Paid-Up Additions (PUA): A Deep Dive into Whole Life’s Cash Value Booster

What is a Paid-Up Addition?

A Paid-Up Addition (PUA) is a mini sliver of Whole Life insurance paid with one single premium and stacked onto a traditional Whole Life policy. Paid-Up Additions can only be purchased through a traditional Whole Life policy by adding a PUA rider and/or electing dividends to buy paid-up additions. PUAs are the most powerful component of a whole life policy when designed for rapid cash value accumulation.

(Clickable) Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

How Do Paid-Up Additions Work?

Paid-Up Additions work just like an ordinary Whole Life insurance policy. Each PUA has its own cash value and death benefit component. However, because it is fully paid-up with one single premium, the cash value of a Paid-Up Addition accelerates towards critical much sooner. Just like any Whole Life policy, a PUA’s cash value must grow every single day so that it equals the death benefit by age 121.

Below we will show you how adding a flexible Paid-Up Additions rider onto an ordinary Whole Life Insurance policy can transform it into a good investment vehicle because of the disproportionate amount of PUAs that can be pumped into your policy.

Benefits of Paid-Up Additions (PUAs)

The main benefit of a Paid-Up Addition (PUA) is the rapid acceleration of cash value growth inside a traditional Whole Life policy. Ordinary Whole Life often gets a bad rap for taking 12-14 years to break even. Adding a Paid-Up Additions rider and funding it to the maximum can cut this breakeven period in half or sooner since over 90% or more of your PUA premium goes straight to your Whole Life policy’s cash value.

The other less-appreciated benefit of Paid-Up Additional life insurance is the added permanent death benefit. Most clients consider the death benefit an ancillary feature or a necessary evil to participate in the non-correlated and tax-sheltered growth of Whole Life insurance. However, what most consumers don’t realize is that the amount of Whole Life dividends they stand to receive will be based not only on how much cash value they have but also on the amount of their policy’s permanent death benefit (including PUAs).

Since each PUA purchases paid-up life insurance, these little paid-up policies keep stacking upon each other, which essentially raises the death benefit target that your guaranteed cash value must reach. Therefore, these PUAs will increase your share of any future dividend pools declared by your mutual insurance company. If you use those additional dividends to purchase even more PUAs, you obviously continue to increase your policy’s cash value and paid-up life insurance, which increases your share of the next declared dividend pool, and so on.

You can imagine how this cycle can create an exponential compounding effect, especially when you maximize your PUA payments.

Even if for some reason no dividends were paid ever again by your mutual insurance company, the cash value of a paid-up addition MUST equal its death benefit by age 121. This contractual provision inside every Whole Life policy causes your cash value to grow on a daily basis converging on your death benefit.

