Max-Funded IUL: Safely Grow Tax-Free Cash Value

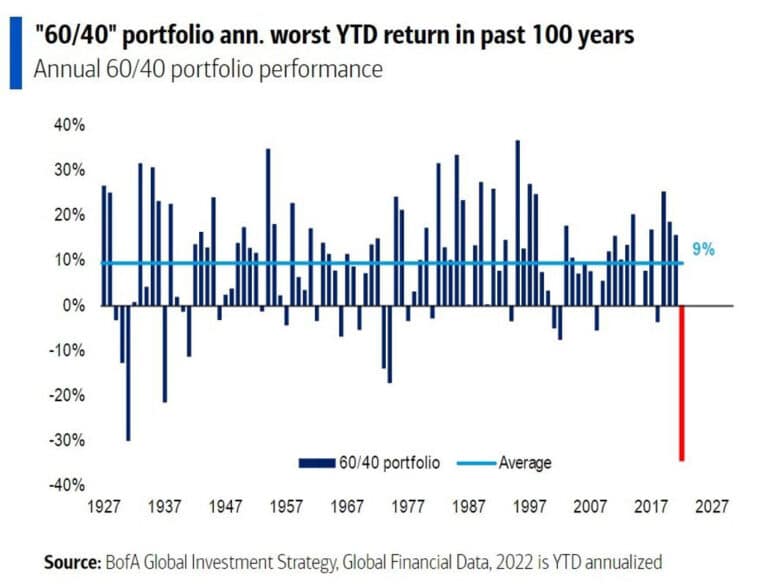

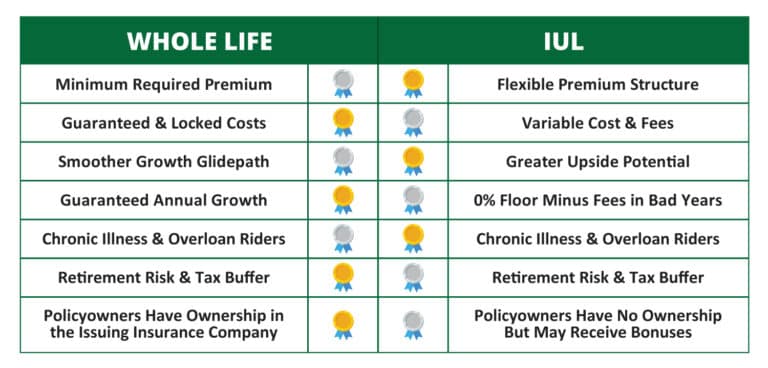

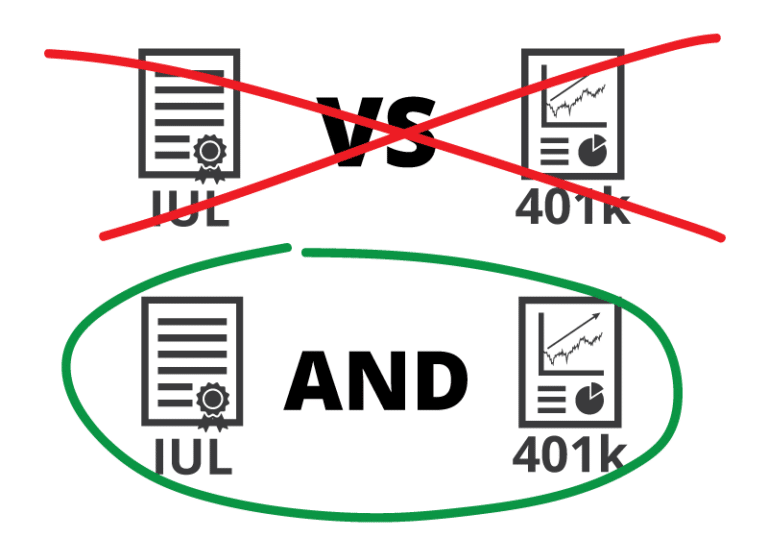

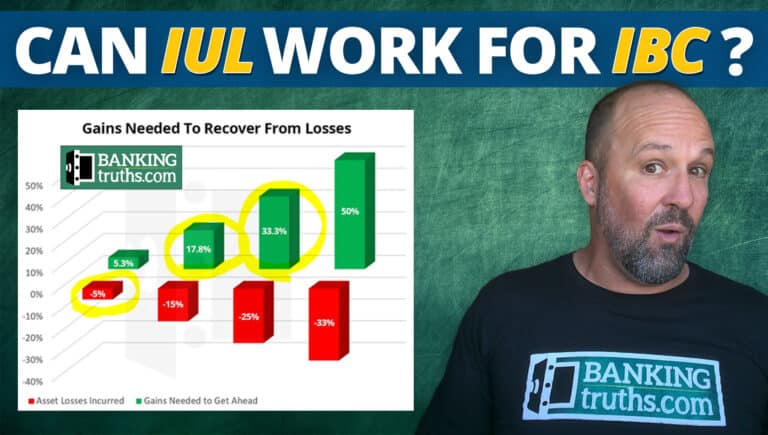

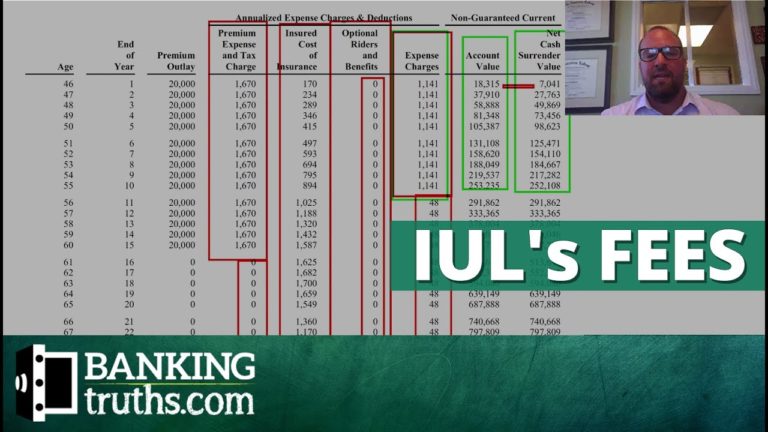

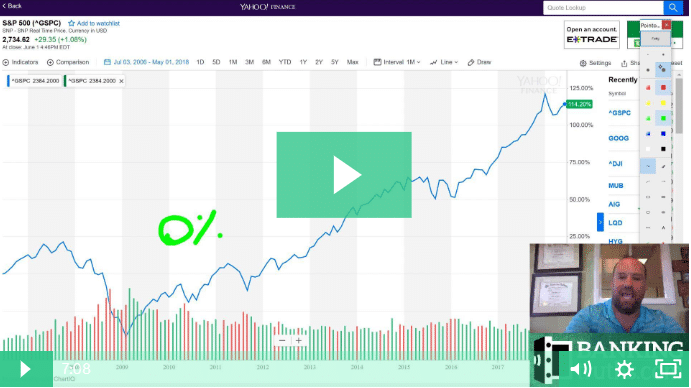

