Penn Mutual Review: The Best Dividend-Paying Whole Life Policy & Why

Disclaimer: Which dividend-paying Whole Life policy may be best for you will vary depending on your particular age, occupation, hobbies, and health situation. We are NOT one-trick-ponies. Our main value proposition is that we perform extensive analysis and anonymous shopping among the best mutual life insurance companies to find our clients the best whole life insurance policy.

All that said…

In the vast majority of situations, we are finding that Penn Mutual’s “Guaranteed® Whole Life” product is outperforming every other mutual insurance company’s dividend-paying whole life policy, with room to be wrong and still win.

Here’s why:

The base policy of Penn Mutual’s Guaranteed® Whole Life policy is one of the leanest & meanest available.

Table of Contents

Top Whole Life Product For IBC Gets Even Better

How Efficient is Penn Mutual's Base Whole Life Policy?

The underlying performance and cost efficiency of the base Whole Life policy matters a lot, even if you are bolting on term riders and PUA riders so you can overfund.

The cost structure of your base Whole Life (and all future paid-up additions) will depend on the following factors:

- Your age

- Your health rating

- How much coverage you want

- The company’s baked-in cost structure

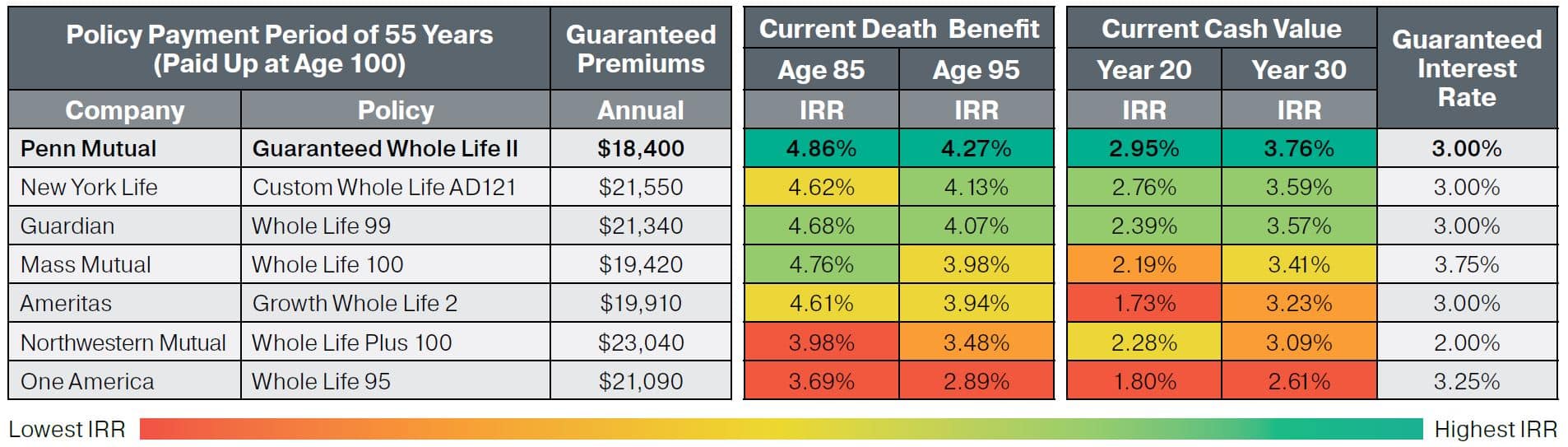

You can see below how the cost of the exact same $1,000,000 base policy on a 45-year-old Preferred Male varies between $18,400 – $21,090 depending on the insurance company. Furthermore, the internal rate of return (IRR) of just the base premium also has a wide range of variance between the major mutual companies as well as some mutual holding companies.

Keep in mind that this is only for a pure base whole life insurance policy without any term insurance rider or paid up additions rider (PUA) to streamline costs or enhance performance. But this is important because the efficiency of a Whole Life company’s base premium is usually indicative of how potent their Paid-Up Additions are, since PUAs are often just mini over-funded versions of the base.

You can see clearly that Penn Mutual’s Guaranteed® Whole Life base policy has one of the lowest premiums cost of the group, as well as the strongest IRR for long-term performance of their cash value and death benefit.

The underlying actuarial efficiency of Penn Mutual’s Guaranteed® Whole Life insurance policy is so important since it accounts for a significant portion of your total premium allocation. Remember that underneath any cost-cutting or performance-enhancing riders, your Whole Life base policy at the core should be able to stand on its own 2 feet.