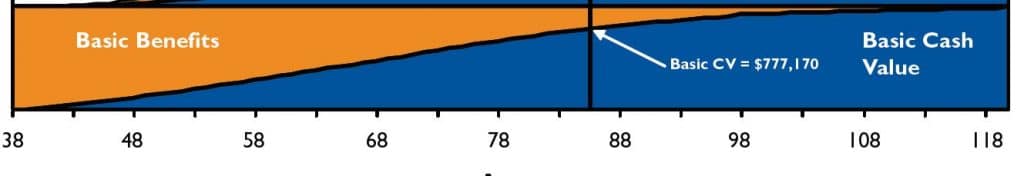

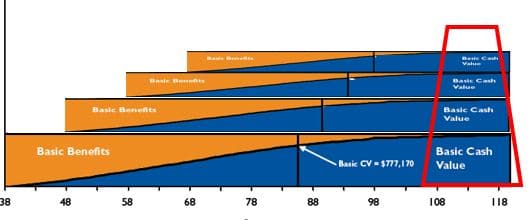

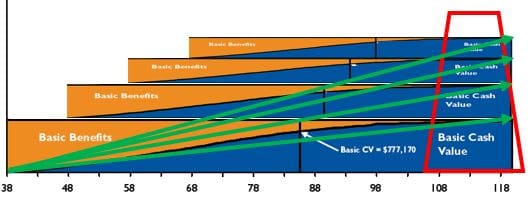

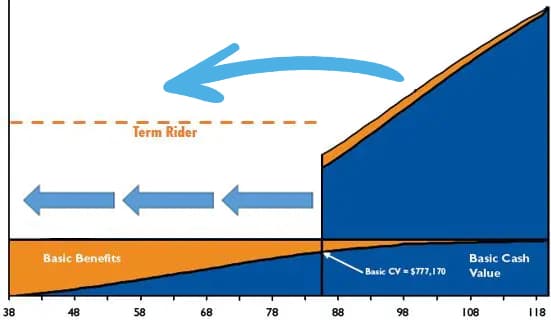

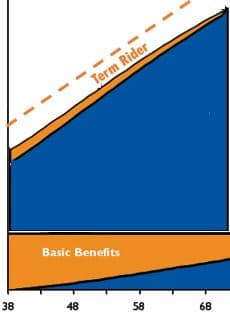

(The image below is not drawn to an exact scale but conceptually represents how stacking Paid Up Additional life insurance on top of a Whole Life policy increases the death benefit and the trajectory of the guaranteed cash value’s growth curve.)

Therefore, if your cash value must equal your death benefit over time, do you really want less death benefit?

Most of my new clients tell me they don’t really care about the paid up life insurance until they realize they were sleeping on this commonly misunderstood aspect of Whole Life insurance!

We break down Whole Life’s various ingredients in one of our signature videos using turbo-chargers as an analogy for Paid-Up Additions. After explaining the concept with our race car analogy, we compare different illustrations of policies with varying levels of PUAs in the builds.

You can access the entire case study comparison here in our video “Whole Life’s Growth Components and Riders”.

How Much Paid-Up Insurance & Cash Value do I get from a PUA?

How much paid-up insurance you get from buying a PUA will depend on these 3 factors:

- How old you are

- What health rating you receive

- Quality of that company’s base Whole Life policy

Although the first two factors may appear obvious, the third one probably seems counter-intuitive.

It’s not like a Whole Life policy’s Paid-Up Addition is totally uncorrelated to the base policy. Quite the contrary actually! Remember, a Paid-Up Addition is often just a miniature version of its underlying Base Whole Life policy. Sure, it helps that every PUA is front-loaded with a lifetime’s worth of premium into a present-value single premium. But, how well that PUA performs over time is directly correlated to how efficiently the insurance company has structured it, which is actuarily determined at the onset of the policy.

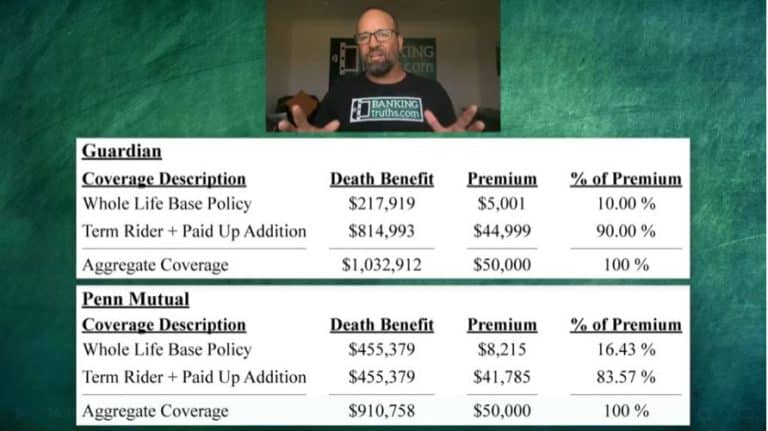

We made an entire video discussing the quality over quantity approach when it comes to adding a PUA rider to your base Whole Life policy. Although it may seem that companies allowing you to pay the most PUA premium should be better, this video clearly demonstrates that the quality of that company’s Paid-Up Additions is far more important.

Since a PUA is often just a micro version of its base policy, the video analysis shows how the efficiency of a company’s base policy is quite important despite how much in Paid-Up Additions they let you pump into their policies.

Examples of Paid Up Additions (PUA) at Different Ages

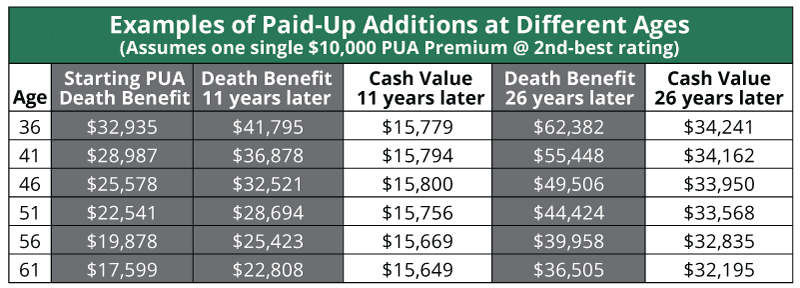

Here are several different examples of how much paid-up additional insurance your paid up additions rider buys you at various ages as well as how both the cash values and death benefits grow over time.

