IUL For Retirement: Unique Utility of Indexed Universal Life

IUL is meant to complement not replace your retirement portfolio. Its protected growth & tax-exemption make IUL an ideal retirement buffer.

IUL is meant to complement not replace your retirement portfolio. Its protected growth & tax-exemption make IUL an ideal retirement buffer.

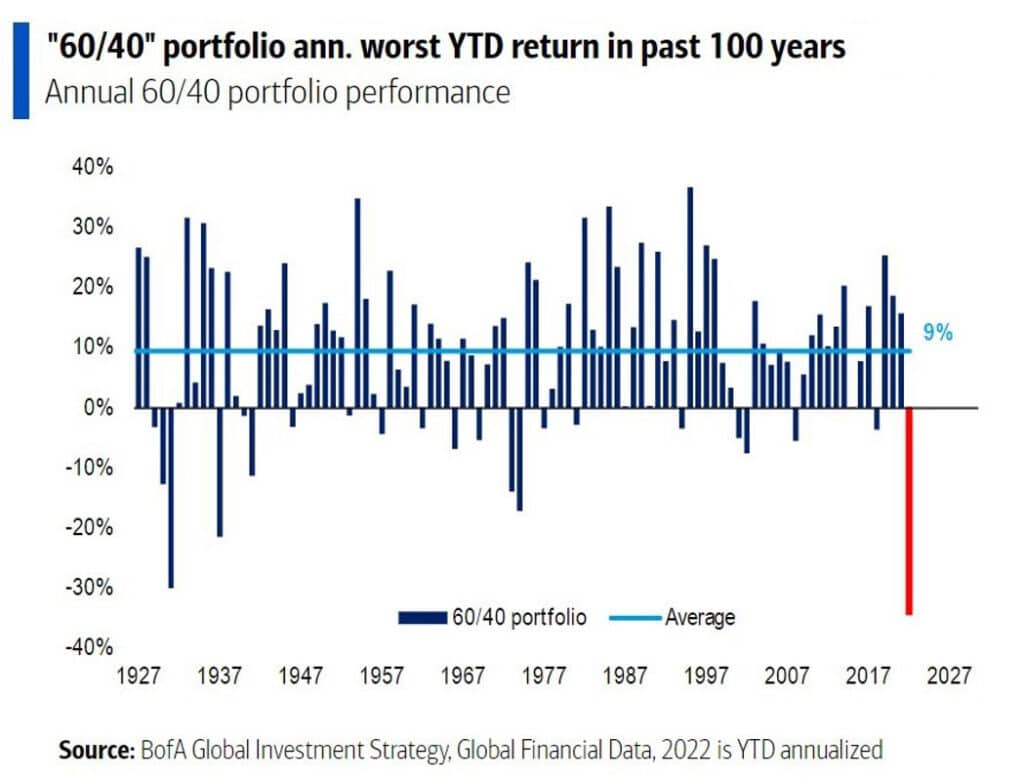

Whole Life insurance is meant to complement not replace your retirement portfolio. Its protected growth & tax-exemption make Whole Life an ideal retirement buffer, not to mention its death benefit can allow you to spend more of your portfolio while you’re alive.

