5 Strategies for Using a HELOC to Build Wealth

Since 2020, home values have experienced significant appreciation, driven by increased demand as buyers sought more space in the wake of the pandemic while taking advantage of prior historically low mortgage rates. According to various market analyses, the average home price has surged by at least 20% across most regions.

This appreciation creates a unique opportunity to use available home equity to build wealth by using loan products such as a home equity line of credit (HELOC). Although it may seem counterintuitive to “go into debt” to build wealth, it can often be mathematically proven to fast-track one’s path to financial freedom.

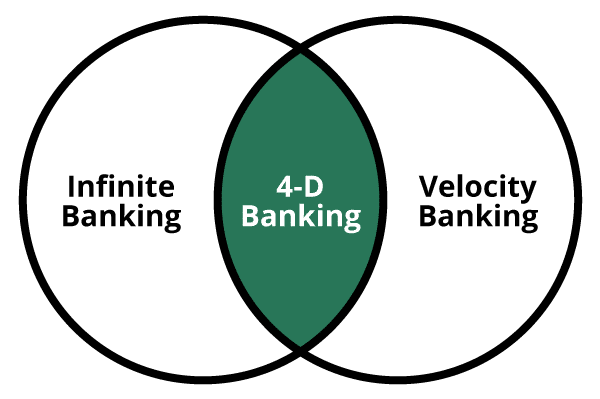

In fact, this HELOC strategy is borrowed from the Velocity Banking method, which for the last three decades has helped homeowners around the world use HELOCs to pay off their existing mortgages faster and consolidate high-interest debt. Many of these same tools and tactics were applied when figuring out how to use home equity to build wealth.

Book yourself a free consult with a financial planner fluent in using a HELOC to build wealth, or you can watch our free webinar on how to combine a HELOC with other asset-backed lines of credit to build wealth with.

What Exactly is Home Equity?

Quite simply, home equity is the current market value of your home minus any outstanding loans against it.

The simplest way to calculate home equity is to imagine how much cash you would deposit in your bank account if you sold your house today, after paying off any home loans and closing costs.

So if you could sell your house for $700,000 but have $500,000 in total loans collateralized by the property, then your home equity is $200,000.

The problem with home equity is that it’s just a phantom number that floats up and down but doesn’t do anything in your life until you either sell your house or do a cash-out refinance.

That is, unless you use this HELOC strategy to convert the home equity trapped inside brick and mortar into liquid capital you can use to build wealth and create cash flow.

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Never any pressure or hard pitches

- Learn Velocity Banking to build wealth

Unlocking Trapped Home Equity with a HELOC Strategy

Many families with significant home equity don’t want to sell because they either like where they live, or already locked in a low-interest mortgage, or both.

If this is the case, opting to use a home equity line of credit (HELOC) provides a viable solution. These loans allow homeowners to convert their illiquid home equity into cash they can use without sacrificing their primary residence or even increasing the fixed interest costs on their current mortgage balance.

How does a Home Equity Line of Credit (HELOC) Work?

Unlike a cash-out refinance, the HELOC strategy is much more flexible in many ways. First off, you don’t need to borrow against all of your available home equity right away, although some HELOC lenders do require a minimum initial draw.

Since the outstanding balance will fluctuate, your minimum monthly payment due will usually be interest-only. Lastly, HELOCs often have a variable interest rate, but many offerings come with a lower fixed interest rate for an initial promotional period of 6-12 months.

However, The major advantage of a home equity line of credit is that it only charges simple interest unlike a cash-out refinance with front-loaded amortized interest. A HELOC operates similarly to credit card balances in that interest accrues at simple interest on your average daily balance.

Thus, homeowners can withdraw funds at will with a HELOC, depending on how much equity they have. During the draw period, typically lasting 5 to 10 years, borrowers can access liquidity to build wealth. (The wealth-building efforts should ideally cash-flow over and above the HELOC’s simple interest payments so the principal can be paid down. This both reduces HELOC interest and frees up the line for future investments).

