[Updated] How Section 7702 Changed Whole Life & IUL in 2022

Last Updated April 26, 2022

7702 is the section in the tax code that determines how much premium can be funded into a life insurance policy before triggering adverse tax consequences.

Revamping code section 7702 in last year’s regulation changes represents the first major change since the 1980s to MEC testing, premium funding limits for permanent life insurance, and whole life’s guaranteed growth rate.

Although the key changes to IRS section 7702 can be very technical, the major takeaways are listed below as well as a video showing 2022’s Top 4 Whole Life companies.

Key Takeaways:

- Legislative changes to how IRS code section 7702 is calculated now allows policyowners to pay more premiums for less permanent death benefit without triggering MEC status (which incurs unfavorable taxation on lifetime distributions)

- Since the fees/charges of Indexed Universal Life are largely tied to the amount of death benefit, this now makes today’s IUL policies more cost-efficient (see comparisons of new and old 7702)

- Since the cash value must eventually equal the death benefit in Whole Life insurance, these changes also water down the guaranteed growth inherent to Whole Life, but the extra capacity for premium often makes up for it depending on the product & company. (see video on how the Top 4 Whole Life companies stack up in 2022)

- These 7702 changes are not retroactive and only apply to go-forward policies (see FAQ for more details)

(Use the clickable takeaway bullets above for more detail or watch Hutch’s video on the Top 4 Whole Life companies below).

What is this recent change to Tax Code 7702 by Congress all about?

Late in December 2020, Congress voted to pass what would later be known as the Consolidated Appropriations Act of 2021. Buried deep into the 5,593-page bill were some monumental revisions to IRC section 7702.

This section of the tax code dictates the premium limits for life insurance policies before they are considered a MEC (Modified Endowment Contract) and receive adverse tax treatment by the IRS. These 7702 changes represents the first major change to life insurance funding parameters since 7702 was originally enacted in the 1980’s.

Specifically IRC 7702 determines the interest rate assumptions for multiple different actuarial calculations for permanent life insurance. In addition to determining the maximum allowable premium for any type of permanent life insurance, 7702 also determines how strong Whole Life’s guarantees will be.

Why life insurance companies wanted this change to section 7702 and what it did for them

Life insurance companies had been previously pushing for this change so they could continue operating a sustainable business protecting American policyholders amid continually declining interest rates. You see, interest rates were high in the 1980s when the original 7702 enacted these actuarial interest rate assumptions that remained static in the tax code until now.

Interest rate assumptions of 4% or even 6% seemed to be extremely conservative in the 1980s, but these actuarial assumptions today put insurance companies in a bind, especially after the fed drastically cut rates in 2020 responding to the economic turmoil of COVID-19.

Although yields inside the insurance company general accounts were declining, the products they offered were tied to this older/higher 7702 actuarial assumption derived in the much higher interest rate environment of the 1980s. Furthermore, the high guaranteed growth rate set promised in Whole Life policies was based on these same outdated parameters.

According to the WSJ, US House staff said the changes IRC section 7702 were necessary “to reflect economic realities” and give consumers “access to financial security via permanent life-insurance policies.”

Otherwise, many life insurance products would no longer be sustainable to offer given without some major change to the outdated interest rate assumptions from the 1980s. Left untouched, tax code section 7702 could obviously hurt the solvency of most life insurance companies and the reliability of the life insurance industry as a whole.

How the necessary changes to code section 7702 will affect future funding parameters for accumulation-based life insurance products

By lowering the 7702 interest rate assumptions to something more fitting with the times, it allowed life insurance companies to maintain a sustainable business model and continue to be a bedrock for American families.

Since 7702 lowers the actuarial interest rate assumption for premiums to create a future death benefit, consumers now must put in more premiums for the same amount of death benefit. The exact ratio will still obviously vary by age, health, product type, etc.

However, unlike with death benefit-focused insurance products where clients are trying to pay the least amount of premiums possible for the most amount of coverage, accumulation-based products are optimized by paying the most amount of premium for the least amount of death benefit (to lower the underlying costs).

Remember, 7702 was originally enacted by Congress to keep wealthy clients from avoiding future taxation by requiring a certain ratio of death benefit for any desired premium amount.

What does this mean for everyone, including the people that would’ve previously considered themselves too old or unhealthy for accumulation-based life insurance products?

It means that they may be pleasantly surprised by the new parameters. This is especially true since these changes will also apply to survivorship or 2nd-To-Die Policies, where the cost savings can be compounded inside these policies that need 2 people to die before they pay a death claim.

How this change to code section 7702 specifically affects IUL policies (as well as VUL policies)

Watch Hutch’s brand new comparison of new vs. old WL or you can read below to learn more about how the 7702 changes affected these policies.

Probably the biggest concern that clients have with IUL, VUL, or any non-guaranteed product on a Universal Life chassis (UL), is the potential for increasing fees. Although many pundits overplay this risk like it’s a big scary monster under the bed, well-informed clients have learned that this risk can be substantially mitigated by paying the maximum allowable premiums for the first 4-7 years.

