You've got questions. We've got answers!!!

Learn how to Maximize Your Pension. Have all your questions answered on a FREE educational call!

Do you relate with these statements?

I want to maximize my pension, but I first need to determine if this is legit.

I want to know the pros, the cons, and the math for my unique situation.

I want an advisor who will help me understand my options and design a comprehensive program that will maximize both my retirement & legacy.

• I want to maximize my pension, but I first need to determine if this is legit.

• I want to know the pros, the cons, and the math for my unique situation.

• I want an advisor who will help me understand my options and design a comprehensive program that will maximize both my retirement & legacy.

No pressure, just answers & options

For the last 17 years our team has been helping clients like you use life insurance products to maximize their pension.

Here's what WON'T happen on our call together...

No Hard-Pitch

No Holding Back Info

No Lackluster Products

No Pressure, Ever!

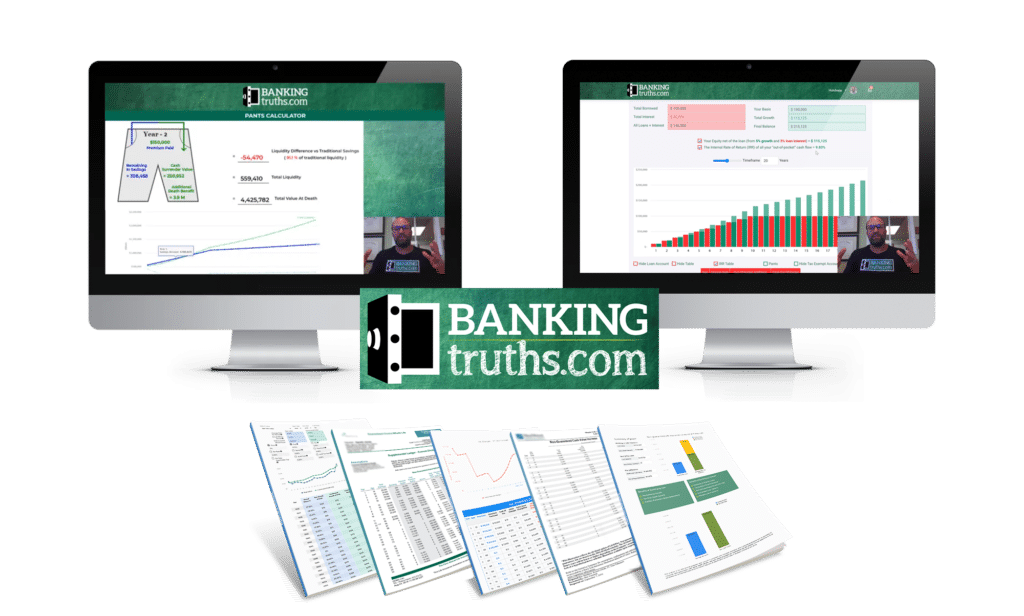

Let us do the "Shopping & Modeling" for you

We're all independent brokers & contracted with multiple life insurance companies.

So we're constantly stress-testing which insurance policies/companies will give you the best fit for your particular situation.

Our clients are really smart people like you!

Our goal is to educate you about all your options,

and then let you sell yourself what’s best.

SCHEDULE YOUR CALL TODAY!

STEP 1

Complete the form so we can share accurate & timely info with you. (Rest assured we are not interested in spamming anyone. You can easily opt-out of any genre of communication whenever!)