How Penn Mutual Compares With An Over-Funded 10-Pay.

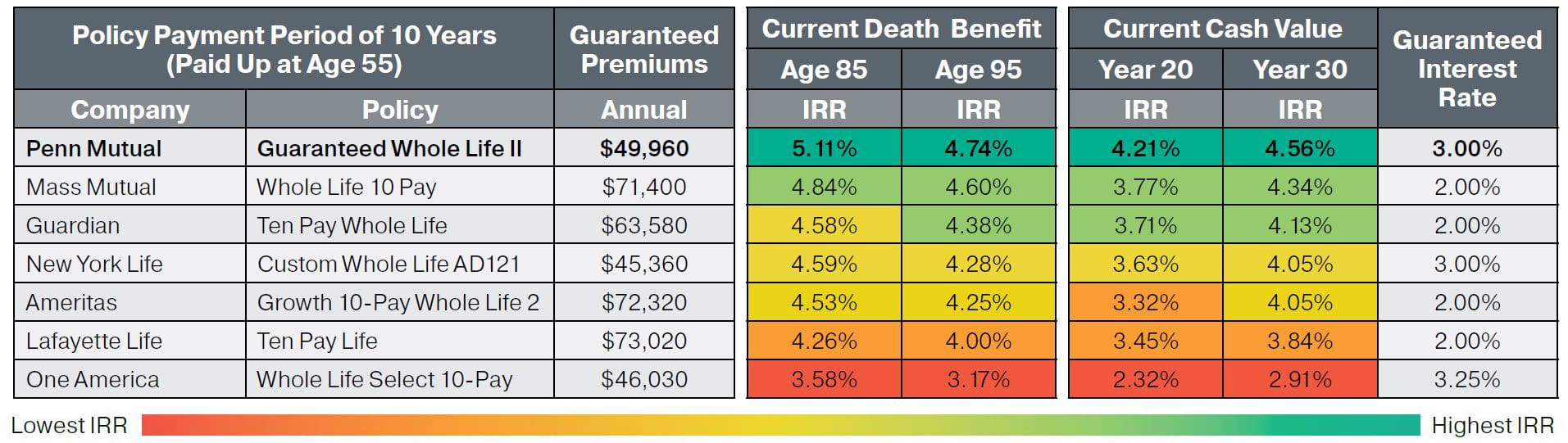

When looking at the following examples comparing the best whole life companies, keep in mind these 3 things:

- Actual results will vary for each company depending on your particular age, health, and premium structure, but we’ve found Penn to consistently illustrate much better than their competitors in almost all cases.

- This example below assumes ten maximum-funded premium payments (we can often create further efficiency by designing a 7-pay or 8-pay policy).

- This whole life cash value chart is assuming today’s low dividend rate for perpetuity (watch an example of an actual historical dividend-paying whole life policy from 1980 as rates rise and fall over the years).

Even when over-funding these whole life policies, you can see that Penn Mutual’s Guaranteed® Whole Life policy requires less total premium yet still produces a superior IRR than other competing dividend-paying whole life insurance policies. This is because the majority of these premiums are going towards purchasing paid up additions. As I fully explain in our detailed article about PUAs, paid up additions are like little mini whole life policies all paid up in one shot with a single premium and stacked onto your base whole life policy.

Since you saw that Penn’s Guaranteed® Whole Life policy has the best performance for a relatively low premium on its base whole life policy, it’s no surprise that the paid up additions have a similar actuarial structure.

Penn Mutual's Flexible (PUA) Paid Up Additions Rider

One attractive feature about Penn Mutual’s Paid Up Additions Riders is they are fully underwritten at the onset of the policy, giving you a range of flexibility and a long runway.

Many Whole Life companies have a “use it or lose it” PUA payment policy. If you don’t max-fund your policy right away or you can’t once every 3-years, you get shut out from doing future paid-up additions.

Some companies only required you to pay $100 per year into your PUA rider to keep it open. However, things happen and people forget. On my own mother’s Whole Life policy, there was confusion since the base premium was in bold. Her extra $100 wasn’t sent in that year, and just like that she lost her right to overfund for good.

