What is 4-D Banking?

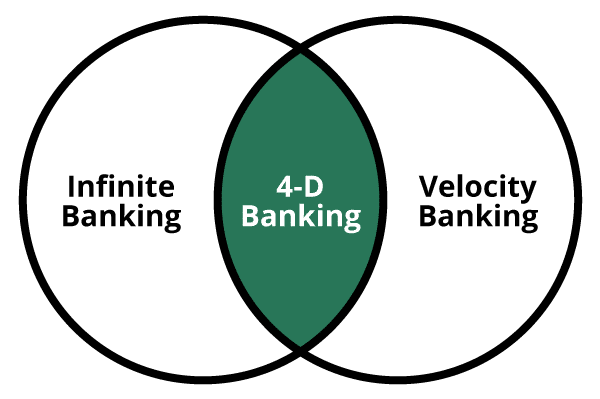

4-D Banking is the ultimate privatized banking and cash flow management system that combines the best aspects of both Velocity Banking and Infinite Banking.

The 4-D Banking System is a multidimensional approach to wealth building. It aims to take full advantage of time, the 4th dimension, and its steepening effect on your compound interest curve. You only get one compound curve over your lifetime, so as Warren Buffett’s co-founder said:

“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger.

The wealthy have been practicing the “Buy, Borrow, Die” strategy for eons to maximize compounding and minimize taxes.

By being able to collateralize and borrow against multiple dimensions of compounding assets for future liquidity needs, your asset base does NOT lose its place in line on your compound curve. Each account type ideally supports the others from having to liquidate and kill compounding, even under extreme conditions.

Table of Contents

At Banking Truths, we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Learn in the context of your model

- Never any pressure or hard pitches

What's the Difference Between Velocity Banking?

Velocity Banking is a strategy using a home equity line of credit (HELOC) to reduce the total amount of interest you pay on mortgages and credit cards, whereas Infinite Banking is a strategy of borrowing against the continuously compounding cash value of Whole Life insurance to enhance your wealth-building efforts.

Limitations of Velocity Banking

The major limitation of Velocity Banking is its sole focus on paying off debt, which can only be paid down to zero.

Then what?

Why wouldn’t you apply this ultra-efficient discipline and cash flow management tactic to wealth-building as well?

Also, because compound interest gets steeper over time, it may make more sense to start stacking cash-flowing assets once all bad debt is either paid or transferred, even while still carrying certain low-interest and/or deductible loan balances.

Limitations of Infinite Banking

The major drawback of Infinite Banking is its hyper-focus on Whole Life insurance. Yes, Whole Life is undoubtedly the most solid foundational asset for privatized banking, but the zealots of IBC will tell you it won’t work with other assets or even other types of insurance policies, for that matter.

Needless to say, this stance may be self-serving if your sole occupation is an insurance agent.

Think about it, though: If borrowing against a life insurance policy is ideal for wealth-building, then why wouldn’t we apply that same thinking to other asset classes you can borrow against? Especially if adding in other assets and loan types makes the system more efficient, and an Infinite Banking Whole Life policy can help mitigate the risks of these more volatile assets?

Why The "Debt-Free-Dream" is Dead

Some of you hear the word borrow and see red. We’ve sold countless life insurance policies to people thinking they’re interested in Infinite Banking, but when we check in with them on policy reviews, the new policy is added to their collection of single-use assets because they can’t bring themself to borrow.

Here’s the deal…

The “debt-free-dream” that the Dave Ramsey-ites fantasize about has been an outright lie from the very start.

You can also listen to Hutch’s 30-minute rant about shifting your mentality around debt/borrowing here on Apple Podcasts, Spotify, or YouTube.

Below are the 3 major reasons why the debt-free-dream is an outright lie:

1) Cash is Debt:

Cash is simply an issuance of government debt: The paper you’re hoarding is no longer backed by gold but by “the full faith and credit of the US Government.” How’s their credit rating? Getting worse. How would you rate your faith in them as they keep printing into oblivion, diluting the value of your dollars?