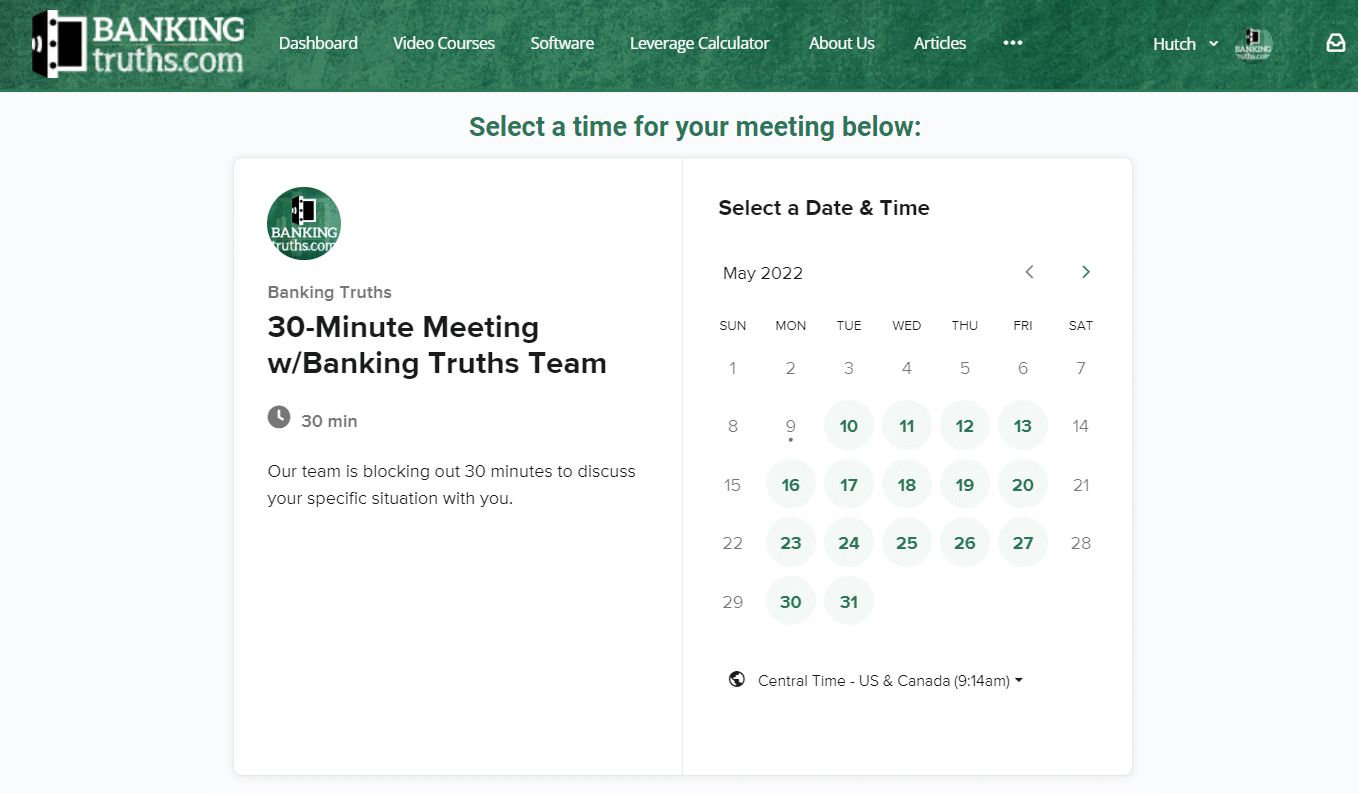

STEP 2

Pick a 30-minute slot on our team’s calendar.

STEP 3

Jump into a zoom call with our team, where we answer any questions you may have and show you some of your options.

WHAT ARE YOU WAITING FOR?

FAQs About This Process

Probably not. We have found that as long as you are under 60 and in average health, the Pension Max strategy still works.

That said, we’ve found that people tend to disqualify themselves prematurely. In fact, in many cases, we have often been able to work magic by shopping to multiple insurance companies and properly framing peoples’ health facts so they compete for your business.

Even Suze Orman, who has publicly been against Whole Life insurance, even went on record in Costco Magazine as saying that Whole Life insurance is a worthwhile tool in conjunction with pension planning. (We’ll provide you the article when we speak).

Furthermore, it’s well-documented public knowledge that major banks, Fortune 500 companies, and even famous college football coaches have permanent life insurance on their balance sheets as a beneficial financial tool.

We do NOT charge an up-front fee for our initial meeting to help you with your understanding of the Pension Maximization strategy and related insurance products. Throughout this initial call, we are both mutually exploring if it would be a good fit for us to proceed further together.

Assuming we both decide to explore a professional relationship further, we will also NOT charge for any follow-up meetings.

We only get paid once you buy a life insurance policy on yourself or a family member. As independent life insurance agents, we are unattached as to which company or policy type you ultimately choose and are happy to educate you about your options, modeling them out for your particular situation.

Well, it depends on how complicated your health situation is, and which insurance company you like best.

If you are in relatively clean health (perhaps just some minor issues that are controlled), underwriting can take as little as a week and in many cases even without a health exam (since insurance companies have embraced AI underwriting)

If the insurance company has to do some digging into your health situation (looking into old doctor records and requesting a paramedical exam), this could push the timeframe from 1 to 2.5 months.

After an initial confidential health interview, if we determine that complications are likely, we can “anonymously shop” your fact-pattern to various carriers to see who plans to play nice with you.

Several things, actually.

Most of our competitors have some kind of longer-term “sweetheart contract” with certain insurance companies. This incentivizes them to concentrate their business with said carrier to increase their commission payout in some way, shape, or form (often to your detriment).

We went fully independent in 2012 after having worked directly under 2 major insurance companies. We decided it was best for the clients we serve to only maintain base broker contracts with any and all carriers. Having no minimum quotas gives us the flexibility to stay nimble, move with the market, and always offer the best of breed companies & products to our clients. That way we can match you with the most appropriate offering.

What else?

Our founder John “Hutch” Hutchinson’s wife is an elementary school teacher. So his first order of business was to learn how “Pension Maximization” could help his own situation. In typical Hutch fashion, he obsessed over the Pension Maximization strategy and found a way to take it to the next level by combining a Whole Life policy with some laddered term insurance products to make it as efficient as possible for teachers on a budget.

We’d be happy to have an initial conversation to see if on paper there’s a mutually beneficial fit to move forward together.

Well, there is no catch. But of course I’m going to say that, right?

Let me elaborate…

Is there a cost?

Short term: yes – there are upfront costs and the first couple of years are the worst years.

Long term: not really – since a properly designed Pension Maximization strategy causes you to recapture considerably more net spendable dollars from your pension that would be gone forever, if you hadn’t paid for these policies.

It’s really as simple as that, and that is what we at BankingTruths.com intend to model for you in an educational, non-salesy manner. Then you can decide if and how much you want to direct towards this type of strategy to maximize your pension.

There’s no catch. We offer to do this modeling for free because we’ve done this enough times to know that most of you will see the benefit of Pension Maximization, and not only get some policies on yourself, but tell your co-workers about the power of this strategy.

We’re ready when you are. Just remember, you’re not getting any younger. So when’s the best time to plant an oak tree? 20 years ago. When’s the next best time?

Now!

So, book your free call below and let us prove it to you.