Direct Recognition vs. Non-Direct Recognition: The Whole Story About Whole Life Insurance Loans

In this article, we’re going to dissect the most confusing concept when it comes to infinite banking: Direct vs Non-Direct Recognition loans.

Our detailed case study video below also dissects the big myth that “you must choose a Non-Direct Recognition company,” and the contrarian reasons why Direct Recognition may be a much better approach.

Here’s why you should listen to me about the Non-Direct vs Direct Recognition debate:

- I’ve been selling Whole Life insurance for 18 years

- I have 11 total Whole Life insurance policies on 6 Family members

- From 3 different mutual companies (including one that lets you choose Non-Direct or Direct Recognition)

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What’s the difference between Direct Recognition vs. Non-Direct Recognition?

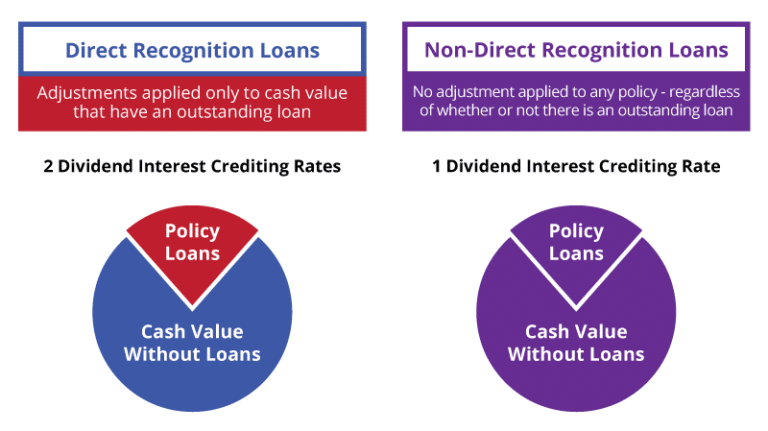

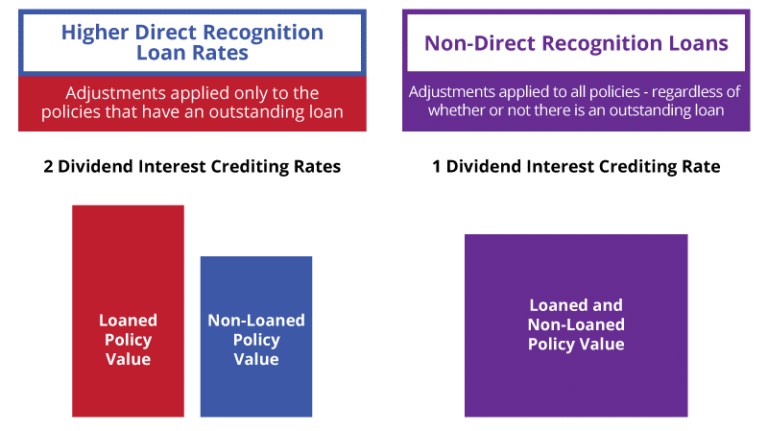

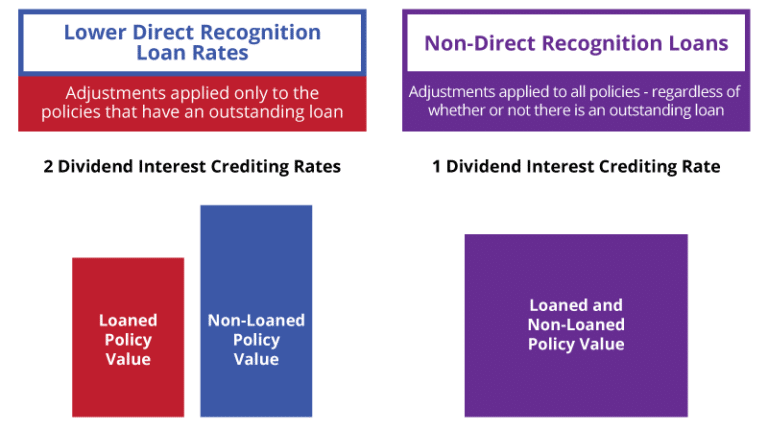

Direct recognition is a method where a mutual insurance company has separate dividend rates for borrowed and unborrowed cash value. Non-Direct Recognition is a method where an insurance company credits all Whole Life policies with an equal dividend rate, regardless if there is a loan outstanding.

