If exploring this strategy is not a major priority right now…

No problem, we’re not going anywhere. However, there’s a benefit to always starting a program sooner than later. Think about it. The earlier you start putting non-performing assets to work, the better your compound interest will look. Plus, insurance products are age-based, and no one is getting any younger.

However, if there’s a good chance you’ll be no-showing or rescheduling on us after booking a meeting, we’d prefer that you just wait until you have the time to seriously explore what’s possible with your own private bank. Once you’re ready, we’re big on service. We do all the shopping and modeling for you and make the whole process as turnkey as possible.

If you’re looking to endlessly shop amongst multiple providers…

We get how it’s totally normal to get multiple bids. However, we find that this activity usually causes more confusion than clarity and wastes a lot of everyone’s time (including your own).

We’re always happy to have a conversation to earn your business, but it’s not the best use of your time for you to do the interpreting of multiple apples to oranges illustrations from several agents. That’s what a trusted advisor does for you.

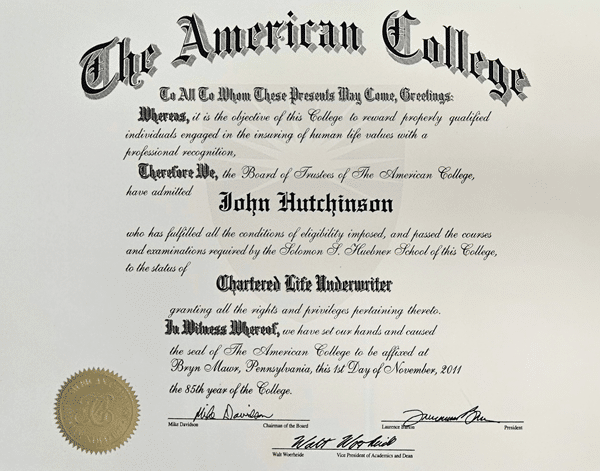

In case you missed it, the crux of our value proposition listed above is:

- – Quality

- – Service

- – And Coordination.

-

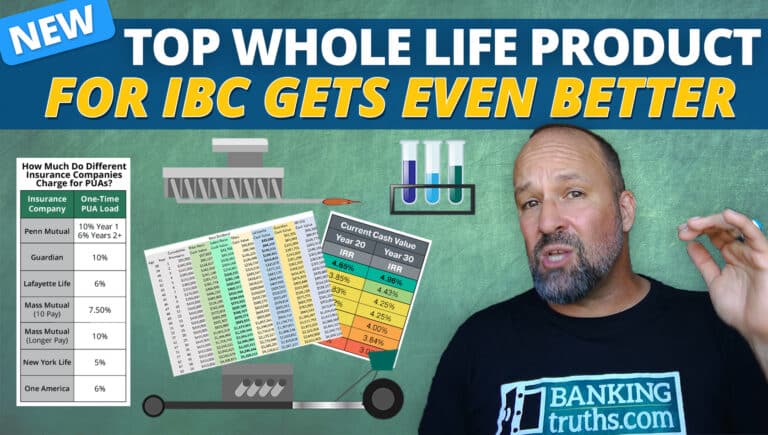

We are committed to using the leanest designs using the highest quality products from the oldest and most financially solvent insurance companies. We spend the time to educate you about how we arrived at the recommendations. We also discuss the implications of each choice and how that ties into your overall financial picture so you can make a balanced decision.

So save yourself the time and energy. Decide who you feel most comfortable with, and let us do the shopping, modeling, and compiling for you, so you can learn about the top companies for your situation.

If you’re looking for short-cuts or magic-bullets to make up for irresponsible financial behavior…

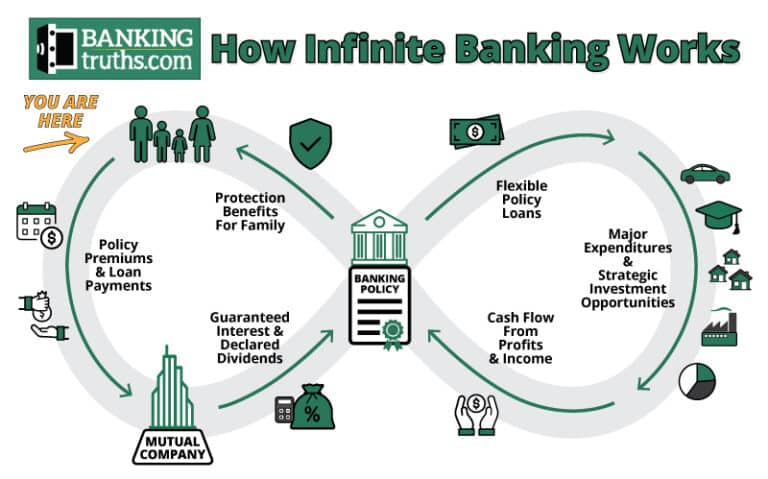

That’s just not what the banking strategy is about. It’s true that you leverage the miracle of compounding by paying simple interest on a decreasing balance while earning compound interest on an increasing balance. However, you can’t “spend your way” to financial independence. The strategy is not a short-cut or magic-bullet to replace solid long-term financial responsibility.

If you’re drowning in consumer debt (not including mortgage or business loans)…

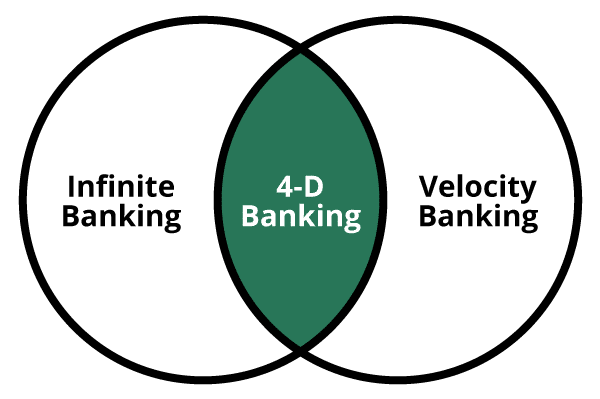

You’re simply not ready for infinite banking strategy yet, and probably should be focusing on Velocity Banking. Although other “bottom-feeder” banking groups advocate setting up a banking policy concurrently with long-term debt elimination, we just couldn’t sleep at night making these kinds of recommendations.

If you can fully “refinance” all your bad-debt through your first year’s policy premium, there may be a case for starting a banking policy now. Otherwise, you really should throw everything you have at your consumer debt. The only insurance recommendation that would be appropriate would be possibly taking out a convertible term policy that you can easily expand into a banking policy someday once you can see the light at the end of your debt-tunnel.

If you’re looking to completely get off the financial grid…

The banking strategy is probably not for you. It’s true that you will have more privacy, confidentiality, growth, and other benefits by keeping the bulk of your reserves on deposit with an insurance company rather than a traditional bank. However, due to anti-money-laundering concerns, you can’t pay your premium with a bundle of cash or bitcoin.

You still need the conduit of a traditional bank to pay your premiums. You also will need a traditional bank account to accept a wire or cash a check from the insurance company when you choose to borrow against your life insurance policy.

We believe in utilizing traditional bank accounts for what they’re good for: utility, convenience, and at times loan optimization. Otherwise, we help you to replicate what big banks themselves are doing by parking their cash reserves inside investment-grade life insurance policies to maximize growth and other benefits.