Simplify Your Research on Whole Life Companies, Products, and Providers

A typical progression for someone who is researching Whole Life insurance goes something like this:

- Read everything you possibly can about the product online.

- Sift through cryptic opinions (positive and negative) and tally random votes to see if you should even keep talking to the providers who are pitching you.

- Have multiple agents run proposals, so you can hopefully pick the best one.

- Take a leap of faith and hope you didn’t get screwed.

Sound familiar?

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

No matter where you are in this process, I’m about to save you a bunch of time, energy, and anxiety.

My prescribed course of action is numbered below according to the steps above.

- Save Your Time and Energy. This Thing is For Real!

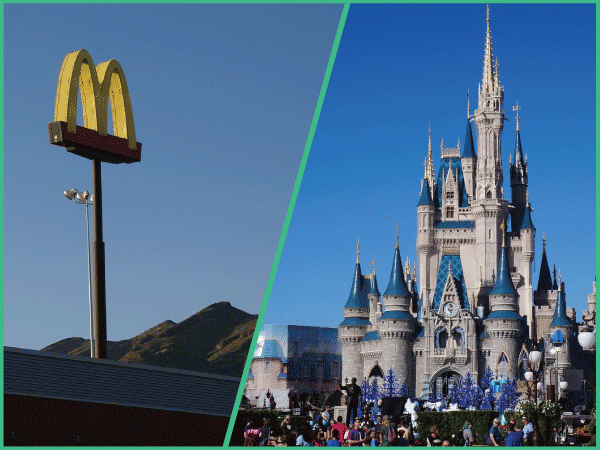

Don’t take my word for it. Just look and see how famous entrepreneurs and even how big banks themselves have used Permanent Life Insurance to safely grow their liquid cash reserves very efficiently by having $1 wear multiple hats.

Click here to read how 3 of the most famous iconic entrepreneurs who ever lived used Whole Life Insurance to either start, grow, or save their business empire.

Click either image below to open in a new tab.

- Money Talks and Opinions are like…

Take the opinion completely out of it. You could scour the internet as well as ask every single person you know if they think this is a good idea, but is that going to get you any closer to the truth?

- Are the random people you’re asking really qualified to give you an intelligent answer, or are they just parroting what they too have heard when polling random opinions?

- Do you really think the trolls on the internet really have a financial situation that you would even want?

Common advice leads to common results.

Are you asking the CFO’s of those two huge banks why they signed off on investing over $20 Billion dollars each into permanent life insurance? Are you speaking to icons of industry about why they didn’t follow the herd and stick with common opinion when positioning their cash reserves in a way that allowed their business to flourish against all odds?

Can we agree that they didn’t get bamboozled for billions of dollars, and that something good must be going on here?

Fact trumps opinion all day. So use your time efficiently by getting straight to the brass tacks of the matter. The remainder of this article will show you how to do just that as quickly and efficiently as possible.

- If You Want Professionals Who Will Provide the Most Efficient Policy Designs From The Most Financially Solvent Insurance Companies on the Very First Go-Around…Look No Further

Conserve your energy and leave the shopping to us.

As independent brokers, we are current with the market and always gravitate to best of breed in terms of the most competitive companies and policy design. Sometimes a client’s unique health concerns may dictate using some of the second-tier companies when they’re willing to offer a superior health rating, but only if we can prove it’s a huge win.

Otherwise, we stick with the top tier carriers, which happen to be among the biggest, oldest, most solvent, and highest yielding companies out there, not to mention the stingiest when it comes to commission rates.

All of these companies are dealing with essentially the same mortality data, so when certain companies decide to pay agents a higher commission rate, who’s pocket do you think that comes out of?

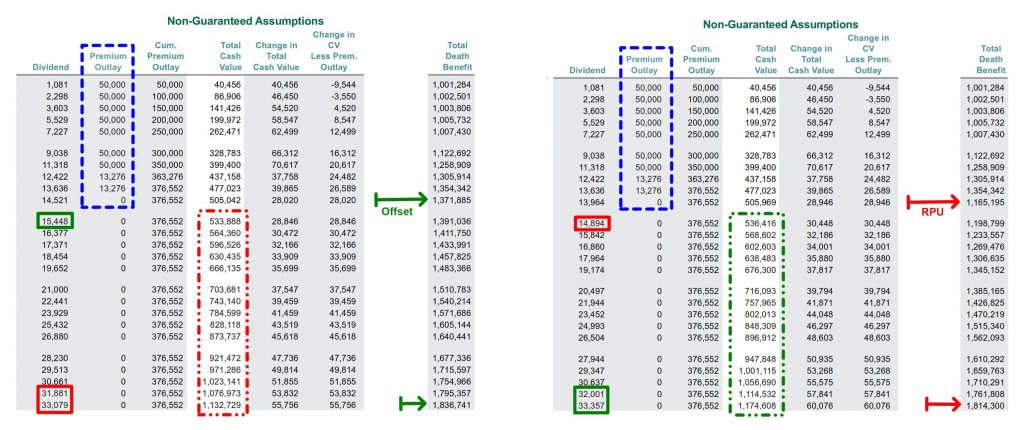

Regardless, choosing the best product manufacturer is actually not the biggest determining factor of Whole Life Policy performance.

How the writing agent designs your policy makes the biggest difference in how well your Whole Life policy performs from a cash on cash standpoint.

Most insurance agents simply don’t know how to construct a policy for maximum efficiency. And the small minority of agents that do know how, often do not do it because it could greatly reduce their potential commission.

We know exactly what banking clients are looking for – strong cash value growth and the earlier the better. Am I right?

- How would you like it if you were shown comparable illustrations from the top 2-3 companies using efficient policy design specs from the jump?

Click here to save time, energy, and money now.

- Feel Confident About Your Choice and Move Forward with Your Life

Due to straight-talk education and the testing of multiple different scenarios we do from competing insurance companies, you can feel comfortable knowing you made the best possible choice.

Rather than simply hoping that you picked the right guy who talked a good game, you can have this one-stop-shop make all the best insurance companies put their best foot forward to compete for your business.

You undoubtedly will have questions. Although this may be the first time you’re asking a certain question, it’s extremely rare that we get a question that we haven’t heard hundreds of times already. That’s why we have compiled an extensive suite of articles, videos, and free reports to help you accelerate your education at your own pace.

Our virtual one-on-one educational meetings will help you fill in the blanks for you as well as address your specific concerns by attaching your specific numbers to the factors in question.

Once we have arrived on a program that you know you will be comfortable with, we do most of the heavy lifting getting you started with the insurance company of your choice.

That way you go on with your life while we do what we do best with getting you the best possible rating. On an ongoing basis, we provide you with ongoing automated updates on your particular company, state of the industry reports, and advanced planning ideas.

We’re always just an email or phone call away if you have any questions or need to make adjustments going forward.

Why Waste Any More Time?

It’s got to be tiresome sifting through all the noise and trying to sniff out the snake-oil jockeys. We respect how valuable your precious time and money is, so we’ve simplified this whole process for you.

Give us a call and see how you feel. We don’t bite, and we are ready to provide exactly what you’ve been looking for with streamline efficiency and white glove service.

Click here to schedule your no-obligation custom consultation.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com