Buy-Sell Agreements Using Insurance

Key Takeaways for this Buy-Sell Agreement Article

Most founders wouldn’t want to partner with another’s grieving widow, yet it’s unlikely that business cash flow could sustain a proper buyout during ongoing operations, especially after losing one of its co-owners.

The likelihood of this type of catastrophe is slim, but the consequences are grave.

This article will explain what a buy-sell agreement is as well as discuss the advantages and disadvantages of different types of buy-sell agreements and funding methods.

We find that even if business owners have navigated through the complexity of drafting legal documents, their buy-sell agreements often lack sufficient funding if one of the owners were to pass away prematurely or become too sick or hurt to keep working.

Why gamble at the highest stakes of your life when a properly drafted buy-sell agreement can address every contingency, and certain buy-sell life insurance policies can cover the worst outcomes like death & disability.

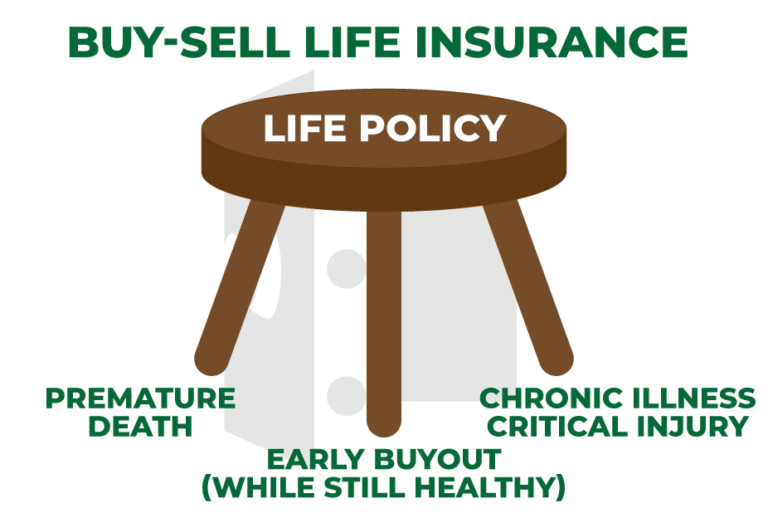

Like a key employee, a properly structured buy-sell life insurance policy can wear multiple hats hedging against the biggest risks listed in a buy-sell agreement.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

What Is a Buy-Sell Agreement?

A buy-sell agreement is a legal document stipulating the orderly transfer of a business partner’s ownership interest if they leave the business due to death, disability, or other pre-determined contingencies. Since a premature death is often the most surprising and disruptive event that can trigger a buy-sell agreement, life insurance on the owners is a common pairing with this type of legal agreement.

Ironically, any of the business owners are much more likely to become too sick or hurt to keep working, yet disability insurance is rarely used with buy-sell agreements. Even more likely to happen is that none of the owners will die prematurely nor become disabled, and yet we rarely find that the company or its owners have a segregated sinking fund to buy out the first owner to retire.

When structured properly, modern-day buy-sell life insurance policies are uniquely qualified to handle all 3 of these contingencies simultaneously.

Buy-sell life insurance backs the legal language laid out in the agreement with adequate funding to ensure a smooth transition during what could be the most tumultuous time the business ever experiences.

Table of Contents

What Do Buy-Sell Agreements Do?

Buy-sell agreements consolidate ownership of a business and ensure its continuity upon the exit of one of its owners through the following five provisions:

- Establishing the agreement’s trigger events

- Naming who can buy the ownership interests.

- Stipulating the order of operations for the sale.

- Determining the business value or valuation method.

- Verifying the funding sources needed for the buyout.

Having the buyout details worked out in advance provides a fair and systematic process during a disruptive time due to the exit of a key owner.

What Are the Benefits of a Buy-Sell Agreement?

The main benefit of a Buy-Sell is the continuity of a closely-held business despite the disruption of losing one of its owners, often because of unfavorable circumstances. Buy-sell agreements that are both properly drafted and funded can provide certainty and peace of mind for the following parties:

- The exiting owner’s family knows there are clear provisions and reliable funding methods to fairly compensate them for their inherited ownership interest.

- The remaining owners fully understand any future ownership regime and know there will be adequate sources to buy out another owner without disrupting business cash flow or operations.

