2024 Ultimate Guide to Premium Financed Life Insurance

Premium financed life insurance used to be an exotic strategy reserved for the ultra-wealthy, but the secret of premium financing has slowly spread over the last 25 years. When interest rates hit historic lows premium financing became more popular than ever with elite life insurance agents as well as the banks offering premium financing loans. Now that rates are rising, consumers and their advisors need to carefully consider the various risks involved laid out in this comprehensive article.

For a well-designed premium financed plan, there can be tremendous growth potential as well as unique tax and estate planning benefits. However, there are numerous risks that should be considered. Throughout this comprehensive article, we will discuss what is premium finance exactly, how it works, the pros and cons of premium financing, as well as the numerous steps involved in starting your own program.

At any point, you can schedule a call to discuss your own unique situation with one of our specialized premium finance life insurance agents.

You can also quickly navigate to the different sub-topics in this extensive article below:

The Top 4 Myths Behind Becoming Your Own Banker (Article)

Learn How This Banking Concept Really Works (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life Insurance (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

(Clickable) Table of Contents

What is premium finance (specifically what is premium financed life insurance)?

Why use premium financing?

Who is the ideal candidate for premium financed life insurance?

Example of how premium financing works (Flowcharts)

How does premium financed life insurance work?

Premium Finance Exit Strategies

Pros and Cons of Premium Financing

The Pros of Premium Financing

6 Main Benefits Premium Financed Life Insurance Provides Individuals:

Estate Planning Advantages of Premium Financed Life Insurance

Business Planning Strategies Coupled with Premium Finance

The Risks of Premium Financed Life Insurance

Lender Risk with Premium Finance

Loan Interest Risk with Premium Finance

Loan Benchmark Risk

Collateral Risk with Premium Financed Life Insurance

Policy Performance Risk with premium financing

Policy Charges Risk with Premium Financed Life Insurance

Taxation Risk of Premium Financing

7 Steps to take with your Premium Financed Life Insurance Agent

Conclusion about Premium Financed Life Insurance

What is premium finance life insurance?

Premium finance is a strategy where policyowners will pay massive life insurance premiums in conjunction with borrowing from a third-party lender, rather than tying up their own capital. Just like how the wealthy expect extremely favorable loan terms to purchase real estate, they are often offered sweetheart loans to purchase large amounts of life insurance instead of paying premiums out of pocket.

Typically, the borrowing policyowner will make regular payments on these premium finance loans. However, some do choose to roll up or capitalize interest into their premium financing arrangement, anticipating that the cash value growth of the underlying life insurance will outperform the accruing loan interest. It is worth noting that the borrower is responsible for posting collateral whenever the cash surrender value of the life insurance policies is less than the outstanding loan balance.

Why use premium financing?

Simply put, the leverage available from premium financed life insurance allows policyowners to acquire substantially more life insurance for a small fraction of the cash flow outlay normally needed to support this big of a policy. This not only allows them to keep other assets performing elsewhere, but it often produces a very attractive tax-free IRR (internal rate of return) for a relatively nominal out of pocket cost.

The ideal plan for most premium financed life insurance strategies is that the low-interest payments to borrow these massive early premium payments creates a compounding snowball of cash value growth. If the cash value compounding overcomes the extremely low hurdle rate of the premium financing, then the policy itself can absorb the loan using the built-in policy loan feature, as well as provide the policyowner a substantial windfall. These future policy distributions can be in the form of supplemental tax-exempt retirement income, a tax-free death benefit to heirs, or both.

Who is the ideal candidate for premium financed life insurance?

Premium financing is ideal for those seeking large amounts of life insurance who are in relatively good health as well as have reputable credit.

That said, older insureds or those in substandard health may benefit substantially from certain premium financed life insurance designs since favorable leverage spreads can often make up for the higher cost of insurance. Depending on the situation, a premium financed life insurance strategy may allow older insureds or those in substandard health to acquire the proper amount of coverage they need for a fraction of the out-of-pocket cash flow cost.

However, not everyone can qualify. Premium financed life insurance is typically a strategy reserved for high net worth individuals ($5,000,000+), family trusts, or successful business entities. However, exceptions may be made for high-income earners as well as certain estate planning and/or business planning situations where the underlying insureds do not have this level of net worth.