Guess what, the new 7702 changes further reduce this risk by allowing you to either:

- Pay more premiums into the same amount of death benefit (which IUL fees are largely based on)

- Or, wrap less death benefit around the same amount of premiums without triggering MEC (Modified Endowment Contract) status on your policy

Prior to Congress changing the code section 7702, industry veterans were speculating that further interest rates declines may completely do away with using IUL as an accumulation/retirement vehicle. This is because it would be so difficult to generate a decent return over and above the internal charges based on the old section 7702 rates.

But alas, “New 7702” to the rescue!

Now by legally allowing policyowners to have a smaller death benefit wrapper around their cash values, IUL companies should be able to offer attractive risk-adjusted returns in any interest rate environment

Even in today’s environment of lower caps and participation rates, the new lower fees structure should hopefully offset the cap compression.

Update (Sept 8, 2021) – Now that most IUL companies have come out with their new products, we have confirmed that there is an advantage to stuffing more premium into less death benefit permitted by the 7702 interest rate changes. However, it appears that insurance companies have also repriced their internal IUL fees to cope with the low-interest rates they expect on their investment portfolio. To clarify, there is still a measurable benefit for IUL’s cash value accumulation due to the 7702 changes, it’s just not as drastic as we had hoped.

(Note: whereas the 7702 interest rate change has no adverse effects on IUL products designed for accumulation, there are two major aspects of the new section 7702 that will negatively impact future Whole Life products, and render today’s Whole Life policies still available as unicorns of the past. The soon to be extinct Whole Life offerings today are competitive with the top IUL products only with significantly more guarantees. Read below for more).

How this change to 7702 will specifically affect future Whole Life policies

Watch Hutch’s brand new comparison of new vs. old IUL or you can read below to learn more about how the 7702 changes affected these policies.

Here’s the good news and the bad news for future Whole Life insurance policies with the new 7702 revisions:

- Good News (Kind of): the new lower 7702 interest rate changes will allow bigger front-loaded premiums into the same amount of whole life death benefit. Or, less death benefit will be needed to wrap around the same premiums required to carry a new whole life policy. This seems like good news (like it is for IUL) but remember with Whole Life your guaranteed cash value must contractually crawl closer toward your death benefit (read more at BankingTruths.com/Guaranteed). So, if the amount of cash value you have has to grow closer to your death benefit on a guaranteed basis, do you really want a smaller death benefit?

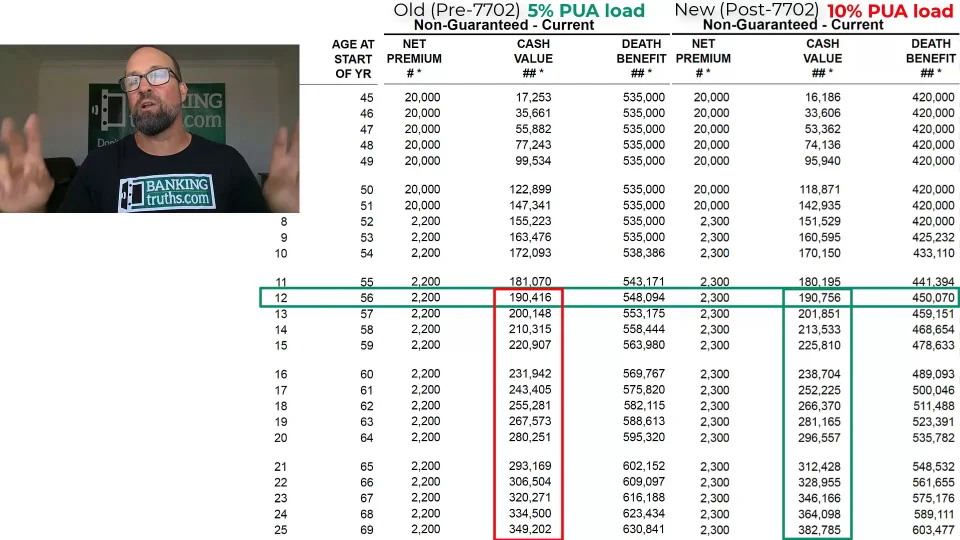

- Bad News (Part 1): the new lower 7702 interest rate will slash all future Whole Life policies’ guaranteed cash value growth rates from 4% to either 3% or even 2%. (Remember that any PUA payments as well as dividends purchasing PUAs are added directly to the guaranteed cash value balance and ride on a growth trajectory dictated by the 7702 rate in place WHENEVER your whole life policy was originally purchased). So, the old guarantees (which you can still get until they shelf the old products) will be considerably stronger than the new ones.

