Mutual Insurance Company vs. Stock Insurance Company, and the Hybrid Mutual Holding Company

Why Does it Matter?

Think about the name of this product you’re considering buying to act as your own bank and retirement buffer. It’s called “Whole Life,” and that’s how long this financial contract is designed to last. Therefore, you want the company backing those promises to have its financial interests aligned as closely as possible with yours.

Key Takeaways on Mutual vs. Stock vs. Mutual Holding Company:

- Mutuality means you have a piece of ownership in the issuing company when buying one of their participating policies, entitling you to any dividend distributions.

- Stock companies are owned by shareholders. Anyone can buy stock and be entitled to dividends, whether they’re a customer or an outside investor.

- Just because you hear the word “mutual” doesn’t mean it’s a “True Mutual Company.” There is a hybrid structure called a “Mutual Holding Company” (MHC), which has attributes of both stock and mutual companies, which should cause you to ask more questions.

- In my 18 years of experience, both selling and buying polices for Infinite Banking, I have yet to see any policy from a Mutual Holding Company outperform the exact same cash flows run through top True Mutual Companies.

- Demutualization is the process by which a True Mutual or a Mutual Holding Company fully converts into a stock company. Certain demutualization paths have produced more favorable outcomes for policyholders when being compensated for their ownership stake.

So, let’s start by drilling deeper into the differences between the three types of Whole Life companies.

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What is a Mutual Life Insurance Company?

A mutual life insurance company is owned directly by its participating policyholders. There are no external shareholders, which means the only possible way to have an ownership interest in the company is to buy a participating policy.

When I was a child, I remember constantly hearing Prudential’s catchy TV jingle, “Get a piece of the ROCK!” where they’d really emphasize that last word as they flashed Pru’s Rock of Gibraltar logo. I didn’t discover the meaning behind their catchy jingle until much later, when I would later work for Prudential.

To signify the financial stability new policyholders were buying into, Prudential would send them a chip of the actual Rock of Gibraltar.

In fact, only the policyholder can elect the board of directors making company decisions. And profits will either flow back to them through policy dividends or be retained with the company as surplus.

Our team analyzes insurance company balance sheets on Vital Signs for our new clients. It’s typical to see the True Mutual companies retaining relatively larger surpluses than the vast majority of their peers. Part of this comes from their flagship product being Whole Life insurance, which is designed to collect higher premiums than necessary to prioritize solvency first and then later distribute dividends.

This ownership structure is engineered to serve the long-term obligations of multiple generations of policyholders. Therefore, their management style, the products offered, and the investment choices tend to be conservative in nature. Because of that, we often see top-tier Comdex scores, which is a single composite financial health score comprised of marks from all the major ratings agencies.

What is a Mutual Life Insurance Company?

Dividends from a mutual insurance company are paid to whom? The participating policyholders and only the participating policyholders. Unlike stock companies, there are no outside investors with their hands out. When a mutual insurer has a profitable year, that money flows back to the people who own the company: you and your fellow policyholders.

This is why mutual life insurance company dividends work so differently from stock dividends. With a stock insurer, profits get split between policyholders and shareholders, and Wall Street typically expects their cut first. With a True Mutual, there’s only one line, and you’re in it.

So why are dividends from a mutual insurer structured this way? Because the entire ownership model is designed around long-term policyholder interests rather than quarterly earnings reports. The mutual company collects conservative premiums, retains healthy surpluses, and distributes what’s left over to the people whose premiums built that surplus in the first place.

Which Companies Are True Mutual Companies That Still Sell Participating Whole Life Insurance:

There is list a very short list of companies, where you can still actually get a piece of their respective rocks. Here they are listed from oldest to newest:

- New York Life (since 1845)

- Penn Mutual (since 1847)

- Mass Mutual (since 1851)

- Northwestern Mutual (since 1857)

- Guardian Life (since 1860)

- Savings Bank Mutual Life (since 2017)*

* Savings Bank Mutual Life of Massachusetts recently converted from a stock insurance company to a mutual company.

