with uncapped S&P 500 indexed crediting strategies don’t pay dividends, as many critics point out.

None of IUL limiters (like caps, particpation rates, or lack of dividends) are due to malicious intent on the part of the insurance company; they are simply a function of how the option-hedging strategies work under the hood of Indexed Universal Life.

Remember that Indexed Universal Life insurance is meant to complement, not replace, your other wealth-building efforts. In bear markets, a max-funded IUL can provide a safe harbor of liquidity while still staying somewhat exposed to the next bounce. IUL’s risk-adjusted returns in bull markets will certainly outperform short-term bonds and taxable savings accounts, both of which are much closer to IUL’s risk profile than the S&P 500 index.

Fees and Costs May Erode Indexed Crediting

Critics will commonly decry IUL for its fees, charges, and commissions. Again, all of these policy costs can be substantially reduced with a max-funded IUL since you are essentially shrink-wrapping the least amount of death benefit possible around whatever premium payments you’re comfortable making.

Regardless, premium loads, administrative costs, and ongoing costs of insurance are a reality since it is an insurance product. You should have your agent run a detailed report itemizing the different fees and projected performance, not only at favorable market averages but also simulating lackluster returns. That way, you can see the effect on your future cash value and death benefit in these different scenarios to determine if the benefits of your max-funded IUL will be worth the costs.

When a max-funded IUL gets even just average indexed crediting, you’ll find that insurance fees and costs may start out high when you have the least amount of money invested, but then substantially decrease to be on par with cheap index funds around retirement age. This is just the opposite of managed money fees that exponentially grow along with your account balance.

Lack of Guarantees

It’s true that most max-funded IULs naturally lack guarantees for both it’s cost structure and performance options. There are guaranteed maximum charges, but they are usually 3-4 times what is being illustrated. There are minimum possible caps and participation rates, but they are substantially lower than the levels commonly being illustrated.

Quite frankly, the insurance company has a lot of levers to pull to make their product less favorable than what is being shown. This, again, is why max-funding an IUL is so important. Your cash value can outrun the fees in most circumstances, and if not, you can exit the product with most or all of the money you put into it.

This is also why company selection is so important. Some IUL companies have a history of unfavorably changing their cost or performance parameters on their clients after the fact. To be clear, even the top companies needed to lower caps and participation rates when prevailing interest rates dropped, but they have since raised them for all customers. However, there is clearly a trend for certain carriers to more aggressively water down these performance metrics way below market on existing clients to subsidize new unsustainable product offerings they plan to change after the fact.

Is Max-Funded IUL a Good Idea?

A max-funded Indexed Universal Life policy is ideal for safely growing liquid capital in a way that’s immune from stock market losses, future higher taxes, or lawsuits.

Critics are quick to say IUL is a bad investment either without full understanding of the product or because over time the pure stock market will have greater long term returns. But this can leads to concentration and correlation risk since bonds have become almost just as volatile as stocks as seen in 2022:

In the past people chose the 60/40 portfolio with 40% bonds to dampen volatility, but using IUL can actually be less volatile than bonds, while still providing valuable exposure to equity markets.

Due to its unique tax treatment and growth methodology, IUL works well as an invaluable “buffer asset” in retirement and your own private bank along the way.

You can read all about the detailed pros & cons of Indexed Universal Life here, but below are two ideal use cases for a max-funded IUL.

Max-Funded IUL for Infinite Banking

Using life insurance to become your own banker is traditionally done with Whole Life insurance. Many Infinite Banking practitioners prefer Whole Life vs. IUL for this purpose. However, a max-funded IUL can absolutely work with Infinite Banking when the following 3 features exist:

- A guaranteed 0% floor, protecting your cash value against market losses

- A low indexed loan rate, enabling borrowed cash value to earn indexed crediting

- High IUL caps and participation rates, allowing you to earn above the indexed loan rate

Rather than saving, spending, and replenishing your savings in traditional bank accounts, Infinite Banking seeks to keep your liquid capital compounding, even while borrowing against it for emergencies, opportunities, and major expenses.

However, can you take advantage of some of the best generational buying opportunities in history for stocks and real estate by borrowing against your max-funded IUL that avoided the market crash? Probably not. It’s unlikely you’d sell stocks or mutual funds when they’re down to buy real estate that is down.

