IUL For Retirement: Unique Utility of Indexed Universal Life

A common mantra echoed across financial media is that “you won’t need Indexed Universal Life insurance in retirement.”

The story goes that because you’ve been such a responsible investor in your 401(k), you probably won’t need any sort of life insurance product once you start taking retirement income, much less Indexed Universal Life.

You no longer need any IUL death benefit to replace income from your job. You can “self-insure” since your assets are the ones at work now, producing income for both you and your spouse. Whatever is left over from your assets will act as your legacy to heirs.

So, let that term policy lapse and start preparing the surrender paperwork for your IUL since you can probably get a better return in index funds.

Sound familiar?

You’re missing something… something big actually.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

Everyone intrinsically knows not to put all their eggs in one basket, so they buy different stocks and mutual funds across a bunch of different accounts. The flaw with this stale view of diversification is that globalization & technology have tied us all together at the hip so that markets & sectors are now more correlated than ever.

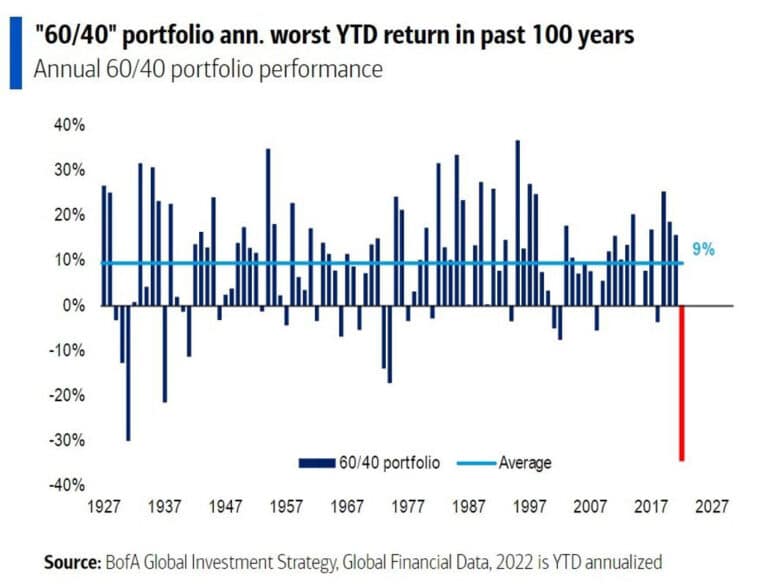

Even the quintessential 60/40 portfolio (60% stocks for growth and 40% bonds for safety) would’ve wreaked havoc on retirees in real terms, as shown here by Bank of America Global Research:

Sure, you can stomach this kind of volatility while you’re still working and contributing to your portfolio. Even better, you get to buy investments on sale! But if you’re still taking retirement withdrawals while your mutual funds are down, then you’ll have to redeem excess shares that can’t recover for you later on.

This creates a portfolio death spiral where you can only hope that you run out of money before you run out of breath.

Since we’re on the subject of mortality, let’s discuss the 4 unique ways IUL can help you with this retirement dilemma, shall we?

#1: IUL for a Retirement Volatility Sponge

Although Indexed Universal Life is not completely uncorrelated to the stock market, it has a unique growth methodology where you can get stock market participation without stock market risk.

What this means is that IUL offers a contractual 0% floor, protecting against market losses in down-market years. So if the S&P 500 experiences a negative return, you simply get 0% crediting (less any costs of insurance). Yet some IUL policies still provide the opportunity to earn up to double-digit returns tracking the S&P 500 index during up-market years.

