Ohio National Demutualization Explained

& How To Rescue Your Ohio National Whole Life Policy

Updated on 4/19/2021.

We have 3 detailed videos below answering these different sets of questions that most people will have on Ohio National’s demutualization and buyout.

You can click on any of the questions or sub-topics below to watch a brief but informative video or read its transcript (directly below the video player):

(Clickable) Table of Contents

Bookmark this page as we will continue to update it as we receive more information on Ohio National demutualization or buyout developments:

Click on any of the 3 subtopics above to scroll down to the appropriate video or transcript.

The Top 4 Myths Behind Becoming Your Own Banker (Article)

The Simple Science Behind The Banking Concept (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

The Top 4 Myths Behind Becoming Your Own Banker (Article)

The Simple Science Behind The Banking Concept (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

- Conceptually what it means to be a mutual vs. stock insurance company + A look at the dividend history of companies that have demutualized vs. true mutual companies

(Click below the video to open/close transcript)

So let’s get into it. Just a quick review, a mutual company is called that because they’re owned by their policyholders, which happens to be the same constituency that they serve as customers. So there’s a natural financial alignment going on there.

And you can read more about this at bankingtruths.com/mutual. And there’s a study that shows that executives at a Mutual Insurance Company get paid far less than their stock company peers, and this is because of an overall financial philosophy that’s more conservative at a mutual company.

This includes the investment time horizon, a mutual company is simply concerned about its long term obligation to its policyholders and therefore invest generally more conservatively. And obviously, dividends are only paid to one party their whole life policyholders.

A stock company on the other hand, you can see that there’s an extra hand in the cookie jar. Dividends go to Whole Life policyholders, but also stock dividends go to the stockholders, which are the owners of the company. And when a mutual company demutualized and goes public, what happens is the whole life policy holders actually get issued shares of stock? So they may still be owners of the company. But it’s not inherent through their policy ownership. They’re simply just a customer of the company.

As we said, stock company executives tend to get paid more, but also they tend to often get paid in stock options. So some of the biggest owners or stockholders are the executives themselves. And this presents just a natural little conflict of interest going on.

Furthermore, the investment time horizon is taking the focus from long term to very short term. Why? Because on the stock exchange, you are judged quarterly with your earnings reports, which translates to a new valuation, pretty much every quarter on an exchange.

And so because of this, mutual companies tend to be just a little more stable in what they’re doing with their money inside. So this piece here shows a history of whole life dividends from 1997 to 2021. It’s bookended by two of our favorite mutual companies, Mass Mutual, and Penn Mutual and in the middle are companies that have demutualized in the 1990s (MetLife and Hancock) right around the 2000 mark, and Ohio National obviously recently, and what you can see is actively demutualized in the 1990s, their dividends were already a little more watered down than everybody else.

And at that 2000 mark, when MetLife and Hancock demutualized, their dividends were still quite robust. But if we scroll down, in fact, we made a separate chart that for “as what have you done for me lately”, we can see that their dividends again are far watered down compared to their true mutual peers.

And looking right at 2021, it’s scary lower. What’s also interesting here is Ohio National was still mutual in 2015. But you can see as we move towards 2021, their dividend started to diverge from their true mutual peers, which is a little bit concerning because they hadn’t even demutualized a 2021.

So what does that mean going forward?

- Analyzing a report showing Ohio National’s financial strength change over the last 5 years

- The main reason why Ohio National’s solvency fell hard over the last few years

- The biggest advantage of Ohio National’s demutualization

- A look at an actual client’s 2 Ohio National Whole Life policies to see projections from 2016 vs. actual performance now

(Click below the video to open/close transcript)

So what you’re looking at here is a report we run for our clients. It’s a life insurance, financial strength profile. And looking back to 2016, which is arguably the last of the glory days for Ohio National.

We were actually reviewing an new incoming client that was considering more policies but had two old Ohio policies that we didn’t sell him and when we compared Ohio versus the best performance at that time, Penn Mutual, which still is the best performer as far as whole life policies go. They were pretty close in terms of financial ratings.