- The current employees and creditors of the company can feel confident knowing the business is prepared to withstand the temporary disruption from the loss of one of its owners.

Although most buy-sell agreements are never actually triggered, the peace of mind they can provide for all involved allows its owners to focus on enhancing enterprise value.

Also, it’s worth noting that buy-sell agreement life insurance with chronic illness riders can create liquidity out of thin air to purchase illiquid ownership interests during the most catastrophic situations. When paired with a properly drafted buy-sell agreement this immediate liquidity may also provide massive tax benefits for both the deceased and surviving owners’ families.

What’s Included in a Buy-Sell Agreement?

The following provisions are essential to having a legally enforceable buy-sell that seamlessly transfers ownership to surviving owners while providing the deceased owner’s heirs with payment for their inherited business interests:

- Which owners will be included in the buy-sell agreement?

- What rights and obligations do the various owners (and heirs) have?

- What different events can trigger the buy-sell agreement to take effect?

- How will the company be valued when the buy-sell agreement is enforced?

- Which insurance products or buyout strategies will be used to fund the buyout?

- How will the buy-sell agreement be structured, and what are its tax implications?

The remainder of this article will dig deeper into some of the more complicated bullets above, where many options are possible to choose when deciding which type of buy-sell agreement to have drafted.

Which Events Trigger a Buy-Sell Agreement?

A buy-sell agreement is essentially a dormant document while all owners are actively working in good standing with the business. None of the legal provisions stipulated in the document are enforceable until one of the buy-sell agreement’s triggering events occurs. Below are the most common triggering events found in buy-sell agreements, starting with:

- Death of an owner

- Disability of an owner

- Bankruptcy of an owner

- A felony conviction of an owner

- Violation of covenants by an owner

- Retirement of an owner (early or otherwise)

- Owner divorce (when losing ownership to spouse)

How is Valuation Determined in a Buy-Sell Agreement?

All buy-sell agreements must have some sort of valuation clause to determine the total value of the business at the time the buy-sell agreement gets triggered. A valuation clause is important for all buy-sell agreements so surviving owners can plan for payments without disrupting the business. Also, the potentially exiting owners can plan for what their heirs will be legally entitled to.

The 3 ways a business can be valued within a buy-sell agreement are:

- Fixed price in the buy-sell agreement.

- Fixed formula in the buy-sell agreement.

- Fair market value appraisal upon triggering events.

Fixed Price: The first method of setting a fixed price for the business within the buy-sell agreement is the simplest and cheapest. However, since the actual value of the business will continue to be dynamic, this may result either in the surviving owner(s) paying too much or the exiting owner’s heirs receiving too little. However, I’ve found that many buy-sell clients don’t mind when quickness/simplicity is desired to get the buy-sell agreement in place, and it is funded adequately with life insurance.

Fixed Formula: The second method of setting a fixed formula within the buy-sell agreement can be ideal if all the owners can come to an agreed-upon set of metrics to determine the future value of the business upon a triggering event. Although this creates simplicity in terms of a company’s valuation, this can cause complexity with funding the buyout since the valuation will fluctuate while funding sources like life insurance will likely stay fixed. That said, if a shortfall occurs, the remainder of the buyout can come as installments from the business cash flow. Conversely, if there are surplus funds from insurance, they can either go back to the business or the owner’s family, depending on who is paying for the policy.

Fair Market Value Appraisal: The third method of appraising the business upon a triggering event seems like it would be the most accurate. However, getting multiple appraisals may be expensive as well as time-consuming. Plus, it is unlikely that two independent appraisers will arrive at the same value, so ambiguity still must be dealt with during a very difficult time when emotions are running high. If choosing the fair market value appraisal method, it’s important to clearly define in the buy-sell agreement exactly how many appraisals will be performed, by whom, and how the discrepancies be averaged or weighted.

Any or all of these valuation methods can work well as long as all parties agree to their potential imperfections. Also, the methods should be clearly communicated to potential heirs since they won’t be privy to deciding what goes into the buy-sell agreement. In addition, it’s important to revisit the business’s value and/or valuation method at regular intervals to ensure the document remains relevant and fair to all parties involved.