What is a Stock Life Insurance Company?

A stock life insurance company is owned by shareholders who may or may not also be customers of the company. Anyone can buy a stake in the company and share in the potential profits simply by buying the stock. Management’s primary fiduciary duty is to its stockholders first, and their customer policyholders second.

A stock company’s profits can either be distributed through stock dividends or retained as surplus, which may affect the stock price. This is especially true if the stock is listed on an exchange, where its price fluctuates daily and can move violently depending on how the Wall Street interprets their quarterly earnings reports.

This ownership structure must constantly juggle policyholder promises with the need to generate returns on equity. However, in general, stock companies tend to focus on products that will have higher built-in profit margins and can affect the company’s bottom line to appease the impending scrutiny for the next quarterly earnings report.

If you’re simply getting a level term policy, or a version of Universal Life with a guaranteed rider, then you’re probably fine going with a stock company. But I personally would be wary of buying any kind of performance product without a guarantee, since I know the stock insurance company has another master to serve beyond just its policyholder customers.

Several of the big-name, well-known insurance companies you know of used to be mutual insurance companies that sold participating Whole Life insurance. When these companies demutualized, their Whole Life policies were granted shares of the newly-formed stock company.

So, their policies stayed in force, but usually with watered-down performance, and no longer holding the equity in the reorganized company. Their equity component moved into the stock, which often performed well afterward, though it was subject to ongoing volatility that didn’t exist in their Whole Life policies.

Which Companies Are Stock Companies That Used to Sell Participating Whole Life Insurance:

- Equitable (1992), in exchange for AXA stock

- John Hancock (1999), in exchange for MFC stock

- Met Life (2000), in exchange for MET stock

- Prudential (2001), in exchange for PRU stock

- Ohio National (2022), in exchange for cash payments

What is a Mutual Holding Company (MHC)?

A Mutual Holding Company (MHC) is a mashup of both a mutual and a stock company. An MHC is created when a True Mutual Company transforms its operating insurance business into a Stock Insurance Company, which then becomes wholly owned by a newly formed parent: the Mutual Holding Company.

At the onset of this hybrid entity, the participating policyholders are the only owners of this Mutual Holding Company parent company. So, at least initially, they still own 100% of this newly formed stock insurance company.

However, the alleged benefit of this hybrid structure is its ability to raise capital by issuing or selling stock to outsiders in either the main operating Stock Company or new stock subsidiaries.

I’m not sure why “capital raising” was such a major constraint, since their True Mutual Company peers grow to massive companies, mainly using these methods of fund-raising to support organic growth:

- Issuing subordinated surplus notes

- Borrowing against their rock-solid balance sheet

- Using reinsurance to free up reserves for operations/growth.

Regardless, at some level, the option to someday dilute or demutualize to raise capital was certainly made easier by transitioning from a True Mutual Company to a Mutual Holding Company.

Because I personally hope to have a long and stable relationship with my issuing insurance companies for my “Whole Life,” no amount of rhetoric or sugarcoating could personally make me comfortable with this elephant in the room.

Many Mutual Holding Company agents will swear up and down that neither demutualization nor dilution is, nor has ever been, on the table. They claim that their favorite MHC is just as committed to its mutuality as their True Mutual Company peers.

Regardless of my opinion or theirs, nobody can argue the stone-cold fact that adopting a Mutual Holding Company structure creates an easier path to future dilution, all the way up to full demutualization…full stop!

Could one of the True Mutual Companies potentially demutualize without first becoming an MHC? Yes, of course they could. But they haven’t indicated a desire, much less undergone extensive legal restructuring, to lean into that route, unlike their Mutual Holding Company peers.

