How Pension Maximization Works with Life Insurance to Get More Guaranteed Retirement Income

What is Pension Maximization?

Pension Maximization is a strategy that helps you get the most out of your pension. When you retire, you usually have to choose between a single life benefit (higher monthly payment just for you) or a joint and survivor option (lower monthly payment that continues to your spouse if you die). Instead of taking the lower payment to protect your spouse, Pension Maximization suggests taking the higher payment and using life insurance coverage to provide income for your spouse if you pass away.

Although Pension Maximization might seem complicated, the benefits are clear:

- More pension income for you if you have a long and happy retirement.

- The same guaranteed income for the surviving spouse if you pass away early.

- More assets to leave to kids or other heirs if both you and your spouse die early.

- Flexibility to choose between extra income in retirement or leaving a legacy. Plus, you can change your mind at any time if your financial goals change.

Our professionally licensed pension maximization experts can help you increase your retirement income without cutting out children and grandchildren as a traditional pension plan does.

Table of Contents

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

How Pension Maximization Works

Many retirees don’t realize that traditional pension plans function identically to how guaranteed lifetime annuities work. Pension providers and life insurance companies use the same life expectancy tables to determine sustainable payouts for all.

Many traditional pension plans use terms like the “life-only annuity option” for their highest payout and the “joint and survivor annuity option” for the lowest payout, which continues after the pension recipient dies. Most people will pick the lower payout to protect their spouse, which can often cost six figures of lost pension benefits throughout retirement.

Since both pensions and life insurance companies are using the same mortality data, think of it this way:

By choosing the lower payout, you’re essentially buying life insurance from your pension provider. You’re paying money back into the pension plan to make sure your spouse will get money if you die before them.

But getting this kind of insurance through a “joint and survivor benefit” can feel really expensive since you’re no longer working.

A better approach is to acquire life insurance before you retire when you’re younger and likely healthier, so the insurance is cheaper.

Here's how Pension Maximization works in 7 steps:

- Get your pension benefit options from your pension provider.

- Calculate how much life insurance you need to replace your pension income.

- Apply for and buy life insurance to provide income for your surviving spouse.

- Confidently choose the highest monthly pension benefit available.

- If you die early, your spouse collects the life insurance payout.

- Your spouse then buys a guaranteed income annuity with the death benefit to replace your pension income.

- Any extra payout can go to your children, charities, churches, or other beneficiaries.

Choosing the lower joint and survivor option is easy and convenient, but the proactive planning of Pension Maximization can provide much more financial security for your entire family no matter what happens.

Why Pension Maximization is So Important

Choosing the lower joint and survivor option on your pension might seem simple, but it almost always results in less money for you during retirement and cuts out any heirs beyond your surviving spouse.

Here’s why:

Pension plans calculate your risk of dying based on averages, not your specific health. So you’re lumped in with the good, the bad, and the ugly. If you have a long and healthy retirement, the money you give up goes to other people in the pension pool, not your family.

But when you buy your own life insurance, the cost is based on your specific health, which can often be cheaper to guarantee the same income stream for your surviving spouse.

Plus, the money you spend on premiums is guaranteed to go to someone in your family no matter what, not someone else’s family.

Only 4 Possible Things Can Happen In Retirement

When you start taking your pension, only one of these four things will happen:

- You die soon after retiring, and your spouse lives on.

- Both you and your spouse die soon after retiring.

- Your spouse dies early, but you live on long afterward.

- Both you and your spouse live long and healthy lives in retirement.

First of all, sorry to bring the room down.

I’m not trying to be morbid or overdramatic, but it’s important to understand the implications of these 4 potential outcomes.

Let’s see how each situation plays out, both WITH and WITHOUT using the pension maximization strategy:

1) You Die Shortly After Retiring, But Your Spouse Lives On:

This situation should always be designed to be at least a tie between taking the smaller joint life pension payout and taking the bigger single life benefit along with a life insurance policy.

Insurance agents specializing in pension maximization planning can calibrate the exact amount of life insurance death benefit needed early on. In fact, they can even bring down the cost by subsidizing with term life insurance or term riders on Whole Life.

As your surviving spouse gets older, you need less death benefit to provide them the same amount of guaranteed lifetime income. So, a properly designed Pension Maximization strategy will almost always come out ahead as time goes by.

2) You and Your Spouse Both Die Shortly After Retiring:

This is where you really see the shortfall of a traditional pension plan vs. the power of Pension Maximization.

If both you and your spouse get killed in a car wreck right after choosing the lower joint life payout from your pension, what will your kids get from the pension provider?

Nothing, nada, zip, zilch.

However, had you taken the time to set up a carefully calibrated Pension Maximization strategy, then your heirs would have received any life insurance death benefit as secondary beneficiaries on the policies.