5 Ways a Buy-Sell Agreement Can Be Funded

Once the parameters of a buy-sell agreement are defined, the owners must decide which of the following 5 funding methods (or combination) will consummate an eventual buyout:

- A Sinking Fund

- Debt-Financed Buyout

- Sale of the Business to a 3rd Party

- Installments from Business Cash Flow

- Life Insurance and/or Disability Insurance

The eventual buyout funding may include any combination of these five funding sources, especially if one owner’s interest dwarfs that of the other owners or if certain owners are unable to qualify for sufficient insurance. Let’s briefly discuss each buy-sell funding method:

Sinking Fund: If the business could create a sinking fund sufficient to buy any owner out, then this would obviously be the cleanest way to fund a buy-sell agreement. Realistically though, the owners will often prefer to deploy their capital in ways that expand the business, so a sinking fund is unlikely to be the sole funding method for a buy-sell agreement. That said, if the business or its owners can create a continuously compounding tax-efficient sinking fund using life insurance cash value, then it can be used as business liquidity along the way and potentially a down payment to buy out a retiring owner in the future.

Debt-Financed Buyout: Owners of seasoned businesses often feel they can acquire financing at a moment’s notice. This may not be the case during the disruptive event of a fellow owner dying or becoming disabled, especially if the owner is also a key employee of the business. However, if favorable financing can be acquired, then this can be an attractive option to buying out an exiting owner or their heirs. Borrowing to buy out heirs can create a clean break allowing the remaining owners to be fully vested in their efforts.

Sale of the Business to a 3rd Party: One way to create liquidity for a buy-sell agreement is for the remaining owners to sell the entire company to a 3rd party so everyone gets cashed out. Needless to say, the sale of a closely-held business can be quite a complicated and lengthy process, so it should not be counted on as a reliable funding method. It’s also worth noting that potential 3rd party buyers may smell blood in the water, resulting in the business selling for a fire sale price.

Installments from Business Cash Flow: It’s common for business owners to assume that ongoing business cash flow can handle any buyout situation, regardless of the timing or type of triggering event. Consider that when a business loses one of its key owners, the result may be waning company cash flow for the foreseeable future. Even if business cash flow does remain steady, much of that money cannot be used to fuel future business growth for the remaining owners. Generally speaking, funding a buy-sell agreement through business cash flow should only be leaned on as a supplement after using insurance proceeds or the other funding methods discussed above.

Life Insurance and Disability Insurance: Life insurance for buy-sell agreements is quite common, where either the business takes out a term insurance policy on all owners, or each owner takes out policies on each other. That way, immediate liquidity can be counted on for pennies on the dollar if an owner passes away prematurely. However, buy-sell agreements funded with term life insurance don’t account for an owner becoming too sick or hurt to work nor leaving the business early for any of the other reasons that trigger a buy-sell agreement. Business owners should consider one of the modern-day buy-sell life insurance policies that not only pay out if an owner becomes chronically ill/injured but that also build up liquid cash value at competitive long-term growth rates to act as a sinking fund for buying out healthy owners someday.

Book a complimentary consultation to discuss buy-sell life insurance options with a seasoned agent.

Life Insurance in Buy-Sell Agreements: Advantages & Disadvantages

Most buy-sell agreements are funded with life insurance for the immediate liquidity it can provide to finalize a buyout if one of the owners passes away. However, there can often be challenges when using life insurance in conjunction with a buy-sell agreement.

Disadvantages of Life Insurance in Buy-Sell Agreements

- Owners may not qualify for coverage (or not favorably).

- Disparity in pricing between different owners may exist.

- Buy-sell life insurance premiums are not tax-deductible.

- There is an ongoing premium obligation for the business or owners.

Oftentimes, business owners will stall on starting or finalizing their contingency plans because of some combination of the challenges above when using buy-sell agreement life insurance. However, when a knowledgeable life insurance professional educates, structures, and positions policies with a properly structured agreement, most business owners quickly learn how the benefits outweigh the challenges.

Advantages of Life Insurance in Buy-Sell Agreements

- Life insurance payouts are income tax-free.

- Lump sum death benefit creates immediate liquidity.

- Certain policies offer disability or chronic illness riders.

- Cash value gets tax-advantaged growth to buyout retiring owners.

Businesses usually have some sort of cash reserves on the books and/or its owners are taking ongoing distributions from the company. If so, these funds may be reallocated to fund buy-sell life insurance policies that protect against death and disability while accruing a sinking fund that can simultaneously provide the owners with ongoing liquidity if needed for emergencies or strategic opportunities.