Guess what? UsDebtClock.org has even calculated your share of their debt, and I’ll bet your stockpile of cash isn’t keeping up with it.

So much for being debt-free!

The 4-D Banking system looks at cash as simply a fungible medium of exchange. Keep cash constantly in motion between assets and liabilities, not as a store of value. If you had $100,000 in an FDIC-insured account since 2021, it now only spends like $70,000, still circling the drain.

2) You Have a Lien Against Your 401(k):

If you have $1,000,000 in your 401k, it’s not all yours, not even close. You owe the government a healthy portion of that Milly, my friend. How much, you ask?

Well, when you go to pull it out, Congress will decide how much they need. That promise of “tax-deferred growth”, and that lure of “pre-tax dollars” is damn good marketing and sounds oh so much better than the truth.

The truth is, you could’ve had the taxes taken right out of your check and kept the rest to invest.

But instead, you took a perpetual floating rate loan from the government.

Not only that, but you locked up 2-3 times the original tax in an escrow account until you’re age 59.5!

Worse yet, the government, who will eventually decide how much you owe them, has the financials of a bankrupt wastrel with a bleeding heart.

3) The Stocks You Applaud Have Billions in Debt:

Even the most celebrated American stocks carry hundreds of billions of dollars in debt, yet you still invest in them directly or inside the sacred index funds.

Check out these filings from September 2024:

- Apple had $109 billion total debt & cash equivalents of only $55.5 billion

- Coca-Cola had $47.1 billion total debt & cash equivalents of only $18.1 billion

- Berkshire Hathaway had $124.8 billion total debt & a whoppin’ $325 Billion in cash

Are Apple and Coke bad companies?

Is Warren Buffett, the biggest shark in the tank, some kind of degenerate?

Why doesn’t he just pay off the $124.8 billion from Berkshire’s massive cash pile so they can be “debt free”? 🤗

All of these companies transformed their attitude about the true cost of money with a corporate finance concept popularized in the 1990s called “Economic Value Added” (more on that in the next section).

The truth is that Warren has been carrying manageable debt and is temporarily hoarding cash so he can opportunistically buy gobs of cash-flowing assets at a deep discount during the next correction.

4-D Banking may be a way for you to do a scale model of the same.

"You Finance Everything You Buy" (Even When Paying in Cash)

This truth bomb hit me like a lightning bolt after first reading one particular sentence in Becoming Your Own Banker: Unlock The Infinite Banking Concept:

“The very first principle that must be understood is that you finance everything that you buy – you either pay interest to someone else or you give up interest you could’ve earned otherwise.” – Nelson Nash

Think about that for a second, even though being “out of debt” and paying cash for everything may feel good, there’s always a cost. It’s either an overt cost in the form of a stated loan interest rate or the hidden opportunity cost on your own liquid capital once you remove it from your accounts and transfer the compounding to someone else.

In fact, it was that corporate finance concept (EVA) we discussed above that planted the seeds of Nelson Nash’s Infinite Banking Concept, as he shares in Chapter 6 of his book:

“Before being introduced to EVA, corporations were borrowing capital from banks and paying interest—but they were treating their own capital (equity) as if it had no cost! When they were brought face-to-face with the error of their ways and conducted their business with this fact included in the equation, then the profitability increased dramatically. EVA’s basic premise is—if you know what’s really happening, you’ll know what to do. The same thing applies to The Infinite Banking Concept.” – Nelson Nash

These corporate managers were no longer able to be complacent with corporate cash and lazy practices simply because “that’s the way we’ve always done things.”

EVA was the new way! And now you know it too.

By applying a cost of capital to every dollar, whether it came from debt or retained earnings, companies like Coca-Cola, AT&T, and CSX Railroads started making better decisions and boosting shareholder value.

One of EVA’s originators considered this cost of money measurement almost like par for a golfer. With EVA as the lens, managers could see which initiatives they were consistently making bogey or worse and which activities were yielding them birdies or better.

In his book, Nelson Nash suggested that the tax-exempt risk-free rate of return inside a properly structured Whole Life policy provided that perfect measurement of EVA’s par for households.