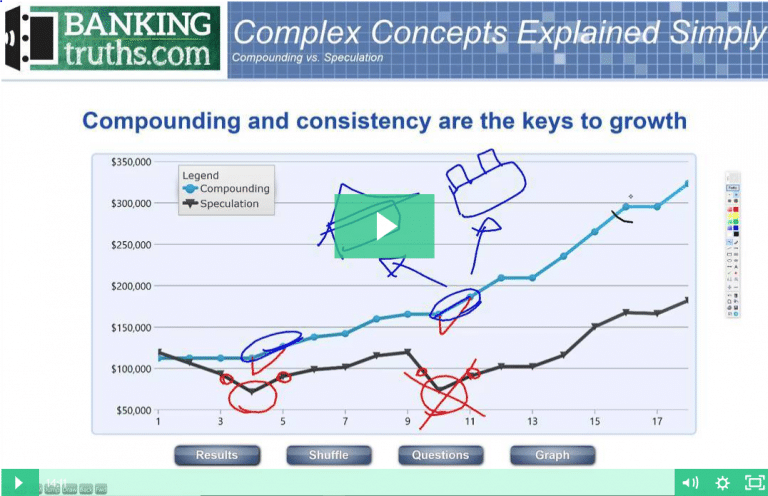

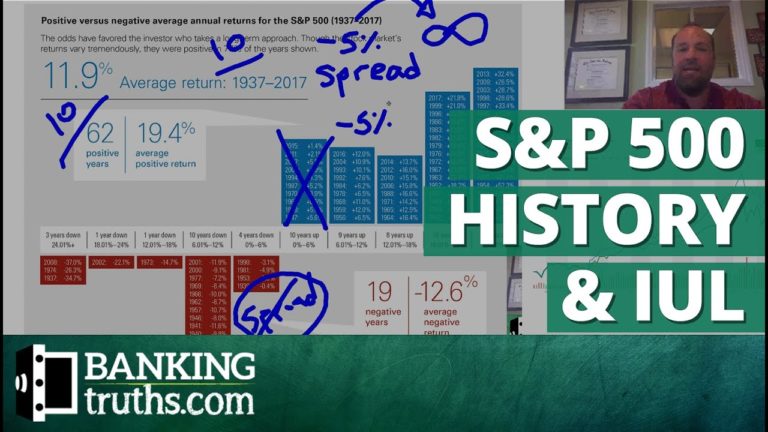

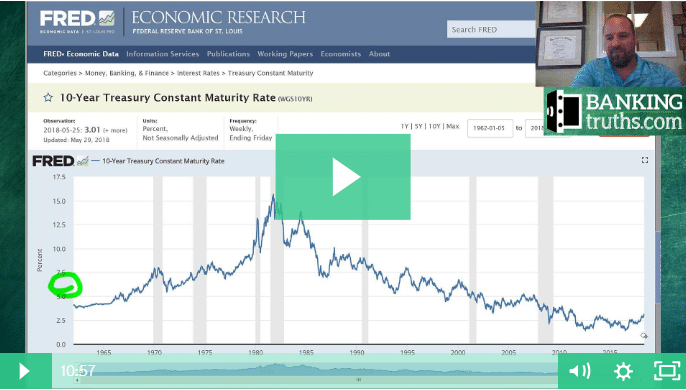

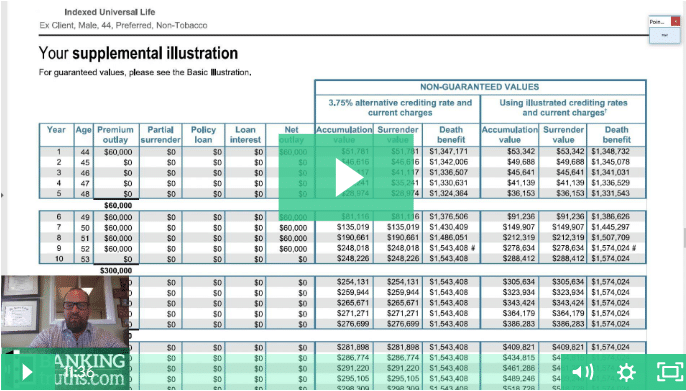

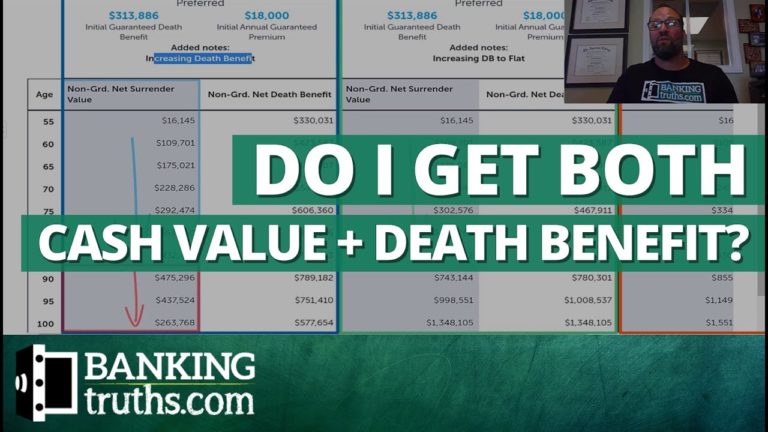

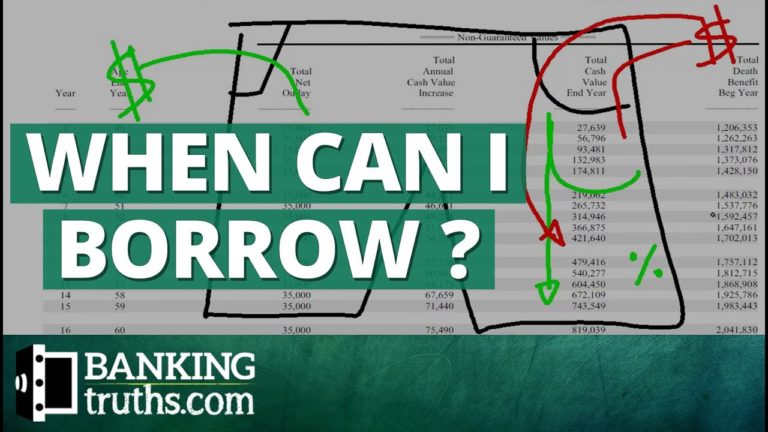