A very unique loan product for this HELOC strategy is a “First Lien HELOC” where your entire outstanding mortgage balance becomes a flexible HELOC essentially, where you pay it down as often as you like, but borrow up to 90% of your total home equity anytime an opportunity arises. Learn more about First Lien HELOCs here.

Maximizing passive cash flow during this initial draw period is exactly how to use home equity to build wealth. However, keep in mind that after the HELOC’s initial draw period ends (usually after 5-10 years), the repayment period begins, and the remaining balance is amortized into principal and interest payments like a traditional 20 or 30-year mortgage.

It’s, therefore, critical when leveraging home equity to have an exit strategy for these new investments and employ careful cash flow planning to pay back the borrowed money against your home’s equity.

5 Ways to Use a HELOC to Build Wealth & Increase Cash Flow

Using the HELOC strategy to amass assets can certainly speed up one’s journey to financial freedom if deployed and managed properly.

When considering how to use home equity to build wealth, it’s ideal to choose investments that will both appreciate and produce cash flow. That way, the investment itself can make the monthly payments as well as continue appreciating above the outstanding balance.

Below are the most common investment strategies people employ when using home equity with similar tactics to Velocity Banking only to build wealth rather than pay off a mortgage faster:

1) Using a HELOC to Invest in Real Estate

Down Payments on New Investment Properties

Using a Home Equity Line of Credit (HELOC) for a down payment on an investment property is perfect for those looking to expand their rental property portfolio. By leveraging their home equity, investors can take advantage of timely real estate investing opportunities without having to sell other investments, deplete their savings, or utilize hard money loans.

Sometimes you can even get the best deal by making an all-cash offer to beat out other buyers, even if you refinance the new investment property after the purchase.

Proper cash flow analysis is necessary to ensure that the rental income generated from the new investment property will cover both its mortgage payments plus the variable interest costs associated with the HELOC debt. Quite frankly, there should also be surplus rental income to aggressively repay the HELOC for the investment choice to pencil.

That way, you can more quickly restore the borrowing capacity with this HELOC strategy to seize future opportunities that may arise in the real estate market or to handle any major improvements that will eventually be needed.

Improvements to Increase Real Estate Value or Rents

Using a HELOC to fund home improvements may increase your home’s equity, but it doesn’t cash flow, so you’ve just added another long-term bill to do so.

However, doing the same home improvements on existing investment properties is a different story. Upgrades such as modernizing kitchens and bathrooms, enhancing curb appeal, and incorporating energy-efficient appliances can not only attract higher-paying tenants but also improve your property’s marketability and longevity.

Using a HELOC to build wealth in conjunction with the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method can significantly amplify an investor’s ability to acquire and improve distressed rental properties, swiftly turning them into cash-flowing assets. This approach can kick-start one’s rental property portfolio getting the most bang for your buck in both appreciation and cash flow per dollar invested.

Certain banks even offer HELOCs on investment properties, so you can continue to tap into your equity as it evolves and recycle it through other investment opportunities.

2) Using a HELOC to Invest in Your Own Business

Seed Capital for Starting a New Business Venture

Using home equity for seed capital can provide entrepreneurs with the necessary funds to get the proof of concept with a minimum viable product without diluting their business equity by raising capital at a low valuation.

Since business ideas don’t provide enough collateral for traditional loans, the HELOC strategy allows for flexibility in financing when it’s needed the most. This enables business owners with home equity to allocate capital towards startup costs such as research and development, inventory, marketing, and operational expenses. However, entrepreneurs should have a robust business plan in place that both mitigates risk and forecasts sufficient cash flow to ensure timely repayment of their home equity loan.

Borrowers should have a clear path to monetization, which may eventually lead to the business itself qualifying for its own line of credit to practice Velocity Banking within a corporation of LLC. This obviously would free up the business owner’s HELOC, so they have enough equity available in the future to expand their business beyond what the bank may be comfortable lending the business itself.