Most premium finance clients fall into these camps:

- For wealthy families whose asset base is largely illiquid (real estate or closely held business interests), premium finance can be an ideal option to help them expand their personal estate planning without upsetting the apple cart.

- Many high net worth individuals have been using premium financed life insurance as a synthetic ROTH of sorts since actual ROTH IRAs have low contribution limits and even prohibit high-income earners from contributing. The leverage available from premium finance also offers appeal since over the last 25 years there has been a favorable spread between the low borrowing rate and the potential for cash value growth within the policies.

- For established businesses that need to maintain a strong balance sheet to acquire certain contracts, bonding, or other loans to keep their operations intact, premium financing allows them to acquire key person protection for invaluable employees or to shore up buy-sell agreements amongst the owners. More recently we are also seeing businesses and even universities set up “golden handcuff” retirement programs for highly paid employees whom they wish to retain and reward.

Below, we will describe very specific uses employed by these 3 distinct camps of premium finance borrowers or you can click here now to skip down to that section.

If your situation sounds like one of the ones described above, you can book a call here with of our life insurance agents to discuss how premium financing can work for your situation.

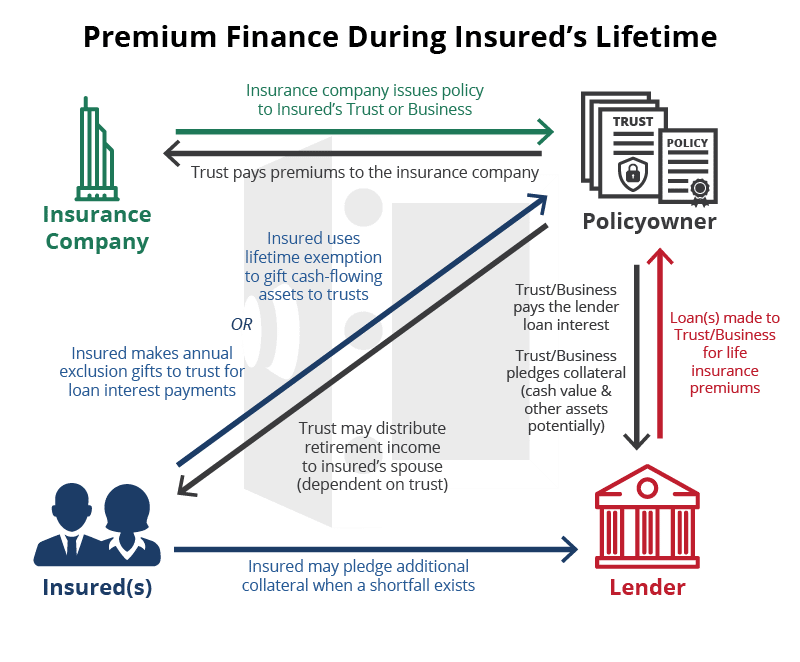

Example of how premium financing works (Flowcharts)

How does premium financed life insurance work?

Typically, a high net worth individual (or his/her ILIT trust or business) applies for copious amounts of life insurance for estate planning or retirement planning. The life insurance policies will largely be Indexed Universal Life (IUL) or Whole Life insurance since lenders recognize that these types of policies are quite stable and can therefore offer a very high loan-to-value ratio of 90% or higher.

The premium financed life insurance policies will most often be funded with the maximum allowable premium during the first 4-7 years to achieve high early cash value as well as strong long-term performance.

Although, the borrower will sometimes pay the first premium out of pocket to avoid posting collateral, more times than not the policyowner will concurrently petition a 3rd party lender for a large premium finance loan to pay premiums. The intent is for the individual, trust, or business to pay regular payments (usually interest-only) to the lender. However, some more aggressive premium financed strategies advocate for the borrower to “capitalize” or roll up accruing interest into the loan in hopes that the cash value growth will outrun the ballooning premium finance loan.

Regardless, the borrower/policyowner must be prepared to have sufficient liquid assets or marketable securities to post as collateral at any time there is a shortfall between the policy cash values and the total amount borrowed for the premium financed life insurance. That said, the life insurance policies, if designed properly, can often make up the lion’s share of collateral required by the lender. Sometimes, the policyowner may even pay the early premium(s) themselves to avoid this additional moving target with premium financing.