Book a complimentary consultation to discuss buy-sell life insurance options with a seasoned agent.

Below we will discuss how buy-sell life insurance works in conjunction with different types of agreements and how they can be either structured for simplicity, tax efficiency, or both using hybrid buy-sell agreement structures.

Types of Buy-Sell Agreements

Although there are now several types of advanced or hybrid buy-sell agreement structures, most of them spawn from one of these two original types of buy-sell agreements:

- Entity Purchase (formerly Stock Redemption)

- Cross-Purchase Agreement

Entity purchase and cross-purchase are the original two forms of a buy-sell agreement, each with different ownership structures and potential tax implications. However, there are also several hybrid buy-sell agreements that legally combine elements from each to alleviate complexity and/or adverse tax implications.

So, when looking at the different types of buy-sell agreements below, just remember that most of them are simply a hybrid combination of the first two. Here is the full list, including the various types of hybrid buy-sell agreements:

- Entity-Redemption Agreement

- Cross-Purchase Agreement

- Cross-Endorsement Agreement

- Life Insurance LLC Agreement

- Wait & See Buy-Sell Agreement

- One Way Buy-Sell Agreement

In order to better understand the hybrid buy-sell agreements and their advantages, let’s first discuss entity-purchase vs. cross-purchase in detail to better understand their distinct differences.

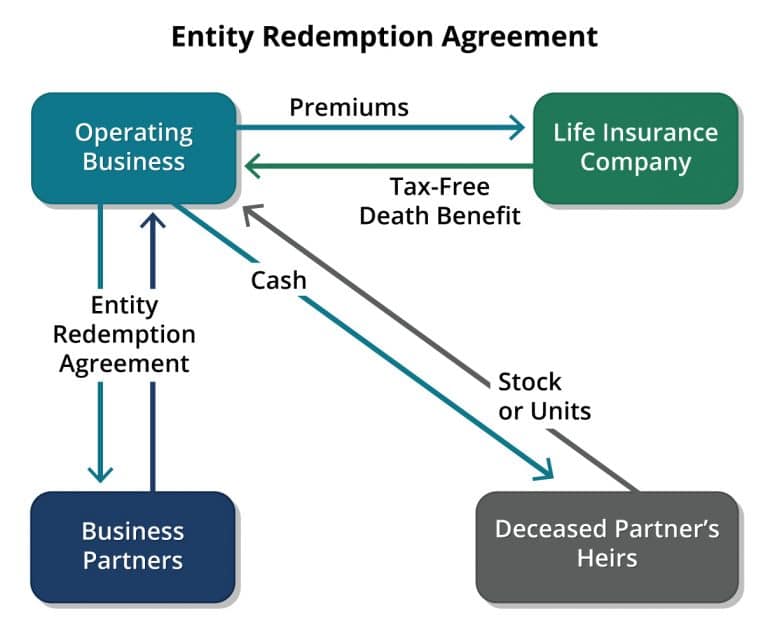

Entity Redemption Agreement

This type of buy-sell agreement used to be known as a stock redemption plan since most companies were corporations. However, since an LLC issues ownership in units rather than stock, the more accurate term is “entity redemption.” With an entity redemption buy-sell agreement, the company itself will be the payor and beneficiary of the owners’ life insurance policies. If one of the owners passes away, the company will use the death benefit to buy back the ownership interest from the deceased owners’ heirs. Those ownership units are retired at the company level, which essentially increases the surviving owners’ interests in the company on a pro-rata basis.

The main advantage of an Entity Redemption Buy-Sell Agreement is that it is simple to administer, since all insurance policies are owned at the company level. Therefore, only one policy is needed for each owner, and each owner pays their pro rata share of aggregated premiums according to their ownership percentage.

The main disadvantage of an Entity Redemption Buy-Sell Agreement is the lack of an increased basis for surviving owners when the company buys back ownership. Since the company itself receives the death benefit and uses the proceeds to buy out the deceased owner’s heirs, the company gets no increase in basis for the ownership it paid for.

If instead the owners personally bought back the ownership interests, then they would receive an increase in their basis with whatever they paid for the company. This would allow owners to recognize less of a taxable gain if they sold their company in the future, or potentially take tax-free K-1 distributions out of their company even if they never sell.

