5 Reasons Borrowing May Be Better Than Paying Cash

Let’s discuss borrowing…

One of the most frequently asked questions I get when it comes to discussing how to build your own bank with life insurance is:

“Why do I have to borrow my own money to get at the funds inside my banking life insurance policy?”

The short answer is that you actually don’t have to borrow if you don’t want to. You have the right to withdraw up to what you put into your life insurance without any tax consequences whatsoever, and still leave the growth inside to continue compounding for you while supporting the insurance component.

However, there may be some very strong arguments for why you may actually WANT to borrow rather than withdraw your principal.

Before I hit on the 5 huge benefits you can receive from borrowing against your cash value rather than withdrawing it, let’s address the little voice and alarm bells ringing in your head right now. They probably sound something like this:

• “Borrowing is bad!”

• “Debt makes me see red!”

• “How can loans help me get ahead”

I understand that you’ve been conditioned to run for the hills when you hear the word “borrow” or anything related to “debt.”

However, a policy loan is different. It is a private loan with the life insurance company because they are holding your cash value as collateral; therefore the transaction is not required to appear on your public credit report. So even though you are borrowing from their general fund, you’re technically not “in debt” because everyone involved knows you could simply choose to wipe out that loan at a moment’s notice by surrendering your cash value back to the insurance company.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

If they are holding a liquid asset of yours that’s safely compounding and large enough to extinguish the loan whenever you want, are you technically in debt?

Let’s just be clear that they won’t ever loan you any more money than you have in your cash value account, and they won’t ever let you get upside down. If it ever did get to that point, you would have the option to true up the account through some minimal maintenance payment or you can always just surrender your policy’s cash value to extinguish the loan.

If that were to happen, wouldn’t you be in almost the exact same position (no cash and no loan) as if you had just paid cash in the first place?

FAQ: “Why then,” you may be asking, “would I go through all this hassle of borrowing when I can just plunk down my hard-earned cash and be done with it?”

Answer: If it were possible to get your hard-earned dollars working harder for you and wearing multiple hats, why would you have it do just one thing?

Let’s get into those 5 reasons why borrowing against your cash value may be more advantageous than paying cash. We’ll compare and contrast these two paths using a hypothetical example of two best friends, Sammy Saver (paying cash) and Benjamin “Benji” Banker (borrowing against his own bank built with cash value life insurance) when they each buy a $25,000 car.

(Note: This strategy also works incredibly well when funneling investment capital for real estate through a banking life insurance policy as well as the money you plan to infuse into your own business.)

1. When Borrowing Against a Life Insurance Policy there is a Death Benefit

Let’s use some simple math:

• Sammy Saver withdraws $25,000 in cash from his $30,000 bank account to buy a $25,000 car.

• Benji Banker borrows $25,000 against the $30,000 cash value inside his $500,000 life insurance policy to buy a $25,000 car.

Now, if Sammy Saver were to die in his sleep one night, then his heirs would obviously inherit his car as well as the remaining $5,000 in his bank account. If Benji Banker were to die in his sleep, however, his heirs would also get his car, and a $475,000 tax-free death benefit. You see, the $25,000 loan from the life insurance company was really just an advance on the $500,000 death benefit. So the insurance company pays the remaining $475,000 death benefit as a tax-free lump sum and the family of course still has the $25,000 car fully paid off. Just looking through the lens of what happens at death, whose family is better off? No brainer, right?

2. Borrowing Against Your Cash Value May Produce Positive Arbitrage

Wait, what? You see, certain insurance companies offer policies where you can lock in your cost to borrow at today’s low interests. Yes, that’s right. You can lock in today’s rates, not just for the life of a current loan, but for the life of the entire policy. That means for your entire life and all future loans you can borrow against your compounding cash value at today’s low loan interest rates that will remain contractually guaranteed.

Tip: Remember too, that if you set this up for your kids or grandkids, then you lock in today’s low rates for them as well.

If you’re a business owner, are there any banks out there that will lock in your line of credit at today’s low-interest rates for the rest of your life? Didn’t think so. In fact, you may have a hard time getting this deal from your mommy.