With Penn Mutual’s paid-up additions rider, you only need to heavily fund it once every 5-years to keep your PUA rider fully available so you can continue to max-fund at any time during the next 5-year window. And by “heavily fund it once every 5-years”, you don’t even need to do the maximum. With Penn you only need to pay HALF of whatever your maximum PUA payment is once every 5 years to keep your option open to pay the maximum for the following 5-years.

This “half-every-5-years” flexibility window gives you time to ride out most cycles and keep your full PUA window open and available.

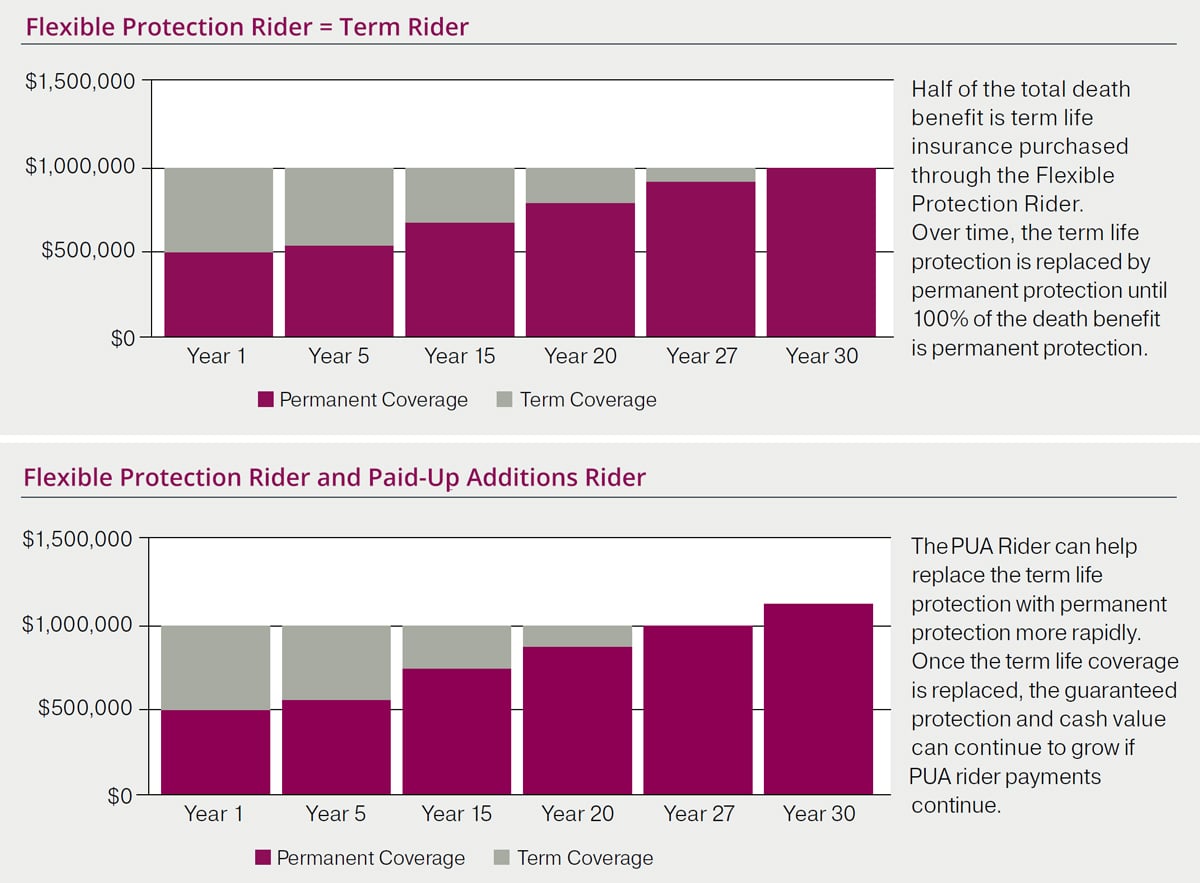

As with most carriers, Penn has a term rider (called the Flexible Protection Rider) that allows you to keep your Whole Life cost structure low so you can put the majority of your total premium towards paid up additions.

They offer both a level term rider and increasing term rider depending on how long you’d ideally like to over-fund your policy.

As you can see from the two graphs below, the more PUAs you pay into your policy, the quicker the term rider is replaced by purely paid up whole life insurance (which also increases your overall cash value performance as well as your cut of future dividend pools.