So, the simplicity provided by an entity redemption buy-sell agreement comes at the cost of losing a key tax advantage that could be monetized by the surviving owners. Keep in mind that some of the hybrid buy-sell agreements were designed to preserve this advantage.

That is a perfect segue way into cross-purchase agreements, since the owners preserve this tax advantage, albeit with some added complexity.

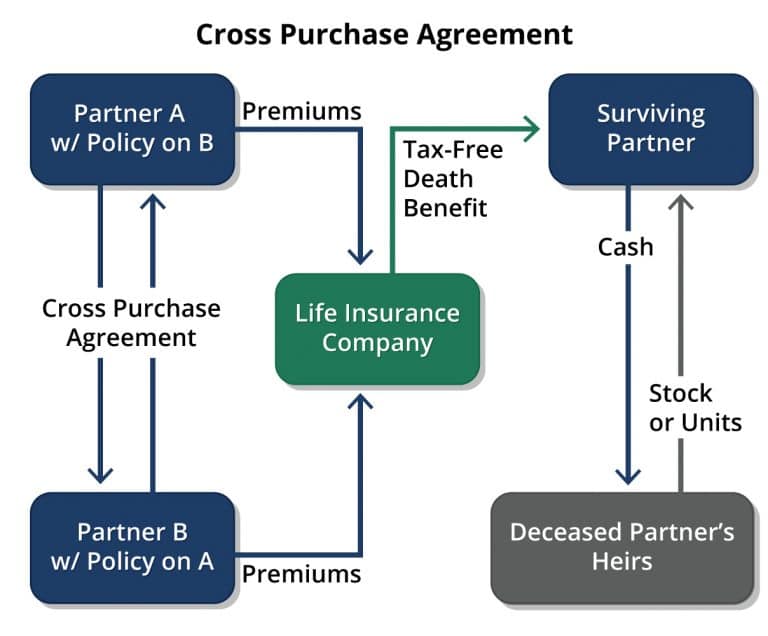

Cross-Purchase Agreement

A cross-purchase buy-sell agreement is structured so that each owner personally owns a life insurance policy on all the other owners. If one owner dies, then the surviving owners will all personally receive some amount of tax-free death benefit to buy their pro-rata share of stock/units from the deceased owner’s heirs.

The main advantage of a cross-purchase buy-sell agreement is their immediate increase in basis for the amount they paid for the newly acquired stock/units. Even though they received the life insurance death benefit tax-free, they still used the money to buy an increased level of ownership in the company. That increase in basis allows them to recognize less capital gains tax if they ever sell the company or potentially take tax-free K-1 distributions from the business.

The main disadvantage of a cross-purchase agreement is the added complexity. When there are more than 2 owners, the amount of separate policies needed will exponentially increase:

- When 2 owners each owner needs a policy on the other owner (2 x 1= 2)

- When 3 owners each owner needs a policy on the other 2 owners (3 x 2= 6)

- When 4 owners each owner needs a policy on the other 3 owners (4 x 3= 12)

- When 5 owners each owner needs a policy on the other 4 owners (5 x 4= 20)

Not only does this increase logistical complexity for the owners, but there may be some serious premium disparity depending on the age/health differences between owners. For example, the oldest owner will be paying substantially less for policies on the younger owners’ lives and vice versa.

Many owners wonder if the juice is worth the squeeze when it comes to adding this level of complexity for a potential tax benefit that’s only realized if one of the owners dies prematurely.

Let’s pivot to some of the hybrid buy-sell agreements that aim to preserve the tax advantages of a cross-purchase agreement with the simplicity of an entity redemption agreement.

Cross-Endorsement Hybrid Buy-Sell Agreement – The Ultimate Solution

Cross-endorsement is a hybrid buy-sell agreement structure that preserves the tax benefits of a cross-purchase agreement with the simplicity of an entity redemption. Also, the cross-endorsement method can also help with every possible buy-sell triggering event when using some of the modern-day life insurance policies that have chronic illness riders and competitively build cash value.

Policy ownership in a cross-endorsement hybrid buy-sell agreement: With a cross-endorsement buy-sell agreement, each owner pays for their own policy, has their own trust as the listed beneficiary, and controls any cash value. So similar to an entity redemption structure, only 1 policy per owner is needed rather than several fractional policies in a cross-purchase agreement. Since business owners generally value control, they will often like that they personally own their policies ensuring that premiums are paid in a timely manner protecting their family.