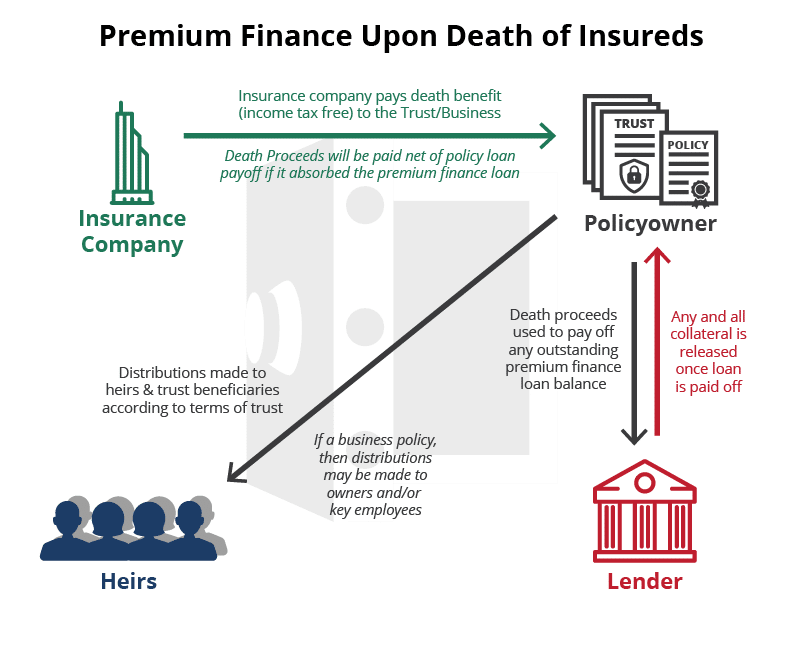

Premium Finance Exit Strategies

Because a premium finance loan will usually come due every 3-5 years (sometimes as long as a 10-year loan term), the borrower/policyowner must be prepared to “refinance” their premium financed life insurance throughout the policy’s accumulation period. Maintaining good credit, sufficient collateral, and a favorable relationship with your lender is key to refinancing with continuing favorable loan terms/rates.

The policyowner should also have a clear exit strategy in place for their premium financed life insurance. Perhaps they are planning to sell property or a business resulting in a future windfall that can pay off or pay down their premium finance loan.

The ultimate backstop for most premium financed life insurance arrangements, however, utilizes the policy’s built-in policy loan feature. Usually, we see this internal refinancing into the policy loan feature somewhere between year 10-15 in the premium financing illustration.

One potential benefit of rolling a premium finance loan into a traditional policy loan is that many IUL policies will have a locked or capped loan rate somewhere between 5%-6%. A built-in policy loan that is locked or capped can help the borrower hedge against higher future interest rates.

However, the main benefit of rolling the loan back to the insurance company is that policy loans do not come due until the insured dies, in which case the death benefit would pay off the loan. Also, policy loans do not have mandatory interest payments like most 3rd party lenders will require. In fact, the insurance company must extend this flexible right to borrow to their policyholders without requiring annual servicing payments so long as the policy loan balance stays below a certain threshold (usually around ~90% of cash value depending on the insurance company).

Again, the ideal plan for most premium finance strategies is that the low early interest rates to borrow massive early premium payments creates a compounding snowball of cash value growth. That way, the cash value growth has enough time to sufficiently overcome the hurdle rate of these extremely low premium finance rates throughout the first 10-20 years.

If so, there will ideally be sufficient policy equity and cash value growth momentum to not only absorb the internal policy loan without further interest payments, but also provide substantial tax-exempt payments in the form of supplemental retirement income and/or death benefit to heirs.

You can schedule a call with one of our specialized life insurance agents to explore a proper exit strategy for your situation.

Pros and Cons of Premium Financing

The internet is full of both pundits who crucify premium finance, as well as promotors who paint only the rosiest pictures of it. Premium financed life insurance has a clear set of risks and benefits along with caveats for each. Below we will factualize the pros and cons of premium financing while providing some context around the common opinions you will find from both sides of the argument.

What are the benefits of premium financed life insurance while living? The Pros of Premium Financing

The main benefit of premium financed life insurance is the ability to acquire substantially more life insurance for a significantly lower cash flow outlay. Keep in mind though that premium finance will of course look great when showing today’s favorable spread as a constant that compounds favorably for decades into the future.