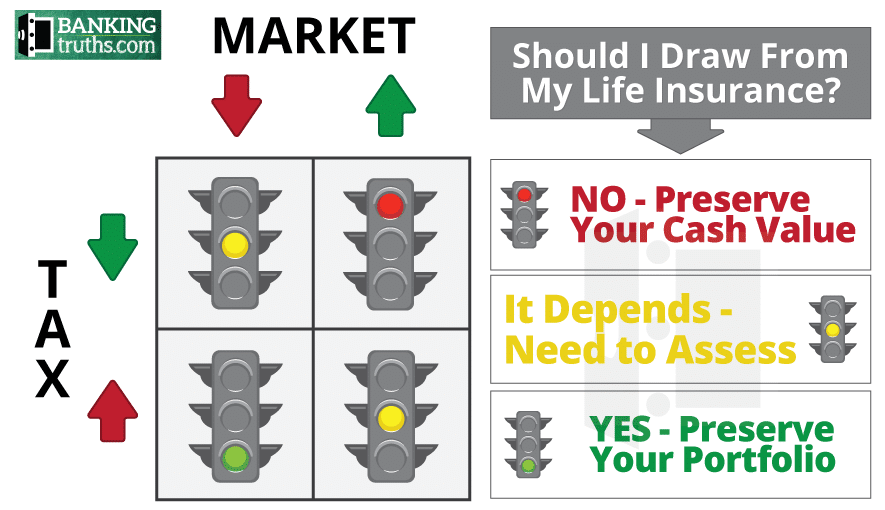

If there is a market crash and you have cash value allocated to Indexed Universal Life insurance during retirement, you could take your immediate income needs from your IUL policy, thereby allowing your stocks and mutual fund accounts to heal.

Otherwise, in a down market, you must redeem significantly more shares of stocks or mutual funds to meet your ongoing standard of living. Once consumed, the shares you consumed can obviously no longer participate in the next market rebound.

Picture yourself instead with a pool of liquid cash value within IUL, unaffected from the crash. Thereby, you can still enjoy an uninterrupted standard of living during these years while your stock portfolio licks its wounds.

It’s the guaranteed 0% floor and fully flexible withdrawals that make insurance products like IUL or Whole Life indispensable in retirement as a “volatility sponge.”

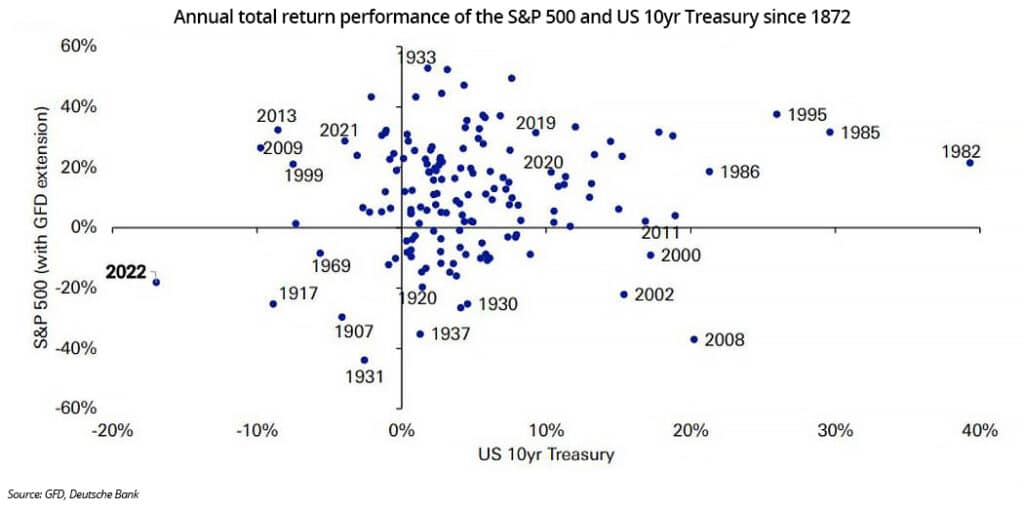

It used to be that retirees would protect against sequence-of-withdrawals risk with some kind of blended stock/bond portfolio like the well-known 60/40. But with this new global paradigm of immense correlation, will that still work during the worst times when retirees need protection the most?

As you can see here in Deutsche Bank’s scatter plot showing historical stock/bond returns, both stocks and bonds correlated together to the downside in nearly identical portions.

When considering IUL for retirement, it’s not about whether you can get a better rate of return elsewhere. It’s about having an actual hedge in down markets so the rest of your portfolio can rebound before you sell any shares.

