Reduced Paid-Up Insurance (RPU) Explained

Understanding One of Whole Life’s Non-Forfeiture Options

What is the Reduced Paid-Up Non-Forfeiture Option?

Reduced Paid-Up status is a feature available only on Whole Life policies, which gives the policyowner the right to a fully paid-up policy for a reduced amount of guaranteed death benefit whenever they are ready to stop paying premiums.

The exact amount of reduced paid-up insurance will depend on how much cash value in the policy, how old the client is, as well as how long premiums have been paid.

The other available non-forfeiture option for whole life is extended term insurance, where the policyowner maintains the full amount of death benefit (rather than taking a smaller amount of reduced paid-up insurance). The downside to extended-term insurance is that it will not last indefinitely like reduced paid-up insurance.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What is the difference between the reduced paid-up option and a paid-up addition?

A paid-up addition is a small chunk of whole life that is added to a base whole life policy often through extra premium payments, whereas the reduced paid-up insurance option is chosen when someone no longer wants to pay premiums and henceforth reduces their base policy. After electing the reduced paid-up non-forfeiture option available on all whole life policies, their base policy essentially then takes the form of a paid-up addition.

If you would rather read about how paid-up additions supercharge whole life insurance then you can go here instead.

Why choose the Reduced Paid-Up Insurance vs. the Extended Term Insurance Non-Forfeiture option?

Policyholders who no longer wish to pay whole life premiums would choose the reduced paid-up insurance option when they are not concerned with the amount of death benefit that remains, but are more concerned with preserving existing cash value. Conversely, the extended-term insurance option would be elected when the policyholder needs to maintain the maximum amount of death benefit for as long as possible

Also, the policyholders’ cash value continues to diminish with extended-term insurance until eventually exhausted, whereas with reduced paid-up insurance it continues to grow.

Clients often wonder what the impact to their Whole Life policy will be when they are ready to stop paying premiums. The perception is that they must pay for their “whole life.”

However, there are two very favorable options available when that time comes.

- Premium Offset – This is where you stop paying out-of-pocket premiums but use a portion of your dividends to cover the ongoing base Whole Life premium. These ongoing premiums not only maintain your death but also add to the guaranteed cash value of your policy.

- Reduced Paid-Up (RPU) – One of the contractual options that every single Whole Life policyholder has is the ability to elect the reduced paid up insurance option on their policy. Doing so reduces your Whole Life death benefit to the point where it is considered contractually paid up with no further premiums due. Because the policy is contractually paid up at this point, this option tends to produce the best long-term cash value growth even though the death benefit shrinks initially.

To clarify, you do not need to decide between these two options at the onset of the policy. You can choose either option once you are ready to stop paying premiums.

I wrote this article to explain the pros and cons of each option and to give you a generic example of how each option can affect ongoing cash value and death benefit performance using a hypothetical example with real policy data.

How Do I Choose Between Premium Offset and Reduced Paid-Up?

Obviously, you will need to consider your entire financial, tax, and estate planning situation with your advisors before making your final choice, but here are the main simplified reasons you would choose one vs. the other:

When To Use a Premium Offset vs Reduced Paid-Up Insurance:

Remember, this is where you stop paying premiums out-of-pocket and use your dividends and any prior overfunding to cover the annual premium?

- If you want to maintain maximum death benefit because your health has taken a turn for the worse or your family/business has a lot of financial obligations you want to protect against, then you will definitely want to just offset your premiums. Again, this means that you simply no longer pay them out of pocket. Utilizing dividends and prior overfunding will hinder your cash value growth somewhat, but it is usually nominal if you have been diligently paying significantly more than the base premiums during the early years of the policy

- Maintaining your ability to pay premiums in the future is another reason to temporarily offset premiums. If you want to resume paying premiums in the future, you can do so even after offsetting premiums for a number of years. Choosing to offset premiums is not an irrevocable decision, unlike electing “Reduced Paid-Up status for your policy. Offsetting can be a temporary election. You can offset premiums at any point in the lifecycle of the policy so long as that annual dividend payout is large enough to cover the base premium and/or you have significantly overfunded your premium payments in the past.

In a nutshell, offsetting premiums either temporarily or even permanently will probably be the way to go if:

- Your health has taken a turn for the worse

- You’re just not ready to irrevocably reduce your death benefit for financial reasons

- You want to keep your option open to contribute more money to your policy in the future.

Now that you get the gist of a premium offset, let’s discuss the reduced paid-up insurance non-forfeiture option (a.k.a. RPU) that is available on every whole life policy by law.

When To Use the Reduced Paid-Up Insurance Option:

Remember, this is where you elect the irrevocable option to contractually stop paying premiums ever again?

- If your burning desire is for maximum cash value performance going forward, you don’t mind reducing the death benefit, and you are sure that you will never want to contribute any more premiums to your policy again, then electing the reduced paid-up insurance option may be your best option.