Learn how to combine your HELOC with a matrix of assets you can borrow against so you can keep everything compounding even while borrowing against them.

Acquiring New Business Equipment or Inventory

Oftentimes, a seasoned entrepreneur’s biggest asset is his/her business, and their second-biggest asset is their primary residence. Converting trapped home equity into liquid capital via flexible home loan (HELOC) can help an entrepreneur acquire new business equipment or inventory, thereby optimizing the performance of their best-performing asset.

Using a HELOC to build wealth through their business will almost always be a better option than expensive inventory financing options like factoring (borrowing against future receivables at around 30% APR). However, even if financing business equipment or vehicles directly through the bank comes at a higher rate than using their HELOC, business owners may choose to preserve their home equity available in their HELOC for future opportunities or emergencies.

Investing in Education and Personal Growth

Keep in mind that despite how successful your business is, you will likely always be your family’s biggest asset. So, investing in education that can help you monetize new skills may prove to be a valuable way to use a HELOC to build wealth.

I’ve personally found that quality personal growth or business coaching seminars have often produced at least a new business idea, behavior, or relationship that has outpaced the cost. Not to mention that much of what I have learned at these events has helped my mindset to enhance the enjoyment and fulfillment I receive from my hard work and wealth-building activities.

3) Using a HELOC for Private Money Lending

Private Loans, Notes, and/or Deed of Trust Lending

Engaging in private-money lending or deed of trust lending through a HELOC can offer lucrative returns if the loans are carefully chosen and underwritten. By acting as a private lender, homeowners can lend borrow against their home equity to loan to real estate investors, developers, and or other businesses for tidy profits.

In fact, when investing in these short-term amortized notes, you benefit from the very thing Velocity Bankers are striving to avoid…front-loaded amortized interest. Since you are being repaid principal and interest on a set schedule, you can theoretically start ramping up your investment in these notes, which exponentially stacks up increasing cash flow which can systematically pay down your home equity line credit for future usage.

However, prudent investors must conduct thorough due diligence on potential borrowers and assess the collateralization of these types of private loan arrangements to mitigate the risk of your borrowers defaulting on their fixed monthly payments.

Assuming you research the note issuers thoroughly, contractual principal and interest payments will pour in and stack upon each other, which can exponentially increase the velocity of using your HELOC to build wealth.

Book a free call to hear how to exponentially stack cash flow using private notes in conjunction with Velocity Banking principals.

4) Using a HELOC Investing in Stocks

Borrowing against your home equity to randomly invest in stocks will most likely be a recipe for disaster! If things go badly in the short run you could potentially lose money in the underlying stocks as well as going deeper into HELOC debt to finance them at variable interest rates.