First, let’s clear up the confusion between Direct vs Non-Direct recognition loans. Here’s another way to think about it:

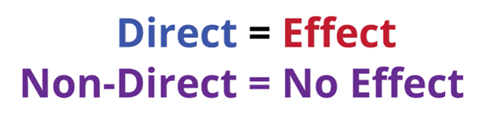

Just replace the word “direct” with “effect” to easily remember the difference.

Direct Recognition loans will have a “direct effect” on your dividend rate for that portion of your cash value backing the loan. Conversely, Non-Direct Recognition loans have “no effect” on your Whole Life dividend payout, meaning your entire cash value balance will receive the same dividend rate whether or not you have an outstanding loan.

To the untrained eye, Non-Direct Recognition seems to be the superior choice if you plan on taking Whole Life loans, but the devil is in the details.

And those hidden details are exactly what this article will dive into.

Table of Contents

Deconstructing the Myth of Non-Direct Recognition Loans

You’ve likely heard that Non-Direct Recognition is some kind of magic-bullet policy feature that allows you to collect perpetual positive arbitrage from borrowed cash value.

We’ll disprove this nonsense below, but put on your critical thinking cap for just a moment.

- Your agent has a secret advantage, where his select clients learn to siphon continuous arbitrage from a 150+ year-old insurance company.

- This same insurance company happens to be one of the strongest and most solvent financial companies in America.

Both of these things cannot be true, correct?

So let’s dive in…

The Truth Behind Non-Direct Recognition

What is Non-Direct Recognition?

Non-Direct Recognition means that having a policy loan will have no effect on your dividends. All Whole Life policyholders receive the same crediting rate, regardless if they have a loan outstanding.

However, you’ll find that over time, any positive arbitrage between a Non-Direct Recognition company’s overall growth rate and their loan rate is often very short-lived.

Dividends are declared and set for the entire policy year. So whenever there’s a disparity between total return and whatever they’re charging you for loan interest, a non-direct recognition life insurance company must either:

- Subsidize this disconnect from the other non-borrowing policyholders.

- Or raise your loan rate when taking a Non-Direct Recognition loan.

Even though borrowing against your cash value has “no effect” on your dividend rate, Non-Direct Recognition companies end up mitigating the effect of money leaving their general investment account by adjusting their loan rate accordingly.