Because you can peg the cost to borrow against your policy cash value, you still have the potential to earn over and above this rate each and every year as dividend and crediting rates are determined using higher interest rate assumptions.

3. Borrowing Maintains Your Place in Line on the Compound Curve

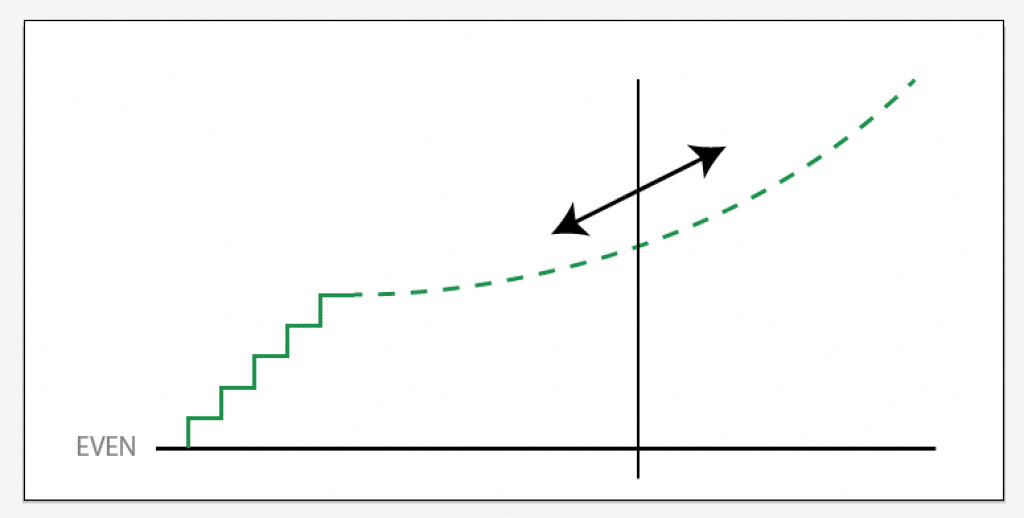

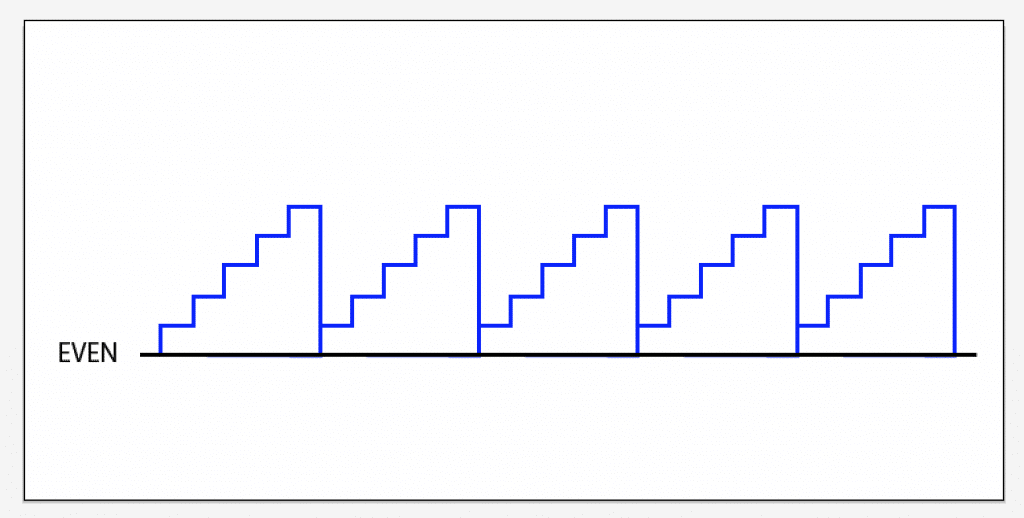

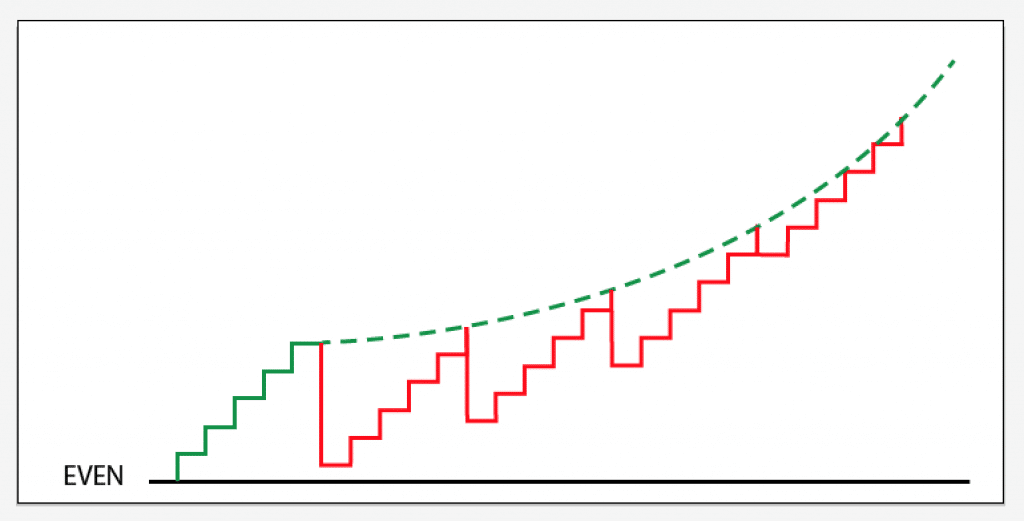

Even if there’s no positive arbitrage whatsoever, and the cost to borrow exactly equals the interest credited to your policy (which is an option on several policies today), borrowing against a growing balance continues the onward march of your compound interest curve. You see, compounding gains more and more momentum as the curve gets steeper the further it moves to the right. As you can see in the graphic below, compounding becomes most powerful near the right-hand corner, which takes time and continuous compounding (something we specialize in helping clients create for themselves).

When Sammy Saver withdraws his cash to avoid any sort of “borrowing,” he wipes out his entire compound interest curve on that block of funds and starts over at the very beginning and slowly rebuilds it as he replenishes his savings account, but he has substantially delayed the powerful steepening effect that eventually occurs at the far right-hand side of the chart

Sammy Saver