You shouldn’t be accepting less than Whole Life’s guaranteed growth (or cutting into compounding by paying tax annually on your growth). And if you are going to go for higher returns, then borrow against your continuously compounding cash value, but replenish the policy with some of the spoils as there’s a cost to that money.

Applying this big institutional thinking to the cash flow funneling throughout your entire 4-D Banking system can help you make better ongoing decisions, and we can help you measure it.

Why Practice 4-D Banking?

Now more than ever over the last 50 years, our wealth is slowly being siphoned away from us:

- silently through inflation,

- and overtly through taxation.

The root cause of both is reckless governmental spending and money manipulation…ehm…I mean money creation by central bankers.

Financial markets will play along with these shenanigans for years, sometimes even decades, before the cracks in the facade become too fractured. Then volatility erupts, and markets crash violently!

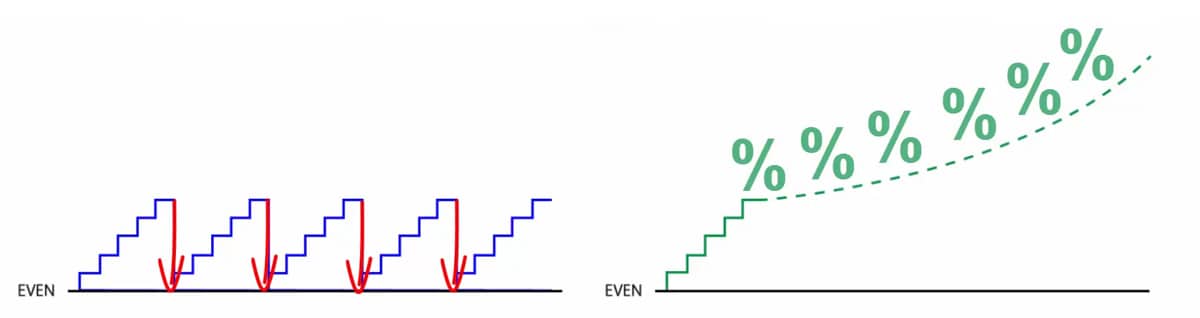

One of my favorite sayings about investing is:

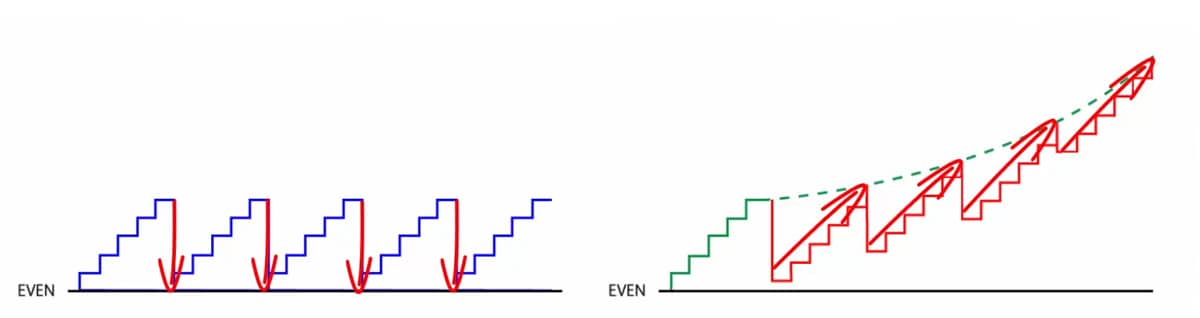

“Stocks take the stairs on their way up, but use the elevator on their way down (or sometimes even the window).

Market corrections brew slowly, then ignite suddenly as everybody piles towards the exit at once, clamoring for liquidity.

4-D Banking seeks to take advantage of market corrections for the rare generational buying opportunities they are by having stable assets (some truly principle-protected) waiting on deck to deploy their liquidity (without killing their compounding).

By combining the practices of Infinite Banking along with the cash flow management tactics of Velocity Banking, market corrections present the ideal opportunity to acquire cash-flowing assets at a deep discount and using the cash flow to service the loans until they again appreciate.