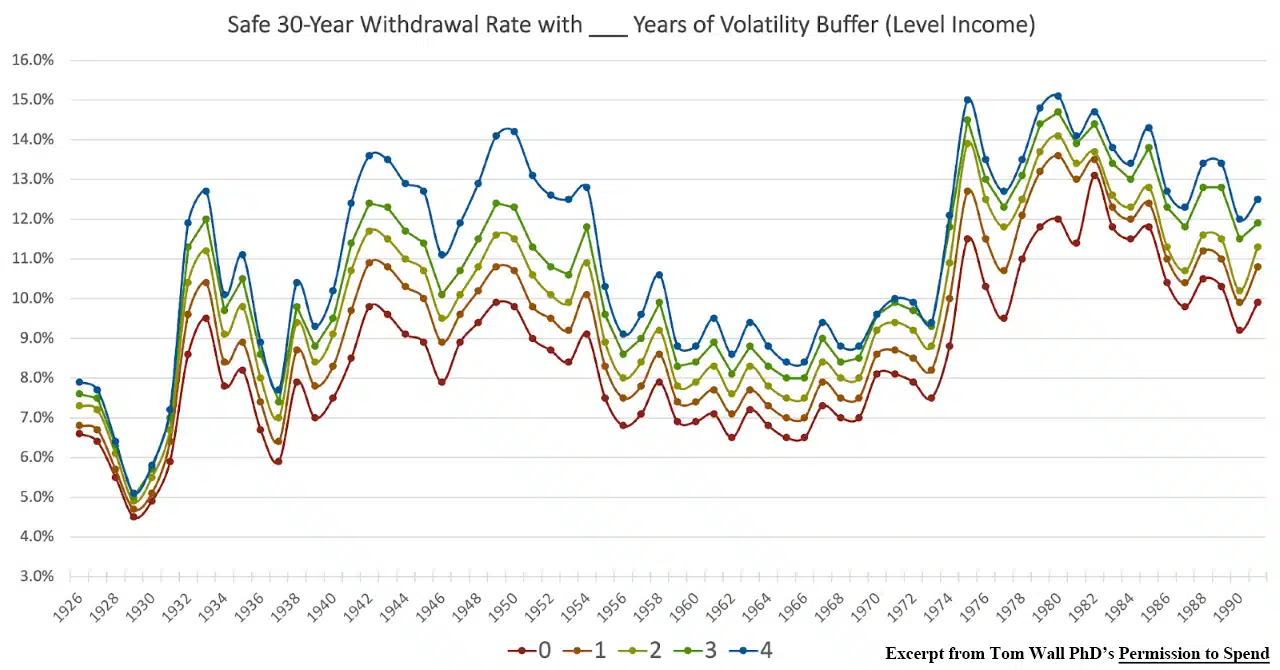

Author Tom Wall Ph.D. did a study of the year-by-year maximum allowable withdrawal rate and how it could be increased substantially by the existence of a volatility sponge in retirement. The more years of non-market retirement you had stored to delay drawing from your portfolio in down years, the greater the withdrawal rate you could take from those assets.

Notice the height difference between the lines across the different years where retirement would have started. The line height illustrates the difference in the withdrawal rate you could’ve consumed from your portfolio depending on how many years of replacement income you could’ve pulled from your volatility sponge (like IUL).

Of course, all of this benefits from hindsight assuming the retiree knows the exact sequence coming. Obviously, we won’t have this kind of clairvoyance when entering retirement, but at least he historically proved the validity of having a volatility sponge in retirement. Its ability to preserve a portfolio is sometimes quite vast, depending on the exact sequence of returns as seen in the most spread out years.

Rather than entirely allocate to bonds in a 60/40 portfolio, why not think of Indexed Universal Life (or Whole Life insurance) as an “actuarial bond” with true immunity from market losses backed by the most solvent financial companies in America?

None of these true mutual insurance companies took $0.01 of bailout money in 2008, and they were actually the ones that bailed out failing banks after 1929 before FDIC was in existence. This is because life insurance companies are held to much higher regulatory standards of financial solvency and liquidity than fractional reserve banks.

In addition to just absorbing the impact of volatility on a retirement withdrawal strategy, IUL can also offer tax-efficiency for further optimized results.

#2: IUL as a Tax-Eraser in Retirement

Many high-income earners are unaware of how the tax treatment of Indexed Universal Life is very similar to a Roth Account, only without all the barriers to entry. Because there are no high-income limitations and no annual maximum on contributions, IUL is often called “the Roth of the rich.”

Except a Roth IRA cannot also act as a volatility sponge like we saw IUL can in the section above.

So, although you may not need any Indexed Universal Life insurance during retirement, you will probably want it for its tax treatment.

Here’s why:

Most of your other sources of retirement income will be taxable in some way, shape, or form. None of the following are immune from Uncle Sam:

- Rental Real Estate

- Taxable Brokerage Accounts

- Tax-Deferred Annuities

- Social Security

- Deferred Compensation plans

- IRAs, 401(k)s, Profit Sharing Plans, Pensions, etc.

As tax rates continue to change with the different regimes occupying Congress during your retirement, what if you could “time your tax” by toggling the amount of taxable retirement distributions you want each and every year?