Since death benefits paid income tax-free go towards protecting widows, orphans, and failing businesses, the government will essentially reward you for cash value with Roth-like tax advantages. Book your free consultation with a max-funded IUL expert to discover the optimal product and growth strategies for your specific situation.

Tax-Deferred Growth & Tax-Exempt Withdrawals

Any tax benefits created by legislatures to drive behavior deemed to provide a societal good, and life insurance income tax efficiency is no different. Since death benefits go towards protecting widows, orphans, and failing businesses, the government will essentially reward your cash value with Roth-like tax advantages.

For everybody except those in the absolute lowest tax brackets, the tax-sheltered nature of IUL has a massive advantage over traditional banking products like CDs and high-yield savings accounts. Imagine earning 5% and then forgoing 30% of your growth just to pay state and federal taxes; your real yield equals 3.5%.

Conversely, if your max-funded IUL earned 6% income tax-free, you must earn over 8.5% in taxable savings products to achieve the same net yield. If you’re paying over 40% in state and federal taxes, you’d need to earn over 10% to have it equal a net 6%

With $36 Trillion of national debt and growing, having a pool of liquid assets immune from taxation will be key. This is especially true for retirees, where most of their retirement savings are allocated to 401(k)s that have never been taxed. Being able to strategically pull from a max-funded IUL without bumping into the next highest tax bracket can help them make their retirement savings last longer since fewer shares need to be sold to produce the same net after-tax income.

Chronic Illness Riders

Most Indexed Universal Life policies come equipped with some sort of Chronic Illness Rider for no additional cost. Chronic illness riders allow policyholders to access a portion of their death benefit income tax-free even while still alive, assuming they are diagnosed with a qualifying chronic illness or critical injury.

The ability to tap into the death benefit, even though you aren’t dead yet, can offer peace of mind, knowing that there is a safety net available in case of unexpected health issues or debilitating injuries. This feature can provide crucial financial relief, helping to cover medical expenses or everyday living costs during difficult periods without requiring the depletion of other savings or assets.

The Ultimate "Retirement Buffer"

Even though we are discussing Max-Funded IUL for its indexed growth features, it is, after all, an insurance product, and its 3-pronged protection component for retirees is indispensable:

- Protection from market losses

- Protection from future higher taxes

- Protection against premature death or serious illness/injury

If you are committed to using a max-funded IUL policy to protect yourself from having to over-withdraw from your retirement accounts, then most of the top performing IUL companies offer some sort of free chronic illness rider just in case.

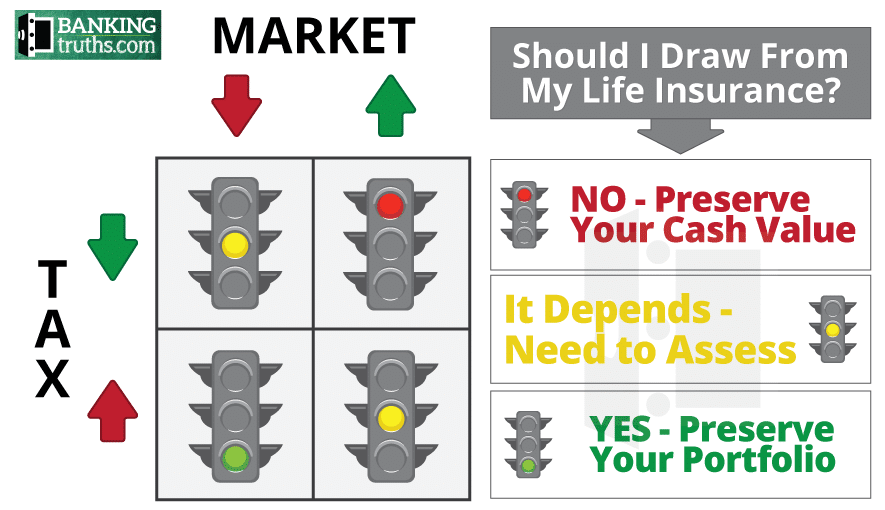

Many advanced retirement planners advocate having a “buffer asset” in place to draw income during market crashes or periods when taxes on 401(k) withdrawals would be too steep. This keeps you from having to sell more shares of your taxable stocks or mutual funds inside a 401k simply to produce the same amount of net retirement income you’ve grown accustomed to.

