Borrowing Begets Discipline

I was talking to a relatively new friend (who’s not a client yet) about borrowing against his HELOC or from his 401(k) to sparingly buy some assets he’d been wanting to own that were currently down in price.

He recoiled in disgust at my borrowing idea!

He didn’t even have a HELOC in place and wouldn’t think of borrowing from his retirement accounts, not even to buy undervalued assets.

Upon further questioning, he also revealed that he was:

- maxing out his 401(k)

- maintaining a modest emergency fund

- trickling into his kids’ custodial accounts every month

- knocking out monthly credit card debt as soon as it came up.

He admitted that he created automated cash flows tied to these internal covenants to keep things simple, keep him disciplined, and keep him on track.

However, I had to point out that all of this “responsible behavior” left him largely illiquid.

Then it occurred to me that BORROWING, the very thing he hated, may be the exact thing he needed to get out of this seemingly responsible but constricting situation.

He could build up a liquid war chest of cash value and marketable securities he could keep compounding and borrow against, if these sorts of opportunities arose.

Since hating debt motivated him to pay it down quickly, it’s actually better than him just willy-nilly sending money away on auto-pilot every month to illiquid accounts that couldn’t be used to capitalize on future opportunities.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

His lack of accountability around his own liquidity reminded me of the corporate finance concept EVA concept, which Nelson Nash discussed in the original IBC book:

“Before being introduced to EVA, corporations were borrowing capital from banks and paying interest—but they were treating their own capital (equity) as if it had no cost! When they were brought face-to-face with the error of their ways and conducted their business with this fact included in the equation, then the profitability increased dramatically. EVA’s basic premise is—if you know what’s really happening, you’ll know what to do. The same thing applies to The Infinite Banking Concept.” – Nelson Nash**

If it works for companies Coca-Cola, AT&T, and Delta Air Lines, so couldn’t it work for my friend too?

By being calculated and responsible about taking loans to buy assets, the borrowed funds would, therefore, help him have:

- more conviction when pulling the trigger on these asset purchases

- better entry prices when taking on a loan to do so

- more accountability to pay down the debt quicker

Think of how much lazy money he kept collecting dust in taxable savings accounts for well over a decade and the compounding he either missed out on or shared with the government!

“The very first principle that must be understood is that you finance everything that you buy – you either pay interest to someone else or you give up interest you could’ve earned otherwise.” – Nelson Nash

How about all the auto-draft dollars that went into accounts he couldn’t legally access without stealing from his kids or taking early withdrawal penalties from his 401(k)?

What’s the remedy?

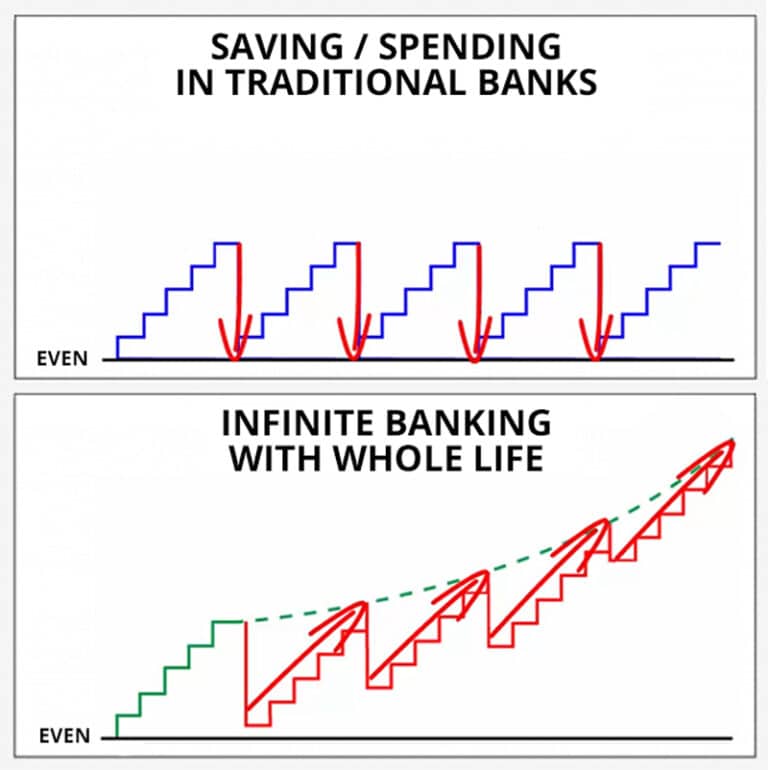

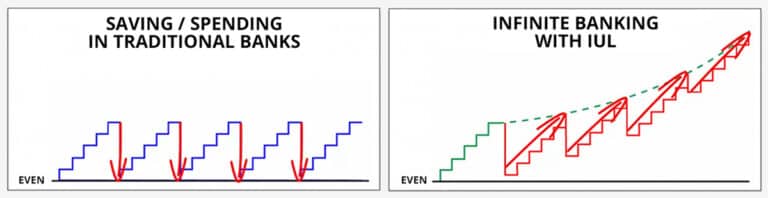

Nelson Nash’s infinite banking system is a solid start, but having a properly designed life insurance policy in place is the foundational key that unlocks the utility of all the other assets in your world that were previously off-limits with 4-D Banking.

Would my friend need his inefficient taxable savings accounts as his emergency fund if he could borrow against his 401(k), home equity, or steadily compounding life insurance policy?

What if he could pounce when opportunity knocks and then pause his future auto-drafts until he paid down the loan used to buy the assets he got on sale?

The same financial discipline he applied to his pedestrian auto-pilot system could then be applied toward knocking down the loan while the assets compounded.

Each account type ideally supports the others from having to liquidate and kill compounding, even under extreme conditions.

“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger.

What if you could reimagine your cash flows and assets to create multiple layers of compounding, where you can have liquid access to each when opportunity comes knocking?

Borrowing is a counterintuitive but effective way to create financial discipline, just ask the major corporations that created billions of value for shareholders using EVA that applied a cost of money to every move they made.

Learn to apply this big institutional thinking to your personal finances.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

** Disclosure: John “Hutch” Hutchinson has no affiliation or association with The Infinite Banking Concept®, The Infinite Banking Institute, Nelson Nash, nor his book “Becoming Your Own Banker: Unlock The Infinite Banking Concept.”

This analysis represents the author’s professional opinion based on 18 years of experience and should not be considered tailored financial advice for your personal situation. Individual policy performance will vary based on personal circumstances, company dividend performance, policy design, and loan usage. Consult with a qualified financial professional before making insurance decisions.