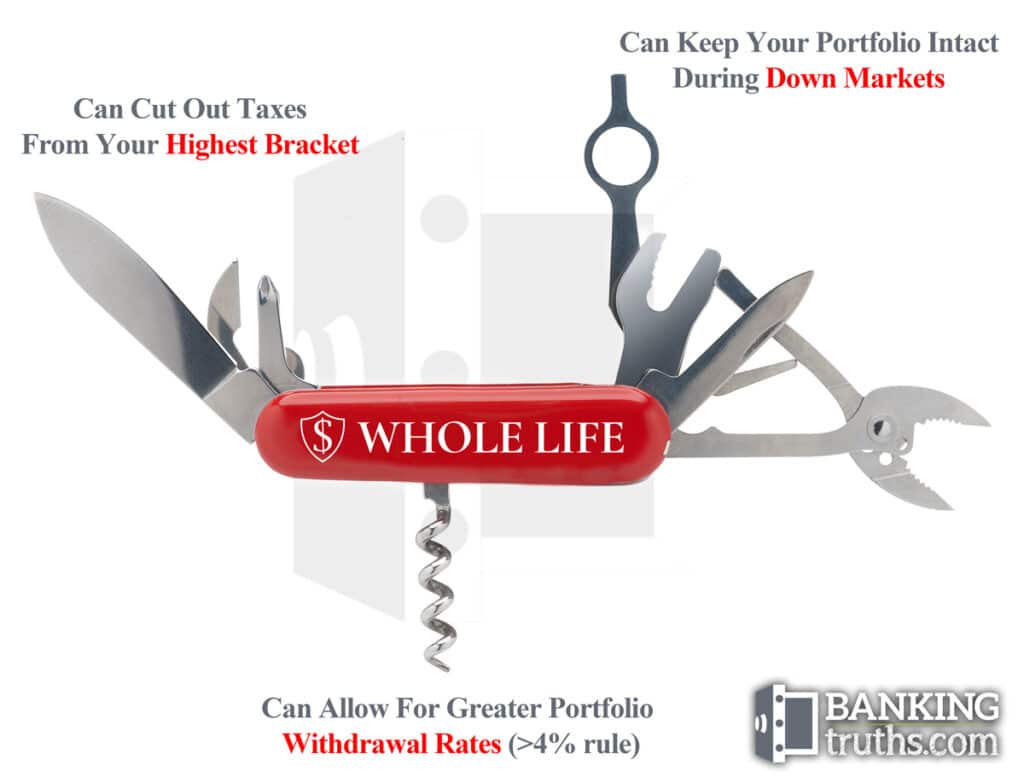

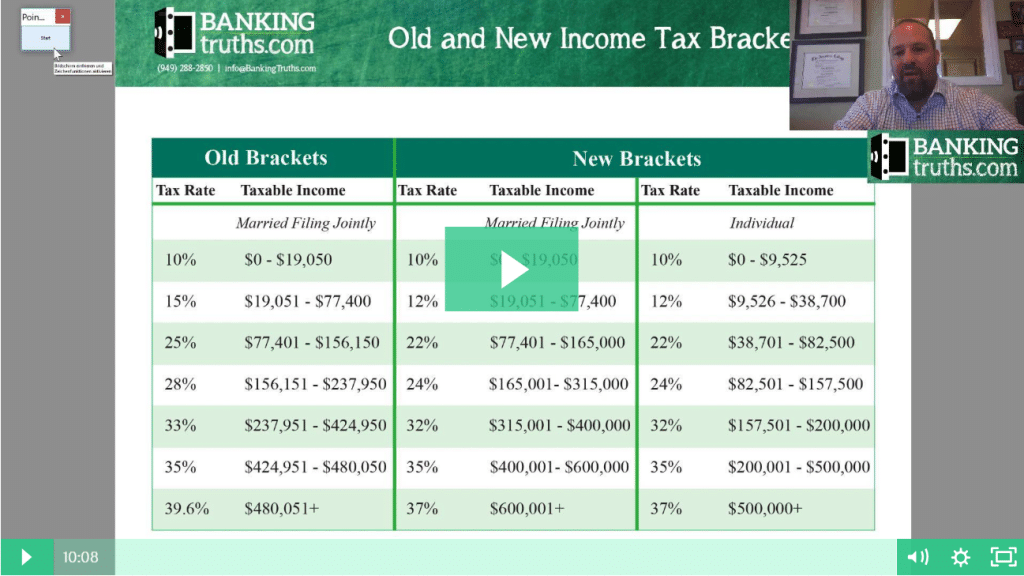

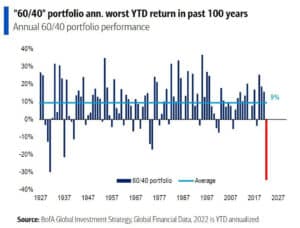

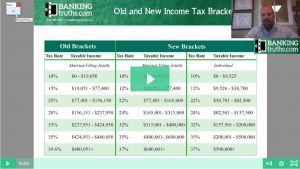

This video explores how the tax sanctuary of life insurance can help protect your other investments against the threat of future higher taxes, whether it is a Whole Life policy or Indexed Universal Life (IUL). Having this buffer can help you better control your tax situation during the distribution phase of your life.

IUL is meant to complement not replace your retirement portfolio. Its protected growth & tax-exemption make IUL an ideal retirement buffer.

Whole Life insurance is meant to complement not replace your retirement portfolio. Its protected growth & tax-exemption make Whole Life an ideal retirement buffer, not to mention its death benefit can allow you to spend more of your portfolio while you’re alive.