Since a max-funded IUL in retirement would be immune to both market downturns and taxation, it is really the ultimate buffer asset. This allows you to pause retirement income from traditional sources when it is less efficient. Take a look at this matrix from Hutch’s IUL for retirement article, which shows when and how to use max-funded IUL as a buffer asset.

Most Indexed Universal Life insurance agents model IUL for as a steady “retirement income supplement,” but we believe during the biggest market crashes or worst eras of tax policy, you may need more of a “retirement income replacement” for a period of multiple years.

Thankfully, you can borrow against a max-funded IUL’s cash value without depleting its usefulness and keeping its trajectory on the compound interest curve. You don’t have to pay it back, but you may want to so you can use it again and again for any of the 3 circumstances above.

Ability to Borrow Against Your Continuously-Allocated Cash Value

With a max-funded IUL, you can take a loan at any time for any reason while keeping your full cash value balance allocated to indexed crediting strategies. Whether you’re taking advantage of an outside investment opportunity, or handling a family or business emergency, or taking supplemental retirement income, your entire cash value balance stays allocated within your max-funded IUL policy.

In fact, there is an entire movement around using life insurance as your own private bank called “infinite banking.” The idea is to keep your tax-exempt cash value continuously compounding inside the policy, even if you borrow against it for liquidity to use for other things. That way, you pay simple interest on a flat or decreasing policy loan balance, while earning compound interest on an increasing balance.

Unlike traditional loans with strict terms and due dates, any life insurance loan is against the death benefit. So, technically, no payments are ever due, and your death benefit can pay off any outstanding loan balance.

Also, most of the best performing IUL policies have something called an “overloan protection rider.” This rider keeps your policy from lapsing and you from losing the tax benefits of a permanent life insurance coverage if you take too much income while still alive. Essentially, the rider automatically freezes the last 1% of cash value to ensure that a nominal burial policy gets paid, which negates all tax on prior income tax-free distributions from your IUL.

Is Max-Funded IUL Right for You?

Whether a max-funded IUL policy is right for you will depend mainly on your:

- Short & Long Term Financial Goals

- Sensitivity to Future Tax Increases

- Other Wealth-Building Efforts

- Overall Risk Tolerance

Although max-funding provides sufficient early surrender value to exit if needed, IUL should only be considered as a lifelong investment decision. A max-funded IUL can help tremendously as a retirement buffer and also along the way as your own bank when emergencies and opportunities arise.

We find that most people are overexposed to raw systematic market risk in your 401k, taxable brokerage accounts, not to mention your monthly income from your job or business. Having a pool of liquidity immune to market risk can help you stay afloat in rough times, or possibly help you take advantage of generational buying opportunities using cash value from an unscathed max-funded IUL policy.

Also, with the $36 Trillion of National Debt intensifying the threat of future higher taxes, the tax-exempt nature of Indexed Universal Life can keep you from having to cash out more shares of your taxable investment or retirement accounts than necessary. Yes, you could also draw income from a Roth to keep from bumping into the next tax bracket, but do you really want to cash shares of your Roth when taxes are up, but markets are down?

Almost every retiree will face these 2 issues without a favorable solution. By repositioning inefficient savings accounts or unmatched 401k contributions into a max-funded IUL now can help you become your own banker today and better navigate retirement tomorrow.

How IUL Works & The Best IUL Companies Build Their Products

Again the 4 core aspects to make up the best IULs for cash accumulation will have a combination of:

- Low fees and ongoing cost of insurance

- Competitive and Diverse IUL investment options

- Contractually locked or capped loan options

- A History of Treating Past Policyholders Fairly

IUL Policy Fees & Costs of Insurance

It’s about the bottom line: credits minus debits equals your equity in an IUL. Therefore, controlling costs should be as important (if not more) as your projected performance since performance may or may not occur. The underlying costs definitely will.

As you read in our history of IUL section above, Indexed Universal Life rides on a UL chassis. This is essentially an annual renewable term policy to give you the lowest initial cost of insurance. That way most of your early cash value can have the potential to grow in the underlying IUL investment strategies.