To be fair, though, there are a number of well-known, well-capitalized insurance companies that have not yet demutualized decades after their transitions to become Mutual Holding Companies. However, a number of them also no longer sell participating Whole Life insurance, but now focus on Index Universal Life (IUL) as their flagship product, such as:

- Pacific Life (formerly Pacific Mutual)

- Securian (formerly Minnesota Mutual)

- Mutual of Omaha (currently reorganizing into an MHC according to S&P Global)

It’s possible that an MHC structure also facilitates mergers and acquisitions of IUL companies to beef up that side of the business. Even though most agents and clients interested in Infinite Banking want nothing to do with IUL, this ultimately could prove to be a profitable move for the MHC policyholder owners.

If I were attracted to a Mutual Holding Company engaging in this profitable activity, I would want to see those profits flow down to my Whole Life policy’s performance through policyholder dividends.

However, as I shared earlier, in my 18 years in the business, I have yet to see any of the Mutual Holding Companies outperform their True Mutual Peers or come close when running an apples-to-apples comparison with an Infinite Banking design.

Bottom line: Ask more questions, do your own due diligence, and compare the performance between the Mutual Holding Company’s Whole Life policy you’re considering and the same cash flows through their True Mutual peers.

Which Mutual Holding Companies Still Sell Participating Whole Life Insurance?

After the demutualization of Ohio National in 2022 (which we’ll discuss momentarily), these are the remaining Mutual Holding Companies, which still sell participating Whole Life:

- Mutual Trust Life (2015) was absorbed by Pan-American Life Insurance Group

- Lafayette Life (2005) merged into Western & Southern Financial Group

- One America (2000) became the stock subsidiary of American United Mutual Insurance Holding Company

- Ameritas (2000) merged with Acacia Mutual Holding Company

- National Life Group (1999) merged into National Life Holding Company

When buying Whole Life policies from these companies, you are no longer buying into a True Mutual Company. You are buying a piece of the Mutual Holding Company, the parent company that owns the Stock Insurance Company subsidiary, whose paper your policy is printed on.

Do your own due diligence, but after 18 years of experience, both selling and buying my own life insurance, I have personally NEVER seen a Whole Life policy from ANY of the Mutual Holding Companies outperform the top 2 optimally designed True Mutual companies’ products using the exact same premium payment structure…EVER…and I keep trying.

Proponents of Mutual Holding Companies often take issue with this statement above. However, I often find that when people are defensive or get triggered by my bold (but true) statement above, they usually either work for an MHC or sell Mutual Holding Company policies almost exclusively.

Remember, you are ideally entering into a financial contract with that company, where the relationship will hopefully last as long as the product you’re buying is named: “your Whole Life.” If so, then why not have direct equity ownership in some of the oldest and most solvent dividend-paying companies, which haven’t felt the need to open the door to future capital raising through potential dilution of their mutuality?

The only reason I would potentially even consider this tradeoff is if the Mutual Holding Company’s product performance was so much better than the top 2 True Mutual companies, and again, it’s NOT EVEN CLOSE!

Below we will explore what happened to policyholders when what were once major mutual companies either got absorbed by another major True Mutual Company vs. those that had IPOs listed on the New York Stock Exchange. We will also discuss what happened when Ohio National, the biggest and most popular Mutual Holding company, demutualized through a private sale to a Canadian Pension Fund.

Demutualization: The Exit From Mutuality Into a Full Stock Company

What is Demutualization with Insurance Companies?

Demutualization is a process whereby a Mutual Insurance Company or Mutual Holding Company converts its ownership from being wholly owned 100% by its participating policyholders into a Stock Company owned by stockholders, some of which may be the prior policyholders, but often with outside investors.

How Can Demutualization Affect the Participating Whole Life Policyholders?

This depends on which of the 2 paths that Demutualization can take when a True Mutual Company or Mutual Holding Company chooses to transform into a stock company and sell stock to outsiders to raise capital:

- Policyholders’ ownership interests are exchanged for cash (like Ohio National)

- Policyholders’ ownership interests are exchanged for stock (like Prudential)

Let’s take a look at the historical examples of 2 types of demutualizations:

Ohio National Policyholders Got a One-Time Cash Payment For Their Share of Equity in the Demutualized Insurance Company

Ohio National was the biggest and fastest-growing Mutual Holding Company of the last decade, which still sold participating Whole Life. They were extremely popular among Infinite Banking agents because of their abnormally high commission and renewal rates when agents chose to concentrate their business there, reaching high levels of production.