- The longer that you have had the policy and the more extra premium payments you have made along the way will determine how big of a reduction is necessary. (Note: if you elect to have future dividends go towards purchasing Paid-Up Additions, then your death benefit will continue to increase again from that new lower Reduced Paid-Up amount even though you’re no longer paying premiums.)

Warning: Although the insurance company is obligated to accommodate your request for reduced paid-up insurance at any time during the life of the policy, we highly recommend that you wait at least 7 years utilizing this option. Electing Reduced Paid-Up status anytime during the first 7 years may cause your policy to lose some of the favorable tax benefits afforded to permanent life insurance.

To summarize, choosing the reduced paid-up insurance option is best when you are sure that you no longer contribute any more premiums to your policy. We find that this most often comes into play when a client is about to retire and losing some permanent death benefit is not a major concern. Often at this point, their main priority becomes maximizing cash value performance with the least amount of “mortality charges.”

If so, it may be time to explore what electing Reduced Paid-Up status will do to your policy.

Seeing the Effect of either the reduced paid-up option or premium offset on the Same Policy:

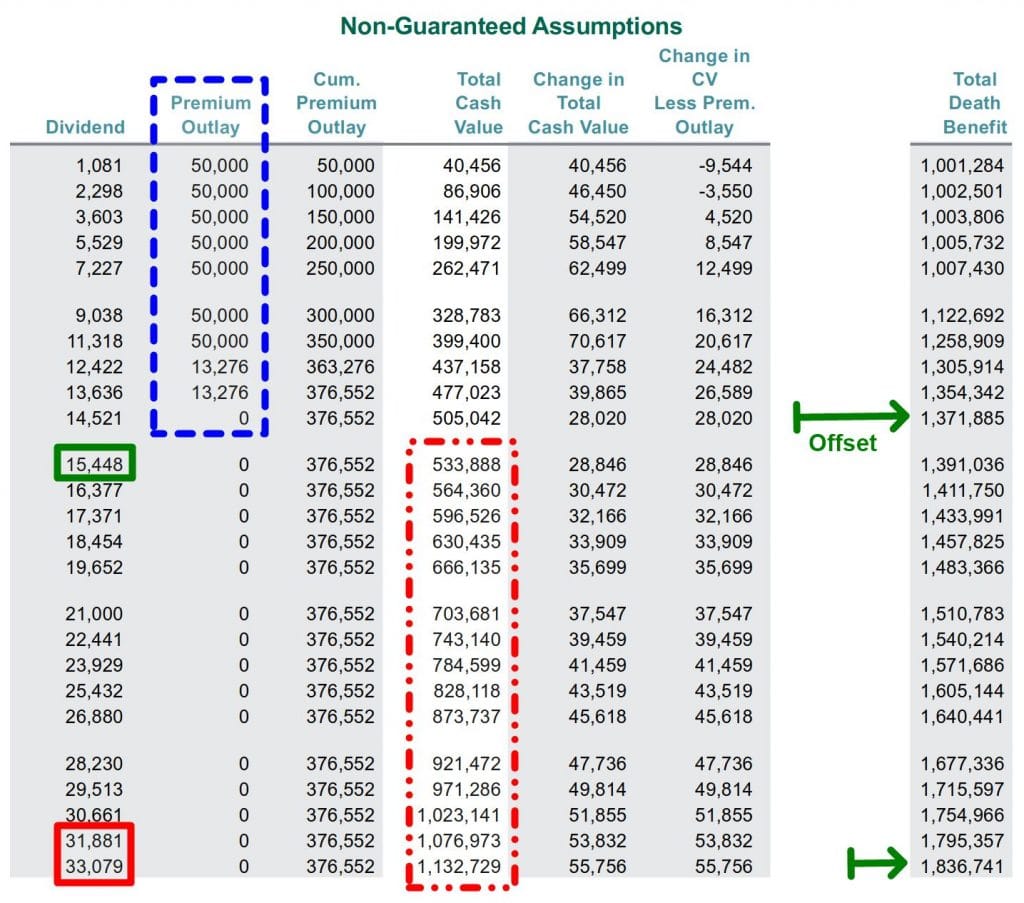

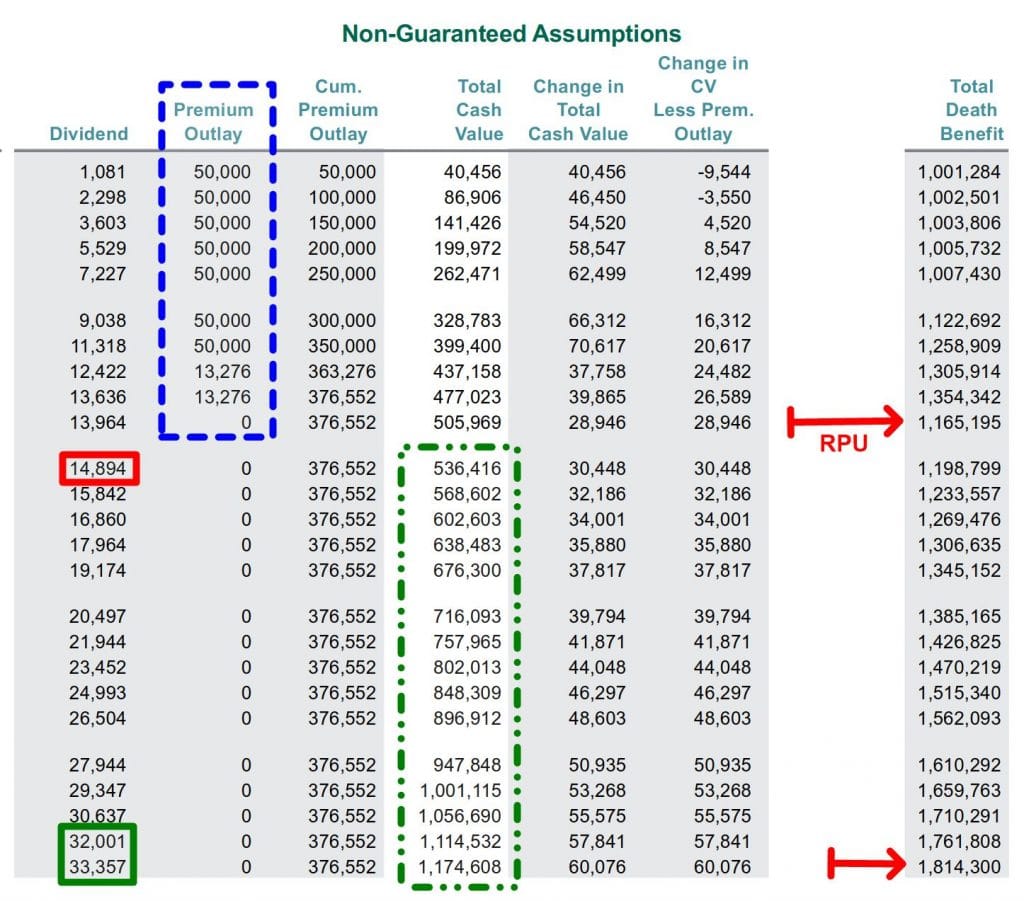

The insured on the policy used is of a 47-year-old male with a standard rating class (3rd down from the best rating). We wanted to use an example where the insured is not very young, nor in great health, so people can see how well a Whole Life policy can perform without cherry-picking the most favorable types of situations.

In the examples below, the maximum allowable $50,000 annual premium is paid for seven years in a row, and then the minimum $13,726 premium is paid for 2 more years. After year 9, no further premiums are paid.

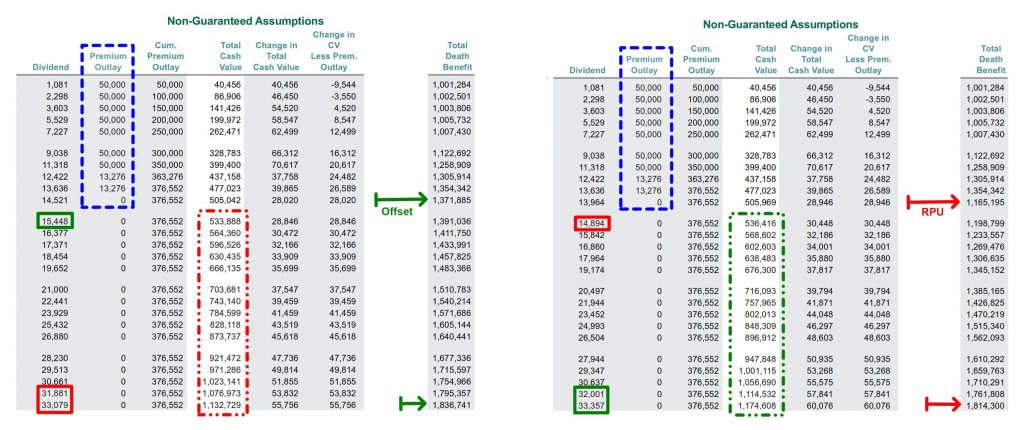

This way, you can clearly see an apples-to-apples comparison between offsetting premiums and electing the reduced paid-up option in year 10.