Imagine withdrawing amounts from your taxable sources right up until you reach those really ugly tax brackets, and then supplementing the rest of your desired lifestyle using Indexed Universal Life’s tax-exempt distributions.

Can you think of any reason why Congress may need to raise taxes on everybody to some degree?

Off the top of my head, I can think of more than 36,000,000,000,000 reasons! What’s pitiful is that when I originally posted the first iteration of this “IUL for Retirement” piece, the national debt was just over $20 Trillion. Seven years later, it increased by over 60% to over $36 Trillion.

What will the lowest and highest tax bracket look like when you finally retire?

IUL is no longer just a tax tool for the rich.

Which way must taxes go… for everybody?

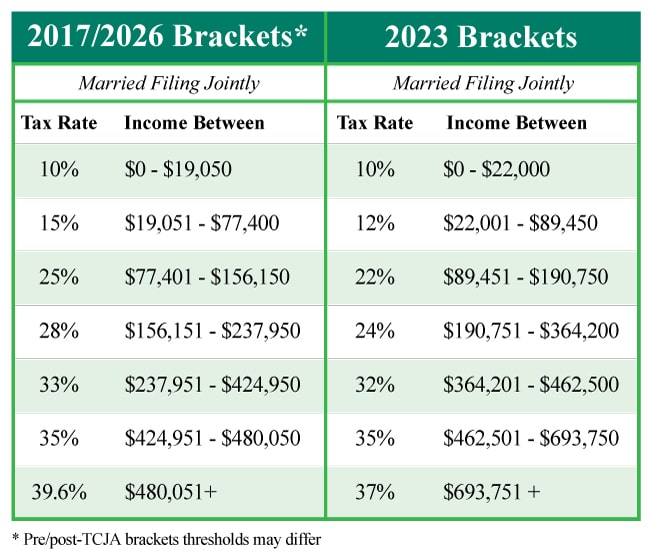

Did you know that tax rates are already set to rise in 2026?

The favorable tax brackets from the Tax Cuts & Jobs Act were written in temporarily and already scheduled to sunset away at the end of 2025. Even if Congress doesn’t meet to stroke the pen again and raise taxes even further, their pen has already been stroked to eat into the income of all retirees.

The more that tax rates rise, the more you will wish you had assets allocated to IUL.

You can either proactively prepare or react and adjust your standard of living downward.

Let’s just say you took $30,000 of supplemental retirement income from an IUL to avoid the 28% bracket plus 5% of state tax. You would need to withdraw nearly $45,000 from your 401(k) to end up with that same $30k after tax.

Using IUL this way over a twenty-year period, IUL could’ve saved you $300k in taxes ($15k x 20 years). Not only that, but the existence of IUL for this purpose means you wouldn’t have to draw an additional $900k from your 401k ($45k x 20 years).

It’s all about efficiency. Who cares who wins the performance battle between IUL vs. 401(k) before retirement? You absolutely need your 401k to crush it since you’ll have to withdraw 33% more than you would from an IUL in this case from the middle bracket. What if tax rates go even higher?

With Indexed Universal Life, you don’t need to take as much risk nor need as much return since its distributions are more tax-efficient in nature.

Yes, you could take tax-exempt income from a Roth vs. an IUL. But remember that a Roth IRA won’t help you protect your portfolio in down markets, as we discussed in the section above.

What makes IUL (and Whole Life insurance) so valuable for retirement is they have the capability to be simultaneously a “tax eraser” and a “volatility sponge.”

Here’s why that’s so important

#3: How IUL May Help You Increase the 4% Rule

The more annual income you scrape from your portfolio, the more you put your entire portfolio at risk throughout retirement. When those last dollars leave your retirement accounts each year at your highest bracket, you are excessively increasing both your tax and your risk of running out of money.

Here’s why…

Have you ever heard the 4% Rule?

It came out of a famous study by financial planner William Bengen to find a safe withdrawal rate for his clients. In 1994, he concluded that retirees couldn’t pull more than 4% (adjusted for inflation) from their nest eggs without also running the risk of running out of money.

Bengen suggested the 4% rule must be followed regardless of the actual portfolio earnings, since retirees couldn’t predict the future sequence of returns for future income needs.