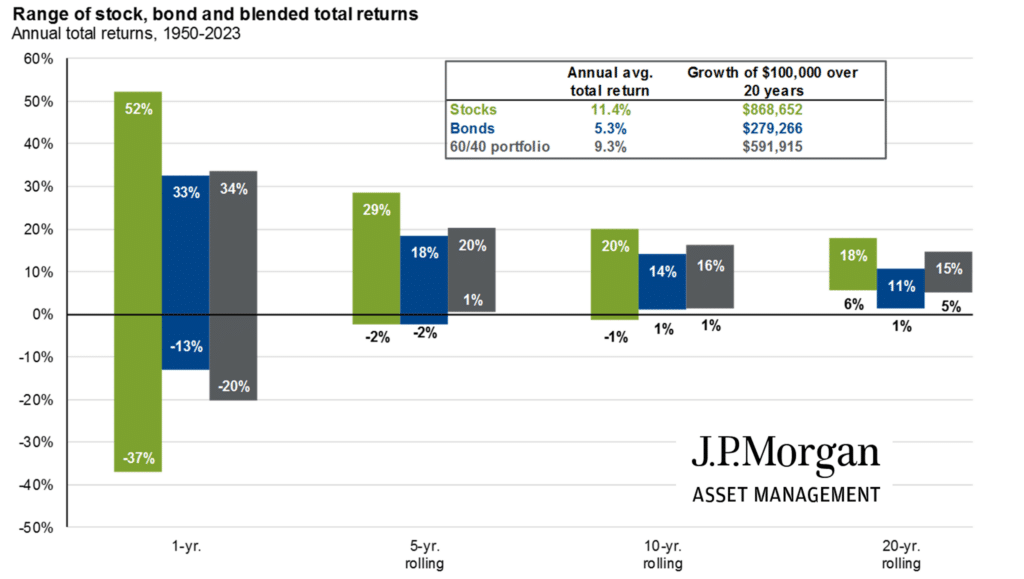

However, when you zoom out and look at the rolling returns of the S&P 500, you can see that given enough time, dollar cost averaging into a well-diversified portfolio eventually proved to be positive even during the worst historical periods. What you see below is the range of returns from both the best and worst outcomes during different historical timeframes.

When considering the last 70 years of S&P 500 returns, any given year may have made you as much as 40% but lost up to 37%. However, as you stretch out the time frame, you find that the range of returns narrows. For instance, the worst 5-year slice of the last 70 years only lost 3%.

That means if you bought the S&P 500 at the very top of the biggest bubble over the last 70-years, you would only be down 3% just 5 years later.

The absolute worst 20-year slice you could find over the last 70 years produced a positive 6% year-over-year average return.

Regardless, I am not saying you should be using your HELOC to barrel into stocks because they have long-term appreciation potential. Using your home’s equity to build wealth with stocks requires additional cash flow to service the HELOC’s interest payments at the very least. Even the highest-paying dividend stocks in the S&P 500 won’t provide sufficient cash flow to service an ongoing home equity loan.

However, one ingenious way to create enough free cash flow to pay HELOC interest and repay additional principal is to employ “The Wheel Strategy.”

Cash Flow Potential of Stocks with the Wheel Strategy

Conservatively, the wheel strategy can generate 1%-2% percent of free cash flow per month regardless of the stock’s movement. One of my clients, who is also a real estate investor, looks at the wheel strategy like he does his investment properties. Here’s what he said:

“Once I acquire a quality property, I stop focusing on the price of the asset. It’s all about whether the property generates consistent positive cash flow and the long-term appreciation will take care of itself.”

As we saw with the S&P 500’s rolling returns over the last 70 years, the appreciation has always happened over time and has often been quite lucrative. However, when using home equity to buy stocks, you have to think differently to consistently generate cash flow along the way.

How the Wheel Strategy Works

The wheel strategy goes in this order and can be repeated many times:

Collect an immediate premium for selling a put on a stock you want to own anyway. If the stock does not fall below your put’s strike price, then repeat step #1. Either way, you keep the premium.

If the stock falls below your strike, your brokerage will automatically buy the stock at the strike price you initially chose (subsidized by the initial premium collected).

Collect another premium selling a covered call at or above the strike price of the original put you sold. If the stock stays below the strike price until expiration, then repeat step #3.

If the stock rises above the strike price of the covered call, your brokerage will automatically sell the stock at the strike price you initially chose (resulting in all premiums kept as pure profit plus any appreciation above the strike price of the original put assignment).

Use profit from premiums to pay down the HELOC and repeat step #1 with the original loan proceeds.

If you do the wheel strategy with a margin account, you can first utilize the equity of your other stock/ETF holdings as a placeholder sell the put in step #1 instead of borrowing cash right away from your HELOC. So, no interest is charged when you generate option income during the first leg of the wheel strategy.

You would only borrow against your home equity if you were assigned the stock on margin to avoid getting a margin call. The ability to instead borrow from your HELOC removes much of the risk of the strategy.

Listen to our recorded webinar on “4-D Banking” on combining your HELOC with multiple asset types and retirement accounts you may already have to bolster the ultimate emergency/opportunity fund.

Even then, you have generated option income twice of the same stock and you can perhaps still benefit from appreciation. If the stock goes down, then the income generated offsets some of the risk and you can continue to sell options on your position to generate cash flow.