So when we look at the COMDEX, which is really grating on a curve or the percentile ratings, Ohio is in the top 92% of all insurance companies, not just life insurance, all insurance companies.

Penn was 91, Ohio was a $27 billion company – Penn was 17 billion. They both had nice surpluses, Penn had a little bit more as a percentage of their admitted assets.

If we jump all the way down to income and earnings, you can see that total income net premiums written were a lot larger for Ohio than they were for Penn Mutual. So their net operating earnings for Penn was negative 8 million, you have to add three zeros to all these numbers, because they were investing in systems and growth, which actually did come to fruition and provided nice dividends going forward.

Now, fast forward to June 2020, we’re looking at a whole different story. All of a sudden, Ohio National’s a C student versus Penn increased their A student-ness, they went from 91 and 93. Paid increased their surplus, Ohio’s went down Penn increased their total invested assets, almost one and a half times not quite 9.4 billion to 14 billion now jumping down to income and earnings.

All of a sudden, whoa, there’s a big difference. Ohio’s negative, but not negative 8 million of net operating earnings negative 78 million, we’re going to talk about why that happened in just a moment, versus Penn went from negative 8 million to plus 44. And total income is a lot more for Penn because those growth initiatives work.

So this is a story that appeared in Investment News in September of 2018. Ohio National exits the variable annuity business. Now, it’s not uncommon for companies to change their approach but Ohio National really loaded up on variable annuity business in December of 2018. You can see here Ohio National officially terminates select VA trails, that’s variable annuity trails. Now trails are renewal Commission’s paid to the advisors and agents.

Now they did this because they were trying to be more profitable, or they were trying to save this cancerous part of their business that they had on their books by making it more cost efficient by not paying advisors.

And I realize nobody cares about how much the advisor gets paid. But it’s concerning that this is a contract. This is a promise by a well respected insurance company, if they can break this promise, what other promises can they break.

So now you understand why they went from net operating earnings of $104 million, and negative $78 million in a period of five short years. And why the net premiums written went from 2.7 billion to 272 million.

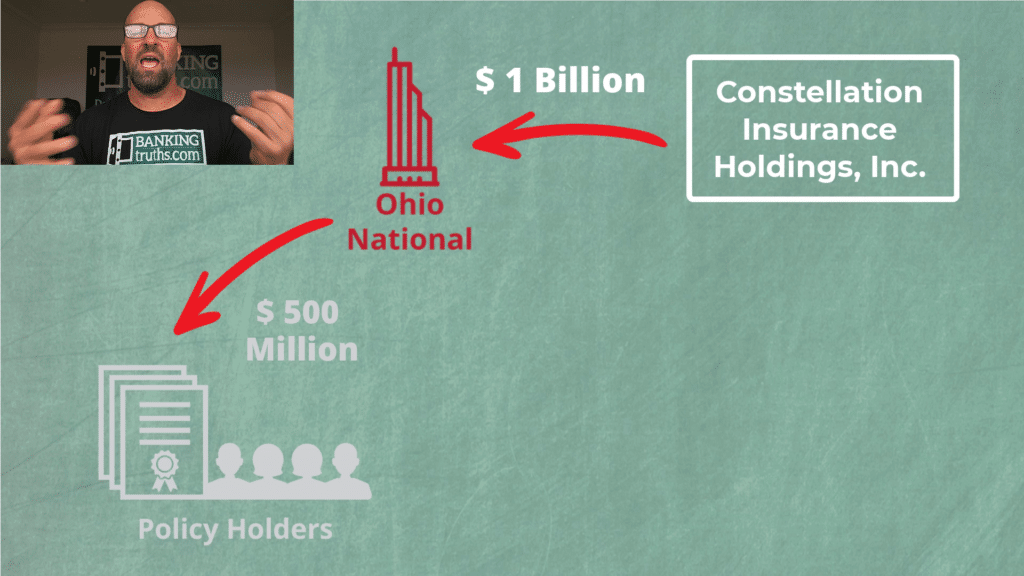

And the agents and advisors lost faith. And when they stopped writing that business, now all of a sudden the incoming cash flow that that Ohio National relied upon as a business was no longer there. And so one of the advantages, probably the biggest advantage of being a stock stock company is the ability to raise capital and they obviously needed to raise capital, they’re running at a huge negative. And one of the concerning things to me is the amount of the buyout and the type of the buyout.