Renting the death benefit in a cross-endorsement hybrid buy-sell agreement: The other owners will simply “rent a portion” of their fellow owners’ death benefit. This is a legally recognizable transaction that provides the renting owners an increase in taxable basis so long as published term rates are used (from IRS tables or the insurance company). Each owner only rents what is necessary from each other’s policy to purchase the value stated in the buy-sell agreement. Theoretically, the owners can assess the company value each year, and whatever portion of the death benefit isn’t rented to the other owners can go straight to their own family. Rather than reapply for policies as the company grows, each owner can start with a bigger policy (arguably needed for their personal planning) and adjust the amount they rent out each year to other owners.

How cross-endorsement handles disability-related buy-sell trigger events: Let’s assume each owner uses a modern-day life insurance policy with either a chronic illness or long-term-care rider. If so, then there’s a strong likelihood that the policy beneficiaries can receive a percentage of the tax-free death benefit even though the insured owner hasn’t died yet. Technically, these riders are simply an advance of the tax-free death benefit, which the IRS allows due to Long-Term-Care insurance code. The co-owners can choose to account for this in their rental agreement as well.

(It’s worth noting that a true disability policy will often have superior coverage to a rider on a life insurance policy. However, many owners find a comprehensive disability buy-out policy to be cost-prohibitive, whereas a rider on a life insurance policy will be a fraction of the cost or possibly free. Keep in mind that there are no deals in insurance and that everything is priced almost perfectly by actuaries. We believe that at least some protection and potential liquidity provided by a cheap/free rider is better than nothing if an owner’s disability were to trigger a buy-sell agreement).

Life insurance cash value can help non-death/disability triggers: Chances are that none of the owners will die or become disabled prematurely, which doesn’t mean you shouldn’t insure against these catastrophic events. But how do owners plan for the most likely buyout scenario of a healthy owner retiring from the business or any of the other early exits for cause? The simple answer is a sinking fund, which often is cumbersome and unrealistic since all company resources are usually in play. However, it’s safe to assume that the individual owners are saving at least some of the company distributions they receive toward their own retirement.

It’s common for business owners to have higher reserves in cash than their W2 peers, since they may need to inject liquidity into their existing business or new potential ventures. If this is the case, then they may receive more competitive growth rates and tax advantages from allocating their savings to life insurance cash value rather than traditional checking/savings. Doing so simultaneously props up all the buy-sell defensive hedges discussed above. Plus, they can borrow against their cash value balance at any moment for immediate liquidity without killing the compounding of their cash value (see our 6-minute animated video on how this works).

By allocating a portion of their company distributions to personally owned buy-sell life insurance using the cross-endorsement method, they naturally have their own “sinking fund with superpowers” to help buy out another owner at any time for any reason.

Summing up the benefits of a cross-endorsement buy-sell agreement: The cross-endorsement is the ultimate hybrid buy-sell agreement since it’s relatively simple with everyone owning and controlling their own policy and renting portions to the other owners. The renting owners will receive an increase in basis when using any of the rented death benefit to buy out a deceased owner’s heirs. This increase in basis will allow them to avoid future capital gains taxes should they ever sell their ownership interests in the future or potentially allow them to take tax-free distributions from the company long before they sell. If the buy-sell life insurance policies come with certain riders, they have an inexpensive hedge against certain disability events as well as death, and the owners can use the continuously compounding cash value to buy out an owner for a non-health-related triggering event.

One word of warning for a cross-endorsement buy-sell agreement: The IRS created a landmine called “Transfer for Value” when buying, selling, or renting life insurance which can cause the death benefit to be taxable rather than tax-free. These rules exist mainly for life settlements, not buy-sell agreements, and so there are listed exceptions to this transfer-for-value landmine. One exception is business owners who transfer policies between partners in a company together. This sounds like any owners would be exempt, but upon closer examination of the fine print, “partner” means co-owner of an LLC taxed as a partnership, not C-corporations, S-corporations, or LLCs taxed as any type of corporation.

So, the cross-endorsement hybrid method only works for business owners who co-own some kind of LLC together (whether it is the main operating LLC tied to the buy-sell agreement). Co-owners with only a corporation will want to look into forming some kind of LLC together with a bona fide business purpose, which brings us to our next hybrid buy-sell agreement structure.

