Unlock Deep Historical

Research into IBC

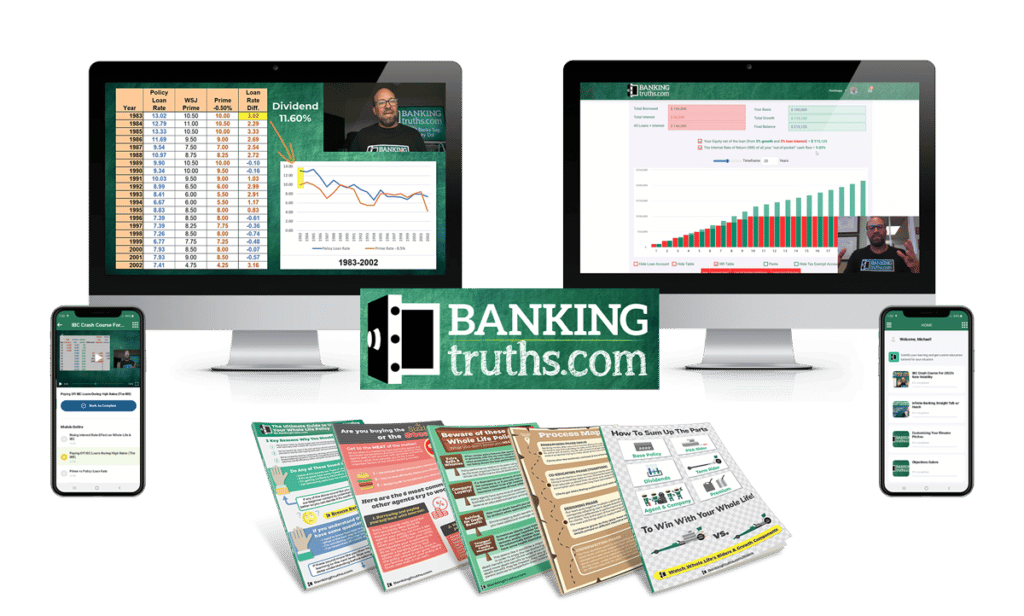

Quickly figure out if Whole Life Banking is right for you with our data-driven video course

What This Course Consists Of:

- 6 Core Video Lessons (each 8-12 min)

- Historical Data Back Spanning 42 Years

- Interactive Modeling Software (Growth & Loans)

- Guide to Optimal Whole Life Policy Design

- Supplemental Learning Library

Here’s what you’ll learn in the FREE video course:

- How to quantify Whole Life’s early fees

- Examine 40-years of dividend & loan rates

- How to measure if borrowing is really “a good deal”

- When to use policy loans vs. an outside loan

- How to find that perfect policy “sweet spot” size

About The Course Instructor

John "Hutch" Hutchinson ChFC, CLU, AEP, EA (inactive)

16 years ago Hutch began his own personal learning journey into the infinite banking concept. Known for his straight-talk style, Hutch will simplify how Whole Life works. Through his trained eye, you’ll see subtle distinctions within 42 years of policy data. You will also learn how best to optimize a Whole Life policy to be your own private bank.

Your Guided Tour Through Whole Life History

From IBC’s Most Modern Innovators

The IBC Crash Course Curriculum:

Lesson #1: Rising Interest Rate Effect on Whole Life & IBC

“History doesn’t repeat, but it does rhyme.” See what happened to Whole Life dividends the last time interest rates spiked & fell.

See an actual max-funded Whole Life policy from 1980-2022. Dividend rates spiked up and then trended way lower for decades. But the ongoing dividends received were MUCH bigger than originally illustrated due to that early stacking and continuous compounding!

Lesson #2: Paying Off IBC Loans During High Rates (The IRR)

Loan payments are always despised as an unwanted expense. It is always possible to just withdraw and have no interest payments.

However, since PUAs keep compounding for you, Whole Life loan payments may actually produce a solid positive long-term IRR. This video measures the mathematical efficiency of different payback scenarios compared to just withdrawing.

Lesson #3: 40-Year Study of Policy Loans vs. the Prime Rate

This historic study compares the internal policy loan rate compared to both that year’s dividend rate and the Prime rate.

Hutch shows you year by year when it would’ve been more efficient to use the policy loan vs. an outside line of credit. He also helps you see how the dividend rate trends along so you can have a plan to optimize any future borrowing situations.

Lesson #4: Measuring the Effect of Arbitrage on Rate Spreads

Using proprietary software, Hutch shows the effect of both positive and negative arbitrage in different interest rate environments.

If you do plan to borrow against your policy for emergencies, strategic investment opportunities, or major expenditures like kids’ colleges, it’s imperative to understand the mathematical impact of servicing your policy loan over time.

Bonus #1: Test & Measure Your Assumptions w/ our Software

Once you complete the first 4 lessons above, you will automatically unlock your access to our proprietary modeling software.

Then you can plug in your own assumptions to stress test different variables. That way you can understand the long-term impact of growth rates, loan rates, payment amounts, as well as arbitrage (both positive & negative).

Lesson #5: Testing Policy Sizes for IBC’s Optimized Whole Life

Finding that perfect Whole Life policy size is one of the biggest challenges for folks starting IBC face.

If the policy is too big, you can make contributions at will, but the additional cost will erode the growth. If you choose a more streamlined policy, you’ll cap your contributions. Hutch demonstrates this dynamic for you showing several policy examples.

Lesson #6: Cost/Benefit Analysis of Whole Life’s Early Fee

How can you quantify Whole Life’s fees/costs when it’s known as “a black box” or bundled product?

Hutch uncovers his workaround to determining a policy’s true early cost and also reveals 2 forgotten benefits you get. He then performs a cost/benefit analysis for this early hit to liquidity, so you can see if it’s worth it.

Bonus #2: Whole Life Design Secrets

Whole Life Policy myths & proper design techniques most likely deserve their own entire course.

However, we boiled down the basics for you in this comprehensive 10-page PDF guide. That way you can be more informed about what to look for when examining illustration proposals from any agent (even if it’s not us).

I came across BankingTruths.com while researching to further the benefits of my 2 existing whole life policies. I was pleasantly surprised at the amount of freely available information and their apparent depth of knowledge and sincerity. - Robert (Inventor)

"A friend told me about this concept. I researched the articles & videos at BankingTruths.com and was intrigued by the level of detail and transparency." - Kelly (Investor)

"Working with the team at Banking Truths has been a great experience. Their depth of knowledge and professionalism have made me a client for life." - Phil (Entrepreneur)

"A friend told me about this concept. I researched the articles & videos at BankingTruths.com and was intrigued by the level of detail and transparency." - Kelly (Investor)

"Working with the team at Banking Truths has been a great experience. Their depth of knowledge and professionalism have made me a client for life." - Phil (Entrepreneur)

Unlocking a wealth of IBC info has never been easier...