Infinite Banking with IUL: Can IBC Work with Indexed Universal Life?

Does Infinite Banking with IUL Work?

The short answer is yes, IUL can work for infinite banking. An IUL banking policy offers the potential for immediate positive arbitrage and better long-term performance. But using Indexed Universal Life for IBC also adds additional risk for the policyowner.

All the benefits and potential upside described below assume your particular IUL banking policy is:

- Chosen Wisely

- Designed Properly

- Funded Thoroughly

- Managed Diligently

Unfortunately, I can report from my own personal experience that if one or more of these factors are neglected, then infinite banking with IUL will NOT go well. However, if you adhere to all four of these factors, then an IUL banking policy may work well on its own merits.

Through 17 years of practicing infinite banking, I have learned that IBC can only truly be optimized when life insurance is just one component of an overall framework of coordinated assets designed for strategic and defendable leverage. Learn more about incorporating multiple components into a comprehensive infinite banking strategy.

(Clickable) Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

When I First Considered IUL For Infinite Banking

Like most Infinite Banking agents, I used to be completely against using IUL for IBC. This hatred for Indexed Universal Life had been forced down my throat so to speak. I would quickly be shamed by the circles of infinite banking agents for even daring to question the continuous echoes of slander against IUL.

I didn’t dare risk my reputation amongst these circles of friends and mentors…until one day when I lost a big family business case to a competing agent selling IUL.

- I cautioned the client about IUL’s lack of guarantees

- I showed how IUL’s bold print seemed too good to be true

- I alerted him about the fine print where the company could change the game

Yet he didn’t seem to care. He moved forward with another agent using IUL for his multi-generational family bank.

This caused me to question the Kool-Aid I was drinking and assumptions I was perhaps taking for face value.

I realized these assumptions I was taking for granted with IUL required additional investigation. I started digging into the contract language and running various IUL calculators to stress-test various types of illustrations.

I realized that some of the slander I had taken as gospel was perhaps over-exaggerated.

• Half Truth: IUL cost structure could get out of hand, BUT only if the policy was BOTH under-funded and neglected (never monitored nor adapted).

- But even if the client underfunded the policy and the actual growth was much less than originally illustrated, you could always reduce a portion of the death benefit in retirement to mitigate IUL’s dynamic cost structure.

• False Claim: All the talk about these IUL companies “keeping” excess S&P 500 returns over the cap.

- This was utter nonsense and fear-based sensationalism. IUL companies use S&P 500 options to create the cap & floor. The parameters are directly correlated to current options pricing and the company’s option budget (based on prevailing interest rates).

• Half Truth: IUL illustrations showed positive crediting every single year, even on borrowed money.

- This was true, but most agents didn’t realize there were hypothetical historical reports showing your particular IUL policy’s premium and loan schedule run through different historical periods so you could see the effect of negative years on growth and loans.

• False Claim: The surrender charges on IUL cut off your access to infinite banking for IUL in the early years.

- You can easily eclipse the bulk of any surrender charge by overfunding the first few years, which most people plan to do anyway. Any cash value restricted from temporarily borrowing because of the early surrender charge is still actually working for you in the indexed crediting strategies. IUL haters don’t tell you that part.

Had I been wrong about IUL the whole time?

I was about to find out.

My Personal Experience Using Infinite Banking with IUL

After careful consideration, I decided to personally add some IUL banking policies to my existing portfolio of Whole Life policies designed for IBC.

Keep in mind that this was between 2013-2015 when Indexed Universal Life was in its heyday. Conditions for IUL banking policies were absolutely ideal because:

- Interest rates were high enough which provided IUL companies with a bigger option budget.

- Stock market volatility was at historic lows which meant option pricing was very cheap.

- The above 2 factors combined meant very high IUL caps leading to great-looking illustrations.

So at first glance, these IUL banking illustrations looked absolutely incredible!

But, if there’s one true fact about both Whole Life or IUL illustrations is that none of them will materialize exactly as they’re shown. That’s because as soon as a single year’s dividend rate or cap rate changes, then the rest of the illustration changes.

How far off could these IUL illustrations be, I thought?

Oh, I would find out the hard way!