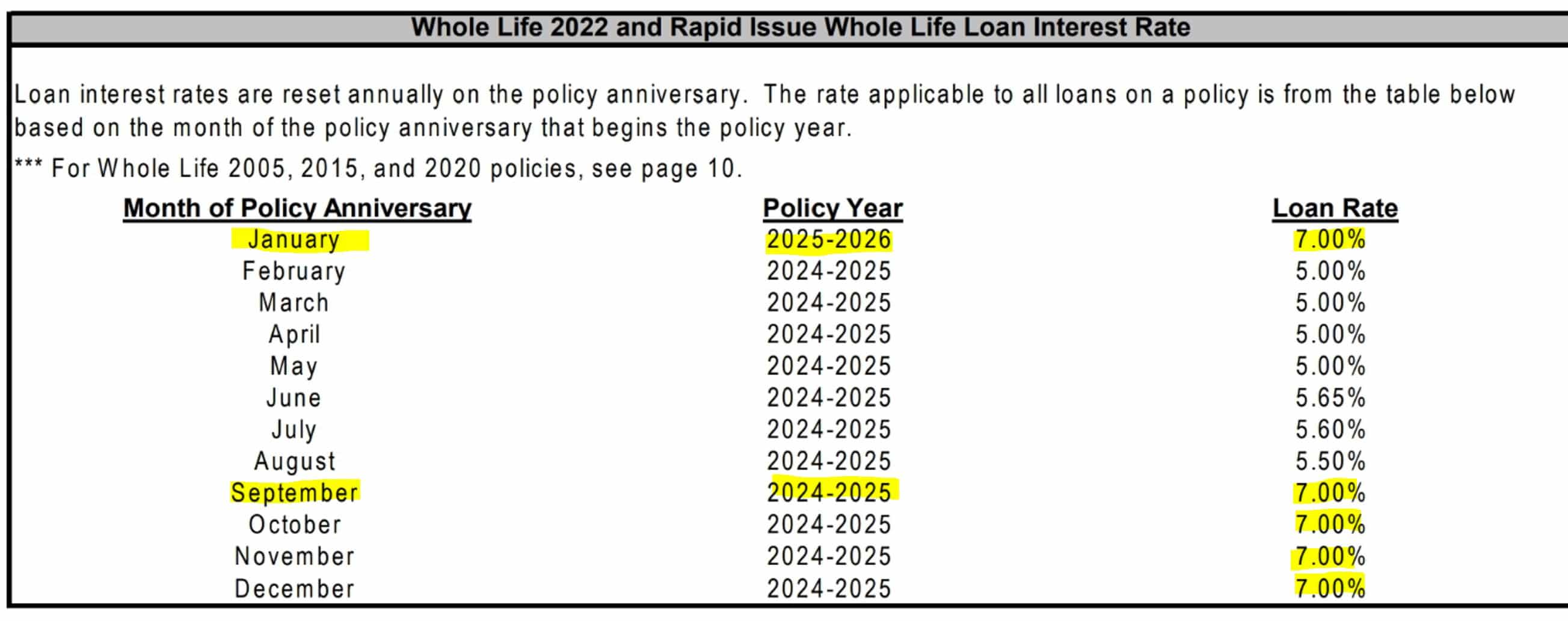

For example, between 2022-2023, we saw Non-Direct Recognition loan rates jump from 3% to over 5.7% as the Fed aggressively cranked up interest rates. In September 2024, we saw the most popular Non-Direct Recognition company for Infinite Banking raise their loan rate to 7%.

Here’s the truth behind one of the most common infinite banking myths:

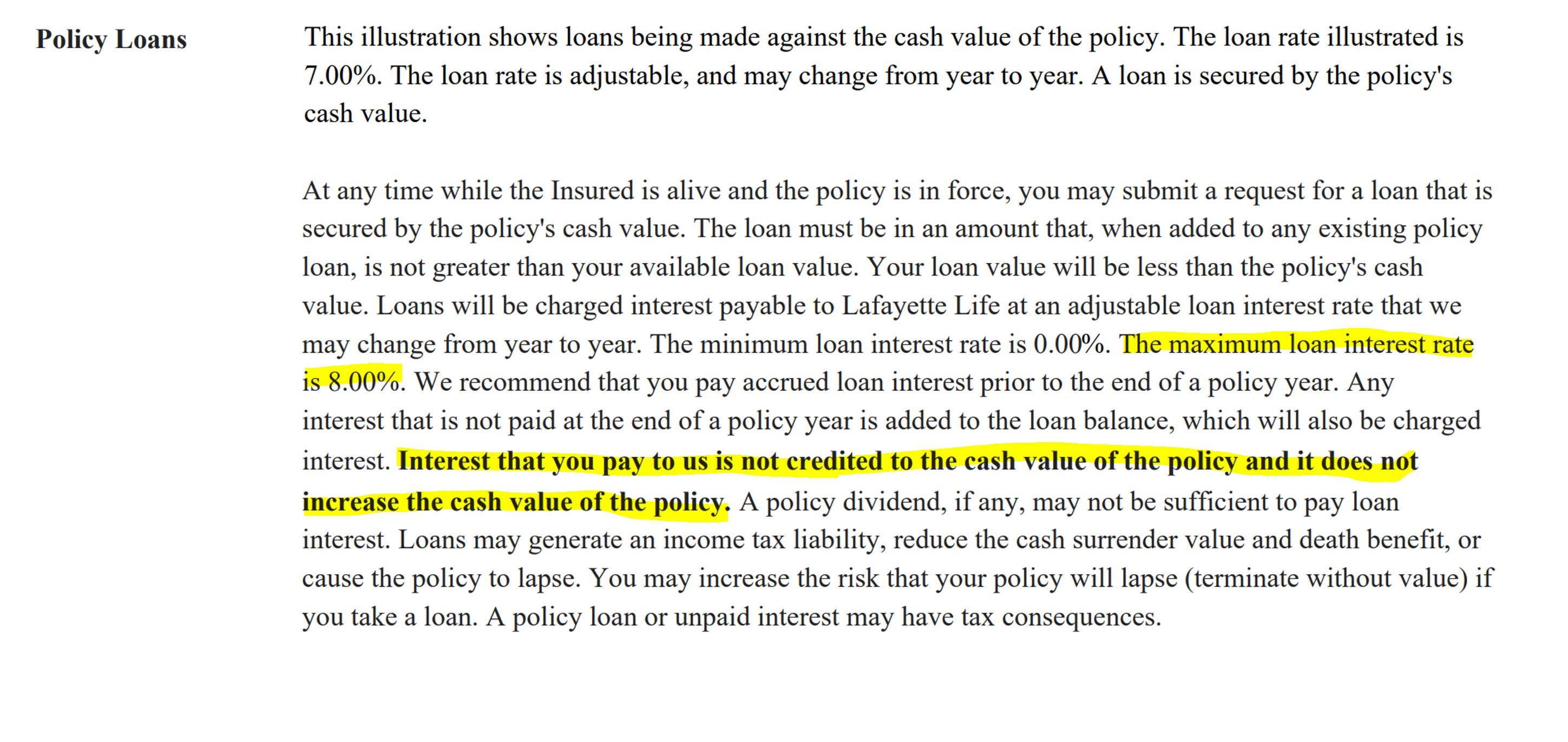

When you borrow against your Whole Life insurance policy, you are not paying yourself back interest like many agents would have you believe. The insurance company is simply giving you a loan from their general investment account, while your continuously compounding cash value acts as collateral (since they’re already investing it for you).

However, during certain eras (like now) some Whole Life policies actually will get a higher dividend than normal when taking a loan.

In fact, you may have seen this effect in Nelson Nash’s book.

It is because the examples Nelson showed in his book were all from Direct Recognition companies, not Non-Direct Recognition!

What does that tell you?

The Direct Recognition Advantage During High Interest Rate Environments

What is Direct Recognition?

Direct Recognition is a method insurance companies use to pay a different dividend rate on cash value with a loan. This adjusted dividend may be lower or higher depending on both the Whole Life dividend rate as well as the Direct Recognition loan rate.

Did you know that Direct Recognition loans were being shown all throughout Nelson Nash’s book “Become Your Own Banker: The Infinite Banking Concept.”

You see, Nelson Nash was a Guardian agent in the year 2000 when he wrote The Infinite Banking Concept – Becoming Your Own Banker and Guardian is a Direct Recognition company.

To this day his examples still make IBC enthusiasts believe their Whole Life policy will be better off by taking a loan than not. That wouldn’t be true with even the best Non-Direct Recognition policies. For instance, the top 2 non-direct recognition life insurance companies are Mass Mutual and New York Life.

Nelson’s dividend bump from borrowing only happened because Guardian is a direct recognition company. When the loan rate is above the dividend rate, a direct recognition life insurance company will pay an enhanced dividend to any cash value with a direct recognition loan against it.

Why?

Because the aim of Direct Recognition is to be fair to all policyholders. And if you are borrowing at a higher rate than what dividends are paying to policyholders who aren’t borrowing, you need to be compensated fairly since you’ll be paying a slightly above-market loan rate back to the insurance company’s general investment account.

So, Direct Recognition companies pass on a subsidy to those borrowing in this environment.

Since those loan payments generate higher dividends for your particular policy, it may feel like you’re paying yourself back interest, but technically you’re not.