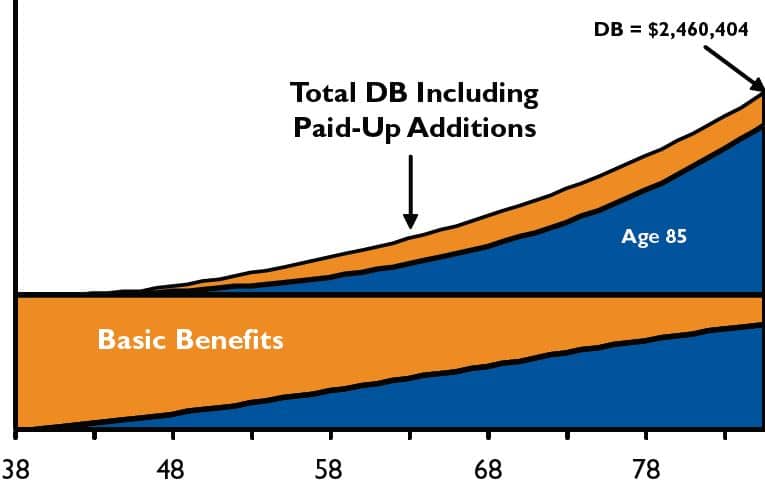

The death benefit for this 47-year-old male with a standard rating starts at $1,000,203. It comprises a $333,401 base Whole Life policy with a Supplemental Term Rider adding $666,802 of additional temporary death benefit. This allows the majority of the initial $50,000 premiums to go towards purchasing Paid-Up Additions, which increases both the early cash value and the permanent death benefit.

The two examples you’re about to see are exactly the same from years 1-9. The differences begin in year 10 after premiums cease, and continues to diverge through year 25 shown. Below is an image of each scenario separately, with a bulleted explanation for each. After that is an image showing the two scenarios side by side to compare on one screen (desktop or bifocals recommended).

Premium-Offset Scenario:

Below are some observations to consider regarding the premium-offset illustration above

- The blue-box demonstrates the premiums paid (maximum premiums years 1-7, minimum premiums years 8-9).

- The top green-arrow shows when premiums are offset (notice how the death benefit doesn’t increase quite as much after year 9).

- The green-box indicates how keeping substantially more death benefit entitles the policyholder to a bigger dividend than the RPU scenario initially.

- The tall-red-box shows the cash value growth after offsetting premium. The growth of the Cash Value between years 10-11 = 5.71%, which is slightly lower than the reduced paid-up scenario.

- The second green-arrow shows how the year-25 death benefit remains slightly larger than the reduced paid-up scenario. The RPU was able to close the gap because all the dividends were used to purchase PUAs every year. Conversely, the offset scenario had to utilize a portion of the dividend to pay the original base policy premium every year.

- The short-red-box at the bottom left of the page shows that dividends start to fall behind the reduced paid-up scenario, even though the offset scenario still has a slightly larger death benefit. Although mutual companies won’t unbundle the exact formula, it’s obvious that the lower ongoing cash value has made a difference.

You can compare the Premium-Offset illustration above with the reduced paid-up illustration below.

Reduced Paid-Up (RPU) Scenario:

Below are some observations to consider regarding the RPU illustration above:

- The blue-box demonstrates the same premiums paid (maximum premiums years 1-7, minimum premiums years 8-9).

- The top red-arrow shows when the reduced paid-up insurance option was elected and the death benefit drops over $200,000 as a result.

- The top red-box on the left demonstrates how the policyholder’s dividend payout is initially reduced compared to the Premium Offset scenario. This is because the amount of death benefit is considered in calculating how big of a dividend the policyholder gets.

- The tall-green-box shows the cash value growth after contractually reducing the death benefit. The growth of the Cash Value between years 10-11 = 6.01%, slightly higher than the premium offset scenario.

- The bottom red-arrow shows how the year 25 death benefit is now only slightly less than the premium-offset scenario. The reduced paid-up insurance was able to close the gap over time. This is because the full dividends in the RPU scenario were used to purchase PUAs every year. The offset scenario, on the other hand, had to utilize a portion of the dividend to pay the original base premium every year.

- The short-green-box at the bottom left of the page shows that dividends are now greater than Premium Offset scenario, even though the RPU scenario still has a slightly lower death benefit. Additional cash value helped.

Both scenarios are side by side below so you can compare them on a large monitor:

Start with the End in Mind

Since life isn’t always as linear as our plans are, we help our prospective clients stress-test their Whole Life policy under different funding scenarios. We consider all the following life events:

- What if I can’t pay premiums that long?

- What if cash flow increases and I want to pay more?

- What if I have to skip premiums or light pay my policy for a while?

- What if I want to do a Premium Offset vs. RPU?

- When can I maximize retirement income that I don’t intend on paying back?

- What if I want some retirement income while maintaining a bigger death benefit?

We’ve found that witnessing how a policy performs under these different conditions helps to solidify the abstract bits of information that clients find when randomly poking around the internet.

Click here to schedule a call with one of our team members to look at some of these scenarios customized to your unique situation.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com