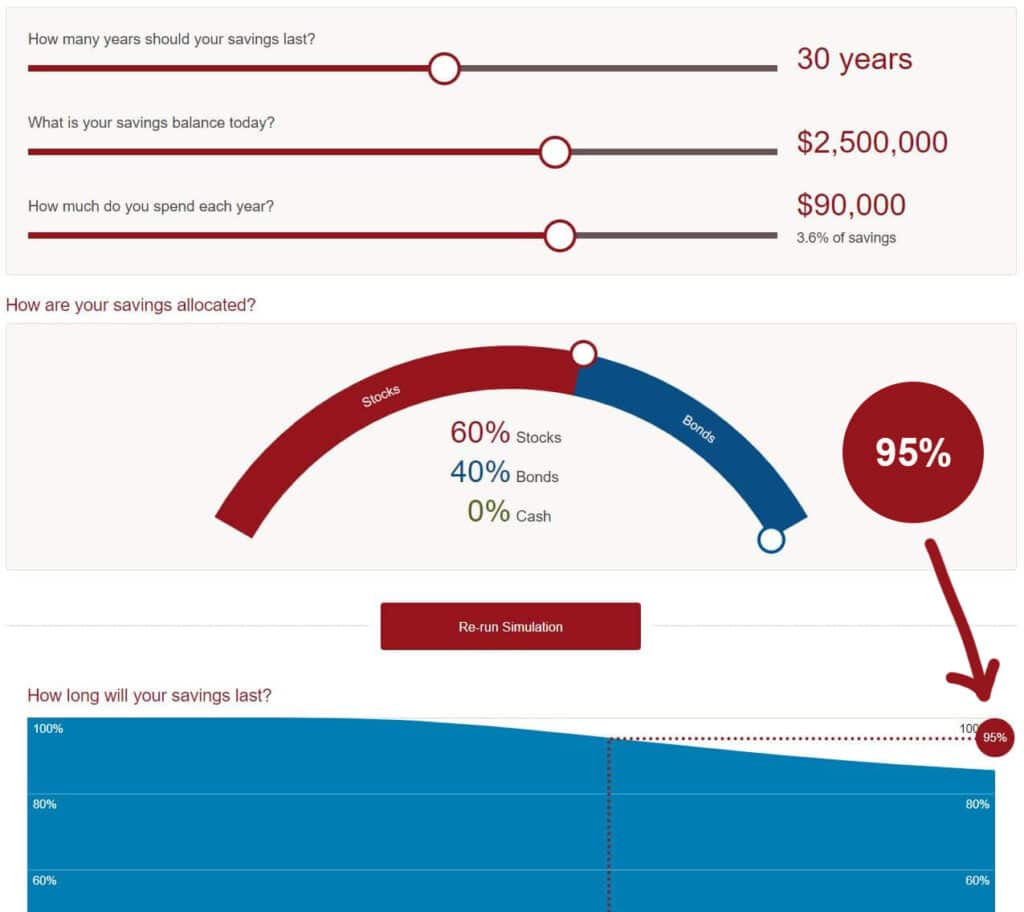

Although the assumptions used for the original 4% rule are somewhat outdated, we can see its overall validity still applies using Vanguard’s online Monte Carlo calculator. A Monte Carlo calculator simultaneously runs over 100,000 different 30-year scenarios to stress-test the validity of a desired retirement withdrawal strategy.

Vanguard’s calculator below shows that you have a 95% success rate of pulling $90,000 of inflation-adjusted income for 30 years from a $2,500,000 portfolio invested in 60% stocks and 40% bonds.

Academic studies have proven that the original 4% rule now runs closer to 3.5% using data Bengen didn’t have from 1995-present.

For that reason, we used a withdrawal rate of 3.6% of your portfolio equaling the $90,000 of gross income before taxes to arrive at the 95% probability of success.