On the other hand, when Benji Banker borrows against his funds, he maintains the growing momentum on his continuously compounding curve, even while his equity is performing double-duty (in this case buying a car). If Benji Banker simply services the policy loan with the exact same amount of diligence that Sammy Saver replenishes his savings with, he will be paying interest on a decreasing balance, while earning interest on an increasing balance and picking up the other benefits listed in this article.

Benji Banker

Your right brain can easily tell which one of these charts puts its owner in a better financial position. If you want to see the math in action, definitely watch our detailed mathematical case study which goes through all the math in about 15 minutes.

On to our 4th benefit of borrowing…

4. Many Companies offer some sort of free Chronic, Critical, and or Terminal Illness Rider

Let’s look again at Sammy and Benji getting the same 2 cars:

• Sammy Saver withdraws $25,000 in cash from his $30,000 bank account to buy a $25,000 car.

• Benji Banker borrows $25,000 against the $30,000 cash value inside his $500,000 life insurance policy to buy a $25,000 car.

Now if Sammy Saver were to get diagnosed with a form of cancer that would be getting severely worse in say the next 6 months, let’s look at the overall financial result of this transaction. Sammy would have the new car and $5,000 in his bank account to help support his family and enjoy his final days with. If Benji Banker got diagnosed with the exact same disease and he also had a Chronic, Critical, and/or Terminal illness rider on his policy (which can often be a free rider depending on the company), then he would have the car and quite possibly a 6-figure advance of his death benefit or an ongoing stipend of around 2% of the death benefit paid monthly. In this example that’s around $10,000 per month.

