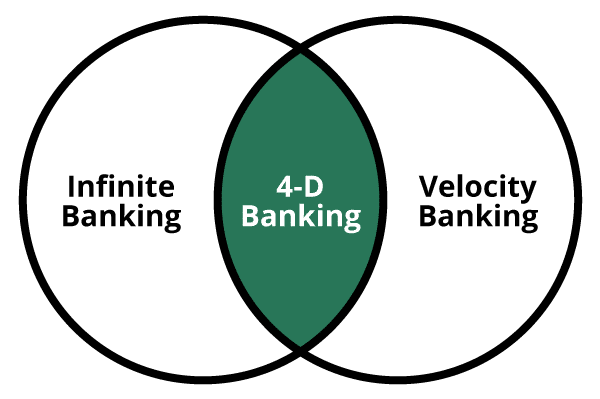

What is 4-D Banking?

4-D Banking is the ultimate privatized banking and cash flow management system that combines the best aspects of both Velocity Banking and Infinite Banking. The 4-D Banking System is a multidimensional approach to wealth building. It aims to take full advantage of time, the 4th dimension, and its steepening effect on your compound interest curve.