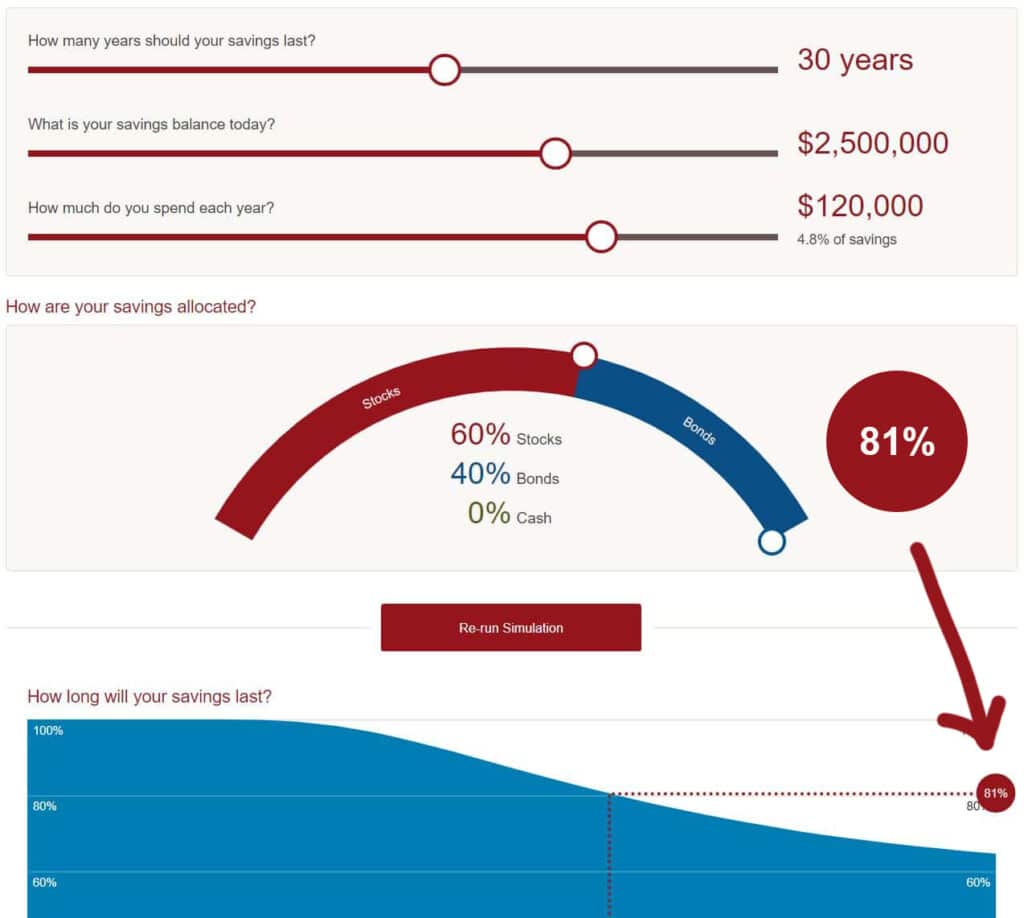

Surely some of you are thinking $90,000 before taxes may not be enough to live comfortably on. A modest income increase from $90k to $120k may not seem like a major change, but look what happens when increasing the withdrawal rate from 3.6% to 4.8% from the same $2,500,000 portfolio.

Your chances of success drop substantially from 95% to 81%!

Your retirement plan just went from having a 1/20 chance of failure to almost a 1/5 chance of failure by modestly increasing your income!

Those are still decent odds, but are you willing to gamble for the highest of stakes of your life when you can’t go back to work on Monday?

Not only did you substantially increase your risk by taking that extra $30k, but you’re also leaving a tip for Uncle Sam since that extra $30,000 comes out at your highest marginal tax bracket.