That said, since the inception of premium finance around 25 years ago, the net spread between cash value growth and premium finance loan rates has been a favorable proposition for those with well-designed max-funded policies. Quite simply, a properly-structured premium financed life insurance strategy allows you to potentially earn copious amounts of tax-exempt interest on an increasing cash value balance while paying simple interest on a flat balance (once all premiums have been borrowed).

This is a recipe for financial success, but the ingredients and sequencing obviously matter.

Needless to say, premium financed life insurance is a complex transaction that has multiple moving parts to be managed properly. Those who design, build, and continually navigate a well-structured premium finance strategy can expect the following benefits.

6 Main Benefits Premium Financed Life Insurance Provides Individuals:

- Replaces the need for paying wasteful term insurance premiums typical of high-income earners during working years.

- Substantially more cash value compounding in your favor (even if encumbered by the premium finance loan).

- The ability to keep your other liquid and illiquid assets deployed elsewhere.

- Potential for positive arbitrage between the policy’s cash value growth rate and premium financed loan rate (obviously dependent on actual performance).

- Potential for supplemental tax-exempt retirement distributions that would be immune from your highest and most penal tax brackets.

- And/or the existence of a tax-free death benefit outside the estate, which allows the insured to tactically spend down less tax-efficient assets in their estate during their lifetime as well as the ability to utilize other more complex estate planning strategies (all dependent on additional estate planning).

Estate Planning Advantages of Premium Financed Life Insurance

There are also some clear and unique advantages that premium financed life insurance can provide wealthy families for complex estate planning situations.

- Paying interest on premiums rather than paying the larger premiums themselves can make the most out of limited and compressed gift tax exemptions/exclusions

- May create a larger pool of tax-free death benefit for families with estate equalization concerns or estate liquidity issues (i.e.: blended families or closely-held business situations where only certain heirs are active in the business and limited assets exist otherwise)

- May allow families with illiquid estates the ability to acquire the proper amount of coverage needed simply by posting collateral and capitalizing interest payments rather than pay massive premiums

- May allow insureds in substandard health the mathematical wherewithal to acquire sufficient coverage needed for proper estate planning (since the favorable leverage can sometimes overcome the higher cost of insurance)

- Immediate creation of tax-free liquid assets at death when swelling estates have exhausted all their gifting & estate planning exemptions. Oftentimes substantial charitable gifting at death or advanced charitable trust strategies delaying distribution to heirs can help wealthy families avoid estate taxes. A premium financed life insurance policy in an ILIT can support heirs if these charitable measures deplete the estate or delay distributions to heirs.

Business Planning Strategies Coupled with Premium Finance

Since premium financed life insurance is now practically mainstream with advanced personal planning, business usage of premium finance is becoming more common. Since businesses and business owners are accustomed to utilizing leverage to grow and scale, it’s no surprise that premium financing is being used to amplify the effect of several age-old business planning strategies.

- Executive Benefits Planning – Life insurance is one of the last legal ways to retain and reward owners and key employees with exclusive benefit packages. By utilizing existing IRS regulations for split-dollar, deferred compensation, and/or executive bonus plans, businesses can legally carve-out certain employees or groups to provide customized carve-out plans. Premium finance can allow businesses to offer these programs while retaining control of their precious capital, especially where certain bonding, licensing, or lending constraints require them to maintain certain optics on their financial statements.

- Key Man Protection – When the possibility of a key employee dying will negatively impact the business, premium financed life insurance can allow businesses to implement this protection for a fraction of the cash flow outlay. Also, when done in conjunction with some of the executive benefit planning described above, the business may simultaneously protect against that same key employee leaving to work for a competitor or starting their own venture.

- Buy-Sell Agreements – All too often, the most uninsured risk that businesses face is one of the owners dying when surviving owners do not have the cash or cash flow to buy out their heirs. How likely is it that a business can make after-tax payments to buy out surviving heirs after losing one of its key rainmakers? Premium finance can often help make this typically expensive planning much easier to stomach, especially when it is done in conjunction with executive benefit planning for the same owner who will hopefully enjoy a healthy retirement someday.

The Risks of Premium Financed Life Insurance

There are multiple moving parts involved with premium financed life insurance, and therefore multiple types of risks associated with any premium finance arrangement.

Lender Risk with Premium Finance

Premium financed life insurance is most often illustrated with funds being borrowed continuously from a 3rd-party lender for at least 11-20 years before any sort of exit strategy is illustrated. This is in stark contrast to the fact that most premium financing arrangements start with an initial loan term of only 3-5 years.