So instead of a mutual company going public and providing stock, they’re getting bought out of house getting bought out by a Canadian investment company that was built specifically to buy up non-performing insurance companies to provide a yield for people they owe pensions to teachers/cops/firemen.

And so the Masters, the owners of the company, will no longer be the policyholders. But it’ll be recipients of pensions in Canada.

I wonder how much loyalty they’re going to have to the policyholders.

Also, the amount of the buyout if we jump back to how big of a company it is, it’s $1 billion. 500 million is going to get paid out amongst all policyholders. And it depends on how much cash value death benefit you have. They’re going to calculate all that.

But the buyout and also 500 million is going into the company to kind of reboot, if you will, but essentially a $1 billion total buyout. It seems quite small for a company this large. And so it makes me wonder if it’s looked at as a complete distressed asset at this point.

So because of that, we’re going to look at two old policies that one of my clients has and look at the projected performance back in 2016, compared to the actual now.

We’re really lucky to have these two inforce illustrations, one from the past and one from the present, because the one from the present we requested about a month before Ohio National announced demutualization and since then, we’ve tried to get more data as I’m sure has so many other people with Ohio National polls. And they’re just inundated. They said, everybody has to wait a couple months, because we have to redo our software.

But we at least have this. And what you can see is that he was expecting in 2021, a dividend of $3400. Instead, he’s going to get a dividend of $2400. So you can say, oh, it’s only $1000, but it’s really about a third of his dividend going away.

And if we back this up, because we have prior statements, what you’re going to see is the total return on his policy after paying a premium he’s actually going to be getting in 2021, is going to be a lot less than he was expecting based on his 2016 inforce illustration.

Now granted, that was run several dividend drops ago, but it gets worse. Remember, I said he has another policy? Well, this one’s an older policy from 2005, he’s paying more premium, he was expecting a dividend of nearly $7300, for 2021. And it’s only going to be a little more than half that at $3672.

- Our “have your cake and eat it too” Ohio National WL rescue strategy mapped out

- Looking at the math behind borrowing against your waning Ohio National policy to start a better policy now

- Recap of the strategy and what to do next.

(Click below the video to open/close transcript)

A lot of agents will probably tell you simply replace the old Ohio policy with the best performing whole life policy you can find from a true mutual company. But wait a second, there’s a problem with that.

Remember, you’re supposed to get a buyout from Ohio National! Well, if you replace the policy, then you lost your ownership in the company. Not only that, if we do an RPU (reduced paid up) or you stop paying premiums, that’s going to reduce the amount of buyout you’re probably entitled to.

So we want to keep paying premiums for a while on the Ohio National Policy – get the maximum dividends you can buy. And not only that, but when we look back at the history of companies that demutualised it took a little while for their dividends to fall off a cliff.

Nobody knows how long it will take. But we really want to squeeze as much juice out of the Ohio policy as you can, but probably simultaneously start a new policy so that you can have that infinite banking vehicle – you can have the tax exempt retirement vehicle that’s going to be robust in retirement.

And we found with the Ohio policies, they really start to peter out around retirement age 65, which will give a lot of you a good ramp up period for a new policy.

But you’re thinking “Wait a second, I don’t have the money to pay premiums on my old policy and the new policy”. Well, maybe you do, maybe you don’t. But we have these turnkey cash value line of credit programs almost like a HELOC.