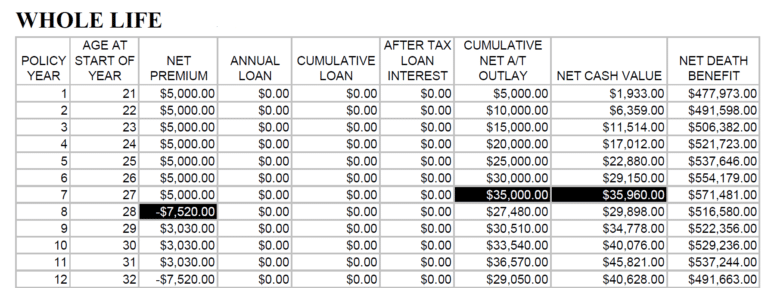

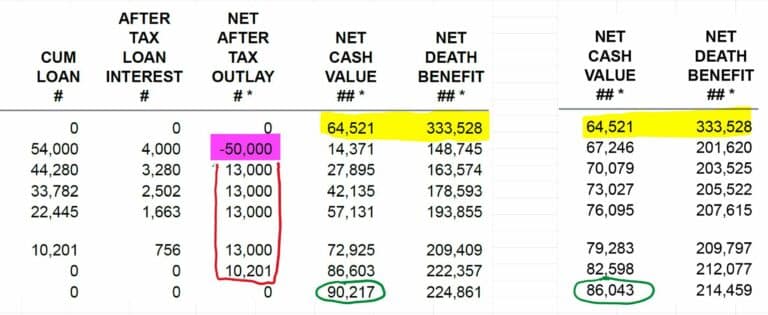

I have my own real-life example from my wife’s very first small Guardian whole life policy we got 18 years ago. It happens to have the same 8% loan rate as the examples in Nelson’s book, only with a historic low 5.75% dividend rate at the time of this screenshot.

See what happens below when she borrows against this Direct Recognition policy vs. when she doesn’t.

In both the left and the right scenarios you’ll see the exact same starting cash value and the death benefit. For simplicity’s sake, we ran this in-force scenario as if she was no longer paying premiums.

- See how in year 2 on the left she’s borrowing $50,000

- She’s also paying down the loan plus interest for the next 5 years.

- Notice how once the loan is completely paid off, she has $90k of cash value instead of 86k.

Why is that?

This is a Direct Recognition loan at work in a high-interest rate environment.

She paid for an above-market loan, and the company, therefore, treated her fairly by subsidizing her policy with a higher dividend. In fact, she’s got 4% more total cash value than if she hadn’t borrowed at all, and she didn’t even borrow against her entire balance ($50,000 of $64,521).

I’m NOT showing you this because it’s her best policy borrowing option, so don’t get hung up on these details. We’ll be discussing better borrowing options she has later on in this article.

The reason I’m showing you this is to illustrate the power of Direct Recognition, the ultimate BACKSTOP.

Once properly educated about the benefits of Direct Recognition, they agree they would rather have a protected and controlled cost to borrow.

What if her policy instead had a Non-Direct Recognition loan, charging 8% for loans when the dividend rate was 5.75%?

Would she get any dividend subsidy from the insurance company on that borrowed money?

The answer is clearly NO!

Let’s look at an extreme example from the 1980’s that may not seem so extreme if rates keep rising.

From 1983-1985’s Mass Mutual’s Non-Direct Recognition loan rate was above the dividend rate by well over a full percentage point.

Did Non-Direct Recognition policies get a subsidy on the dividend over these few years?

The answer is clearly NO!

If this was instead a Direct Recognition loan rate that stayed higher than your dividend rate, would you get an enhanced dividend when borrowing?

The answer is clearly YES!

Is it possible we may see these types of hyper-inflationary interest rate spikes in the future?

Time will tell, but I’m leaning yes with the inflationary pressures that haven’t been tamed, and The Fed keeps printing money.

However, this disconnect between Non-Direct Recognition Loan rates and dividend rates is already happening with one of the most popular Non-Direct Recognition companies for Infinite Banking.

See below how their loan rate bumped all the way up to 7% even though their dividend is under 6%.

Will your Non-Direct Recognition dividend get a subsidy on loaned money?

The answer is clearly NO!

If this was instead a Direct Recognition loan rate that stayed higher than your dividend rate, would you get an enhanced dividend when borrowing?

The answer is clearly YES!

See for yourself with the highlight in bold below:

What’s even more interesting is the 8% cap on this Non-Direct Recognition loan.

Aren’t they basically admitting that if interest rates skyrocket like they did in the 1980’s, that they’ll have to squash everyone’s dividend?

How else could they give out 8% loans and pay double-digit dividends?

So, isn’t this Non-Direct Recognition (with a cap) far worse than just being Direct Recognition agreeing to treat all policyholders fairly always?

The answer is clearly YES!

Remember Nelson Nash teaching about being an honest banker?

- Direct Recognition is honest banking.

- Non-Direct recognition leads to dishonest banking.

Non-Borrowing policyholders must subsidize borrowers with Non-Direct Recognition, or the borrowers must eventually be penalized for siphoning from the general account.

Not so with Direct Recognition. It just treats all policyholders fairly.