As I said earlier, I’ve never seen a Mutual Holding Company even close to outperforming one of their True Mutual Company peers, and Ohio was no exception, despite its popularity in the Infinite Banking community. I’m proud to say I never sold a single Ohio National Whole Life policy, and I was certainly relieved once I learned they were set to officially demutualize in 2022.

Apparently, they had pushed the envelope on certain annuity sales, offering customers unrealistic income guarantees for customers while also promising agents high commission & renewal rates. In 2018, they effectively stopped paying the agents their contractual trail commissions in hopes of meeting the promised income guarantees for clients without going insolvent. No such luck.

Unfortunately, the Whole Life policyholders got left holding the bag as they only collectively received a $500 million dollar cash payment for their ownership interest in a $40 billion dollar insurance company. Policyholders could take their share of the payment in cash or as a one-time Paid-Up Addition premium into their Ohio National Whole Life policy that would soon be named Augustar.

I’ve reviewed several of these new Augustar policies since, and none that I’ve seen pay any further dividends. Every policy I’ve seen is left to grow at the lower guaranteed rate. Since the policyholders received cash rather than stock, they no longer have an equity stake in the newly formed stock company, Augustar, nor the Canadian Pension Fund that bought them.

Ouch.

Prudential, Met Life & John Hancock Policyholders All Got Stock & Ongoing Policy Dividends

Conversely, in the course of doing business, I’ve reviewed several post-demutualization Whole Life policies from Prudential, Met Life, and John Hancock. They not only still received dividends, but also got stock for their share of the equity component. The Policyholders received shares of stock based on the amount of cash value and permanent death benefit their policies had, similar to how Whole Life dividends are calculated.

Demutualization became a sweeping trend between the late 1990s and early 2000s amongst these large Mutual Insurance Companies. Old Whole Life companies like Equitable, Manulife, Metropolitan Life, Mutual of New York, and Prudential were massive entities that had non-policyholder investors wanting a piece of the action, and Wall Street provided a gateway to these investments.

Most of the clients would have preferred to keep the high-performing Whole Life policy from a True Mutual company, like the one they originally signed up for, but at least they didn’t lose their equity component in the underlying insurance company.

So, even though the dividends on their old Whole Life policies were watered-down, Their newly acquired stock also paid dividends, as you can see by the little D’s seen in these Yahoo Finance charts. You can also see, by the steep rise in value after the IPO, acquiring an early piece of ownership in a solid mutual company can be a profitable venture.

Notice how at first the dividends were paid annually, just like the policy dividends were paid when these were both True Mutual companies. Eventually, the stock company began paying stock dividends quarterly to appease Wall Street and investors wanting their share of profits quicker.

Both of these charts are set on the “Max” timeframe, meaning the chart goes back to their initial public offering on the New York Stock Exchange, not to the beginning of their existence as a mutual company. Since both of these insurers have been around for over 100 years, you would expect these charts to go back much further than the early 2000s. That is because only their stock price history after demutualizing will show up on the chart, since only policyholders had ownership, not outside stockholders needing Wall Street to price their ownership Monday through Friday.

Mutual-to-Mutual Mergers

Both companies were True Mutuals, but Mass Mutual was five times bigger than Connecticut Mutual. They saw the efficiencies of scale created in a very competitive market by combining forces, and so the merger went into effect in 1996.

Connecticut Mutual’s policies remained completely intact, with Mass Mutual honoring all the original guaranteed schedules for every owner’s policy. In fact, each new policyholder even got a new pro rata share of ownership in the newer, bigger/stronger Mass Mutual. Their policies were the same as before, only they were now printed on Mass Mutual paper and received their dividend scale.