Therefore, there is a genuine risk of having the loan come due in the early years when the cash surrender value is not sufficient to have the built-in policy loan feature cover this steep capital call.

Lenders can call the loan or choose not to refinance for any number of reasons such as:

- The borrower’s credit score worsens

- The borrower’s amount of collateral diminishes

- The life insurance company’s ratings worsen significantly

- The lender arbitrarily decides not to renew your loan at the end of the term

Keep in mind that many banks offer attractive premium finance rates as sort of a teaser program to develop a deeper relationship with affluent borrowers. Some even require the borrower to transfer their collateral accounts to the lending bank rather than the accepting borrowers existing accounts and relationships. Therefore, when shopping for your premium finance loan it is good to either:

- Utilize a lender whose core business is premium financed life insurance and won’t require transferring collateral directly into their possession

- Or to use a lender with whom you already have a strong relationship, so you are not forced to upset your personal apple cart by transferring accounts away from your existing financial institutions

Doing either of the above may increase your chances of your premium finance loan being renewed at the end of the loan term.

It is also worth noting that premium financed life insurance has become more mainstream over the last 25 years. More and more lending institutions have become familiar with these programs and as a result, are comfortable offering these loan programs. As it has become challenging for banks to earn competitive yield in this low interest and now volatile economy, more lenders are becoming interested in the proposition of collateralized premium financed life insurance.

Therefore, if one premium finance lender does not renew your loan with favorable rates/terms, then perhaps another will.

Loan Interest Risk with Premium Finance (adjustable & based on what?)

How high can your interest rate go with premium finance?

Premium finance loans are most often an adjustable-rate loan even though the loan spread may be fixed for the entire term of the loan. Most often premium financing rates are expressed as a fixed spread over some underlying loan benchmark such as LIBOR, WSJ Prime, or certain Treasury Rates, all of which will cause the premium financing rate to fluctuate.

Nonetheless, while the threat of future higher interest rates has always loomed over premium finance borrowers, it obviously hasn’t come to fruition in any meaningful way since the inception of premium financing around 25 years ago. That said, many borrowers are concerned that hyperinflation and spiking interest rates still remain an impending threat that will occur at some point in the future.

For an additional fee or higher interest rate, many lenders will offer a true fixed premium finance interest rate for the term of the loan (usually 3-5 years but sometimes as much as 10-years). The additional fee or higher interest rate is used by the lender to purchase derivatives to hedge their risk of interest rates floating higher while your loan maintains the lower fixed rate.

However, just as what occurred with fixed vs. adjustable-rate mortgage products over the last 25 years, premium finance borrowers would have been much better off choosing the lower and unhedged adjustable-rate option. Remember, the hope of most premium finance borrowers is that their cash surrender value will grow to a point where they can relinquish all collateral and even absorb the outstanding debt using the policy loan feature (especially if you have an IUL policy with a locked or capped policy loan).

Loan Benchmark Risk? – What will your premium financing rate be based on?

Another unique loan interest rate risk worth mentioning is how your loan rate will be calculated in the future. At the time of this article being written (Q4-2020), most premium finance loans are based on LIBOR (London Interbank Offered Rate) plus some fixed spread usually with a minimum floor regardless of how low the underlying benchmark goes. Although LIBOR remains extremely low even with a modest spread added to it, this benchmark is scheduled to go away at the end of 2021.

It is not known if COVID-19 will slow down the process of its removal, nor exactly how this will affect existing financial contracts using LIBOR (like the myriad of premium financed life insurance loans).

It is predicted that loans previously tracking LIBOR will someday track a benchmark called SOFR (Secured Overnight Financing Rate). However, the exact transition and conversion process has yet to be laid out for existing or prospective borrowers still being quoted premium financing rates involving LIBOR.

Collateral Risk with Premium Financed Life Insurance

There is always the potential risk that a premium finance borrower will have to produce more collateral if the value or quality of their collateral declines. Banks have denied certain types of corporate and municipal bonds after being downgraded.

When stock and even municipal bond portfolios decline drastically (like they did during the onset of COVID-19) lenders may ask borrowers to produce recent statements and post more collateral if there is a shortfall.