- Bad News (Part 2): the new lower 7702 interest rate will cut the future Reduced Paid-Up (RPU) non-forfeiture option substantially. You can read more about how the reduced paid up non-forfeiture option works, but essentially this is your contractual rip-cord when you want to be done paying premiums. Once the RPU option is elected, a whole policy reduces it’s death benefit, and is then shed of mortality charges. The cash value continues growing toward the death benefit on a guaranteed basis, but the new lower IRC 7702 rate will make the RPU assumptions much less favorable than what exists with today’s whole life policies. Similar to my question above, if your cash value has to grow towards your new death benefit in a Whole Life policy that has elected RPU status, do you want more guaranteed death benefit or less on a fully paid up basis?

What does this mean?

It means that even though the newer post-7702 Whole Life policies will accommodate more premiums, the guaranteed lifetime growth of these new policies will be compressed. So, more of the cash value growth will be tied to the company’s fluctuating dividend scale (which is something they can and do change), and less of your total growth will be derived from the company’s guaranteed cash value trajectory that is baked in by contract.

Unlike with IUL, where you benefited by waiting for the post-7702 smaller death benefit version, with Whole Life you will most likely want to lock in the current classic version without the compressed guarantees. Don’t get me wrong, whole life companies will undoubtedly create future products that are competitive, but much of their total return will be tied to non-guaranteed factors, which they can toggle, unlike the guaranteed cash value component.

Often the most attractive feature of Whole Life is the guaranteed growth that clients can stack in their favor by adding term riders and paying disproportionate PUA payments. This guaranteed feature will be watered-down in future versions of the product due to the recent changes to code section 7702.

Obviously, the new 7702 interest rate changes will help whole life companies run a more sustainable business and keep their promises to existing policyholders. In that way, those who acquired these older vintage Whole Life products can continue enjoying these soon-to-be EXTINCT guaranteed parameters at the loss of new policyholders.

The last time the top-performing Whole Life company shelved a mispriced product, they only gave agents just over a week’s notice to sell the old product before it went away because they didn’t want a fire sale on a product that was no longer a sustainable offering for them.

The guarantees of future Whole Life policies will be getting significantly watered-down. However, clients can lock in the stronger lifetime guarantees of classic Whole Life for a short time until these newer product offerings are approved by the Department of Insurance.

FAQs about the change to 7702

No it does not. Your existing Whole Life or IUL policy would use the section 7702 interest rate parameters and premium limits that were in place at the time of issue.

(Update April 26, 2021: Certain carriers are allowing retroactive 7702 interest rate changes for policies initiated in 2021, but before their product line was approved).

It depends. Every carrier will be different. They must have their legal teams review the new IRC 7702 revisions, actuaries must then design the products, and only then can the State departments of insurance approve the product. Afterward, the carrier must adjust illustration software to accommodate the new product launch. Some carriers are saying Spring, others are saying summer, some are saying by year-end.

(Update April 26, 2021: Certain IUL carriers are starting to release the new products with updated 7702 assumptions. More to follow shortly).

Most likely no, but this is case dependent. Whenever you roll existing cash value into a new policy via 1035 exchange, the “rollover amount” is considered a premium and will be subjected to any premium load charged by the new policy. Even if the new contract is substantially more efficient, your cash value will have to take a step back to take strides forward.

This is something we often to model for new incoming clients with older policies. We often find they are more comfortable retaining older policies if they are decent, although in the worst cases it may make sense to switch. Most often though we can help them optimize the existing policy so that it no longer requires future premiums. That way they can keep their old policy and optimize it, while diverting new money premiums into a more efficient offering.

Well, that all depends, and we must disclose that you always run the risk of becoming less healthy or dying while you wait. However, assuming you stay healthy, the new IUL seems like it will be worth waiting for, while the old Whole Life has some clear advantages that will soon be obsolete (namely the stronger guaranteed growth rate and RPU parameters).

(Update April 26, 2021: Definitely lock in the old Whole Life while you still can. If you are interested in the new IUL, we can start to show you some of the new offerings now, with more soon to be releasing each week/month)

Most likely yes, since the industry lobbied hard for this change throughout 2020. Let’s face it, the old parameters were antiquated and costing them money. For that reason, we expect to see all life insurance companies create new products adopting these new parameters thereby making their business more sustainable.

Final Thoughts on the Recent Changes to IRC 7702

The recent changes to code section 7702 brought about by the Consolidated Appropriations Act of 2021 were necessary for the sustainability of the entire life insurance industry as we know it. By updating the antiquated 7702 interest rate and actuarial assumptions originally set forth in the 1980’s, insurance companies can continue offering competitive accumulation products while maintaining promises to prior policyholders.

Clients who cherish the iron-clad guarantees of Whole Life insurance may want to lock them in with the current product offerings that will soon be extinct.

For those looking to maximize their upside potential with IUL/VUL and aren’t as concerned with the fluctuating fees at the core of these products, the upcoming changes will minimize this risk even further by allowing them the opportunity for growth on larger premiums to outrun these new compressed death benefit fees.

Although these major changes to section 7702 will undoubtedly reshape the industry as we know it, they ensure that life insurance will remain a relevant and viable tool not only at the death of our clients but for full enjoyment throughout their lives as well.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com