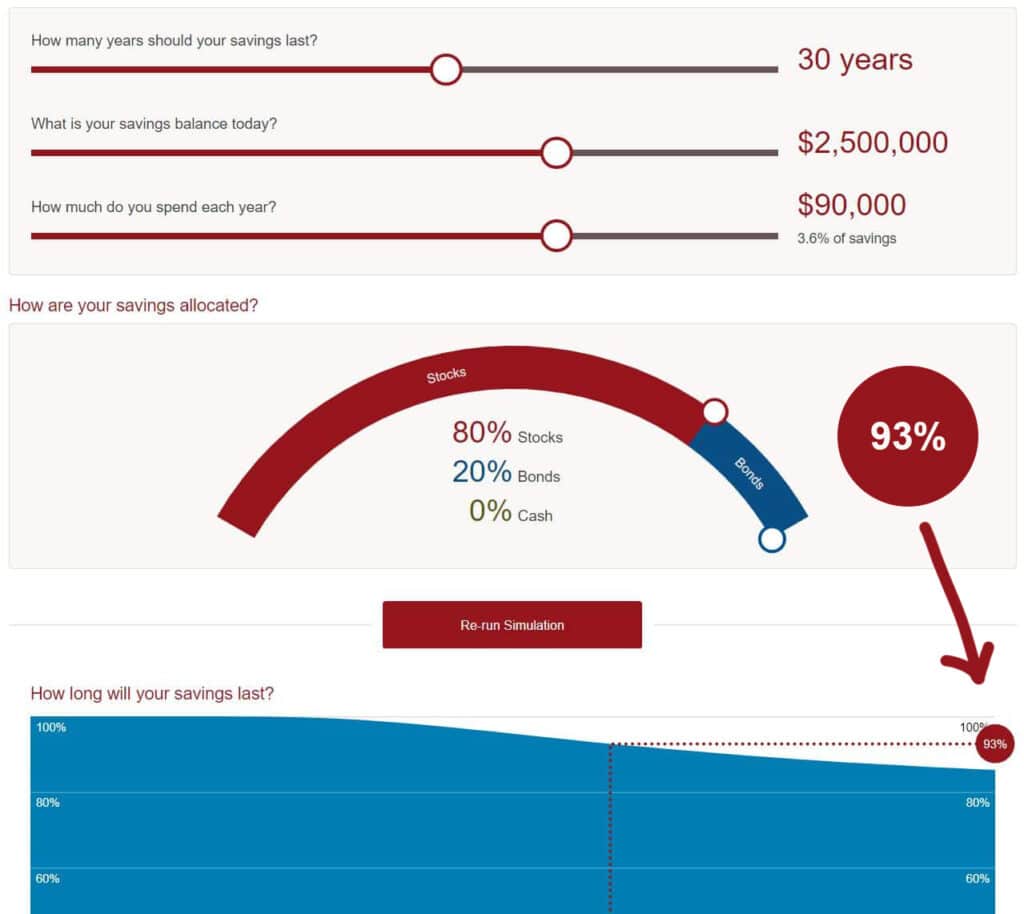

Surely some of you probably think you can fix the problem simply by kicking up the allocation to stocks a notch.

However, you’ll notice when we put the income back to the safer withdrawal rate of 3.6% or $90k that the chances of your portfolio lasting 30 years actually go down from 95% with a 60/40 portfolio to 93% by using an 80/20 portfolio.

Don’t get me wrong, you may get lucky, but the numbers say that upping your risk doesn’t statistically help you over 100,000 scenarios.

(Note: Bengen’s original study even used a more conservative 50/50 blend of stock and bonds. We bumped it up to a 60/40 blend after finding that increasing exposure to stocks further actually made things worse as you’re seeing above.

What if instead of allocating the entire 40% bond component in your retirement savings to traditional bonds, you instead acquired some of these “actuarial bonds” offered only by insurance companies?

Couldn’t you then do what Tom Wall proved with his historical study? Couldn’t you purposely increase your withdrawal rate knowing you’d only pull from your IUL in down markets?

By doing so, you could let the stock portion of your portfolio do what it does best and run wild over time if you knew you didn’t have to pull from it during the worst down markets.

Mutual fund company Alliance Bernstein found that replacing even just half of a 60/40’s bond component with fixed indexed annuities “beat the traditional 60/40 over 98% of the time, with an average outperformance of 9.9% in winning periods.”

By offering some combination of Indexed Universal Life, Whole Life, and Fixed Annuity products you not only get the true stability needed in these Monte Carlo analyses, but you also better protect against these common risks in retirement:

- Higher future taxes

- Rising interest rates

- Sequence of withdrawals risk

- Longevity risk (running out of money)

- Chronic Illness needing long-term care

Even though most people don’t care about IUL’s death benefit, let’s see how it can help especially with the last 2 risks mentioned above.

#4a: IUL’s Death Benefit Can Replace Retirement Spending

Clients are always more excited about the unique tax and risk-management characteristics of life insurance for retirement, and the death benefit is often the least appealing feature. However, you shouldn’t discount the utility of a permanent death benefit in the context of retirement planning.

Here’s what I mean:

If you knew that you had a guaranteed accounts-receivable that your spouse and children would receive tax-free at your death, wouldn’t you increase your consumption of retirement assets during your lifetime?

Of course, you would!

The existence of a guaranteed permanent death benefit allows you to more aggressively spend down other assets in your portfolio.

This ability to “monetize your own death benefit” is massive and can be mathematically proven. However, the problem with IUL is that it normally doesn’t offer a guaranteed death benefit.

With some insurance companies, you can get a No-Lapse Guarantee rider which would guarantee the death benefit. However, using this rider either negates or limits use of the cash value during retirement. So although this guaranteed death benefit can be acquired with Indexed Universal Life, it truly makes it an either/or conversation between cash value and death benefit, unlike with Whole Life insurance.