Keep in mind, this graphic is not displaying ultra-aggressive over-funding like we recommend. Oftentimes, our clients will completely replace their term-rider with paid-up additions by the 4th or 5th year with a max-funded infinite banking policy the way we design them.

To better understand how whole life works with the different riders for optimal performance, check out our very popular video complete with examples of optimally designed dividend paying whole life insurance.

Penn Mutual's "Overloan Protection Rider" Can Keep Loans From Lapsing Your Policy.

Let’s say that during retirement you take recurring tax-exempt policy loans that you have no intention of repaying. With many other whole life policies, you have to constantly manage your loan to cash value situation and possibly even make payments throughout old age to keep your policy from lapsing.

Otherwise you may get stuck with a huge tax bill when you can afford it the least!

Penn Mutual’s Overloan Protection Rider solves that common issue when using whole life for retirement assuming the following 3 things:

- You are at least 75 years old when the policy is set to lapse from excessive loans

- Your Penn Mutual Guaranteed® Whole Life policy has been in-force for at least 15 years

- Your total policy loan equals 99% of your whole life cash value

When all 3 of these things happen, Penn Mutual’s Overloan Protection Rider will automatically freeze that remaining 1% of non-loaned cash value to preserve a minimal amount of whole life insurance for your heirs. Doing so ensures the tax-exempt status of all your prior lifetime distributions (policy loans or withdrawals) so your whole life policy stays in force preserving the tax sanctuary throughout your golden years.

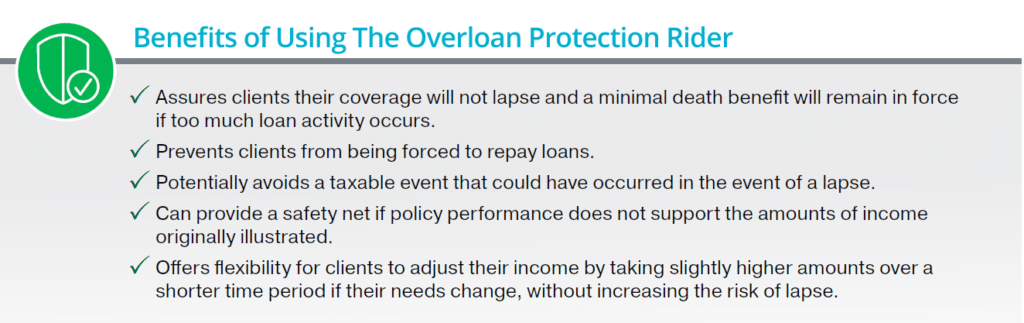

Here are the benefits of this unique whole life insurance rider according to Penn Mutual:

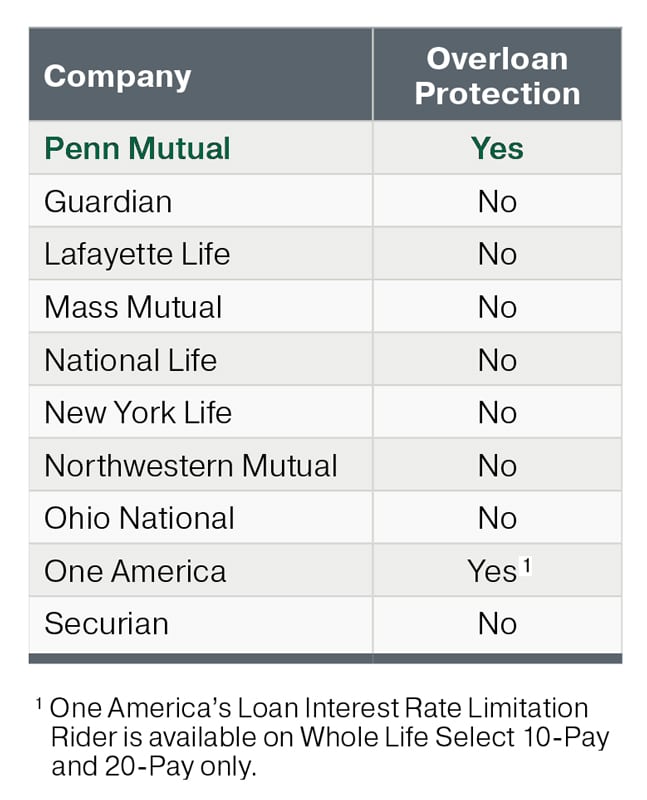

When looking at all the other whole life companies that offer dividend-paying whole life insurance, only two companies offer this sort of protection against excessive loans when using whole life for retirement. Even then, Penn Mutual is the only company that offers it when also applying a term insurance rider in conjunction with a paid up additions rider (PUA). The other mutual holding company offers it only on their 20-pay or 10-pay whole life product, which obviously will have much less premium flexibility.