Once you understand this shortfall of traditional pension plan survivor benefits, why would you ever reduce your pension only to have other peoples’ families receive the equity from all your years of hard work?

3) Your Spouse Dies Early, But You Live a Long Retirement:

This will depend on the contract language within your specific pension plan.

Most of the time, if you pick the lower payout to protect your spouse, but they die early, you’re stuck with less money for life.

Basically, you made the responsible choice to protect your spouse, but now that he or she is gone, your reduced pension payout goes to help other peoples’ family in the pension pool, not yours.

However, with Pension Maximization using life insurance, you can leave the death benefit for your kids, or you can spend the cash value as extra income for yourself.

In fact, we have an entire article dedicated to how Whole Life insurance can benefit your retirement.

4) You and Your Spouse Live a Long and Healthy Retirement:

If a carefully calibrated Pension Maximization strategy can better hedge against unlikely outcomes, why not benefit from the most likely scenario to occur?

If both you and your spouse enjoy a happy retirement for 25-30 years, then opting for the highest payout was clearly the best option, full stop!

In addition to maximizing your full equity available in your traditional pension plan, you can also choose how best to realize the equity paid into your Whole Life policy. You can spend some of the cash value as extra tax-free income, while leaving some amount of death benefit to your kids tax-free.

Pension Maximization Pros and Cons

Like any financial strategy, Pension Maximization has its pros and cons. It can be complex at first, but with the right planning, it can recover six figures in retirement income that you would otherwise be giving up by choosing the lower joint life payout to provide income for the surviving spouse.

6 Key Benefits of Pension Maximization

1) Increased Retirement Income:

You can get 7%-15% more guaranteed monthly income by choosing the highest single-life pension benefit. Not only that, but if your pension has a COLA (cost of living adjustment), then the maximum benefit will become exponentially bigger as you receive these annual increases.

2) Children Are Not Automatically Disinherited:

Wouldn’t you opt for your children to receive any unpaid pension benefits if you and your wife died too soon? Of course you would, but this is NOT an option within traditional pension plans. However, using life insurance for pension maximization, you can designate your spouse as the primary beneficiary and children as the secondary beneficiaries.

3) Ongoing Flexibility Between Income & Legacy:

Every year that goes by where the pension participant doesn’t die means their spouse will need less money from life insurance to provide the same income. You can leave the extra death benefit for your kids, or you and your spouse can spend some of the cash value during retirement as extra income. Pension Maximization with life insurance gives you this ongoing flexibility, whereas your pension benefit selection can’t be changed once you elect it.

4) Key Tax Advantages of Life Insurance:

Your 403(b), 457 plan, spouse’s 401(k), and even your monthly pension benefits are all exposed to future higher taxes. This becomes more concerning as our national debt continues mounting.

However, any extra income you take from your Whole Life insurance policy designed for Pension Maximization is tax-exempt similar to a Roth.

5) Long-Term Care Protection:

Many modern Whole Life insurance policies can give you a tax-free advance on your death benefit even if you’re still alive. Some life insurance companies include this benefit as a free rider to add on, while others charge an annual fee for it.

Either way, being able to access a significant “living benefit” tax-free when you need it most is a great ancillary benefit of a pension maximization strategy using life insurance.

6) Using Whole Life as Your Own Bank:

Even though pension maximization involves mainly death benefit to replace pension income, you can become your own banker using Whole Life’s cash value both during retirement and beforehand. Think of the cash value as your own private savings and loan account for not only emergencies, but also strategic investment opportunities as they arise.

4 Potential Problems With Pension Maximization

While pension maximization can offer massive advantages over simply checking a box to reduce your pension for decades, it’s essential to approach the strategy with caution. Without thorough planning and professional guidance, individuals may encounter issues that could result in less money for their entire family in the long run.

1) Potential for the Insurance Policy Lapse:

If premium payments are not paid, your life insurance policy may lapse, leaving your spouse with insufficient income after you pass away.

Keep in mind that insurance companies do have grace periods and can send notifications to multiple parties if premiums are late.

Also, state laws mandate that a Whole Life policy must have two safeguards for late premiums. One is a policy feature called Automatic Premium Loan (APL) where the necessary premium payment is borrowed automatically from the cash value if it is not paid by the grace period. Second is a feature called the “reduced paid-up” nonforfeiture option, where rather than lapsing, a Whole Life policy will reduce its death benefit to a sustainable amount requiring no further payment for the life of the policy.

2) Required Premium Payments:

Since Whole Life insurance provides a guaranteed death benefit for a guaranteed level premium, the payments will be substantially higher than a comparable term insurance policy or even universal life insurance. Pension participants can bring down the cost of this guaranteed level premium amount by initiating a policy before they retire while they are younger and, in most cases, healthier.