See what happened to a 1980 Mass Mutual 10-pay policy compared to high-yield savings accounts policy after dividend and interest rates spiked in the 1980s then trended downward for decades.

Mutual Holding Companies Can’t Easily Merge With a True Mutual

Not that Mass Mutual or any other of the True Mutual would’ve wanted to buyout the policyowners of a distressed Ohio National entity. However, even if Mass Mutual had wanted to absorb Ohio National, it would not have been easily possible due to Ohio’s Mutual Holding Company status.

You see, since the operating insurance company with a Mutual Holding Structure is technically a Stock. A True Mutual Company cannot merge with or absorb a Stock Insurance Company while preserving the membership rights of the policyholders within the Mutual Holding Company parent.

It’s legally impossible due to the True Mutual Company status. The moment that stock exists anywhere in the chain, the legal structure is incompatible with a pure mutual.

Stock ownership cannot be “merged” into mutual ownership without:

- eliminating the stock altogether

- buying out other shareholders of any of the subsidiaries (if any exist)

- conducting either a full demutualization or a re-conversion to a mutual

So, rather than full demutualization or being acquired by another stock company, this most favorable route of a Mutual Holding Company getting absorbed by a True Mutual Company is not even available due to its legal structure.

Bottom Line on Mutual Companies, Stock Companies, and Mutual Holding Companies

Historically, Mutual Companies have been more conservative than their Stock Company peers in terms of the levels of surplus they retain, the types of products they offer, and even their executive compensation.

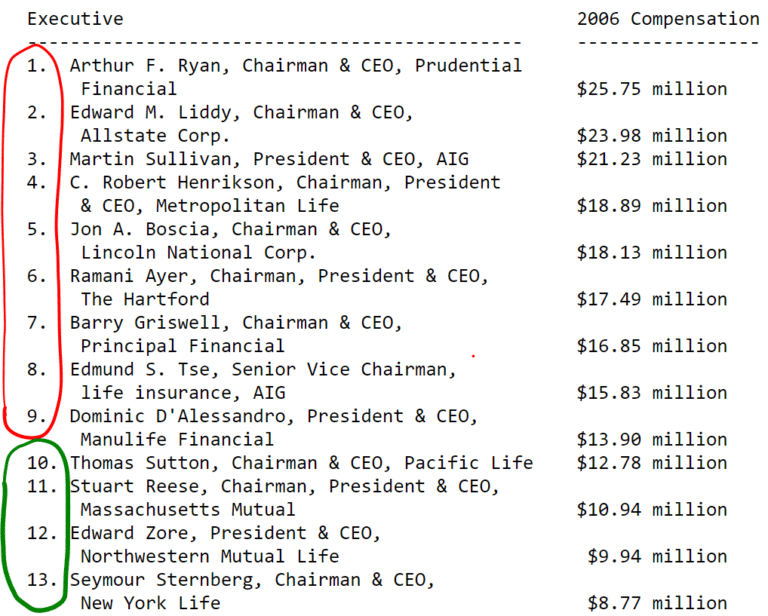

Take a look at this older compensation study from National Underwriter magazine comparing CEOs of Stock Companies vs. CEOs of Mutual Companies.

Notice how the top 9 on the list are from stock companies, while the next 4 are mutual companies, and the highest paid Mutual Company CEO was paid half of what the highest paid Stock Company CEO got.

Clearly, the more conservative approach to just about everything within a True Mutual Company’s business model lends well to those wanting the stability and guarantees of Whole Life insurance for retirement and/or Infinite Banking.

And although Mutual Holding Companies sell similar policies and are still 100% owned by their policyholders for now, no one can dispute that the MHC took the step of legally converting its operating business into a stock company.

To me personally, this is concerning and an unnecessary added risk I didn’t feel the need to take, especially since their performance is eclipsed by any of their True Mutual Company peers in an apples-to-apples comparison.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com