The 4-D Banking system is designed to be a consolidated defense against all of these major wealth-eroding factors:

- Inflation

- Taxation

- Market Corrections

- Personal Tribulations

Since 4-D Banking has life insurance as its ultimate backstop, there are natural protections against the ultimate personal deal-breakers that will completely derail your family’s financial plans, such as premature death, disability, and potentially even lawsuits.

The 4 Distinct Asset Classes Used in 4-D Banking

Keeping 4 diverse asset classes compounding simultaneously can help you also help you bolster your offense while providing the defensive protection discussed above. The 4-D Banking system expands upon the Infinite Banking system by having a network of different asset classes beyond just a life insurance policy to bolster your own private banking system. The four distinct asset classes of a 4-D Banking system should include all the following to be complete:

Life Insurance Cash Value:

Don’t do what banks say…Do what they do! Park your safe & liquid reserves in max-funded insurance policies for enhanced growth and tax-immunity for life, while simultaneously protecting against premature death/disability/lawsuits.

Whole Life insurance is the ultimate foundational asset for 4-D Banking since it’s guaranteed to grow every year no matter what, and the fact that you can borrow against 95% of your cash value at any time for any reason. Having this rock as your foundation allows you to make other moves with this as your backstop, knowing your liquid capital keeps compounding in the background, immune from market risk and taxation.

Contrary to what IBC purists say, Indexed Universal Life can functionally work for Infinite Banking. Yes, it does pose slightly more risk, since IUL doesn’t have a guaranteed cost structure, but these costs can be mitigated through proper design. As you would expect, IUL then gives you greater exposure to upside potential since you get to track the S&P 500 with a cap and a 0% protective floor during the worst market downturns.

Learn the difference between Whole Life & Indexed Universal Life in our in-depth article.

Stocks, ETFs, & Options:

Over time, stocks and ETFs promise the best opportunity for long-term compounding on liquid assets, which equates to a much bigger 4-D Banking system in the future. Not only that, but over time certain margin loans have often been the cheapest money you can access, and you can even deduct the loan on your taxes as investment interest. There’s no credit reporting for your broker’s built-in low-cost margin loan as your primary line of credit, it’s simply a function of equity.

Hearing the words “loan” or “margin” in relation to your diversified portfolio often causes people to get nervous, and rightfully so because in any given year the stock market can swing violently.

