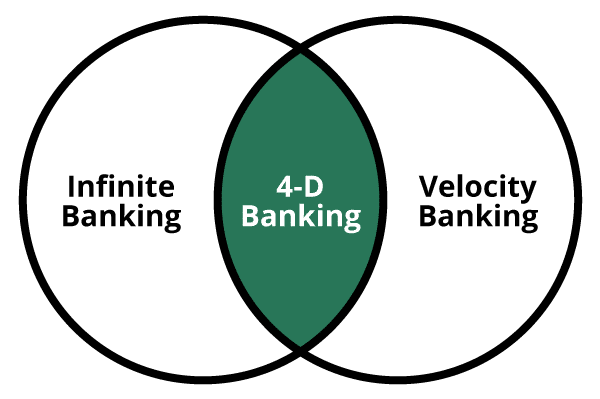

What is 4-D Banking?

4-D Banking is the ultimate privatized banking and cash flow management system that combines the best aspects of both Velocity Banking and Infinite Banking. The 4-D Banking System is a multidimensional approach to wealth building. It aims to take full advantage of time, the 4th dimension, and its steepening effect on your compound interest curve.

Here’s a detailed thread with:

Here’s a detailed thread with:

If $BTC trades below $90k by April, you pay $5,100 for 100 shares of $IBIT even if it’s trading lower.

If $BTC trades below $90k by April, you pay $5,100 for 100 shares of $IBIT even if it’s trading lower. If $BTC rips above $109-110k, then all appreciation above that price is yours to keep.

If $BTC rips above $109-110k, then all appreciation above that price is yours to keep. If neither happens, then both options expire worthless & you keep $9 or lose $16.

If neither happens, then both options expire worthless & you keep $9 or lose $16.

!

!

,

,