Basically, as you get older your paid-up life insurance costs get higher and higher. To buy the same amount of paid-up life insurance as the year before, you must pay a slightly higher single premium each year you get older. Looking at the paid-up value formula another way, since that single premium has less time to reach its eventual death benefit destination by age 120, you must essentially front-load it with more premium dollars from the jump.

So the younger you can start a policy designed to allow for maximum PUAs, the more paid-up life insurance you bolt onto your Whole Life insurance policy, which as you learned:

- Increases your guaranteed cash value growth

- And increases your cut of future dividend pools

Keep in mind, that if you use your Whole Life dividends or a PUA rider to purchase Paid-Up Additions over time, your policy will end up with a collection of PUAs from these different age ranges regardless of when you start your policy.

* Based on a 5.75% dividend at 2nd best health rating, your actual PUA parameters may be more or less.

It’s normal for prospective clients to disqualify themselves by thinking they are too old to start a Whole Life policy. However, as you can see, the cash value for a Paid-Up Addition is quite robust regardless of how old you are. In fact, the difference in the PUA’s immediate cash value between a 35-year-old and a 60-year-old is practically non-existent.

Even after 11 and 25 years, the cash value of a Paid-Up Addition bought at age 35 and age 60 is surprisingly close. The main differentiator is the amount of paid-up additional insurance it buys you.

For now, it should be abundantly clear that stacking Paid-Up Additions in your Whole Life policy as early and often as you can will benefit you later on when that time comes.

Sure you should’ve started stacking Paid-Up Additions inside a Whole Life policy when you were younger and healthier, but the past is the past.

When’s the best time to plant an oak tree? … 20 Years Ago!

When’s the next best time? … Now!!

Effect on PUAs from Different Health Ratings

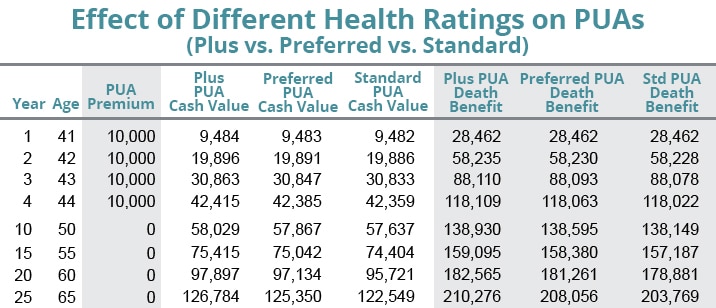

Whole Life consumers often feel they’ll be missing out and their policy will drag if they don’t get the absolute best rating from the insurance company. As you can see below this definitely is NOT true as we compare and contrast the Paid-Up Addition performance for a 40-year-old at Standard, Preferred, and Preferred Plus/Best/Elite or whatever that mutual company calls their best health rating.

Clients will often think it’s better to hold off starting a policy so they can lose weight or lower their cholesterol. However, we’ve found that as long as our clients get a standard or better, the difference is pretty nominal as you can see above.

Even if they do hold off in hopes of getting a slight bump in rating, it doesn’t make up for getting an extra year older or even losing that extra time their cash could be compounding inside Paid-Up Additions.

Are Paid-Up Additions (PUAs) Taxable?

Paid-Up Additions are not taxable, unlike dividends that accumulate at interest at the insurance company. A PUA’s cash value grows tax-deferred and the death benefit is tax-free since it is technically a miniature whole life insurance policy unto itself.

If you structured the exact same design as a standalone single premium Whole Life policy that was NOT a paid-up addition riding on top of an ordinary whole life policy, it would be considered a Modified Endowment Policy (MEC), which loses some of Whole Life’s key tax advantages.

Because a Paid-Up Addition is attached to a base whole life policy, you often will have additional capacity to pay large single premiums into a PUA rider year after year while staying within the MEC thresholds to preserve the Roth-like tax advantages of whole life insurance.