Collateral is obviously posted during the early years of every premium financed life insurance policy when the cash surrender value has yet to eclipse the amount of the loan balance. If the policy underperforms the original assumptions (such as we have seen as IUL caps or Whole Life dividends have declined) then collateral requirements may increase and probably need to be posted with the lender for a longer period of time than originally intended.

There are certain providers that offer non-recourse premium financing loan arrangements. In a true non-recourse situation, the policyowner would pay all or a portion of the initial premium so the policy cash value is sufficient to collateralize the entire loan arrangement. In such a case, no outside collateral nor personal guarantee would be needed from the lender, and their sole recourse for any default would simply be the policies themselves. It is worth mentioning, that the loan interest charged for this type of arrangement is typically a little higher than what you can get from a premium financing arrangement where the lender has some recourse.

Policy Performance Risk with premium financing

There is also a risk that your IUL or Whole Life policy will not perform as well as it was originally illustrated. Regardless of how well the policy performs, the borrower is still on the hook for the total loan amount, interest payments, and any unforeseen collateral gaps resulting from poor policy performance.

Recently IUL companies have faced the challenge of increased market volatility, which raises the options pricing thereby lowering IUL caps. Throughout most of 2020, the average amount of market volatility has been more than double that of previous years.

Also, for the last couple of decades interest rates, in general, have been declining. And life insurance companies rely largely on yield to provide ongoing policy growth parameters like Whole Life dividend rates as well as IUL caps and participation rates. We, therefore, have seen the projected growth declining on all life insurance products since carriers must adjust policy growth parameters as the yield on their general accounts morphs with outside economic forces.

Thankfully though, premium finance loan rates and life insurance company portfolio rates for the most part move in tandem. That is why for the 25 years or so premium finance has been in existence, there has been a favorable spread between what you can borrow at and what your life insurance cash value and death benefit can potentially grow to.

To protect against the risk of poor policy performance, it’s paramount that you do these 3 things:

- Make sure you fund the policy to the maximum allowable IRS limit to reduce early collateral gaps and provide robust long-term performance

- Have an expert choose, design, and build you a diversified premium financed life insurance portfolio with multiple policies for unique and ideally

uncorrelated growth triggers as well as hedging against company-specific risks - Stress test against poor assumption sets to plan for unforeseen collateral gaps and plot out potential exit strategies

Most premium finance clients and agents alike simply pick the winner of the illustration beauty contest when choosing the underlying premium financed life insurance product. Implementing a premium finance strategy after this kind of one-dimensional analysis has led many premium finance life insurance clients to disappointing results and perhaps additional collateral necessary to support the premium financing.

Diversifying amongst different insurance companies and products that perform well during poor assumption sets can help you not only build a more sustainable premium finance strategy but also plot out when a potential exit strategy makes sense if things don’t work out favorably.

Policy Charges Risk with Premium Financed Life Insurance

The other risk specifically with a premium financed life insurance policy is the underlying charges.

With a Whole Life policy, the underlying mortality charges are fixed at the onset of the policy and can never go up. However, an IUL policy’s charges are dynamic. This amplifies the risk of achieving worse policy performance than was originally illustrated since the underlying charges will increase unless the adjustments are made to offset the poor performance. The policyowner will either need to pay more premiums or reduce the death benefit to offset the poor performance.

Also, any IUL company can actually increase the charge structure of a policy that’s already been sold, whereas a Whole Life company cannot. Now it’s worth noting that this horrific move is rarely used by life insurance companies that offer Indexed Universal Life, but it is possible.

Again, diversifying with multiple products from different life insurance companies in your premium financed life insurance portfolio to hedge against the potential of higher than illustrated IUL charges is key to developing a sustainable premium financing strategy.

More and more we are seeing premium financiers adding slices of Whole Life insurance into their premium finance designs to hedge against this risk. Similar to lowering standard deviation with non-correlated asset classes in an investment portfolio, adding Whole Life to a mix with IUL can support the entire premium financing strategy during rocky times. With a properly structured Whole Life policy, this can be done without sacrificing much in the way of projected returns during even the most optimistic of projections.

Taxation Risk of Premium Financing

Serious tax traps exist if a premium finance transaction goes wrong even though the embedded tax benefits are some of the main draws of premium financed life insurance.

First of all, the loan interest payments on premium finance loans are not deductible. Though certain promoters and exotic structures may offer the prospect of deducting your interest on premium finance loans, you should know that the IRS severely frowns upon tax-deductible life insurance of any sort since the back-end benefits are essentially tax-free.