On a different note regarding loans, perhaps the only thing that someone could fault Penn Mutual with is the fact that they are a direct recognition company. This means that whatever portion of your cash value has a policy loan against it will receive either a higher or lower dividend than the portion of your cash value without a loan.

On the surface, this sounds like a bad thing, especially if you are looking for the best whole life policy for infinite banking. However, in a rising interest rate environment, direct recognition loans may be more beneficial than non-direct recognition loans.

Regardless, we often find that the superior policy performance of Penn Mutual’s Guaranteed® Whole Life usually still outperforms its best non-direct recognition peers, even when substantial loans are illustrated through the life of the policy using today’s low dividend rates.

Penn Mutual's Chronic Illness Rider

Although most of our clients are adding whole life insurance to their financial arsenal primarily for cash value growth, private banking loans, and future tax-exempt retirement distributions, many of them overlook or underestimate this value of living benefits on a hybrid life insurance policy.

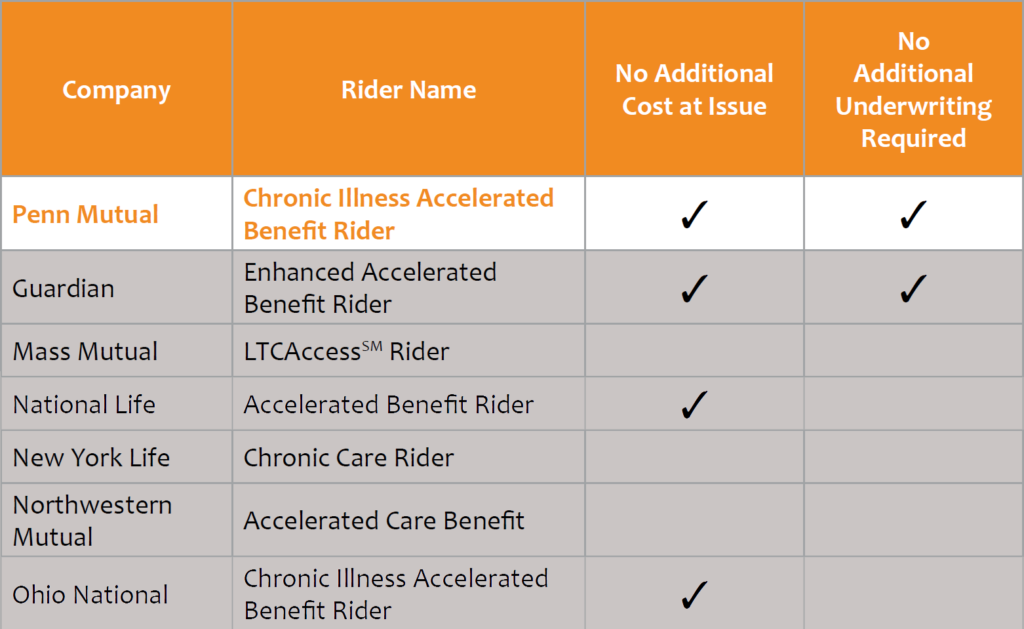

Many of the other best whole life insurance only offer living benefits or a chronic illness rider for an additional charge on their dividend paying whole life insurance policy. Penn Mutual’s Chronic Illness Accelerated Benefit Rider can be added at issue onto their Guaranteed® Whole Life policy for no additional charge and with no additional underwriting.

How do these living benefits work with the chronic illness rider on Penn's hybrid life insurance policy?

Penn’s chronic illness rider allows you to access a portion of your death benefit (over and above your cash value) each year for an amount not to exceed the lesser of:

- 24% of your death benefit (including your base whole life policy, any term insurance riders, and paid up additions)

- $240,000

- The current year IRS per diem amount for long term care ($420/day or $153,300/year as of 2023)

(Note: The ability, limits, and conditions to the receipt of a tax-free portion of the death benefit are described in more detail in Internal Revenue Section 101(g). Qualifying distributions are not deemed to be taxable since they are an acceleration of a tax-free death benefit.)