Thankfully your maximum risk will be buying stocks you want to own anyway at a price lower than they’re trading today. So you are essentially getting paid to DCA (dollar-cost-average) into quality businesses of your choosing.

Risk Disclaimer of the Wheel strategy: Keep in mind that markets tend to rise slowly and then crash suddenly.

“Said another way, stocks tend to take the stairs on their up and the window on their way down!”

So you may go months generating free cash flow without ever buying one stock, and then suddenly have several assigned to you at once, even if you’re diversified. At that point, your HELOC backstop can hopefully come to the rescue to repay any margin loans, removing the risk of liquidation.

When navigated correctly, “The Wheel Strategy” not only can pay interest for using home equity to build wealth, but also allows investors to benefit from capital appreciation and consistent cash flow well over and above the HELOC’s monthly payments.

5) Building an Emergency Fund

To be clear, using a HELOC to build an emergency fund will not have a positive net return right away. In fact, at the time of this writing high-yield savings accounts are yielding around 4.5%, whereas promotional introductory offers on HELOCs are around 6.5-7%.

However, establishing a financial safety net is a critical financial strategy, especially for those leveraging a Home Equity Line of Credit (HELOC) to build wealth. While a HELOC offers a flexible method to access funds for investment or other purposes, it can also help with financial strain if unexpected expenses arise or investment returns do not meet expectations.

Counting on your HELOC to emergency fund is not reliable since lenders have a history of revoking access during recessionary periods.

For that reason, it is often to have 3–12 months of monthly expenses in some sort of emergency fund you have guaranteed access to.

The ultimate financial safety net is using Whole Life as your bank, emergency fund, and opportunity fund. Not only is Whole Life principal protected, but it has guaranteed growth every year as well as annual dividend payments, all of which accrue tax-free. If the insured passes away prematurely, the death benefit over and above the cash value may be enough to pay off the entire HELOC balance as well as the primary balance.

The practice of Infinite Banking with Whole Life insurance has much in common with Velocity Banking. In fact, each can be enhanced when both are deployed together.

Talk with an independent insurance broker who can answer detailed questions about using Whole Life to become your own bank and help you shop the best infinite banking policies.

4 Risks of Using a HELOC to Build Wealth

Using home equity to make money carries 4 inherent risks that must be considered beforehand. The volatility of a HELOC’s variable interest rates can lead to unexpected fluctuations in repayment amounts vs. a fixed monthly payments on an existing mortgage.

Unexpected cash flow strains and/or bad investment choices can cause borrowers to become further in debt or possibly even foreclose on their house in the worst cases.

Additionally, the decline of property values may jeopardize a homeowner’s access to HELOC they may have been counting on. Therefore, a thorough understanding of these risks below, combined with robust financial planning, is crucial to effectively utilize a HELOC without falling into financial trouble.

This is exactly why it’s recommended to bolster your potential access to liquidity through a combination of assets, and not just the HELOC.

1) Over-leveraging a HELOC (without a backup plan)

The benefits of using a HELOC to consolidate debt or build wealth may excite someone so much that they become complacent, ignoring the risks associated with over-extension.

While leveraging home equity can accelerate wealth-building strategies, the potential for over-leveraging poses significant financial risk. Homeowners who over-leverage and exhaust all of their equity may find themselves painted into a corner with insufficient reserves or cash flow to even maintain the debt against their home equity.

No matter how good an investment opportunity looks on paper, the risk that may appear to be unlikely will sometimes come to fruition, or the investment itself may take much longer than expected to blossom. Only those with staying power get to realize an investment’s full potential over time.

When using a HELOC to build wealth, you should have multiple liquidity sources to access cash on demand. Learn how to position different assets you already own to become your own banker and create the ultimate emergency fund matrix.