This video discusses the 2 distinct ways that Whole Life insurance policy can provide income in retirement. See the effect of bleeding down a policy with withdrawals then loans, as well as how the policy behaves when taking only dividends in cash.

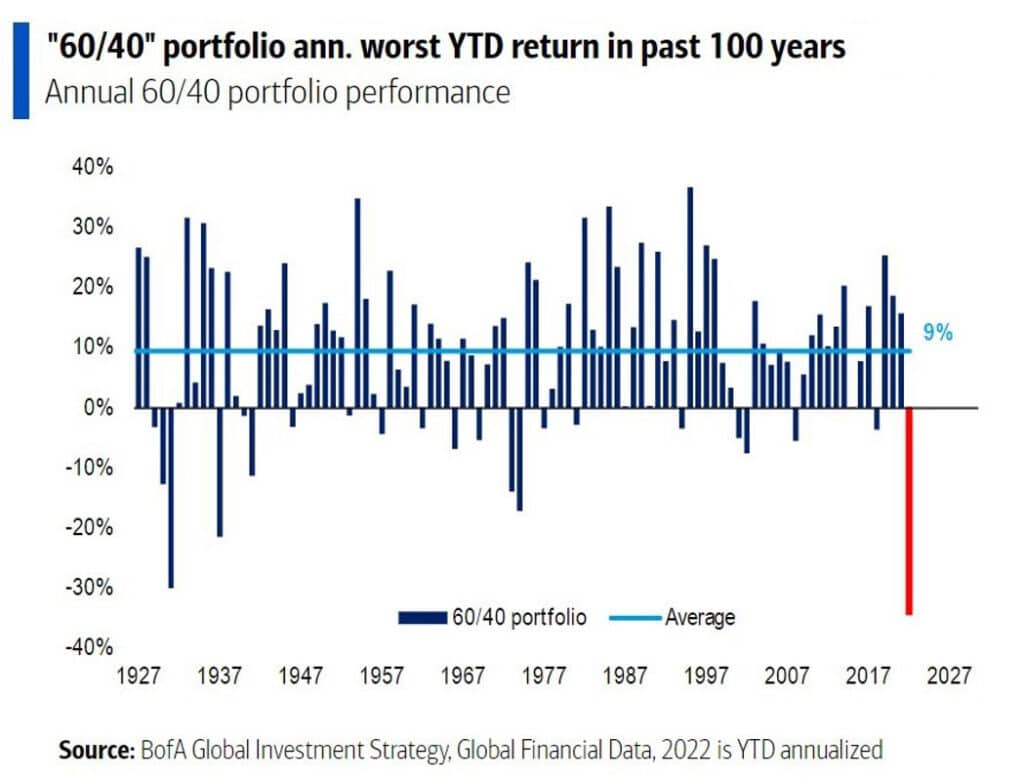

People tend to consider Whole Life’s growth in a vacuum, rather than consider all the utility it has both pre & post retirement. This video goes over how Whole Life is more than just a better place to safely store cash, but how it unlocks the potential growth and usage of other retirement funds in the process.

This video explores how the tax sanctuary of life insurance can help protect your other investments against the threat of future higher taxes, whether it is a Whole Life policy or Indexed Universal Life (IUL). Having this buffer can help you better control your tax situation during the distribution phase of your life.

This video explores the history of municipal bond yields and how rising rates will cause serious challenges. Life insurance, however, may benefit greatly from a rising interest rate environment.

Indexed Universal Life’s growth can help both before and during retirement in a number of different ways. In addition to helping you accumulate wealth safely on the way to retirement, IUL can help you safely spend more of your other assets in retirement.

[Video] Hutch explains how Whole Life can help you to maximize your government Pension Maximization. It’s relevant for all governmental employees. The example shown features Hutch’s wife and her teacher pension as an example.

NOT sure where to start, but ready to dive in?

Quickly figure out if Whole Life Banking is right for you with our data-driven video course:

Hope you enjoy the loads of content above explaining how private banking & retirement strategies work with properly-structured life insurance.

Whether you’re looking for the high-level concepts or the focus details in various case studies we got you covered.

For those ready to take their learning to the next level you can book your own complimentary no-pressure consult here to have your questions answered and your own personalized case study modeled out. We find the light-bulb finally goes on once clients see the concept through their own numbers.