How do you qualify for this acceleration of your death benefit even though you're not dead?

Essentially Penn Mutual’s Chronic Illness Benefit Access Rider can be triggered one of two ways, which happen to be very similar to the two triggers for a traditional long term care policy:

- Inability to complete at least 2 Activities of Daily Living (ADLs are bathing, dressing, eating, transferring, toileting, and continence)

- The insured has a severe cognitive impairment that requires substantial supervision by another person to protect the insured from threats to health and safety for a period of at least 90 consecutive days.

The major difference between Penn Mutual’s chronic illness rider vs. a long term care policy is the fact that these triggers can be for a temporary situation with long term care, whereas with Penn’s living benefits these triggers must be deemed to be the onset of a permanent condition according to a medical practitioner unrelated to the insured.

Also, every year you want another acceleration, the insured must be re-certified by a medical professional.

Keep in mind too that the acceleration is really just a very favorable lien against your death benefit. Here the amount of the loan is not limited by how much cash value you have as collateral because the whole life insurance companies were expecting to pay your death benefit at life expectancy.

However, these early accelerations do accrue at interest against that future receivable. That said the lien accrues at Moody’s Corporate Bond Index (4.38% as of April 10th, 2022).

At least this is a very fair and favorable present value advance, especially if you’re in bad shape, you can’t work, and really need the money.

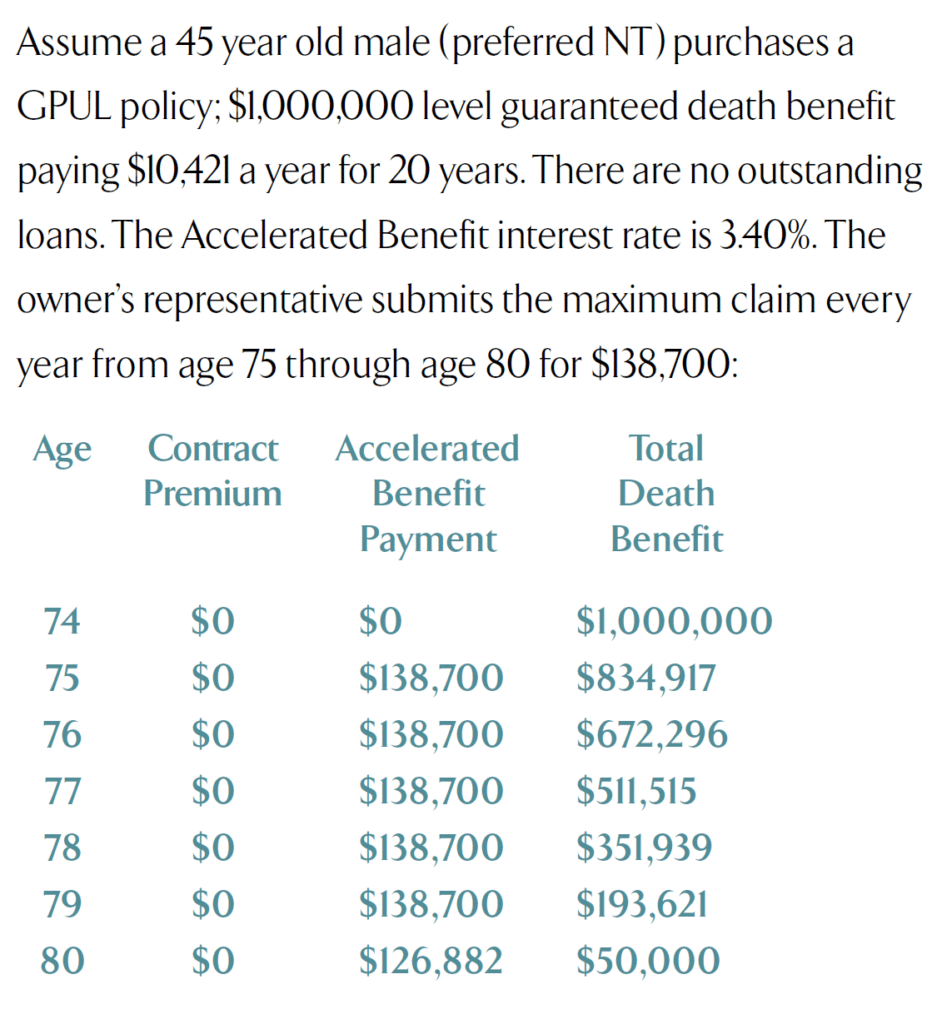

Below is a generic example from Penn Mutual on a different product that is pure death benefit with no cash value at the time of acceleration. Remember, the exact amount you would receive during lifetime and at death is a totally dynamic figure and will depend on your age at issue, age of claim, health, death benefit, cash value, policy performance, and so on.

