New Series: Whole Life Through Every Cycle

(Dividends, Loans, & Policy Evolution)

We’re clearly entering a new chapter as a global economy. But Whole Life has already been through it all before at over 170-years old.

Hutch walks you back in history to see how Whole Life has behaved through inflation and economic turbulence. He also does a deep-dive into every facet of modern-day Whole Life when designed optimally for Infinite Banking (IBC).

This timely new video series is broken up into 2-parts:

- How current economic turmoil affects Whole Life (and why it’s more important than ever)

- Using modern design techniques to optimize Whole Life to be the ultimate insulator from whatever turbulence comes.

Each part has multiple short videos to learn in chunks. Underneath each video you’ll also find:

- timestamped chapters (to skip around)

- related content (for deeper learning)

Don’t forget you can always use the gearshift to speed up the video player. You can even listen as a podcast and go back to revisit the visuals to study further.

Enjoy,

Hutch – Founder of BankingTruths.com

Part 1: Rising Rates on Whole Life Dividends & Loans

(3 - Videos Below)

Video 1: Rising Interest Rates on Whole Life and Infinite Banking

Wondering how rising rates affect Whole Life dividends & cash value?

This video goes into a detailed study using historical data from an actual policy from 1980-2022. Even though dividend rates spiked up and then ebbed & flowed lower for decades, the actual dividends paid kept getting bigger and bigger.

See what the 10-Pay Whole Life policy from 1980 was illustrated to yield in terms of both dividends and cash value vs. what actually happened. The results are mind-blowing and the message is clear: You’re still early!!!!

0:00 = Intro on the History of Interest Rates since 1980

0:55 = Rising rates have inflated our National Debt to GDP Ratio

2:40 = Analyzing the assumptions & details of historic Whole Life study

3:50 = Today’s high-yield savings accounts vs. Whole cash value

6:25 = Details of actual higher dividends paid vs. the lower original projections

8:18 = Year-by-year dividend rates trending down (after 1987) vs. rising dividend payouts

10:09 = Why actual Whole Life dividends keep growing despite rates falling

[Article] – Learn more about Whole Life Dividends:

https://bankingtruths.com/whole-life-dividends-explained/

[Article] – Understand Whole Life’s Guaranteed Growth & 4-Ways to Accelerate it

https://bankingtruths.com/whole-lifes-guaranteed-growth/

Video 2: IRR of IBC Loans? How Paying Whole Life Loans Can Help Build Cash Value

I know loan payments seem like an unnecessary expense to be avoided at all costs.

But if you handle them properly, Whole Life loan payments can actually produce a positive long-term IRR (regardless of what you use the money for).

Sure you could just withdraw and have no interest payments, but since Paid-Up Additions keep compounding on your behalf this video demonstrates how IBC loans can actually be an efficient use of cash flow.

Using the same example from our prior video on rising rates from the 1980 policy, see different borrowing scenarios and how measure the efficiency of different payback scenarios compared to just withdrawing.

0:00 – Intro to how IBC loans can produce an IRR for you

0:33 – Describing the policy funding then borrowing scenario

3:20 – When does it make sense to float a Whole Life loan with interest only

4:22 – How much growth you’d be missing by withdrawing vs. what you gain by paying interest

5:53 – Comparing paying down principal & interest vs. interest only on your Whole Life loan

7:32 – How effective are IBC loans way out by age 85

9:03 – What if I just start a new PUA instead of paying loan interest on the old PUA

13:20 – Applying the same level of responsibility as if you paid cash for everything.

[Article] – How Life Insurance Loans Work

https://bankingtruths.com/how-life-insurance-loans-work/

[Video] – Life insurance Loans Explained

https://bankingtruths.com/videos/life-insurance-loans-explained/

[Video] – How Soon Can I Borrow from Whole Life Designed for Infinite Banking

https://bankingtruths.com/when-can-i-use-my-bank/

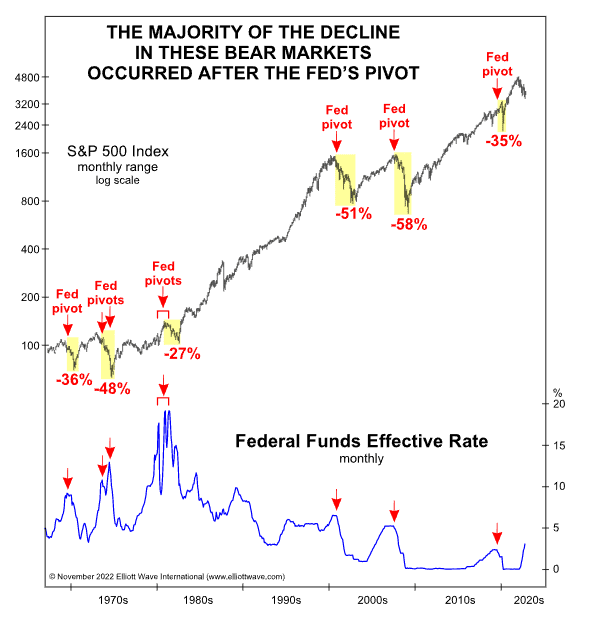

Video 3: What Happens When the FED Pivots from Rising % Rates

What happens when the Fed pivots from rising interest rates & why it’s so important to build your own infinite banking Whole Life policy before they do.