Second, there is also the risk of overfunding your premium financed life insurance policy to the point where it changes its tax classification from a life insurance policy to a modified endowment contract (MEC). When doing so, any cash value distributions during your lifetime become taxable at that time according to your highest marginal income tax rate.

It is safe to say that both of these first two taxation risks of premium finance are easily avoided since either would essentially be an “unforced error” of sorts.

However, this final potential tax trap can result if a policyowner were to take substantial retirement distributions from the premium financed life insurance policy to the point where it could no longer survive without more premiums. If so, the policyowner may be inclined to simply fold up the tent and cancel the life insurance policy.

But should the premium finance policy be canceled and the total distributions exceeded what was paid into the policy, then the amount in excess would all be taxable in the year of cancellation. This would obviously include any loans/withdrawals to pay back the premium finance lender.

Therefore, any cancellation situation in retirement would cause concentrated taxation since all prior distributions over and above basis will be added together and taxed in that single year. This would probably push anyone into the highest and most penal of tax brackets assuming they weren’t there already.

It is worth mentioning, however, that most premium finance life insurance companies have something called an “overloan protection rider” built into their policies now to avoid this exact taxation risk. Quite simply, an overloan protection rider is like a parachute that deploys when the policy loan has grown so big it is about to lapse the policy and cause this horrible tax trap.

When the overloan protection parachute kicks in (often when the total loan amount is greater than 95% of total cash value), it simply cuts off the policyowner from taking any further lifetime distributions and freezes a nominal amount of death benefit for the heirs.

This move by the insurance company preserves the tax-exempt tax status of all prior lifetime distributions until the death of the insured consummates everything as tax-free.

Although different life insurance companies have different rules that trigger this helpful rider, an overloan protection rider incurs no cost to install into your premium financed life insurance policy. Thankfully, many insurance companies had seen enough of this tax trap occurring in the past to create this helpful rider for those seeking to use whole life and indexed universal life insurance for retirement.

7 Steps to take with your Premium Financed Life Insurance Agent (Proper Sequencing)

Premium financing is an extensive process with multiple moving parts where the sequence and timing should be orchestrated by a specialized premium finance life insurance agent.

1) Informal modeling of your premium financed life insurance strategy

This first step is essential for you to see if the potential benefit is worth going through the other more intensive steps below needed to implement any premium financed life insurance policy. This is also where you can learn about the different product features and visualize the pros and cons of premium financing through different assumption sets.

Learn about the best Indexed Universal Life companies or the top Whole Life insurance product on the market now.

2) Confidential (but informal) field underwriting by your agent to be shopped anonymously amongst desired premium finance companies

This second step is so incredibly important to optimize your premium financing strategy. Since the underlying cost of insurance charges will be based on your health rating, it is important to shop the insured’s health situation to multiple carriers since certain insurance companies are more forgiving with certain issues than others.

It is imperative that your premium finance agent shops the underwriting situation on an “informal basis.” This is because all life insurance companies share their official findings with the Medical Information Bureau (MIB). Therefore, if negative data goes through official underwriting channels, the well will be poisoned so to speak, and your insured’s health status will be common knowledge amongst other insurance companies.

3) Compare informal health ratings that have been received by desired companies and have your agent rerun the numbers to find the most favorable financial outcomes that can be achieved by premium financing.

This third step is similar to the first one, but only with more precise underlying data plugged into the assumptions. This is where the really intensive stress-testing of various companies and policy designs take place so the policyowners can narrow down which company/product(s) they will include in their premium financed life insurance portfolio.

Since this step is somewhat similar to step one only more intensive, the complex learning curve often gets easier here. Context that was once foreign now becomes familiar. Although the potential clients begin building upon what they learned previously, this is still not where the final design is modeled and finalized.

This step is simply to choose the best set of ingredients for their premium financed life insurance portfolio.

4) Formally apply with your premium finance life insurance agent to the top company or companies (diversification is recommended here)

Once the premium financed companies have been narrowed down to 2-3 companies, and their informal health ratings appear to be favorable, we start officially applying to these companies.

Potential clients often get nervous during this step because they mistakenly assume that an official application is a contract or some sort of commitment to do business with that company. It is not. A formal application is simply a policyowner petitioning the insurance company for an official health rating. Once the life insurance company declares what the insured’s health rating will be, policyowners can still decide if and how much business they choose to do with said company.