Direct Recognition is not always a penalty to borrowers. Sometimes it’s a benefit. It just depends on the relationship between:

- The loan rate

- The dividend rate

Here’s how it works below…

Direct Recognition in a Low-Dividend Environment

People think the point of Direct Recognition is to penalize them when they borrow, when in actuality it is designed to treat all policyholders fairly.

You just saw an example above how my wife’s actual policy received much bigger dividends when her loan rate was higher than the dividend rate. This is often what happens when you borrow from a Direct Recognition company in a rising interest rate environment where dividend rates haven’t caught up yet.

But what about when the loan rate is lower than the dividend rate with Direct Recognition?

As you would probably expect with Direct Recognition, a loan rate lower than the dividend rate will indeed diminish your dividend payout (only on the borrowed amount)…BUT…

You may have a better overall net result because you have a lower cost of money with the lower loan rate.

What’s interesting, when we ran an intensive borrowing situation for some clients in 2022, the suppressed dividends of the lower Direct Recognition loan rate actually beat the non-affected performance of a similarly designed Non-Direct Recognition policy.

Why?

Because the Non-Direct Recognition had a higher loan rate which encumbered its higher dividends. Obviously, this may not always be the case going forward, but this actually happened in the rapidly rising interest rate environment of 2022

Part of why I personally prefer having several Direct Recognition policies is because as both an entrepreneur and an investor, I value control.

Direct Recognition gives me the peace of mind of knowing my cost of capital won’t ever get out of alignment.

That’s why having a Direct Recognition policy for me is like the proverbial bird in the hand, since I know I’ll always be treated fairly:

If loan rate > dividend rate – I know my Direct Recognition dividend will be juiced up

If loan rate < dividend rate – my Direct Recognition dividend may be lower, but then I also know I’m getting a below-market loan rateIf the loan rate < dividend rate BUT I can find an even lower outside loan rate – then I would of course use the lower outside loan while earning my full and often higher Direct Recognition dividend.

Regardless, it often hasn’t mattered whether you had Direct or Non-Direct because you usually would have been better off using what I call “synthetic Non-Direct Recognition” loan over the last 40 years using a Cash Value Line of Credit (CVLOC).

Shopping Outside Loans to Create “Synthetic Non-Direct Recognition”

When borrowing against my Whole Life policies over the last 18 years, most of the time I could find substantially lower rates than either a Direct or Non-Direct Recognition Whole Life policy could offer.

How?

I shop the rates of several turnkey Cash Value Line of Credit programs (CVLOC), which essentially act like “Synthetic Non-Direct Recognition.”

Synthetic Non-Direct Recognition Loans have the same “non-effect” on your dividend as an actual Non-Direct Recognition policy loan. This is because a synthetic Non-Direct Recognition loan is not affiliated with your whole life company in any way.

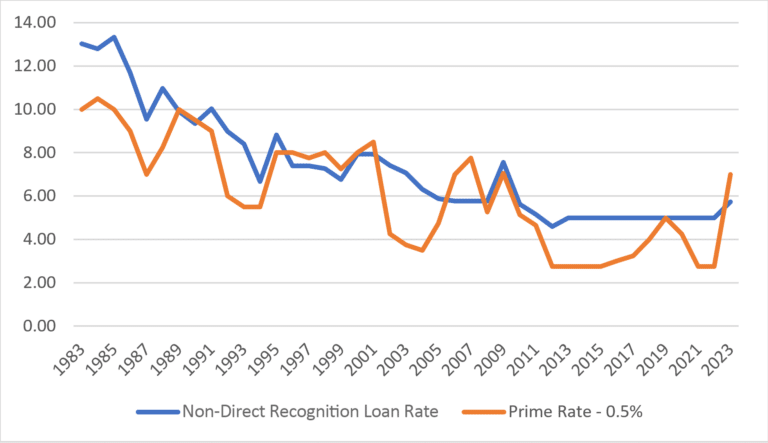

Let’s look back over the last 40 years to see how often you could’ve found a cheaper outside loan.

This graph compares one of the most popular Non-Direct Recognition company’s loan rate to Prime minus 0.50% (a conservative CVLOC rate).

Only in 7 out of the last 40 years was this CVLOC rate more than half a percent higher than the Non-Direct Recognition loan.

7 out of the last 40!

Plus look at the long runs where Prime minus 0.50% has been substantially lower than the Non-Direct Recognition loan rate.