2) Losing Your Primary Income Source or Having Unexpected Expenses

One of the most significant risks associated with leveraging a Home Equity Line of Credit (HELOC) arises from potential disruptions to one’s primary income source. The loss of a job, a reduction in hours, or unforeseen circumstances such as medical emergencies can create substantial financial strain, making it challenging to maintain the timely payments needed to use home equity to build wealth.

Additionally, unexpected expenses, such as repairs or sudden family financial obligations, can compound the pressure on a homeowner’s budget. While a HELOC may provide immediate access to funds, it is essential to acknowledge that these borrowed sums will need to be repaid, often at variable interest rates, which you have no control over.

Prudent financial management and the establishment of a robust emergency fund are critical steps to mitigate these risks while navigating the complexities of using a HELOC as a wealth-building tool.

3) Variable Interest Rate Fluctuations

When borrowing against a HELOC to make money, one of the most pressing concerns revolves around the volatility of interest rates. Unlike a fixed interest rate mortgage, HELOCs typically come with a variable rate that can fluctuate over time based on market conditions. Monthly payment amounts can significantly increase, leading to heightened monthly expenses that may not have been accounted for when initially borrowing to build wealth.

Homeowners may find themselves facing higher repayment obligations, which can erode cash flow, strain budgets, and ultimately impact their ability to stay the course with investments that may take longer than expected to blossom.

To effectively manage the risks associated with interest rate fluctuations, it is imperative for borrowers to model a range of scenarios so they can build out contingency plans for every outcome. This also entails regular monitoring of external market trends and their own internal financial cushion to accommodate any potential interest hikes.

4) Market Fluctuations and Home Value Depreciation

The real estate market is subject to cyclical fluctuations that can unexpectedly lead to steep declines in property values. Should the market shift unfavorably, homeowners may find themselves in negative equity positions, where the outstanding balance on their HELOC exceeds the current value of their primary home.

If your existing mortgage plus HELOC exceeds the current market value of your home, most lenders will either cap or possibly even call in your home equity line of credit.

“Capping” means you won’t be able to borrow any additional funds, even if your balance was under the originally stated maximum draw amount. I had this happen to me in 2009 after property values plummeted, even though I was current on my payments and nowhere near my max draw amount.

Keep in mind too that these abrupt drops in home values usually correlate to stock market losses, which may compromise your other backup sources to access cash on demand. That is why it is so important to have multiple non-correlated sources of emergency funds.

Having your lender “calling” your HELOC is the worst-case scenario, making the loan due immediately. This may force you to sell the same assets you were using to build wealth, quite possibly at a deep discount, depending on market conditions. Check your loan contract language to make sure this call feature isn’t available to the lender before setting up a HELOC.

Final Thoughts on Using a HELOC to Build Wealth

Leveraging a Home Equity Line of Credit (HELOC) to amass assets can certainly speed up one’s journey to financial freedom if deployed and managed properly. However, it is essential to carefully plot out both your cash flow and risk management strategies to safely navigate the complexities associated with using borrowed capital.

Remember that leverage can work two ways. As the name suggests, a lever can help you better lift heavy objects, but it can also snap if you try and take on too much with the lever.

Before implementing a HELOC strategy, it is advisable for homeowners to seek custom advice from financial professionals. An experienced adviser can provide tailored insights, helping to navigate the complexities of borrowing against home equity while addressing individual circumstances of their financial situation and long-term financial goals.

If so, the flexibility of a HELOC can enable borrowers to access funds as needed, empowering them to seize investment opportunities quickly and efficiently while building wealth and enjoying tax benefits associated with interest payments.

Still Just Researching Velocity Banking?

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson has no affiliation or association with any of the following and does not feel compelled to do so since he is a published life insurance authority, policy design geek, and a multi-faceted accredited financial strategist:

- The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

- Bank on Yourself, Pamela Yellen, nor her book The Bank on Yourself Revolution

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.

** “Bank On Yourself®” is a registered trademark of Hayward-Yellen 100 Limited Partnership.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- Never any pressure or hard pitches

- Learn Velocity Banking to build wealth