You can manually monitor your cash value usage from IUL during retirement so you have a balance of retirement income and death benefit, but this may be a tall order for many retirees.

Learn how Whole Life always has a certain amount of guaranteed death benefit despite how many withdrawals and also discover the key differences between Whole Life vs. IUL here.

#4b: IUL’s Death Benefit For Chronic Illness/Injury

What if you got chronically ill or critically injured?

Statistics show that one out of two retirees will need some sort of “Long-Term Care” whether in a facility or in the comfort of their own home.

Did you know that certain Indexed Universal Life policies have special riders or policy stipulations allowing you to legally access the tax-free death benefit for these reasons even though you haven’t died?

Nobody cares to imagine themselves as too sick or hurt to function on their own. Everybody believes it can’t happen to them, however, bad things can happen to good people.

Getting a traditional Long-Term-Care policy can be very expensive, and those premiums are essentially a pure cost since they don’t build any cash value equity in your policy that you can use along the way.

However, a hybrid Indexed Universal Life insurance policy with a chronic/critical illness/injury rider can allow the policyholder to hedge against this serious risk while simultaneously building up cash value for retirement income if long term care isn’t needed.

I’ve heard several tear-jerking stories over my career about clients who bought these types of hybrid life policies only to end up contracting some kind of horrible debilitating illness. Having this chronic illness benefit actually allowed them to:

- Alleviate financial stress which could accelerate their illness

- Get quality care they couldn’t afford to pay out of pocket

- Pay for travel & lodging expenses for extended family to be with them

Who wouldn’t want this kind of hedge in their back pocket?

Bonus: IUL as a Better Holding Tank for Pre-Retirement Liquidity

Everyone needs to keep a certain amount of safe and liquid cash reserves, especially on the way to retirement.

If you’re a real estate investor or business owner, you probably have considerably more money in cash than you do invested in the stock market. Even for W-2 employees, the rule of thumb is to have somewhere between 6-12 months of expenses in cash.

What if you used IUL as the receptacle for your safe and liquid reserves instead?

What if you kept just enough in your checking account to manage a few months’ expenses, while your longer-term reserves were compounding safely inside of IUL?

Did you know that the two biggest banks in America each have over $20 Billion Dollars of their customers’ deposits invested in Life Insurance policies taken out on their key executives? That’s why our site is called BankingTruths.com and our motto is “Don’t do what banks say…Do what they do!”

The major banks know that properly structured life insurance is the only way to simultaneously keep money liquid while growing at favorable rates without taxes or market risk.

Click here or on the image below to watch our 4-minute video examining the balance sheets of the two biggest banks in America with data straight from the FDIC.

Although IUL is not guaranteed by FDIC, it can have your liquid assets working much harder for you.

Not one of the true mutual insurance companies took a penny of bailout money in 2008, and mutual insurance companies

were actually the ones that bailed out failing banks after 1929, long before FDIC was in existence. This is because life insurance companies are held to much higher regular standards than fractional reserve banks in terms of financial solvency and liquidity.

Let’s not forget too, that being liquid at the right time can substantially boost your retirement nest egg.

Think about all the opportunities you could have capitalized on if you were highly liquid following the crash of 2008. What’s not actionable is to cash out stocks that lost 50% to buy depressed real estate or vice versa.

Maybe if your cash equivalents actually earned a decent growth rate (like they can in IUL), you wouldn’t mind keeping more of your assets safe and liquid.

There’d be no need to press in good years since your IUL wins in those years too, and no need to panic when the sky starts falling again. Simply wait for the pandemonium to set in and then scoop up the best real estate deals of your life.

Click here to watch a 6-minute video on how to take this big institutional thinking down to the personal and small business levels.

Imagine the positive impact on your retirement if you had all your assets working for you all the time, even your safe and liquid cash… or cash value rather. You would be well-positioned to utilize all of IUL’s retirement benefits without having the lost opportunity cost along the way.

Closing Thoughts

Most people overlook the unique utility that an IUL retirement policy can provide to clients wanting to maximize their net-spendable income throughout retirement. IUL’s rare growth methodology and favorable tax treatment make it the ideal complement to a diversified portfolio of retirement assets.

Click here to explore the most comprehensive article written on exactly how Indexed Universal Life works, as well as an in-depth examination of IUL’s pros and cons.

Click here to schedule a custom consultation to match the best IUL product and company with your unique preferences and situation.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com