Our clients with high cash value balances often get Prime minus 1.00% or even Prime minus 1.25%, and sometimes promotions occur where anyone can get these special rates.

Again, there would be no effect on your Whole Life dividends like Non-Direct Recognition since these are simply turnkey lines of credit program collateralized by your whole life policy but offered by an actual bank.

Think about it, if borrowing from an outside lender in no way affects your dividend, then it’s all about finding the lowest rate, right?

In fact, even if you had the best Non-Direct Recognition policy, you’d probably still use a Cash Value Line of Credit program if you could lower your loan rate by 1%-2% per year.

Recapturing 1%-2% of loan interest over time can result in massive amounts of compounding in your favor.

Most people researching Direct vs. Non-Direct Recognition for infinite banking usually have a knee-jerk reaction like they shouldn’t do this. Usually, it’s one of these 2 erroneous thoughts echoing in their brain:

- Won’t my Whole Life policy perform better if I use the native policy loan?

- Don’t I want to get away from using banks and use my new Whole Life policy instead?

First of all, you’re never fully getting away from banks when using a policy loan.

Let’s face it, no whole life insurance company whether they’re Direct or Non-Direct Recognition is going to send your loan proceeds to you in small unmarked bills, golden eagles, or bitcoin. The insurance company will either:

- wire the policy loan funds to an actual bank

- or send you a paper check that you eventually must deposit into an actual bank

Why would you ever use your policy’s Non-Direct Recognition loan rate if it was higher than a Cash Value Line of Credit program?

Only if you had one of these 3 issues would you use a policy loan:

- A bad credit score so you can’t qualify for a CVLOC

- You needed absolute privacy for this loan (no credit reporting),

- You want to float the loan without making monthly interest payments.

Truth be told, though, several CVLOC vendors are now accommodating to at least 2/3 of these issues:

- You need at least a 650 credit score

- Many lenders only do a soft pull when you start a CVLOC, but don’t report this “cash-secured loan” to credit bureaus

- Many will let you capitalize interest rather than pay interest only. Worst case, you can always borrow a bit more to service the interest

Ok, but what about how a Non-Direct Recognition loans make my policy perform better?

Remember how there’s no effect to your dividend when taking a Non-Direct Recognition Loan?

So, if you borrow from an outside lender with a lower rate, you’ll actually end up with more net cash value!

Sometimes you can find lower rates within assets and account types you already own like stocks, HELOCs, and or 401(k) loans.

Did you know you can always flip an outside loan back to your policy loan at will?

It’s easy, you contact the CVLOC lender to have your entire balance paid off using your policy loan.

I profitably used CVLOCs for the entirety of the last decade, knowing I could flip it back to my Direct Recognition loan at any time if interest rates ever got out of whack.

Guess, what actually happened in 2023?

The CVLOC lenders started competing for my business with rates lower than their advertised rates. Not only did they undercut all the Direct and Non-Direct Recognition policy loan rates, but they also undercut their fellow bankers’ rates.

Here are 3 reasons why they did this and will likely continue doing this:

- Banks are in the business of fractional reserve lending. Unlike insurance companies, they’re allowed to loan out multiple dollars for every dollar they have on deposit.

- Banks view Whole Life loans as ultra-low risk. Banks have been buying billions of dollars of life insurance on the lives of their key executives for eons, so they understand how safe and steady this type of collateral is.

- Banks know how safe mutual insurance companies are. The proof is how they’ll lend against 95% of your cash value. An LTV of 95% is absolutely unheard of, but it’s not an accident. Banks know these insurance companies are literally the safest highest quality “A-paper” companies to lend money against.

But you have even more options than your Whole Life policy’s native loan or even these Cash Value Line of Credit programs

Examples of Outside Loans (Synthetic Non-Direct Recognition)

Infinite Banking enthusiasts often won’t even consider loan options other than a policy loan because they’ve been led to believe there is some magic advantage to funneling any borrowing through the policy.

Ironically, the only way to get a dividend advantage from borrowing is with a Direct Recognition Loan. Yet these same IBC enthusiasts also insist that Non-Direct Recognition is a must.

