Free Download: "Whole Life as the Income Bridge for a Dynamic Retirement Glidepath"

This PDF curates the newest research dispelling typical financial planning myths causing retirees to run out of money.

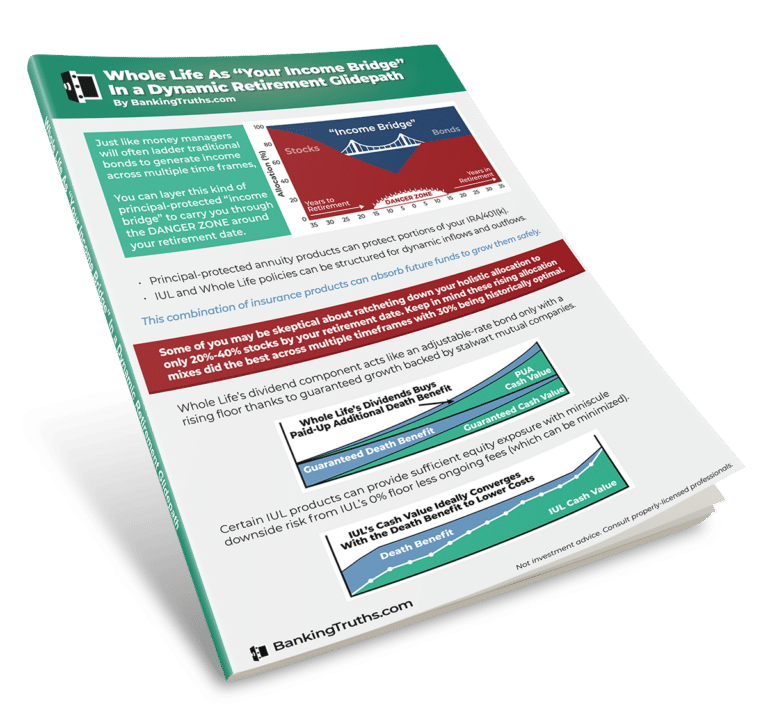

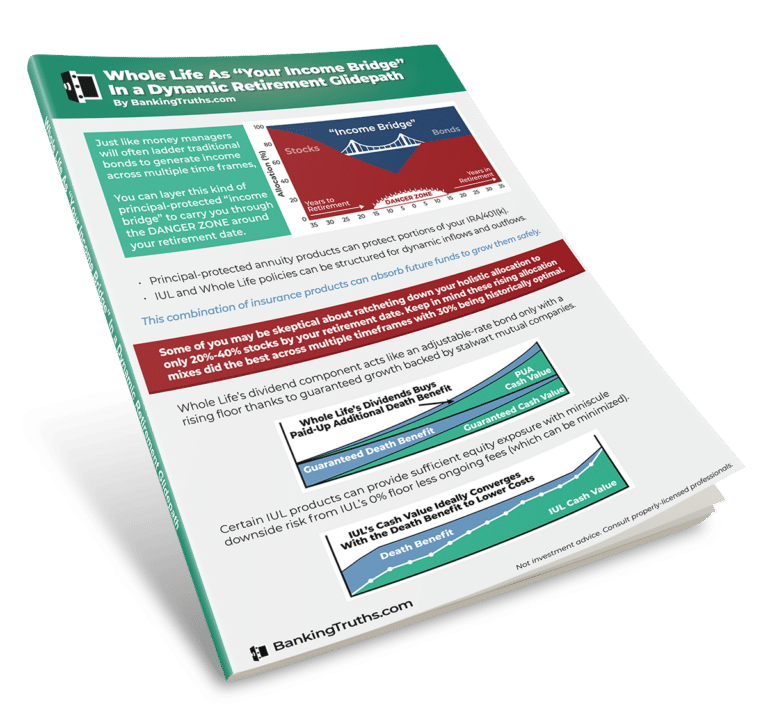

It’s decades worth of retirement withdrawal studies combined with the latest findings into one single comprehensive guide designed to educate clients on how Whole Life can complement, NOT replace, your portfolio.

Free Download: "Whole Life as the Income Bridge for a Dynamic Retirement Glidepath"

This PDF curates the newest research dispelling typical financial planning myths causing retirees to run out of money.

It’s decades worth of retirement withdrawal studies combined with the latest findings into one single comprehensive guide designed to educate clients on how Whole Life can complement, NOT replace, your portfolio.

BY READING THIS 10-PAGE FREE PDF, YOU'LL LEARN:

1.

Popular Whole Life Hype

When agents woo you with too much rhetoric, it often means they’re afraid to go deep into the math with weaker policies.

2.

Common Retirement Pitfalls

Beware of these common mistakes when it comes to your set-it-and-forget-it IRA or 401(k). Understand the math behind the myths.

3.

Deep Education on How Whole Life Can Bridge the Gap When Your Portfolio is Most Vulnerable

Bolster the weakest point of failure for any retirement plan are the years right before and after your retirement date.

4.

What to Consider When Using Whole Life as Your Income Bridge in Retirement

A list of bullets to consider and decide how exposed you are to retirement risks like market volatility, rising taxes, and volatility.

This Free Report Will Reveal the Variables in the Most Crucial Word Problem of Your Whole Life!

What Clients Are Saying:

“I was pleasantly surprised at the amount of freely available information and their apparent depth of knowledge and sincerity.”

– Robert (Inventor)

“For someone inherently skeptical and completely new to permanent life insurance, working with Banking Truths was extremely helpful…all with a focus on education and not sales.”

– Anon (Retired)

“I found them to be approachable, transparent, and highly competent as it related to the industry, the policy options, and optimizing the policies to fit within my strategy.”

– Garth (Executive)

“I researched at BankingTruths.com and was intrigued by the level of detail and transparency.”

– Kelly (Investor)

Unlock your access to the "WL as Your Income Bridge" PDF Today!

Experienced Independent Experts