IUL’s cost per unit of insurance starts low when you’re young, but it becomes more expensive every year as you get older. However, with all the best IUL companies you only pay for the amount of death benefit that is over and above your IUL’s cash value (since you’re already technically entitled to it).

The intention with all the best IUL policies for cash accumulation is that your cash value growth will keep converging upon the death benefit once the cost per unit of insurance increases with age. Even though the insurance component becomes technically more expensive, you will be paying for fewer units of pure IUL insurance.

It’s very important to have your IUL agent stress-test your proposed policy with below-average crediting rates so you can understand the impact of any IUL fees if for whatever reason 2024’s best IUL policies don’t perform as well in the future as they were originally projected.

IUL Investment Options

Whatever part of your premium and cash value isn’t absorbed by fees and cost of insurance will be entitled to either a fixed rate of return (currently 3%-5%) since the best IUL companies invest heavily in bonds.

You can elect to have your cash value grow by this annually declared fixed rate OR you can choose one of the IUL investment options. When you elect indexed crediting, the best IUL companies take that 3%-5% fixed interest they were planning on paying you anyway, and they buy S&P 500 options with it.

Just as with any options strategy, your max loss will be the cost of the options themselves, hence the 0% floor. With many IUL investment options your upside will be greater than that 3%-5% bird-in-the-hand fixed rate option, but also limited by:

- IUL Cap: The top-end upside ceiling when tracking the S&P 500

- IUL Participation Rate: A percentage of S&P 500 gains captured (often 100% or less)

In today’s environment, the best IUL companies offer S&P 500 cap strategies currently between 9%-11% with a 100% participation rate. That means if you had say a 10% cap and a 100% participation rate, you can get dollar-for-dollar participation of S&P 500 indexed growth between 0% and 10%.

Although you probably want unbridled stock market participation from your long-term stocks and mutual funds, you may want to smooth that roller coaster ride for some portion of your savings, especially dollars you want to keep safe and liquid, but steadily growing.

Some IUL companies offer uncapped S&P 500 strategies with a 0% floor, no cap, and some kind of watered-down participation rate of say 40%-60%. That means in years after a big market drop you could earn half of the S&P 500 gains or so without worrying about market losses.

It’s worth noting that certain VUL companies offer higher participation rates of, say, 90% of uncapped S&P 500 growth. However, instead of the traditional 0% floor guaranteeing no market losses, these VUL companies charge a 3% fee, which effectively makes your 0% floor -3%.

IULs with VCIs: Volatility Control Indexes

Over the past few years Volatility Control Indexes (VCIs) have become increasingly popular among some of the best IUL companies. They are often designed and managed by household financial names like Barclays, Goldman Sachs, and J.P. Morgan.

Essentially, these exotic indexes are allocated by an algorithm that gives the client exposure between a stock market index and either bonds or cash depending on the level of volatility present in the market. The idea was that these VCIs would provide a steadier and smoother return for the best IUL policies and therefore a better result for clients.

However, it’s worth noting that the promises of these Volatility Control Index strategies have not panned out well for clients.

The fact that bonds have had negative returns in 2022 and a choppy 2023 contributed to the 0% crediting in these VCI’s. Also, certain VCIs offering more than 100% participation rate are using leverage within the algorithm, which acts as a higher hurdle rate. Even though you still have a protective 0% floor, the hurdle rate to positive crediting within Volatility Control Indexes has gotten significantly higher as short term rates have spiked up.

In fact, we’ve seen multiple years of zero crediting, whereas the pure S&P 500 indexed strategies have rebounded nicely.

Some agents believe the best IUL companies are the ones with the snazziest Volatility Control Index strategy. Even though the familiar names behind the design of these Volatility Control Index may be comforting to see, just beware that most VCIs were designed to excel in a low to no interest rate environment.

Some of the best IUL companies may have Volatility Control Index options available, but I would caution you against becoming overly impressed by back-tests cherry-picked showing a lower interest rate environment that is vastly different from the one we’re in now.

Be sure the best Indexed Universal Life Insurance policy for your situation should also have a solid S&P 500 option as well… maybe more than one!

IUL Loan Options

One last feature for that determines the best IUL companies is the type of participating loan available.

Assuming you’re following our formula for an IUL that’s chosen, designed, and funded properly, you can borrow against 90+% of your cash value with a locked loan rate between 5%-6%. Yes, some of the best IUL companies do have a locked loan rate of 5%. That way you can borrow against your cash value while it remains fully invested in the IUL crediting options.