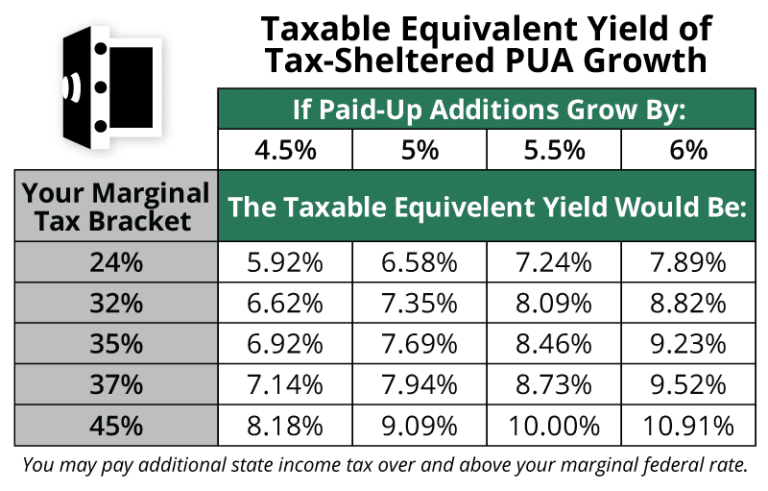

Because the growth of a PUA is not taxable, the taxable equivalent yield needed to equal the same net after-tax result is much higher. (See the table below).

The fact that Paid-Up Additions are not taxable becomes an even bigger deal as taxes go up. Even if your average tax bracket is lower, you absorb that with your income, and therefore all investment types earnings get taxed at the highest marginal rates. Don’t forget to add your state income tax too when determining where you fall on this table.

Adding a Term Insurance Rider to a Whole Life Insurance Policy to Maximize your PUA Rider

Many clients would ideally prefer to pay for as little Base Whole Life as possible while maximizing the amount of Paid-Up Additions that can fit inside their policies, especially if they are becoming their own banker using the infinite banking concept.

Thankfully, many mutual insurance companies offer a term insurance rider that bolts onto your base Whole Life policy so you can increase the amount of Paid-Up Additions that fits inside your policy. Remember how if you pay too much premium into your Paid-Up Additions rider too quickly, you run the risk of your Whole Life insurance policy becoming a Modified Endowment Contract (MEC) and losing Whole Life’s most favorable tax advantages?

Blending a term insurance rider onto your base whole life policy is a way to maintain all the proper death benefit ratios while allowing you to stuff a disproportionate amount of PUA premium into your policy earlier than you would normally be allowed to. With a term rider, you’re essentially creating a cavity so you can disproportionately increase the amount Paid-Up Additions that you can stuff into a Whole Life policy.

Normally, a term insurance rider is priced as annual-renewable-term. So you can create this temporary (term) receptacle to fill with PUAs for a fraction of the cost that Base Whole Life would cost. The idea is to front-load the PUA rider as quickly as you can, so the term insurance rider will drop off before the cost to carry the rider becomes too cost-prohibitive as you get older.

Accelerating this early growth by maximizing the amount of paid-up additional life insurance that will continue compounding into the future by forcing your cash value to crawl higher at a steeper pace.

Just to be clear, this term insurance rider on its own does nothing to enhance wealth building inside a Whole Life policy. In fact, it will even add some additional mortality charges. However, these charges are often a very nominal amount considering the amount of temporary death benefit it props up, which gives you loads of PUA capacity that you otherwise wouldn’t have with just a PUA rider added to an ordinary Whole Life insurance policy.

By adding a term insurance rider to squeeze in a disproportionate amount of Paid-Up Additions well in excess of your base premium, you can substantially accelerate Whole Life’s long-term growth curve into the near term to become your own banker with the infinite banking concept.