Seeding your policy now may prove to be very timely for investment opportunities in the near future, while protecting you from market & tax volatility in the long-term.

0:00 = How high interests rates spiked in the 70s & 80s

1:04 = Why the FED will probably have to pivot

2:26 = What happened to the S&P 500 after a FED pivot

3:15 = Positioning now for a pop in asset bubbles using Whole Life & IBC

[Article] Learn the 4 ways Whole Life can help with your retirement:

https://bankingtruths.com/4-ways-whole-life-insurance-helps-retirement/

[Article] How Safe Are Life Insurance Companies:

https://bankingtruths.com/safe-life-insurance-companies/

[Video] How Whole Life’s growth helps retirement.

https://bankingtruths.com/whole-lifes-growth-helps-retirement/

Video 4: Prime vs Policy Loan Rate

COMING SOON!

Want notified when we release the video?

Part 2: Whole Life Policy Design Considerations for IBC

Video 5: [Analogy] Stuffing Premium into Whole Life w/ Riders is Like Stuffing Cash into Different Size Envelopes.

Whole Life’s base policy is like a small card-sized envelope that you’re trying to stuff with cash $$$!

Adding certain riders like a PUA rider and/or a Term Rider is like substantially increasing the size of the envelope without increasing the size of the costs.

This video is short & fun and explains in a simple way the policy design conundrum that every new client wonders about.

[Video] Whole Life’s Riders & Growth Components Explained (a study of the same base policy designed a few different ways).

https://bankingtruths.com/riders

[Article] Paid-Up Additions – Whole Life’s Turbo Charger

https://bankingtruths.com/pua-paid-up-additions/

Video 6: Testing Policy Sizes for Optimizing Whole Life & IBC

Finding the right policy size is one of the biggest challenges for folks looking into IBC.

To efficiently become your own banker with Whole Life insurance, it’s important that your policy isn’t so big you can’t stuff it full of premium, but not so small that you shut the door on future contributions.

This video shows how the same premium amount interacts with different size policy and policy riders.

0:00 – Intro

1:00 – Comparing a 1980’s 10-pay vs. a modern IBC Whole Life policy

4:29 – Optimizing our policy further by front-loading premiums

6:09 – Tradeoffs to increasing your capacity to front-load Whole Life

7:40 – The downsides of downsizing and seeing future premium capacity

[Video] Base isn’t Necessarily Bad in Whole Life: Dispelling the Myth of the 10/90

https://bankingtruths.com/ibc-10-90-split-banking-policy-design-myths/

[Video] How Flexible Can WL Be?

https://bankingtruths.com/videos/whole-lifes-flexibility/

[Article] The Infinite Banking Concept (IBC] Explained

https://bankingtruths.com/becoming-your-own-banker-explained/

Video 7: Whole Life's Fees | Cost/Benefit Analysis for an Optimal IBC Life Insurance Policy

How much are the fees in Whole Life insurance designed for infinite banking (IBC)? It’s hard to quantify exactly because Whole Life is known as an actuarial black box. Don’t worry though, we uncover the net effect by isolating how much of your premiums are missing in the first couple years.

But listen, I don’t mind paying for value. And in this video we hone in on 2 major benefits you get for those Whole Life costs (over & above your cash value growth of course). One is kind of obvious, and the other is kind of a trick question, but a very important benefit of infinite banking. More importantly, we quantify those 2 benefits and measure their IRR both separately and together.

This video will absolutely bump your paradigm around the cost of Whole Life insurance.

0:00 – How to find Whole Life’s fees inside the “black box”

1:31 – Comparing a smaller & bigger policy to see the difference in cost

3:06 – The 1st obvious benefit you receive for your money for Whole Life’s fees

4:16 – The 2nd trick-question benefit you get for Whole Life’s early costs

6:40 – Do you actually get more benefits for paying bigger Whole Life fees

8:08 – How you can maximize the 2 extra benefits without paying extra fees

9:51 – Measuring the IRR of Whole Life’s early costs to those long-term benefits

[Video] Base is allegedly the most expensive component of Whole Life, but that’s also company dependent.

https://bankingtruths.com/ibc-10-90-split-banking-policy-design-myths/

[Article] Electing the RPU option can wipe away all Whole Life’s mortality charges past year 7:

https://bankingtruths.com/rpu-reduced-paid-up-option/

DOWNLOAD THE ULTIMATE GUIDE TO WHOLE LIFE FOR IBC

What You NEED To Know, Whether You Work With Us or Not!