Because financial stress can often accelerate the symptoms of many diseases, a large tax-free advance might allow Benji Baker to focus on healing and give him a better shot of surviving or even just enjoying his family in a way that otherwise wouldn’t be possible during his final days. Even if he has no shot of surviving, but say he has a few months before the symptoms really start to take him down, he could use the advance on the death benefit to thoroughly enjoy life while he still can.

What if you knew you only had 6 months to live and you actually had the financial freedom to enjoy it?

Sorry to get all doom and gloom, but bad things do happen to good people unexpectedly, and I think it should be obvious that paying cash falls way short of borrowing against a properly structured life insurance policy in this example.

Moving on… Let’s get happy again by looking at a monster retirement benefit you get even if you don’t get sick.

5. Create More Future Tax Exempt Income Using OPM

Over the years you can create an enormous snowballing pool of retirement assets by funneling money that you plan to use for strategic investments and major purchases through a properly structured life insurance policy designed for banking. By keeping that continuously compounding curve chugging uphill while servicing your loan balances, you get that compounding effect on a much bigger balance growing in your favor. Also, because life insurance provides a social good in the eyes of both the federal and all state governments, lifetime loans are not taxed so long as you keep some amount of the policy in force until the death of the insured.

So what that means is that during retirement you can bleed down the lion’s share of the life insurance policy by taking decades of retirement income loans even though you never intend to pay those loans back. You see, as long as some amount of death benefit is delivered (regardless of how small of an amount your beneficiaries get), your loans during your lifetime will be completely forgiven and maintain their tax-exempt status.

If you’re concerned about rising taxes, this is huge. Your future tax bracket can actually go up because of three different factors:

1. The government raises taxes for your income bracket

2. You lose exemptions and deductions in retirement for things like raising children, mortgage interest, and business deductions you may have been taking during your working years

3. You become more successful than you are now.

So in order to receive $50,000 of net-spendable income in retirement, many of you will need $75,000 (or more) of gross pre-tax retirement income to have $50,000 left over after tax. Think about it, probably every asset you have (401k plans, IRAs, Taxable Brokerage Accounts, Rental Real Estate Income, etc.) will be fully subject to taxation at some rate to be decided in the future. What’s nice about life insurance is if you want that $50,000 of net-spendable retirement income, you only need a $50,000 distribution from your life insurance banking mechanism, not $75,000 or more from a pre-tax retirement plan.

And unlike other types of retirement plans that are essentially off-limits until you reach age 59.5, you can utilize your equity inside your banking life insurance policy at any time for any reason and the full value of the policy keeps compounding for you, even it’s doing double duty elsewhere in your life along the way. It’s an opportunity to create a much bigger pool of assets for yourself, not by taking additional risk, but simply by strategic financial efficiency.

Summing it all up:

Hopefully, you get by now that you actually don’t HAVE TO borrow against your life insurance to get at your money. However, doing so may be advantageous for many reasons when you look at all of life’s possibilities and the additional benefits a banking life insurance policy can provide. I get it, you want to be as financially responsible as you can be by saving cash, paying cash for every purchase, and saving more cash again for the next purchase.

What you hopefully can see by now is that if you route those same exact cash flows into building and borrowing against your own banking mechanism using a properly-designed life insurance policy, you pick up a host of additional benefits from the same dollars. Not to mention, you also have the potential to build up a much bigger nest-egg that happens to be tax-exempt and available for use at any time for any reason.

If it was possible to get your hard-earned dollars working harder for you and wearing multiple hats, when would you want to start that?

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

John “Hutch” Hutchinson has no affiliation with any of the following:

- The Infinite Banking Concept®, The Infinite Banking Institute Nelson Nash, nor his book Becoming Your Own Banker – Unlocking the Infinite Banking Concept

- Bank on Yourself, Pamela Yellen, or her book The Bank on Yourself Revolution

* “The Infinite Banking Concept®” is a registered trademark of Infinite Banking Concepts Inc.

** “Bank On Yourself®” is a registered trademark of Hayward-Yellen 100 Limited Partnership.