Remember the ideal conditions I described for IUL banking from 2013-2015? I circled those periods below on these graphs showing what happened afterward.

Well, here’s what happened from 2013-2022:

- Interest rates trended much lower, which shrunk the IUL companies’ option budget

- Stock market volatility spiked after COVID, which made options more expensive

- The above 2 factors combined meant very low IUL caps, leading to a crappy performing IUL

Even though the IUL banking policies I now owned ceased to be as good as originally intended, I didn’t cancel them. However, I did start funding them more minimally.

Some of my IUL companies were definitely better than others, so I observed in the industry how different IUL companies were treating their existing policyholders. Was it significantly different from what they offered new customers with “teaser rates” and such? Yes!

Long story short, some IUL companies treated their policyholders much more fairly than others given the conditions, so I learned firsthand how important evaluating the best IUL companies can be.

2. I picked this policy for some snazzy sounding “volatility-control-indexes” (VCIs). They were uncapped, had great participation rates. They were brand new indexes so they only had backtested historical data, which looked great.

Boy was I wrong! These snazzy volatility-control-indexes have thrown up multiple goose eggs (0% returns) for multiple years in a row. I’ll be sticking to the S&P 500 with a solid cap & floor from now on.

What About The Dangers of Infinite Banking with IUL?

Didn’t my IUL banking policies blow up since I started light-funding some of them and ceased funding some of them completely?

Nope, not even close.

Some of them still performed nicely given how lightly I funded them. This is because the cost of insurance is lowest in the early years, even lower than Whole Life.

Contrary to popular belief, the rising cost structure within Indexed Universal Life isn’t an imminent certainty.

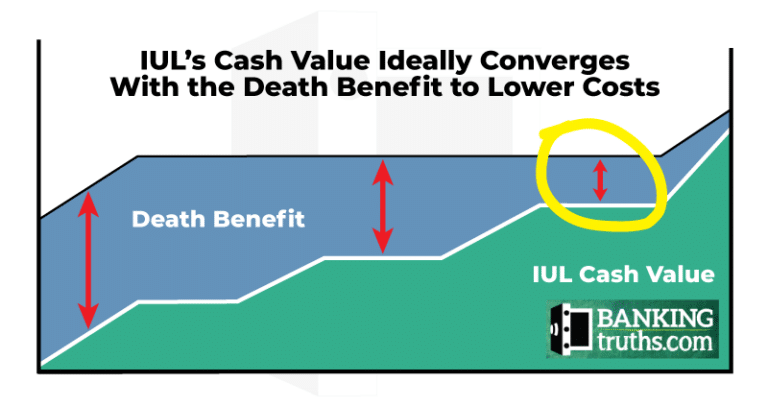

The cost per unit of death benefit does indeed get more expensive as you get older. However, if your policy is designed, funded, and monitored properly then the cash value should converge upon the death benefit, which reduces the amount of death benefit you’re paying for.

So even though the cost per unit of death benefit goes up, you can control the amount of death benefit you’re paying for later in life when the cost of the insurance becomes prohibitive.

Even if you can’t fund your IUL banking policy thoroughly or it doesn’t get awesome performance, you can always choose to manually reduce the death benefit to a manageable amount.

Regardless of whatever doomsday scenarios you hear about infinite banking with IUL, none of them are immediately imminent during the early years, even if you substantially underfund them in years 2-3 or beyond.

You have time and options to manage the long-term rising cost structure.

Are There Advantages To Using IUL For Infinite Banking?

Assuming you are ok with additional downside risk and lack of guarantees when using an IUL banking policy, there are definitely some unique features available on certain policies:

- Ultimate Flexibility of Premium Payments

- Opportunities for immediate positive arbitrage

- Locked loan rates in the 5%-6% range for IBC loans

- Chronic Illness riders come standard for most IUL policies (not all Whole Life)

For certain clients with a greater appetite for risk-managed returns or for clients setting up a comprehensive infinite banking strategy using a network of financial instruments, an IUL banking policy may be an appealing piece of their puzzle.

Again, this assumes your IUL banking policy is chosen, designed, funded, and managed optimally on an ongoing basis.