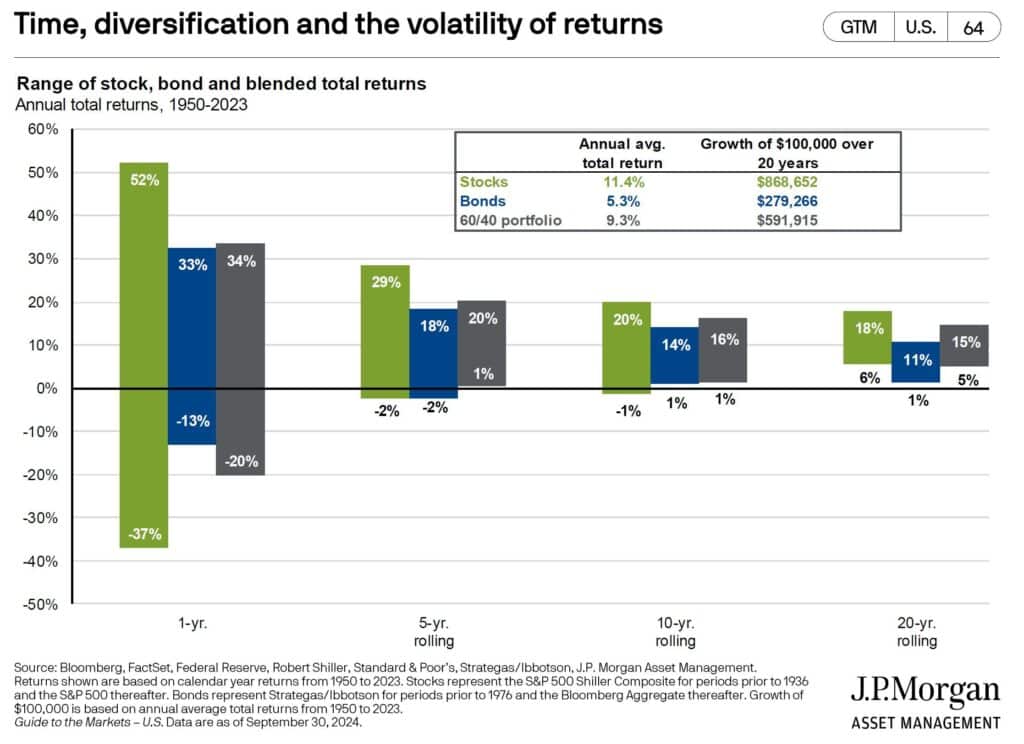

However, this graph below from J.P. Morgan Asset Management shows what happens to stock market volatility when you “zoom out” and apply the 4th dimension of time to the range of S&P 500 returns from 1950-2023:

- Had up to a -37% 1-year return when investing in the frothiest bubble

- 5-years later, that investment would only be down -2%

- Conversely, 5-years after buying the biggest dip, you’d be up 29%

- The worst 20-year holding period produced a positive 6% return

- The average return was 11%

Remember, the other more stable assets in the 4-D Banking system are there to transfer any loans away from the portfolio during times of risk. Ideally you buy some of the dip, which would put you on the right side of those green bars above.

401(k) Plans and Roth IRAs:

Stop taking all the risk, investing aggressively for your federal partner in a 401(k) so they can tax you as much as they choose to in the future. Instead, let them subsidize another potential backstop liquidity pool for you RIGHT NOW (with a potential $50,000 loan option per spouse). Just knowing you have this equity can allow you to build wealth outside the 401(k) plan.

Borrow against the other accounts listed above, knowing you can backstop the loan feature on your solo 401(k) loan. Set one up today if you have any kind of self-employment income whatsoever, simply for the flexibility.

If you have a Roth IRA, this may be the holy grail of tax-havens, but it stinks in terms of liquidity since you can’t pull any of the growth until your age 59.5. Plus there’s no way to borrow against it. It’s a single-use asset. You either have to consume it or pass it on. However, you can pull out your principal prior to age 59.5. I’m not saying you should, but knowing that you can provides yet another backstop to liquidity, which allows you to borrow against your assets to add layers of compounding to your 4-D Banking system you can use.

Keep in mind that when you build assets outside of government plans, they manufacture tax-free treatment by borrowing against them.

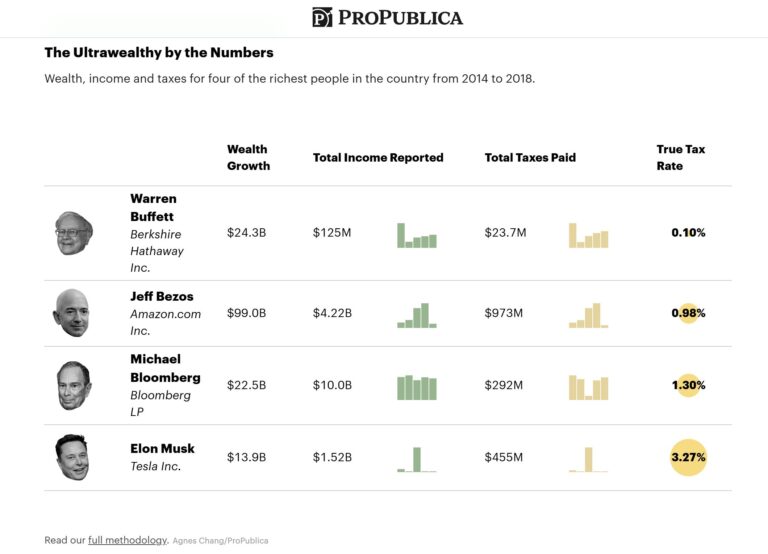

Take a look at the effective tax rate for the ultra wealthy who derive the bulk of their income borrowing against assets or occasionally selling at more favorable long-term capital gains rates than ordinary income.