Historically speaking a Cash Value Line of Credit has most often provided lower rates than both Direct and Non-Direct Recognition policies, not to mention these other benefits:

- Online portal and/or free wires

- Simplicity of taking 1 loan against multiple family policies

- Easier record-keeping for deductions (with qualified tax reasons)

However, before tapping your policy equity using a CVLOC, you may want to also consider these 8 potential sources of outside loans:

- Home Equity Line of Credit (HELOC)

- Securities Backed Line of Credit

- Business Line of Credit

- Long-Term Balance Transfer Offers

- Car Loan

- Mortgage

- Student Loan

- Intra-Family Loan

With the 8 examples above you can keep your full borrowing capacity intact with your Whole Life policies since these other 8 loan types are collateralized by just your promise to pay and/or whatever non-liquid asset is backing the loan (car, real estate, business receivables, etc.).

Even though this creates some repayments to budget for, you can always just incrementally borrow against your untapped Whole Life policy to make the payments for one of these other 8 loan types.

Hutch’s Real-Life Examples of Different Outside Loans

Here are 2 examples of how I’ve used outside loans myself in the rising interest rate environment of 2023:

- Cash Value Line of Credit vendors were competing for my loan business, and I was able to lock in 5% for 1-2 years (rather than use policy loans in the 5.7%-8% range)

- I bought a small SUV for my teenagers and got a 3.76% auto loan straight from the dealership

Each of these loans feels just like a Non-Direct Recognition Loan, only at lower rates: 5% and 3.76% vs. a 5.7% policy loan rate.

Not only did I get better rates, but the auto loan is collateralized by the car itself, not my policy. Therefore, I keep my Whole Life policy’s full borrowing capacity intact for emergencies or opportunities.

The CVLOC on the other hand is collateralized by my policy, which obviously reduces my future borrowing capacity, but at least I get a lower rate while my cash value keeps compounding.

Plus, rather than having to nickel & dime each of my family members’ Whole Life policies every time I need money, I can pull from one single line of credit. It’s also quite convenient to repay one single loan source like a CVLOC.

How to Choose the Right Loan Type

How do you know which type of loan to take and when?

Whenever I need access to capital for any substantial purchase or investment, I consider all the following factors:

- Where can I get the absolute lowest rate, and can I service the monthly interest?

- How much convenience do I want in taking the loan?

- Do I need absolute privacy or credit score cosmetics?

- Will I need my maximum capacity to borrow in the near future?

- Do I need total payment flexibility?

- What is the most convenient way to access capital?

- Can I safely collateralize other less-liquid assets (vehicles, property, stocks)?

Considering all of these different considerations together may lead to a different loan choice than simply the loan with the lowest rate.

Thankfully, having a Whole Life policy can substantially increase your optionality regardless of whether it is from a Direct Recognition or Non-Direct Recognition company.

Conclusion on Direct vs Non-Direct Recognition Life Insurance Loans vs Alternative Loans

Non-Direct Recognition loans are often glorified as a must-have feature for Whole Life insurance, especially within the infinite banking community. It’s painted as some sort of perpetual free-lunch arbitrage gimmick that often doesn’t exist with ultra-solvent 150+ year old mutual insurance companies.

Although Non-Direct Recognition companies don’t adjust your dividend if you have loans against your policy, they do adjust your loan rate to compensate for being Non-Direct.

Conversely, Direct Recognition companies will adjust any dividends owed to you on borrowed money. But contrary to popular belief the direct effect on your dividend is not always negative. If your loan rate ever becomes higher than your dividend rate, you can actually receive a higher dividend than if you hadn’t borrowed.

Because Nelson Nash used only Direct Recognition examples in his book, this is why infinite banking enthusiasts believe they will be rewarded for borrowing against their policy.

Over the last 40 years Whole Life policyholders have been able to acquire loans with lower rates than either a Direct or Non-Direct Recognition company has offered most of the time.

Since I personally view the policy loan feature as my ultimate backstop to borrow that no one can take away from me, I prefer the contractual safeguards that Direct Recognition offers me knowing I will be treated fairly whichever way rates trend.

At the end of the day, the main driver of how successful your infinite banking strategy will be comes down to superior performance from the underlying dividend-paying Whole Life insurance policy.

Our philosophy is to show our clients the very best whole life performers from both the Direct and Non-Direct Recognition life insurance companies, educate them about the pros and cons of each, and let them decide for themselves which makes the most sense for their own banking strategy.

You can tap the green button under the pic below to have us walk you through that analysis whenever you’re ready.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com