But it’s turnkey for life insurance, there’s multiple lending institutions that will do this, they’re very favorable rates, three and a half at a minimum, sometimes as low as 3%. And we already saw that the Ohio policies are performing better than that. And hopefully they will for some time.

So you’d be getting positive arbitrage on this side of the fence. And it won’t take too long before you’re getting positive arbitrage on the other side of the fence.

And I know there’s that acquisition period, those first years of the worst years with the new policy. But remember, you’re getting the buyout money from Ohio National that can help subsidize that.

This is infinite banking at its finest. You have multiple bites at the apple, you have your cash value working in multiple places. While a lot of times people are buying real estate or investing in their business, this time, you have two very stable assets on either side, and you’re growing the equity in the new policy. So you can still do those other things like real estate, grow your business, or whatever, and still have a robust policy during retirement that you thought you’d have.

I know a lot of people get skittish when I say the word loan or borrow, but this is my new leverage calculator. And let’s just test the efficiency of this strategy.

So what I’m going to show is an initial loan of $15,000, and then annual loans of $15,000 a year for the next three years after the first year. So four years total. And we’re just going to say we’re going to use the ball and we get a three and a half. And let’s just say we’re only going to get growth of four. And remember, this could either be either policy, you’re getting growth from both Ohio and Penn.

But if it’s just one, what I want you to see is your total that you borrowed over the first four years is $60,000. But the total interest paid, we’re paying interest every year at three and a half percent is $28,000. And the total growth is almost $42,000.

Now you think oh, that’s not great. I’m paying all this interest. But remember, for paying all this interest, this is your equity on taking that loan, but your IRR (your internal rate of return) out of all your out of pocket cash flow, which is not $60,000 or $15,000. It’s just the interest that is to borrow. The IRR, you would think would be 0.5% – 4% growth rate, less a 3.5% loan rate. It’s actually 5.23%. Now let me just explain to you what that means.

Every year if we borrow at 3.5% for $15,000. The first year, it’s $525. The second year, it’s $1050. Because there’s two $15,000 loans. Then $1575, then $2100. And then there’s a $60,000 loan outstanding.

We use that to pay premium, but all we did was pay interest and we just continue paying interest. I understand that interest rates could go up, maybe they will, maybe they won’t. But if interest rates go up, what else should go up? Probably whole life dividends too.

And again, I’m using 3.5% – we might be able to get this down to 3%, possibly. But just comparing this of these cash flows, you would have paid $28,000, you got almost 4.2. And it’s saying that you would have to put these cash flows in this order and earn 5.23% to have $42,000 of equity.

This is very, very interesting.

Well, what happens if we get a lower loan rate, let’s say you qualify for the 3%? Well, look what happened to our our IRR, it’s 7.22%. Why? Because instead of paying $525 and $1050, we’re paying a lot less interest, and instead of paying ongoing $2100, we’re paying $1800.

And so we get the same amount of equity, that equates to a higher IRR. Well, the growth rate of the whole life policy and the new Penn policy was closer to 5%. Let’s just say if it’s 4.75%, what’s our IRR now it’s 10% why we’re still paying the 3% on the $15,000, $30,000 and so on.

But our equity is now more! Why? Because we got a higher growth rate. So you can see that this is an attractive proposition.

And don’t forget, we’re just showing arbitrage off one policy. What if you’re getting arbitrage off both?

So this is what we plan to test for clients that have these Ohio National Policy. You’re not getting any younger and you’re probably not getting any healthier. Ohio National is probably not getting much healthier for you, as a whole life policy holder that is, but this is something we can act upon now.

And we can test and measure what this will look like for you. If you were able to keep it, get your buy out, earn your dividends if it makes sense. Pay your premium if it makes sense, if not RPU it. Get your guaranteed growth at the very least, and leverage that equity into a new policy.

I encourage you to book a call on our calendar so we can perform this in-depth analysis. And if it makes sense for you, maybe we can help you realize the dream you initially had when you took out that Ohio National policy.

I hope to talk to you soon!

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com