What Happens to IUL When It’s Late-Funded

Here’s two other videos explaining IUL scenarios:

What Happens to IUL When it’s Light-Funded

Indexed Universal Life’s Full Range of Flexibility

What Happens to IUL When it’s Late-Funded

Let’s take a look at the exact same IUL policy funded three different ways.

So even the one the top left it says Ex. Client, no this is not an ex-client of mine – it stands for example client. We should call it flex client because our clients crave flexibility. Even if they don’t need it, they want to know that they have access to it and that’s one of the beautiful things about Indexed Universal Life.

So even though eventually, three hundred thousand dollars of premium enters all of these policies, you can see here with these lines representing the non guaranteed cumulative premium, the journey to get the three hundred thousand dollars was different for all three of these scenarios.

And I love the nifty visualization software here but I’m going to take it back to their simplified spreadsheet version so you can just see exactly what’s going on. So again three policies that are exactly the same the 1.295 of death benefit with planned premium of sixty thousand dollars for five years.

The scenario on the left actually shows optimal funding the maximum non-net premium we could squeeze into this IUL policy in the first five years. Now we are using an enhanced cash value rider so you can see the cash value tracking quite nicely along the way as premiums are paid.

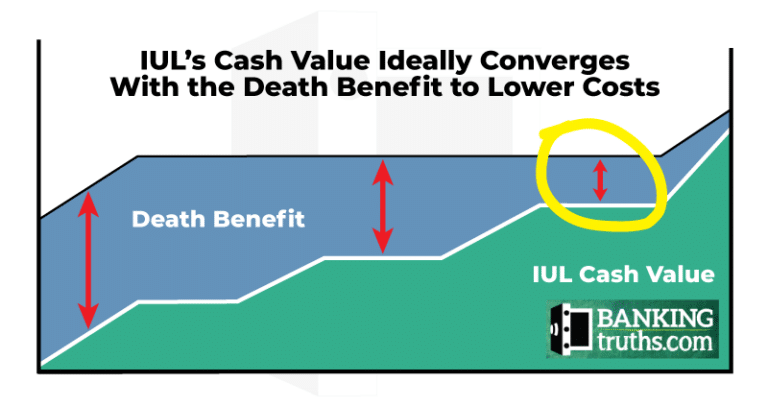

And we also are using an option to death benefit or increasing death benefit during the funding years. So you can see the death benefit increases by the amount of the cash value during the funding period at which time we then level it off.

Now in scenario two, you can see sixty thousand dollars was paid the first year but then for whatever reason, the client hit a speed bump and they couldn’t fund the full sixty thousand.

Keep in mind, if they needed liquidity, they could fund the 60 thousand and borrow against the policy but for whatever reason, this client couldn’t stroke the check so they light funded the policy in years two, in year three they put in twenty thousand dollars, same with year four.

Then in year five and six, the client got their windfall event and caught the policy mostly up and finished it off, putting in the full three hundred thousand by year seven.

Often times, regardless of the length of the funding period, we find that when you’re over funding Indexed Universal Life that the net cash surrender value will equal the amount of premiums paid when using the average AG 49 crediting rates. So our clients will often have things like cash, money market, savings, CDs, low yielding bonds.

I tell them that during the funding period the policy will behave a lot like that and we’ll have the same risk profile or similar at least, but they’ll have liquidity especially if they use these enhanced cash value riders.

Now on the right, you can see that after the first year of sixty thousand this client had to skip funding altogether – some kind of all hands on deck emergency for their cash but then they’re able to resume the normal funding path from years four through eight.

And as we saw before, most of their money is in there but because of the time value of money effect and they didn’t have as much growth to offset the charges they’re not quite yet even at the end of that 8 year but they catch up shortly thereafter.

So with all of that in mind, let’s go back and visualize how these policies behave over time. We’ve been looking at the net cumulative premium and again this is a visual representation of what you just saw – the green one is light-funding, the blue is optimal, and the orange you can see that there’s just no additional funding and then they catch it back up but they all eventually get to the same place.

And if they do that, let’s then look at surrender value and this is just going right up until they start to take income which is why you can see the surrender value starts to go down between years 64 and 65.

The glide path of these policies, once they’re fully funded, is about the same. Obviously, the cash value is going to be less for the scenarios that took them longer to max fund, because the money is not in there earning index crediting but it’s really not that far off. And for a vehicle that has a risk profile similar to high-grade investment bonds, cash, or something of that nature they’re actually getting decent growth once that funding period ends.

And if we just skip right to age 64, it’s not a bad figure to have, knowing that your money was safe – it was liquid, it was working for you, it was propping up death benefits the whole time.

You can see the blue line is ahead at seven hundred sixteen thousand dollars but six hundred and thirty-three thousand isn’t too bad of a result, even considering that you light-funded along the way in the early years. Even 567 for something where you skipped three years and it took you all of eight years to get the full premium in there. That’s not too bad.

Furthermore, if we look at the income of these scenarios, which we’re going to do income for 20 years, but let’s just look at the first year. So the income you’re able to pull off these policies using the software solves of max income for 20 years, you can see it’s actually pretty close.

Sure, we’d love to be able to take sixty-four thousand dollars a year (almost sixty-five thousand dollars a year) in an optimal funding situation but sometimes life gets in the way. So if you had to light-fund at fifty-seven it isn’t too shabby especially considering that as long as the policy never gets cancelled, all this income will be tax exempt.

Even if you had to light-fund at fifty-one thousand of tax-exempt income for a vehicle where there was little to no risk is not too shabby.

Let’s stretch this out all the way to life expectancy and look at age eighty-five here. When we do that you can see the cumulative income, the total income for all three, is a pretty nice figure.

Put in three hundred thousand, get almost 1.3 of income. Put in three hundred thousand get 1.44. Put in three hundred thousand, get over a million and you know that’s not all.

This is the income that they are taking but again in order to preserve the tax sanctuary of life insurance, you need to leave some death benefit behind. And let’s face it our clients are not going to leave the undertaker with the bill.

So if we just look at the non guaranteed death benefit here, in addition to seven figures of tax-exempt income, we’re looking at slightly less than two hundred thousand of tax-free death benefit at the end of all that.

And just to explain what the shape is representing, again this is the non guaranteed death benefit. We saw that the death benefit grows in the early years by the amount that the cash value grows.

So obviously the blue line (when you’re getting all the money in there early), it’s growing quite nicely at a steady pace. The green line is a little more staggered. The orange, you know, takes a step back before taking a step forward.

All of them are pretty close. You can see they’re all within about twenty thousand dollars of the same death benefit during the working years. And then what we do here to optimize income or to maximize income is we drop the death benefit between right before we take income to the maximum allowable level that the IRS will let us squash the death benefit to.

And notice part of how we make the income competitive for these late-funded scenarios is we’re able to more aggressively drop the death benefit. Now, most of my clients get Indexed Universal Life because cash value an income is the goal. So if that’s the case they would have no problem taking 874 of death benefit versus just over a million for the max funded scenario.

The reason we can’t squash that death benefit more is that there are better performance and certain thresholds that need to be maintained in order for this policy to qualify for the tax treatment of life insurance. But because we can squash the death benefit, we still get very healthy income off of the late-funded policies and it produces a pretty nice result for our clients.

Click here to schedule a call with us to take a deeper dive into Indexed Universal Life to help you understand how this could look for your situation going forward.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com