Don’t forget that having this death benefit in place allows you to take substantially more guaranteed retirement income, plus any future COLA increases on that larger amount. So it’s almost like having a scheduled recapture of all those insurance premiums to be paid back to you with interest.

Also, as less death benefit is needed to replace the pension, they can draw from that cash value tax-free or leave the extra death benefit to other heirs.

3) Life Insurance May Underperform 403(b) & 457 plans:

Pension participants may speculate whether they can build up more capital in mutual funds than they can in Whole Life’s cash value. In most market environments, mutual funds will outperform Whole Life’s cash value, which grows more like a tax-exempt savings account. However, this may be answering the wrong question correctly.

Remember that pension maximization involves Whole Life’s death benefit replacing the lost pension funds if the retiree dies early. Since mutual funds have no death benefit, you would need such an unattainable return to confidently choose the single-life pension benefit, or you would simply be rolling the dice for your spouse.

4) Initial Complexity to Calibrate the Math:

You see, two different retirement income products need to be calibrated to guarantee income for the surviving spouse. Determining the right type of life insurance policy and the amount of coverage required can be complicated, necessitating careful analysis from a licensed insurance professional financial planner.

Understand that once the initial architecture is complete and the products are in place, the Pension Maximization strategy is basically autopilot. We share the entire process below, including how to determine the proper amount of insurance to provide income equal to their pension’s joint and survivor benefit option.

Which Life Insurance Products Are Used For Pension Maximization

The success of your Pension Maximization strategy depends on carefully calibrated life insurance decisions. This includes:

- Company & Product Selection

- Amount & Duration of Funding

- Laddering Coverage For Key Time Frames

- Reverse Engineering Potential Future Income

Here’s how the different insurance products can work (or not) for Pension Maximization:

Universal Life Does NOT Work for Pension Maximization

This is because no sort of UL product (including IUL and VUL) has a built-in guarantee for its death benefit.

Although it is possible to pay extra for a guaranteed rider, a late premium payment or any use of the cash value nullifies the death benefit guarantee.

This makes Universal Life insurance a non-starter for Pension Maximization.

7 Reasons Whole Life Insurance is Ideal for Pension Maximization

Whole Life should be the core of any Pension Maximization strategy for multiple reasons.

- Whole Life has a guaranteed level premium

- Whole Life has safeguards against insufficient premiums or late premiums

- Whole Life can be designed to be fully paid up by retirement

- Whole Life has a guaranteed death benefit

- Spending Whole Life’s dividends doesn’t nullify the original guarantee

- Whole Life’s Paid-Up Additions give you the ongoing flexibility to choose between extra income or extra death benefit for heirs

- Whole Life can be used as your own bank both during retirement and beforehand

The combination of guarantees and ongoing flexibility makes Whole Life the ideal engine behind maximizing your pension with life insurance.

Laddering Term Insurance to Bring Down the Cost of Pension Maximization.

The biggest amount of death benefit is needed right before and after retirement begins to replace pension income for a surviving spouse. Therefore, we can often layer in one or more term insurance policies to provide this temporary death benefit for a fraction of the cost of Whole Life.

However, because term insurance only provides a guaranteed death benefit for a temporary length of time and not throughout your life expectancy, term on its own cannot carry a pension maximization strategy.

However, savvy insurance agents specializing in pension maximization will add in some amount of term life insurance coverage or add a term rider onto a Whole Life insurance policy to bring down the overall cost of a Pension Maximization strategy.

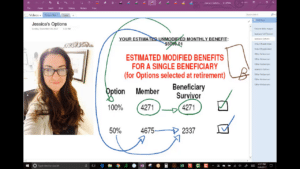

Pension Maximization Example Video (10 minutes)

In this video, I explain how Pension Maximization works using my wife Jessica’s pension as an example. We show how choosing the highest payout with a Whole Life policy on the side can offer more financial security for our family. Watch the video here to learn more.

This approach allows for flexibility in maximizing her retirement income while safeguarding financial support for myself and the kids. Even though we may not need her pension payout, why should we lose all her pension equity she worked so hard for if she got unlucky and passed away prematurely?

Final Thoughts on Pension Maximization Using Life Insurance

Though Pension Maximization might seem complex at first, the benefits are clear:

- More income during a long retirement.

- Security for your spouse if you pass away early.

- More assets to leave to your heirs.

- Flexibility to balance retirement income with family legacy goals.

You don’t have to do the testing, measuring, and shopping alone. It’s critical to have a knowledgeable insurance agent and financial planner to help you not only implement, but also fully understand the various components.

Hear Hutch discuss the Pension Maximization strategy on a recent podcast episode.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com