5) Concurrently apply to third-party lenders for the premium finance loan

As the premium financed life insurance is being officially applied for, so too should be the premium finance loan if the first premium will be financed. Sometimes the policyowners choose to pay the first premium themselves to quickly lock in their current health or younger age while more complicated estate planning is being finalized.

Doing so may also avoid future collateral issues if the policy is designed in such a way that most of that first premium is available in cash surrender value before the 2nd policy is due.

However, when premium financing is desired at the onset, the loan underwriting has a similar timeframe to policy underwriting and should be done concurrently.

6) Where applicable, concurrently engage in complimentary estate planning

When premium financing will be done in conjunction with certain irrevocable trusts designed to enhanced asset protection strategies and/or dynasty estate planning, the legal work should commence, once the policyowner is committed to the premium finance transaction.

When premium finance is more of a retirement planning strategy than an estate planning strategy, then it may not be imperative to have the legal planning completed before the life insurance policies are initiated. Since the legal work can take considerably longer, and the policies can be immediately transferred to an ILIT via sale at any point in the future, then it may be optimal to initiate the policies earlier rather than waiting and having them become less efficient at a later age.

It is worth noting that keeping such large life insurance inside one’s estate may cause estate tax if two married spouses both die before the policies are sold to the newly completed trusts. That said, if both spouses were to pass away early to where the death benefit caused estate tax, then one tiny premium payment yielding such a massive death benefit (even net of estate tax) would result in considerably more wealth to heirs than if the insured died without placing the insurance.

7) Service and monitor the policies

Although finally putting the premium financed life insurance policies in their proper place represents a huge milestone in this transaction, the work has just begun. This is why it is so important that you have a team behind your premium financed life insurance transaction to help you throughout the different phases.

Remember, the prior illustrations used to model the future are imperfect because they usually show linear growth and ongoing market arbitrage when in fact, the policy values will certainly fluctuate.

Whether it is an IUL or Whole Life policy, IUL caps and participation rates will vary over time as will Whole Life dividend rates. Even if you modeled rising loan interest rates in the premium financing scenario, they certainly won’t evolve exactly as modeled.

This is why it is so important to review the design on a regular basis with an expert to manicure the premium financed life insurance policies along the way so your desired retirement and estate planning objectives are met.

Conclusion about Premium Financed Life Insurance

Premium financed life insurance is not for everyone, but for certain fact patterns it can be an incredibly powerful tool to leverage relatively small interest payments on massive premiums. This can translate to tax-exempt retirement income or a liquid tax-free death benefit to assist with complex estate planning situations.

Oftentimes potential clients wonder if premium financed life insurance is something they actually need, or if they would be better off putting their money elsewhere. We remind them that adding an overlay of life insurance (premium financed or not) creates a whole additional planning dimension with its own unique set of benefits that can’t be replicated elsewhere. Life insurance shouldn’t replace their wealth building, but enhance it, and premium finance is simply a way to add this unique dimension of planning without large out of pocket costs.

Rather than simply make an apples to apples case when measuring the return on investment for their interest payments, potential premium finance clients should also consider these qualitative issues:

- Could committing temporary collateral and making relatively small interest payments, create another large bite of the apple as well as add a unique wealth preservation tool to your war chest?

- What else in your financial world do you have to protect yourself against future higher taxes?

- Do you have another way to capture upside in the S&P 500 index without risk of market losses?

- Are there potential estate tax issues with the changing political landscape in the near future?

- Regardless, is your estate liquid enough to be equitably distributed amongst heirs or will in-fighting occur as a result of trying to equitably share in illiquid assets?

- Do you have substantial retirement account balances that will be forced out within 10-years after death when taxes may be much less favorable than they are today?

- Could relatively small interest payments (potentially paid by RMDs) in today’s low-interest-rate environment leverage a much larger tax-free lump sum to heirs?

If any of these considerations give you pause, then a properly designed premium financing strategy may be a viable option to explore further. You can book your own no-obligation consultation with one of our life insurance specialists to help you explore the pros and cons of premium finance for your situation.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

The Top 4 Myths Behind Becoming Your Own Banker (Article)

Learn How This Banking Concept Really Works (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life Insurance (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

The Top 4 Myths Behind Becoming Your Own Banker (Article)

Learn How This Banking Concept Really Works (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life Insurance (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)