Since interest rate volatility is likely to continue for some time, we believe the best IUL companies should offer some sort of locked or capped loan rates.

IUL is actually a unique hedge against interest rates:

- If rates are low, you may be better off borrowing against outside lines of credit, collateralized loans such as auto loans, or even certain student loans while keeping your IUL compounding.

- If rates are high, you can flip as much of the loan as possible to your IUL policy especially if it has a 5%-6% capped loan rate.

Keep in mind that you are allowed to first withdraw everything you put into an IUL on a tax-free basis. However, when you withdraw from an IUL you lose the compounding on that money vs. when you borrow against it.

Most people plan on taking tax-exempt loans from an IUL policy rather than withdrawals for two reasons:

- Loans against any asset are not considered a taxable distribution (like with real estate or margin loans)

- Some people plan to use IUL as their own private bank (using the infinite banking concept)

- The best IUL companies offer opportunities for positive arbitrage (growth rates vs. loan rates)

Again, the intention with all the best Indexed Universal Life policies is that these indexed crediting strategies will outrun the underlying fees by such a wide margin that the policyholder hopes to draw massive amounts of tax-exempt income largely from IUL loans.

As of 2024 we’re finding that the best Indexed Universal Life insurance companies offer lock or capped loan rates somewhere between 5%-6% while still offering full participation in some or all of their indexed crediting strategies.

Some people hear the word borrow and see red. However, when you look at this historical example, remember that IUL cap rates were much higher in the past and may drift higher with higher rates.

As you can see below, the S&P experienced losses less than ¼ of the time in the last 86 years, and over ¾ of the time the S&P had positive returns. Further notice that in the positive years, you would’ve easily hit the cap ¾ of the time. If that’s the case, then wouldn’t it be better to keep that cash value working for you in the IUL investments by borrowing against IUL using a locked 5% loan rather than taking a tax-free withdrawal?

Having a locked or capped loan, allows you to pay simple interest on a flat or decreasing loan balance while earning compound interest on an increasing balance.

Ancillary Features of The Best IUL Policies

Oftentimes insurance agents will over-hype certain ancillary features of a policy as if this is what determines who the best IUL companies are.

Chronic illness riders on an IUL are a nice feature, but most companies have some sort of free chronic illness rider built into their policy. If protection against chronic illness is your priority then perhaps you should consider the best policy for pure Long Term Care protection rather than the best IUL for cash accumulation.

Another popular feature that is catching attention is a “rate-lock” feature in certain IUL investment strategies where if you have positive crediting, then you can essentially lock it in at any point throughout the year.

Again, these features may sound attractive, but none will be as important as the combination of the 3 features described in the sections directly above:

- Lean IUL Policy Fees

- Robust IUL Investment Options

- Locked IUL Policy Loan Options

- IUL Company Reputation (with existing policyholders).

The best IUL companies will be very well-rounded in all these 4 core categories.

The Best IUL Companies Treat Past Policyholders Fairly

Therefore, it is important to consider the overall history of the insurance company and how it treats existing IUL policyholders.

Did the company once offer the top IUL policy, but then substantially change the game for the worse once they launched a new product to compete as best IUL policy?

You know how banks will offer a teaser rate to open a CD or savings account just to get new customer money in the door? You see certain IUL companies will subsidize these unrealistic new offerings by squashing what’s possible for their inforce policies.

Don’t get me wrong, all of the best IUL companies have had to lower caps and participation rates as rates kept getting lower and lower from 2009-2022. However, some IUL companies were more aggressive about lowering caps than others.

Furthermore, as rates ticked back up, we got to see which were really the best IUL companies by fairly raising caps, not only for their latest and greatest IUL policy but for all their existing policyholders.

We also saw how in the spirit of fairness some of the best IUL companies would lower their loan rate for clients simultaneously to lowering their S&P 500 caps.

Makes sense, right?

What’s right is right!

It’s worth noting that several of the best IUL companies have stated that the caps for their past products can’t be exactly equal to their current product offerings. This is because it may not be an apples-to-apples comparison since their old IUL products may have vastly different mortality assumptions, bonus structures, and even entirely different IUL investment methodologies.