Let’s explore these unique features…

Ultimate Premium Flexibility with IUL vs. Whole Life for Infinite Banking

Oftentimes, the reason why clients are reluctant to initiate a Whole Life insurance policy designed for personal banking, is the rigid annual premium commitment they perceive is there.

People are reluctant to take on a “new bill” that may last their “whole life.”

What they don’t realize is that Whole Life can be designed with term riders so that only 10%-30% percent of the maximum-allowable premium is required every year.

For clients needing ultimate flexibility, IUL offers the ultimate flexibility. Technically no premium is ever due so long as you have sufficient equity within your IUL banking policy.

Also, if you fund your IUL to the maximum the first year, you can often skip the next 2-3 years depending on the design.

We don’t recommend this, but it is possible so long as you plan to either:

- Catch up on those skipped premiums within the next few years

- Reduce the death benefit in the future to bring down the future cost structure

For clients requiring the maximum amount of annual flexibility, infinite banking with IUL may be the way for them to start something rather than nothing at all.

IUL Banking Policies Offer the Potential for Immediate Arbitrage

People are often attracted to infinite banking with IUL for the prospect of positive arbitrage.

What does this mean?

Positive arbitrage means the cash value you’ve borrowed against has the potential to earn more than the loan interest. Some people think you’re paying yourself back interest with an IUL banking policy, but if you were, you couldn’t earn this positive arbitrage.

So it’s actually better that you’re not paying yourself back the interest as cute as that sounds.

If we look at this chart of historical S&P 500 returns you can see that it produced positive growth ¾ of the time and negative growth ¼ of the time. Furthermore, if we look at ¾ of those positive times you would’ve easily hit a 10% cap.

If you choose a company with a locked 5%-6% loan rate, then borrowing against an IUL banking should be a good long-term proposition…assuming your policy is chosen, designed, funded, and monitored properly.

IUL Banking Policies with Locked Loan Rates

Some of the best IUL carriers of 2024 will actually lock in your IUL policy’s loan rate FOR LIFE while still letting you fully participate in some or all of their policy’s indexed crediting strategies (even on loaned money).

How low are these locked loan rates?

There are mutual companies offering some of the best performing IULs that will lock in a 5% or 6% loan rate for life as soon as you initiate one of these policies.

This gives you a great opportunity to earn immediate positive arbitrage since you can earn 9%-11.25% each year tracking the S&P 500 index, even on the amount of money you borrow to use for other opportunities and expenditures.

Many people plan on borrowing against their IUL banking policy value to:

- Buy vehicles

- Send kids to college

- Acquire investment real estate

- Lend money to their business ventures

- Take tax-free income instead of paying at the high brackets in retirement

Locking in a lifetime loan rate now using today’s low 5%-6% policy loan rates is an amazing advantage, especially since your policy still has the opportunity to track the upside of the S&P 500 index into low double-digits.

It’s an incredible hedge since no bank or brokerage account will let you lock in your margin loan rate or line of credit today for your entire life.

Even if you prefer Whole Life for infinite banking, we like it when our clients have some amount of IUL within a comprehensive network of assets for infinite banking simply for the hedge against rising loan rates.

Chronic Illness Riders

These days it seems that just about every company offering Indexed Universal Life has some sort of free Chronic/Critical Illness rider attached to their IUL policies.

Some free riders are more robust than others when it comes to IUL banking policies. Not all Whole Life policies have free chronic illness riders, but we generally recommend the ones that do.

Note: If this is the main reason why you are considering an Indexed Universal Life policy, then you should definitely consider some other hybrid life policies that are built more for maximum LTC protection as opposed to cash value performance or infinite banking for IUL.

Depending on how your actual numbers look, you may find that these IUL banking policies with a free chronic illness rider may provide you with a sufficient hedge against Long Term Care while building an asset rather than paying an additional cost.

Final Thoughts on Infinite Banking with IUL

Despite the nay-sayers and IUL haters, an IUL banking policy is possible provided it is:

- Chosen Wisely

- Designed Properly

- Funded Thoroughly

- Managed Diligently

Feel free to book your own custom call with our team.

In an ideal world, an IUL banking policy is part of a comprehensive network of assets for strategic and defensible leverage.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com