Keep in mind that this is an ultra-simplified example using a death benefit only product to show how Penn Mutual’s chronic illness rider allows you to accelerate the death benefit for living benefits.

5 Compelling Facts about Penn Mutual as a Company

- Established in 1847, Penn Mutual is the second oldest American mutual life insurance company behind New York Life.

- Just because Penn is one of the oldest dividend-paying whole life company, they are an industry leader in technology with their new ACE-underwriting software. Most people can apply for up to $5,000,000 of whole life insurance and even term life insurance (fully convertible to their best whole life policy). Although Penn Mutual reserves the right to resort to traditional underwriting, oftentimes we are seeing EXAMs waived and policies issued within a week by this new ACE system which leverages technology to get necessary underwriting data.

- Penn Mutual has a significantly higher 5-year average yield on their investment yield. Unlike other whole life companies, Penn Mutual has no mortgage-backed securities on its balance sheet. Penn instead has made some very savvy investments into tech venture capital having profited handsomely in the company “Ring” as well as turning a $100,000 early investment in Snapchat into a $40,000,000 windfall for their balance sheet.

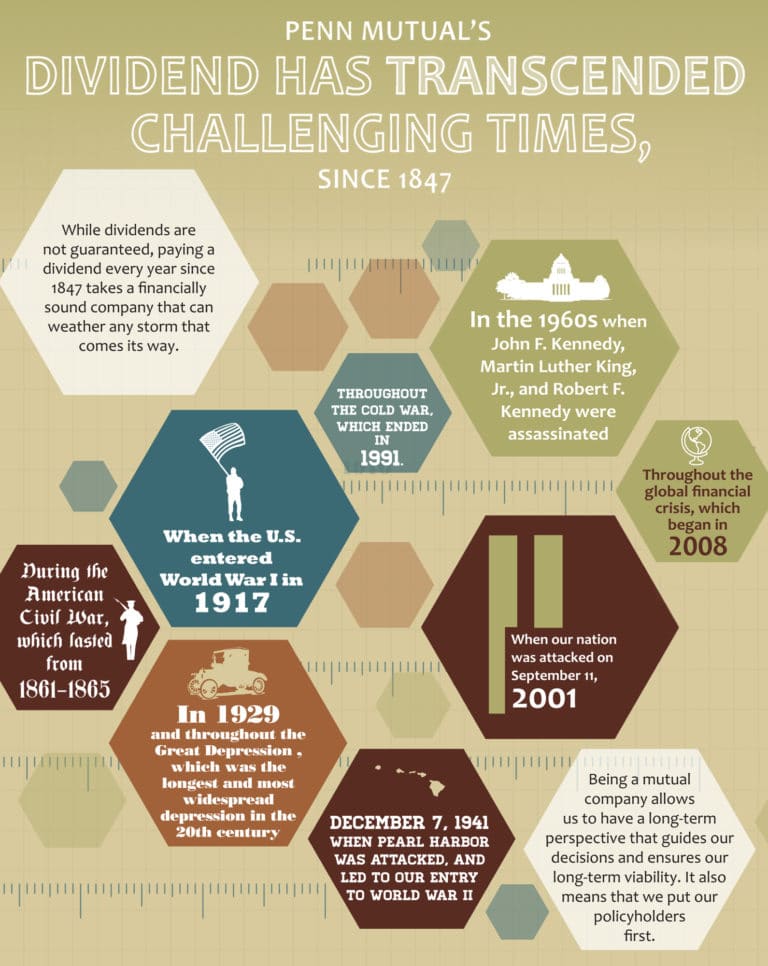

- Penn Mutual maintains one the biggest percentage of surplus assets on their balance sheet compared to other dividend paying whole life companies (Surplus was 14.7% of General Account Assets as of January 2019). A healthy surplus is incredibly important during low-yield environments so they can continue providing healthy dividends to whole life policyholders without disrupting fluid operations. Penn Mutual has paid a dividend to whole life policyholders for 173 years straight since its inception in 1847.