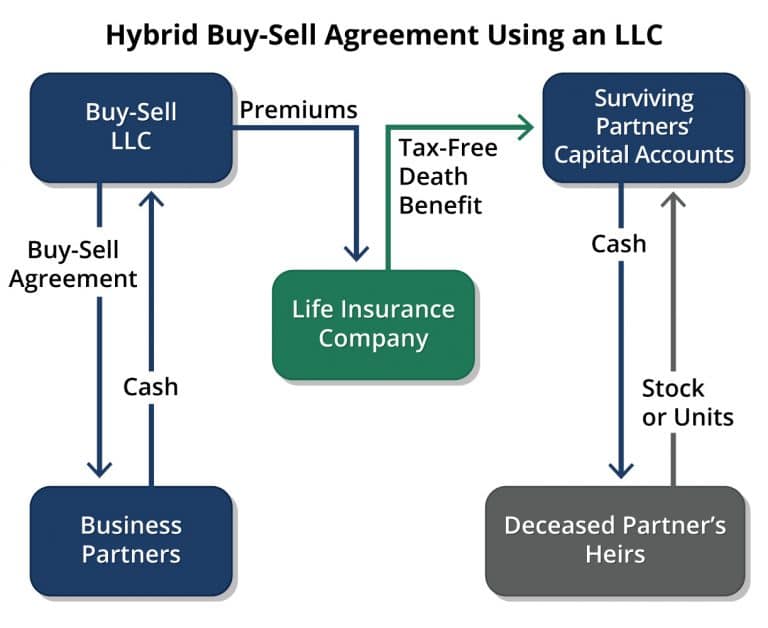

Life Insurance LLC Buy-Sell Agreement

One creative hybrid buy-sell solution is to have the business owners form a separate LLC with the purpose of solidifying their buy-sell agreement as well as administering the underlying insurance policies. Similar to the cross-endorsement above, a properly structured “Life Insurance LLC” requires only one policy per owner and also preserves the increase in basis for each owner when using the death benefit to buy out the deceased owner’s interest in the company.

The only drawback to the Life Insurance LLC is the necessity to form this new entity. That said, owners of a true corporation or LLC taxed as a corporation cannot use the cross-endorsement method unless they are also co-owners of another LLC.

Policy ownership in “Life Insurance LLC” buy-sell agreement: Similar to the simplicity of an entity redemption buy-sell agreement, only one life insurance policy per owner is needed in the Life Insurance LLC. Yet if the operating agreement is drafted properly, the premium payments and eventual death benefit can be allocated pro rata to the different owners’ capital accounts so that they not only receive the proceeds tax-free, but these same proceeds will also increase their basis in the company when used to buy out the deceased owner’s heirs.

Hopefully, these buy-sell life insurance policies also have embedded chronic illness/injury riders so some liquidity will come to the other owners if one of them is too sick or hurt to continue working in the company. Obviously, there is some additional complexity to adding another entity and having it drafted properly. However many owners often find the potential tax advantages are worth it, not to mention the additional asset protection benefits that a separate LLC offers with its exposure to lawsuits.

Life Insurance LLC can double as a lending/leasing company: Another way many businesses protect themselves against lawsuits is to set up a separate lending or leasing company with the core operating company as the main customer. Usually, most of the risk of lawsuits comes from the operating company itself, so segregating assets and diverting copious amounts of cash flow into a separate lending/leasing company may help to create a partition protecting against potential future creditors.

When using some of the modern-day cash value policies with competitive embedded growth and loan features, the business owners can fund their buy-sell life insurance while simultaneously borrowing against the cash value at any time to lend money to the operating company or buy equipment for future leasing opportunities. The entire policy cash value balance can continue compounding within the policy even though the business owners took a loan for other purposes (see our 6-minute animated video on how this works).

Life Insurance LLC cash value can help non-death/disability triggers: Similar to the cross-endorsement method, the cash value can act as a sinking fund to buy out owners that retire early or become disabled according to the buy-sell agreement. The only difference here is that all policies are owned at the LLC level. Over time, it’s likely that a large sinking fund will build up as the result of the continuously-compounding cash value. Even if the owners are heavily borrowing against the Life Insurance LLC cash value, they should be using the cash flow from their endeavors to pay down the liens while the life insurance cash value climbs to a higher place in line on the compounding curve inside each of the owners’ policies.

