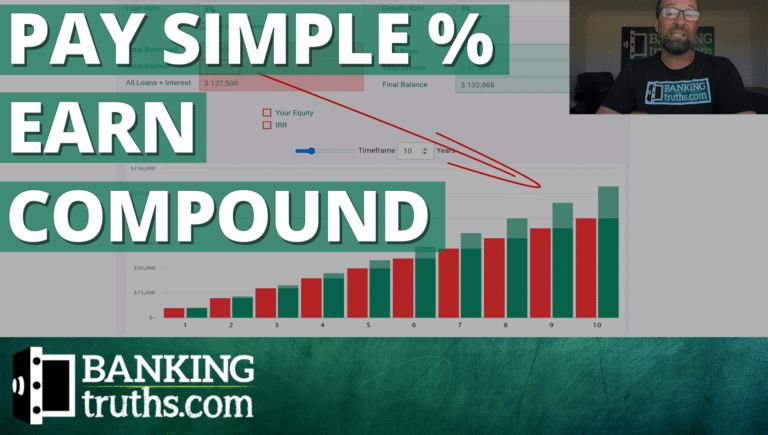

5 Reasons Borrowing May Be Better Than Paying Cash

“Why do I have to borrow my own money from life insurance?” You don’t actually! This article explores this age-old question and lays out why borrowing against WL beats paying cash even if there were no positive arbitrage.