- Because of Penn Mutual’s superior yield on its portfolio and healthy surplus, they were able to maintain their dividend scale for 10 straight years after 2008 where all other dividend paying whole life insurance companies lowered theirs. Only recently in 2019 did Penn lower their dividend scale from the continuing pressure of low-interest rates, but they’re still leaps and bounds ahead of other whole life insurance companies as you can see in this dividend history chart:

As you can see, Penn Mutual had one of the more competitive dividend histories before 2008 and without a doubt the most competitive dividend whole life policy since. Below is an example of how powerful such a consistent dividend history can be.

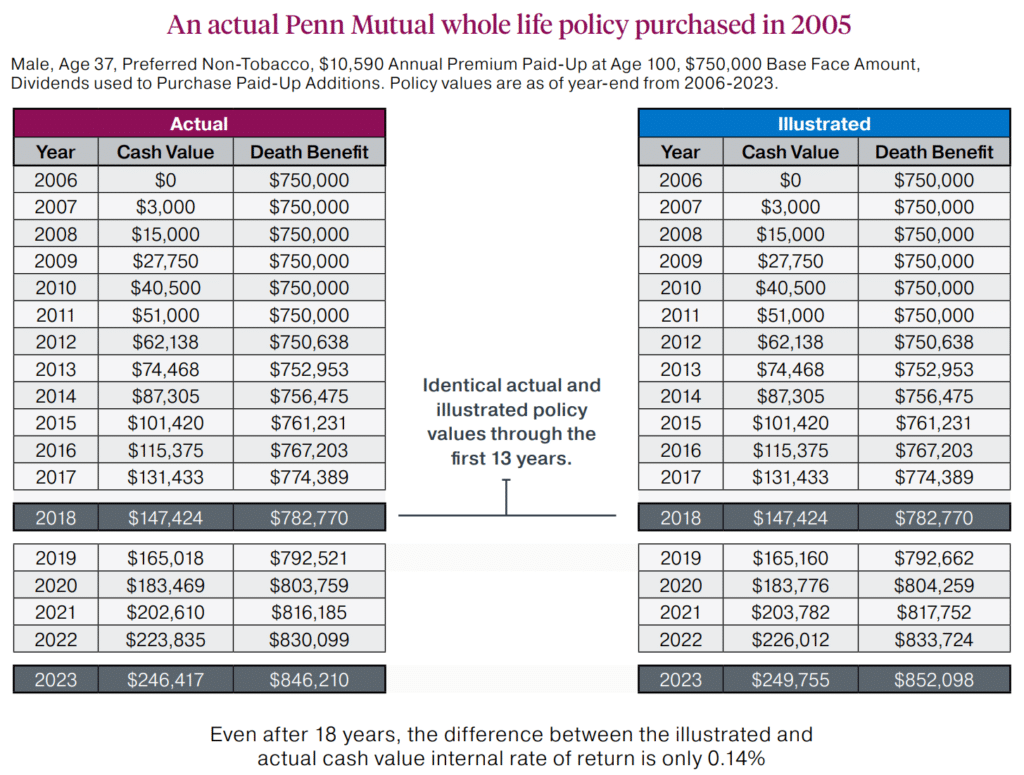

On the left in red shows how Penn Mutual’s actual whole life policy performed, and on the right in gray shows how it was originally illustrated 14 years prior on a whole life cash value calculator. You can see in these two whole life cash value charts that they are identical from 2006 to 2018. Only in 2019 is there a slight divergence due to a decreased dividend. Although this is a pure base policy and therefore not designed optimally for cash value, you can see the divergence widens in 2020, it is a relatively small percentage of the total cash value.

Now What???

If you’re looking for the absolute best whole life insurance policy on the market, built lean and mean the very first time with the optimal blend of riders for maximum cash value performance, then look no further. Penn Mutual’s long-term commitment to policyholder value is obvious, and we’ll show you how to make the most of it with policy design and how to seamlessly integrate the best dividend paying whole life insurance policy into your other wealth-building efforts.

- Whether you send us over a competitor’s illustration you’re looking at to compare the exact same numbers through Penn’s cash value calculator,

- Or we jump on a web-conference together and build you the best dividend paying whole life policy from scratch while answering any questions and filling in any gaps in your learning.

We assure you a worthwhile experience with no pressure, no hard pitches, and no games. You’ll see the absolute best from the very start. We don’t have time for games either.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com