Level or Increasing Term Riders

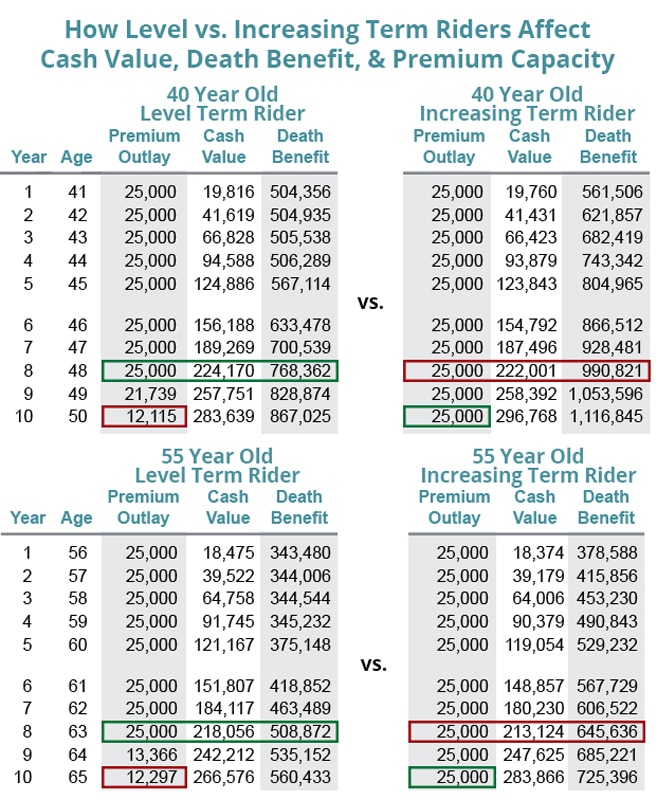

Certain insurance companies offer either a level or an increasing term insurance rider as an option to fit onto their Base Whole Life policies so you can pay extra PUA premium:

- A term rider with a level death benefit will limit how long you can pay into your PUA rider. However, a level term rider will have a lower carrying cost since the amount of term you are paying for decreases as you replace the term rider’s death benefit with Paid-Up Additions.

- A term rider with an increasing death benefit will obviously have a greater carrying cost since you will maintain more term insurance for a longer duration.

However, for younger people looking to purchase Paid-Up Additions for multiple decades, this can be a great option since the cost difference between a level and increasing term rider is nominal.

Here are a couple of examples of the difference between flat and increasing term rider for both young and older people.

* Based on a 40-year old at the 2nd best health rating with a steady 5.75% dividend.

Your actual growth projections & term rider costs may be more or less.

For a 40-year old the slight cash value erosion from the increasing term rider may be worth the ability to continue max-funding past the 8th year, not to mention the added death benefit which may be welcomed for family protection.

The 55-year-old, who is closer to retirement, may not have as strong of ambitions to continue max-funding past the 8th year. Plus, the erosion effect on the cash value is more than double for significantly less of a death benefit bump from the increasing term rider.

All of this will vary case by case, but hopefully, these 2 examples help you conceptualize the effect of this lever when designing your own Whole Life policy funding path.

Use a Flexible Paid-Up Additions Rider to Buy PUAs as Early and as Often as You Can

A Paid-Up Additions rider allows you to buy PUAs with additional premium over and above the required base premium of an ordinary Whole Life policy. A flexible Paid-Up Additions rider allows you to be flexible with when and how much of these PUAs you want to buy in the future.

You see, certain mutual insurance companies that offer Whole Life insurance with a Paid-Up Additions rider have a “use it or lose it” policy. If you neglect to pay a certain amount of additional premium in a certain year to fund your paid up additions rider, many carriers will revoke your right to purchase PUAs in future years.

Some Whole Life companies require buying a de minimis amount (around $100) of Paid-Up Additions each year to maintain your ability to maximize the Paid-Up Additions rider in future years. Other insurance companies require you to maximize your PUA rider at least once every 3-5 years in order to keep the window open.

Although having some flexibility sounds comforting to clients, we find that this issue of a flexible Paid-Up Additions rider is often overblown. It’s normal to feel pressure from any sort of mandated PUA premium, but it actually can keep your policy on track like a disciplined forced savings (that is technically only forced every 3rd year which isn’t even optimal).

You see, if you don’t plan on paying the maximum allowed into your Paid-Up Additions rider at least once every 3 years you are definitely not optimizing the base Whole Life policy you’re paying for. PUAs are a privilege and the most robust component of a Whole Life policy. Paid-Up Additions are something you want to pay into as early, often, and as hard as you feasibly can.

We’ve found that if you’re planning on front-loading a policy with some kind of big 1st year PUA dump-in from prior savings or some kind of windfall, it’s often more mathematically efficient to spread that large first-year Paid-Up Additions payment over the first 3-4 years of the policy. In fact, we created a special video analyzing 1st-year PUA payments into Whole Life.

There’s nothing wrong with slamming a Whole Life policy with a massive first-year Paid-Up Additions payment. Ideally though, you’ll want to pay a similar amount for 3-4 years in order to justify the amount of Base Whole Life needed to support that first large PUA payment. If not, you are probably being oversold an unnecessarily large base Whole Life policy that could be designed more efficiently to meet your goals.

Using RPU to Turn any Size Policy into a PUA

One little-known option that is available on every Whole Life policy from any insurance company is the Reduced Paid-Up (RPU) Non-Forfeiture option. It allows you to stop paying premium at any time throughout the life of the policy by reducing your Whole Life death benefit to a lesser but fully paid-up amount according to how much in premiums you’ve paid thus far.