Although most of us will still need to earn ordinary income while we build up our 4-D Banking system, the ideal is to use the “Buy-Borrow-Die” strategy like the wealthy to minimize our taxes and maximize compounding over multiple generations.

Hard Assets (Real Estate & Precious Metals):

Rather than keep hard assets as single-use assets, open up a line of credit as a backstop liquidity pool for each hard asset you own. Using a HELOC to build wealth can unlock a massive amount of investment potential, as long as you use the spoils to service the loan. You can also get HELOCs on your investment properties as additional liquidity or just another back stop as you’re adding liquid layers of compounding to your 4-D Banking system.

As the ultimate backstop, when the sky is falling with all other asset classes, gold has proven to be a safe haven during the last several corrections. See this chart of gold futures (orange line) vs. the S&P 500 during the last few corrections.

Gold during the Tech Bubble of 2000-2002

Gold during the Great Recession 0f 2008-2009

Gold during the 2020 Pandemic and 2022 Correction

Physical gold actually holds its value even better, since people will have to pay a premium over the spot price to own it. Although you may think gold & silver may be a single use asset, there are national operations online that set up precious metals loans and lines of credit. Plus, you could easily go to a Local Coin Store (LCS) or pawn shop for a short-term loan without cashing out your bullion.

Single Use Assets or 4-D Banking Building Blocks?

Keep in mind, that simply having these types of accounts does not constitute 4-D Banking. Many people already possess all of these accounts but keep them separate as single-use assets, each stranded on its own island waiting to be consumed at some future date.

Instead, these 4 asset classes must co-exist, working in concert together to maximize current liquidity and their collective future compounding.

By strategically choosing where to allocate your loan balances and ongoing servicing payments according to the ultra-efficient cash flow principles of Velocity Banking, you enhance your ability to earn compound interest on increasing balances while paying simple interest on decreasing loan balances (potentially even with tax deductions).

The 4 Major Benefits of 4-D Banking

Creating your own private banking system with this network of distinct assets and loan options allows you to reap the following 4 benefits:

- Makes Illiquid Assets Liquid & Accessible – Brokerage accounts, high-yield savings, life insurance cash value, and 401k plans were all once single-use assets waiting patiently to be consumed later on. Now you can tally up their liquidity. Since 4-D Banking takes into account access & liquidity for each, more money is available for timely investment opportunities, and less money needs to be preserved in taxable savings accounts that don’t keep up with inflation.

- Keeps Multiple Assets Compounding At Once – Since liquidity needs can be satisfied by strategically borrowing against different assets you own, then more of your money stays working for you through the different layers of 4-D Banking. The income you previously earmarked to replenish dips in your savings account can now go towards paying down loans against your assets that continue to work for you, even while extracting temporary liquidity.

- Lowers Your Overall Cost of Money – Since you understand there’s always a cost of money (EVA), and you’re no longer killing compounding by depleting your accounts, you can now optimize your overall borrowing cost by moving your loans to the optimal account. Each account will have a different borrowing cost, and certain loans may be deductible. Even the higher-rate loan accounts provide value by giving you the confidence to take advantage of lower-cost deductible loans against continuously compounding assets you would’ve liquidated otherwise.

- Reduces Your Current (and Future) Exposure to Taxation – Keeping assets compounding by its very nature reduces taxes by not creating taxable gains. Plus, your ongoing investment loan costs can be deducted against your net investment proceeds such as rental income, short & long-term capital gains, dividends, and even ordinary interest from CDs, savings accounts (not that you’ll have a lot of taxable bank interest anymore when deploying the 4-D Banking system).

Rather than fear market corrections, having a fully deployed 4-D Banking system in place can help you take advantage of crashes by keeping your stable assets compounding while using strategic leverage to scoop up deeply discounted cash-flowing assets during the most opportune times.

Book your own complimentary consultation to learn more about implementing the 4-D Banking system.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson has no affiliation or association with any of the following and does not feel compelled to do so since he is a published life insurance authority, policy design geek, and a multi-faceted accredited financial strategist:

The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.