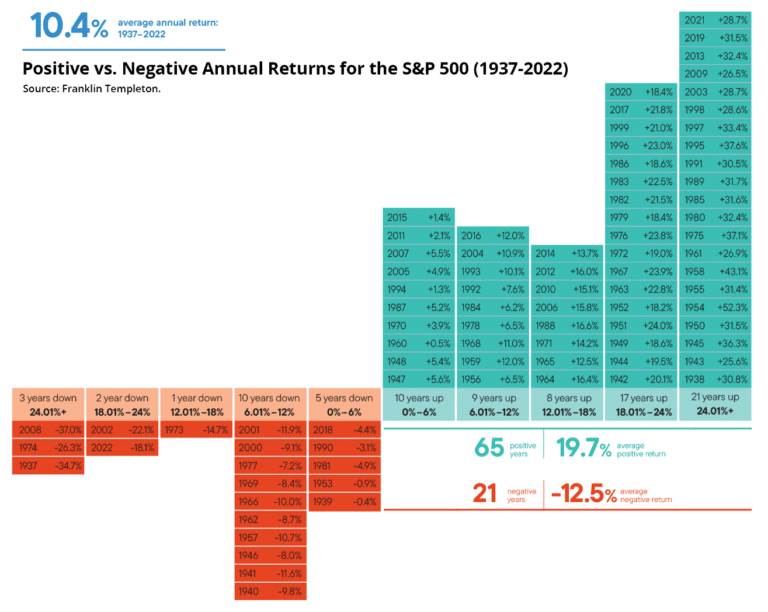

Safeguard your cash against market downturns, higher taxes, and future uncertainties with a Max-Funded Indexed Universal Life (IUL) policy. Discover how max-funded IUL minimizes costs, safely builds wealth for Infinite Banking, and offers buffered retirement income.