Summing up the benefits of the Life Insurance LLC buy-sell agreement: The 2-fold advantages of the Life Insurance LLC hybrid buy-sell agreement are:

- The simplicity of having only one policy per owner, while preserving any potential increase in basis for the other owners if any of the policies pay out for death or disability-related reasons.

- Separately, if cash value life insurance is used then the owners will naturally accrue a robust sinking fund to buy out any owners who leave the company for any reason while still healthy.

Other Hybrid Buy-Sell Agreement Structures

For the vast majority of companies either the Cross-Endorsement or Life Insurance LLC (discussed above) will be the optimal buy-sell agreement structure depending on their desire for effectiveness, tax advantages, and simplicity.

That said, there are two other hybrid buy-sell agreement structures worth mentioning:

The One-Way Buy-Sell Agreement: This structure is specifically put in place when there is only one owner, and his/her future successor is someone like a key employee, family member, or some other strategic relationship. If so, a one-way buy-sell agreement would be drafted between the existing owner and the desired successor. Usually, the successor will purchase one of the modern-day buy-sell life insurance policies mentioned above to create liquidity through the death benefit for premature death or chronic illness and accrue a sinking fund through the cash value.

Since the policy will be owned directly by the successor, then it will receive an increase in basis, like with a true cross-purchase agreement. If multiple successors are named in the agreement, then each successor would need a separate policy unless all successors decided to form a Life Insurance LLC. Usually though, a One-Way Buy-Sell Agreement is for smaller businesses, favoring simplicity above all else.

The Wait-and-See Buy-Sell Agreement: A wait-and-see buy-sell agreement is simply a document that can act as either an entity redemption agreement or cross-purchase agreement, depending on what is desired at the time of a triggering event. This hybrid buy-sell structure is ideal when the future plans of the company or its owners are in flux, and maximum flexibility is the main goal.

That way, no concrete plans nor valuation needs to be determined until a triggering event occurs. A wait-and-see buy-sell simply lays out an order of operations upon a triggering event, stating whether the entity itself or the remaining owners have first right of refusal to buy out an exiting owner’s interest in the company.

It’s much more common that all owners want to retain their pro rata ownership in the company, in which case a wait-and-see buy-sell agreement may be too ambiguous.

How to Start a Buy-Sell Agreement

If you’ve decided you don’t necessarily want any of your co-owners’ heirs as future partners in the business, then it’s probably time to start the process of properly structuring and funding a buy-sell agreement for your company.

We’ve found these steps are helpful to keep a complex process moving in the right direction toward the goal of having a fully implemented buy-sell agreement:

- Meet internally to discuss your fellow co-owners’ ideal outcomes with a buy-sell agreement.

- Engage a competent attorney to draft the buy-sell agreement’s legal language.

- Work with a seasoned life agent to model the cost-benefits of different insurance options.

- Fine-tune the triggering events for the buy-sell agreement.

- Determine how the company can be fairly valued at that time.

- Implement the legal agreement and insurance policies.

- Revisit the agreement at regular intervals and/or when major shifts in the business occur.

Most business owners have aligned interests, which often make this process go smoother, especially when they are working with competent and knowledgeable professionals who communicate well throughout the process.

Final Thoughts on Buy-Sell Agreements

Although many of the triggering events of a buy-sell agreement such as death, disability, or removal of an owner for cause are unlikely to occur, it’s far better to have a funded legal agreement in place and not need it, than to need it and not have it.

Oftentimes though, the perceived expense or complexity of setting up a buy-sell agreement keeps business partners from setting up this protective measure. Ironically, the cost of not having one could be catastrophic, whereas the living benefits of having a buy-sell agreement far outweigh the costs.

Using modern-day buy-sell life insurance policies with controlled growth options may actually help achieve better performance on safe and liquid cash reserves which can eclipse the entire cost of a buy-sell agreement and then some. By positioning cash reserves and/or business cash flow into properly structured buy-sell life insurance policies, all owners can hedge against unlikely but catastrophic events like premature death or certain disabilities while accruing cash value at competitive tax-advantaged growth rates. This “sinking fund with superpowers” can be used to grow the business along the way and/or buy out retiring owners in the future.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com