Lowering your permanent death benefit to Reduced Paid-Up status strips your base Whole Life policy of all future mortality charges and essentially shrink-wraps it into a big fat PUA. You no longer can pay premiums into a Whole Life policy with RPU status, but the cash value will contractually grow towards the death benefit each year. Also, your Reduced Paid-Up policy will continue to earn dividends which can actually continue to purchase ongoing PUAs if you have that dividend option elected.

Regulators mandate that insurance companies offer the Reduced Paid-Up Non-Forfeiture Option to protect consumers from having their Whole Life policies lapse. However, many of my clients strategically elect RPU status once they are done funding their policies after a number of years to transform their entire policy into a massive Paid-Up Addition, which reduces mortality drag and optimizes the performance of their entire cash value balance.

Paid-Up Additions when Becoming Your Own Banker

If you have not heard of this phenomenon of using Whole Life insurance to become your own banker you can check out our article 5 Steps to Be Your Bank with Whole Life Insurance.

Maximizing your Paid-Up Additions through a robust PUA rider is the crux of what transforms an ordinary Whole Life insurance policy into a vehicle for becoming your own bank. For decades now, Infinite banking concept insurance agents have been customizing Whole Life policies to balance an optimized cost structure while creating a sufficient cavity to stuff the maximum amount of Paid-Up Additions on an accelerated schedule.

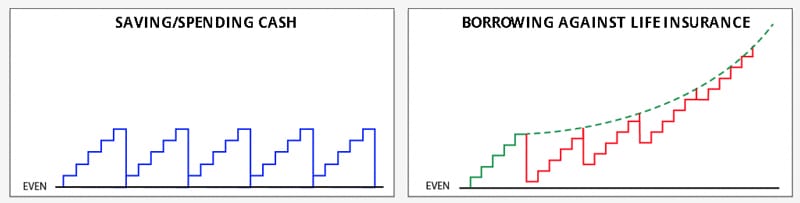

Ideally, you would reroute your existing cash flows normally flowing to things like mortgages, car payments, retirement plans, and college savings through a properly designed Whole Life insurance policy before they reach their final destination. This can create a massive amount of additional compounding on your behalf, not to mention additional tax-exempt retirement savings that is completely immune to the whims of stock market volatility.

If this concept sounds completely foreign to you, you can learn the basic science behind using Whole Life as your own bank in our 6-minute video where we go over this schematic together.

Make no mistake about it, continuous compounding of your safe and liquid assets is where Whole Life shines, and Paid-Up Additions are now a not so secret ingredient to accelerate this effect.

Final Thoughts on Paid-Up Additions

Paid-Up Additions are unlike any other financial vehicle in that PUAs are:

- Guaranteed to grow every year regardless of rates or market movements

- Compound upon themselves by earning dividends to buy more PUAs

- Have a built-in guaranteed death benefit over and above the cash value

- Can be accessed any time completely exempt from income taxes

Some would say, that Paid-Up Additions are by far the most attractive feature of a Whole Life policy. Unfortunately though, PUAs cannot be purchased as a stand-alone product.

That said, savvy life insurance agents know how to re-engineer an ordinary Whole Life insurance policy using a combination of riders and design techniques to disproportionately stack the amount of your premium that goes to Paid-Up Additions thereby rapidly accelerating your cash value growth.

Shrink-wrapping the proper amount of death benefit needed to fit the amount of cash you’d ideally like to pump through your policy is like getting custom-fitted for a suit from a master tailor.

In doing so, we’ve found that clients who once thought of themselves as being too old or uninsurable to “look good in such a garment” often reconsider once they see it for themselves. Don’t hesitate to book your own free consultation for a no-pressure custom-fitting session that’s sure to be educational at the very least.

Many agents are reluctant to illustrate Whole Life insurance with a term insurance rider in conjunction with a flexible paid-up additions rider because doing so drastically reduces their commissions. The Banking Truths Team has no qualms whatsoever about offering this type of policy since we make it up in volume. Our independent agents are adept at designing policies from the top mutual companies in this fashion.

You can have us get started designing a custom policy to hold maximum PUAs for you. Simply input your age, estimated health rating, as well as the time you want to connect with us via screen-sharing to have us run some different company’s PUA calculators and explore the optimal whole insurance policy designs for you.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com